Best Pay-As-You-Go Auto Insurance in Texas (Top 10 Providers in 2026)

Safeco, Progressive, and Allstate have the best pay-as-you-go auto insurance in Texas. Allstate pay-as-you-go charges just $1.50 per day, but costs can add up for high-mileage drivers. Safeco and Progressive have more competitive rates for auto insurance by the mile in Texas, starting at $27 monthly.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated February 2026

1,278 reviews

1,278 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

1,278 reviews

1,278 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsSafeco, Progressive, and Allstate have the best pay-as-you-go auto insurance in Texas, offering comprehensive auto insurance and affordable rates.

Whether you’re seeking affordable coverage or top-notch customer service, these top providers have you covered.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Texas

| Company | Rank | Safe Driving Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 24% | A | Tailored Policies | Safeco | |

| #2 | 20% | A+ | Local Agents | Progressive | |

| #3 | 23% | A+ | Member Discounts | Allstate | |

| #4 | 18% | A- | Simplified Pricing | Metromile | |

| #5 | 19% | A++ | Accident Forgiveness | USAA | |

| #6 | 22% | A+ | Telematics Technology | Nationwide |

| #7 | 18% | A | Simplified Pricing | MileAuto | |

| #8 | 17% | A | Flexible Pricing | American Family | |

| #9 | 16% | X | Tech-Savvy Users | GoAuto | |

| #10 | 12% | A | Personalized Discounts | Farmers |

With options tailored to fit your driving habits and budget, finding the ideal pay-as-you-go auto insurance in Texas has never been easier.

If you want to dive right into finding the best Texas auto insurance online, compare rates with our free quote tool.

- Safeco has the best auto insurance for Texans looking to pay as they go

- Progressive and Allstate also have affordable car insurance for Texans

- Make sure to read pay-per-mile car insurance reviews before choosing a company

#1 – Safeco: Top Pick Overall

Pros

- Tailored Policies: Safeco’s selection of coverages makes it easy to tailor policies. We go over coverage options in our Safeco review.

- Multiple Discounts: Safeco offers a selection of discounts, from a good driver to a bundling discount, that help customers save.

- Accident Forgiveness: Qualifying drivers will avoid rate increases after an accident.

Cons

- Customer Satisfaction: Safeco has some below-average customer ratings.

- Can’t Purchase Online: While you can get an online quote, purchases must be completed through an agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Local Agents

Pros

- Local Agents: Progressive has some local agents who can provide in-person assistance.

- Loyalty Discount: Sticking with Progressive can result in lower rates.

- Coverage Options: Progressive offers add-ons like gap coverage. Our Progressive review covers coverage options in more detail.

Cons

- UBI Rate Increases: Drivers may have rate increases after participating in Progressive’s UBI discount program.

- Customer Satisfaction: The company has just average ratings from J.D. Power.

#3 – Allstate: Best for Member Discounts

Pros

- Member Discounts: Allstate has plenty of discounts, which you can learn about in our review of Allstate.

- Coverage Options: Allstate has plenty of extra add-on coverages to choose from.

- Availability: Allstate auto insurance is available to purchase in every state.

Cons

- Availability of UBI Discount: Not all states offer Allstate’s discount for good driving.

- High-Risk Rates: Allstate’s rates for high-risk drivers, such as drivers with DUIs, are higher than the average.

#4 – Metromile: Best for Simplified Pricing

Pros

- Simplified Pricing: Metromile’s pricing is straightforward. Read more about it in our review of Metromile.

- Coverage: Metromile offers basic coverages and a few add-ons like roadside assistance.

- Online Convenience: Metromile’s app allows drivers to check rates.

Cons

- Not For Frequent Drivers: Metromile is only economical for drivers who drive less than 10,000 miles per year.

- Availability: Metromile is only available in a few states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Some USAA customers won’t face a rate increase after an accident.

- Membership Perks: USAA members can get discounts on shopping and traveling.

- Customer Service: USAA has good customer service reviews, which you can read more about in our USAA review.

Cons

- Military-Only: USAA only sells insurance to military and veterans.

- Agent Availability: USAA doesn’t have a wide base of local agents to visit in person.

#6 – Nationwide: Best for Telematics Technology

Pros

- Telematics Technology: Nationwide’s general app lets customers make claims and policy changes directly from their phones.

- Coverage Options: Nationwide has a gap insurance and more. Our Nationwide review goes over coverages in more detail.

- Accident Forgiveness: Some drivers may avoid rate increases after an accident at Nationwide.

Cons

- DUI Rates: Nationwide’s DUI rates are above the average.

- Availability: Nationwide isn’t available in some states.

#7 – Liberty Mutual: Best for Customized Coverage

Pros

- Customized Coverage: Liberty Mutual has great policy customization options. Learn more in our Liberty Mutual review.

- 24/7 Support: There is a 24/7 helpline for claims and policies.

- Bundling Discount: Liberty Mutual offers a great discount if customers purchase more than one type of insurance.

Cons

- Availability of UBI Discount: Not all states offer a discount for usage-based driving.

- Customer Ratings: Some customers gave Liberty Mutual negative reviews.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Flexible Pricing

Pros

- Flexible Pricing: American Family offers flexible pricing, with the ability to add or remove coverages to fit a budget.

- Customer Service: American Family has decent customer service reviews. Find out more in our American Family Review.

- Coverage Options: American Family has add-ons like roadside assistance.

Cons

- Availability: American Family isn’t available in every state.

- DUI Rates: American Family’s rates for DUIs can be higher than the average.

#9 – AAA: Best for Usage-Based

Pros

- Usage-Based: AAA offers a good driving discount based on usage.

- Roadside Assistance: AAA offers one of the best roadside assistance programs. Read more in our AAA review.

- AAA Membership Perks: AAA members can get discounts on shopping and traveling.

Cons

- Membership Fee: Drivers must be AAA members to purchase auto insurance.

- Sold by Various Clubs: Customer service may not be consistent across states.

#10 – Farmers: Best for Personalized Discounts

Pros

- Personalized Discounts: Farmers has plenty of discounts for drivers. Find out more in our review of Farmers.

- Accident Forgiveness: Farmers may forgive some drivers’ first accident.

- Local Agents: Customers can look for a local agent to provide in-person assistance.

Cons

- Availability of UBI Discount: Not all drivers will be able to get a UBI discount, depending on their state.

- No Gap Insurance: New car owners may want to choose a different company.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Mechanics of Pay-As-You-Go Auto Insurance in Texas

With cheap usage-based auto insurance, you pay a daily rate and then a per-mile rate. If you want some pay-per-mile auto insurance examples, look below to can see how Allstate’s Milewise works. Cheap low-mileage auto insurance companies are only recommended for those who drive fewer than 10,000 miles annually.

In Texas, pay-as-you-go auto insurance operates on a simple premise: drivers pay a daily base rate along with a per-mile charge, offering flexibility and potential savings. For insight into this model, consider Allstate’s Milewise program, which illustrates how pay-per-mile insurance functions in practice.

However, it’s important to note that while cheap low-mileage auto insurance can be advantageous for those driving under 10,000 miles yearly, it may not suit high-mileage drivers seeking comprehensive coverage.

Pay-As-You-Go Auto Insurance in Texas: Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $29 | $72 | |

| $44 | $115 | |

| $30 | $75 | |

| $44 | $115 |

| $32 | $86 | |

| $27 | $71 | |

| $22 | $59 |

Explore pay-as-you-go auto insurance options in Texas with our comprehensive guide. Discover monthly rates for minimum and full coverage from top providers like Allstate, Progressive, and Safeco.

From budget-friendly options to comprehensive plans, find the coverage that suits your needs and budget.

Texans Who Need Pay-As-You-Go Auto Insurance

Texans who are considering pay-as-you-go auto insurance should assess their driving habits and demographics to determine suitability. By examining how rates fluctuate based on factors such as mileage and age, individuals can gauge whether pay-per-mile car insurance aligns with their needs.

Texas Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $60 | $107 | $132 | $155 |

| 16-Year-Old Male | $70 | $119 | $141 | $177 |

| 20-Year-Old Female | $79 | $124 | $141 | $167 |

| 20-Year-Old Male | $85 | $140 | $157 | $196 |

| 30-Year-Old Female | $82 | $122 | $138 | $174 |

| 30-Year-Old Male | $91 | $142 | $151 | $189 |

| 40-Year-Old Female | $82 | $126 | $134 | $167 |

| 40-Year-Old Male | $85 | $142 | $147 | $179 |

| 50-Year-Old Female | $79 | $125 | $132 | $165 |

| 50-Year-Old Male | $83 | $130 | $141 | $171 |

| 60-Year-Old Female | $48 | $83 | $104 | $133 |

| 60-Year-Old Male | $67 | $109 | $131 | $163 |

| 70-Year-Old Female | $45 | $75 | $83 | $125 |

| 70-Year-Old Male | $58 | $106 | $124 | $154 |

Explore Texas auto insurance rates based on age, gender, and annual mileage. From teenage drivers to seniors, discover how factors like gender and mileage impact monthly premiums. Whether you’re a young driver or a seasoned motorist, understanding these rates can help you make informed decisions about your coverage.

Low-mileage auto insurance for seniors is often cheaper than for young drivers. Now that you know age and how annual mileage affects auto insurance rates, look below to see how location can impact rates.

Texas Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Austin | Dallas | El Paso | Houston | San Antonio |

|---|---|---|---|---|---|

| 16-Year-Old Female | 1,050 | 1,040 | $1,020 | 1,030 | 1,035 |

| 16-Year-Old Male | 680 | 690 | $670 | 675 | 685 |

| 20-Year-Old Female | 240 | 245 | $250 | 260 | 255 |

| 20-Year-Old Male | 275 | 280 | $260 | 265 | 270 |

| 30-Year-Old Female | 150 | 140 | $130 | 135 | 145 |

| 30-Year-Old Male | 155 | 160 | $145 | 150 | 160 |

| 40-Year-Old Female | 210 | 205 | $195 | 200 | 202 |

| 40-Year-Old Male | 212 | 210 | $200 | 205 | 207 |

| 50-Year-Old Female | 208 | 205 | $195 | 200 | 202 |

| 50-Year-Old Male | 213 | 210 | $200 | 205 | 207 |

| 60-Year-Old Female | 125 | 120 | $115 | 118 | 123 |

| 60-Year-Old Male | 125 | 122 | $118 | 120 | 123 |

| 70-Year-Old Female | 215 | 210 | $205 | 207 | 209 |

| 70-Year-Old Male | 218 | 215 | $210 | 213 | 214 |

Auto insurance for low-mileage drivers may be cheaper in some cities. Discover the varying monthly auto insurance rates across different age groups, genders, and cities in Texas. From the premiums of 16-year-olds to those of 70-year-olds, find out how factors like age and location influence insurance costs in Austin, Dallas, El Paso, Houston, and San Antonio.

Meeting Texas Auto Insurance Requirements

Safeco stands out as the top choice for pay-as-you-go auto insurance in Texas, offering comprehensive coverage and affordable rates.Dani Best Licensed Insurance Producer

While liability auto insurance is cheap, full coverage does provide better protection. Ensuring compliance with Texas’ auto insurance requirements is imperative for all drivers. While liability coverage meets the state’s minimum standards and is typically more affordable, opting for full coverage offers enhanced protection.

With comprehensive coverage, drivers safeguard themselves against a broader range of risks, providing greater peace of mind on the road. By investing in full coverage, drivers not only fulfill legal obligations but also prioritize their own financial security and peace of mind on the unpredictable highways of Texas.

Texas Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $217 | $614 |

| 16-Year-Old Male | $249 | $674 |

| 20-Year-Old Female | $59 | $161 |

| 20-Year-Old Male | $64 | $94 |

| 30-Year-Old Female | $55 | $81 |

| 30-Year-Old Male | $59 | $87 |

| 40-Year-Old Female | $48 | $130 |

| 40-Year-Old Male | $49 | $217 |

| 50-Year-Old Female | $45 | $130 |

| 50-Year-Old Male | $46 | $133 |

| 60-Year-Old Female | $44 | $116 |

| 60-Year-Old Male | $47 | $123 |

| 70-Year-Old Female | $47 | $134 |

| 70-Year-Old Male | $48 | $137 |

From minimum to full coverage, discover how rates vary for different demographics. Whether you’re a 16-year-old male or a 70-year-old female, find insights into the cost of Texas auto insurance tailored to your profile.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

More Ways Low-Mileage Drivers Save Money on Auto Insurance

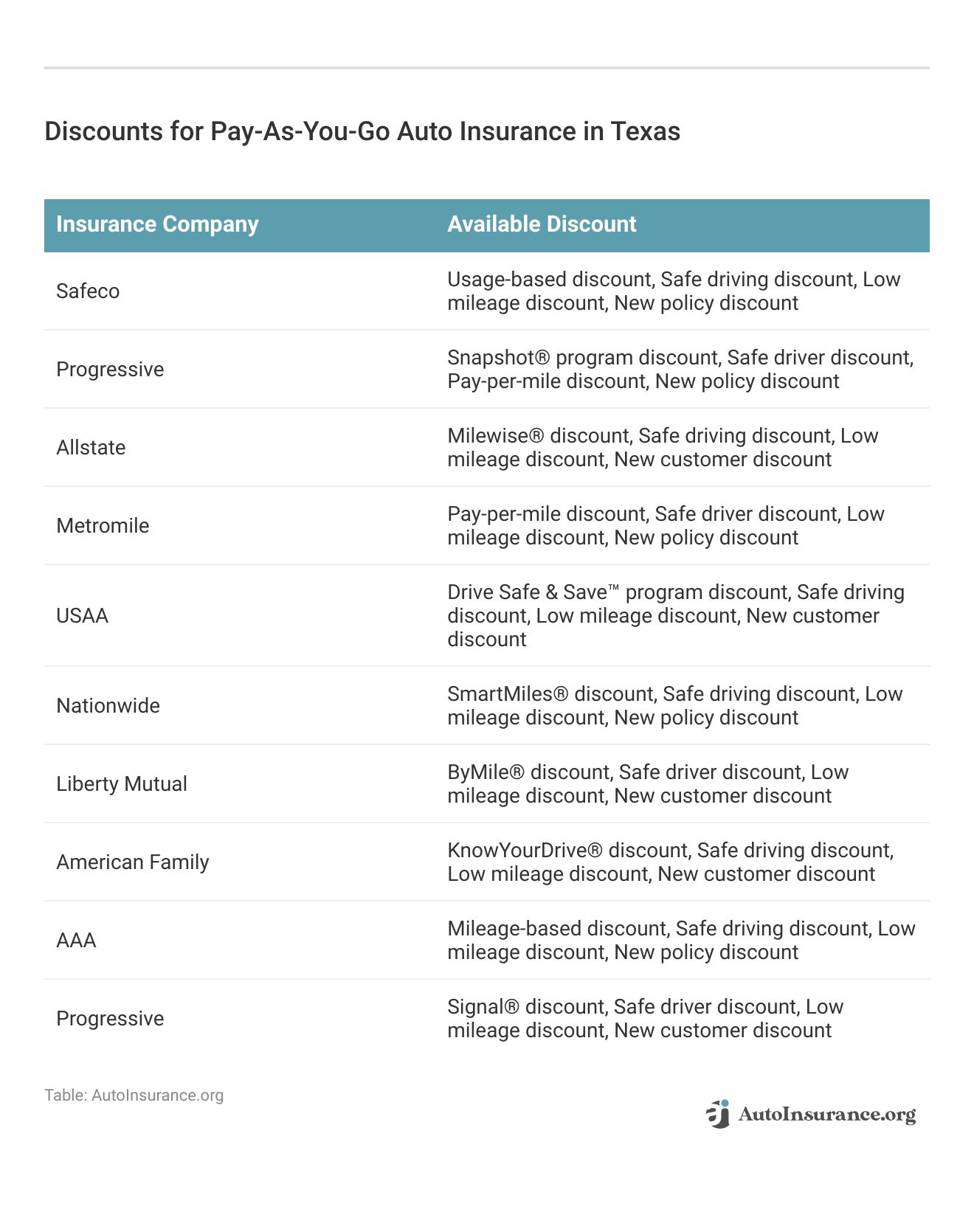

Shopping at the best pay-as-you-go auto insurance companies will help most drivers save. There are additional strategies for low-mileage drivers to cut costs on auto insurance premiums. While opting for pay-as-you-go policies is one effective method, exploring discounts offered by top insurance providers can further enhance savings.

Whether you’re in search of affordable coverage for Texans or seeking discounts tailored to your driving habits, the best Texas auto insurance companies extend a range of money-saving opportunities.

Discover Exclusive Discounts for Pay-As-You-Go Auto Insurance in Texas. Explore a comprehensive table featuring 10 leading insurance providers and their available discounts, including mileage-based incentives, safe driving rewards, low mileage discounts, and exclusive offers for new policyholders. Find the perfect fit for your driving habits and budget.

Get The Best Pay-As-You-Go Auto Insurance in Texas

Whether you are looking for the best auto insurance companies for telecommuters or retired drivers, the first step is to compare rates and check reviews. You can also use a pay-per-mile car insurance calculator to determine which company offers the best rate. It will help you quickly find cheap auto insurance for Texans.

Additionally, leverage pay-per-mile car insurance calculators to pinpoint the most favorable rates tailored to your driving habits and needs. By utilizing these tools, you’ll swiftly identify affordable options and ensure comprehensive protection for your vehicle in the Lone Star State.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Frequently Asked Questions

How much does the average Texan pay for auto insurance?

It depends on what company is chosen. For example, minimum coverage at USAA averages 27/mo, but minimum coverage at Liberty Mutual averages $68/mo.

Who is the cheapest auto insurance in Texas?

USAA has the cheapest Texas auto insurance rates, followed by Safeco. Looking for no down payment auto insurance will also help reduce costs. Enter your ZIP code below to find cheap quotes in your Texas area.

Is pay-per-mile insurance available in Texas?

Pay-per-mile auto insurance coverage is available at several companies. If you are looking for the best insurance for your rarely used vehicle, make sure to read our article on the best auto insurance for limited-use vehicles.

What is the best pay-per-mile auto insurance in Texas?

Safeco has the best pay-per-mile car insurance, although you should always read multiple pay-per-mile auto insurance reviews and get quotes before making a decision.

What is the best auto insurance for Texas seniors?

The best low-mileage car insurance for seniors is at companies like Safeco and Allstate.

Who is State Farm’s biggest auto insurance competitor in Texas?

The biggest competitor of State Farm low-mileage auto insurance is Progressive. You can learn more about State Farm low-mileage car insurance in our State Farm review.

Who is cheaper than Geico in Texas?

USAA has the cheapest pay-per-mile car insurance that meets Texas auto insurance requirements.

Did Geico raise its auto insurance rates in Texas?

Yes, Geico recently raised rates, so it may not be the best choice for the cheapest pay-per-mile auto insurance.

Is Allstate Milewise a good option for Texas drivers?

Yes, Allstate Milewise can provide affordable auto insurance for Texans who drive less than the average driver. Read our article on cheap auto insurance for infrequent drivers to help you find the best deal.

What is the difference between Allstate Milewise and Drivewise?

Allstate Drivewise is a UBI program that tracks driving behaviors and may issue a low-mileage auto insurance discount on a regular policy, while Allstate Milewise is coverage that charges per-mile after a base fee.

Does Allstate handle auto insurance claims well?

Is Allstate auto insurance cheaper than Geico in Texas?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.