Best Bloomington, Illinois Auto Insurance in 2026 (Find the Top 10 Companies Here)

You can get the best Bloomington, Illinois auto insurance from Erie, Travelers, and Farmers for as low as $75/month, offering top-notch service and protection. Whether you're driving on Veterans Parkway or parked at Illinois State, these providers understand local needs. Compare quotes for your perfect policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated October 2024

Company Facts

Full Coverage in Bloomington Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Bloomington Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Bloomington Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

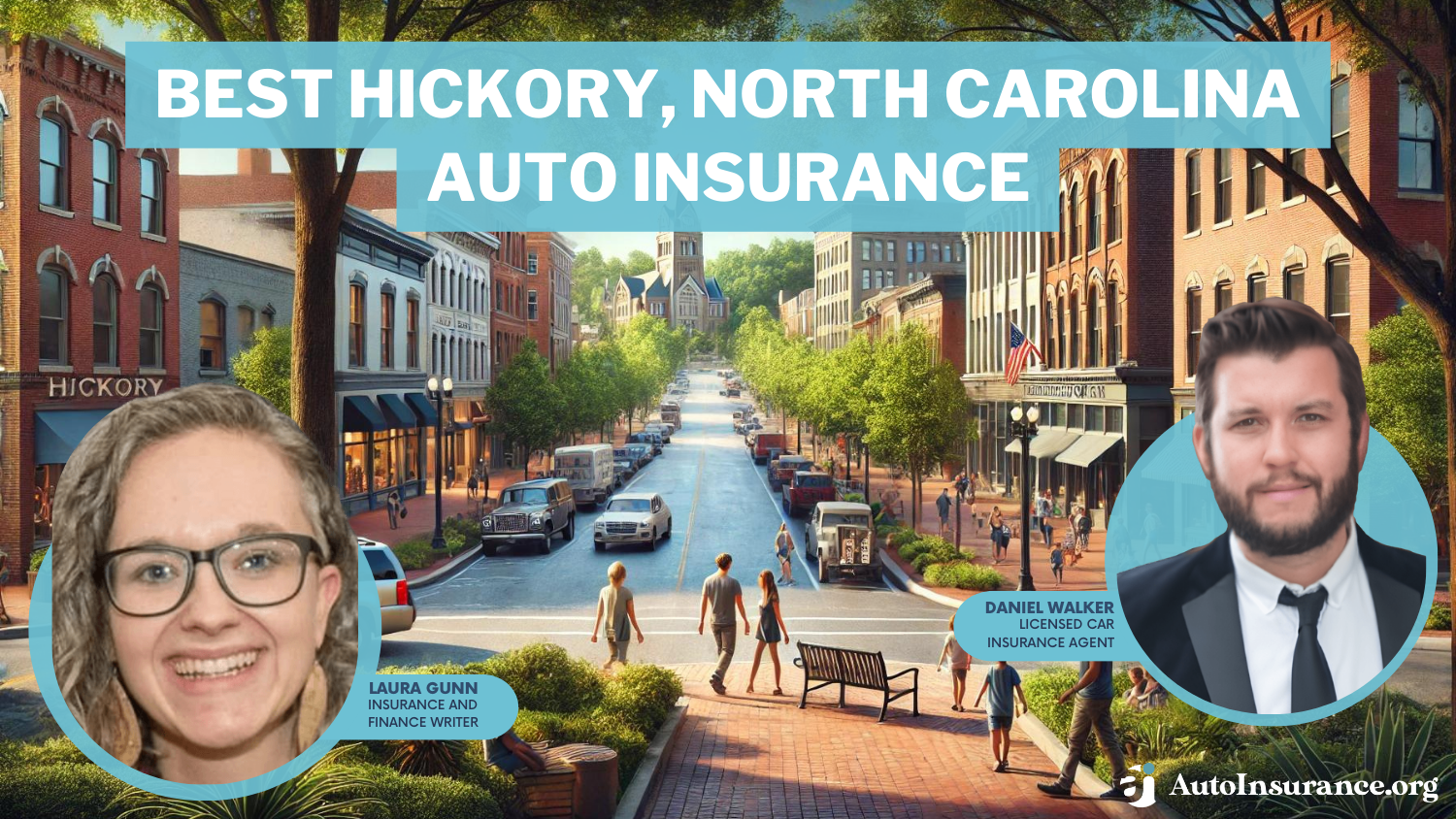

When looking for the best Bloomington, Illinois auto insurance, top providers like Erie, Travelers, and Farmers offer stellar coverage starting at just $75 monthly. Erie’s competitive options might just steal the show. Don’t let insurance woes slow you down when cruising through Bloomington.

Navigating Bloomington’s auto insurance maze? Don’t sweat it. While Illinois demands 25/50/20 coverage minimums, finding pocket friendly protection doesn’t have to be a headache. Stick with us for the inside scoop on snagging the best Bloomington, Illinois auto insurance without breaking the bank.

Our Top 10 Company Picks: Best Bloomington, Illinois Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Affordable Rates Erie

![]()

#2 8% A++ Comprehensive Options Travelers

#3 12% A Strong Coverage Farmers

#4 15% B Local Expertise State Farm

#5 10% A+ Competitive Pricing Progressive

#6 12% A+ Comprehensive Coverage Allstate

#7 10% A+ Flexible Policies Nationwide

#8 8% A Flexible Discounts Liberty Mutual

#9 11% A Personalized Service American Family

#10 10% A++ Reliable Coverage Auto-Owners

Shop around to get the best insurance in Bloomington that’ll keep you rolling without breaking the bank. By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- In Bloomington, Erie stands tall in the insurance industry

- The state of Illinois demands you a minimum insurance

- Seniors, set aside $138 each month for auto insurance in Bloomington

#1 – Erie: Top Overall Pick

Pros

- Cost-Effective Coverage: Erie’s $190 monthly rate in Bloomington outshines competitors, balancing affordability with essential protections for local drivers.

- Diverse Protection Plans: Bloomington motorists benefit from Erie’s wide-ranging options, addressing local weather and road conditions effectively.

- Accident Grace Period: Erie’s forgiveness program shields Bloomington residents from rate hikes after their first at-fault incident, preserving financial stability. Learn more information in our page titled, Erie auto insurance review.

Cons

- Limited Savings Options: Bloomington policyholders may find Erie’s discount selection less extensive than other local insurers, potentially limiting overall savings.

- Support Accessibility: Erie’s smaller presence in Bloomington could result in slower response times compared to larger insurance providers in the area.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Comprehensive Options

Pros

- Balanced Pricing: Travelers’ $200 monthly premium in Bloomington strikes a chord between cost-efficiency and thorough coverage for local drivers. Learn more information in our page titled Travelers auto insurance review.

- Discount Options: Bloomington residents can take advantage of Travelers’ discounts—safe driving and bundling policies. This cuts down on costs.

- Emergency Assistance: Travelers’ robust roadside support ensures Bloomington drivers receive prompt help during unexpected situations on local roads.

Cons

- Youthful Driver Rates: Bloomington’s younger motorists might face steeper premiums with Travelers compared to other local options.

- Out-of-Pocket Concerns: Higher deductibles for certain coverages could strain Bloomington residents’ finances during claims, impacting overall affordability.

#3 – Farmers: Best for Strong Coverage

Pros

- Tailored Safeguards: Farmers’ extensive options allow Bloomington drivers to craft policies matching their unique needs and local driving conditions. Learn more information in our page titled Farmers auto insurance review.

- Safe Driver Rewards: Bloomington’s cautious motorists can significantly reduce costs through Farmers’ good driver incentives, encouraging safer roads.

- Personalized Assistance: Farmers’ local representatives in Bloomington ensures drivers receive attentive, customized support for their insurance needs.

Cons

- Premium Pricing: At $210 monthly, Farmers’ rates in Bloomington may challenge budget-conscious drivers seeking more affordable coverage options.

- Digital Limitations: Bloomington policyholders might find Farmers’ online resources less comprehensive than tech-savvy competitors, impacting convenience.

#4 – State Farm: Best for Local Expertise

Pros

- Unbeatable Rates: State Farm’s $180 monthly premium leads the pack in Bloomington, offering full coverage at an unmatched price. Learn more information in our page titled State Farm auto insurance review.

- User-Friendly Mobile App: State Farm’s digital tools, including a user-friendly mobile app, make managing policies, filing claims, and accessing services convenient for tech-savvy Bloomington residents.

- Discount Variety: State Farm’s range of savings options helps Bloomington residents maximize their insurance dollar through various incentives.

Cons

- Customer Satisfaction Concerns: Some Bloomington policyholders report mixed experiences with State Farm’s service quality, affecting overall satisfaction.

- Limited Policy Flexibility: Bloomington drivers seeking highly customizable coverage might find State Farm’s options restrictive for specialized needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Competitive Pricing

Pros

- Economical Options: Progressive’s $195 monthly rate appeals to Bloomington’s cost-conscious drivers seeking comprehensive coverage without breaking the bank.

- Customizable Coverage: Bloomington motorists can tailor Progressive policies to match their specific driving habits and needs in the local area. Learn more information in our page titled Progressive auto insurance review.

- Snapshot Program: Progressive’s Snapshot program allows Bloomington drivers to potentially lower their premiums based on their actual driving habits. This usage-based insurance option is ideal for safe drivers looking to reduce costs further.

Cons

- High-Risk Driver Costs: Bloomington motorists with imperfect records might face elevated rates with Progressive, impacting affordability for some.

- Potential for Rate Increases: Progressive’s initial low rates may increase over time, especially if a driver’s risk profile changes or if they file multiple claims. This potential for rising costs could make long-term affordability a concern.

#6 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Safeguards: Allstate’s broad coverage selection ensures Bloomington drivers can secure comprehensive vehicle protection tailored to local needs.

- Exceptional Support: Bloomington policyholders praise Allstate’s responsive customer service and accessible local agents, enhancing overall satisfaction. This includes extensive protection and add-ons. Learn more information in our page titled Allstate auto insurance review.

- Diverse Cost-Cutting Measures: Allstate’s numerous discounts help Bloomington residents optimize their insurance spending through various savings opportunities.

Cons

- Premium Pricing: Allstate’s $220 monthly rate in Bloomington may deter drivers seeking more affordable options in the local market.

- High-Risk Limitations: Bloomington motorists with less-than-perfect records might find Allstate’s options restricted or costly, limiting accessibility.

#7 – Nationwide: Best for Flexible Policies

Pros

- Vanishing Deductible Program: Nationwide offers a vanishing deductible program, which reduces your deductible by $100 for each year of safe driving. Bloomington drivers who maintain a clean record can significantly lower their out-of-pocket expenses in case of a claim. Learn more information in our page titled Nationwide auto insurance review.

- Safe Driving Incentives: Bloomington’s careful motorists can capitalize on Nationwide’s significant safe driver discounts, encouraging responsible road behavior.

- Reliable Assistance: Nationwide’s efficient support network ensures Bloomington policyholders receive prompt, effective help when needed.

Cons

- Demographic Rate Variations: Certain Bloomington driver groups, particularly younger motorists, might face higher Nationwide premiums, affecting overall accessibility.

- Coverage Customization Limits: Bloomington residents seeking highly specialized policies might find Nationwide’s options somewhat restrictive for unique needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Flexible Discounts

Pros

- Adaptable Protection: Liberty Mutual enables Bloomington drivers to craft policies aligned with their unique circumstances and local driving conditions.

- Bundle Benefits: Bloomington residents can achieve substantial savings by combining auto and home coverage with Liberty Mutual. Learn more information in our page titled Liberty Mutual auto insurance review.

- Comprehensive Roadside Support: Liberty Mutual’s emergency assistance provides Bloomington drivers peace of mind during unexpected events on local roads.

Cons

- Cost Considerations: Liberty Mutual’s $210 monthly rate in Bloomington may be less appealing for budget-focused drivers seeking more affordable options.

- Varied Service Experiences: Some Bloomington policyholders report inconsistent satisfaction levels with Liberty Mutual’s support and claims handling processes.

#9 – American Family: Best for Personalized Service

Pros

- Value-Driven Pricing: American Family’s $200 monthly rate offers Bloomington drivers a balance of affordability and thorough coverage. Learn more information in our page titled American Family Auto Insurance Review.

- Savings Spectrum: Bloomington residents can access various discounts, potentially reducing their insurance expenses significantly through multiple incentives.

- Community-Focused Support: American Family’s strong local presence ensures Bloomington drivers receive personalized, attentive service tailored to area needs.

Cons

- Risk-Based Pricing: Some Bloomington drivers, particularly those with less-than-ideal records, might face higher American Family premiums.

- Tech Integration Gaps: Bloomington policyholders might find American Family’s digital tools less advanced than some competitors, impacting online convenience.

#10 –Auto-Owners: Best for Reliable Coverage

Pros

- Claims Satisfaction Guarantee: Auto-Owners offers a unique claims satisfaction guarantee, promising Bloomington residents a refund of their premium if they are not satisfied with the claims service. Learn more information in our page titled Auto-Owners auto insurance review.

- Superior Customer Care: Bloomington drivers praise Auto-Owners for its exceptional support and efficient claims processing, enhancing overall satisfaction.

- Attractive Incentives: Auto-Owners’ safe driving and multi-policy discounts help Bloomington residents optimize their insurance costs effectively.

Cons

- Policy Customization Limits: Bloomington motorists seeking highly specialized coverage might find Auto-Owners’ options somewhat restrictive for unique needs.

- High-Risk Driver Rates: Bloomington residents with imperfect driving records may face steeper premiums with Auto-Owners, affecting accessibility.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

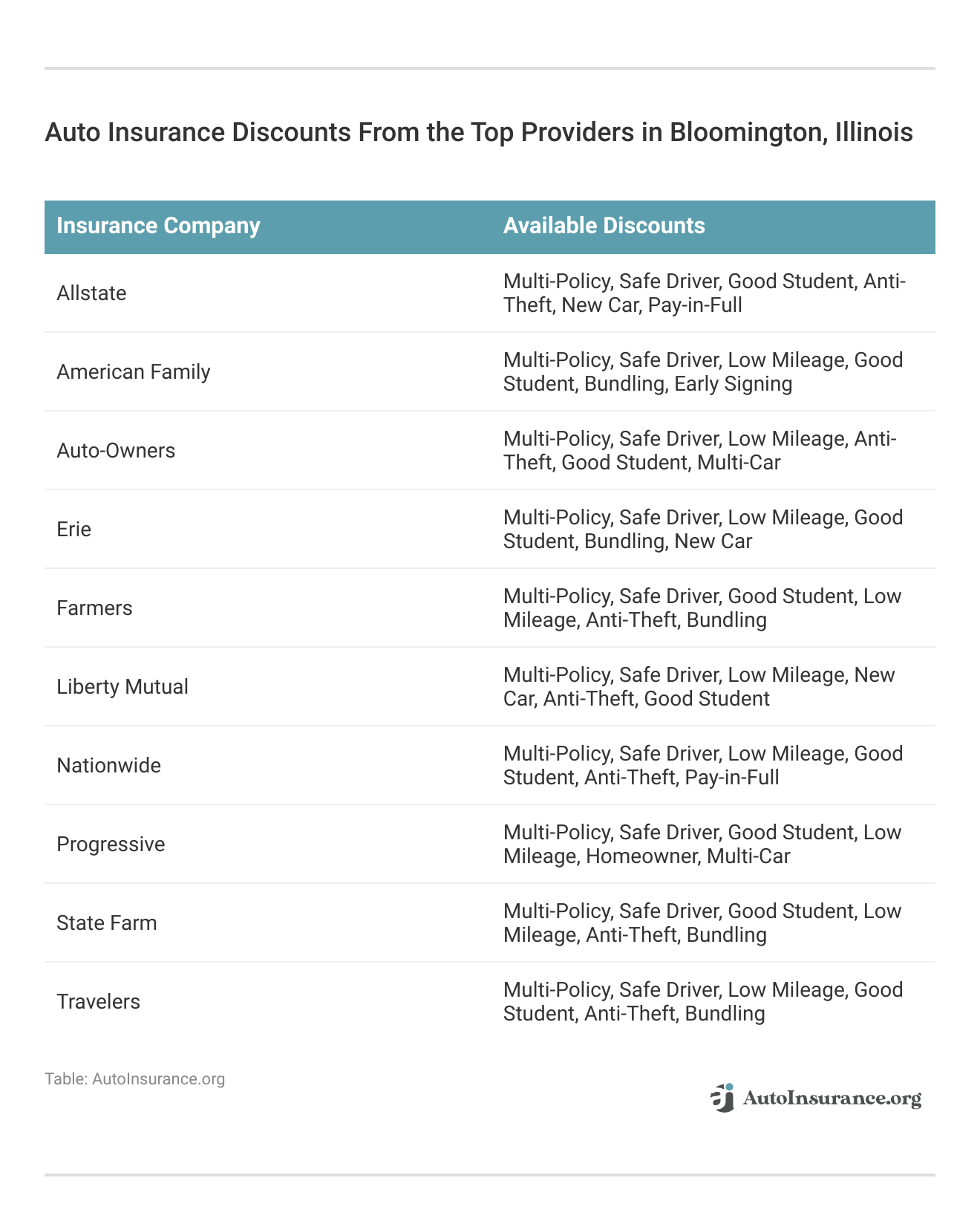

Discounts and Auto Insurance Rates in Bloomington, IL

Grip your steering wheels, Bloomington drivers. Here’s the stark truth of auto insurance costs in our Illinois heartland. From the bare minimum to full coverage, these numbers hit where it counts—in your wallet.

Bloomington, Illinois Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $220

American Family $87 $200

Auto-Owners $82 $195

Erie $80 $190

Farmers $90 $210

Liberty Mutual $90 $210

Nationwide $88 $205

Progressive $85 $195

State Farm $75 $180

Travelers $85 $200

Whether you’re a frugal student or a careful family provider, knowing these figures is your first step toward wise coverage choices. Below shows Bloomington, Illinois’ minimum auto insurance requirement:

- $25,000 for property damage liability coverage

- $25,000 for bodily injuries per person

- $50,000 for total bodily injury per accident

These rates are only the beginning. The best auto insurance premiums in Bloomington, Illinois, depends on things like your driving history and the car you drive.

Auto Insurance by Driving Behavior in Bloomington, IL

This detailed breakdown unveils how various driving infractions impact full coverage premiums across major insurance companies in Bloomington, IL. Interestingly, while most providers significantly hike rates for accidents and DUIs, some like Liberty Mutual and State Farm show more lenient increases for certain violations.

Bloomington, Illinois Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $268 | $460 | $355 | $431 |

| American Family | $212 | $303 | $241 | $401 |

| Farmers | $292 | $377 | $347 | $367 |

| Geico | $145 | $195 | $181 | $277 |

| Liberty Mutual | $147 | $208 | $166 | $183 |

| Nationwide | $137 | $175 | $157 | $205 |

| Progressive | $232 | $348 | $293 | $257 |

| State Farm | $165 | $198 | $181 | $181 |

| Travelers | $176 | $232 | $221 | $257 |

| USAA | $138 | $198 | $166 | $270 |

Individuals looking for cheap auto insurance for a bad driving record might find Nationwide and USAA to be good options, as they generally impose only slight rate hikes after an incident.

It’s important to note that these rates are averages and personal quotes can differ depending on various factors such as the severity of the violation, its timing, and the person’s overall driving history.

Auto Insurance Costs With DUI in Bloomington, Illinois

This table lays bare the cost of a DUI on full coverage premiums from different car insurance companies in Bloomington. Liberty Mutual and State Farm offer the most lenient rates post-DUI, while Allstate imposes the steepest penalty.

Bloomington, Illinois Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $431 |

| American Family | $401 |

| Farmers | $367 |

| Geico | $277 |

| Liberty Mutual | $183 |

| Nationwide | $205 |

| Progressive | $257 |

| State Farm | $181 |

| Travelers | $257 |

| USAA | $270 |

Drivers with a DUI should compare multiple providers, as the difference between the highest and lowest rates exceeds $250 monthly.

Bloomington’s Annual Driving Distance vs Coverage Costs

In Bloomington, how far you drive each year changes what you pay for insurance. The table makes it clear. Nationwide beats the rest, no matter if you drive a little or a lot.

Bloomington, Illinois Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $378 | $757 |

| American Family | $286 | $571 |

| Farmers | $346 | $691 |

| Geico | $196 | $392 |

| Liberty Mutual | $176 | $352 |

| Nationwide | $169 | $337 |

| Progressive | $283 | $565 |

| State Farm | $177 | $353 |

| Travelers | $213 | $426 |

| USAA | $188 | $376 |

All insurers double their rates when mileage increases from 6,000 to 12,000 annually. Car insurance agents in Bloomington can provide personalized advice on how these rates apply to individual cases and may recommend cheap usage-based auto insurance options for low-mileage drivers seeking additional savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bloomington Insurance Patterns – Age, Gender, and Provider Dynamics

This deep dive looks at how age and gender change the price of car insurance with different companies in Bloomington. Through examining a range of data, the study highlights significant patterns and trends, shedding light on how different demographic factors impact insurance premiums.

Bloomington, Illinois Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $629 | $820 | $288 | $311 | $239 | $240 | $250 | $250 |

| American Family | $514 | $708 | $178 | $230 | $178 | $178 | $164 | $164 |

| Farmers | $801 | $835 | $210 | $219 | $183 | $183 | $162 | $172 |

| Geico | $384 | $400 | $155 | $148 | $123 | $125 | $118 | $143 |

| Liberty Mutual | $361 | $401 | $113 | $119 | $108 | $116 | $89 | $100 |

| Nationwide | $293 | $372 | $126 | $136 | $109 | $111 | $98 | $103 |

| Progressive | $606 | $679 | $190 | $207 | $159 | $149 | $132 | $137 |

| State Farm | $333 | $421 | $126 | $146 | $112 | $112 | $100 | $100 |

| Travelers | $410 | $515 | $147 | $155 | $138 | $146 | $127 | $135 |

| USAA | $373 | $410 | $151 | $165 | $116 | $117 | $108 | $106 |

Notably, the data confirms that auto insurance rates higher for males, especially in younger age brackets, when comparing car insurance quotes in Bloomington, IL.

Insurance costs are generally higher for younger, single drivers, especially those under 25.Travis Thompson LICENSED INSURANCE AGENT

Differences between genders and age groups further influence rates, with older individuals often benefiting from lower auto insurance premiums.

Looking at prices from different companies like Geico, Liberty Mutual, and USAA can help you find the best deal for you. Picking the right insurance based on who you are can save you money.

Credit Scores and Car Coverage – Bloomington’s Financial Equation

Bloomington, IL insurance companies significantly adjust premiums based on credit scores. Allstate shows the most drastic rate hikes for poor credit, while Liberty Mutual offers the smallest gap.

Bloomington, Illinois Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $481 | $349 | $305 |

| American Family | $383 | $262 | $222 |

| Farmers | $392 | $330 | $314 |

| Geico | $320 | $157 | $122 |

| Liberty Mutual | $248 | $156 | $124 |

| Nationwide | $200 | $163 | $143 |

| Progressive | $320 | $274 | $254 |

| State Farm | $264 | $158 | $122 |

| Travelers | $270 | $218 | $177 |

| USAA | $256 | $177 | $146 |

Interestingly, some insurers charge those with bad credit nearly triple the rate of good credit customers. Does getting an auto insurance quote hurt your credit score? Fortunately, it doesn’t, as insurers typically use a soft inquiry, allowing consumers to shop around without impacting their credit.

Auto Insurance Premiums in Bloomington, IL Based on ZIP Code

This table reveals subtle variations in Bloomington car insurance rates across different ZIP codes. The 61702 area commands the highest premiums, while 61704 offers the most affordable rates.

Bloomington, Illinois Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 61701 | $237 |

| 61702 | $254 |

| 61704 | $235 |

| 61705 | $239 |

In Bloomington, Illinois, the cost of auto insurance differs depending on your ZIP code. Even if you’re in a tough spot, like being homeless, you can still find a policy that fits your situation. Check out our page titled, “Cheap Auto Insurance When Homeless” for more information.

We’ve found a way to get you cheap car insurance in Bloomington, IL. This isn’t just a table below—it’s a chance to cut your premiums while keeping your coverage strong.

Good student bonuses and safe driver rewards are out there, and insurers are eager to ease your burden. So, use this information wisely, but keep your focus on the big picture—finding the best auto insurance in Bloomington, Illinois, that gives you solid coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Bloomington, Illinois Auto Insurance Cost Factors

Understanding what drives insurance costs in Bloomington is crucial for finding the best coverage. Local factors like traffic patterns and crime rates uniquely impact premiums in this Illinois city.

Every insurance company in Bloomington, IL uses proprietary algorithms to calculate rates, considering the top 7 factors that affect auto insurance rates. These typically include age, driving record, credit score, vehicle type, commute time, coverage level, annual mileage, and location within the city.

Bloomington’s Commute Time

Bloomington’s average commute time impacts local auto insurance premiums. Shorter travel distances often mean lower rates when searching for an Illinois car insurance quote.

Rush hour traffic density in Bloomington can influence accident risk assessments. Understanding your daily drive helps insurers accurately price your policy. Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Frequently Asked Questions

How can I find the best auto insurance in Bloomington, IL?

Start by comparing auto insurance quotes in Bloomington, IL from multiple insurance providers. Look for companies that offer competitive rates, strong customer service, and comprehensive coverage options. Consider factors like discounts, policy customization, and the company’s financial strength to ensure you get the best value for your coverage.

Is auto insurance mandatory in Bloomington, IL?

Yes, auto insurance is mandatory in Bloomington, IL. Like most states, Illinois requires all drivers to carry a minimum amount of auto insurance to legally operate a vehicle on public roads. For more information, read our article titled “When did auto insurance become mandatory?”

What are the minimum auto insurance requirements in Bloomington, IL?

Drivers in Bloomington, IL must carry at least the state-mandated minimum coverage, which includes $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $20,000 for property damage.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Can I purchase additional coverage beyond the minimum requirements?

Yes, purchasing additional coverage beyond the minimum requirements is advisable. Options such as higher liability limits, comprehensive and collision coverage, and medical payments coverage can provide enhanced financial protection in the event of an accident or other incidents.

How are auto insurance rates determined in Bloomington, IL?

Auto insurance rates in Bloomington, IL are influenced by several factors, including your driving history, age, gender, type of vehicle, coverage limits, and deductible amounts. Additionally, insurance companies consider local factors such as the frequency of accidents and thefts in the area.

Read More: Why do auto insurance rates vary so much?

Are there any discounts available for auto insurance in Bloomington, IL?

Yes, many insurance companies offer discounts that can help you save on your auto insurance premiums in Bloomington, IL. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles with certain safety features.

What should I do after a car accident in Bloomington, IL?

After a car accident in Bloomington, IL, you should ensure everyone’s safety, call the police to file a report, exchange information with the other driver(s), take photos of the accident scene, and contact your insurance company to start the claims process.

Can my credit history affect my auto insurance rates in Bloomington, IL?

Yes, your credit history can impact your auto insurance rates in Bloomington, IL. Insurers often use credit scores as one of the factors in determining premiums, with better credit scores generally leading to lower rates.

How can I lower my auto insurance premiums in Bloomington, IL?

To lower your auto insurance premiums in Bloomington, IL, you can consider raising your deductible, bundling multiple policies with the same insurer, maintaining a clean driving record, and taking advantage of available discounts, such as safe driver or good student discounts. Read our article titled “How to Lower Your Auto Insurance Rates” for more information.

Does the length of my daily commute affect my auto insurance rates in Bloomington, IL?

Yes, the length of your daily commute can influence your auto insurance rates in Bloomington, IL. Longer commutes typically result in higher premiums because more time on the road increases the risk of accidents.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

What insurance company is based in Bloomington, IL?

Who is the cheapest full coverage auto insurance?

How much is full coverage auto insurance in Illinois?

Which one is the best insurance?

What is the most popular type of insurance?

Which cover type is best for car insurance?

How many insurance companies are in Indiana?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.