Best Charleston, South Carolina Auto Insurance in 2026 (Check Out These 10 Providers)

For the best Charleston, South Carolina auto insurance, State Farm, USAA, and Progressive lead the market. State Farm, at $85 per month, is best for its nationwide network. USAA shines with military benefits, while Progressive offers superior coverage options in car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Charleston South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Charleston South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Charleston South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top pick for the best Charleston, South Carolina auto insurance is State Farm, known for its exceptional nationwide network and competitive rate of $85 per month.

State Farm leads among the best options for Charleston drivers, offering extensive coverage and reliability. USAA excels in providing outstanding benefits for military families, while Progressive is noted for its flexible car insurance coverage.

Our Top 10 Company Picks: Best Charleston, South Carolina Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | B | Nationwide Network | State Farm | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 12% | A+ | Coverage Options | Progressive | |

| #4 | 20% | A+ | Broad Coverage | Allstate | |

| #5 | 14% | A | Customizable Policies | Farmers | |

| #6 | 12% | A | Unique Discounts | Liberty Mutual |

| #7 | 10% | A++ | Flexible Coverage | Travelers | |

| #8 | 15% | A+ | Variety Discounts | Nationwide |

| #9 | 12% | A+ | Senior Discounts | The Hartford |

| #10 | 18% | A | Membership Benefits | AAA |

These companies stand out by consistently delivering excellent service tailored to various needs, including the provision of full coverage auto insurance.

Find the best comprehensive auto insurance quotes by entering your ZIP code above into our free comparison tool today.

- State Farm is highly rated for its comprehensive coverage options in Charleston

- State Farm offers the best nationwide network for Charleston auto insurance

- State Farm provides competitive monthly rates, starting at $85

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Coverage Options: Provides extensive coverage tailored for Charleston, South Carolina drivers, including liability, collision, and comprehensive plans.

- Competitive Monthly Rates: Rates start at $190, offering affordability for quality auto insurance specific to Charleston.

- Nationwide Networks: State Farm flaunts a strong nationwide network, featuring extensive coverage options and consistent service in Charleston, South Carolina, which you can explore in our State Farm review.

Cons

- Limited Discount Programs: Offers fewer discounts specific to Charleston compared to competitors, which may impact potential savings.

- Claims Processing Speed: Some customers in Charleston report slower-than-average claims processing, which can affect the timeliness of issue resolution.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA showcases top military benefits in Charleston, offering tailored services and discounts that underscore their dedication to military members and their families, which you can learn about in our USAA review.

- Competitive Rates for Qualified Drivers: Offers some of the lowest rates for eligible drivers in Charleston, enhancing affordability for comprehensive auto insurance.

- Top-Rated Customer Service: Known for excellent customer service and efficient claims processing, benefiting Charleston policyholders with reliable support.

Cons

- Restricted Eligibility: Exclusive to military members and their families in Charleston, restricting access for others.

- Limited Local Office Presence: Fewer physical locations in Charleston compared to other insurers, potentially reducing convenience for in-person customer service and support.

#3 – Progressive: Best for Coverage Options

Pros

- Competitive Rates: Provides attractive pricing with multiple discount opportunities, making it a strong choice for affordable auto insurance in Charleston.

- Flexible Coverage Options: Progressive highlights its flexible coverage in Charleston, offering customizable plans that cater to diverse customer needs. Read our Progressive review to learn more.

- Unique Tools and Discounts: Features tools like the Snapshot program, which can help Charleston drivers save on their premiums based on driving habits.

Cons

- Higher Premiums for Some Drivers: Despite competitive rates, some Charleston drivers may find higher premiums due to individual risk factors or driving history.

- Variable Customer Service: Customer service experiences can vary, with some Charleston policyholders reporting inconsistent support and longer wait times for claims processing.

#4 – Allstate: Best for Broad Coverage

Pros

- Broad Coverage Options: Allstate highlights its broad coverage options, featuring comprehensive plans in Charleston that manifest a strong commitment to protecting a wide range of customer needs, as detailed in our Allstate review.

- Local Discounts: Offers specific discounts for Charleston drivers, such as safe driver and multi-policy discounts, which can lower overall premiums.

- Strong Local Presence: Well-established in Charleston, providing accessible local agents and support for personalized service and claims assistance.

Cons

- Higher Average Premiums: Premiums can be higher compared to some competitors, which may impact affordability for Charleston drivers.

- Inconsistent Claims Handling: Some Charleston policyholders report variability in claims processing efficiency, leading to potential delays in resolving insurance issues.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customizable Policies

Pros

- Local Discounts: Provides discounts specific to Charleston drivers, such as multi-car and bundling discounts, which can reduce overall insurance costs.

- Customizable Policies: Farmers showcases customizable policies, offering flexible options tailored to meet individual needs, making them a strong choice for Charleston auto insurance. Read our Farmers review to see how it can work for you.

- Strong Local Agent Network: With numerous agents in Charleston, Farmers ensures accessible, personalized service and support for local policyholders.

Cons

- Higher Premiums for Some Drivers: Rates for the best Charleston, South Carolina auto insurance can be higher for certain drivers, impacting affordability.

- Inconsistent Service Experience: Customer service experiences can vary, with some Charleston drivers reporting issues with claims processing and support responsiveness.

#6 – Liberty Mutual: Best for Unique Discounts

Pros

- Comprehensive Coverage Options: Provides extensive coverage plans tailored for the best Charleston, South Carolina auto insurance, including options for roadside assistance and rental reimbursement.

- Unique Discounts: Liberty Mutual spotlights its unique discounts, showcasing innovative savings tailored to Charleston drivers. Discover more in our Liberty Mutual review.

- Customizable Policies: Allows Charleston residents to tailor their auto insurance coverage with add-ons and enhancements suited to their needs.

Cons

- Higher Premiums for Some: Rates for the best Charleston, South Carolina auto insurance can be higher compared to other providers, potentially affecting overall affordability.

- Variable Claims Experience: Some Charleston drivers report inconsistencies in claims handling and customer service, leading to potential delays and dissatisfaction.

#7 – Travelers: Best for Flexible Coverage

Pros

- Extensive Coverage Options: Offers a variety of coverage plans for the best Charleston, South Carolina auto insurance, including options like accident forgiveness and new car replacement.

- Attractive Local Discounts: Provides Charleston drivers with discounts such as safe driver and multi-policy savings, which can reduce overall insurance costs.

- Advanced Tools: Travelers spotlights its advanced tools, showcasing innovative features that enhance the customer experience and simplify insurance management in Charleston. Find out more in our Travelers Mutual review.

Cons

- Higher Premiums for Some Drivers: Rates for the best Charleston, South Carolina auto insurance may be higher for certain drivers, impacting affordability.

- Inconsistent Customer Service: Some Charleston policyholders report variability in customer service quality, which can lead to challenges in claims processing and support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Variety Discounts

Pros

- Comprehensive Coverage Options: Offers extensive coverage plans tailored for the best Charleston, South Carolina auto insurance, including features like vanishing deductible and accident forgiveness.

- Local Discounts: Provides specific discounts for Charleston drivers, such as those for safe driving and bundling multiple policies, which can lower overall costs.

- Strong Customer Support: Nationwide spotlights outstanding customer support in Charleston, offering responsive service and personalized help that showcases their commitment to client satisfaction. For more details, read our Nationwide review.

Cons

- Potentially Higher Premiums: Rates for the best Charleston, South Carolina auto insurance can be higher compared to some competitors, which may affect affordability for some drivers.

- Limited Availability of Discounts: Some discount options may not be as extensive or easily accessible for Charleston residents compared to other providers.

#9 – The Hartford: Best for Senior Discounts

Pros

- Excellent Coverage Options: Provides a range of coverage plans for the best Charleston, South Carolina auto insurance, including features like lifetime car repair guarantees and new car replacement.

- Local Discounts Available: The Hartford spotlights local discounts, offering tailored deals that highlight their commitment to the best Charleston, South Carolina auto insurance. Discover our The Hartford review for more details

- Strong Local Customer Service: Known for high-quality customer service in Charleston, ensuring responsive support and effective claims handling.

Cons

- Higher Premiums for Some Drivers: Rates for the best Charleston, South Carolina auto insurance may be higher for certain drivers, impacting overall affordability.

- Limited Availability of Discounts: Some discount opportunities may not be as extensive or accessible in Charleston compared to other insurance providers.

#10 – AAA: Best for Membership Benefits

Pros

- Comprehensive Coverage Plans: Offers extensive coverage options for the best Charleston, South Carolina auto insurance, including roadside assistance and accident forgiveness.

- Local Discounts and Benefits: Provides specific discounts for Charleston drivers, such as multi-car and bundling savings, enhancing affordability.

- Strong Local Presence: AAA highlights its strong local presence in Charleston, featuring agents who demonstrate deep community ties and personalized service, which is covered in our AAA review.

Cons

- Potentially Higher Premiums: Rates for the best Charleston, South Carolina auto insurance can be higher compared to some competitors, which may affect affordability.

- Limited Online Tools: May have fewer online tools and digital features for managing policies compared to other insurers, which could impact convenience for Charleston residents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Charleston, South Carolina

In Charleston, South Carolina, the minimum auto insurance requirements include liability coverage to meet state financial responsibility laws. This basic coverage must include bodily injury and property damage limits that meet or exceed state-mandated amounts. While meeting these minimums is essential for legal compliance, they may not provide comprehensive protection.

For those seeking the best Charleston, South Carolina auto insurance, considering higher coverage limits and additional options can offer better protection and peace of mind beyond the state’s minimum requirements.

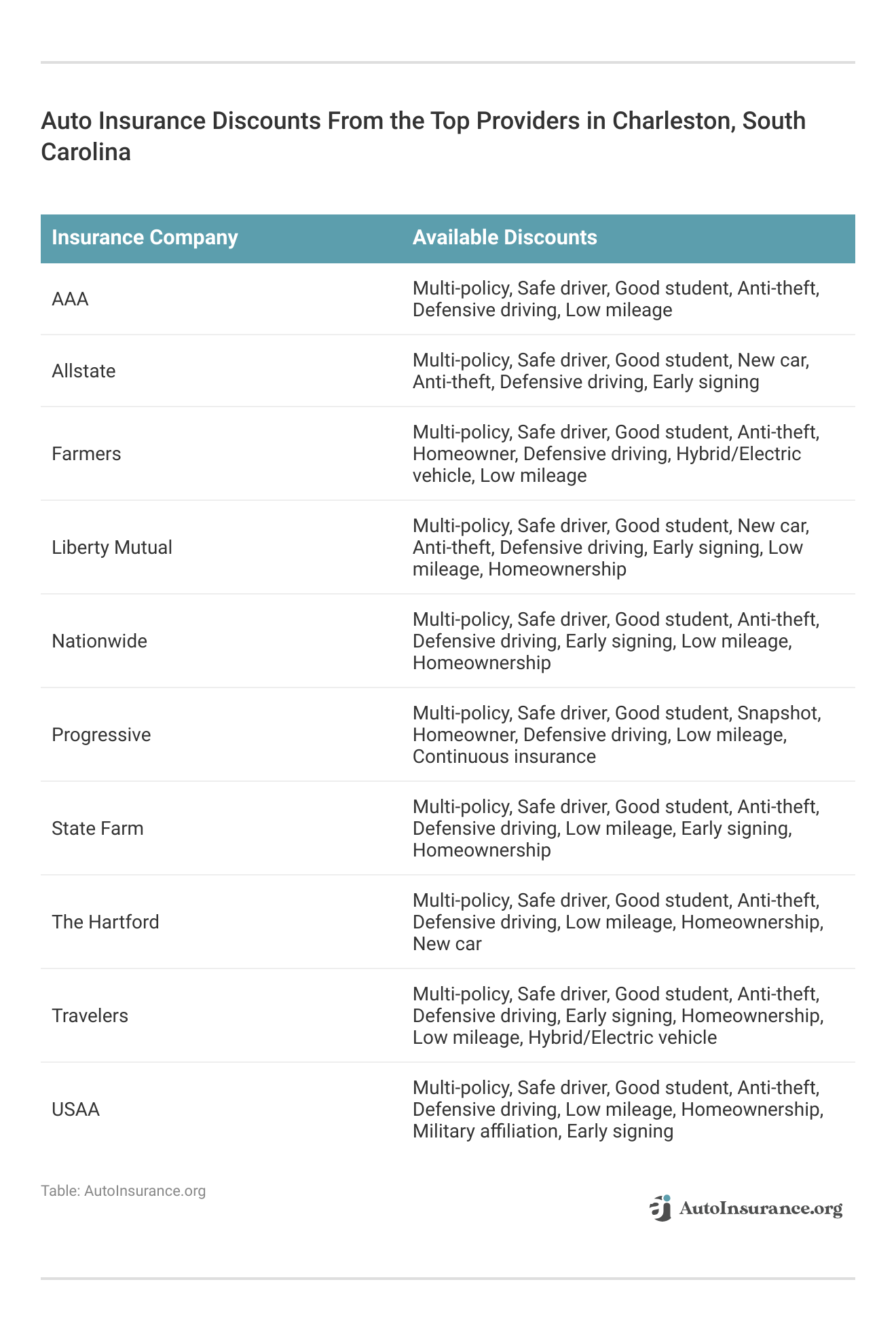

Best Charleston, South Carolina Auto Insurance Rates by Coverage Level

The level of coverage you choose directly affects the cost of best Charleston, South Carolina auto insurance. Opting for higher coverage limits or additional features, such as comprehensive and collision coverage, typically results in higher premiums. Conversely, selecting lower coverage levels or opting for only the minimum required can reduce your insurance costs.

Charleston, South Carolina Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $100 | $215 |

| Allstate | $100 | $210 |

| Farmers | $95 | $200 |

| Liberty Mutual | $105 | $220 |

| Nationwide | $88 | $185 |

| Progressive | $90 | $185 |

| State Farm | $85 | $190 |

| The Hartford | $97 | $205 |

| Travelers | $92 | $195 |

| USAA | $75 | $175 |

To find the best Charleston, South Carolina auto insurance at an affordable rate, it’s crucial to balance your coverage needs with your budget to ensure you receive the protection you need without overpaying. Review the specific coverage needed for the best Charleston, South Carolina auto insurance to ensure compliance with local regulations. To delve deeper, refer to our in-depth report titled “How Much Coverage You Need?”

Best Charleston, South Carolina Auto Insurance by Age, Gender, and Marital Status

When seeking the best Charleston, South Carolina auto insurance, age, gender, and marital status play significant roles in determining rates. Insurance companies often offer varying premiums based on these factors, with younger drivers typically facing higher costs compared to older, more experienced drivers.

State Farm offers the best Charleston, South Carolina auto insurance with its affordable rates and extensive local network.Brad Larson Licensed Insurance Agent

Gender and marital status also influence rates, with married individuals and female drivers often receiving lower premiums. For those searching for the best Charleston, South Carolina auto insurance, understanding how these demographic factors affect pricing can help in finding affordable coverage tailored to your personal situation. To gain further insights, consult our comprehensive guide titled “How Insurance Providers Determine Rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Charleston, South Carolina Auto Insurance by Driving Record

The best Charleston, South Carolina auto insurance rates vary depending on your driving record, with clean driving records generally leading to the most affordable premiums. Insurers typically reward safe drivers with lower rates, reflecting their reduced risk.

Conversely, accidents or traffic violations can significantly raise your premiums. Factors That Affect Auto Insurance Rates include your driving history, vehicle type, and coverage options.

Best Charleston, South Carolina Auto Insurance by Credit History

When searching for the best auto insurance in Charleston, South Carolina, your credit history can play a crucial role in determining your premium. Insurance companies often use credit scores to assess risk, with higher scores generally leading to lower rates.

By maintaining a good credit history, you can potentially secure more affordable coverage options and better terms. Therefore, it’s beneficial to review your credit report regularly and address any issues to ensure you receive the best auto insurance rates available. For detailed information, refer to our comprehensive report titled “How Credit Scores Affect Auto Insurance Rates.”

Best Auto Insurance in Charleston, South Carolina

When searching for the best Charleston, South Carolina auto insurance, finding the cheapest options by category is crucial for maximizing value. This involves evaluating various insurance providers based on their affordability for specific coverage types, such as liability, collision, and comprehensive insurance.

State Farm stands out in Charleston, South Carolina, for its combination of affordable auto insurance rates and a robust local agent network, making it a top choice for comprehensive coverage.Dani Best Licensed Insurance Producer

By comparing these categories, you can identify which insurers offer the most cost-effective solutions while still meeting your coverage needs. The best Charleston, South Carolina auto insurance not only provides adequate protection but also helps you stay within your budget by offering competitive rates across different coverage categories.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Charleston, South Carolina Auto Insurance Companies

When evaluating the best Charleston, South Carolina auto insurance, it’s essential to consider the cheapest auto insurance companies by category to find the most affordable rates. This means looking at which insurers offer the lowest premiums for various coverage types, such as liability, collision, and comprehensive auto insurance.

By identifying these top-rated providers in each category, you can secure the best Charleston, South Carolina auto insurance that fits your budget without compromising on coverage quality. Comparing these companies helps ensure you get the most cost-effective solution tailored to your needs.

Frequently Asked Questions

What is the best Charleston, South Carolina auto insurance?

The best Charleston, South Carolina auto insurance varies depending on individual needs, but top options often include comprehensive coverage, competitive rates, and strong customer service from local insurance companies.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Where can I find auto insurance quotes in Charleston, SC?

You can find auto insurance quotes in Charleston, SC through local insurance companies, online comparison tools, and insurance brokers who specialize in Charleston, South Carolina auto insurance.

What are the local Charleston, SC insurance companies offering the best auto insurance coverage?

Local Charleston, SC insurance companies offering the best auto insurance coverage typically include those with strong customer reviews, comprehensive auto insurance policies, and competitive rates, such as those listed in reviews for best Charleston, South Carolina auto insurance.

When should I review my auto insurance coverage in Charleston, SC?

You should review your auto insurance coverage in Charleston, SC annually or whenever you experience major life changes, such as moving or purchasing a new vehicle, to ensure you have the best Charleston, South Carolina auto insurance.

Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code below to begin.

How can I get the best car insurance rates in Charleston?

To get the best car insurance rates in Charleston, South Carolina, compare quotes from multiple local insurance companies, maintain a clean driving record, and inquire about available discounts.

How does my credit history affect my auto insurance rates in Charleston, SC?

Your credit history can affect your auto insurance rates in Charleston, SC, as insurers often use credit scores to assess risk, with higher scores generally leading to lower premiums and better coverage options. For a comprehensive analysis, refer to our detailed guide titled “How Credit Scores Affect Auto Insurance Rates.”

How much is car insurance in Charleston, South Carolina?

The cost of car insurance in Charleston, South Carolina varies based on factors like your driving history, vehicle type, and coverage level, but you can get accurate rates by requesting quotes from local insurance providers.

Which company gives the best insurance in Charleston, SC?

The company that gives the best insurance in Charleston, SC depends on individual needs and preferences, but top-rated companies often offer excellent coverage options, competitive rates, and reliable customer service.

Why is car insurance so expensive in South Carolina?

Car insurance can be expensive in South Carolina due to factors like high population density, higher accident rates, and state regulations that impact insurance premiums, making it important to find the best Charleston, South Carolina auto insurance for cost-effectiveness.

What are the best car insurance policies in Charleston, SC?

The best car insurance policies in Charleston, SC include those that offer comprehensive coverage, affordable premiums, and additional benefits like roadside assistance and rental car coverage, tailored to local needs.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.