Cheap Gap Insurance in Louisiana (10 Most Affordable Companies for 2026)

State Farm, The Hartford, and Progressive top the list for cheap gap insurance in Louisiana. Minimum monthly rates start at $30 with State Farm, but senior drivers can lower Louisiana gap insurance costs with exclusive discounts from The Hartford. Get the best gap insurance in Louisiana with these top providers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Updated October 2024

Company Facts

Min. Coverage for Gap Insurance in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap Insurance in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap Insurance in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap gap insurance in Louisiana are State Farm, The Hartford, and Progressive, offering reliable coverage with proven customer satisfaction.

These providers have the best Louisiana auto insurance for all types of drivers who need gap coverage on their auto lease or loan. State Farm is the cheapest gap insurance company, but The Hartford has the best rates for seniors while USAA specializes in military discounts.

Our Top 10 Company Picks: Cheap Gap Insurance in Louisiana

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | B | Wide Network | State Farm | |

| #2 | $35 | A++ | Senior Drivers | The Hartford |

| #3 | $38 | A+ | Flexible Options | Progressive | |

| #4 | $40 | A+ | Strong Coverage | Allstate | |

| #5 | $42 | A | Discount Opportunities | Liberty Mutual |

| #6 | $45 | A | Local Presence | Farmers | |

| #7 | $47 | A++ | Military Focus | USAA | |

| #8 | $49 | A+ | Comprehensive Coverage | Nationwide |

| #9 | $53 | A++ | Customizable Options | Travelers | |

| #10 | $55 | A | Customer Service | American Family |

Whether you’re looking for budget-friendly options or top-notch service, these companies deliver unmatched value.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

- State Farm is the top pick for cheap gap insurance in Louisiana at $30/month

- The Hartford and Progressive also offer budget-friendly gap insurance rates

- Gap insurance in Louisiana protects against vehicle depreciation

#1 – State Farm: Top Overall Pick

Pros

- Extensive Agent Support: State Farm gap insurance in Louisiana is backed by one of the largest networks of agents, offering personalized and accessible customer service.

- Most Affordable Rates: State Farm offers the lowest starting rates for gap insurance in Louisiana at $30 per month. See more details in our article titled State Farm auto insurance review.

- Comprehensive Discounts: State Farm provides a variety of discounts for gap insurance in Louisiana, including multi-policy and good driver discounts, adding further value.

Cons

- Agent Dependency: Heavy reliance on local agents for policy management might be inconvenient for customers preferring online management of gap insurance in Louisiana.

- Financial Rating: State Farm’s B rating from A.M. Best is much lower than other Louisiana gap insurance companies on this list.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The Hartford: Cheapest for Seniors

Pros

- Competitive Rates: The Hartford offers gap insurance in Louisiana at competitive rates, starting at $35/month. Compare quotes for free in The Hartford review.

- Senior Discounts: The Hartford is designed to sell cheap Louisiana gap insurance for seniors with special savings and policy offers for AARP members.

- Multi-Vehicle Discounts: Insure more than one car with The Hartford to get up to 25% off Louisana gap insurance rates.

Cons

- Membership Required: The Hartford gap insurance is only available to senior drivers over 65 who are Louisiana AARP members.

- Average Claims Experience: The Hartford gap insurance claims are average in Louisiana, but other companies on this list have much higher ratings and reviews.

#3 – Progressive: Cheapest Flexible Options

Pros

- Diverse Coverage Options: Progressive stands out for its wide range of additional coverage options that can be bundled with gap insurance in Louisiana, offering comprehensive protection.

- UBI Discount Programs: Special usage-based insurance (UBI) discount opportunities are available for Louisiana gap insurance through Progressive Snapshot.

- Strong Financial Standing: Its A+ rating from A.M. Best indicates confidence in its gap insurance offerings in Louisiana. Check out our Progressive auto insurance review for full ratings.

Cons

- Complex Discount Criteria: Some Progressive gap insurance discounts have stringent eligibility requirements, making them difficult for some customers to access.

- Average Customer Satisfaction Ratings: Louisiana gap insurance reviews of Progressive aren’t bad, but drivers have better experiences at other companies on average.

#4 – Allstate: Best for Strong Coverage

Pros

- Robust Coverage Options: Allstate provides some of the most comprehensive coverage options to tailor gap insurance in Louisiana.

- High Claims Satisfaction: Allstate is known for its high claims satisfaction rates, making it a reliable choice for gap insurance in Louisiana.

- Multi-Policy Discounts: Allstate offers 25% discounts for customers who bundle gap insurance in Louisiana with other policies. Discover more savings in our Allstate auto insurance review.

Cons

- Complicated Policy Terms: The terms and conditions for gap insurance in Louisiana with Allstate can be complex and difficult for some customers to understand fully.

- Lengthy Quote Process: Obtaining a quote for gap insurance in Louisiana from Allstate can be more time-consuming compared to other providers, which may deter potential customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best Discount Opportunities

Pros

- Comprehensive Discount Options: Liberty Mutual offers a broad range of discounts for gap insurance in Louisiana, making it easier for customers to save on their premiums.

- Strong Online Resources: Liberty Mutual provides a comprehensive digital platform for managing gap insurance in Louisiana, with tools for everything from policy management to claims filing.

- Local Agent Access: Customers in Louisiana can benefit from Liberty Mutual’s local agents, who provide personalized support and guidance for gap insurance.

Cons

- Poor Customer Satisfaction: Liberty Mutual has one of the lowest ratings for customer satisfaction from gap insurance shoppers in Louisiana. Get full rankings in our Liberty Mutual auto insurance review.

- Strict Discount Qualifications: Some discounts for gap insurance in Louisiana require customers to meet specific criteria that may be difficult for everyone to achieve.

#6 – Farmers: Best for Local Presence

Pros

- Strong Local Agent Support: Farmers provides gap insurance in Louisiana through a well-established network of local agents, offering personalized service and guidance.

- Customizable Policies: Farmers offers a range of customizable options for gap insurance in Louisiana, allowing drivers to tailor their coverage to meet specific needs.

- Bundling Discounts: Farmers offers significant discounts when gap insurance in Louisiana is bundled with other policies. Get a full list of the best Farmers insurance discounts.

Cons

- Poor Customer Service: Farmers is at the bottom of the list for customer satisfaction when it comes to gap insurance in Louisiana.

- Limited Online Tools: Farmers’ digital platform for managing gap insurance in Louisiana is less robust compared to other top providers, making online policy management less convenient.

#7 – USAA: Cheapest for Military Families

Pros

- Exclusive Military Focus: USAA provides gap insurance in Louisiana specifically tailored to the needs of military members and their families, offering unique benefits and coverage options.

- Top-Tier Financial Stability: USAA’s A++ rating from A.M. Best underscores its financial strength, making it a reliable choice for gap insurance in Louisiana.

- Exceptional Customer Service: USAA consistently receives high marks for customer service, ensuring a positive experience for gap insurance in Louisiana. Get the details in our USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA gap insurance in Louisiana is only available to military members and their families, limiting its accessibility to the general public.

- Higher Rates for Non-Bundled Policies: Louisiana gap insurance with USAA may be more expensive if not bundled with other policies, such as homeowners insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Cheapest Comprehensive Coverage

Pros

- Financial Rating: Nationwide’s A+ rating from A.M. Best indicates strong financial stability, ensuring reliable gap insurance in Louisiana. Our Nationwide auto insurance review shows more.

- Strong Claims Handling: Nationwide is known for its efficient and fair claims process for gap insurance in Louisiana, providing peace of mind to policyholders.

- Multi-Policy Discounts: Nationwide offers substantial discounts for bundling gap insurance in Louisiana with other policies.

Cons

- Above-Average Premiums: Gap insurance in Louisiana with Nationwide starts at $49 per month, which is higher than many competitors, potentially limiting its appeal.

- Complex Policy Terms: Some customers find the terms and conditions for gap insurance in Louisiana with Nationwide to be complex and difficult to navigate.

#9 – Travelers: Cheapest Customizable Options

Pros

- Cheap Customization: Louisiana drivers can tailor gap insurance to their needs at Travelers with unique coverage options that are often more expensive with most companies.

- Financial Strength: Travelers’ A++ rating from A.M. Best reflects its superior financial stability, ensuring reliable gap coverage in Louisiana. Get full ratings in our Travelers auto insurance review.

- Safe Driving Rewards: Safe drivers in Louisana can save 25% on gap insurance with Travelers safe driver discounts.

Cons

- Digital-First Focus: Travelers’ emphasis on online policy management for gap insurance in Louisiana might not appeal to customers who prefer more personalized, in-person service.

- Poor Customer Service: Louisiana drivers complain of slow gap insurance claims processing and difficulties with the website.

#10 – American Family: Best Customer Service

Pros

- Strong Customer Service: American Family is known for its strong customer service, ensuring a positive experience for gap insurance policyholders in Louisiana.

- Flexible Payment Plans: American Family offers various payment plans for gap insurance in Louisiana, allowing customers to choose an option that best fits their budget.

- Local Agent Support: American Family’s extensive network of local agents provides personalized service and support for gap insurance in Louisiana, enhancing customer satisfaction.

Cons

- Strict Discount Qualifications: Some discounts for gap insurance in Louisiana require meeting stringent criteria. Learn more in our online American Family review.

- Potential for Rate Increases: Renewal rates for gap insurance in Louisiana with American Family may increase, impacting long-term affordability.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Gap Insurance Rates in Louisiana

The monthly premiums for gap insurance in Louisiana vary depending on the insurance company and the level of coverage you select.

Choosing the right gap insurance involves understanding the cost differences among providers. The table below presents a side-by-side comparison of monthly rates for both minimum and full coverage auto insurance.

Louisiana Gap Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $40 | |

| $55 | |

| $45 | |

| $42 |

| $49 |

| $38 | |

| $30 | |

| $35 |

| $53 | |

| $47 |

State Farm stands out with the lowest rates, offering $30 for minimum coverage and $120 for full coverage, making it an excellent option for those looking to save.

If you’re a small business owner, check out these marketing resources from Open Doors to help your business grow and succeed. #NBCUOpenDoors https://t.co/KHOshenYfU pic.twitter.com/k3AvQHG0QG

— State Farm (@StateFarm) May 10, 2024

The Hartford and Progressive also provide competitive pricing, with minimum coverage rates of $35 and $38, respectively. On the higher end, American Family and Travelers offer full coverage at $153 and $151 per month, respectively, appealing to drivers seeking more comprehensive and customizable protection.

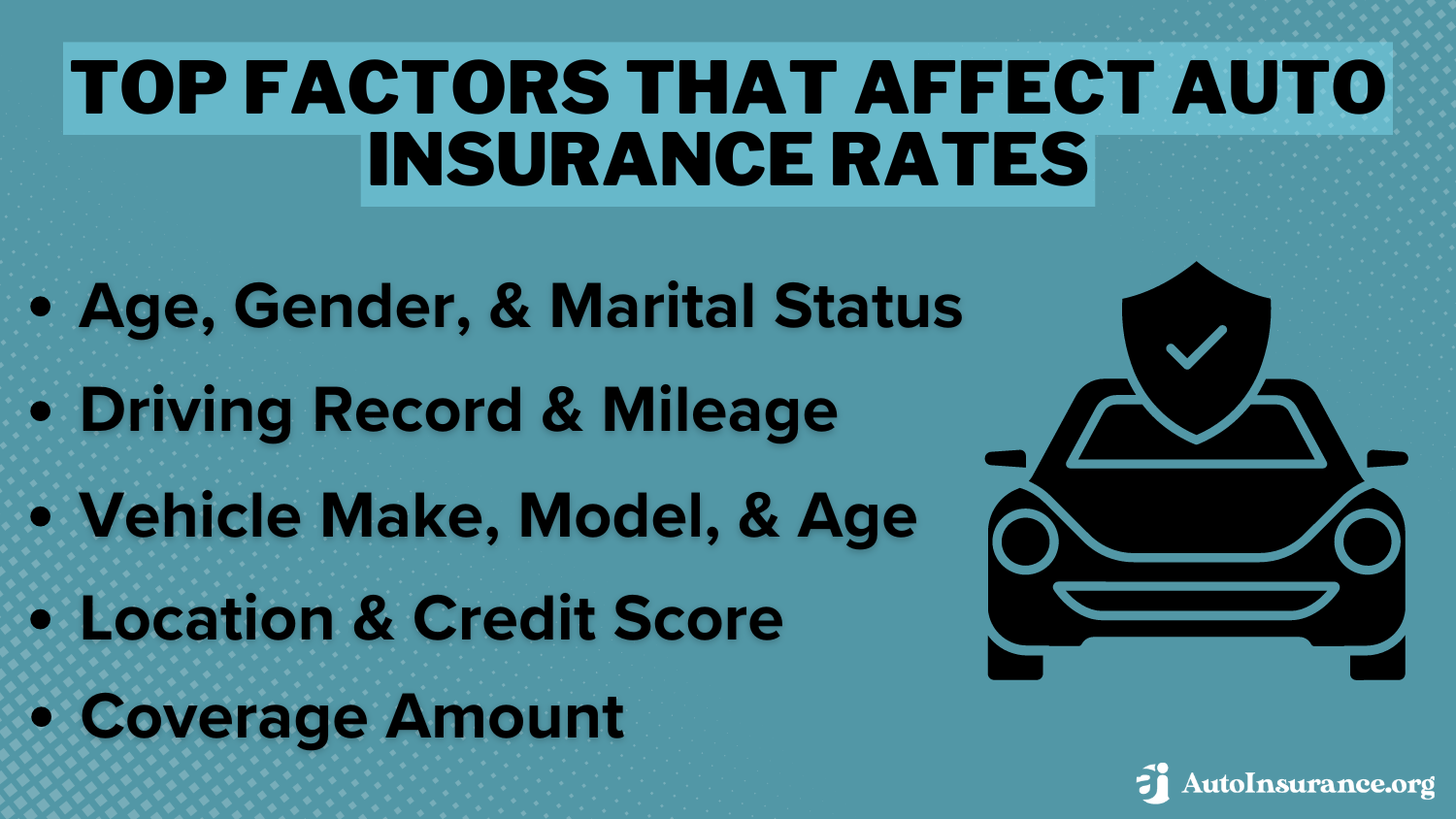

The Factors That Influence Louisiana Gap Insurance Costs

Various factors significantly influence the cost of gap insurance in Louisiana. The type, value, and age of your vehicle are important — high-performance cars generally result in higher gap insurance costs due to the greater potential financial loss.

Louisiana Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Customer Satisfaction | B+ | Overall positive feedback, though claims handling could improve |

| Discount Availability | B+ | Discounts available for safe drivers and multi-policy holders |

| Regional Variation | B | Urban areas have significantly higher premiums than rural regions |

| Average Premiums | C+ | Premiums are well above the national average, especially in urban areas |

| Premiums for High-Risk Drivers | C | High premiums for drivers with accidents or violations |

The location of your vehicle is critical, as areas with higher risks, such as those prone to natural disasters or high crime rates, often see expensive Louisiana gap insurance premiums.

Your driving history plays a key role as well. A clean record can help lower premiums, while accidents or violations may increase them. Accident forgiveness programs can sometimes mitigate gap insurance rate increases in Louisiana, but providers often require a safe driving record and continuous coverage before providing that policy perk.

Learn More: How Auto Insurance Companies Check Driving Records

Cost Analysis of Common Auto Insurance Claims in Louisiana

Auto insurance claims in Louisiana often arise due to a variety of incidents, reflecting the state’s driving conditions, weather patterns, and urban environments. The most frequent claims are tied to collisions and comprehensive damage, with costs varying significantly depending on the claim type.

5 Most Common Auto Insurance Claims in Louisiana

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 33% | $3,900 |

| Comprehensive | 24% | $2,700 |

| Property Damage | 19% | $4,300 |

| Bodily Injury Liability | 15% | $17,500 |

| Personal Injury Protection (PIP) | 9% | $8,800 |

These figures demonstrate the importance of having appropriate coverage in place, as costs can escalate quickly, particularly in cases involving bodily injury liability.

Accidents and claims across Louisiana vary depending on the city, with larger metropolitan areas experiencing higher volumes of incidents.

Louisiana Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Baton Rouge | 7,500 | $5,700 |

| Lafayette | 3,800 | $2,900 |

| Lake Charles | 3,100 | $2,400 |

| New Orleans | 11,000 | 8,300 |

| Shreveport | 4,200 | $3,200 |

This data highlights the regions where drivers are most at risk, emphasizing the importance of understanding local conditions when selecting auto insurance coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Biggest Savings on Gap Insurance in Louisiana

Minimizing the expense of gap insurance in Louisiana can be achieved through a few key strategies. We’ve established that keeping a spotless driving record is crucial, but exploring available discounts can also lead to substantial savings:

Auto Insurance Discounts From the Top Providers for Gap in Louisiana

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Anti-Theft | |

| Safe Driver, Multi-Policy, Good Student, Defensive Driving Course, Vehicle Safety Features | |

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Homeowner | |

| Safe Driver, Multi-Policy, Multi-Car, New Car, Homeowner, Pay-in-Full |

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Accident-Free |

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Snapshot, Pay-in-Full | |

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Defensive Driving Course, Vehicle Safety Features | |

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Military, Federal Employee |

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Homeowner, Early Quote | |

| Safe Driver, Multi-Policy, Multi-Car, Good Student, Military |

These are the best car insurance discounts to ask for, including those for bundling multiple policies and equipping your vehicle with safety features.

Choosing a higher deductible is another practical method to lower your insurance costs, as it decreases the insurer’s potential payout. Additionally, boosting your credit score is an effective way to secure more favorable rates, as insurers often take credit history into account when setting premiums.

Top-Rated Gap Insurance Providers in Louisiana

State Farm is the leading option for cheap gap insurance in Louisiana, offering a broad network of agents and competitive rates starting at $30/month.

Louisiana Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Good Driver Discount | A | 20% | Geico, State Farm, Allstate, Progressive |

| Good Student Discount | A | 15% | State Farm, Allstate, Liberty Mutual |

| Multi-Policy Discount | A- | 18% | Nationwide, Liberty Mutual, USAA |

| Defensive Driving Discount | B+ | 10% | Travelers, Geico, Allstate |

| Low Mileage Discount | B | 8% | Progressive, Nationwide, Liberty Mutual |

The Hartford stands out for its cost-effectiveness and competitive discounts for senior drivers who qualify with an AARP membership. Progressive is also highly regarded, known for its flexible payment options and customizable coverage plans that meet the diverse needs of Louisiana drivers.

With over 19,000 agents nationwide, State Farm’s competitive rates and personalized service make it the best choice for gap insurance in Louisiana.Kristen Gryglik Licensed Insurance Agent

These insurers provide not only strong financial protection but also specialized solutions that cater to the unique situations of guaranteed auto protection (gap) insurance in Louisiana, positioning them as the top choices for gap insurance in the state.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Frequently Asked Questions

How much is gap insurance in Louisiana?

Gap insurance in Louisiana typically costs between $30 and $55 per month, depending on the provider and your coverage level.

Is gap insurance in Louisiana actually worth it?

Yes, gap insurance in Louisiana is worth it if you owe more on your vehicle loan than its current value, as it protects you from financial loss in the event of a total loss or theft. Learn how gap insurance works after a car is stolen.

What exactly does gap insurance in Louisiana cover?

Gap insurance in Louisiana covers the difference between your car’s actual cash value and the remaining balance on your auto loan in the event of a total loss or theft.

How do you figure the cost of gap insurance in Louisiana?

To figure the cost of gap insurance in Louisiana, compare quotes from different insurers based on your vehicle’s value, loan balance, and desired coverage level. Enter your ZIP code to start comparing gap insurance costs near you.

What is the most Louisiana gap insurance will pay?

The most gap insurance will pay is typically the difference between the actual cash value of the vehicle and the remaining balance on your auto loan, excluding past due amounts and fees. Compare replacement cost vs. actual cash value to learn more.

What are the cons of gap insurance in Louisiana?

The cons of gap insurance in Louisiana include added monthly costs, coverage limitations, and it may be unnecessary if you owe less than the car’s current value.

What are the three situations where you might consider purchasing gap insurance in Louisiana?

Consider purchasing gap insurance in Louisiana if you’re financing a new vehicle, leasing a car, or have a long-term loan where you could owe more than the car’s value. Learn more about the benefits of auto insurance.

Does gap insurance in Louisiana cover past-due balances?

No, gap insurance in Louisiana does not cover any past-due balances on your loan; it only covers the difference between your car’s value and the loan amount at the time of loss.

Does gap insurance in Louisiana pay a deductible?

No, gap insurance in Louisiana typically does not pay your insurance deductible; it covers the difference between the vehicle’s actual cash value and the remaining loan balance.

Should I drop my gap insurance in Louisiana?

You should only consider dropping your Louisiana gap coverage once your loan balance is lower than your vehicle’s market value, reducing the risk of being upside down on your loan.

How do you start a gap insurance claim in Louisiana?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.