Cheap Gap Insurance in Washington (Top 10 Low-Cost Companies for 2026)

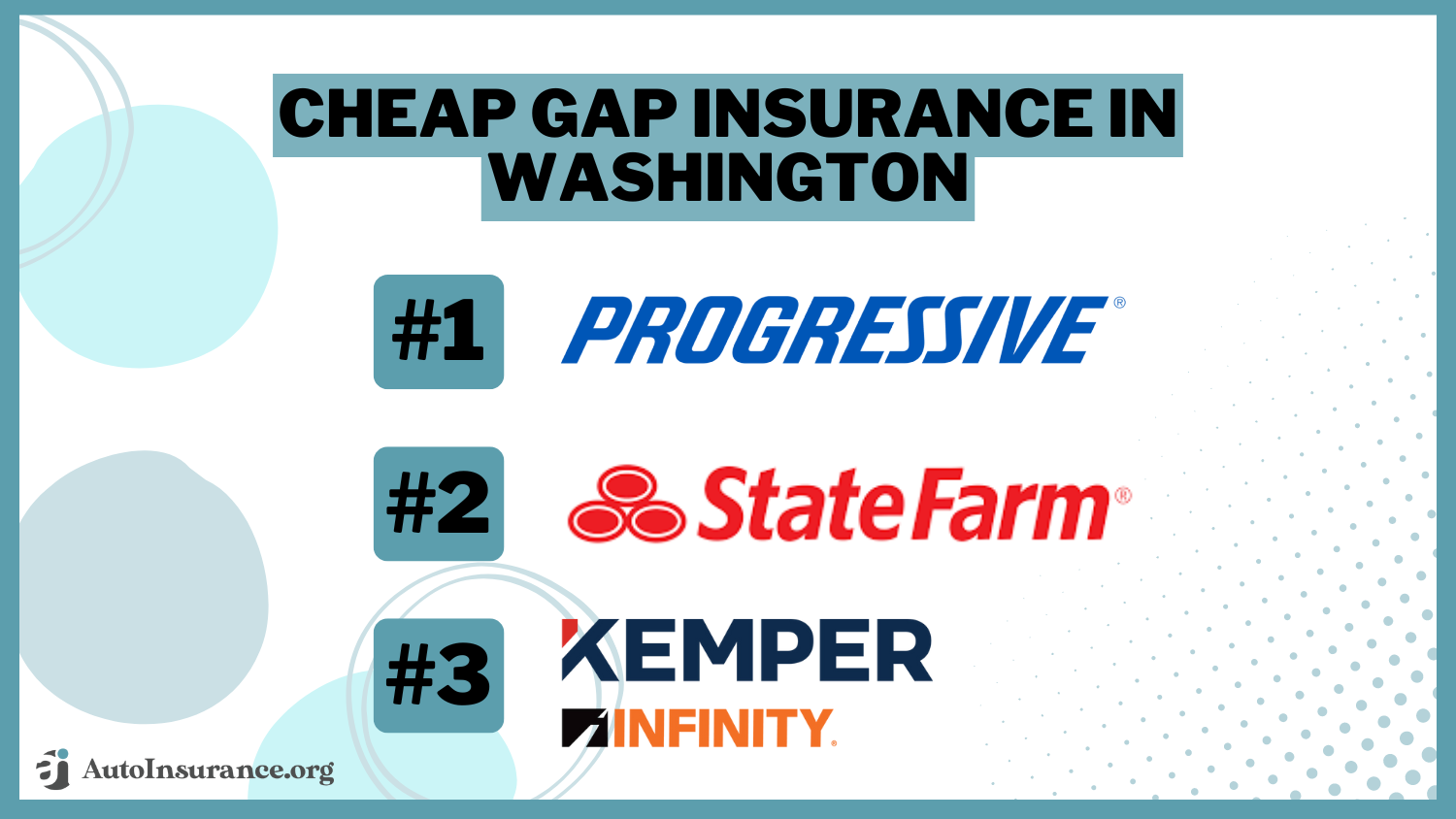

Cheap gap insurance in Washington is best through Progressive, State Farm, and Kemper, with rates starting at $10 per month. Progressive offers competitive low-mileage discounts, State Farm excels in customer service, and Kemper is ideal for high-risk drivers who need cheap Washington gap insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated October 2024

Company Facts

Min. Coverage for Gap in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Progressive, State Farm, and Kemper are the top providers of cheap gap insurance in Washington, offering a range of new car insurance options to suit various needs.

Our Top 10 Company Picks: Cheap Gap Insurance in Washington

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $25 A+ Low-Mileage Discounts Progressive

![]()

#2 $30 B Customer Service State Farm

![]()

#3 $31 A Online Tools Safeco

![]()

#4 $35 A++ High-Risk Drivers Kemper

#5 $36 A+ Widespread Availability Nationwide

![]()

#6 $37 A Safe Drivers Farmers

#7 $38 A Customizable Policies Liberty Mutual

![]()

#8 $40 A Costco Members American Family

![]()

#9 $41 A+ Comprehensive Coverage Allstate

![]()

#10 $45 A++ Bundling Policies Travelers

Whether you prioritize customer service, coverage options, or affordability, these providers offer robust solutions tailored to different requirements.

Enter your ZIP code above to find cheap Washington auto insurance rates in your area.

- Progressive offers the best cheap gap insurance in Washington at $10/month

- Affordable gap coverage is available for high-risk drivers through Kemper

- Drivers should look for exceptional customer service when choosing gap insurance

#1 – Progressive: Top Overall Pick

Pros

- Low-Mileage Discounts: Drivers working from home or on the road less than average can save up to 30% on Washington gap coverage.

- Customizable Plans: Progressive gap insurance in Washington State lets you tailor coverage to fit your specific needs. Check out our Progressive review for full insights.

- Easy-to-Use Platform: Progressive’s digital tools enhance the experience of managing gap insurance in Washington policies.

Cons

- Limited Physical Locations: Fewer in-person service options for Progressive gap insurance in Washington may inconvenience those who prefer direct interaction.

- Policy Bundling: Cheap gap insurance in Washington options may require bundling, limiting standalone policy choices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Cheapest With Excellent Customer Service

Pros

- Reliable Customer Service: State Farm provides consistent support for handling gap insurance in Washington queries.

- Comprehensive Agent Network: Access to numerous local agents allows for personalized gap insurance in Washington assistance. Read our State Farm review to learn more.

- Intuitive Online Access: State Farm’s digital resources simplify the process of managing gap insurance in Washington State.

Cons

- Rigid Coverage Options: State Farm gap insurance in Washington may offer fewer opportunities for customization compared to others.

- In-Person Requirements: Certain policy updates might necessitate visits to a branch for gap insurance in Washington, which could be less convenient.

#3 – Kemper: Cheapest for High-Risk Drivers

Pros

- Targeted Coverage: Kemper gap insurance in Washington is ideal for high-risk drivers, offering focused protection options.

- Streamlined Online Management: Its user-friendly website facilitates straightforward management of high-risk gap insurance in Washington.

- Efficient Digital Tools: Kemper’s web tools make it easy to oversee and update your gap insurance in Washington policy, which you can check out in our Kemper review.

Cons

- Discount Shortage: Kemper offers limited discounts on cheap gap insurance in Washington State, potentially leading to higher premiums.

- Coverage Availability: The availability of Washington gap insurance might differ across regions, requiring thorough research.

#4 – Safeco: Best Online Tools

Pros

- Comprehensive Online Tools: Safeco’s platform simplifies the management of gap insurance in Washington, making it more accessible. Uncover key details in our Safeco review.

- Strong Digital Experience: The user interface is designed for ease, helping customers efficiently manage gap insurance in Washington.

- Flexible Policy Options: Safeco offers customizable gap insurance in Washington, allowing for tailored coverage that meets specific needs.

Cons

- In-Person Support: Limited physical locations for gap insurance in Washington State may require reliance on online tools.

- Discount Availability: Fewer discounts on gap insurance in Washington could result in slightly higher premiums.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Cheapest With Widespread Availability

Pros

- Wide Availability: Nationwide offers gap insurance in Washington State and across most states in the country, making it easy to keep your policy if you ever move.

- User-Friendly Interface: Its platform makes managing Washington gap insurance straightforward and less time-consuming. Discover specific features in our Nationwide review.

- Flexible Policies: Nationwide gap insurance in Washington allows for customization to better meet individual requirements.

Cons

- In-Person Access: Washington gap insurance may require branch visits, which could be inconvenient for some.

- Discount Limitations: Nationwide gap insurance in Washington might offer fewer promotional discounts, affecting affordability.

#6 – Liberty Mutual: Cheapest Customizable Policies

Pros

- Customizable Coverage: Liberty Mutual gap insurance in Washington can be tailored to meet diverse customer needs.

- Accessible Online Tools: Its platform ensures easy management of gap insurance in Washington, making policy updates seamless.

- Reliable Digital Experience: Liberty Mutual’s online resources provide a hassle-free way to oversee gap insurance in Washington. See our Liberty Mutual review for further details.

Cons

- Limited Discounts: Liberty Mutual offers fewer gap insurance discounts in Washington State, which might affect overall costs.

- In-Person Services: Access to in-person support for Washington gap insurance may be restricted, relying heavily on digital tools.

#7 – American Family: Cheapest for Costco Members

Pros

- Member Benefits: American Family offers exclusive Washington gap insurance discounts for Costco members. See if you qualify in our AmFam auto insurance review.

- Customizable Plans: Drivers can adjust American Family gap insurance policies in Washington to meet individual coverage needs.

- Easy Digital Access: American Family’s online platform simplifies the process of managing gap insurance policies in Washington.

Cons

- Availability Restrictions: Washington gap insurance with American Family may be limited to specific membership groups.

- Higher Premiums: Fewer discount opportunities might lead to higher gap insurance rates in Washington.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Cheapest for Safe Drivers

Pros

- Driving Discounts: Farmers offers gap insurance in Washington, giving safe drivers the chance to save up to 30% on their premiums.

- Flexible Policy Options: Farmers gap insurance in Washington State can be tailored to match specific coverage needs. Discover all the specifics in our Farmers review.

- Simple Online Management: Farmers’ platform makes it easy to manage and update gap insurance in Washington policies.

Cons

- Discount Limitations: Farmers offers fewer discounts for gap insurance in Washington, potentially raising costs.

- Branch Access: Managing gap insurance in Washington may require visits to physical branches, which could be inconvenient for some drivers.

#9 – Travelers: Best for Bundling Policies

Pros

- Combined Coverage Benefits: In Washington, Travelers rewards drivers with gap insurance discounts when they consolidate their policies, leading to significant savings.

- Efficient Online Tools: Its digital resources simplify the management of gap insurance in Washington, making updates easier.

- Tailored Coverage: Travelers offers customizable gap insurance in Washington to better align with individual needs. Check out our Travelers review for a thorough analysis.

Cons

- Discount Restrictions: Gap insurance in Washington through Travelers may offer limited discounts, affecting overall affordability.

- In-Person Support: Physical locations for Travelers gap insurance in Washington may be limited, relying more on digital platforms.

#10 – Allstate: Cheapest Comprehensive Coverage

Pros

- Comprehensive Protection: Allstate gap insurance in Washington State is designed to offer extensive coverage for full protection. Find more information in our Allstate review.

- User-Friendly Online Tools: Its digital resources facilitate easy management of gap insurance in Washington policies.

- Customizable Policies: Allstate gap insurance in Washington allows for adjustments to meet diverse coverage requirements.

Cons

- Increased Costs: Allstate’s gap insurance in Washington often offers limited discounts, which can result in elevated premiums.

- Restricted Access: The availability of in-person assistance for gap insurance in Washington may be limited, primarily depending on online resources.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Gap Insurance Costs in Washington

Several critical factors influence gap insurance rates in Washington. Here’s a snapshot of monthly rates for minimum and full coverage across various insurance companies:

Gap Insurance Rates in Washington by Provider

Insurance Company Monthly Rates

![]()

$41

![]()

$40

![]()

$37

![]()

$35

$38

$36

![]()

$25

![]()

$31

![]()

$30

![]()

$45

The vehicle’s make and model can affect premiums, with higher-value vehicles generally leading to higher costs. Additionally, the outstanding loan balance and the level of coverage you choose significantly impact rates. Progressive tops our list of companies offering the best auto insurance by vehicle type in Washington.

Comparing these rates helps ensure you choose a Washington gap insurance policy that fits your budget and coverage needs. Be sure to compare quotes from multiple companies and evaluate each option based on the specific protection you require.

Read More: Where to Compare Auto Insurance Rates.

The Ultimate Gap Insurance Handbook for Washington Drivers

Guaranteed auto protection (gap) insurance provides crucial financial protection by covering the difference between your vehicle’s value and the remaining loan balance if your car is totaled. To fully benefit from gap insurance, it’s important to understand its key aspects and how it fits into your overall insurance plan.

Should I get gap insurance for a used car? Washinton gap insurance covers the difference between your vehicle’s value and the loan balance if your car is totaled, so you may want coverage on a used car if you have an outstanding loan balance.

The good news is many Washington gap insurance companies offer various discounts that can reduce your premium. Key opportunities include bundling your gap insurance with other policies, such as home insurance, to get lower rates.

Auto Insurance Discounts from the Top Providers for Gap in Washington

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, Early Signing, Pay-in-Full | |

| Safe Driver, Multi-Policy, Bundling, Good Student | |

| Safe Driver, Multi-Policy, Bundling, Low Mileage | |

| Safe Driver, Multi-Policy, Bundling, Pay-in-Full | |

| Safe Driver, Multi-Policy, Bundling, New Vehicle |

| Safe Driver, Multi-Policy, Bundling, Accident-Free |

| Safe Driver, Multi-Policy, Bundling, Pay-in-Full | |

| Safe Driver, Multi-Policy, Bundling, New Vehicle | |

| Safe Driver, Multi-Policy, Bundling, Good Student | |

| Safe Driver, Multi-Policy, Bundling, Accident-Free |

Additionally, maintaining a clean driving record and qualifying for safe driver discounts can further reduce costs. Some insurers also provide discounts for paying premiums in full rather than monthly installments. If you need gap insurance for a new car, you may qualify for exclusive new car insurance discounts.

Explore all available discounts to potentially reduce your premium. Compare quotes from multiple insurers to find the most discounts and competitive rates.

Selecting the right policy not only ensures you are covered in case of an accident but also helps you manage costs effectively. Taking the time to evaluate your options will lead to better coverage and peace of mind.

Choosing the Right Washington Gap Insurance Company

Progressive offers the best cheap gap insurance in Washington with unbeatable monthly rates starting at just $10. Kemper has the cheapest rates for high-risk drivers with at-fault auto accidents on their records, and State Farm provides the best gap insurance customer service.

Selecting the right gap insurance in Washington involves evaluating various providers, understanding your coverage needs, and considering available discounts. Start by assessing your vehicle’s value and outstanding loan balance to determine the appropriate coverage level.

By comparing Washington auto insurance quotes and thoroughly reviewing policy details, you can find gap coverage that offers both comprehensive protection and cost savings.Brandon Frady Licensed Insurance Producer

You can find affordable Washington auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

What is Washington gap insurance and how does it compare to standard coverage?

Washington gap insurance is designed to cover additional expenses not included in standard car insurance. It provides an extra layer of protection but is not required by law.

Which Washington gap insurance company is usually the cheapest?

Progressive and State Farm are often the cheapest gap insurance companies in Washington.

Is gap insurance required in Washington state?

No, gap insurance is not required in Washington. However, it can be a wise addition if you owe more on your car loan than the vehicle’s value. Find your cheapest gap insurance quotes by entering your ZIP code below into our free comparison tool.

What is the minimum auto insurance required for Washington State?

Washington minimum auto insurance requirements include coverage of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

What is the best full coverage auto insurance in Washington?

Progressive and State Farm are considered top choices for full coverage insurance in Washington.

How much is Washington auto insurance per month for full protection?

The average cost of full protection car insurance in Washington state ranges from $80 to $150 per month, depending on the provider and coverage level.

What is the cheapest auto insurance in Washington state?

The cheapest car insurance in Washington typically comes from providers like Geico, Progressive, and State Farm, offering competitive rates for basic and full protection coverage.

Which car brand has the most affordable Washington auto insurance rates?

In Washington state, brands like Honda and Toyota often have the most affordable insurance due to their safety features and lower repair costs.

Who is the most trusted auto insurance company in Washington?

Companies like State Farm and USAA are among the most trusted insurance providers in Washington state, known for their customer service and reliable coverage.

What is the most expensive type of auto insurance in Washington?

Washington high-risk auto insurance is often the most expensive, but Kemper offers competitive rates on gap coverage and other policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.