Cheap Mercury Auto Insurance in 2026 (Earn Savings With These 10 Companies!)

Erie, USAA, and State Farm are the top providers of cheap Mercury auto insurance. Since the brand was discontinued and all Mercuries are now used cars, finding cheap car insurance for a Mercury is easy. Minimum coverage starts at $22 per month, and you can save even more by enrolling in a UBI program.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated January 2025

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsDrivers looking for cheap Mercury auto insurance can find it with Erie, USAA, and State Farm, especially if they want to try usage-based auto insurance.

Erie is our top pick for cheap car insurance for Mercuries. It may not have as many discounts as some of its competitors, but Erie’s focus on customer care has led to low average rates and excellent claims handling.

Our Top 10 Company Picks: Cheap Mercury Auto Insurance

| Company | Rank | Monthly Rates | AM Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A+ | Personalized Policies | Erie |

| #2 | $22 | A++ | Military Benefits | USAA | |

| #3 | $33 | B | Financial Strength | State Farm | |

| #4 | $37 | A++ | Industry Experience | Travelers | |

| #5 | $39 | A+ | Competitive Rates | Progressive | |

| #6 | $44 | A+ | Vanishing Deductible | Nationwide |

| #7 | $44 | A | Claims Service | American Family | |

| #8 | $53 | A | Safe Drivers | Farmers | |

| #9 | $61 | A+ | Usage-Based Discount | Allstate | |

| #10 | $68 | A | 24/7 Support | Liberty Mutual |

Learn where to find the cheapest liability-only auto insurance for a Mercury. Then, compare rates by entering your ZIP code into our free comparison tool today.

- Minimum insurance is usually enough for a used Mercury

- Mercury insurance quotes average $42 per month for minimum coverage

- Erie and USAA have the cheapest Mercury car insurance rates

#1 – Erie Insurance: Top Pick Overall

Pros

- Competitive Rates: Finding cheap car insurance for a Mercury is usually easy with Erie, especially if you’re a teen driver. See how much you might pay in our Erie auto insurance review.

- Excellent Customer Service: Erie has a reputation for offering some of the best customer service on the market.

- Efficient Claims Handling: According to most customers, you won’t have to wait extended periods for resolution when you file a claim with Erie.

Cons

- Fewer Discounts: Erie only offers 8 discounts, much fewer than most of its competitors.

- Limited Availability: Unfortunately, Erie only offers its great coverage options in 12 states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Families

Pros

- Specialized Military Coverage: USAA specializes in coverage for active-duty military members. From international coverage during deployment to reduced garaging rates, USAA is an excellent option for anyone in the military.

- Ample Discounts: USAA offers 14 discounts to help drivers save. See all your discount options in our USAA auto insurance review.

- Low Rates: No matter where you live or what type of driver you are, USAA almost always has some of the cheapest auto insurance for a Mercury.

Cons

- Limited Physical Locations: With fewer brick-and-mortar locations compared to some of its competitors, finding face-to-face help can be challenging at USAA.

- Eligibility Requirements: Only active or retired military members and their immediate families are eligible to purchase car insurance from USAA.

#3 – State Farm: Best for Personalized Service

Pros

- Customizable Policies: State Farm offers a variety of coverage options if you want more than minimum insurance for your Mercury. Options include rental car reimbursement and rideshare insurance.

- Extensive Network of Agents: State Farm has one of the largest networks of agents in the country, making it easy to get personalized help for your insurance needs.

- Generous Discounts: With 13 discounts, State Farm makes it easy to save. Safe drivers can take advantage of the Drive Safe & Save UBI program for extra savings.

Cons

- Rates can be high. Although it usually has affordable Mercury insurance quotes, State Farm can be expensive for drivers with low credit scores.

- Average Rates for Mobile App: State Farm offers a mobile app, but many customers are not impressed. Learn more about the app in our State Farm auto insurance review.

#4 – Travelers: Best for Bundling Insurance Policies

Pros

- Flexible Coverage Options: There are plenty of ways to get the exact coverage you want from Travelers. Add-on options include accident forgiveness and gap insurance.

- Affordable Rates: Travelers typically offers cheap Mercury car insurance. See how much Travelers might charge you in our Travelers auto insurance review.

- Bundling Discounts: If you purchase a Travelers auto insurance policy with home or renters coverage, you can save on both.

Cons

- Limited Availability: Travelers is available in most of the country, but eight states are currently not eligible for coverage.

- Customer Service Varies: Travelers gets mixed reviews for its customer service experience, especially regarding claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Budgeting Tools

Pros

- Name Your Price Tool: Use the Name Your Price tool to see Progressive coverage options that match your monthly budget.

- Snapshot: Save up to 30% with Progressives UBI program Snapshot. See if Snapshot is right for you in our Progressive auto insurance review.

- Convenient Online Tools: Progressive focuses on a superior online experience. As such, it offers innovative digital tools for you to manage your policy and start claims.

Cons

- Unexpected Rate Increases: Many customers report unexpected rate increases for their Progressive coverage, even though nothing had changed in their lives.

- Mixed Customer Service Reviews: Despite being one of the cheaper options for car insurance, Progressive has struggled to improve customer loyalty ratings.

#6 – Nationwide: Best for UBI Savings

Pros

- SmartRide: SmartRide offers safe drivers potential savings of up to 40%. If you’re a low-mileage driver, consider SmartMiles. Learn more about each program in our Nationwide auto insurance review.

- Multiple Discounts: Nationwide offers 11 discounts to help drivers keep their insurance costs down.

- On Your Side Review: Once a year, drivers can take advantage of this review plan to make sure the coverage in their Nationwide policy still suits them.

Cons

- Less Advanced Mobile App: Although Nationwide has a mobile app, many customers report that it doesn’t offer services they’d expect a modern app to have.

- Limited Coverage Options: Nationwide offers a few excellent add-ons but lacks the diversity of choice you can find elsewhere.

#7 – American Family: Best for Costco Members

Pros

- Costco Policies: Costco members can find affordable Mercury insurance rates from the warehouse. These policies are written by American Family.

- Excellent Discounts: American Family offers 18 generous discounts to help you save.

- Coverage Options: Mercury owners have a few good coverage options to add to their American Family policy. Explore these options in our American Family auto insurance review.

Cons

- Limited Availability: Today, American Family is only available in 19 states.

- Average Rates: American Family certainly doesn’t have the most expensive auto insurance quotes for Mercury drivers, but it’s also not the cheapest.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers Insurance: Best for Discount Options

Pros

- Tons of Discounts: Farmers has one of the longest lists of discounts on the insurance market, with a whopping 23 savings opportunities.

- Add-on Options: Add options like glass coverage and accident forgiveness to your Farmers policy for the best Mercury auto insurance possible.

- Great A.M. Best Ratings: Farmers has a strong financial stability rating from A.M. Best, meaning you won’t have to worry about your claims. See more ratings in our Farmers auto insurance review.

Cons

- Limited Local Agents: Farmers doesn’t have the largest network of agents, which can make finding personalized help difficult.

- Higher Rates: Farmers is usually a costlier option for Mercury insurance costs, especially for teens.

#9 – Allstate: Best for Full Coverage Service

Pros

- Excellent Coverage Options: Add extra coverage to maximize your Allstate policy with add-on options like roadside assistance and rideshare insurance.

- Great Financial Stability: Allstate has the highest rating A.M.Best offers – an A++. Learn more about Allstate’s ratings in our Allstate auto insurance review.

- UBI Programs: Allstate offers two UBI programs to help you save – Drivewise and Milewise. Milewise offers low per-mile rates, and you can save up to 40% with Drivewise.

Cons

- Higher Rates: Allstate might have excellent coverage options, but you’ll have to pay for it. Allstate is usually one of the most expensive coverage options.

- Reviews Are Mixed. It may be one of the largest insurance companies in the country, but that doesn’t mean everyone loves their Allstate coverage. A common customer complaint is that the claims process can be slow.

#10 – Liberty Mutual: Best for Quick Claims Service

Pros

- Responsive Claims: No one wants to make Mercury auto insurance claims, but Liberty Mutual makes the process as easy as possible with its responsive service.

- Ample Coverage Options: Add coverage like Liberty Mutual’s lifetime repair guarantee or roadside assistance to get the best Mercury car insurance possible.

- Excellent Range of Discounts: Take advantage of Liberty Mutual’s 17 discounts to keep your Mercury insurance coverage affordable.

Cons

- Customer Service Issues: Many Mercury car insurance reviews from Liberty Mutual say the company is not good at explaining complex policy issues. See what else customers have to say in our Liberty Mutual auto insurance review.

- Higher Average Rates: Whether your driving record is clean or you have multiple traffic incidents, Liberty Mutual’s rates tend to be at least slightly higher than the national average.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mercury Auto Insurance Rates

There are many factors that affect auto insurance rates, such as age, gender, marital status, driving history, and credit score. Depending on the model you drive, your rates may be higher or lower than expected. For example, Mercury Grand Marquis car insurance rates are typically a little higher than they are for a Sable. Additionally, since each state has different Mercury coverage requirements, auto insurance rates by ZIP code vary.

Check below to see how much you might pay with our best Mercury car insurance companies.

Mercury Auto Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $22 | $58 |

| $53 | $139 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $22 | $59 |

Finding cheap auto insurance for a Mercury isn’t usually difficult. The average cost of minimum auto insurance for Mercurys is $42 each month. As you add coverage to your Mercury car insurance policy, this cost will increase.

Once you determine the type of coverage you’re looking for, you can find and compare quotes from several insurance companies to determine which works best for you. Getting quotes is usually simple — just fill out the request form most companies offer on their websites, like the one you see below.

Alternatively, you can use a quote comparison tool to check rates from multiple companies at once. You can enter your ZIP code into our free comparison tool above to see how much you might pay for your insurance.

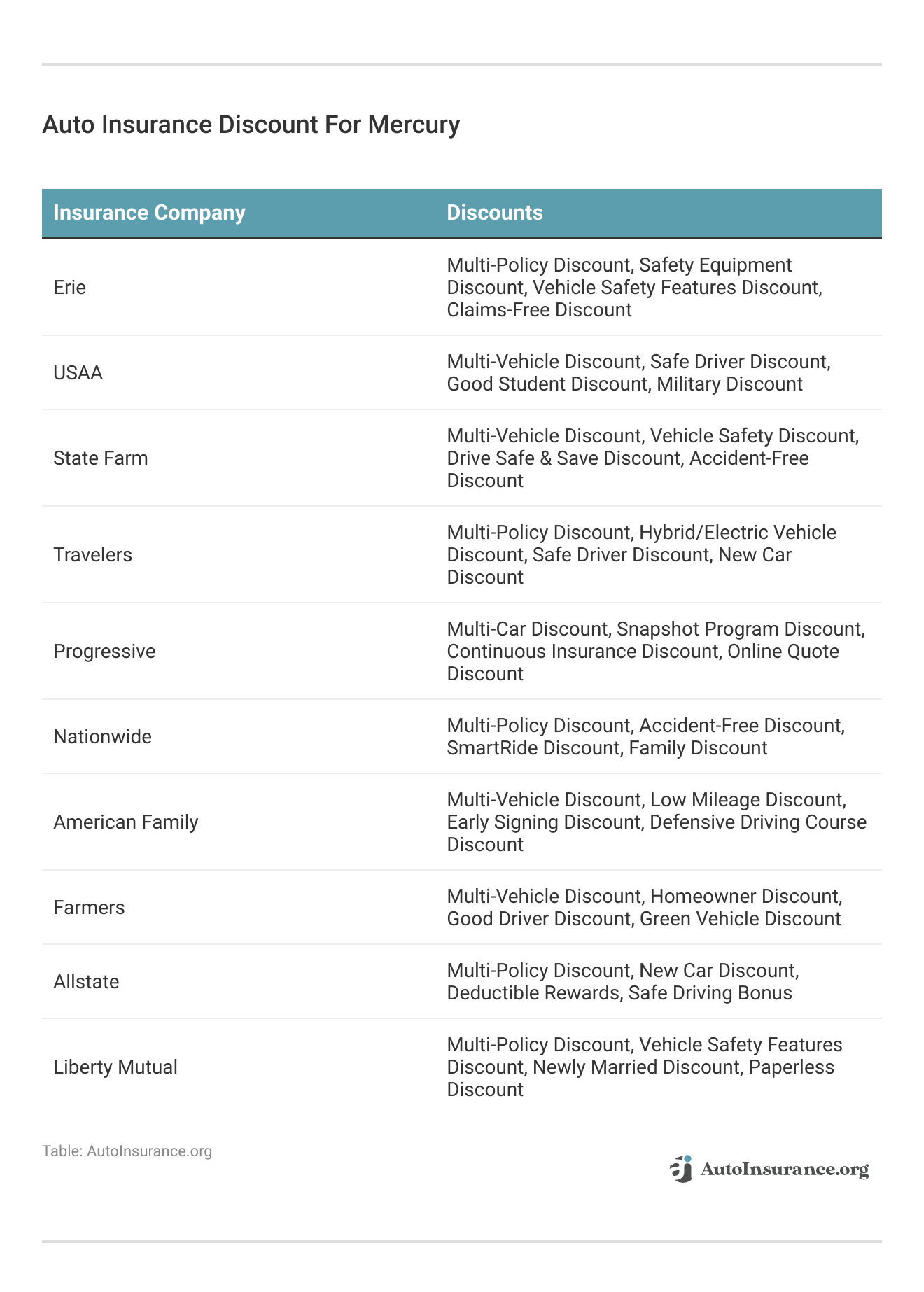

Mercury Auto Insurance Discounts

You could qualify for auto insurance discounts on your Mercury car insurance. Some of the most common Mercury insurance discounts include:

- Accident-Free Discount

- Defensive Driving Auto Insurance Discount

- Good Driver Auto Insurance Discount

- Good Student Auto Insurance Discount

- Military Discount

- Senior Auto Insurance Discount

- Bundling Insurance Policies Discount

- Safety Device Discount

- New Car Auto Insurance Discount

Car insurance discounts can help you save up to 25% on coverage. If you are eligible for a discount, speak with a representative from your car insurance company to learn more about your options.

Many discounts are automatically applied to your policy when you sign up, while others require proof. For example, most insurance companies will require school transcripts to verify your grades before you can receive a good student discount.Eric Stauffer Licensed Insurance Agent

However, not all discounts are available with every company. Check below to see insurance companies offering discounts for Mercury drivers to help you find the cheapest car insurance for a Mercury.

You can also find cheap usage-based auto insurance (UBI) from most major companies, including all of our top 10 picks. UBI programs track your driving habits and provide discounts for safe drivers. Most companies offer a discount of about 30% to the best drivers.

Mercury Auto Insurance Coverage Options

If you seek a minimum coverage or liability-only car insurance policy, the types of auto insurance coverage you need depends on location.

You must follow your state minimum auto insurance requirements before you can drive legally. Depending on where you live, you may need to purchase some or all of the following auto insurance coverage:

- Property Damage Liability: The best property damage liability auto insurance companies cover you if you cause an accident and damage someone’s car or other personal property.

- Bodily Injury Liability: Bodily injury liability auto insurance covers you if you cause an accident and injure or kill one or more people.

- Personal Injury Protection (PIP): Personal injury protection (PIP) auto insurance helps pay medical bills and may replace lost wages after a covered accident.

- Medical Payments: Medical payments coverage on auto insurance helps with hospital bills and doctor visits after a covered accident.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage helps if someone causes an accident but doesn’t carry proper insurance coverage.

Contact your state’s Department of Motor Vehicles if you’re unsure of the type and amounts of car insurance coverage you need where you live.

One in eight drivers don’t have insurance🤯. Are you prepared to deal with the aftermath of one of them crashing into you😱? You need uninsured motorist coverage, and we have the guide for you👉: https://t.co/HRY9Rq9pmO pic.twitter.com/YGplwTC6Sr

— AutoInsurance.org (@AutoInsurance) August 26, 2024

Many drivers purchase additional coverage to carry what’s often referred to as Mercury full coverage insurance, which also includes:

- Collision: Collision auto insurance helps if you cause an accident and damage your car. Once you pay your deductible, collision insurance will pay for repairs up to your vehicle’s actual cash value (ACV).

- Comprehensive: Comprehensive auto insurance helps if inclement weather, wild animals, theft, or vandalism cause damage to your Mercury.

If you add collision and comprehensive insurance to your car insurance policy, you’ll be protected if you’re in an accident or if wild animals or inclement weather damage your vehicle.

Full coverage offers the best auto insurance for a Mercury, but keep in mind that more coverage can significantly increase your rates.

Mercury Optional Auto Insurance Add-Ons

Some Mercury drivers may purchase additional coverage, often considered add-on insurance, to protect their vehicles. Some of the most popular add-on options include:

- Rideshare Insurance: If you drive for a company like Uber or Lyft, rideshare coverage helps ensure you stay covered no matter what you’re doing. Some insurance companies won’t cover you if you’re in an accident while driving for work. The best rideshare auto insurance covers you if you’re ever in an accident.

- Emergency Roadside Assistance: While it varies between companies, the best roadside assistance plans includes tow coverage, flat tire repair, and fuel delivery services. If you drive a lot, roadside assistance helps you stay safe on the road.

- Rental Car Reimbursement: Rental car reimbursement helps you get your money back if you rent a car because yours is in the shop following a covered accident.

Several other add-on options help drivers customize their Mercury insurance policies. In addition, you can speak with a representative from any company you’re considering to learn more about your Mercury car insurance coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Mercury Auto Insurance Today

Choosing your Mercury car insurance company may feel daunting, but it doesn’t have to. Finding the right company is easy when you know the type of auto insurance you want and compare Mercury car insurance quotes from companies in your area that offer it.

Find and compare Mercury car insurance quotes and discount options from several auto insurance companies before you choose a policy. Enter your ZIP code into our free comparison tool to find cheap auto insurance for a Mercury today.

Frequently Asked Questions

Is Mercury auto insurance cheap?

Since Mercury was discontinued as a brand, most drivers can find affordable insurance easily. Used cars typically have low insurance rates (Read More: Best Auto Insurance for Used Cars).

Are Mercuries expensive to insure?

Mercury auto insurance coverage is relatively affordable, especially since you’ll likely only need a minimum car insurance policy.

What discounts can you get with Mercury cars?

Mercuries are eligible for a variety of discounts, the same as any other type of car would qualify for. Popular options include savings for being a good student, a safe driver, or paying for your policy in full.

Should you get full coverage for a Mercury?

Full coverage auto insurance offers better protection for your vehicle, but it’s not always the best choice. Since Mercuries are used cars at least ten years old, buying less coverage might be a better option for you.

Which companies have the cheapest Mercury auto insurance rates?

The company with the lowest rates for you depends on your unique situation. However, we’ve found that Erie, USAA, and State Farm have the cheapest Mercury auto insurance rates.

What Mercury car insurance coverages do I need?

Almost all U.S. states require you to carry liability insurance. In addition, you may need Mercury full coverage insurance if you have a car loan or lease.

Are Mercuries reliable cars?

Most drivers report that their Mercury vehicle is a safe, reliable car. In fact, Mercuries are consider safe used vehicles to give to young drivers. Giving a Mercury is a good way to help drivers under 25 get the best auto insurance because Mercury rates tend to be low.

Why did they stop selling Mercury cars?

We often get the question “Why did Mercury cars go out of business?” Although Mercury cars still have loyal fans, Ford decided to end the brand in 2011 after years of weak sales.

Why is Mercury Insurance so cheap for Mercury vehicles?

Mercury Insurance often offers competitive rates for Mercury car owners due to factors like vehicle safety ratings and their tailored discount programs. Mercury vehicles, like many reliable sedans and SUVs, may be considered lower-risk, which helps keep insurance premiums affordable.

Why is insurance for a used car so cheap?

Most used cars — Mercuries included — have cheaper insurance rates because they don’t cost much to repair or replace. Most drivers choose minimum coverage for their Mercuries to help keep rates low. If you want full coverage, make sure you understand your auto insurance deductible, as a high deductible can negate the benefit of more coverage.

Is there a cancellation fee for Mercury Insurance on Mercury cars?

Who is known for cheapest car insurance for Mercury cars?

Can you trust Mercury Insurance for covering your Mercury?

Is Mercury auto insurance reputable for Mercury cars?

Does Mercury Insurance have a grace period for late payments on Mercury vehicle coverage?

How can you save on your Mercury insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.