Best Davenport, Florida Auto Insurance in 2026 (Find the Top 10 Companies Here)

The top three companies for the best Davenport, Florida auto insurance, are State Farm, USAA, and Allstate with rates starting at only $75 monthly. These insurers offer extensive coverage, substantial discounts, and excellent customer service, making them the top recommendations in Davenport, Florida.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2024

Company Facts

Full Coverage in Davenport Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Davenport Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Davenport Florida

A.M. Best Rating

Complaint Level

Pros & Cons

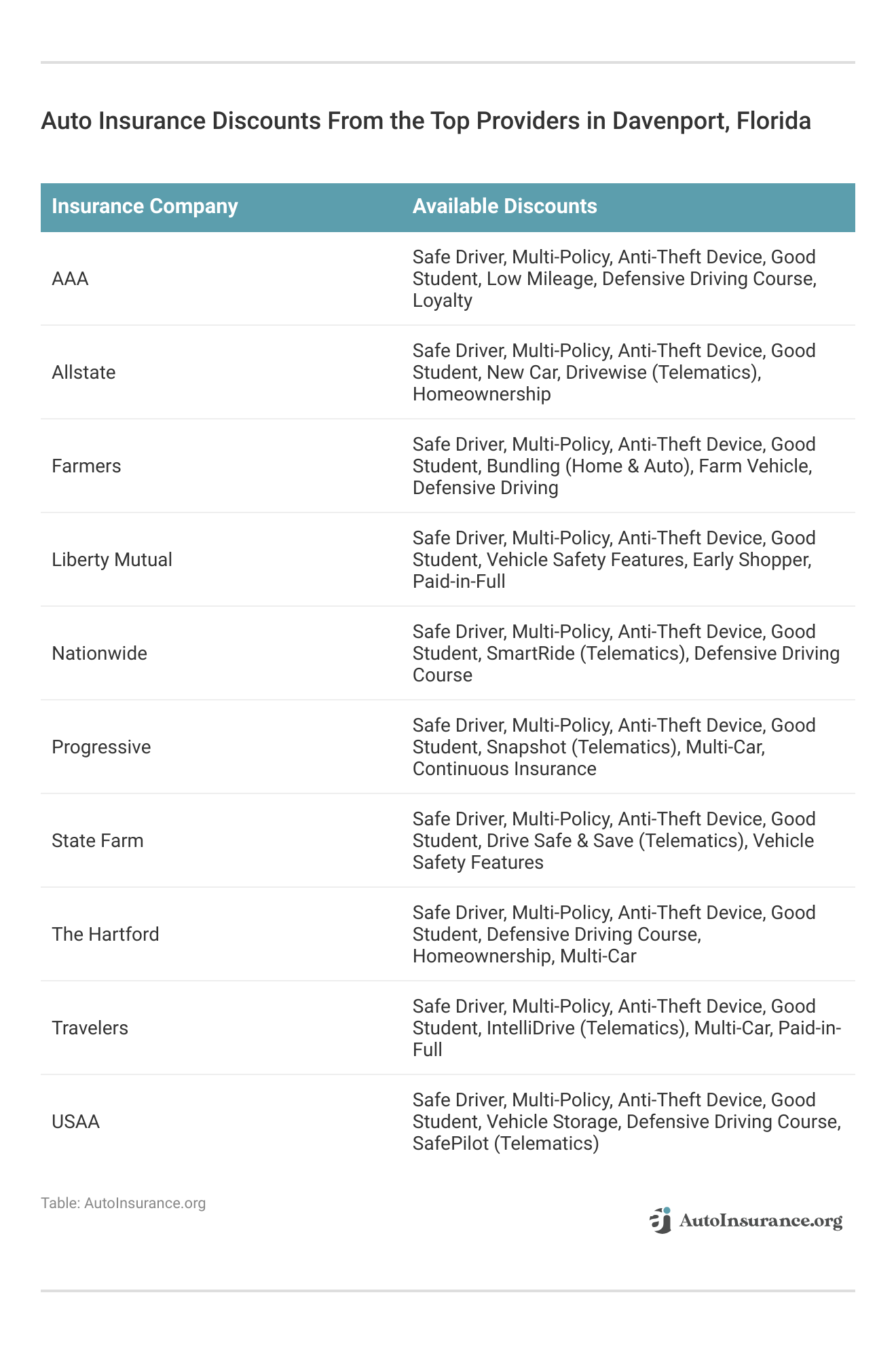

We’ll cover factors affecting auto insurance rates in Davenport, Florida, and highlight auto insurance discounts to ask for, like those for safe driving or bundling policies.

Our Top 10 Company Picks: Best Davenport, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% B Local Agents State Farm

![]()

#2 10% A++ Military Benefits USAA

![]()

#3 14% A+ Extensive Coverage Allstate

#4 12% A Unique Discounts Liberty Mutual

#5 10% A+ Member Benefits Nationwide

#6 8% A+ Senior Discounts The Hartford

#7 15% A Membership Benefits AAA

#8 18% A++ Strong Financials Travelers

#9 12% A Customizable Policies Farmers

#10 20% A+ Competitive Pricing Progressive

Before you buy Davenport, Florida auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Davenport, Florida auto insurance quotes.

- State Farm is the best auto insurance in Davenport, Florida

- Compare quotes for rates starting at $75/month

- Teen and young adult drivers face the highest auto insurance costs

#1 – State Farm: Top Overall Pick

Pros

- Strong Customer Service: Known for excellent customer service and reliable claims handling. As one of the best Davenport, Florida auto insurance providers, State Farm’s local agents offer personalized support, making it easier to address specific needs and concerns.

- Wide Range of Discounts: Offers up to 15% bundling discount and multiple other discounts for safe driving, student drivers, and more. This makes State Farm a top choice among the best Davenport, Florida auto insurance providers for those looking to save on premiums.

- Extensive Coverage Options: Provides a variety of coverage types including rental car reimbursement and roadside assistance. As a leading name in the best Davenport, Florida auto insurance market, State Farm ensures you can find coverage tailored to your needs. Learn more through our State Farm auto insurance review.

Cons

- Variable Rates: Premiums can vary significantly based on individual risk factors and geographic location. This means you might experience fluctuations in quotes compared to other top contenders for the best Davenport, Florida auto insurance.

- Limited High-Risk Discounts: Fewer options for discounts if you have a high-risk profile, such as multiple accidents or traffic violations. This could result in higher premiums for those seeking the best Davenport, Florida auto insurance with less-than-perfect driving records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Excellent Customer Satisfaction: Consistently high ratings for customer service and claims satisfaction. With its A++ rating from A.M. Best, USAA stands out as one of the best Davenport, Florida auto insurance providers due to its reliability and financial strength.

- Comprehensive Coverage: Offers extensive coverage options including rental reimbursement and roadside assistance. USAA’s broad coverage is a key reason it is considered among the best Davenport, Florida auto insurance companies. For a complete list, read our USAA review.

- Competitive Pricing: Generally offers competitive rates for those eligible. The benefits extend to all aspects of the policy, including lower premiums due to their high financial stability, making it a top choice for the best Davenport, Florida auto insurance.

Cons

- Eligibility Restriction: Only available to military members and their families. This exclusivity limits access to USAA’s benefits and discounts, making it less accessible compared to other providers of the best Davenport, Florida auto insurance.

- Higher Rates for Some: Premiums can be higher for drivers without military affiliation. Non-military members might not have access to the same competitive rates and benefits, affecting their options for the best Davenport, Florida auto insurance.

#3 – Allstate: Best for Extensive Coverage

Pros

- Variety of Discounts: Offers up to 14% bundling discount and multiple discounts for safe driving, bundling, and more. This extensive list of discounts helps reduce overall insurance costs, positioning Allstate as one of the best Davenport, Florida auto insurance providers.

- Strong Financial Stability: High ratings for financial strength and stability from A.M. Best. This ensures that Allstate is a reliable choice for long-term insurance needs and is considered one of the best Davenport, Florida auto insurance companies.

- Extensive Coverage Options: Provides comprehensive coverage options including accident forgiveness and new car replacement. Allstate’s broad coverage ensures it stands out as a leading option for the best Davenport, Florida auto insurance. Read more in our review of Allstate.

Cons

- Higher Premiums: Can be more expensive compared to some competitors, especially if discounts do not apply. This higher cost might be a factor for those considering the best Davenport, Florida auto insurance options.

- Mixed Customer Service Reviews: Customer service experiences can vary by location, leading to inconsistent service quality depending on your area. This variability can affect your perception of Allstate as one of the best Davenport, Florida auto insurance providers.

#4 – Liberty Mutual: Best for Unique Discounts

Pros

- Unique Discounts: Offers unique discounts like those for hybrid or electric vehicles. Liberty Mutual, with up to a 12% bundling discount, provides some of the best Davenport, Florida auto insurance options for environmentally conscious drivers.

- Customizable Coverage: Flexible coverage options to fit various needs, including accident forgiveness and new car replacement. This customization helps Liberty Mutual maintain its status as a top provider of the best Davenport, Florida auto insurance.

- Accident Forgiveness: Provides accident forgiveness options for loyal customers, which can prevent rate increases after your first at-fault accident. This feature makes Liberty Mutual a strong contender among the best Davenport, Florida auto insurance companies, which you can check out in our Liberty Mutual review.

Cons

- Higher Premiums: Rates can be higher if you don’t qualify for discounts or have a history of claims. This can make Liberty Mutual a more expensive choice compared to other providers of the best Davenport, Florida auto insurance.

- Inconsistent Service: Customer service quality can vary depending on the location, leading to mixed experiences with claims and support. This inconsistency might affect Liberty Mutual’s reputation as one of the best Davenport, Florida auto insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Member Benefits

Pros

- Member Benefits: Offers perks and discounts such as a 10% bundling discount for policyholders. Nationwide’s member benefits include access to a range of savings opportunities, making it a strong contender for the best Davenport, Florida auto insurance.

- Strong Financial Ratings: High ratings for financial stability and reliability from A.M. Best. This ensures that Nationwide is a secure choice for long-term insurance needs and one of the best Davenport, Florida auto insurance providers.

- Variety of Coverage Options: Provides extensive coverage including new car replacement and accident forgiveness. These options contribute to Nationwide’s reputation as a top provider of the best Davenport, Florida auto insurance. Delve in to find more through our Nationwide insurance review.

Cons

- Higher Costs for Younger Drivers: Premiums can be higher for younger or less experienced drivers due to increased risk factors. This can affect Nationwide’s standing among the best Davenport, Florida auto insurance options for younger individuals.

- Limited Discounts for High-Risk Drivers: Fewer discount options available for drivers with a poor record, which might result in higher premiums. This limitation can affect Nationwide’s appeal for those seeking the best Davenport, Florida auto insurance with high-risk profiles.

#6 – The Hartford: Best for Senior Discounts

Pros

- Senior Discounts: Generous discounts available for senior drivers, making it a cost-effective option for older policyholders. The Hartford’s senior-focused benefits contribute to its status as one of the best Davenport, Florida auto insurance providers.

- Strong Customer Service: Known for good customer service and handling of claims, with high ratings for support from A.M. Best. This reputation makes The Hartford a strong candidate for the best Davenport, Florida auto insurance. See more through our The Hartford auto insurance review.

- Accident Forgiveness: Provides accident forgiveness for long-term customers, which can help keep rates stable after an at-fault accident. This feature enhances The Hartford’s appeal as one of the best Davenport, Florida auto insurance providers.

Cons

- Limited Coverage Options: May not offer as many specialized coverage options as some competitors. This limitation might affect The Hartford’s standing among the best Davenport, Florida auto insurance providers.

- Potentially Higher Rates: Premiums might be higher compared to some competitors, especially if you don’t qualify for senior discounts or AARP membership benefits. This can impact The Hartford’s competitiveness for the best Davenport, Florida auto insurance.

#7 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: Offers roadside assistance and other member perks, with a 15% bundling discount for policyholders. AAA’s membership provides added value beyond insurance coverage, making it a top contender for the best Davenport, Florida auto insurance.

- Strong Financial Stability: Reliable and financially stable insurer with an A rating from A.M. Best, ensuring long-term security. AAA’s stability contributes to its reputation as one of the best Davenport, Florida auto insurance providers.

- Good Customer Service: Positive reviews for customer service and claims handling, offering consistent support and assistance. This solid service record makes AAA a notable option for the best Davenport, Florida auto insurance. Find more through our AAA auto insurance review.

Cons

- Membership Requirement: Membership in AAA is required to get insurance, which may not be suitable for those who are not current members. This requirement limits access to AAA’s benefits compared to other best Davenport, Florida auto insurance options.

- Higher Premiums: Premiums can be higher if discounts are not applied, making it more expensive for some drivers. This potential for higher costs could affect AAA’s appeal as one of the best Davenport, Florida auto insurance providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Strong Financials

Pros

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers is known for its strong financial stability and ability to handle large claims. This financial security makes Travelers a top choice for the best Davenport, Florida auto insurance, ensuring that policyholders are well-protected.

- Extensive Coverage Options: Provides a variety of coverage options including new car replacement, rental car reimbursement, and roadside assistance. Travelers’ comprehensive coverage makes it a standout choice for the best Davenport, Florida auto insurance.

- Innovative Technology: Features user-friendly digital tools and an app for managing policies, filing claims, and accessing insurance documents. Travelers’ investment in technology enhances its appeal as a leading option for the best Davenport, Florida auto insurance.

Cons

- Higher Rates for Some Drivers: Premiums can be higher for drivers with a history of claims or high-risk factors, impacting affordability. This might influence Travelers’ standing among the best Davenport, Florida auto insurance options for certain individuals.

- Customer Service Variability: Customer service experiences can be inconsistent, depending on the location and individual representative. This variability might affect Travelers’ reputation as one of the best Davenport, Florida auto insurance providers, which you can learn about in our Travelers review.

#9 – Farmers: Best for Customizable Policies

Pros

- Comprehensive Coverage Options: Offers a range of coverage options including accident forgiveness and new car replacement. Farmers’ extensive coverage is a key reason it is considered among the best Davenport, Florida auto insurance providers.

- Customizable Policies: Provides the ability to customize policies based on individual needs, allowing for flexible coverage. This customization helps Farmers stand out as one of the best Davenport, Florida auto insurance companies.

- Multiple Discounts Available: Offers various discounts including bundling, safe driver, and multi-car discounts, leading to potential savings. Farmers’ discount options contribute to its appeal as one of the best Davenport, Florida auto insurance providers. Find out more in our Farmers review.

Cons

- Higher Premiums for Some Drivers: Premiums can be higher compared to some competitors, especially if you do not qualify for discounts. This can affect Farmers’ competitiveness among the best Davenport, Florida auto insurance options.

- Mixed Customer Reviews: Customer service and claims handling reviews can be inconsistent, which might impact overall satisfaction. This inconsistency might influence Farmers’ status as one of the best Davenport, Florida auto insurance providers.

#10 – Progressive: Best for Competitive Pricing

Pros

- Snapshot Program: Offers a telematics-based discount through its Snapshot program, which rewards safe driving habits. This program is a standout feature of Progressive, making it a strong choice for the best Davenport, Florida auto insurance.

- Wide Range of Coverage Options: Provides various coverage options including rental car reimbursement and roadside assistance. Progressive’s extensive coverage contributes to its status as one of the best Davenport, Florida auto insurance providers.

- Competitive Pricing: Generally offers competitive rates with up to 12% bundling discounts available. This pricing advantage makes Progressive a notable option for the best Davenport, Florida auto insurance. Learn more in our Progressive review.

Cons

- Customer Service Variability: Customer service experiences can vary, which might impact overall satisfaction. This variability can affect Progressive’s reputation among the best Davenport, Florida auto insurance providers.

- Higher Premiums for Some: Rates can be higher depending on driving history and risk factors, which might affect overall affordability. This can influence Progressive’s standing among the best Davenport, Florida auto insurance options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Auto Insurance Companies for Davenport, Florida

When searching for affordable auto insurance in Davenport, Florida, it’s essential to compare rates from the top insurance companies operating in the area.

By evaluating the annual premiums and coverage options offered by these providers, you can identify which companies offer the most cost-effective policies. This comparison helps ensure that you not only secure the lowest possible rate but also find a policy that meets your specific needs.

Davenport, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $82 $145

Allstate $85 $155

Farmers $88 $160

Liberty Mutual $90 $160

Nationwide $85 $180

Progressive $80 $152

State Farm $80 $150

The Hartford $88 $155

Travelers $87 $155

USAA $75 $140

To make an informed decision, consider factors such as discounts, coverage limits, and customer service ratings alongside the premium costs. Additionally, you might save money by bundling insurance policies, which many insurers offer as a discount.

This means you can potentially reduce your overall insurance expenses by combining your auto insurance with other policies, such as home or renters insurance, with the same provider.

Factors Affecting Auto Insurance Rates in Davenport, Florida

Auto insurance rates in Davenport, Florida, can vary significantly compared to other cities due to a range of factors. Local conditions play a major role in shaping these rates.

For instance, the frequency of traffic congestion and road conditions in Davenport can impact insurance premiums. Additionally, the rate of vehicle theft and local crime statistics influence how much you pay for coverage.

To save auto insurance for three vehicles, it’s important to consider local factors that might affect your rates.

For example, Davenport’s weather patterns might lead to more frequent claims for damage, and local laws and regulations regarding insurance also contribute to the variability in rates.

Understanding these local dynamics can help you better anticipate and manage your insurance costs in Davenport. Enter your ZIP code now to begin comparing.

Cheap Auto Insurance by Credit History in Davenport, Florida

Frequently Asked Questions

What is auto insurance?

Auto insurance is a type of insurance policy that provides financial protection for vehicle owners in the event of accidents, theft, or damage to their vehicles.

It typically covers costs associated with repairs, medical expenses, and liability claims.

Is auto insurance mandatory in Davenport, FL?

Yes, auto insurance is mandatory in Davenport, FL, as it is in the rest of the state of Florida.

Florida law requires drivers to carry a minimum amount of liability coverage, including $10,000 of personal injury protection (PIP) and $10,000 of property damage liability (PDL) coverage. Enter your ZIP code now to begin.

What is personal injury protection (PIP) coverage?

Personal injury protection insurance (PIP) coverage is a type of auto insurance that helps pay for medical expenses, lost wages, and other related costs in the event of an accident.

In Florida, PIP coverage is required and provides benefits regardless of who is at fault in the accident.

What does property damage liability (PDL) coverage cover?

Property damage liability (PDL) coverage helps pay for damages you may cause to someone else’s property while operating your vehicle.

This coverage typically applies to repairs for the other party’s vehicle, as well as damage to objects such as fences, buildings, or utility poles.

Are there additional auto insurance coverage options available?

Yes, there are several additional coverage options available beyond the minimum requirements.

These can include collision coverage (for damage to your own vehicle), comprehensive coverage (for non-collision incidents like theft or vandalism), uninsured/underinsured motorist coverage (for accidents involving drivers with inadequate coverage), and more.

It’s important to consider your needs and consult with an insurance agent to determine the appropriate coverage for your situation. Enter your ZIP code now to begin.

How are auto insurance premiums determined?

Auto insurance premiums are determined based on various factors, including the driver’s age, driving record, type of vehicle, coverage limits, vanishing deductibles, and the area where the vehicle is primarily driven and parked.

Insurance companies also consider factors such as the frequency of accidents and thefts in the region when calculating premiums.

What factors influence the cost of auto insurance in Davenport, Florida?

Factors include local traffic congestion, road conditions, vehicle theft rates, and weather patterns.

Additionally, the driver’s credit history and driving record play significant roles in determining premiums.

Which insurance provider offers the highest bundling discount in Davenport?

Progressive offers the highest bundling discount at 20%. This substantial discount helps reduce overall insurance costs for customers who bundle multiple policies. Enter your ZIP code now to begin.

How does Travelers’ financial stability impact its status as one of the best Davenport, Florida auto insurance providers?

Travelers’ A++ financial rating from A.M. Best reflects its strong financial stability and reliability in handling claims.

This stability enhances its reputation as a top choice for the best Davenport, Florida auto insurance, especially for those concerned about their auto insurance premium.

Travelers’ financial strength suggests that they are well-equipped to manage claims effectively, potentially impacting your overall auto insurance premium positively.

What are the key benefits of using USAA for auto insurance in Davenport?

USAA offers exclusive benefits for military members and their families, including superior coverage options and competitive rates. Its A++ rating from A.M. Best underscores its financial strength and reliability.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.