Best Dayton, Ohio Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

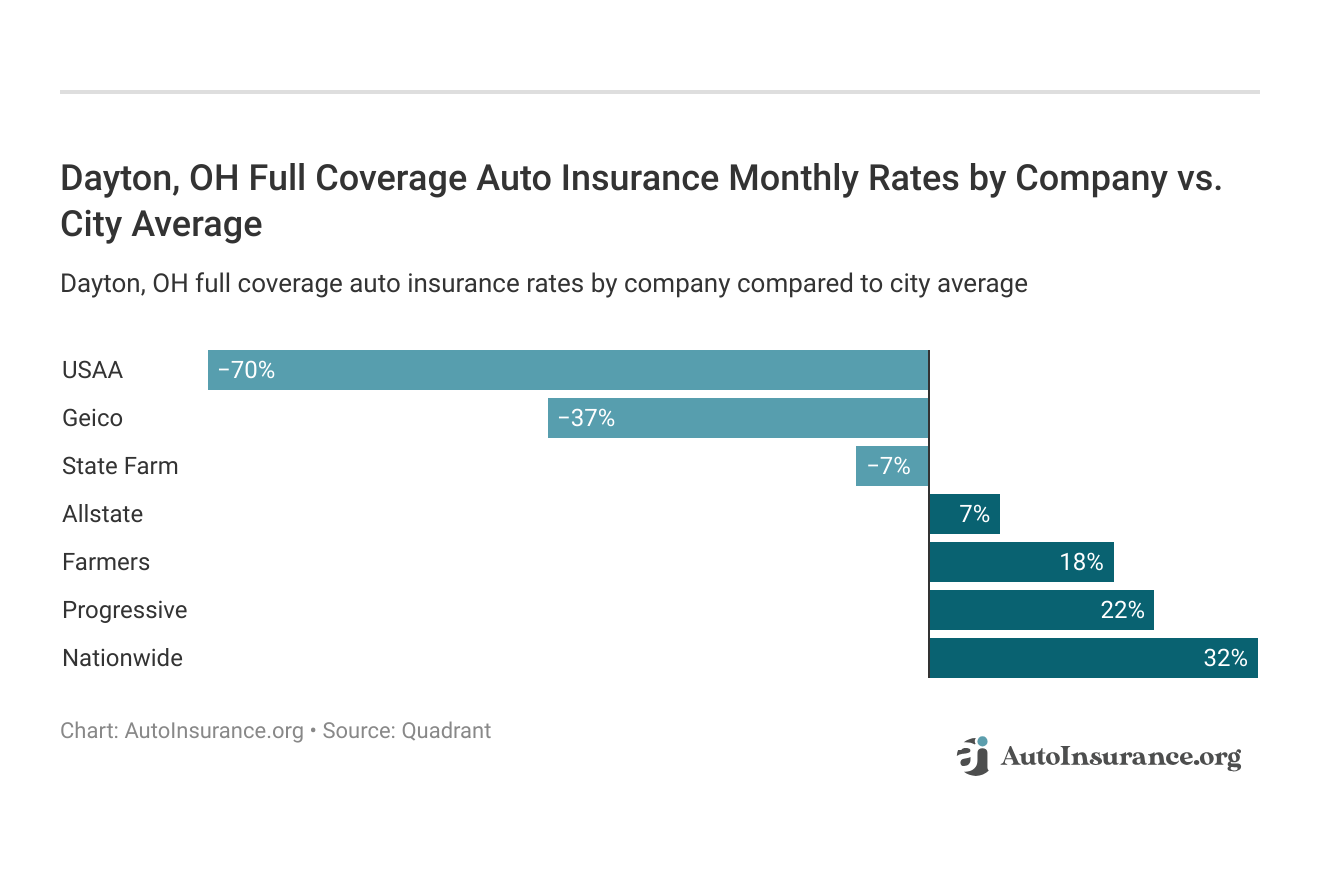

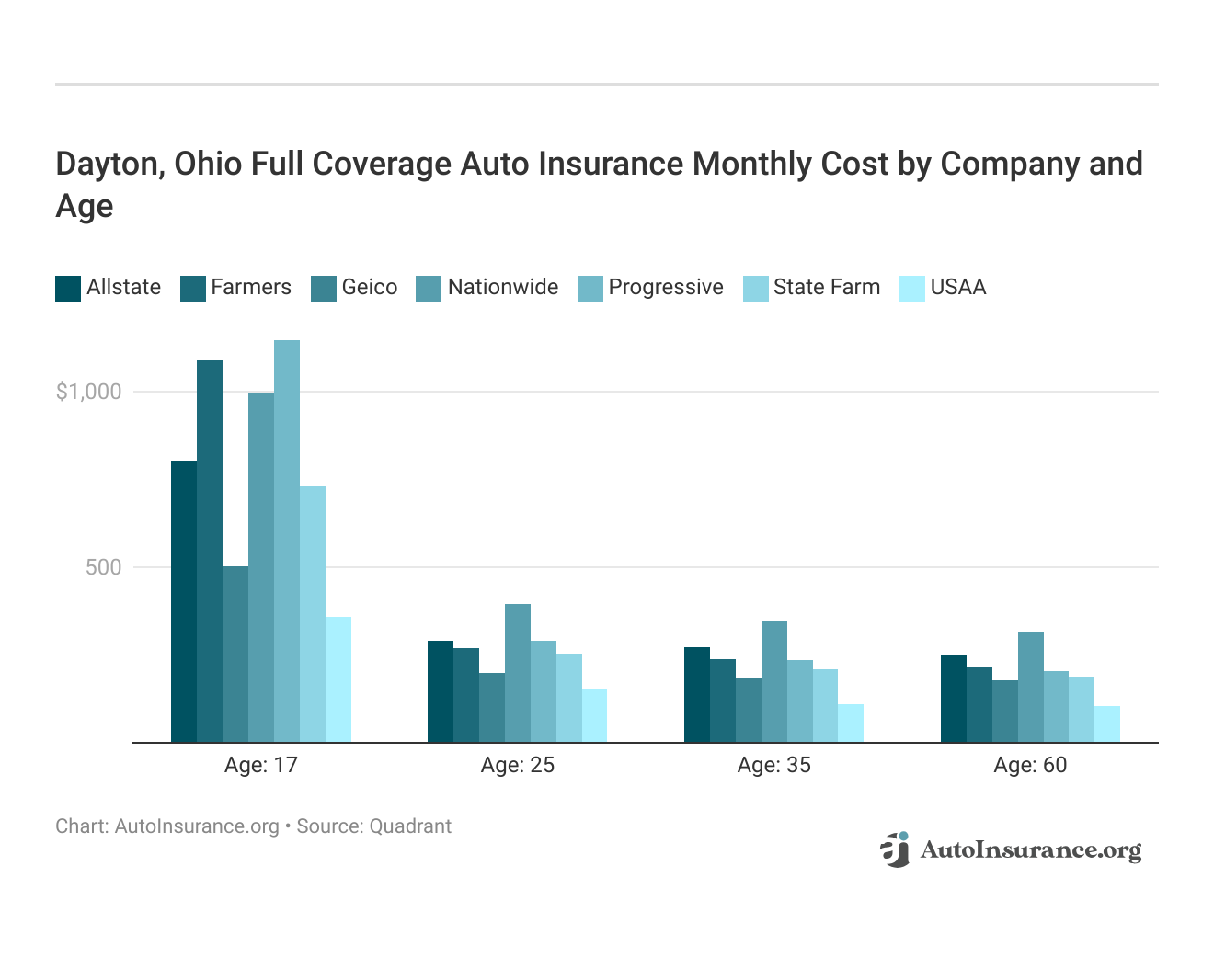

In the region of Dayton, USAA, Nationwide, and Progressive are the top companies offering the best Dayton, Ohio auto insurance coverage for as low as $50/month. Motorists in Dayton stand to gain from these advantageous rates, allowing them to enjoy their daily commutes and leisurely drives with added confidence.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated October 2024

Company Facts

Full Coverage in Dayton OH

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Dayton OH

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Dayton OH

A.M. Best Rating

Complaint Level

Pros & Cons

USAA, Nationwide, and Progressive are the top insurance providers for the best Dayton, Ohio auto insurance coverage starting at $50 a month. Navigating auto insurance complexities can be intricate, but finding top options in Dayton, Ohio doesn’t have to be.

This article highlights leading Dayton insurers, detailing those with superior coverage, pricing, and customer assistance. Wondering if auto insurance is a waste of money? Our expert assessment helps you find the best policy, whether you’re seeking savings or top-tier coverage.

Our Top 10 Company Picks: Best Dayton, Ohio Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 10% A++ Military Members USAA

#2 12% A+ Multi-Policy Savings Nationwide

#3 10% A+ Competitive Rates Progressive

#4 15% A++ Senior Discounts Geico

#5 11% A++ Bundling Policies Travelers

#6 12% B Financial Strength State Farm

#7 13% A 24/7 Support Liberty Mutual

#8 12% A+ Small Businesses The Hartford

#9 14% A Claims Service American Family

#10 14% A+ Add-on Coverages Allstate

- USAA’s ranked as the best car insurance in Dayton

- Dayton, Ohio car insurance rates are below the national average

- Commute times in Dayton are about average

#1 – USAA: Top Overall Pick

Pros

- Unmatched Affordability: USAA’s $50 monthly policies in Dayton offer unparalleled savings for qualified families, outperforming all competitors. Read USAA auto insurance review page to know more.

- Service-Centric Policies: Insurance tailored to military life addresses unique challenges such as deployment and movement.

- Top-Tier Member Approval: USAA consistently receives high ratings from Dayton’s policyholders, indicating a superior overall insurance experience.

Cons

- Limited Membership: Only the Dayton military community can access USAA offerings, excluding a large portion of the city’s population

- Scarce Physical Locations: The limited presence of USAA’s Dayton office may frustrate those who prefer face-to-face insurance discussions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Multi-Policy Saving

Pros

- Cost-Effective Protection: Nationwide provides cost-effective insurance solutions for Dayton drivers, harmonizing budget-friendly rates with extensive vehicle protection strategies. Read Nationwide auto insurance review page to know more.

- Tailored Policy Design: Dayton drivers have the opportunity to personalize Nationwide insurance plans to align precisely with their individual requirements, ranging from fundamental coverage to more comprehensive options.

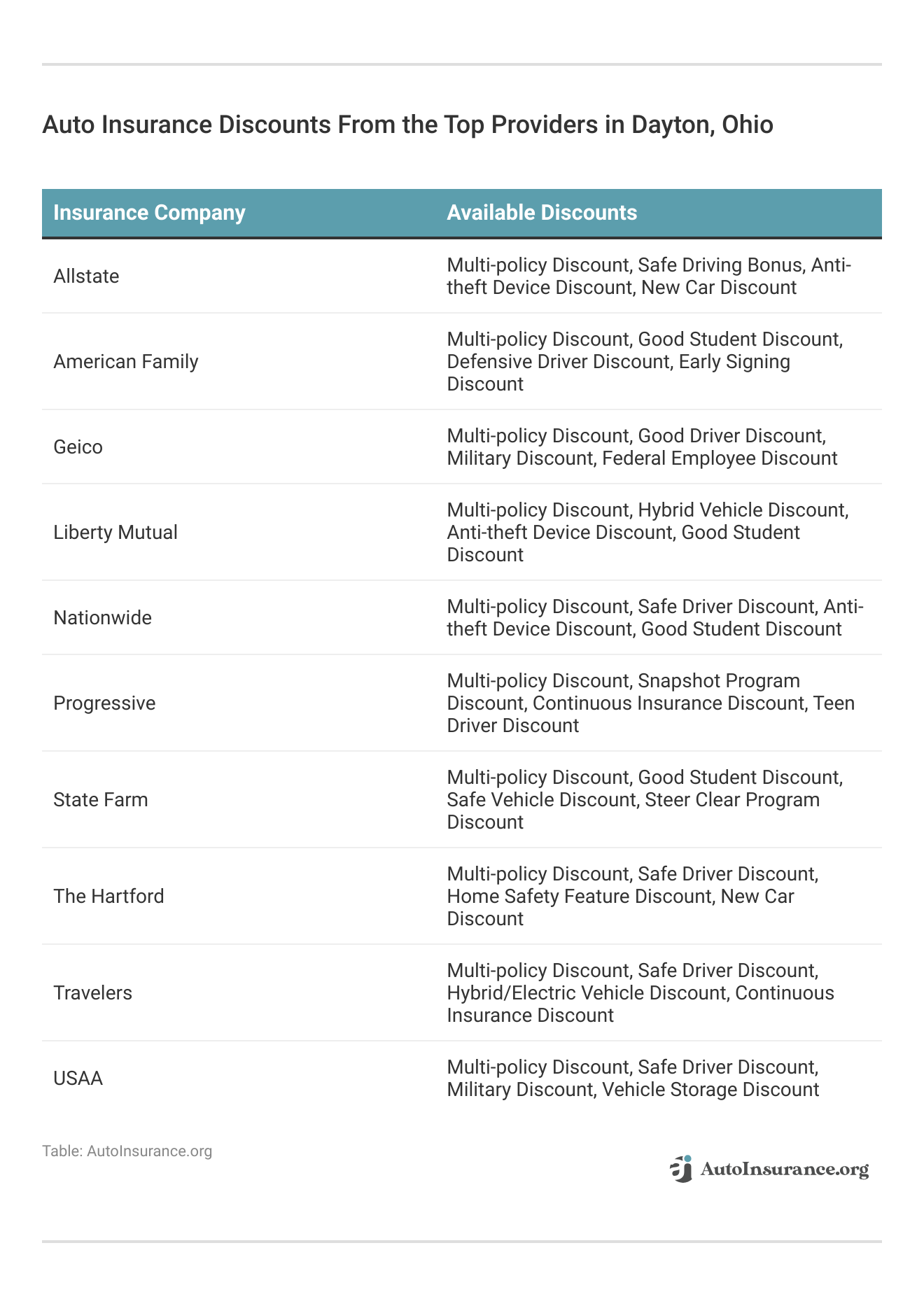

- Multi-Policy Perks: By consolidating multiple insurance coverages with Nationwide, you can achieve significant cost reductions.

Cons

- Unpredictable Assistance: Some Dayton clients report varying experiences with Nationwide’s support quality and claim resolution speed.

- Average Claim Handling: Nationwide’s claim satisfaction scores in Dayton align with industry norms, potentially underwhelming those seeking exceptional service.

#3 – Progressive: Best for Competitive Rates

Pros

- Driving Habit Rewards: The Progressive Snapshot program offers discounts that are directly correlated with an individual’s actual driving habits and on-road behaviors, thereby providing tangible rewards for safe and responsible driving. Read Progressive auto insurance review page to know more.

- Diverse Savings Routes: Numerous cost-cutting options are available, from safe driving bonuses to multi-policy deals.

- Mid-Range Pricing: At $140 monthly, Progressive provides a middle ground between budget options and premium coverage.

Cons

- Nuanced Rate Structure: Individuals with intricate and multifaceted driving records may encounter insurance rates that are significantly higher than they had anticipated. This nuanced rate structure takes into account a variety of factors from their driving history, potentially leading to elevated premiums.

- Inconsistent User Feedback: There have been numerous reports highlighting a range of experiences with Progressive’s customer support and claim resolution procedures. Some users have had positive interactions, while others have encountered significant challenges and frustrations.

#4 – Geico: Best for Senior Discounts

Pros

- Age-Agnostic Pricing: Geico maintains attractive rates across all Dayton driver age groups, appealing to various life stages. Read Geico auto insurance review page to know more.

- Tech-Forward Tools: A sophisticated online interface and mobile application enhance policy management for Dayton’s tech-savvy residents.

- Inclusive Eligibility: Coverage options are extended to all qualified Dayton drivers, without military service restrictions.

Cons

- Impersonal Approach: Dayton policyholders seeking personalized, face-to-face insurance guidance may find Geico’s digital-first model lacking.

- Pricing Variability: While competitive for many, Geico’s Dayton rates may not always be the lowest, especially for drivers with intricate backgrounds.

Frequently Asked Questions

What is Dayton, OH auto insurance?

Dayton, OH auto insurance refers to the insurance coverage specifically designed for vehicles owned and operated in Dayton, Ohio.

It provides coverage for potential damages, liability, and other risks associated with owning and driving a vehicle in the Dayton area.

Is auto insurance mandatory in Dayton, OH?

Yes, auto insurance is mandatory in Dayton, OH, as it is in most jurisdictions. Ohio state law requires all drivers to carry minimum liability insurance coverage to protect themselves and others in the event of an accident. Enter your ZIP code now to begin.

What are the top three auto insurance providers in Dayton, Ohio?

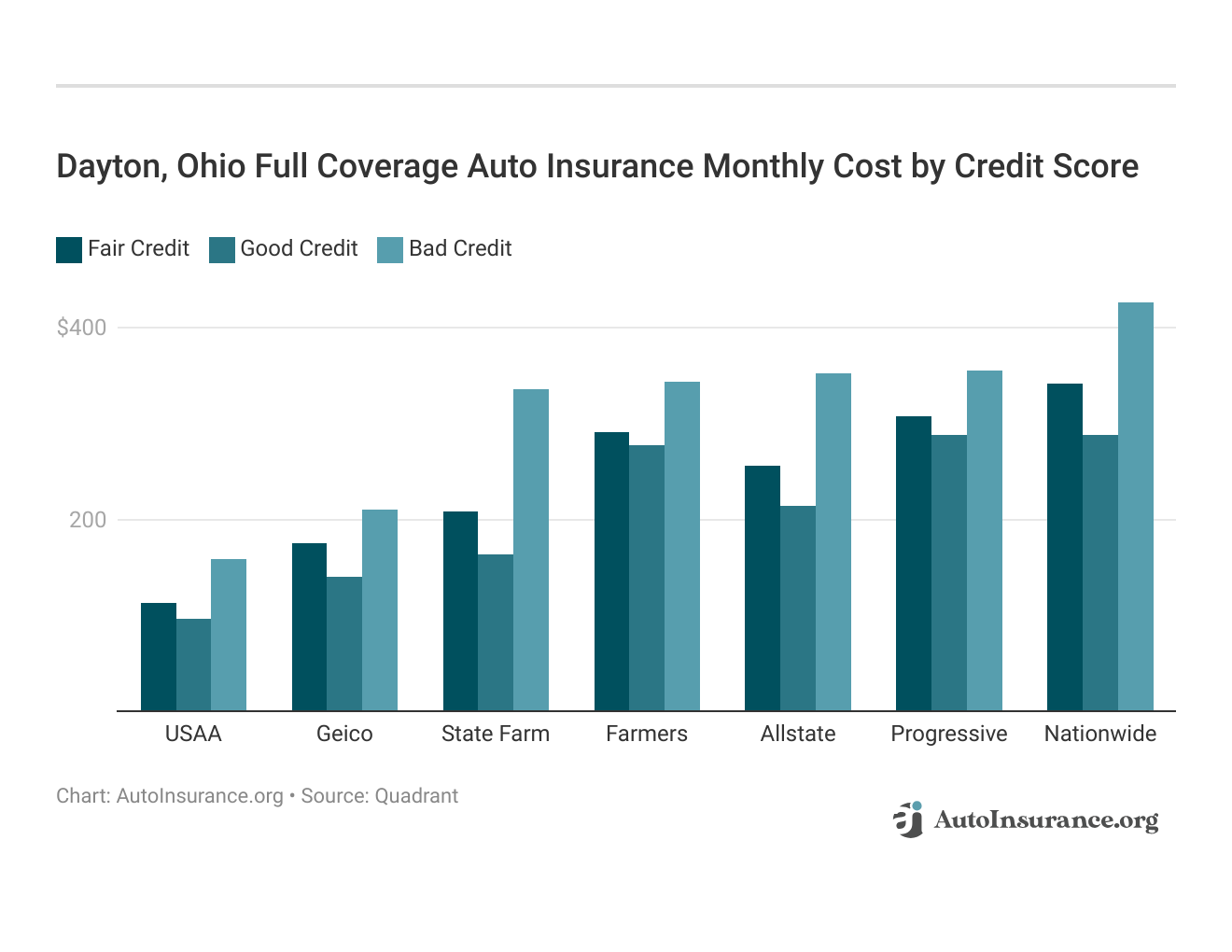

When considering auto insurance rates by ZIP code, Dayton, Ohio residents often find that USAA, Nationwide, and Progressive offer competitive options.

These top providers are noted for their affordability, comprehensive coverage options, and high customer satisfaction ratings.

USAA, in particular, excels in providing tailored rates for military families, while Nationwide and Progressive are known for their customizable coverage plans and user-friendly tools to compare auto insurance rates by ZIP code.

Which auto insurance provider offers the lowest starting rates in Dayton, Ohio?

USAA offers the lowest starting rates for auto insurance in Dayton, Ohio, with rates as low as $50 per month. However, USAA is only available to military members, veterans, and their families.

What is the minimum bodily injury liability coverage required for drivers in Dayton, OH?

Drivers in Dayton, OH, are required to have at least $25,000 in bodily injury liability coverage per person and $50,000 per incident. This minimum requirement helps cover medical expenses for injuries resulting from an accident. Enter your ZIP code now to begin.

Which auto insurance company in Dayton, Ohio is noted for its multi-policy savings?

Nationwide is noted for its multi-policy savings in Dayton, Ohio. Customers can receive significant discounts by bundling auto insurance with other types of auto insurance coverage.

How does Travelers support customers who have had an accident?

Travelers is known for its support in accident situations by offering a range of options for filing claims and assistance in navigating the claims process. Their comprehensive customer service helps streamline recovery after an accident.

What unique feature does Liberty Mutual offer that enhances its auto insurance policies?

Liberty Mutual is distinguished by its 24/7 support, providing continuous access to customer service and claims assistance. This ensures that policyholders receive help whenever they need it. Enter your ZIP code now to begin.

Which provider is highlighted for offering substantial discounts to AARP members?

Geico is highlighted for offering substantial discounts to AARP members. This discount is part of Geico’s effort to provide affordable and the best auto insurance for seniors.

How does the Drivewise program benefit Allstate customers in Dayton, Ohio?

Allstate’s Drivewise program benefits customers by offering discounts based on driving behavior, such as safe driving habits and lower mileage. This program helps reduce premiums for drivers who demonstrate responsible driving.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.