Best Elk Grove, California Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

State Farm, Geico, and USAA offer the best auto insurance providers in Elk Grove, California, with rates at $58/month. State Farm offers the most affordable coverage especially appealing to those seeking comprehensive options. Geico and USAA follow closely, providing excellent rates and tailored programs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated October 2024

Company Facts

Full Coverage in Elk Grove California

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Elk Grove California

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Elk Grove California

A.M. Best Rating

Complaint Level

Pros & Cons

For the best auto insurance in Elk Grove, California, State Farm, Geico, and USAA emerge as the top contenders. State Farm leads with its unmatched combination of affordability and extensive coverage options, making it the premier choice.

Geico follows closely with its competitive rates and broad discounts, while USAA excels in offering specialized benefits for military families.

Our Top 10 Company Picks: Best Elk Grove, California Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 17% B Local Agents State Farm

![]()

#2 25% A++ Affordable Rates Geico

![]()

#3 10% A++ Military Benefits USAA

#4 10% A+ Flexible Options Progressive

#5 25% A Customizable Coverage Liberty Mutual

#6 20% A+ Accident Forgiveness Nationwide

#7 20% A Strong Support Farmers

#8 5% A+ AARP Discounts The Hartford

#9 25% A+ Safe Driving Allstate

#10 25% A Customer Service American Family

These three companies stand out for their exceptional value and tailored insurance solutions. Explore insurance savings in our full guide titled, “Types of Auto Insurance.”

- State Farm offers top value for Elk Grove auto insurance

- Geico’s rates are ideal for Elk Grove, California drivers

- USAA caters to military families in Elk Grove

#1 – State Farm: Top Overall Pick

Pros

- Bundling Savings: State Farm in Elk Grove, California, offers a 17% discount for bundling policies, reducing overall costs. Delve into our evaluation of “State Farm Drive Safe and Save Review.”

- Tailored Service: Local representatives in Elk Grove, California provide personalized support, offering customized guidance and a direct insurance experience.

- Broad Coverage Options: State Farm in Elk Grove, California provides a wide range of coverage options, catering to various personal and business needs.

Cons

- Limited Bundling Savings: The 17% bundling discount in Elk Grove, California is less competitive compared to rivals like Geico and Liberty Mutual.

- Premium Costs: Despite bundling discounts, State Farm’s premiums in Elk Grove, California can be higher, particularly for high-limit or specialized coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Pricing: Geico offers competitive rates in Elk Grove, California, with minimum coverage around $63 per month and full coverage around $150.

- Excellent A.M. Best Rating: With an A++ rating from A.M. Best, Geico ensures financial stability and reliable claim management for Elk Grove, California residents.

- Generous Bundling Savings: Geico offers a 25% bundling discount in Elk Grove, California, for significant savings. Access detailed insights in our guide titled, “Best Geico Auto Insurance Discounts.”

Cons

- Inconsistent Customer Service: Some customers in Elk Grove, California experience mixed service quality with Geico, despite attractive rates.

- Discount Restrictions: Geico’s discounts in Elk Grove, California may not apply to all coverage types or policy adjustments, potentially limiting savings.

#3 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA offers specialized insurance benefits and tailored discounts for military families in Elk Grove, California, ensuring relevant and advantageous services.

- Top A.M. Best Rating: USAA’s A++ A.M. Best rating guarantees financial stability and reliability for policyholders in Elk Grove, California. Dive into our article called, “USAA Auto Insurance Review.”

- Competitive Pricing: USAA’s rates are competitive, with minimum coverage starting at $58 per month and full coverage around $140 in Elk Grove, California, offering excellent value for military families.

Cons

- Eligibility Limitations: USAA services are limited to military families and their immediate relatives, excluding non-military residents in Elk Grove, California.

- Lower Bundling Savings: With a 10% bundling discount in Elk Grove, California, USAA’s savings may be less competitive compared to other insurers like Geico and Liberty Mutual.

#4 – Progressive: Best for Flexible Options

Pros

- Customizable Coverage: Progressive offers adjustable insurance options in Elk Grove, California, letting policyholders tailor their plans to specific needs.

- Solid Financial Stability: With an A+ rating from A.M. Best, Progressive ensures reliable claim management and dependable service in Elk Grove, California.

- Competitive Pricing: Progressive offers affordable rates in Elk Grove, California, with options for diverse driving needs. Uncover details in our guide titled, “Progressive Auto Insurance Review.”

Cons

- Modest Bundling Savings: The 10% bundling discount in Elk Grove, California is lower compared to other providers, limiting potential savings.

- Premium Variability: Premiums in Elk Grove, California can fluctuate based on individual factors, affecting cost-effectiveness for some policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Coverage

Pros

- High Bundling Savings: Liberty Mutual offers a 25% discount for bundling policies, providing significant savings and enhancing overall value.

- Customizable Insurance Plans: Liberty Mutual’s adjustable plans allow policyholders to tailor coverage to their specific needs.

- Solid A.M. Best Rating : An A rating from A.M. Best signifies Liberty Mutual’s financial stability and claims management. Dive into our article called, “Liberty Mutual Auto Insurance Review.”

Cons

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness in Elk Grove, California: Nationwide’s accident forgiveness program prevents premium hikes after a first at-fault accident, offering financial protection in Elk Grove.

- 20% Discount: A 20% discount from Nationwide lowers insurance costs in Elk Grove. Explore savings in our complete guide titled, “Nationwide Auto Insurance Review.”

- A+ A.M. Best Rating in Elk Grove, California: Nationwide’s A+ rating indicates strong financial stability and reliability, ensuring effective claim management in Elk Grove.

Cons

- Discount Coverage Variability in Elk Grove, California: The 20% discount may vary by individual circumstances, affecting cost benefits in Elk Grove.

- Premium Rates in Elk Grove, California: Nationwide’s base premiums can be high, potentially impacting affordability for some in Elk Grove.

#7 – Farmers: Best for Strong Support

Pros

- Robust Customer Support: Farmers offers excellent support, improving the insurance experience in Elk Grove, California.

- 20% Discount: Farmers provides a 20% discount, reducing costs for policyholders in Elk Grove, California. For further details, see our guide titled, “Farmers Auto Insurance Review.”

- A Rating from A.M. Best: The A rating from A.M. Best reflects Farmers’ strong financial performance and dependability, ensuring policyholders in Elk Grove, California, can trust the company’s stability.

Cons

- Discount Application: The availability and application of discounts in Elk Grove, California, may vary, which could impact the overall cost benefits for different policyholders.

- Premium Costs: Despite offering discounts, Farmers’ premiums in Elk Grove, California, can still be relatively high, potentially affecting the overall affordability of insurance coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – The Hartford: Best for AARP Discounts

Pros

- AARP Member Discounts: The Hartford offers exclusive discounts for AARP members in Elk Grove, California, benefiting seniors and retirees.

- 5% Discount: The 5% discount in Elk Grove, California, reduces premium costs for more affordable insurance. For further details, see our guide titled, “The Hartford Auto Insurance Review.”

- A+ A.M. Best Rating: The Hartford’s A+ rating in Elk Grove, California, reflects strong financial stability and reliability.

Cons

- Lower Discount Percentage: The 5% discount in Elk Grove, California, may be smaller compared to other insurers’ offers, resulting in less savings.

- Premium Rates: Even with the AARP discount in Elk Grove, California, The Hartford’s rates may be less competitive than other providers.

#9 – Allstate: Best for Safe Driving

Pros

- Generous Safe Driving Discount: Allstate offers a notable 25% discount in Elk Grove, California, for maintaining a clean driving record, benefiting safe drivers.

- A+ A.M. Best Rating: Allstate’s A+ rating in Elk Grove, California, reflects its strong financial stability and reliable coverage. Discover more in our in-depth guide titled, “Allstate Auto Insurance Review.”

- Extensive Coverage Options: Allstate provides a wide range of coverage options in Elk Grove, California, ensuring tailored protection for diverse needs.

Cons

- Higher Premiums: Allstate’s base premiums in Elk Grove, California, can be relatively high, affecting affordability.

- Discount Eligibility Variability: The 25% safe driving discount in Elk Grove, California, may not be available to all policyholders, limiting potential savings.

#10 – American Family: Best for Customer Service

Pros

- Exceptional Customer Service: American Family’s renowned support enhances the insurance experience in Elk Grove, California.

- Attractive Discount Opportunities: A 25% discount offers substantial savings for policyholders in Elk Grove, California. Read our guide titled, “American Family Auto Insurance Review” for more information

- Strong A Rating from A.M. Best: The A rating confirms American Family’s financial reliability for customers in Elk Grove, California.

Cons

- Potentially Higher Premiums: Premium rates can be relatively high in Elk Grove, California, even with discounts.

- Limited Discount Flexibility: Discounts may be less flexible compared to other insurers in Elk Grove, California.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Auto Insurance Rates for Elk Grove, California by Provider

The table below provides a detailed breakdown of monthly auto insurance rates in Elk Grove, California, comparing different providers and coverage levels.

Elk Grove, California Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$80 $185

$74 $172

$78 $180

![]()

$63 $150

$83 $190

$73 $162

$75 $170

![]()

$68 $160

$79 $181

![]()

$58 $140

Among the insurance companies listed, USAA offers the most competitive rates, with minimum coverage starting at $58 per month and full coverage at $140.

Geico follows with a minimum coverage rate of $63 and full coverage at $150, while State Farm provides rates of $68 for minimum coverage and $160 for full coverage.

Auto Insurance Discounts From the Top Providers in Elk Grove, California

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Safe Driver, Good Student, New Car, Anti-theft, Responsible Payer | |

| Multi-policy, Safe Driver, Good Student, Loyalty, Early-bird, Defensive Driving | |

| Multi-policy, Good Student, Safe Driver, New Car, Homeowner, Business/Professional Affiliation | |

| Multi-policy, Good Driver, Military, Emergency Deployment, Good Student, Anti-theft, Defensive Driving | |

| Multi-policy, Multi-vehicle, Military, Early Shopper, Online Purchase, Homeowner |

| Multi-policy, Accident-free, Safe Driver, Defensive Driving, Paperless, Good Student |

| Multi-policy, Snapshot, Good Student, Continuous Insurance, Safe Driver, Homeowner | |

| Multi-policy, Safe Driver, Good Student, Vehicle Safety, Drive Safe & Save | |

| AARP Member, Multi-policy, Safe Driver, Defensive Driver, Bundling Home & Auto |

| Multi-policy, Safe Driver, Good Student, Military, Loyalty, New Vehicle |

These rates highlight the cost differences across various providers, helping Elk Grove residents make informed choices based on their coverage needs and budget. Read the article called “Full Coverage Auto Insurance” for additional insights.

Monthly Elk Grove, California Auto Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Elk Grove, California auto insurance rates by ZIP Code below:

With rates fluctuating based on local crime statistics, traffic patterns, and other regional factors, it’s crucial to consider how your ZIP code fits into the broader landscape of insurance pricing. By reviewing the rates across different areas, you can identify opportunities for savings and ensure you’re getting the best possible deal for your coverage needs.

Explore insurance savings in our full guide titled, “Does a criminal record affect auto insurance rates?“

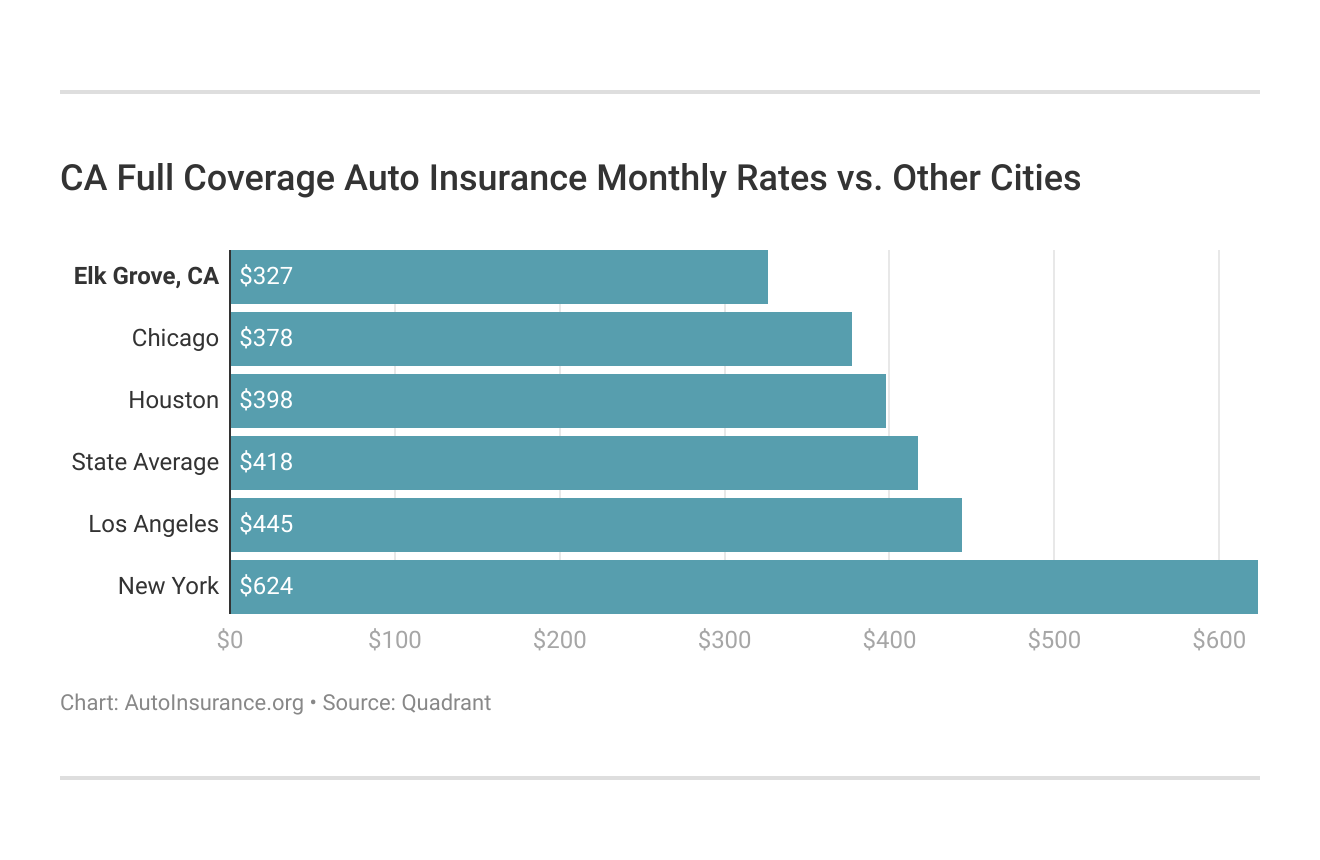

Elk Grove, California Auto Insurance Rates vs. Top US Metro Auto Insurance Rates

You might find yourself asking how does my Elk Grove, California stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

Navigating auto insurance rates in Elk Grove, California, is easier when you know how they measure up against those in other top U.S. metro areas. By comparing local rates, you can make more informed decisions and potentially find better deals that suit your budget.

Elk Grove, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | B | Lower-than-average vehicle theft rate compared to other cities in California. |

| Traffic Density | B | Medium traffic density, with less congestion compared to nearby urban areas. |

| Weather-Related Risks | A | Low risk due to favorable weather, minimal impact from extreme weather events. |

| Average Claim Size | B | Claims are generally average compared to other cities in California. |

| Uninsured Drivers Rate | B | Slightly lower-than-average rate of uninsured drivers for urban California areas. |

Armed with this knowledge, Elk Grove drivers can confidently explore their options, ensuring they secure the best coverage at the most competitive price. Learn more about the offerings in our guide titled, “Where to Compare Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring the Most Affordable Auto Insurance Options in Elk Grove, California

Based on average rates, USAA emerges as the most affordable auto insurance provider in Elk Grove, California, offering competitive pricing that stands out among other insurers in the region.

Discover which auto insurance company in Elk Grove, California offers the most competitive rates, and see how these rates stack up against the average auto insurance rates in California.

Elk Grove, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Low weather-related risks |

| Average Claim Size | B+ | Average claim is $4,500, slightly below average |

| Traffic Density | B | Moderate traffic levels |

| Vehicle Theft Rate | B | Moderate vehicle theft rate, above national average |

| Uninsured Drivers Rate | C+ | 13% of drivers are uninsured |

By exploring your options and comparing rates, you can find a policy that not only protects your vehicle but also aligns with your budget, ensuring peace of mind on the road.

If you’re not a veteran or in the immediate family of someone in the U.S. Armed Forces, you won’t be eligible for a USAA auto insurance policy.

Therefore, you’ll have to choose a company available to all potential customers, such as Geico, Progressive, etc. The quickest road to best Elk Grove, California auto insurance is a clean driving record, age, and whether you qualify for several discounts.

The variable application of Nationwide’s discount in Elk Grove, California, can affect overall savings, though its financial stability remains a strong pointDani Best Licensed Insurance Producer

If you’re in the 16 to 24 age range, auto insurance rates could cost twice as much. We recommended staying under a parent’s policy and pursuing discounts by driving less and maintaining good grades.

Elk Grove, California auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

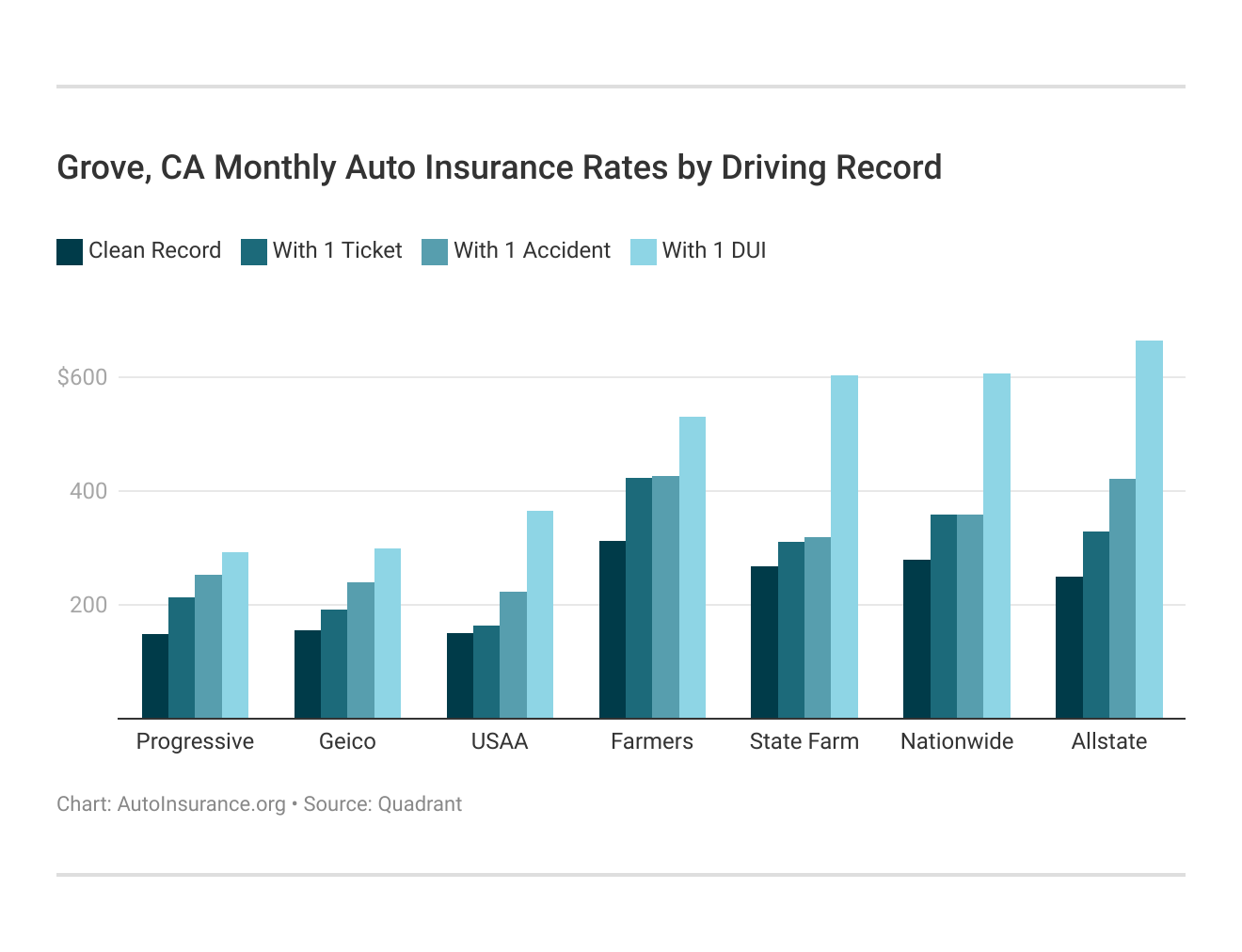

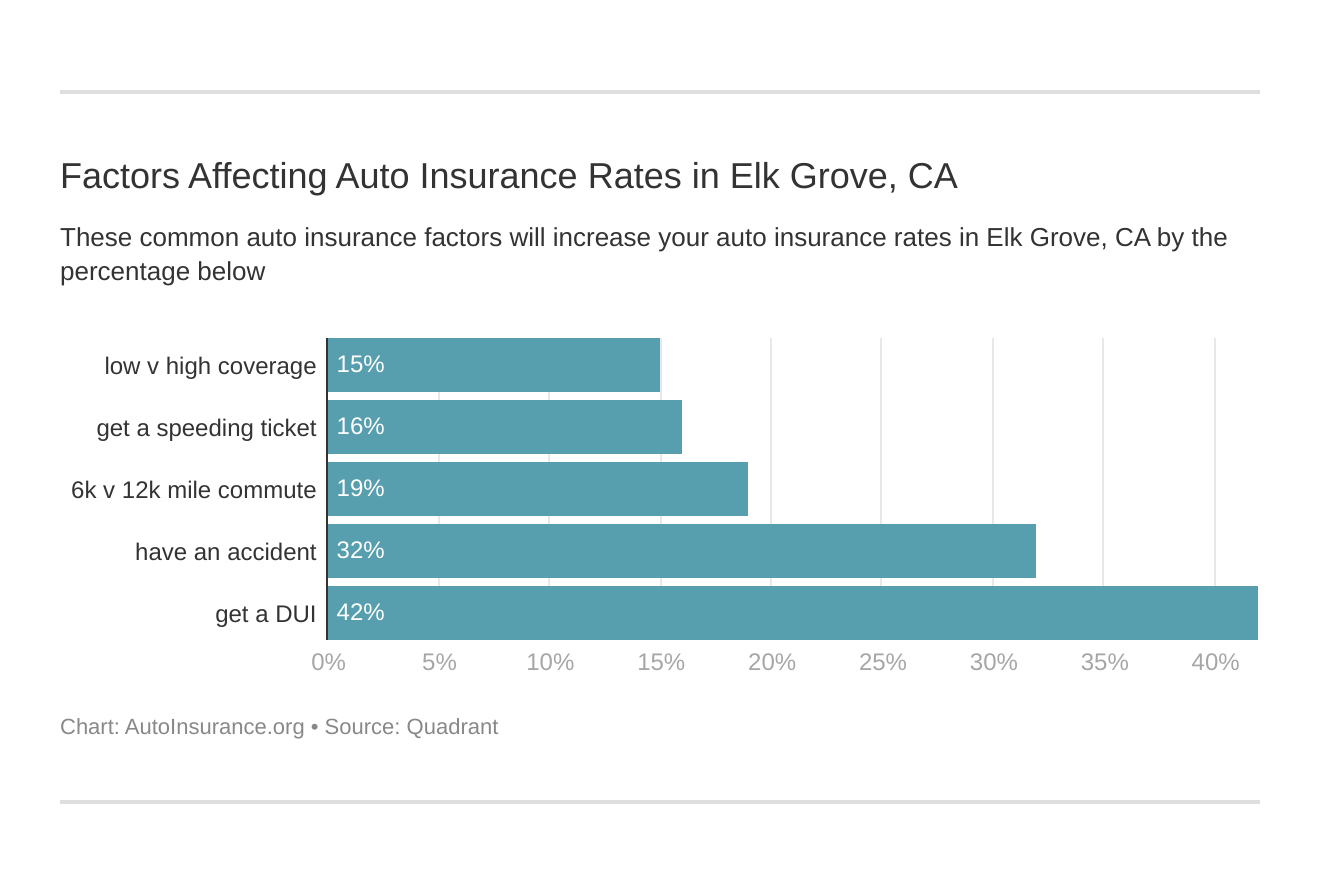

Your driving record will play a major role in your Elk Grove auto insurance rates. For example, other factors aside, an Elk Grove, California DUI may increase your auto insurance rates 40 to 50 percent. Find the best Elk Grove, California auto insurance rates by driving record.

Factors affecting auto insurance rates in Elk Grove, California may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain best Elk Grove, California auto insurance.

These states are no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. California does use gender, so check out the average monthly auto insurance rates by age and gender in Elk Grove, California.

While some states have moved away from using gender to determine auto insurance rates, California continues to include it as a factor, alongside age, which remains a primary consideration for all drivers.

For those in Elk Grove, California, being aware of how rates fluctuate by age and gender can provide valuable insights when seeking the best coverage options. Understanding these variables not only helps in finding affordable insurance but also empowers consumers to make informed decisions tailored to their individual needs.

The report below represents the auto accident and insurance claim statistics for Elk Grove, California, detailing essential factors such as annual accidents, claims, average claim sizes, and the percentage of uninsured drivers.

Elk Grove, California Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 3,100 |

| Total Claims Per Year | 2,800 |

| Average Claim Size | $5,200 |

| Percentage of Uninsured Drivers | 10% |

| Vehicle Theft Rate | 620 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | Low |

The statistics for Elk Grove indicate a considerable number of auto accidents and claims, with a moderate percentage of uninsured drivers. This data underscores the importance of comprehensive insurance coverage and highlights the need for ongoing efforts to enhance road safety in the community.

Minimum Auto Insurance Requirements in Elk Grove, California

All Elk Grove drivers have to meet the minimum California auto insurance requirements.

In California, you have to carry at least:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

California is an at-fault state, which means an at-fault driver must use their auto insurance policy to pay for the no-fault driver’s bodily injury and property damage from the collision.

If an insurance policy is insufficient, the no-fault driver has the right to sue the at-fault driver for the remainder of the cost.

Factors That Influence Auto Insurance Rates in Elk Grove, California

Gender and credit-based auto insurance have been outlawed in California, but commute mileage and vehicle thefts are still factors.

According to Data USA, the average commute time in Elk Grove is 30 minutes, which is five minutes slower than average.

Driving your vehicle less in Elk Grove could save at least ten percent on your auto insurance, but your savings will depend on the company.

The Benefits of Choosing Comprehensive Coverage in Elk Grove, California

Any city with a low vehicle theft rate can get a deal on comprehensive coverage. According to the 2019 FBI statistics, Elk Grove, California, had 200 vehicle thefts.

Elk Grove, California weather is also something you should consider. According to City-Data, Elk Grove 13 flooding disasters in 2019.

Although comprehensive coverage isn’t required, it’s highly recommended to avoid expensive out-of-pocket costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Elk Grove, California Auto Insurance: Key Facts and Bottom Line

Elk Grove, California auto insurance rates are expensive, but it’s still cheaper than Los Angeles auto insurance. The best way to secure cheap auto insurance is to maintain a clean driving record.

Before you buy Elk Grove, California auto insurance, shop around for a policy where you can save money. Use our free comparison tool below to get fast, free auto insurance quotes.

Frequently Asked Questions

Which is the cheapest auto insurance company in Elk Grove, California?

The cheapest auto insurance company in Elk Grove, California, based on average rates, is USAA.

For additional details, explore our comprehensive resource titled, “Compare Auto Insurance Rates by Vehicle Make and Model.”

What factors affect auto insurance rates in Elk Grove, California?

Auto insurance in Elk Grove, California varies for each person because auto insurance costs depend on personal factors such as driving record, age, coverage level, commute, tickets, DUIs, and credit.

What are the minimum auto insurance requirements in Elk Grove, California?

All Elk Grove drivers have to meet the minimum California auto insurance requirements, which include liability coverage of 15/30/5. This means you must have at least $15,000 bodily injury coverage per person, $30,000 bodily injury coverage per accident, and $5,000 property damage coverage.

Why is comprehensive coverage recommended in Elk Grove, California?

Comprehensive coverage is recommended in Elk Grove, California because it provides protection against vehicle theft and damage from non-collision events such as floods. While not required by law, having comprehensive coverage can help avoid expensive out-of-pocket costs.

What is the average auto insurance cost per month in Elk Grove, California?

In Elk Grove, California, the average monthly cost of auto insurance is approximately $150. This figure can fluctuate based on factors such as driving history, vehicle type, and coverage levels.

To find out more, explore our guide titled, “Driving Without Auto Insurance.”

How does the crime rate in Elk Grove, California, affect auto insurance rates?

The crime rate in Elk Grove, California, can influence auto insurance rates, especially concerning vehicle theft and vandalism. A higher crime rate may lead to increased premiums due to the higher risk of claims.

Where can I find full coverage auto insurance near me in Elk Grove, California?

In Elk Grove, California, you can find full coverage auto insurance through local agencies such as State Farm, Progressive, and Allstate. Many of these providers offer customized policies to ensure comprehensive coverage for your vehicle.

What does Progressive Insurance offer for auto insurance in Elk Grove, California?

Progressive Insurance in Elk Grove, California, provides a variety of auto insurance options, including liability, collision, and comprehensive coverage. They also offer tools like Name Your Price to help tailor coverage to your budget.

What auto insurance services are available through State Farm in Elk Grove, California?

State Farm in Elk Grove, California, offers extensive auto insurance services including liability, collision, and comprehensive coverage, along with benefits such as accident forgiveness and local agent support for personalized service.

To learn more, explore our comprehensive resource on “Cheapest Liability-Only Auto Insurance.”

Is fully comprehensive auto insurance necessary in Elk Grove, California?

An Elk Grove, California, fully comprehensive auto insurance is often required by car dealerships, banks, and other lenders if you finance or lease your vehicle. Comprehensive coverage provides peace of mind by protecting your car against a wide range of scenarios, including theft, vandalism, and natural disasters.

What is the best auto insurance for drivers in Elk Grove, California?

What are the minimum requirements for full coverage auto insurance in Elk Grove, California?

What is the most affordable auto insurance group in Elk Grove, California?

Is Geico a reliable auto insurance provider in Elk Grove, California?

Why might it be challenging to obtain auto insurance in Elk Grove, California?

What is the ideal auto insurance coverage to have in Elk Grove, California?

Which insurance companies are exiting the California market?

What are the benefits of comprehensive auto insurance in Elk Grove, California?

Are there any special discounts for auto insurance in Elk Grove, California?

What should I consider when choosing an auto insurance provider in Elk Grove, California?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.