Best Delivery Driver Auto Insurance in 2026 (Find the Top 10 Companies Here!)

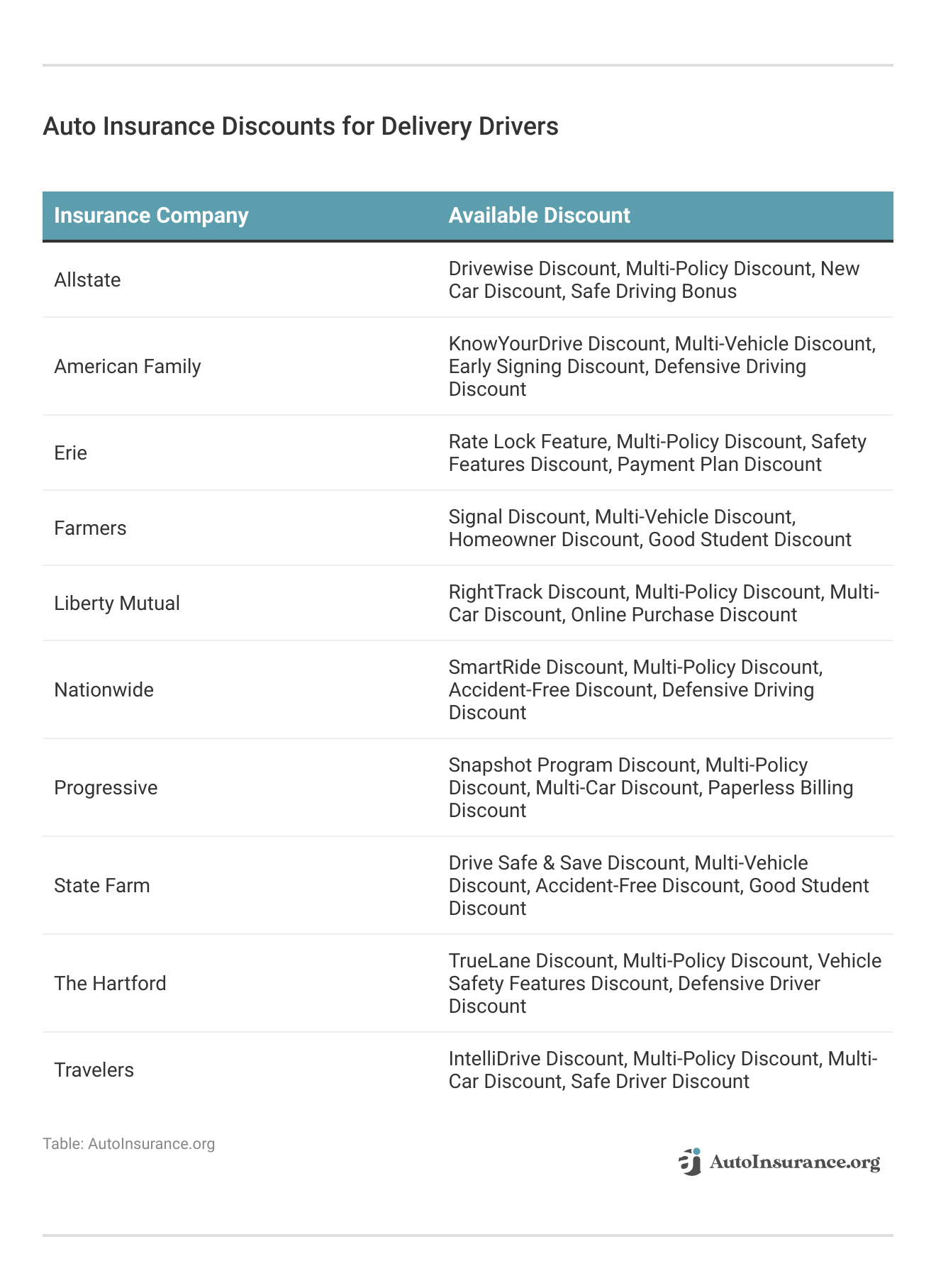

Progressive, State Farm, and Nationwide provide the best delivery driver auto insurance, with rates starting at a mere $33 per month. We aim to assist you in comparing insurance rates from these leading companies, guaranteeing you receive optimal coverage and tailored discounts specific to your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated January 2025

Company Facts

Full Coverage for Delivery Driver

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Delivery Driver

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Delivery Driver

A.M. Best Rating

Complaint Level

Pros & Cons

- Progressive provides competitive rates starting at $33 monthly

- Leading insurance firms offer potential discounts for delivery drivers

- Discount options are available to secure auto insurance for delivery drivers

#1 – Progressive: Top Overall Pick

Pros

- Tailored Plans: In our Progressive auto insurance review, personalized coverage options are tailored to suit vehicles.

- Competitive Pricing: Progressive offers cost-effective rates.

- Discount Variety: Progressive provides various discount opportunities, including those tailored specifically for automobiles.

Cons

- Claims Processing: Individuals may encounter delays or complications during the claims handling process.

- Discount Limitations: Progressive may not provide as wide a range of discounts as some competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Cheap Rates

Pros

- Savings Selection: State Farm offers a diverse array of discount opportunities.

- Financial Resilience: State Farm boasts a sturdy financial backing from a stable corporation.

- Outstanding Client Support: State Farm is celebrated for its prompt and amiable customer service.

Cons

- Policy Limitations: Certain driving requirements may not qualify for additional policy enhancements. Explore further in our State Farm auto insurance review.

- Claims Handling: Individuals may face delays or complications in the claims processing procedure.

#3 – Nationwide: Best for Bundling Discounts

Pros

- Extensive Array of Protection Choices: Nationwide presents an extensive selection of coverage options, empowering customers to customize policies to their specific requirements.

- Safe Driving Rewards: The Vanishing Deductible initiative by Nationwide incentivizes safe driving behavior by gradually reducing deductibles over time.

- Affiliation Savings: Nationwide offers discounts for various affiliations and memberships, making insurance more affordable for specific groups.

Cons

- Mixed Customer Satisfaction: Customer satisfaction ratings fluctuate, as outlined in our Nationwide insurance review, with some customers reporting average experiences.

- Premium Flexibility: Premium rates may fluctuate depending on geographic location and individual profiles, potentially affecting overall affordability.

#4 – Travelers: Best for Coverage Options

Pros

- Affordable Premiums: Our Travelers auto insurance review showcases cost-effective rates that are friendly to various budgets.

- Flexible Policy Choices: Travelers offers policies that can be tailored to individual needs.

- Savings Opportunities: Travelers provides a range of discount options, including those designed specifically for automobiles.

Cons

- Sparse Agent Network: Travelers primarily conducts business online and via phone, with limited in-person agent presence.

- Policy Restrictions: Certain policy add-ons may not entirely address the needs of vehicles.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Personalized Plans: Liberty Mutual provides individualized coverage options tailored specifically for car insurance.

- Budget-Friendly Rates: Liberty Mutual offers competitively priced premiums.

- Outstanding Client Care: Liberty Mutual is renowned for its prompt and user-friendly customer service.

Cons

#6 – American Family: Best for Loyalty Rewards

Pros

- Innovative Policy Features: American Family introduces distinctive policy options like accident forgiveness and deductible rewards, providing enhanced benefits.

- Intuitive Technological Solutions: With user-friendly mobile apps and online tools, American Family simplifies policy management and claims processing for customers.

- Solid Financial Resilience: American Family’s strong financial foundation ensures policyholders have a dependable and secure insurance provider.

Cons

- Potential Premium Variability: Some customers may notice slight variations in American Family’s premiums compared to other insurers.

- Diverse Customer Service Feedback: While many customers share positive experiences, our American Family insurance review highlights occasional challenges with claims processing.

#7 – Farmers: Best for Customizable Policies

Pros

- Tailored Protection: Farmers, as discussed in our Farmers auto insurance review, customizes coverage to meet individual needs.

- Budget-Friendly Pricing: Farmers provides reasonably priced car insurance options.

- Savings Opportunities: Farmers offers various promotions, including those designed for car insurance.

Cons

- Agent Accessibility Challenges: Farmers primarily operates through local agents, which may not be readily accessible in certain regions.

- Coverage Restrictions: Some specific additional coverage options may not fully address policyholders’ requirements.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Add-on Coverages

Pros

- Customized Savings: Allstate offers personalized discount opportunities for individuals.

- Financial Security: Allstate benefits from the backing of a financially robust corporation.

- Exceptional Client Care: Allstate is highly regarded for its quick and accessible service.

Cons

- Policy Restrictions: Certain supplementary policy features may not entirely align with individuals’ needs. Refer to our Allstate auto insurance review for assistance.

- Claims Processing: Individuals may face delays or challenges during the claims handling process.

#9 – Erie: Best for Personalized Policies

Pros

- Cost-Effective Premiums: Our Erie auto insurance review uncovers rates that are both competitive and budget-friendly.

- Flexible Coverage Choices: Erie offers policies that can be tailored to individual needs.

- Savings Opportunities: Erie provides a variety of discount options, including those specifically designed for cars.

Cons

- Sparse Local Agent Presence: Erie primarily conducts business through online and telephone channels, with limited in-person agent availability.

- Policy Constraints: Certain policy add-ons may not completely address the unique needs of classic cars.

#10 – The Hartford: Best for Exclusive Benefits

Pros

- Cutting-Edge Policy Features: The Hartford introduces innovative coverage options like accident forgiveness and deductible rewards, enhancing policy benefits.

- User-Friendly Digital Solutions: With intuitive mobile apps and online tools, The Hartford simplifies policy and claims management for customers.

- Solid Financial Security: The Hartford’s sturdy financial footing ensures policyholders have a dependable and stable insurance provider.

Cons

- Possible Premium Variations: Some customers may notice slight disparities in The Hartford’s premiums compared to other insurers.

- Diverse Customer Service Feedback: While many customers share positive experiences, our The Hartford insurance review highlights occasional challenges with claims processing.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Delivery Driver Auto Insurance Explained

Comparing Delivery Driver Auto Insurance Rates

Specific Auto Insurance Policies for Delivery Drivers

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Different Types of Delivery Driver Auto Insurance

- Business-Use Auto Insurance Coverage: Choose business-use auto insurance for both occasional delivery and non-delivery driving; insufficient coverage may lead to out-of-pocket expenses for delivery accidents due to higher associated risks.

- Business Usage Endorsement Addition: Personal policies may offer a business usage endorsement for part-time delivery drivers to save on insurance. Companies like State Farm and Erie provide add-ons for coverage during work intervals.

- Commercial Auto Insurance: Commercial auto insurance is pricier but covers full-time delivery vehicles comprehensively, with providers handling claims promptly and offering assistance with damages and rentals if possible under your policy.

- Auto Insurance for Individuals: Ensure adequate coverage before using your personal vehicle for food delivery to avoid paying for damages out of pocket if an accident occurs, as personal insurance typically doesn’t cover business use.

- Occupational Insurance: Ridesharing companies may provide coverage in accidents if you have personal auto insurance, but it might only cover liability. You’ll be responsible for any costs exceeding their coverage.

- Delivery Driver Endorsements on Personal Auto Insurance: An endorsement broadens coverage in existing policies, like TNC endorsements for rideshare apps, letting drivers operate under personal policies; otherwise, commercial or delivery insurance is needed.

Buying Delivery Driver Auto Insurance

The Bottom Line on Delivery Driver Auto Insurance

Frequently Asked Questions

What steps should I take if I want to get delivery driver auto insurance?

To get delivery driver auto insurance, follow these steps:

- Research insurance providers that offer coverage for delivery drivers.

- Gather necessary information such as your driving history, vehicle details, and delivery driver activities.

- Contact insurance companies and request quotes for delivery driver auto insurance.

- Compare coverage options, costs, and policy terms.

- Select the most suitable insurance policy for your needs.

- Complete the application process, provide any required documentation, and make the necessary payments.

- Review your policy thoroughly and keep a copy for your records.

- Regularly evaluate your coverage to ensure it meets your evolving needs.

What impact does driving for DoorDash have on auto insurance rates?

Although DoorDash offers insurance protection when you’re making deliveries, it does not cover all of your working hours or private driving. You still require personal auto insurance. However, driving for DoorDash has an impact on car insurance because of higher prices and the supplementary requirement for rideshare insurance. Enter your ZIP code now.

What type of insurance am I required to have for UberEats?

What should you do if you have a food delivery accident?

In the event of a collision, your company’s insurance policy might also protect you, but it probably only covers liability claims. To cover damage repair costs, you must have collision insurance.

What happens if I don’t disclose my delivery driver activities to my insurance company?

Failure to disclose your delivery driver activities to your insurance company can lead to complications or denial of coverage in the event of an accident or claim. It’s important to be transparent with your insurer to ensure you have the appropriate coverage for your needs. Enter your ZIP code now to compare.

Can I make food deliveries without delivery driver insurance?

What perils do I face as a delivery driver using my own auto insurance?

You incur the chance of having an accident while working for which you are not compensated. This indicates that you may be accountable for:

- Damages to your car

- Expensive healthcare costs

- The cost of the other driver’s care

- Damage to the property or vehicle of the opposing party

- Litigation brought about by the incident

Your insurance policy might be terminated if you try to lie to the insurance provider.

Does food delivery driver auto insurance come with workers comp?

No, in the majority of instances, insurance for food delivery drivers simply provides commercial and liability coverage. Food delivery drivers who want to be covered against accidents at work might choose to get standalone workers’ compensation insurance. Enter your ZIP code for more information.

Whose insurance will cover an incident involving a delivery driver?

What about auto insurance for pizza delivery drivers?

Your employer can demand that you get some kind of food delivery insurance. If the work is part-time and the policy is coded to include business use, some policies will pay for delivery trips.

For example, Progressive offers commercial vehicle insurance called pizza delivery insurance to safeguard you and your car while working as a pizza or food delivery driver.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.