Best Auto Insurance for FreshDirect Delivery Drivers in 2026 (Find the Top 10 Companies Here)

Progressive, USAA, and State Farm have the best auto insurance for FreshDirect delivery drivers, as they offer rates as low as $78 per month. These insurers provide both personal and commercial policies, ensuring drivers have the right protection whether using their own vehicles or FreshDirect trucks.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated December 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for FreshDirect Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for FreshDirect Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for FreshDirect Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsProgressive, USAA, and State Farm offer the best auto insurance for FreshDirect delivery drivers, with rates starting as low as $78 per month. If you want to become a delivery driver for FreshDirect, you must have the right auto insurance coverage to cover you if you are in an accident while making deliveries.

Unfortunately, FreshDirect reviews and the company’s website don’t state that it has a company auto insurance policy for employees to join, so employees must get their own insurance policy.

Our Top 10 Company Picks: Best Auto Insurance for FreshDirect Delivery Drivers

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Commercial Expertise | Progressive | |

| #2 | 10% | A++ | Military Drivers | USAA | |

| #3 | 17% | B | Reliable Coverage | State Farm | |

| #4 | 20% | A+ | Custom Options | Nationwide |

| #5 | 15% | A | Discount Availability | Liberty Mutual |

| #6 | 25% | A+ | Comprehensive Plans | Allstate | |

| #7 | 15% | A | Flexible Policies | Farmers | |

| #8 | 10% | A+ | Customer Service | The Hartford |

| #9 | 13% | A++ | Specialized Discounts | Travelers | |

| #10 | 20% | A | Local Support | American Family |

All FreshDirect delivery drivers who use their personal cars will need a valid license and should have commercial coverage. Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- Drivers for FreshDirect must have the legal minimum amount of auto insurance

- FreshDirect also requires its drivers to have a clean driving record

- Drivers can save on commercial auto insurance by shopping around

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

FreshDirect Auto Insurance Requirements

What kind of insurance you need depends on what type of work you do for FreshDirect. For example, truck drivers and drivers using their own cars should have commercial auto insurance. You will also need to know what kind of coverage you need, see our table for info about the rates from best insurers.

FreshDirect Delivery Driver Auto Insurance Monthly Rates by Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $87 $172

American Family $86 $168

Farmers $90 $177

Liberty Mutual $92 $180

Nationwide $89 $175

Progressive $85 $170

State Farm $82 $165

The Hartford $95 $185

Travelers $88 $170

USAA $78 $158

Because FreshDirect will likely ask for proof of insurance before hiring, it’s important to carry the right auto insurance premium that will protect you if you get into an accident while making deliveries.

You may even consider getting buy-and-print auto insurance proof online. The last thing you want is to get sued by another driver and not have the proper protection.

Personal Auto Insurance for FreshDirect

Suppose you work as a food delivery employee for FreshDirect, or another similar role that doesn’t require driving FreshDirect’s vehicles for deliveries. In that case, you’ll need a personal car insurance policy.

These insurers provide both personal and commercial policies, ensuring drivers have the right protection whether using their own vehicles or FreshDirect trucks.Daniel Walker Licensed Auto Insurance Agent

Of course, you’ll need to make sure you meet your state requirements for auto insurance. It is best to ensure that you have more than the minimum state requirements for auto insurance, so you are better protected in case of an accident.

Commercial Auto Insurance for FreshDirect

You should have commercial auto insurance in two situations. First, if you are driving one of the FreshDirect company’s trucks, you’ll need commercial auto insurance. FreshDirect doesn’t specify if they provide commercial auto insurance for delivery drivers, implying drivers will need their own policy rather than signing up with a company policy.

Second, you will also need commercial auto insurance if you use your vehicle to make deliveries for FreshDirect. Delivering food with your car is considered “business use.” Therefore, commercial insurance protects you better if you get into an accident while making deliveries.

In fact, in any situation where you use a personal vehicle for work, it’s important to carry commercial auto insurance. Otherwise, your insurance company could deny your claim if you were in an accident when using your car for business.

Other Requirements For FreshDirect Truck Drivers

In addition to having car insurance, truck drivers must also have a clean driving record to work for FreshDirect. FreshDirect posted the following requirements on their job postings for drivers:

- Eight or fewer points on their driving record.

- Can’t have any suspensions within the last 12 months.

- Can’t have more than one suspension in the last three years.

- Can’t have more than one accident in the previous three years.

- Can’t have more than three moving violations within the last three years.

If you are a tractor-trailer driver, you must also have a CDL Class A license and understand and follow DOT regulations. For more information, read our article titled “How to Insure a Commercial Truck for Personal Use.”

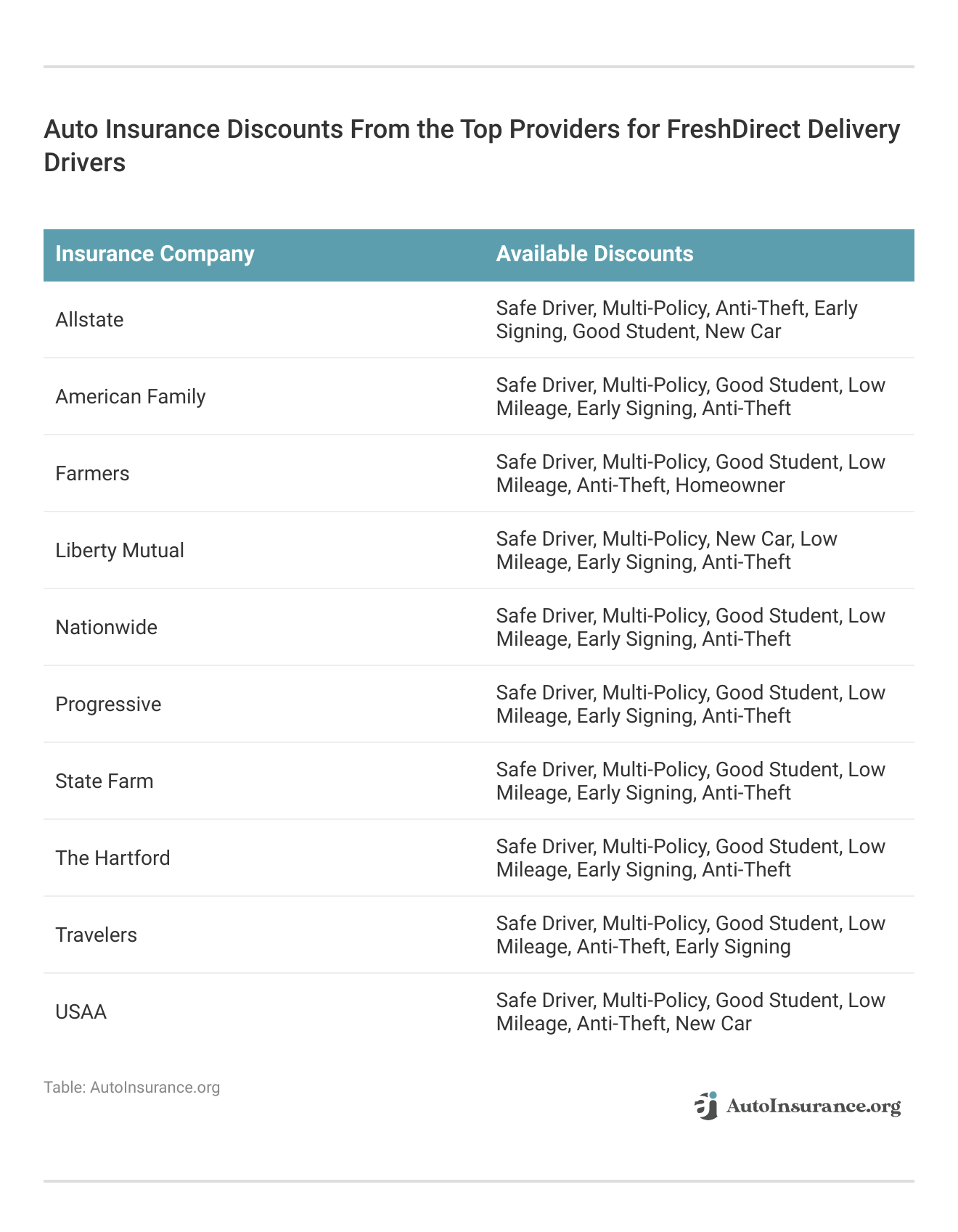

Being well-protected and saving money when working for a company, and driving their vehicles is especially important. See our chart below, check out the discounts you can get from top providers to get more savings.

If you work as a delivery driver for FreshDirect, you can reduce the cost of your auto insurance by following these suggestions and making sure you receive discounts.

The Key Takeaways on Auto Insurance for FreshDirect Delivery Drivers

FreshDirect doesn’t appear to offer a company commercial auto insurance policy for drivers, so they will have to find their own commercial insurance policy. If you aren’t using your vehicle to drive for FreshDirect, you can stick with a standard auto insurance policy on your car. (Read More: What does standard auto insurance cover?)

Shopping around can help cut costs for commercial auto insurance when driving for FreshDirect. Use our free quote comparison tool to find your area’s best auto insurance rates.

Frequently Asked Questions

What kind of insurance do FreshDirect delivery drivers need?

FreshDirect delivery drivers using their personal cars should have commercial insurance for food delivery to cover accidents that may occur during deliveries. Truck drivers and drivers using FreshDirect company trucks also require commercial auto insurance. More information is available in our article titled “Best Commercial Truck Insurance Companies.”

Does FreshDirect provide auto insurance for its drivers?

FreshDirect does not specify whether they provide commercial auto insurance for delivery drivers. Employees must obtain their own insurance policies or look into courier insurance options.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

What insurance requirements are there for FreshDirect truck drivers?

FreshDirect truck drivers must have courier commercial vehicle insurance, a clean driving record, and a CDL Class A license. They are also expected to understand and follow DOT regulations.

How can FreshDirect drivers find affordable insurance?

FreshDirect drivers can find affordable insurance by shopping around and comparing quotes from different insurance providers. It’s important not to sacrifice coverage for lower rates. Use our free quote comparison tool to find the best rates in your area.

What are the best insurance companies for independent food delivery drivers?

The best insurance companies for independent food delivery drivers may vary depending on individual needs and circumstances. However, popular options often recommended for food delivery drivers include Progressive, Geico, State Farm, and Allstate.

Read More: Best Delivery Driver Auto Insurance

How much does courier insurance cost?

The cost of courier insurance can vary widely depending on factors like the driver’s location, the type of vehicle, and the coverage level. On average, courier vehicle insurance may cost between $50 and $200 per month.

What car insurance covers food delivery?

Not all standard car insurance policies cover food delivery. For this reason, delivery drivers need to look for car insurance for food delivery, which often falls under commercial insurance for food delivery.

Do I need insurance to deliver food?

Yes, if you are delivering food for a service like FreshDirect or another company, you will need insurance for couriers or courier commercial vehicle insurance to ensure you are fully protected while making deliveries.

Why do you need courier insurance?

Courier insurance is essential because it provides coverage for delivery drivers who use their vehicles for work purposes. Standard car insurance may not cover accidents or incidents that occur while making deliveries. Courier insurance ensures that drivers are protected against risks such as theft, damage, or accidents that can happen during deliveries.

Read More: Do auto insurance companies check employment status?

Are there any discounts available for FreshDirect employees?

While there isn’t a specific FreshDirect employee discount mentioned, checking with insurers directly for fresh direct discounts may yield some savings for drivers. Use our free comparison tool below to see what auto insurance quotes look like in your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.