Best Jaguar XF Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

For as low as $130 per month, the best Jaguar XF auto insurance is offered by AAA, Progressive, and Travelers. These top providers excel in Jaguar XF car insurance for their affordability and customization options. Discover how they can help reduce your Jaguar insurance cost and save on your premium today.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated January 2025

Company Facts

Full Coverage for Jaguar XF

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jaguar XF

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Jaguar XF

A.M. Best Rating

Complaint Level

Pros & Cons

For the best Jaguar XF auto insurance at $130 per month, AAA, Progressive, and Travelers lead the way. These top providers offer exceptional rates and flexible options for Jaguar XF insurance price. Explore how their coverage options make them stand out and secure the best deal today.

The article also explores types of auto insurance, highlighting their impact on Jaguar insurance cost. Understanding comprehensive, collision, and liability coverage options helps you choose the right plan. Learn how these types of auto insurance affect your premiums and find the best fit for your Jaguar XF’s needs.

Our Top 10 Company Picks: Best Jaguar XF Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A Roadside Assistance AAA

![]()

#2 12% A+ Competitive Rates Progressive

#3 8% A++ Flexible Coverage Travelers

#4 10% A++ Customer Service Auto-Owners

#5 20% A Comprehensive Policies Farmers

#6 20% A+ Multi-Policy Discounts Nationwide

#7 20% B Local Agents State Farm

#8 25% A Customization Options Liberty Mutual

#9 25% A+ Claims Satisfaction Allstate

#10 20% A Broad Coverage American Family

Get fast and cheap auto insurance coverage today with our quote comparison tool above.

- AAA offers the best insurance coverage options for Jaguar XF

- Learn about discounts to lower your Jaguar XF insurance costs

- Understand factors affecting Jaguar XF insurance rates

#1 –AAA: Top Overall Pick

Pros

- Competitive Pricing: As outlined in our AAA auto insurance review, AAA offers a monthly rate of $340 for Jaguar XF insurance, which is competitive compared to other providers like Farmers and Allstate. This helps in managing the cost of comprehensive coverage while providing reliable protection.

- Discount Options: AAA provides multiple discount options, such as bundling discounts and safe driver discounts. These can significantly reduce the insurance cost for a Jaguar XF, making it more affordable in the long run.

- Roadside Assistance: AAA includes roadside assistance as part of their standard insurance package. This feature is beneficial for Jaguar XF owners who may need emergency help while on the road.

Cons

- Limited Coverage Options: While AAA’s rates are competitive, their coverage options for Jaguar XF insurance may not be as extensive as some other providers, potentially leaving gaps in coverage.

- Higher Cost for Newer Models: AAA’s rates may be less competitive for newer Jaguar XF models compared to other insurers like State Farm, which could lead to higher premiums for newer vehicle owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Affordable Premiums: With a monthly rate of $320, Progressive offers one of the more affordable options for Jaguar XF insurance. This price point is lower than competitors such as Travelers and Farmers, which helps in reducing overall insurance expenses.

- Discount Opportunities: As mentioned in Progressive auto insurance review, Progressive provides numerous discount opportunities, including discounts for safe driving and multi-policy bundling, which can further reduce the cost of insuring a Jaguar XF.

- Flexible Coverage Options: Progressive offers a range of customizable coverage options for the Jaguar XF, allowing drivers to tailor their insurance to fit specific needs and preferences.

Cons

- Customer Service Issues: Some customers report issues with Progressive’s customer service, which may affect the overall satisfaction of Jaguar XF owners seeking support or claims assistance.

- Higher Costs for Comprehensive Coverage: Progressive’s rates for comprehensive coverage can be higher compared to some competitors, potentially making it more expensive for those who want extensive protection for their Jaguar XF.

#3 – Travelers: Best for Flexible Coverage

Pros

- Comprehensive Coverage: As mentioned in our Travelers auto insurance review, Travelers offers robust coverage options for Jaguar XF, including comprehensive and collision coverage, with a competitive rate of $350 per month, which covers a broad range of potential issues.

- Discounts for Security Features: Travelers provides discounts for vehicles equipped with advanced security features, which is beneficial for Jaguar XF owners who have invested in additional safety technology.

- Excellent Financial Strength: Travelers has strong financial ratings, ensuring that Jaguar XF owners can trust the company to handle claims efficiently and provide reliable support.

Cons

- Higher Premiums: At $350 per month, Travelers’ insurance rates for the Jaguar XF are higher compared to some other providers like State Farm, potentially making it a less budget-friendly option.

- Limited Availability of Local Agents: Travelers may have limited local agent availability in some areas, which can affect personalized service and ease of managing your Jaguar XF insurance policy.

#4 – Auto-Owners: Best for Customer Service

Pros

- Competitive Rates: Auto-Owners provides Jaguar XF insurance at $330 per month, which is competitive compared to many other insurers. This rate helps keep insurance costs manageable while offering solid coverage.

- Strong Customer Satisfaction: As mentioned in our Auto-Owners auto insurance review, Auto-Owners is known for high customer satisfaction, providing good service and support for Jaguar XF owners, which can enhance the overall insurance experience.

- Customizable Coverage Options: Auto-Owners offers a range of coverage options and add-ons, allowing Jaguar XF drivers to tailor their policy to their specific needs and preferences.

Cons

- Potentially Higher Deductibles: Auto-Owners may require higher deductibles for their Jaguar XF insurance policies, which can lead to higher out-of-pocket costs in the event of a claim.

- Limited Discounts: Compared to some competitors, Auto-Owners may offer fewer discount options, which could result in less overall savings for Jaguar XF owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Comprehensive Policies

Pros

- Comprehensive Protection: Farmers offers extensive coverage options for the Jaguar XF, including comprehensive and collision coverage, with a monthly rate of $360 that reflects the breadth of their insurance offerings.

- Discounts for Bundling: Farmers provides significant discounts for bundling multiple policies, which can be advantageous for Jaguar XF owners who want to combine their car insurance with other types of coverage. Check their rates in our Farmers auto insurance review.

- Good Claims Handling: Farmers has a reputation for effective claims handling, ensuring that Jaguar XF owners receive prompt and fair service when filing a claim.

Cons

- Higher Monthly Premiums: With a rate of $360 per month, Farmers is one of the more expensive options for Jaguar XF insurance, which may not be ideal for budget-conscious drivers.

- Potential Rate Increases: Farmers’ rates can increase significantly after a claim or due to other factors, potentially leading to higher costs over time for Jaguar XF owners.

#6 – Nationwide: Best for Multi-Policy Discounts

Pros

- Affordable Rates: Nationwide offers a competitive rate of $340 per month for Jaguar XF insurance, which is on par with several other providers and helps in managing insurance costs effectively.

- Variety of Discounts: Nationwide offers various discounts, including those for good driving records and multi-policy bundling, which can reduce the overall cost of insuring a Jaguar XF. For more information, read our Nationwide auto insurance review.

- Strong Financial Stability: Nationwide is known for its financial stability, providing Jaguar XF owners with confidence in the company’s ability to handle claims and offer reliable insurance coverage.

Cons

- Limited Coverage Options: Nationwide’s coverage options for Jaguar XF might be less extensive compared to other insurers, potentially leaving some gaps in coverage.

- Higher Costs for Newer Models: The insurance rates for newer Jaguar XF models may be less competitive with Nationwide, making it potentially more expensive for owners of newer vehicles.

#7 – State Farm: Best for Local Agents

Pros

- Lowest Monthly Premiums: As mentioned in our State Farm auto insurance review, State Farm offers the lowest rate at $310 per month for Jaguar XF insurance, making it a cost-effective choice for drivers seeking affordable coverage.

- Extensive Discount Opportunities: State Farm provides a wide range of discount options, including discounts for safe driving and bundling policies, which can further lower insurance costs for Jaguar XF owners.

- Wide Availability of Agents: State Farm has a large network of local agents, making it easy for Jaguar XF owners to receive personalized service and support.

Cons

- Limited Comprehensive Coverage Discounts: While State Farm offers low premiums for Jaguar XF, their discounts for comprehensive coverage may not be as robust as those offered by other insurers.

- Customer Service Variability: The quality of customer service at State Farm can vary depending on the local agent, which might affect the overall experience for Jaguar XF owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customization Options

Pros

- Comprehensive Coverage Options: Liberty Mutual provides extensive coverage options for Jaguar XF, including comprehensive and collision coverage, with a monthly rate of $355 that reflects their broad insurance offerings.

- Discounts for Safety Features: Liberty Mutual offers discounts for advanced safety features in the Jaguar XF, helping to lower insurance costs for owners who have invested in such technology.

- Flexible Policy Customization: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual allows for flexible policy customization, enabling Jaguar XF owners to tailor their coverage to their specific needs and preferences.

Cons

- Higher Monthly Premiums: At $355 per month, Liberty Mutual’s insurance rates for the Jaguar XF are higher compared to some other providers, potentially making it a less cost-effective option.

- Potential for Rate Increases: Liberty Mutual’s rates may increase over time, especially if a claim is filed, which could lead to higher overall insurance costs for Jaguar XF owners.

#9 – Allstate: Best for Claims Satisfaction

Pros

- Extensive Coverage Options: Allstate offers comprehensive insurance coverage for the Jaguar XF at a rate of $370 per month, which includes extensive protection for various types of incidents and damages.

- Significant Discount Opportunities: Allstate provides a range of discounts, including those for safe driving and multi-policy bundling, which can help reduce the cost of insurance for Jaguar XF owners.

- Strong Claims Support: Allstate has a reputation for strong claims support and customer service, providing reliable assistance and efficient handling of Jaguar XF insurance claims. Learn more details in our page, Allstate auto insurance review.

Cons

- Highest Premiums: Allstate’s monthly rate of $370 is the highest among the listed providers, which might be a concern for Jaguar XF owners looking for more affordable insurance options.

- Higher Costs for Younger Drivers: Allstate’s rates can be particularly high for younger drivers, which may result in significantly higher premiums for younger Jaguar XF owners.

#10 – American Family: Best for Broad Coverage

Pros

- Affordable Monthly Rates: American Family auto insurance review provide competitive insurance rates for the Jaguar XF at $325 per month, which is lower than several other providers and helps in managing overall insurance costs.

- Good Discount Options: American Family provides various discount opportunities, such as discounts for good driving records and safety features, which can help reduce insurance premiums for Jaguar XF owners.

- High Customer Satisfaction: American Family is known for high customer satisfaction, offering reliable service and support for Jaguar XF owners, enhancing the overall insurance experience.

Cons

- Limited Coverage Options: American Family may offer fewer coverage options compared to other providers, potentially resulting in gaps in insurance protection for the Jaguar XF.

- Potential for Rate Increases: Insurance rates with American Family may increase after claims or due to other factors, which could lead to higher costs for Jaguar XF owners over time.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jaguar XF Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Jaguar XF from various providers. This helps in identifying the best insurance options based on coverage needs and budget.

Jaguar XF Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $150 $340

Allstate $165 $370

American Family $140 $325

Auto-Owners $140 $330

Farmers $155 $360

Liberty Mutual $150 $355

Nationwide $145 $340

Progressive $130 $320

State Farm $135 $310

Travelers $160 $350

Comparing these rates can help you find the most cost-effective insurance provider for your Jaguar XF. Additionally, it allows you to weigh the benefits of minimum versus full coverage options based on your budget and coverage needs. For additional details, explore our comprehensive resource titled, “What is full coverage auto insurance?“

Jaguar XF Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $147 |

| Discount Rate | $87 |

| High Deductibles | $127 |

| High Risk Driver | $314 |

| Low Deductibles | $185 |

| Teen Driver | $538 |

The graph illustrates how different factors, such as deductible amounts and driver profiles, influence Jaguar XF insurance rates. It highlights the significant cost variations for high-risk drivers and teen drivers compared to standard policies.

Are Jaguar XFs Expensive to Insure

When considering a luxury vehicle like the Jaguar XF, insurance costs are a significant factor. The chart below details how Jaguar XF insurance rates compare to other luxury cars like the Audi A8, Audi S8, and Chevrolet Corvette.

Jaguar XF Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi A8 | $39 | $75 | $33 | $159 |

| Audi S8 | $55 | $114 | $33 | $215 |

| Cadillac CTS-V | $34 | $67 | $28 | $140 |

| Chevrolet Corvette | $41 | $77 | $22 | $149 |

| Infiniti Q70 | $31 | $65 | $28 | $135 |

| Jaguar XF | $34 | $67 | $33 | $147 |

| Lexus GS 300 | $29 | $55 | $28 | $123 |

Analyzing these rates can give you a clearer picture of how the Jaguar XF stacks up against its competitors in terms of insurance expenses. Learn more in our article titled “Best Auto Insurance for Luxury Cars“.

Choosing AAA means securing top-tier insurance with benefits specifically designed for Jaguar XF drivers.Michelle Robbins LICENSED INSURANCE AGENT

However, there are a few things you can do to find the cheapest Jaguar insurance rates online. Shopping around, comparing quotes, and looking for discounts can significantly reduce your insurance costs.

What Impacts the Cost of Jaguar XF Insurance

The Jaguar XF trim and model you choose can impact the total price you will pay for Jaguar XF insurance coverage. Higher-end trims with more advanced features and higher price tags typically cost more to insure due to the increased cost of repairs or replacements.

Additionally, factors such as the car’s age, mileage, and condition also play a significant role in determining insurance rates. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Your driving record, location, and the frequency of claims in your area can further influence the cost. Opting for higher deductibles and taking advantage of available discounts, such as multi-policy or safe driver discounts, can help lower your overall insurance expenses.

Age of the Vehicle

Insurance costs for the Jaguar XF vary significantly based on the vehicle’s age. The average Jaguar XF insurance rates are higher for newer models. For example, auto insurance for a 2018 Jaguar XF costs more than insurance for a 2010 Jaguar XF.

Jaguar XF Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Jaguar XF | $38 | $73 | $34 | $152 |

| 2023 Jaguar XF | $37 | $71 | $34 | $151 |

| 2022 Jaguar XF | $36 | $70 | $34 | $150 |

| 2021 Jaguar XF | $35 | $69 | $33 | $149 |

| 2020 Jaguar XF | $35 | $68 | $33 | $148 |

| 2019 Jaguar XF | $34 | $67 | $33 | $147 |

| 2018 Jaguar XF | $34 | $67 | $33 | $147 |

| 2017 Jaguar XF | $33 | $65 | $35 | $146 |

| 2016 Jaguar XF | $32 | $63 | $36 | $143 |

| 2015 Jaguar XF | $30 | $61 | $37 | $140 |

| 2014 Jaguar XF | $29 | $56 | $38 | $136 |

| 2013 Jaguar XF | $28 | $53 | $38 | $132 |

| 2012 Jaguar XF | $27 | $47 | $38 | $125 |

| 2011 Jaguar XF | $25 | $44 | $38 | $120 |

| 2010 Jaguar XF | $24 | $41 | $39 | $117 |

Understanding how the age of your Jaguar XF affects insurance rates can help you make an informed decision when choosing between newer and older models.

Driver Age

Driver age can have a significant effect on the cost of Jaguar XF auto insurance. For example, a 20-year-old driver could pay more each month for their Jaguar XF auto insurance than a 30-year-old driver.

Jaguar XF Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $538 |

| Age: 18 | $439 |

| Age: 20 | $334 |

| Age: 30 | $154 |

| Age: 40 | $147 |

| Age: 45 | $142 |

| Age: 50 | $134 |

| Age: 60 | $131 |

Being aware of how age impacts insurance rates can help younger drivers plan their budgets more effectively and seek out possible discounts.

Driver Location

Where you live can have a large impact on Jaguar XF insurance rates. For example, drivers in Phoenix may pay less than drivers in Los Angeles.

Jaguar XF Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $194 |

| Columbus, OH | $122 |

| Houston, TX | $231 |

| Indianapolis, IN | $125 |

| Jacksonville, FL | $213 |

| Los Angeles, CA | $252 |

| New York, NY | $233 |

| Philadelphia, PA | $197 |

| Phoenix, AZ | $171 |

| Seattle, WA | $143 |

Considering your location can help you anticipate potential insurance costs and explore regional insurance providers for better rates.

Your Driving Record

Your driving record can have an impact on the cost of Jaguar XF auto insurance. Teens and drivers in their 20’s see the highest jump in their Jaguar XF auto insurance rates with violations on their driving record.

Jaguar XF Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $538 | $592 | $663 | $815 |

| Age: 18 | $439 | $483 | $540 | $718 |

| Age: 20 | $334 | $363 | $421 | $576 |

| Age: 30 | $154 | $167 | $198 | $335 |

| Age: 40 | $147 | $160 | $190 | $322 |

| Age: 45 | $142 | $154 | $183 | $310 |

| Age: 50 | $134 | $146 | $173 | $294 |

| Age: 60 | $131 | $143 | $169 | $287 |

Maintaining a clean driving record can help keep your insurance costs lower, while violations can significantly increase your premiums.

Safety Ratings

Your Jaguar XF insurance rates are influenced by the safety ratings of the Jaguar XF. Vehicles with higher safety ratings typically receive lower insurance premiums due to the reduced risk of injury and damage in the event of an accident. Below is the breakdown of the Jaguar XF’s safety ratings:

Jaguar XF Safety Ratings

| Test | Rating |

|---|---|

| Small overlap front: driver-side | Not Tested |

| Small overlap front: passenger-side | Not Tested |

| Moderate overlap front | Not Tested |

| Side | Not Tested |

| Roof strength | Not Tested |

| Head restraints and seats | Not Tested |

The safety ratings of your vehicle can affect insurance costs, with higher ratings generally leading to lower premiums. Ensuring your Jaguar XF is equipped with the latest safety features can also contribute to obtaining better insurance rates.

Crash Test Ratings

Jaguar XF crash test ratings can significantly impact the cost of your Jaguar XF auto insurance. Vehicles with higher crash test ratings generally incur lower insurance premiums due to their proven safety in collisions. Below are the Jaguar XF crash test results:

Jaguar XF Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Jaguar XF Sportbrake 5HB AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2024 Jaguar XF 4 DR RWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2024 Jaguar XF 4 DR AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2023 Jaguar XF Sportbrake 5HB AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2023 Jaguar XF 4 DR RWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2023 Jaguar XF 4 DR AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2022 Jaguar XF Sportbrake 5HB AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2022 Jaguar XF 4 DR RWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2022 Jaguar XF 4 DR AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2021 Jaguar XF Sportbrake 5HB AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2021 Jaguar XF 4 DR RWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2021 Jaguar XF 4 DR AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2020 Jaguar XF Sportbrake 5HB AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2020 Jaguar XF 4 DR RWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2020 Jaguar XF 4 DR AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2019 Jaguar XF Sportbrake SW AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2019 Jaguar XF 4 DR RWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2019 Jaguar XF 4 DR AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2018 Jaguar XF Sportbrake 5 HB AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2018 Jaguar XF 4 DR RWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2018 Jaguar XF 4 DR AWD | Not Rated | Not Rated | Not Rated | Not Rated |

| 2017 Jaguar XF 4 DR RWD | Good | Good | Good | Acceptable |

| 2017 Jaguar XF 4 DR AWD | Good | Good | Good | Acceptable |

| 2016 Jaguar XF 4 DR RWD | Good | Good | Good | Acceptable |

| 2016 Jaguar XF 4 DR AWD | Good | Good | Good | Acceptable |

Understanding crash test ratings can help you evaluate the safety of your Jaguar XF and potentially lower your insurance premiums by choosing a model with better ratings. Ensuring that your vehicle meets high safety standards can lead to cost savings on your insurance and provide greater peace of mind while driving.

Jaguar XF Safety Features

The Jaguar XF safety features can help lower insurance costs. According to AutoBlog, the Jaguar XF has the following safety features:

- Electronic stability control (ESC) and ABS with traction control

- Dual stage driver and passenger front and side air bags

- Curtain 1st and 2nd row air bags and air bag occupancy sensor

- Front and rear parking sensors and back-up camera

- Tire-specific low tire pressure warning and power rear child safety locks

The Jaguar XF’s advanced safety features, such as dual-stage airbags, a back-up camera, and front and rear parking sensors, can significantly lower your insurance costs.

These features often qualify for a safety features auto insurance discount, which can make your coverage more affordable and provide enhanced protection on the road.

Loss Probability

The Jaguar XF’s insurance loss probability varies for each form of coverage. The lower percentage means lower Jaguar XF auto insurance rates; higher percentages mean higher Jaguar XF insurance rates.

Jaguar XF Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Bodily Injury | no data |

| Collision | 69% |

| Comprehensive | 91% |

| Medical Payment | no data |

| Personal Injury | -2% |

| Property Damage | 1% |

Understanding the insurance loss probability can help you anticipate potential insurance costs and choose the best coverage for your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

5 Ways to Save on Jaguar XF Insurance

Drivers can end up saving more money on their Jaguar XF insurance rates by employing any one of the following strategies.

- Spy on your teen driver.

- Buy a Jaguar XF with an anti-theft device.

- Work with a direct insurer instead of an insurance broker for your Jaguar XF.

- Compare apples to apples when comparing Jaguar XF insurance rates and policies.

- Ask About a student away from home discount.

From leveraging discounts to comparing insurance options carefully, these approaches can lead to considerable savings. For further insights on optimizing your insurance costs, learn more in our article titled “Best Auto Insurance for a Student Away at College.”

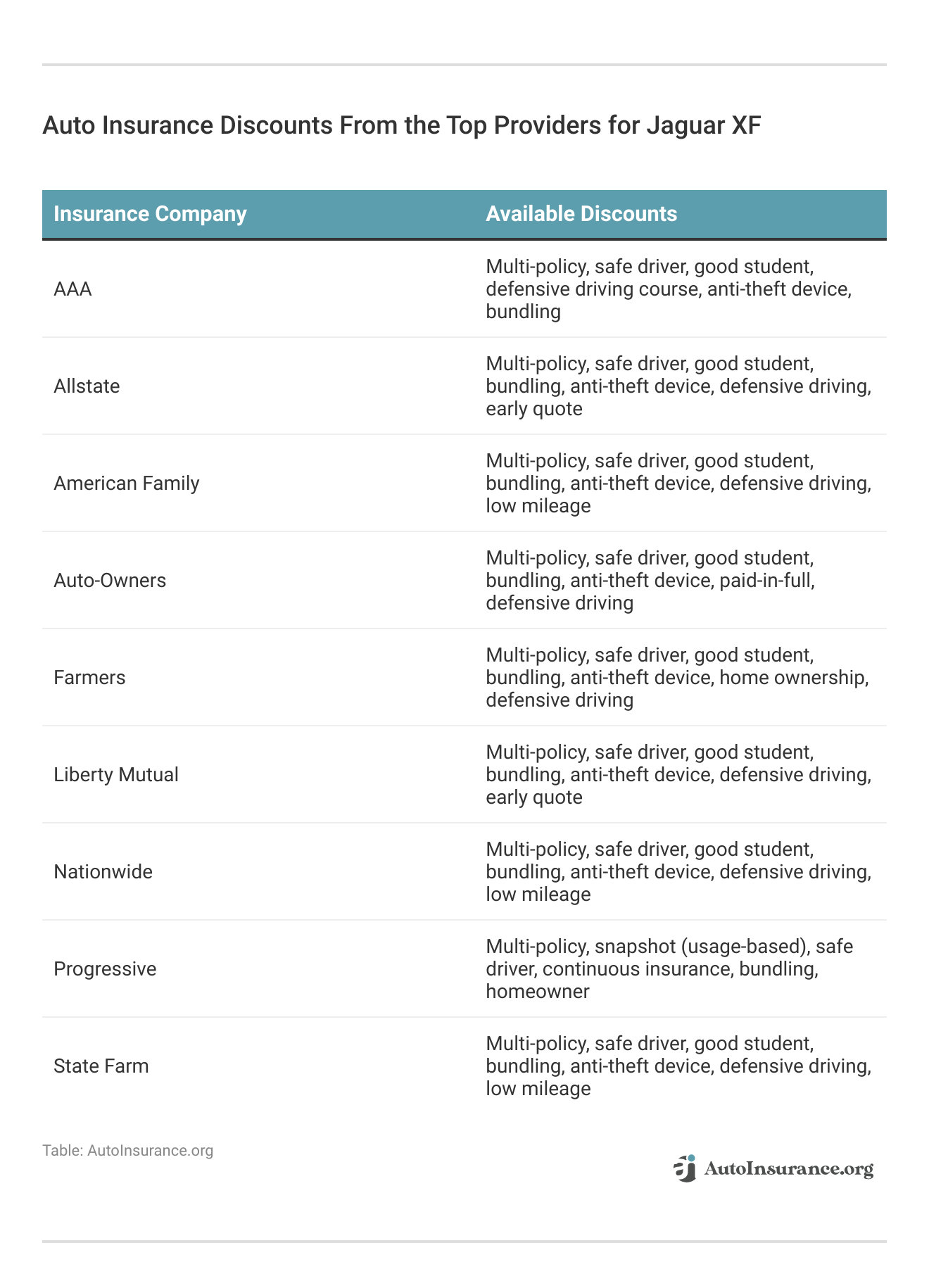

These discounts from top insurance providers for Jaguar XF offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Top Jaguar XF Insurance Companies

When seeking the best company for Jaguar XF insurance rates, it’s essential to consider various factors that influence your premiums. While the actual rates you pay will depend on your unique situation, here are some of the top companies offering Jaguar XF insurance coverage, ordered by market share. (Read more: How to Compare Auto Insurance Quotes)

Top 10 Jaguar XF Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Liberty Mutual | $39.2 million | 5% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

Considering these top companies can help you find the best insurance coverage for your Jaguar XF. Be sure to inquire about available discounts and benefits to maximize your savings.

You can start comparing quotes for Jaguar XF insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

What is the average cost of insurance for a Jaguar XF?

The average cost of insurance for a Jaguar XF is $147 per month or $1,766 per year.

How does the cost of Jaguar XF insurance compare to other luxury cars?

The chart shows that Jaguar XF insurance rates are higher compared to luxury cars like the Audi A8, Audi S8, and Chevrolet Corvette. Learn more in our article titled “Best Auto Insurance for Luxury Cars“.

What factors impact the cost of Jaguar XF insurance?

The cost of Jaguar XF insurance can be influenced by factors such as the trim and model of the vehicle, driver age, driver location, and driving record. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

What safety features does the Jaguar XF have that can lower insurance costs?

According to AutoBlog, the 2020 Jaguar XF is equipped with various safety features that can help lower insurance costs.

How can I save money on Jaguar XF insurance?

There are five ways to save money on Jaguar XF insurance, including comparing quotes, maintaining a clean driving record, choosing a higher deductible, taking advantage of discounts, and considering bundled insurance policies.

Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Is the Jaguar XF more expensive to insure compared to other Jaguar models?

Insurance rates can vary among different Jaguar models due to differences in safety features, repair costs, and overall vehicle value.

Do insurance companies offer discounts for Jaguar XF safety features?

Yes, many insurance companies offer discounts for vehicles equipped with advanced safety features such as anti-lock brakes, airbags, and backup cameras.

What should I consider when comparing Jaguar XF insurance quotes?

When comparing insurance quotes, consider factors such as coverage limits, deductibles, customer service ratings, and available discounts to ensure you get the best value for your insurance policy. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

How does the driver’s credit score affect Jaguar XF insurance rates?

Insurance companies often consider a driver’s credit score when determining premiums. A higher credit score can lead to lower insurance rates, while a lower score may increase costs.

Can I get specialized insurance coverage for my Jaguar XF?

Yes, some insurance companies offer specialized coverage options for luxury vehicles like the Jaguar XF, including agreed value coverage and enhanced repair options. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.