Best Mesa, Arizona Auto Insurance in 2026 (Find the Top 10 Companies Here)

For best Mesa, Arizona auto insurance, American Family, Travelers, and The Hartford are leading choices, offering rates starting at $62 monthly. These providers are known for their exceptional customer service and extensive coverage options. Compare quotes to help you find affordable Mesa, Arizona car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated October 2024

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Mesa Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Mesa Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage in Mesa Arizona

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsFor the best Mesa, Arizona auto insurance, American Family, Travelers, and The Hartford offer rates starting at $62 per month. American Family is highly recommended for its comprehensive coverage. Consider these options to find the ideal car insurance in Mesa, Arizona, for your needs.

Mesa, Arizona auto insurance requirements are 15/30/10 according to Arizona auto insurance laws. Finding the cheapest auto insurance companies in Mesa can seem like a difficult task, but all of the information you need is right here.

We’ll cover factors that affect auto insurance rates in Mesa, Arizona, including driving record, credit, commute time, and more.

Our Top 10 Company Picks: Best Mesa, Arizona Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A | Local Expertise | American Family | |

| #2 | 12% | A++ | Specialized Coverage | Travelers | |

| #3 | 16% | A+ | AARP Discounts | The Hartford |

| #4 | 15% | A+ | Flexible Policies | Nationwide |

| #5 | 12% | A | Discount Variety | Liberty Mutual |

| #6 | 8% | A | Personalized Service | Farmers | |

| #7 | 15% | A+ | Comprehensive Coverage | Allstate | |

| #8 | 17% | A+ | Innovative Features | Progressive | |

| #9 | 20% | A++ | Military Benefits | USAA | |

| #10 | 12% | B | Reliable Service | State Farm |

Before you buy Mesa, Arizona auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Mesa, Arizona auto insurance quotes.

- The cheapest auto insurance company in Mesa is Geico

- The most expensive auto insurance company in Mesa for teen drivers is Farmers

- Get low average auto insurance rates in Mesa, AZ for senior drivers

#1 – American Family: Top Overall Pick

Pros

- Comprehensive Coverage Options: American Family offers a range of coverage options including liability, collision, and comprehensive, along with add-ons like roadside assistance and rental car reimbursement. This makes them a strong contender for the best Mesa, Arizona auto insurance, ensuring robust protection tailored to Mesa, Arizona drivers’ needs.

- High Customer Satisfaction: With consistently high customer service ratings, American Family is known for its excellent support. Mesa, Arizona car owners benefit from responsive service and a user-friendly experience, making it a top choice for those seeking the best Mesa, Arizona auto insurance. Find out more in our American Family insurance review.

- Strong Financial Stability: Holding an A.M. Best rating of A (Excellent), American Family demonstrates exceptional financial stability. This reliability is crucial for Mesa, Arizona drivers who want to ensure that their claims will be paid without issues, reinforcing their position as a provider of the best Mesa, Arizona auto insurance.

Cons

- Higher Premiums for Young Drivers: Rates for younger drivers can be higher, which may impact those seeking budget-friendly options. This can be a drawback for Mesa, Arizona teen drivers looking for the best Mesa, Arizona auto insurance at a lower cost.

- Limited Availability of Certain Discounts: Some discounts might not be available in all areas or have specific eligibility requirements, potentially limiting benefits for some Mesa, Arizona drivers. This can be a drawback for those who might not qualify for all available savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Best for Specialized Coverage

Pros

- Specialized Coverage Options: Travelers provides specialized coverage for unique needs, such as classic car insurance and usage-based insurance. This is ideal for Mesa, Arizona drivers who need tailored coverage, making Travelers a strong candidate for the best Mesa, Arizona auto insurance.

- Innovative Technology: Features a mobile app for easy policy management and claims filing. This technological edge enhances convenience for Mesa, Arizona drivers, aligning with Travelers’ reputation as a leading provider for the best Mesa, Arizona auto insurance.

- Flexible Payment Plans: As outlined in our Travelers auto insurance review, Travelers offers various payment options, including monthly plans. This flexibility can accommodate budgetary needs for Mesa, Arizona drivers, making it easier to manage insurance costs and access the best Mesa, Arizona auto insurance.

Cons

- Potential for Higher Rates: Travelers may have higher average rates, particularly in urban areas like Mesa, Arizona, which could affect affordability. This might be a concern for those looking for the cheapest options for the best Mesa, Arizona auto insurance.

- Limited Local Agents: Fewer local agents could impact personalized service. Mesa, Arizona drivers might find it challenging to get local, face-to-face assistance, which could be a disadvantage compared to providers with more extensive local networks.

#3 – The Hartford: Best for AARP Discounts

Pros

- AARP Discounts: The Hartford offers significant discounts for AARP members, which can be especially beneficial for older drivers in Mesa, Arizona. This makes them a top option for affordable coverage in the best Mesa, Arizona auto insurance market.

- Excellent Customer Service: Renowned for outstanding customer service and support, The Hartford ensures that Mesa, Arizona car owners receive top-notch assistance. This commitment to service excellence makes them a strong contender for the best Mesa, Arizona auto insurance.

- Strong Financial Stability: Holding an A.M. Best rating of A+ (Superior), The Hartford exhibits solid financial stability, providing peace of mind for Mesa, Arizona drivers regarding their claims and coverage reliability, which is crucial for the best Mesa, Arizona auto insurance. Learn more through our The Hartford auto insurance review.

Cons

- Higher Premiums for Non-AARP Members: Insurance rates may be elevated for those who are not AARP members, which could limit affordability for some Mesa, Arizona drivers. This can be a drawback for those not eligible for these discounts.

- Limited Coverage Options for Newer Drivers: Fewer options are available for younger drivers or those with less experience, which may not meet the needs of all Mesa, Arizona drivers seeking comprehensive coverage.

#4 – Nationwide: Best for Flexible Policies

Pros

- AARP Discounts: The Hartford offers significant discounts for AARP members, which can be especially beneficial for older drivers in Mesa, Arizona. This makes them a top option for affordable coverage in the best Mesa, Arizona auto insurance market.

- Excellent Customer Service: Renowned for outstanding customer service and support, The Hartford ensures that Mesa, Arizona car owners receive top-notch assistance. This commitment to service excellence makes them a strong contender for the best Mesa, Arizona auto insurance.

- Strong Financial Stability: Holding an A.M. Best rating of A+ (Superior), The Hartford exhibits solid financial stability, providing peace of mind for Mesa, Arizona drivers regarding their claims and coverage reliability, which is crucial for the best Mesa, Arizona auto insurance. Learn more through our Nationwide auto insurance review.

Cons

- Higher Premiums for Non-AARP Members: Insurance rates may be elevated for those who are not AARP members, which could limit affordability for some Mesa, Arizona drivers. This can be a drawback for those not eligible for these discounts.

- Limited Coverage Options for Newer Drivers: Fewer options are available for younger drivers or those with less experience, which may not meet the needs of all Mesa, Arizona drivers seeking comprehensive coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Discount Variety

Pros

- Discount Variety: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual offers a broad range of discounts including a 12% bundling discount. This variety helps Mesa, Arizona car owners save on premiums, making it a competitive option for the best Mesa, Arizona auto insurance.

- Comprehensive Coverage Options: Provides extensive coverage options, including liability, collision, and comprehensive, tailored to different needs. This comprehensive approach makes Liberty Mutual a solid choice for the best Mesa, Arizona auto insurance.

- High A.M. Best Rating: With an A rating from A.M. Best, Liberty Mutual demonstrates financial stability and reliability, essential for Mesa, Arizona drivers seeking dependable coverage and claims service in the best Mesa, Arizona auto insurance market.

Cons

- Complexity of Policies: The variety of coverage options and discounts can sometimes make it challenging to understand all the available choices, potentially complicating the decision-making process for Mesa, Arizona drivers.

- Higher Rates for Some Demographics: Premiums may be higher for certain demographics, including younger drivers and those with poor driving records, which could affect affordability for the best Mesa, Arizona auto insurance.

#6 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers is known for its personalized service and attention to individual needs. This approach is valuable for Mesa, Arizona car owners who want a tailored insurance experience, contributing to its reputation as one of the best Mesa, Arizona auto insurance providers.

- Strong Financial Stability: With an A.M. Best rating of A (Excellent), Farmers demonstrates reliable financial strength, ensuring that Mesa, Arizona drivers’ claims will be handled effectively, reinforcing its position among the best Mesa, Arizona auto insurance options.

- Good Discount Options: Offers various discounts, including bundling and safe driver discounts, which can help lower premiums for Mesa, Arizona car enthusiasts. This range of discounts supports its appeal for those seeking cost-effective coverage. See more details in our page titled Farmers auto insurance review.

Cons

- Higher Premiums for Younger Drivers: Rates may be higher for younger drivers, which can impact those seeking affordable options for the best Mesa, Arizona auto insurance. This might make it less attractive to new or younger drivers in Mesa.

- Limited Online Tools: Some users report that Farmers’ online tools and resources are less advanced compared to competitors, which could affect the convenience of managing policies and claims for Mesa, Arizona car owners.

#7 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: As mentioned in our Allstate auto insurance review, Allstate offers extensive coverage options including liability, collision, and comprehensive. This comprehensive coverage is ideal for Mesa, Arizona drivers looking for thorough protection, making Allstate a strong choice for the best Mesa, Arizona auto insurance.

- High A.M. Best Rating: With an A+ (Superior) rating from A.M. Best, Allstate shows strong financial stability, which is crucial for Mesa, Arizona drivers who need reliable claims handling and financial security for the best Mesa, Arizona auto insurance.

- 15% Bundling Discount: Provides a 15% discount for bundling multiple policies, which can significantly reduce overall insurance costs for Mesa, Arizona car owners. This discount helps make Allstate a cost-effective option within the best Mesa, Arizona auto insurance providers.

Cons

- Higher Premiums for Certain Drivers: Some drivers, particularly those with less-than-perfect driving records, may face higher premiums. This could be a drawback for Mesa, Arizona drivers looking for affordable coverage options within the best Mesa, Arizona auto insurance market.

- Customer Service Variability: Experiences with customer service can vary, with some customers reporting inconsistent service quality. This variability might affect overall satisfaction for Mesa, Arizona drivers seeking the best Mesa, Arizona auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Innovative Features

Pros

- Innovative Features: Progressive is known for its innovative features, such as the Snapshot program, which can offer discounts based on driving habits. This modern approach appeals to Mesa, Arizona drivers looking for advanced insurance solutions, making Progressive a top choice for the best Mesa, Arizona auto insurance.

- High A.M. Best Rating: With an A+ (Superior) rating, Progressive demonstrates strong financial stability, ensuring reliability and efficient claims handling for Mesa, Arizona drivers. This rating supports its reputation as one of the best Mesa, Arizona auto insurance providers.

- Wide Range of Coverage Options: Provides a variety of coverage options, including liability, collision, and comprehensive. This breadth of coverage is ideal for Mesa, Arizona drivers seeking extensive protection within the best Mesa, Arizona auto insurance. Read more through our Progressive auto insurance review.

Cons

- Higher Premiums for High-Risk Drivers: Drivers with high-risk profiles may face higher premiums, which can be a disadvantage for those seeking budget-friendly options. This could impact affordability for some Mesa, Arizona drivers looking for the best Mesa, Arizona auto insurance.

- Potential for Overcomplicated Policies: The range of options and features might be overwhelming for some users, potentially making it difficult for Mesa, Arizona drivers to choose the best coverage for their needs.

#9 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers specialized benefits for military members and their families, making it an excellent choice for those in the military community. This focus on military benefits contributes to USAA’s standing as one of the best Mesa, Arizona auto insurance providers for those eligible.

- High A.M. Best Rating: With an A++ (Superior) rating from A.M. Best, USAA demonstrates exceptional financial stability, ensuring reliable service and claims processing for Mesa, Arizona drivers. This rating underlines its position among the best Mesa, Arizona auto insurance providers.

- Excellent Customer Service: Known for outstanding customer service, USAA consistently receives high marks from its members. This high level of service is a significant advantage for Mesa, Arizona drivers looking for the best Mesa, Arizona auto insurance experience. Learn more through our USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members, veterans, and their families, limiting access for non-military Mesa, Arizona drivers. This exclusivity might exclude some potential policyholders from accessing the best Mesa, Arizona auto insurance.

- Limited Local Presence: USAA has fewer local offices compared to some competitors, which might affect accessibility for in-person services. This could be a consideration for Mesa, Arizona drivers who prefer face-to-face interactions for their insurance needs.

#10 – State Farm: Best for Reliable Service

Pros

- Reliable Service: State Farm is known for its reliable service and extensive network of local agents, which enhances accessibility for Mesa, Arizona drivers. This reputation for dependable service makes State Farm a notable option for the best Mesa, Arizona auto insurance.

- 12% Bundling Discount: As outlined in our State Farm auto insurance review, State Farm offers a 12% discount for bundling multiple policies, which can lower overall insurance costs for Mesa, Arizona car enthusiasts. This discount helps State Farm remain competitive among the best Mesa, Arizona auto insurance providers.

- Wide Network of Local Agents: State Farm’s extensive network of local agents ensures personalized service and easy access to support for Mesa, Arizona drivers. This widespread presence is a significant advantage for those seeking hands-on assistance.

Cons

- Potentially Higher Rates: State Farm’s rates can be higher for certain demographics, including younger or high-risk drivers. This might affect affordability for those seeking the most cost-effective options for the best Mesa, Arizona auto insurance.

- Limited Discounts for High-Risk Drivers: The range of discounts may be less comprehensive for high-risk drivers, potentially impacting overall savings for Mesa, Arizona drivers with less favorable driving records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Mesa, Arizona

Minimum Required Auto Insurance Coverage in Mesa, Arizona

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $15,000 per person $30,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

It’s crucial to review and understand these mandatory coverages to make sure you are adequately insured and financially protected in the event of an accident.

Cheap Mesa, Arizona Auto Insurance By Driving Record

Your driving record has a significant impact on how auto insurance companies check your driving record and determine rates.

Insurers evaluate your driving history to assess risk, so if you have a record with accidents, speeding tickets, or other violations, you can expect considerably higher premiums, especially when you’re not eligible for low mileage auto insurance discounts.

In Mesa, Arizona, this difference is particularly noticeable. By comparing the annual auto insurance rates for someone with a bad record to those with a clean record, you can clearly see how driving record affects car insurance rates.

Typically, drivers with a clean record enjoy lower rates, while those with a bad record face substantial increases, highlighting the importance of maintaining a clean driving history to secure more affordable coverage.

Cheap Mesa, Arizona Auto Insurance Rates After a DUI

Finding cheap auto insurance after a DUI in Mesa, Arizona is not easy.

Monthly Auto Insurance Rates After a DUI in Mesa, Arizona

| Insurance Company | Monthly Auto Insurance Rates With a DUI |

|---|---|

| Allstate | $529 |

| American Family | $524 |

| Farmers | $484 |

| Geico | $281 |

| Nationwide | $431 |

| Progressive | $299 |

| State Farm | $444 |

| Travelers | $329 |

| USAA | $379 |

Compare the monthly rates for DUI auto insurance in Mesa, Arizona to find the best deal.

Cheap Mesa, Arizona Auto Insurance Rates By ZIP Code

Auto insurance rates by ZIP code in Mesa, Arizona can vary.

Compare the monthly cost of auto insurance by ZIP code in Mesa, Arizona to see how car insurance rates are affected by location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Mesa, Arizona Auto Insurance Rates By Commute

To find the most affordable auto insurance in Mesa, Arizona, it’s essential to compare policies that take into account your specific commute length. By doing so, you can secure a policy that not only fits your budget but also aligns with your driving habits.

Cheap Mesa, Arizona Auto Insurance Rates By Coverage Level

How much does the coverage level you select affect the cost of your auto insurance in Mesa, Arizona?

Monthly Auto Insurance Rates by Coverage Level in Mesa, Arizona

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $429 | $462 | $465 |

| American Family | $367 | $394 | $385 |

| Farmers | $384 | $459 | $519 |

| Geico | $165 | $203 | $231 |

| Nationwide | $309 | $331 | $339 |

| Progressive | $278 | $328 | $357 |

| State Farm | $396 | $553 | $482 |

| Travelers | $250 | $287 | $310 |

| USAA | $253 | $280 | $294 |

Check out the comparison of monthly Mesa, Arizona auto insurance rates by coverage level.

Best By Category: Cheapest Auto Insurance in Mesa, Arizona

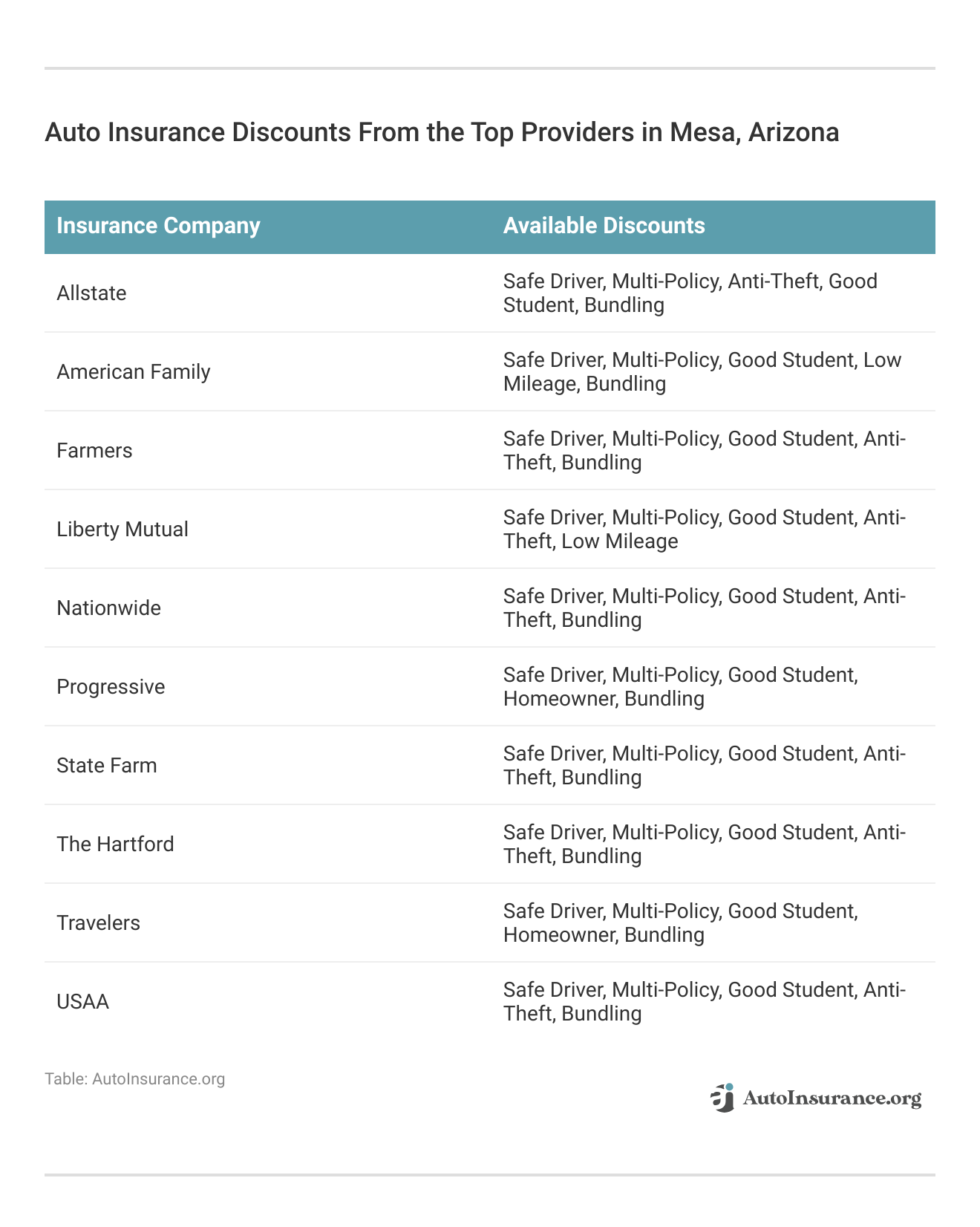

To find the best auto insurance rates in Mesa, Arizona, it’s essential to compare the cheapest insurance companies across various categories. Start by evaluating providers based on key factors such as coverage options, discounts, and customer service.

By analyzing these aspects, you can identify the insurance company that offers the best overall rates tailored to your personal needs and circumstances. This approach ensures you find the most cost-effective and suitable auto insurance option for your specific requirements.

Best Annual Auto Insurance Rates by Company in Mesa, Arizona

| Category | Insurance Company |

|---|---|

| Teenagers | Geico |

| Seniors | Geico |

| Clean Record | Geico |

| With 1 Accident | Geico |

| With 1 DUI | Geico |

| With 1 Speeding Violation | Geico |

Look at how each company performs in terms of affordability for different types of coverage, such as liability, collision, and comprehensive. Additionally, consider any special discounts that might apply to your situation, such as safe driver or multi-vehicle discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Mesa, Arizona Auto Insurance Companies

What auto insurance companies in Mesa, Arizona are the cheapest?

Average Monthly Auto Insurance Rates by Company in Mesa, Arizona

| Insurance Company | Average Monthly Rates |

|---|---|

| Allstate | $460 |

| American Family | $382 |

| Farmers | $454 |

| Geico | $200 |

| Nationwide | $326 |

| Progressive | $321 |

| State Farm | $444 |

| Travelers | $282 |

| USAA | $276 |

Compare the top Mesa, Arizona auto insurance companies to find the best monthly rates.

Factors Affecting Auto Insurance Rates in Mesa, Arizona

Auto insurance rates in Mesa, Arizona, can differ significantly from those in other cities due to a variety of local factors. One major influence is traffic congestion; heavy traffic increases the likelihood of accidents, which insurers account for by raising premiums to cover the higher risk of claims.

Mesa’s traffic situation is particularly notable, with the city ranking as the 928th most congested worldwide according to Inrix, reflecting significant congestion that contributes to higher insurance costs.

Additionally, vehicle theft is a concern, with FBI statistics showing 863 auto thefts reported in Mesa. This elevated theft rate leads to higher insurance premiums, as insurers anticipate more frequent claims.

Beyond traffic and theft, other regional factors also affect insurance rates, including the average length of commutes, which in Mesa is about 25.4 minutes, and the local economic environment.

All these elements combine to create a complex risk profile that influences the overall cost of auto insurance for residents in Mesa.

Compare Mesa, Arizona Auto Insurance Quotes

Before purchasing auto insurance in Mesa, Arizona, it’s crucial to compare rates from cheapest insurance companies to ensure you get the best deal. Rates can differ significantly between providers due to local factors like traffic conditions, vehicle theft rates, and individual insurer policies.

Auto insurance rates in Mesa, Arizona, can vary greatly from other cities due to local factors.Kristen Gryglik Licensed Insurance Agent

By entering your ZIP code, you can access free, personalized auto insurance quotes from multiple companies in Mesa. This comparison will help you find coverage that fits your needs and budget, ensuring you secure the most cost-effective and comprehensive insurance policy available.

Frequently Asked Questions

What factors should Mesa, Arizona drivers consider when choosing auto insurance beyond provider ratings and discounts?

Consider factors such as coverage options, customer service quality, and financial stability of the insurer. Evaluating how well the policy fits your personal needs and driving habits is crucial for finding the best coverage.

How can Mesa, Arizona car owners effectively assess the financial stability of an insurance company?

Review the company’s A.M. Best rating, which indicates financial strength and reliability. Additionally, check independent reviews and financial reports to gauge the insurer’s ability to handle claims. By entering your ZIP code, you can get free quote today.

What are the key differences between liability, collision, and comprehensive coverage, and which might be most suitable for drivers in Mesa, Arizona?

Liability coverage pays for damages you cause to others, collision covers damage to your own vehicle from accidents, and comprehensive covers non-collision incidents like theft or natural disasters. For Mesa drivers, combining these coverages can offer comprehensive protection against various risks.

How do bundling discounts impact overall insurance costs, and are there additional ways to save on auto insurance in Mesa, Arizona?

Bundling multiple policies, such as home and auto insurance, can significantly reduce overall premiums. Other ways to save include taking advantage of safe driver discounts, low-mileage discounts, and regularly comparing quotes.

What role do customer service reviews and satisfaction ratings play in selecting an auto insurance provider?

Positive customer service reviews and high satisfaction ratings indicate reliable and responsive support, which can enhance your overall insurance experience. Evaluating these factors helps ensure you receive quality service when you need it most. Entering your ZIP code to start comparing your quote.

How can Mesa, Arizona drivers utilize technology and mobile apps to manage their auto insurance policies more effectively?

Many insurers offer mobile apps that allow you to manage policies, file claims, and access roadside assistance directly from your phone. Utilizing these tools can streamline policy management and enhance convenience.

What are the common exclusions in auto insurance policies, and how can Mesa, Arizona drivers avoid unexpected gaps in coverage?

Common exclusions include intentional damage, wear and tear, and certain natural disasters. Carefully reviewing your policy and discussing coverage options with an agent can help avoid unexpected gaps and ensure comprehensive protection.

How does an individual’s driving record affect their insurance premiums, and what steps can be taken to improve it?

A poor driving record with accidents or violations typically leads to higher premiums due to increased risk. Improving your driving habits, attending defensive driving courses, and avoiding infractions can help lower your premiums over time. Entering your ZIP code today to start your quote.

What considerations should be made for auto insurance if someone frequently drives outside of Mesa, Arizona or in different states?

Ensure that your policy covers driving in other states and check for any specific regional requirements. Additionally, understand how your insurance provider handles out-of-state claims and adjust coverage as needed for frequent travel.

How do insurance companies determine eligibility for discounts, and what strategies can Mesa, Arizona drivers use to maximize their savings?

Eligibility for discounts is typically based on factors like driving history, vehicle safety features, and policy bundling. To maximize savings, maintain a clean driving record, take advantage of all available discounts, and regularly compare insurance quotes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.