Best Richmond, Virginia Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

The best Richmond, Virginia auto insurance providers are State Farm, USAA, and Erie with starting rates of $63/mo. These companies are all about serving Richmond's varied drivers. They offer great rates, solid coverage, and top-notch customer service while keeping up with the unique insurance scene in the city.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated November 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Richmond VA

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Richmond VA

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Richmond VA

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsStarting at $63 per month, State Farm, USAA, and Erie leading the pack as best Richmond, Virginia auto insurance providers. These auto insurance providers that operate in Richmond, does an excellent job of meeting the needs of the city’s diverse driver population.

State Farm is the best option overall for Richmond drivers who are looking for a place to get individualized insurance coverage for their vehicles.

Our Top 10 Company Picks: Best Richmond, Virginia Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 11% | B | Many Discounts | State Farm | |

| #2 | 18% | A++ | Military Savings | USAA | |

| #3 | 15% | A+ | 24/7 Support | Erie |

| #4 | 10% | A+ | Usage Discount | Nationwide |

| #5 | 12% | A+ | Innovative Programs | Progressive | |

| #6 | 14% | A++ | Custom Plan | Geico | |

| #7 | 17% | A+ | Add-on Coverages | Allstate | |

| #8 | 13% | A++ | Accident Forgiveness | Travelers | |

| #9 | 16% | A | Online App | AAA |

| #10 | 19% | A | Local Agents | Farmers |

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool above to instantly compare prices from various companies near you.

- Richmond, VA has lower auto insurance rates than the national average

- The cheapest auto insurance in Richmond, VA is provided by Erie

- Young drivers in Richmond, Virginia are seen as high-risk

#1 – State Farm: Top Overall Pick

Pros

- Personalized Service: Maintains over 50 local agents across Richmond, ensuring personalized service within a 10-mile radius of most residents. Delve into State Farm auto insurance review for a thorough analysis of their coverage options.

- Bundled Discounts: Offers bundled discounts up to 20% for combining auto with home or life insurance policies in Richmond.

- Safe Driving Rewards: Provides unique “Drive Safe & Save” program, offering Richmond drivers up to 30% off for consistently safe driving habits.

Cons

- Limited Exotic Car Coverage: Lacks specialized coverage for exotic or classic cars, limiting options for Richmond’s auto enthusiasts and collectors.

- High Premiums for Poor Credit: Charges up to 50% higher premiums for Richmond drivers with credit scores below 600 or recent DUI convictions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Lowest Premiums: Offers Richmond’s military families the lowest average premium of $139, nearly 30% below the city’s average rate. Explore USAA auto insurance review for an in-depth examination of policy features.

- Specialized Coverage: Provides specialized coverage for deployed service members, including storage and overseas shipping protection for vehicles.

- Military Discounts: Offers a 15% discount for Richmond-based military members who garage their vehicles on secure bases.

Cons

- Strict Eligibility: Strict eligibility criteria exclude 85% of Richmond’s population who aren’t active military, veterans, or their immediate family members.

- Limited Local Presence: Limited physical presence with only one office in Richmond, potentially inconveniencing members who prefer face-to-face interactions.

#3 – Erie: Best for 24/7 Support

Pros

- Affordable Premiums: Boasts Richmond’s most affordable average premium at $117, saving drivers up to 40% compared to top competitors. Check out Erie auto insurance review for a comprehensive look at their insurance offerings.

- Rate Lock Feature: Unique “Rate Lock” feature guarantees premium stability for Richmond drivers, even after filing a claim.

- 24/7 Local Claims Service: Offers 24/7 local claims service in Richmond, with an average response time of under 30 minutes.

Cons

- Limited Coverage Area: Coverage limited to 12 states, potentially problematic for Richmond residents who frequently travel or have multiple residences.

- Basic Mobile App: Lacks advanced mobile app features, offering only basic policy management for tech-savvy Richmond drivers.

#4 – Nationwide: Best for Usage Discount

Pros

- Comprehensive Online Quotes: Provides Richmond drivers with comprehensive online quotes, comparing rates from over 20 local insurers within minutes. Dive into Nationwide auto insurance review for detailed insights into their coverage plans.

- SmartRide® Usage Discount: Nationwide’s SmartRide® program rewards safe driving with potential savings. Richmond, VA drivers can earn discounts by using a telematics device to track their driving habits, which encourages safe driving and provides additional savings based on actual driving behavior.

- Rental Car Coverage: Covers rental cars up to $35 per day for 30 days in Richmond, exceeding standard rental coverage.

Cons

- Longer Claims Processing: Reports indicate 25% longer claims processing times in Richmond compared to the national average.

- Limited Discounts for New Drivers: Offers fewer discounts for new drivers, which could affect affordability for young or inexperienced drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Innovative Programs

Pros

- Advanced Mobile App: Features a well-rated mobile app for policy management and claims tracking for Richmond, VA policyholders. Get all the details in Progressive auto insurance review for a full breakdown of their services.

- Flexible Coverage Options: Progressive provides a range of coverage options, including custom plans that can be tailored to the specific needs of Richmond, VA drivers. This flexibility allows for personalized insurance solutions.

- Name Your Price® Tool: Name Your Price® tool allows Richmond drivers to customize coverage based on their exact budget constraints.

Cons

- Higher Rates for Certain Vehicles: Premiums can be higher for certain vehicle types, such as sports or luxury cars for policyholders in Richmond, VA.

- Limited In-Person Service: Progressive’s focus on digital and phone-based services may limit in-person support options for Richmond, VA drivers who prefer face-to-face interactions with their insurance provider.

#6 – Geico: Best for Custom Plan

Pros

- Clean Record Discount: Offers up to 25% discount for Richmond drivers with clean records for five years or more. Read Geico auto insurance review for an extensive overview of their policy options.

- Extensive Discount Options: Geico provides a wide range of discount opportunities, including multi-policy and safe driver discounts. Richmond, VA drivers can take advantage of these savings to further reduce their insurance premiums.

- Strong Digital Tools: Geico’s user-friendly digital tools and mobile app provide easy access to policy management and claims processing for Richmond, VA drivers. This convenience enhances the overall insurance experience.

Cons

- Limited Local Agent Network: Geico’s emphasis on digital services means fewer local agents in Richmond, VA. Drivers who prefer personalized service may find this a disadvantage compared to insurers with a stronger local presence.

- No Accident Forgiveness: Does not offer accident forgiveness programs, which could lead to higher rates after an accident.

#7 – Allstate: Best for Add-on Coverages

Pros

- Customizable Coverage: Offers unique “Your Choice Auto” program in Richmond, allowing drivers to customize coverage with specific add-ons. Discover comprehensive information in Allstate auto insurance review for an in-depth policy guide.

- Claim Satisfaction Guarantee: Provides “Claim Satisfaction Guarantee” in Richmond, offering a credit if customers are unsatisfied with claims experience.

- Dedicated Claim Centers: Maintains 15 dedicated claim centers across Richmond, ensuring quick in-person claims processing within 24 hours.

Cons

- Inconsistent Discount Application: Allstate’s discounts and savings opportunities might not be consistently applied across all regions, including Richmond, VA, potentially affecting the overall affordability of policies.

- Limited Roadside Assistance: Roadside assistance in Richmond limited to 20-mile towing, less comprehensive than some competitors’ 100-mile offerings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Decreasing Deductible: Offers decreasing deductible option, reducing Richmond drivers’ collision deductible by $50 annually, up to $500. For a detailed exploration, see Travelers auto insurance review for a complete policy analysis.

- Educational Resources: Features extensive online resources and tools to educate Richmond drivers about insurance options, coverage, and safe driving practices.

- Discount Opportunities for Safe Drivers:

Travelers offers discounts for safe driving and bundling policies. Richmond, VA drivers who maintain a clean driving record can benefit from these savings, reducing their overall insurance costs.

Cons

- Increased Rates for High-End Vehicles: Travelers may charge higher premiums for certain high-end or luxury vehicles, making insurance more expensive for owners of these cars in Richmond.

- Tougher Approval Standards: Travelers’ underwriting criteria can be more stringent, potentially leading to higher premiums or denial of coverage for some Richmond drivers.

#9 – AAA: Best for Online App

Pros

- High Customer Satisfaction: Consistently ranks in top 3 for customer satisfaction in Richmond, with 92% of customers reporting positive experiences. Learn more in AAA auto insurance review for a thorough review of their insurance coverage.

- Exclusive Discounts: Offers Richmond members exclusive discounts averaging 10% on hotels, rental cars, and attractions across Virginia.

- Advanced Mobile App: Provides Richmond drivers with real-time road condition updates and trip planning through advanced mobile app.

Cons

- Increased Rates for Older Drivers: AAA’s rates may be higher for older drivers, impacting affordability for senior drivers in Richmond, VA.

- Lengthy Policy Documents: Policy documents average 30 pages in length, 25% longer than industry standard, often confusing Richmond customers.

#10 – Farmers: Best for Local Agents

Pros

- Incident Forgiveness: Offers unique “Incident Forgiveness” feature, preventing rate increases for Richmond drivers after specific types of accidents. Uncover the full scope of Farmers auto insurance review for an exhaustive look at their offerings.

- Strong Regional Network: Farmers has a strong regional network in Richmond, VA, providing drivers with access to local agents and personalized service.

- Ride-Share Coverage: Provides specialized coverage options for Richmond ride-share drivers, covering gaps in liability between personal and company insurance.

Cons

- Higher Renewal Rates: There is a risk of higher renewal rates with Farmers, which might result in increased premiums over time for long-term policyholders.

- Fewer Single-Car Discounts: Offers 15% fewer discounts for single-car policies in Richmond compared to multi-car policies, disadvantaging individual drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Auto Insurance Providers in Richmond, VA

While USAA tops the charts with the lowest premiums in Richmond, there’s a catch – it’s exclusively for military personnel, veterans, and their families. If you’re looking for auto insurance for military members or veterans, it is probably your go-to option.

For the general public, Geico emerges as the frontrunner, offering the most wallet-friendly auto insurance rates in Richmond, VA. See the table below for price breakdown from different providers.

Richmond, Virginia Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $78 | $138 |

| Allstate | $77 | $136 |

| Erie | $63 | $117 |

| Farmers | $74 | $125 |

| Geico | $68 | $124 |

| Nationwide | $77 | $134 |

| Progressive | $75 | $127 |

| State Farm | $69 | $129 |

| Travelers | $71 | $131 |

| USAA | $81 | $139 |

Wondering which car insurance company in Richmond, VA will treat your wallet well? We have the answers you need right here. Don’t worry – we’ll dive into comparison too, helping you find the best Richmond, Virginia auto insurance for your needs. Below are the discounts from the car insurance companies in Richmond, Virginia.

Finding the best Richmond, Virginia auto insurance requires understanding that rates are determined by various personal factors including age, gender, marital status, location, driving history, and credit score. Each insurance company uses a unique formula to calculate premiums, making it crucial to compare quotes from multiple providers.

Remember, the goal is to find a policy that offers the right balance of coverage and affordability tailored to your unique profile as a Richmond driver. Age is a particularly significant factor, as the best insurance company can vary dramatically depending on the driver’s age levels.

When hunting for the best Richmond, Virginia auto insurance, your credit score isn’t just about qualifying for loans – it’s a major player in determining your premiums too. Check out the table below for the prices.

A DUI in Richmond can dramatically increase your premiums by 40% to 50%, making affordable coverage much harder to find. We’ve researched and compiled a list of the most cost-effective car insurance in Richmond, VA for various driving records, from clean to troubled.

This breakdown can help drivers with all types of records find coverage that balances protection and affordability. Spotty driving history can make your search more challenging, some insurers still offer reasonable rates for higher-risk drivers

Your driving record is a crucial factor in determining your Richmond car insurance rates, acting as a predictor of future risk for insurers.Michelle Robbins LICENSED INSURANCE AGENT

Your daily commute, the level of coverage you choose, any tickets lurking in your driving history, DUIs (which can severely impact your premiums), and even your credit score all play a role in determining your insurance costs.

By managing these risk factors effectively, you can potentially lower your rates and secure more affordable coverage. For instance, maintaining a clean driving record, improving your credit score, and carefully considering your coverage needs can all contribute to cheap car insurance in Richmond, VA.

Age also matters. Young drivers in Richmond, VA are seen as high-risk. The city takes gender into account too. See the chart below:

Remember, each insurance company weighs these factors differently, so it’s essential to shop around. Ask an auto insurance company for quotes to get a clear picture of how your personal circumstances affect your rates.

Required Auto Insurance Coverage for Drivers in Richmond, VA

Fort the minimum requirements for car insurance in Richmond, Virginia, each person held liable would cost $25,000. For bodily injury, the price would rise to $50,000 per incident. Property damage would carry a cost of $20,000 for each event. In Virginia, they make you carry uninsured and underinsured motorist coverage.

If you decide to go without auto insurance, you can pay a fee of five hundred dollars each year. But make no mistake, if you cause an accident, you will still be held responsible for any damages and injuries.

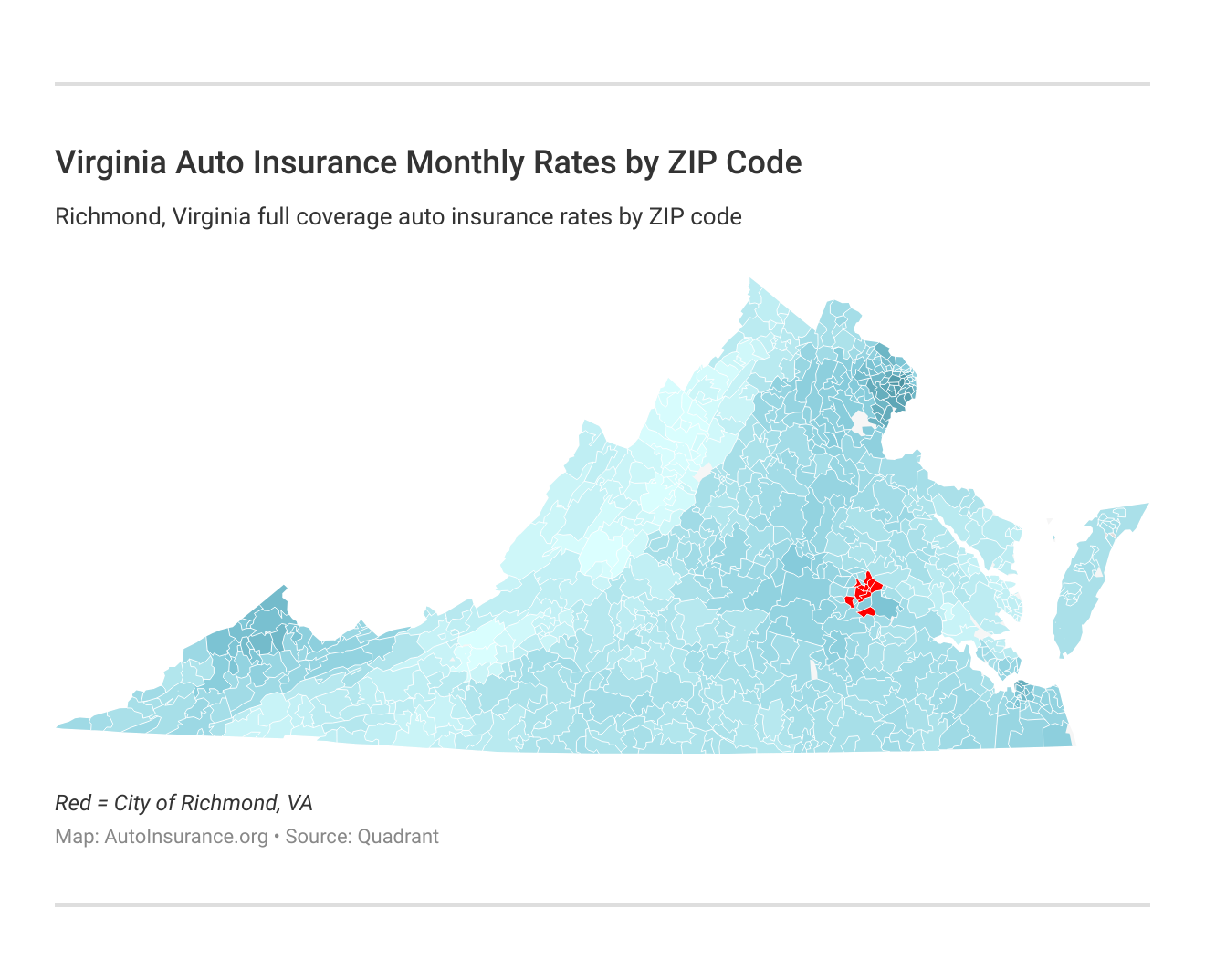

Compare Auto Insurance Rates by ZIP Code in Richmond, VA

Explore the details regarding the monthly auto insurance rates in Richmond, VA, categorized by ZIP Code. This information can help you better understand how your location may influence your auto insurance premiums.

Whether you are a current resident or considering a move to Richmond, this guide will assist you in navigating the landscape of car insurance costs associated with various ZIP Codes in the region.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap car insurance quotes in Richmond, VA .

Frequently Asked Questions

Does Richmond have any unique risks that might affect my auto insurance coverage?

Yes, Richmond has unique risks such as heavy traffic in urban areas, flooding in low-lying regions, and a higher-than-average rate of car theft in certain neighborhoods. These risks may require additional coverage options like comprehensive insurance.

What steps can I take to protect my vehicle from theft in Richmond?

To protect your vehicle from theft in Richmond, consider parking in well-lit or secured areas, installing an anti-theft device, and avoiding leaving valuables in plain sight. Some insurance companies offer discounts for vehicles equipped with advanced security systems. For more information, read our article titled “How to Get an Anti-Theft Auto Insurance Discount.”

How does Richmond’s traffic affect my auto insurance premiums?

Richmond’s busy roadways, particularly during rush hour, increase the likelihood of accidents, which can raise your insurance premiums. If you frequently commute through high-traffic areas, your insurer might consider you a higher risk.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap car insurance quote in Richmond, VA.

How do insurance companies assess the risk of insuring drivers in Richmond, VA

Insurance companies assess risk based on factors like your driving record, vehicle type, and the specific area within Richmond where you live. High-crime neighborhoods, heavy traffic areas, and your daily commute distance can all influence your risk level and, consequently, your premiums.

Read More: What is a good auto insurance score?

How do local laws in Richmond impact auto insurance requirements?

Virginia law requires all drivers to carry minimum liability coverage. In Richmond, this means you must have at least $30,000 per person and $60,000 per accident for bodily injury, and $20,000 for property damage. Failure to meet these requirements can result in fines and license suspensions.

What are the penalties for driving without insurance in Richmond?

Driving without insurance in Richmond can result in severe penalties, including fines up to $500, suspension of your driver’s license, and the requirement to file an SR-22 form to prove future financial responsibility.

How can Richmond drivers lower their auto insurance premiums?

Richmond drivers can lower their premiums by maintaining a clean driving record, bundling insurance policies, increasing their deductible, and taking advantage of available discounts. Installing anti-theft devices and parking in a secure area can also reduce costs.

How does the climate in Richmond, VA, affect auto insurance claims?

Richmond’s climate, with its potential for severe storms and occasional snowfall, can lead to an increase in weather-related claims. It is advisable to have comprehensive coverage to cover damage from flooding, hail, or falling trees.

Read More: Does car insurance cover hail damage?

Are there any local insurance agents in Richmond that specialize in specific needs?

Yes, Richmond has several local insurance agents who specialize in different aspects of auto insurance, including coverage for classic cars, high-risk drivers, or commercial vehicles. Working with a local agent can help tailor your policy to meet your specific needs.

What should new drivers in Richmond know about auto insurance?

New drivers in Richmond should know that their lack of driving experience may lead to higher premiums. To mitigate costs, they should consider taking a driver’s education course, maintaining a clean driving record, and exploring discounts for good students or bundling policies.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.