Best Sacramento, California Auto Insurance in 2026 (Compare the Top 10 Companies)

Geico, State Farm, and Progressive are the best choices for the best Sacramento, California auto insurance, with rates starting as low as $26 per month. These providers are known for their comprehensive coverage options, dependable service, and high customer satisfaction made for your auto insurance in California.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated October 2024

Company Facts

Full Coverage in Sacramento

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Sacramento

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Sacramento

A.M. Best Rating

Complaint Level

Pros & Cons

Compare auto insurance in Sacramento to rates in San Francisco, Anaheim, and Los Angeles to see how your auto insurance premium might differ across these California cities.

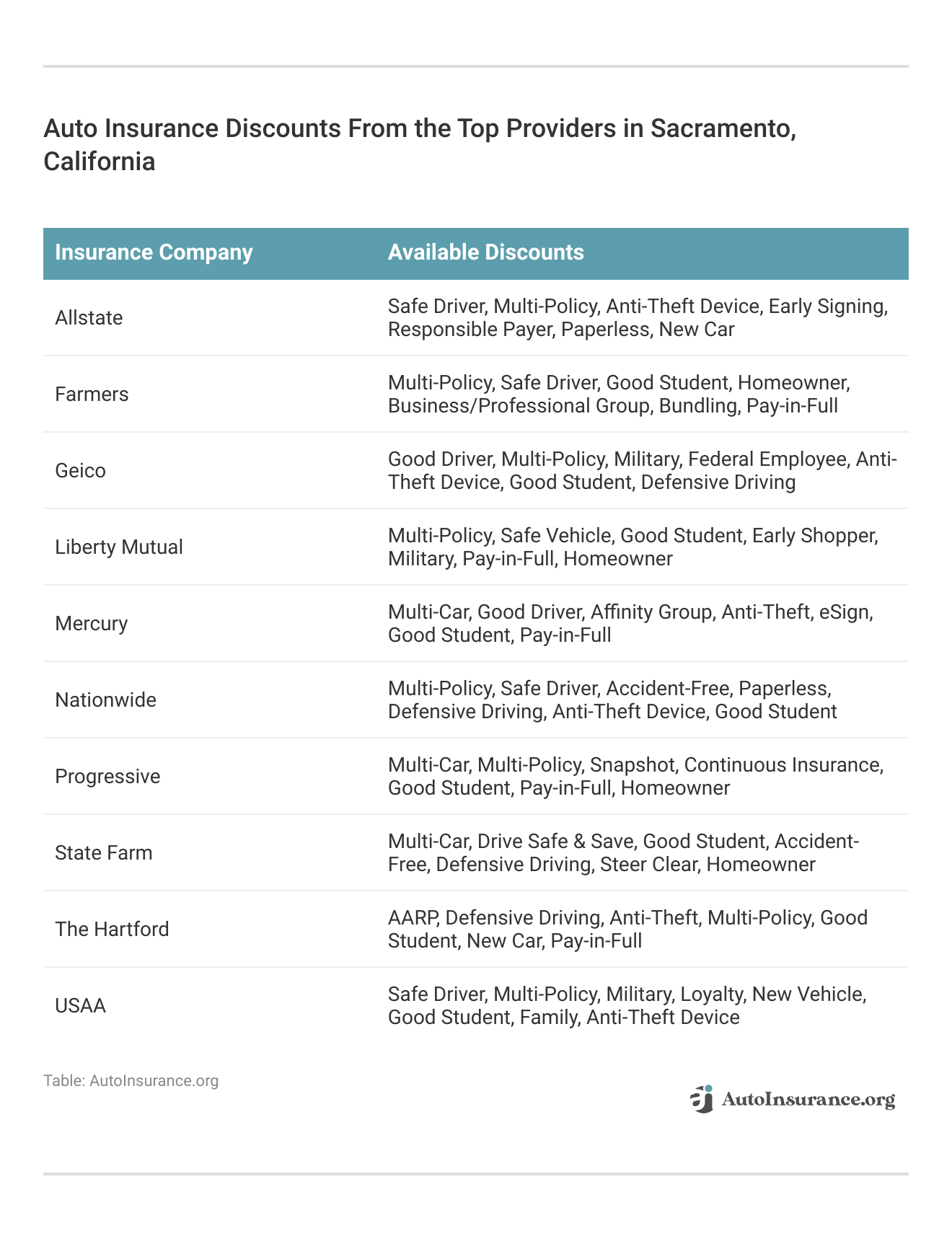

Our Top 10 Company Picks: Best Sacramento, California Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 15% A++ Affordable Rates Geico

![]()

#2 18% B Agent Network State Farm

![]()

#3 7% A+ Online Savings Progressive

#4 22% A+ Customizable Coverage Allstate

#5 14% A Personalized Policies Farmers

#6 16% A Comprehensive Discounts Liberty Mutual

#7 19% A+ Vanishing Deductible Nationwide

#8 12% A++ Military Focused USAA

#9 11% A Low-Cost Coverage Mercury

#10 13% A+ Senior Focused The Hartford

Before you buy Sacramento, California auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Sacramento, California auto insurance quotes.

- Geico, State Farm, and Progressive offer top insurance in California

- Geico and State Farm provide competitive rates and strong coverage

- Coverage options start at $26 per month

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico offers premiums starting around $26 per month, making it a top choice for the best Sacramento, California auto insurance if affordability is your primary concern. The company’s A++ rating from A.M. Best underscores its strong financial stability.

- High Customer Satisfaction: Geico is well-regarded for its ease of use and claim handling, contributing to its reputation as a provider of the best Sacramento, California auto insurance. The 15% bundling discount enhances its appeal by making coverage more affordable.

- Numerous Discounts: With discounts for good driving habits, bundling, and safety features, Geico stands out among the best Sacramento, California auto insurance options for maximizing savings, as highlighted in our Geico auto insurance review.

Cons

- Inconsistent Customer Service: Some customers report variable experiences with Geico’s customer support, which can affect its standing as the best Sacramento, California auto insurance provider. This inconsistency may be problematic when seeking resolution for issues.

- Limited Local Agent Access: Geico’s emphasis on digital service means fewer opportunities for face-to-face interactions with local agents, which could be a drawback for those seeking the best Sacramento, California auto insurance with personal service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Agent Network

Pros

- Large Agent Network: State Farm’s extensive network of local agents offers personalized service, making it a strong contender for the best Sacramento, California auto insurance if you prefer in-person interactions. This network provides tailored support for local drivers.

- Comprehensive Coverage Options: State Farm provides a wide range of coverage options and add-ons. Their 18% bundling discount makes them a leading choice for the best Sacramento, California auto insurance for those looking to save by combining policies.

- Good for Local Support: With high ratings for local agent support and claims service, State Farm is considered among the best Sacramento, California auto insurance providers for those who value robust local support.

Cons

- Potentially Higher Premiums: State Farm’s rates can be higher compared to some competitors, which may impact its appeal as the best Sacramento, California auto insurance for budget-conscious drivers, as detailed in our State Farm auto insurance review.

- Limited Online Discounts: Compared to some digital-first providers, State Farm offers fewer online savings opportunities, which can be a drawback for those seeking the best Sacramento, California auto insurance with extensive online discount options.

#3 – Progressive: Best for Online Savings

Pros

- User-Friendly Online Tools: The comprehensive website and app provided by Progressive make managing your policy and filing claims straightforward, positioning them as one of the best Sacramento, California auto insurance options for digital convenience.

- Competitive Pricing: With rates starting around $26 per month, Progressive is one of the most affordable choices for the best Sacramento, California auto insurance. Their A+ rating from A.M. Best further adds to their reliability.

- Snapshot Program: Progressive’s Snapshot program offers savings based on driving behavior, making it a compelling option for the best Sacramento, California auto insurance if you want to be rewarded for safe driving, as highlighted in our Progressive auto insurance review.

Cons

- Higher Premiums for Some Drivers: Progressive may have higher rates for drivers with less-than-perfect records, which could detract from its status as the best Sacramento, California auto insurance for those with a history of accidents.

- Mixed Customer Service Reviews: Some users report less satisfactory experiences with Progressive’s customer service, potentially impacting its standing as the best Sacramento, California auto insurance provider.

#4 – Allstate: Best for Customizable Coverage

Pros

- Multiple Discounts: With discounts for bundling, safe driving, and safety features, Allstate provides significant savings opportunities, making it a leading choice for the best Sacramento, California auto insurance if you value various discount options.

- Strong Local Agent Support: Allstate’s network of local agents offers personalized service, positioning it among the best Sacramento, California auto insurance providers for those who prefer in-person interactions.

- Accident Forgiveness: The accident forgiveness program for clean driving records makes Allstate a standout option for the best Sacramento, California auto insurance if you want protection against rate increases after an accident.

Cons

- Higher Premiums: Allstate’s rates can be higher compared to some competitors, which may affect its status as the best Sacramento, California auto insurance for those looking to keep costs down, as noted in our Allstate auto insurance review.

- Complex Claims Process: Some customers find Allstate’s claims process to be more complicated, which could be a disadvantage when considering it as the best Sacramento, California auto insurance option.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Personalized Policies

Pros

- Discounts for Bundling: With a 14% bundling discount, Farmers provides savings for combining multiple policies, making it a strong contender for the best Sacramento, California auto insurance if you want to consolidate your coverage.

- Comprehensive Coverage Options: Farmers offers a broad range of coverage options and add-ons, ensuring you can find the best Sacramento, California auto insurance that meets your unique needs and preferences.

- Good Customer Support: Farmers is known for its reliable customer service, contributing to its reputation as a top choice for the best Sacramento, California auto insurance when it comes to support and assistance. Find out more through our Farmers auto insurance review.

Cons

- Potentially Higher Costs: Farmers’ rates may be higher compared to some other providers, which can impact its appeal as the best Sacramento, California auto insurance for those on a tight budget.

- Limited Discounts for Safe Driving: Compared to competitors, Farmers may offer fewer discounts specifically for safe driving, which could be a drawback for those seeking the best Sacramento, California auto insurance with robust safe-driving incentives.

#6 – Liberty Mutual: Best for Comprehensive Discounts

Pros

- Comprehensive Discounts: Liberty Mutual offers a 16% discount on bundling and various other discounts, making it a top option for the best Sacramento, California auto insurance if you’re looking to maximize savings through multiple discounts.

- Customizable Policies: Liberty Mutual provides a range of customizable coverage options, allowing you to tailor your policy to fit your needs, which makes it one of the best Sacramento, California auto insurance providers for those seeking flexibility, as mentioned in our Liberty Mutual auto insurance review.

- Strong Financial Ratings: With an A rating from A.M. Best, Liberty Mutual is recognized for its financial stability, enhancing its reputation as one of the best Sacramento, California auto insurance options.

Cons

- Customer Service Variability: Some customers have reported inconsistent experiences with Liberty Mutual’s customer service, which could affect its reputation as the best Sacramento, California auto insurance provider.

- Potential for Higher Premiums: Liberty Mutual’s premiums can be higher than some competitors, which may make it less appealing for those looking for the most affordable option among the best Sacramento, California auto insurance providers.

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program offers to reduce your deductible over time, making it a strong choice for the best Sacramento, California auto insurance if you want to benefit from long-term savings.

- Discounts for Bundling: With a 19% discount for bundling, Nationwide provides significant savings opportunities, which can be appealing when searching for the best Sacramento, California auto insurance, according to Nationwide auto insurance review.

- Good Financial Strength: Nationwide’s A+ rating from A.M. Best indicates strong financial health, reinforcing its reputation as a reliable option for the best Sacramento, California auto insurance.

Cons

- Complex Policy Options: The variety of policy options and add-ons can sometimes be overwhelming, potentially making it less straightforward to find the best Sacramento, California auto insurance for those who prefer simplicity.

- Mixed Customer Reviews: Some users report less favorable experiences with Nationwide’s customer service, which could impact its standing as the best Sacramento, California auto insurance provider for those prioritizing customer support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Focused

Pros

- Competitive Rates: USAA offers competitive premiums with a starting point around $26 per month, making it one of the most affordable options for the best Sacramento, California auto insurance for military families.

- High Customer Satisfaction: USAA consistently receives high marks for customer satisfaction, contributing to its reputation as a top choice for the best Sacramento, California auto insurance, as highlighted in our USAA auto insurance review.

- Comprehensive Coverage: USAA provides a range of coverage options and discounts, ensuring that you can get the best Sacramento, California auto insurance that meets diverse needs.

Cons

- Eligibility Limitations: USAA’s services are only available to military members and their families, which limits its availability and makes it less accessible for the general public seeking the best Sacramento, California auto insurance.

- Limited Local Agent Network: USAA primarily operates online, which may be less appealing for those seeking face-to-face interactions with local agents as part of their search for the best Sacramento, California auto insurance.

#9 – Mercury: Best for Low-Cost Coverage

Pros

- Affordable Coverage: Mercury offers low-cost insurance options, making it a strong contender for the best Sacramento, California auto insurance for budget-conscious drivers. Their rates can start as low as $26 per month.

- Variety of Discounts: Mercury provides a range of discounts, including those for bundling and safe driving, enhancing its appeal as one of the best Sacramento, California auto insurance providers for savings.

- A.M. Best Rating: With an A rating from A.M. Best, Mercury is recognized for its financial stability, contributing to its reputation as a reliable option for the best Sacramento, California auto insurance. Read more through our Mercury auto insurance review.

Cons

- Limited National Presence: Mercury’s regional focus may limit its availability in certain areas, potentially affecting its appeal as the best Sacramento, California auto insurance for those seeking nationwide coverage.

- Customer Service Issues: Some customers have reported challenges with Mercury’s customer service, which could impact its standing as the best Sacramento, California auto insurance provider for those prioritizing support.

#10 – The Hartford: Best for Senior Focused

Pros

- Senior-Focused Benefits: The Hartford offers specialized coverage and discounts for senior drivers, making it an excellent choice for the best Sacramento, California auto insurance if you’re looking for policies tailored to older adults.

- High A.M. Best Rating: With an A+ rating from A.M. Best, The Hartford is recognized for its financial strength, contributing to its reputation as a top choice for the best Sacramento, California auto insurance. Find details through our The Hartford auto insurance review.

- Customized Coverage Options: The Hartford provides a range of customizable coverage options, ensuring that you can find the best Sacramento, California auto insurance that meets your specific needs and preferences.

Cons

- Higher Premiums for Some: The Hartford’s premiums may be higher compared to some other providers, which could impact its appeal as the best Sacramento, California auto insurance for those looking to save on costs.

- Limited Availability of Discounts: While The Hartford offers some discounts, there may be fewer options compared to competitors, potentially affecting its attractiveness as the best Sacramento, California auto insurance provider for those seeking extensive discount opportunities.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Required Auto Insurance Coverage in Sacramento, California

In Sacramento, California, drivers must meet the state’s minimum car insurance requirements to comply with legal and financial responsibilities.

California law mandates that drivers carry liability insurance with coverage limits of at least $15,000 for injury or death per person, $30,000 for injury or death per accident, and $5,000 for property damage.

Sacramento, California Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $34 $143

Farmers $32 $149

Geico $26 $119

Liberty Mutual $28 $138

Mercury $33 $134

Nationwide $30 $127

Progressive $31 $125

State Farm $29 $137

The Hartford $35 $146

USAA $27 $116

This coverage helps cover the costs if you’re found at fault in an accident, including medical expenses and property repairs for others involved.

Additionally, while these are the legal minimums, considering higher coverage limits or additional types of insurance, such as uninsured motorist coverage or comprehensive coverage, may offer better protection and peace of mind.

Make sure to review your auto insurance policy regularly and adjust coverage as needed to ensure you meet both legal requirements and personal protection needs. Enter your ZIP code now to begin comparing.

Cheapest Companies for Sacramento, California Auto Insurance

Frequently Asked Questions

How does the coverage level selected affect auto insurance rates in Sacramento, California?

The coverage level selected can impact auto insurance rates in Sacramento, with higher coverage leading to higher premiums.

Does the length of the commute affect auto insurance rates in Sacramento, California?

Commute length can affect auto insurance rates in Sacramento, with longer commutes potentially resulting in higher premiums. Enter your ZIP code now to begin.

How does the location or ZIP code impact auto insurance rates in Sacramento, California?

How does a driving record affect auto insurance rates in Sacramento, California?

A driving record with accidents, DUIs, or speeding violations can lead to higher auto insurance rates in Sacramento, CA.

Insurance companies generally consider drivers with a clean record as lower-risk, resulting in more affordable premiums.

Are there specific auto insurance discounts available for seniors in Sacramento, California?

Some insurance companies may offer specific discounts for seniors in Sacramento, CA.

It’s best to check with individual insurance providers to inquire about any available discounts or special programs for senior drivers. Enter your ZIP code now to begin.

How can teen drivers find cheap auto insurance in Sacramento, California?

Which auto insurance provider offers the highest bundling discount among the top Sacramento companies?

Allstate offers the highest bundling discount at 22%. This discount makes it a standout choice for those seeking the best Sacramento, California auto insurance with savings on multiple policies.

What A.M. Best rating does Geico hold, and how does it influence its standing for affordable rates?

Geico holds an A++ rating from A.M. Best, indicating superior financial strength and stability.

This rating supports its reputation for offering the best Sacramento, California auto insurance with affordable rates. Enter your ZIP code now to begin.

How does USAA’s military focus impact its appeal as the best Sacramento, California auto insurance for military families?

What specific benefit makes The Hartford a strong choice for senior drivers in Sacramento?

The Hartford is noted for its senior-focused insurance plans, offering discounts and services tailored to older drivers.

This specialization contributes to its reputation as a top option for the best Sacramento, California auto insurance for seniors.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.