Best Gilbert, Arizona Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Gilbert, Arizona auto insurance are State Farm, Geico, and Progressive. State Farm stands out with its exceptional coverage starting at $48 a month. These companies offer specialized programs tailored for various groups, ensuring top-tier protection in Gilbert, Arizona.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Gilbert AZ

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Gilbert AZ

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Gilbert AZ

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Geico, and Progressive are the top picks for the best Gilbert, Arizona auto insurance. State Farm excels with its extensive coverage options and personalized customer service, making it the standout choice.

Geico and Progressive follow closely, offering competitive rates and strong coverage plans.

Our Top 10 Company Picks: Best Gilbert, Arizona Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Broad Coverage State Farm

#2 12% A++ Competitive Rates Geico

#3 10% A+ Customizable Plans Progressive

#4 17% A+ Robust Discounts Allstate

#5 14% A Local Expertise Farmers

#6 10% A Flexible Policies Liberty Mutual

#7 13% A+ SmartRide Program Nationwide

#8 16% A Customer Loyalty American Family

#9 11% A++ Comprehensive Coverage Travelers

#10 8% A++ Military Benefits USAA

For residents seeking reliable auto insurance in Gilbert, Arizona, these companies provide the best protection and value. Read “Types of Auto Insurance” for more insights.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code above into our comparison tool today.

- State Farm leads with top coverage and service

- Geico and Progressive offer great rates in Gilbert, Arizona

- Coverage options meet diverse needs in Gilbert, Arizona

#1 – State Farm: Top Overall Pick

Pros

- Bundling Discount: Gilbert, Arizona residents can save up to 15% by combining multiple State Farm insurance plans, helping to reduce overall costs while offering comprehensive coverage.

- High Mileage Discount: State Farm offers low-mileage discounts in Gilbert, making it a cost-effective option for infrequent drivers. Check out our guide titled, “State Farm Auto Insurance Review.”

- Wide Coverage Options: State Farm offers a variety of coverage plans in Gilbert, from basic liability to comprehensive options, allowing drivers to choose policies tailored to their needs.

Cons

- Limited Bundling Savings: While the 15% bundling discount is helpful, competitors in Gilbert may offer larger savings, limiting overall discounts.

- Premium Rates: In spite of discounts, some Gilbert residents might find State Farm’s premiums higher than expected for certain coverage levels.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Competitive Pricing: Geico offers a 12% bundling discount in Gilbert, Arizona, along with competitive rates, making it an attractive option for drivers seeking affordable yet comprehensive coverage.

- Top-Rated: Geico’s A++ rating from A.M. Best reflects its strong financial stability, giving Gilbert residents confidence in its ability to manage claims and meet obligations.

- Flexible Rates: Geico offers customizable rate structures in Gilbert, enabling drivers to tailor policies to their needs. Check out our guide titled, “Best Geico Auto Insurance Discounts.”

Cons

- Less Generous Bundling: Geico’s 12% bundling discount, while beneficial, might not be as generous as those provided by some other insurers in Gilbert, which could limit the overall savings for customers.

- Coverage Limitations: Drivers in Gilbert, Arizona, may find Geico’s coverage options limited compared to other major providers, potentially affecting those needing more specialized insurance plans.

#3 – Progressive: Best for Customizable Plans

Pros

- Tailored Plans: Progressive in Gilbert, Arizona, offers customizable insurance plans, letting drivers tailor coverage from basic to comprehensive. Dive into our article called, “Progressive Auto Insurance Review.”

- A+ Rating: With an A+ rating from A.M. Best, Progressive is recognized for its solid financial stability and reliability, ensuring that Gilbert residents receive dependable coverage and service.

- Attractive Bundling Discount: The 10% bundling discount provided by Progressive in Gilbert offers a competitive edge, helping to reduce overall insurance costs while maintaining flexible coverage options.

Cons

- Smaller Discount Range: Progressive’s 10% bundling discount in Gilbert, Arizona, may be less competitive than those offered by other insurers, limiting savings on multiple policies.

- Complex Pricing: Gilbert drivers may face a complicated pricing structure with Progressive, making it harder to find the best policy.

#4 – Allstate: Best for Robust Discounts

Pros

- Generous Discounts: Allstate offers a 17% bundling discount for Gilbert, Arizona residents, providing substantial savings.

- A+ Rating: Allstate’s A.M. Best A+ rating ensures financial stability and reliability for Gilbert drivers. Dive into our article titled, “Allstate Auto Insurance Review.”

- Extensive Coverage: Allstate provides a wide range of coverage options tailored to Gilbert residents’ needs, from basic to comprehensive protection.

Cons

- Higher Premiums: Regardless of discounts, some Gilbert drivers may find Allstate’s premiums high, especially for comprehensive plans.

- Discount Limitations: The savings from discounts might be offset by higher base rates, requiring careful cost evaluation for Gilbert residents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Local Expertise

Pros

- Local Expertise: Farmers provides tailored insurance solutions in Gilbert, Arizona, with personalized service that meets the area’s unique needs.

- 14% Bundling Discount: Gilbert residents can save with a 14% discount by combining policies, offering competitive cost reduction.

- Strong Financial Stability: Farmers’ A rating from A.M. Best ensures financial reliability and dependable service for Gilbert drivers. Gain insights from our guide titled, “Farmers Auto Insurance Review.”

Cons

- Lower Discount: The 14% bundling discount may be less than what other insurers in Gilbert offer.

- Variable Premiums: Premium costs may vary for Gilbert drivers based on coverage and risk factors.

#6 – Liberty Mutual: Best for Flexible Policies

Pros

- Versatile Policies: Liberty Mutual offers flexible policy options in Gilbert, Arizona, allowing drivers to customize coverage to suit their needs.

- 10% Bundling Discount: Gilbert residents can save 10% when bundling multiple plans, ensuring comprehensive coverage at a reduced cost.

- A Rating: Liberty Mutual’s A rating from A.M. Best assures Gilbert drivers of its financial stability and dependable service. For further details see our guide titled, “Liberty Mutual Auto Insurance Review.”

Cons

- Lower Bundling Savings: The 10% bundling discount may be less competitive than higher offers from other insurers in Gilbert, limiting potential savings.

- Limited Coverage Options: Some drivers in Gilbert might find Liberty Mutual’s coverage choices less comprehensive compared to other major insurers.

#7 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide’s SmartRide program in Gilbert, Arizona, rewards safe driving with discounts, appealing to cautious drivers.

- 13% Bundling Discount: Residents can save 13% by bundling policies, balancing savings and coverage. Discover more by exploring our in-depth guide titled, “Nationwide Auto Insurance Review.”

- A+ Rating: Nationwide holds an A+ rating from A.M. Best, indicating strong financial stability and reliable service for Gilbert drivers.

Cons

- Discount Variability: The 13% bundling discount may be lower than those offered by other providers in Gilbert, potentially limiting savings.

- Complex Coverage Options: Gilbert drivers may find Nationwide’s coverage options and discount structures complicated, making it harder to choose the best policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Customer Loyalty

Pros

- Customer Loyalty Perks: American Family emphasizes rewarding long-term customers in Gilbert, Arizona, with additional benefits and perks that enhance the overall value of their insurance policies.

- 16% Bundling Discount: Gilbert residents can access a substantial 16% discount for bundling multiple policies, making it a strong contender for cost savings while securing comprehensive coverage.

- A Rating: American Family’s A rating from A.M. Best indicates its financial stability, providing confidence for Gilbert drivers. Read our article called, “American Family Auto Insurance Review.”

Cons

- Higher Base Rates: Even though the attractive bundling discount, some drivers in Gilbert might find American Family’s base rates to be relatively high, which could affect overall affordability.

- Discount Restrictions: The effectiveness of the discounts might be limited by the initial cost of coverage, impacting the total savings for Gilbert residents.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Thorough Coverage: Travelers provides extensive and comprehensive coverage options in Gilbert, Arizona, ensuring that a broad range of insurance needs are addressed with a high level of protection.

- 11% Bundling Discount: Gilbert residents can save 11% by bundling policies with Travelers. Uncover details in our guide titled, “Travelers Auto Insurance Review.”

- A++ Rating: With an A++ rating from A.M. Best, Travelers is recognized for its exceptional financial strength and reliability, making it a trustworthy choice for Gilbert drivers.

Cons

- Moderate Discount: The 11% bundling discount from Travelers might be seen as moderate compared to higher discounts available from other insurers in Gilbert, potentially affecting overall savings.

- Coverage Costs: Some Gilbert drivers might find that the extensive coverage options come with higher costs, which could impact overall affordability.

#10 – USAA: Best for Military Benefits

Pros

- Military-Specific Benefits: USAA offers specialized benefits for military families in Gilbert, Arizona, providing tailored support and coverage options that cater specifically to those with military affiliations.

- 8% Bundling Discount: Gilbert residents can access an 8% discount for bundling multiple policies with USAA, delivering cost-effective insurance solutions for eligible customers.

- A++ Rating: USAA’s A++ rating from A.M. Best reflects its strong financial stability and reliable service for military families in Gilbert. Gain insights from our guide titled, “USAA Auto Insurance Review.”

Cons

- Lower Bundling Savings: The 8% bundling discount from USAA might be considered lower compared to discounts provided by other insurers in Gilbert, potentially impacting overall savings.

- Eligibility Restrictions: USAA’s benefits are primarily available to military families, which could limit access for other drivers in Gilbert seeking similar coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Monthly Auto Insurance Rates in Gilbert, Arizona

When evaluating auto insurance options in Gilbert, Arizona, it’s crucial to consider both minimum and full coverage rates. The table below provides a snapshot of the monthly rates for various top insurance companies.

Gilbert, Arizona Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$58 $130

$65 $140

$60 $138

$50 $120

$68 $145

$53 $128

$63 $135

$55 $125

$59 $132

$48 $115

USAA offers the most affordable minimum coverage at $48 and full coverage at $115, making it an excellent choice for budget-conscious drivers. Geico and State Farm also provide competitive rates, with minimum coverage starting at $50 and $55 respectively, and full coverage rates of $120 and $125.

Auto Insurance Discounts From the Top Providers in Gilbert, Arizona

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, Anti-theft, Good Student, New Car, Anti-lock Brakes, Early Signing, Smart Student, Drivewise | |

| Multi-Policy, Loyalty, Good Student, Safe Driver, Steer into Savings, Defensive Driver, Low Mileage | |

| Multi-Policy, Good Student, Homeowner, Safe Driver, Alternative Fuel, Pay-in-Full, Signal | |

| Multi-Policy, Good Driver, Good Student, Defensive Driving, Military, Vehicle Equipment, Membership/Employee, Emergency Deployment | |

| Multi-Policy, Good Student, Anti-theft Device, Newly Married, Online Purchase, Hybrid Vehicle, Early Shopper |

| Multi-Policy, SmartRide, SmartMiles, Good Student, Anti-theft, Defensive Driving, Accident-Free, Paperless, Pay-in-Full |

| Multi-Policy, Snapshot, Good Student, Safe Driver, Homeowner, Continuous Insurance, Teen Driver, Multi-Car, Paperless | |

| Good Driver, Good Student, Multi-Policy, Anti-theft Device, Accident-Free, Safe Vehicle, Steer Clear | |

| Multi-Policy, Safe Driver, Good Student, Continuous Insurance, Hybrid/Electric Vehicle, New Car, Homeowner | |

| Military, Multi-Vehicle, Good Student, Defensive Driving, New Vehicle, Family, Loyalty, Safe Driver, Storage, Annual Mileage |

On the higher end, Liberty Mutual and American Family have higher premiums, reflecting their extensive coverage options. For more information, check out our complete guide titled, “Minimum Auto Insurance Requirements by State.”

Comprehensive Guide to Auto Insurance in Gilbert, Arizona: Stats, Rates, and Coverage

Gilbert is the fifth-largest city in the Phoenix Metropolitan Area that is routinely ranked as one of the best places to live in the country.

Comprehensive Guide to Auto Insurance in Gilbert, Arizona: Stats, Rates, and Coverage

| Summary Overview of Gilbert, AZ | Stats |

|---|---|

| Population | 242,354 |

| Density | 5,642 people per square mile |

| Average Cost of Insurance in Gilbert | $340 |

| Cheapest Car Insurance Company | Geico |

In the last two decades, Gilbert has been the fastest-growing municipality in the country. In the last two decades, it has grown from a small farming community to a modern city. Obtain detailed insights by reading our guide titled, “Best Arizona Auto Insurance.”

The rapid growth is brought in a thriving economy supported by a large population. Arizona has 22 national parks and several state parks, many of them an hour to a day-trip away from Gilbert.

With so much to explore and enjoy, it is always great to have the assurance of having the best auto insurance coverage to protect you and your family.

However, buying insurance is a complex process. Finding an auto insurance policy and trying to sort through the various carriers and coverage options can be a lot to handle.

Therefore, we created this complete guide to auto insurance in Gilbert to help you with all your insurance options. The guide will help you understand all the essential factors that go into an auto insurance buying process, including coverage types, rates, factors impacting premium, and much more.

We hope that with this guide, you will be able to purchase the right coverage for your needs and leave with a wealth of knowledge.

The Cost of Auto Insurance in Gilbert, Arizona

The first step to reducing your auto insurance premium is understanding the key factors that influence it.

The comparison of auto insurance rates in Gilbert, Arizona, with other major US metro areas is provided below for your reference.

In this section, we will look at the factors that companies consider while calculating your insurance rates, such as driving history, marital status, credit score, and more. Discover more by exploring our in-depth guide titled, “How Credit Scores Affect Auto Insurance Rates.”

Male vs. Female vs. Age

Your age is a crucial indicator of risk for an insurance company.

These states are no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. AZ does use gender, so check out the average monthly car insurance rates by age and gender in Gilbert, Arizona.

If you are a new teen driver, you will not have a driving history, and therefore the insurer will not have the direct assessment of driving style.

Gilbert, Arizona auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Therefore, insurance companies generally consider young drivers risky. According to actuarial studies, insurance companies have found that, on average, young drivers drive recklessly and may file for a claim in the first few years.

This is why the premium for a young driver is the highest.

As you grow, you not only gain experience but also have a driving record that can potentially lower your risk and, therefore, your premium.

As discussed, the insurance rate is highest for a teen, but it drops drastically as the driver gains experience. The average monthly premium for a teen is nearly four times higher than the average premium for a 35-year-old driver in Gilbert, Arizona.

Gilbert, Arizona Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Low incidence of severe weather impacting premiums |

| Traffic Density | B+ | Moderate traffic levels contribute to manageable premiums |

| Average Claim Size | B | Claims are moderate, with average payouts around $4,500 |

| Vehicle Theft Rate | B | Slightly elevated vehicle theft rate, but not extreme |

| Uninsured Drivers Rate | C+ | Higher-than-average percentage of uninsured drivers (14%) |

With a median age of 33.6, this means that insurance rates for a majority of Gilbertonians tend towards the citywide average minimum. However, remember these are average rates and may not apply in your case.

Arizona is among the majority of states that allow insurance companies to consider your gender while calculating insurance rates.

The average auto insurance rate in Gilbert, Arizona for males is $4,123, and for females, it is $3,892. We have observed the same trend where the average overall rates may be slightly higher for males. Currently, seven states in the country do not allow insurance companies to consider gender while calculating auto insurance rates.

Another minor factor that can impact your auto insurance rates is your marital status.

The average premium for married drivers is lower than that of unmarried drivers. However, gender does still play a role. For further details, see our guide titled, “Auto Insurance for Men vs. Women.”

Here’s the table of insurance rates organized by age and gender:

Cheapest ZIP Codes in Gilbert, Arizona

Your insurer considers where you live an important factor in determining your rate.

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Gilbert, Arizona auto insurance rates by ZIP Code below:

The ZIP code you provide in your insurance application allows insurers to assess specific risks associated with your policy.

Insurance companies consider various factors, including the monthly number of reported accidents in your neighborhood, the frequency of claims, the cost of living, car theft rates, and overall crime rates. As a result, your location within Gilbert does not affect your auto insurance premium.

Finding the Best auto insurance Company in Gilbert, Arizona

Determining the best auto insurance company can be challenging, as it depends on individual needs and preferences. Various factors, such as rates, coverage options, and personal priorities, play a role in deciding which company is the right fit.

In Gilbert, Arizona, comparing the rates of local providers with state averages is essential to finding the most suitable option. Below, we provide an overview to help guide your decision-making process.

Insurance companies may use different methods of calculating insurance rates. Each company may weigh various factors differently and, therefore, may be able to offer you bespoke auto insurance rates.

You should shop around to check for the best insurance quotes.

In this section, we will talk about how different insurance companies weigh various factors.

Cheapest auto insurance Rates by Company

Drivers in Gilbert have many auto insurance companies to choose from for their insurance coverage. Almost all the major insurers are licensed in the city. The competitive environment provides drivers an opportunity to get some discounts.

Depending on your driving history and the overall risk profile, insurance companies can offer you varying rates to slightly different types of coverage, because each insurance company has a complicated method to calculate your premium.

Here’s a table that shows average insurance rates, organized by companies and broken down by age and marital status.

Average Insurance Rates by Company, Age, and Marital Status

| Group | Single 17-Year Old Female | Single 17-Year Old Male | Single 25-Year Old Female | Single 25-Year Old Male | Married 35-Year Old Female | Married 35-Year Old Male | Married 60-Year Old Female | Married 60-Year Old Male | Average |

|---|---|---|---|---|---|---|---|---|---|

| $407 | $428 | $128 | $126 | $141 | $157 | $120 | $153 | $208 | |

| $541 | $618 | $188 | $201 | $143 | $143 | $134 | $135 | $263 | |

| $524 | $663 | $186 | $195 | $176 | $185 | $164 | $175 | $283 | |

| $524 | $670 | $243 | $263 | $210 | $214 | $188 | $199 | $314 |

| $746 | $829 | $192 | $189 | $180 | $156 | $162 | $153 | $326 | |

| $666 | $871 | $250 | $293 | $250 | $250 | $230 | $230 | $380 | |

| $994 | $1,031 | $258 | $266 | $229 | $228 | $203 | $217 | $428 | |

| $826 | $1,039 | $283 | $358 | $263 | $263 | $234 | $234 | $438 | |

| $699 | $902 | $360 | $391 | $322 | $322 | $314 | $314 | $453 |

The average insurance rates vary significantly among different companies based on age and marital status. The table illustrates how younger, single drivers tend to face higher premiums, with rates peaking for single 17-year-olds.

In contrast, married individuals, particularly those aged 60, generally benefit from lower rates across most companies. Geico emerges as the most affordable option for many demographics, while other providers like Farmers and State Farm present higher average costs.

This data highlights the importance of considering various factors when selecting an insurance provider to find the best rates for specific circumstances.

Therefore, it is always advisable to shop around to get the cheapest rate.

You may notice another important aspect from the table above — teens can expect to see a drastic drop in insurance rates as they grow up and gain experience. On average, a 17-year-old male driver can expect to see a 67 percent drop in insurance rate when they grow 25 years old.

But they have to make sure to maintain a clean driving record.

Nevertheless, it is not advisable to base your insurance decision solely on the price. You should review and understand if the coverage is relevant and useful for you.

In the following section, we will talk about the variety of factors that you might need to consider while deciding on your coverage.

Best auto insurance for Commute Rates

The rates mentioned throughout this guide represent average figures. However, if you have a longer than average commute, the impact on your premium will vary by insurance provider. Some insurers consider extended commutes as an additional risk and may raise your premium, while others may not adjust the rate for a moderate increase in annual mileage.

With a full coverage rate of $125, State Farm delivers top-tier protection for Gilbert, Arizona drivers.Michelle Robbins Licensed Insurance Agent

According to the Federal Highway Administration, an average driver in Arizona drives around 12,829 miles per year, which is less than the national average of 14,312 miles.

We partnered with Quadrant Data Solutions to understand the impact of commute on your insurance rate. The table below shows the average insurance rate organized by the insurer and broken down by annual mileage:

Gilbert Auto Insurance Rates: Higher Costs but Lower Income Proportion

| Group | 10 Miles Commute. 6000 Mileage. | 25 miles commute. 12000 mileage. | Average |

|---|---|---|---|

| $204 | $211 | $208 | |

| $260 | $266 | $263 | |

| $283 | $283 | $283 | |

| $314 | $314 | $314 |

| $326 | $326 | $326 | |

| $377 | $384 | $380 | |

| $428 | $428 | $428 | |

| $426 | $449 | $438 | |

| $453 | $453 | $453 |

State Farm, USAA, and Geico tend to increase their insurance rates by a small amount for the additional commute. The rest of the major insurers do not tend to increase the premium within a reasonable mileage limit.

However, remember these are average monthly rates. You can check with your insurer to know their exact policy about any additional commute.

Best Auto Insurance for Coverage Level Rates

You should purchase adequate coverage to secure yourself and your family. However, often, that means buying additional liability coverage along with supplementing your policy with add-ons.

Your coverage level will play a major role in your Gilbert auto insurance rates. Find the cheapest Gilbert, Arizona auto insurance rates by coverage level below:

However, any additional policy or coverage you buy is most likely going to increase your premium amount, because each time you purchase additional coverage or supplemental policy, you are asking the insurer to take on a higher amount of risk on behalf of you.

As we can see from the table, some insurance companies may increase your auto insurance rates by $700-$1,000 while some only increase it by $200.

The low coverage is usually the minimum liability coverage that you must buy to drive your car legally in Arizona. The minimum liability coverage required in Gilbert, Arizona, is:

- Bodily Injury Liability — $15,000 for one person / $30,000 per accident

- Property Damage Liability — $10,000 per accident

Purchasing any additional liability or supplemental coverage will elevate your policy to either a medium or high coverage level. Some of the optional coverages available include collision, comprehensive, MedPay, uninsured/underinsured motorist coverage, and personal injury protection.

However, understanding the different types of coverage and only buying relevant types is a great way to optimize coverage and price.

Best auto insurance for Credit History Rates

Auto insurance companies use your credit score to determine your premium because it helps them assess the risk associated with your policy. In Gilbert, Arizona, your credit score can significantly impact your auto insurance rates.

However, in states like California, Hawaii, and Massachusetts, insurers are prohibited from using credit scores to influence insurance rates. To find the most affordable auto insurance rates in Gilbert based on your credit score, consult the rates provided below.

A high credit score might mean lower risk for a auto insurance company.

As a benchmark, the average credit score in the US is 675, while that of Arizona is 669. You might attract a higher premium if your credit score is lower than average.

There can be several factors that might adversely impact your credit score. Several companies might not penalize you for having a low credit score.

Best auto insurance for Driving Record Rates

One of the most important factors impacting your auto insurance rate is your driving record. Regardless of how high your credit score is or what gender you are, if you have a bad driving record, you provide a direct risk to the insurance companies.

Your driving record will play a major role in your Gilbert auto insurance rates. For example, other factors aside, a Gilbert, Arizona DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Gilbert, Arizona auto insurance rates by driving record.

Any insurance company will charge higher premiums to compensate for the high risk. Therefore, to save on auto insurance premiums, you should aim to have a clean driving record.

nsurance companies can access your driving record through a tool called a motor vehicle report (MVR). The MVR provides a summary that includes details such as traffic tickets, convictions, accidents, and even minor infractions like parking tickets.

Your driving can get tarnished if you are caught speeding, charged with a DUI offense, or cause an accident. Bad driving record can potentially shoot your insurance rates high.

However, the rate of increase may differ between insurers.

If you have a speeding violation on your record, Geico may be the only insurer to not increase the insurance rate. On the other hand, Allstate might increase your rate by as much as $1,300.

For comprehensive coverage in Gilbert, Arizona, State Farm's $125 rate provides reliable and affordable options.Justin Wright Licensed Insurance Agent

If you consider the DUI charge, Progressive might be the most lenient company, whereas American Family might penalize you the most.

These violations indicate risky behavior on your part, and therefore companies increase their premium amounts to safeguard against a potential loss.

We strongly suggest that you keep a clean driving record for not only having the best chance of an economical auto insurance rate but also to keep yourself safe on the road.

Our free comparison tool provides a convenient way of seeking quotes. To start comparison shopping today, you just need your zip code below to get started!

Auto Insurance Factors in Gilbert, Arizona

Auto insurance is not only based on individual-specific factors but also on factors pertaining to the city of Gilbert.

Factors affecting auto insurance rates in Gilbert, Arizona may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Gilbert, Arizona auto insurance.

In this section, we will review how Gilbert can uniquely influence your auto insurance rate.

Metro Report — Growth & Prosperity

Gilbert has been growing rapidly over the last few decades. The population of the suburb of Phoenix has grown from 5,717 in 1980 to an estimated 250,000 in 2018.

The most prominent industries in Gilbert are healthcare, education, and finance. Being a suburb of Phoenix, Gilbert is impacted by the economic activity in the Phoenix Metropolitan Area.

According to the Brookings Institution, the Phoenix metro area ranked 57th in growth and 90th in prosperity between 2007-2017.

- Prosperity (90th)

- Productivity: -0.2 percent (87th of 100)

- Standard of living: -10.3 percent (95th of 100)

- Average annual wage: +3.1 percent (78th of 100)

- Growth (57th)

- Jobs: +6 percent (51st of 100)

- Gross metropolitan product (GMP): +5.7 percent (76th of 100)

- Jobs at young firms: -13.6 percent (46th of 100)

The standard of living in the Phoenix metro area has declined during the last decade. Although this includes other cities in the Phoenix metro area; however, it certainly means that Gilbert has also been negatively impacted.

In the adverse scenario, it certainly is advisable to maintain reliable insurance coverage to protect your investment and assets.

Median Household Income

According to DataUSA, the median household income in Gilbert is $87,566, which is much higher than the national median household income of $60,336.

The household income is also expected to rise, given the rise in job availability and accompanying wages.

Gilbert Auto Insurance Rates: Higher Costs but Lower Income Proportion

| City vs State | MEDIAN INCOME LEVEL | AVERAGE CAR INSURANCE PREMIUM | PREMIUM AS A PERCENTAGE OF INCOME |

|---|---|---|---|

| Gilbert | $7,297 | $340 | 4.7% |

| Arizona | $4,459 | $315 | 7.1% |

Although the auto insurance rates in Gilbert are higher than the average rates in Arizona. However, given the high median household income, the residents of Gilbert pay a smaller proportion of their income toward maintaining their auto insurance coverage.

Homeownership in Gilbert, Arizona

While being a homeowner does not directly impact your auto insurance rates or the ability to qualify for a plan, it may help you get some discounts.

According to DataUSA, the median property value in Gilbert is $286,400, which is considerably higher than the national median property value of $193,500.

Despite the price, 72 percent of the housing units in Gilbert were occupied by their owners. This is also considerably higher than the national occupancy rate of 63.9 percent.

Education in Gilbert, Arizona

Your education is an important factor while determining your insurance rates. Insurance companies consider higher education as an indicator of lower risk.

Education in Gilbert is mainly focused on healthcare with the top three courses being:

- Phlebotomy Technician (154 degrees awarded)

- Veterinary Technician & Veterinary Assistant (99 degrees awarded)

- Nursing Assistant & Patient Care Assistant (95 degrees awarded)

The only large educational institution in the city of Gilbert is the Pima Medical Institute-East Valley, which awarded 537 degrees in 2016.

Wage by Race & Ethnicity in Common Jobs

Asians, Whites, and Alaskan Natives are the highest-paid ethnicities in Gilbert.

Here’s the table summarizing the average monthly wage organized by ethnicity:

Summary of Average Monthly Wages by Ethnicity

| Race & Ethnicity | Average Salaries |

|---|---|

| Asian | $413 |

| White | $339 |

| Alaskan Native | $284 |

In Gilbert, the highest-paid ethnic groups are Asians, Whites, and Alaskan Natives. Asians top the list with an average monthly wage of $413, followed by Whites at $339, and Alaskan Natives earning $284. This highlights a notable wage disparity among different ethnicities in the area.

Wage by Gender in Common Jobs

The percentage of your income spent on auto insurance also varies by gender due to wage disparities in Gilbert. On average, males in Gilbert earn around $5,052 per month, while females earn approximately $3,847 per month.

As a result, females must allocate a higher portion of their monthly income to afford the same auto insurance coverage as males.

Poverty by Age & Gender

Only 5.9 percent of residents in Gilbert live below the poverty line. This is remarkably less than the national poverty rate of 13.4 percent.

Unsurprisingly, the top three demographics living below the poverty line are all females.

Poverty Demographics In Gilbert

| Demographics | Poverty share |

|---|---|

| Females 25-34 | 10.7% |

| Females 35-44 | 8.5% |

| Females 18-24 | 6.6% |

The top three demographics makes about a quarter of the people living below the poverty line.

Auto insurance rates are considerably tougher to maintain for people living below the poverty line. Not only auto insurance takes a larger share of their income, but also the insurance rates are considerably higher for people living below the poverty line.

Poverty by Race & Ethnicity

Whites constitute the largest share (68.3 percent) of people living below the poverty line. This is understandable given the fact more than 80 percent of the residents belong to the white ethnicity.

Employment by Occupations

In 2017, there were 114,000 people employed in Gilbert across various occupations. The top three occupations in the city are management occupations (8.4 percent), computer specialists (4.1 percent), and registered nurses (3.1 percent).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Driving in Gilbert, Arizona

We discussed how your driving record is an important factor in determining your auto insurance rate. For more information, check out our complete guide titled, “Driving Without Auto Insurance.”

However, your driving record is dependent on your knowledge of road rules and conditions. In this section, we will discuss the road condition in Gilbert, along with other factors such as speed traps and vehicle thefts.

Roads in Gilbert, Arizona

We may always prefer one route over the other, probably due to road conditions, traffic, or scenery. Hopefully, you have a drive that you prefer. If not, in this section, we will discuss roads in the city and the respective conditions.

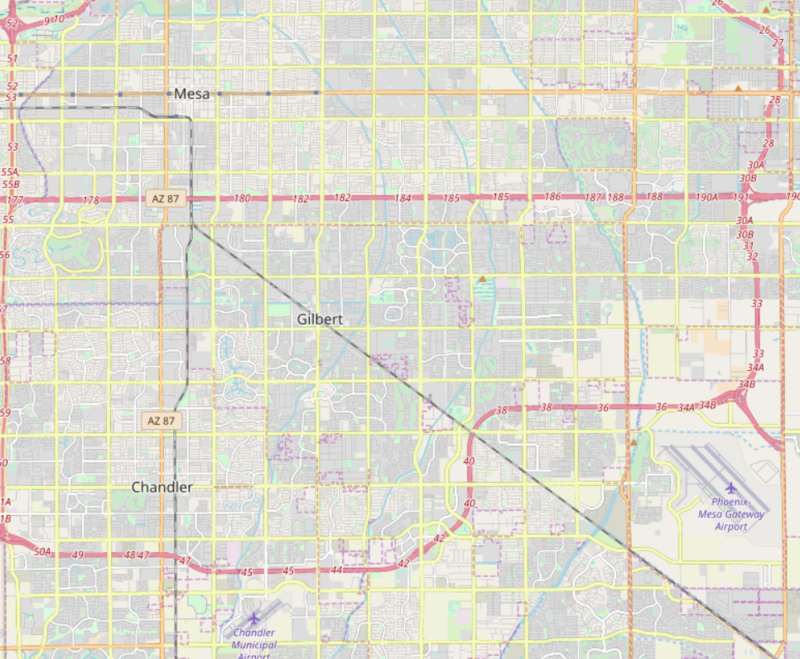

Major Highways in Gilbert, Arizona

The fifth-largest city in the Phoenix Metropolitan Area is connected through state highways and major arterial roads. The city is well connected with other cities in the Phoenix Metropolitan Area.

Here’s the road map of Gilbert:

Gilbert is connected via Arizona State Highway 87, Superstition Freeway, and Santan Freeway.

Popular Road Trips/Sites

Gilbert is among the most prosperous cities in the United States, offering a wealth of attractions for both residents and visitors.

Notable highlights include the Hale Centre Theatre, the Gilbert Historical Museum, the scenic Water Ranch, Freestone Park, and the Rotary Centennial Observatory, providing a variety of cultural, recreational, and educational experiences.

Road Conditions in Gilbert, Arizona

The roads in Gilbert are generally in good condition. But you can always check the AZ 511 app for real-time traffic and road closure updates in Gilbert.

If you are moving to Gilbert, you can watch this video to get a feel of the road conditions and traffic in your new city:

Use of Speeding and Red Light Cameras in Gilbert

Arizona uses red light and speeding cameras in its major cities to deter motorists from breaking laws. However, Gilbert does not have red light or speeding cameras.

You need to be careful, though, as all the other cities in the Phoenix Metropolitan Area (Phoenix, Mesa, Chandler, Scottsdale, and Tempe) have red light and speeding cameras installed.

Vehicles in Gilbert, Arizona

Residents in Gilbert prefer to drive their cars for the daily commute. Probably due to inadequate public transportation network or good roads, people in Gilbert love their cars.

In this section, we will see how the car you drive can impact your auto insurance rate.

Most Popular Vehicles Owned

While we could not find the most preferred car for Gilbert specifically, according to YourMechanic.com, Nissan’s 350Z is the most popular car in the Phoenix area.

Nissan 350Z is a two-door, two-seater sports car manufactured between 2002-2009.

Watch this video to learn what made Nissan’s 350Z a success:

The 350Z was a safe car to drive. Even though the National Highway Traffic Safety Administration did not give an overall rating for the car, they rated the front crash safety as four.

However, the 350Z was not a very fuel-efficient car. The efficiency figure for the car was 20 mpg, with it giving around 25 mpg on the highway and 18 mpg in the city.

The government estimated that your average fuel cost per month would be around $208.

How Many Cars Per Household

Given how important a car is for transportation in Gilbert, most of the households own two cars. Some households own three cars. We see that two cars per household are fairly standard across the country.

Households Without a Car

It is staggering that only 1.7 percent of households in Gilbert does not own a car. This is significantly lower than the national average of approximately 4 percent.

Not owning a car doesn’t mean that you can not buy auto insurance coverage. If you drive occasionally, you can choose to buy a non-owners policy that provides cheap coverage for your occasional drive.

Speed Traps in Gilbert

We saw earlier that insurers would increase insurance rates if you are caught speeding. This can come as a rude shock to you, but this will be over and above the fines that you may have to pay to the law enforcement.

It is always advisable to drive within the posted speed limits. It helps keep everyone on the road safe.

To deter motorists from over-speeding, law enforcement in Gilbert has several speed traps in the city.

Vehicle Theft in Gilbert

According to the Federal Bureau of Investigation, law enforcement in Gilbert reported 152 vehicle thefts in 2018. Despite this, Gilbert remains a relatively safe city. Neighborhoodscout.com notes that Gilbert is safer than 47 percent of cities in the U.S. In comparison to Arizona’s overall crime statistics, Gilbert stands out as much safer.

In Arizona, the likelihood of becoming a victim of violent crime is one in 197, whereas in Gilbert, the odds are significantly lower at one in 1,171. Some of the safest neighborhoods in Gilbert include areas around S Higley Rd, E Queen Creek Rd, S Recker Rd, and S Val Vista Dr, among others.

Traffic in Gilbert

While we like our cars, but nobody wants to get stuck in traffic. It reduces overall productivity and increases vehicular pollution.

In this section, we will look at various factors related to traffic in Gilbert.

Traffic Congestion

The good thing about living in Gilbert is there is little congestion compared to the other cities in the Phoenix Metropolitan Area.

You can stay ahead of traffic by using the AZ 511 app or website like localconditions.com.

Transportation

Though Gilbert does have lower congestion, being a suburb, many residents need to commute to Phoenix daily.

According to DataUSA, commuters in Gilbert spend around 25.6 minutes on their daily commute. This is nearly equal to the average amount of time spent by daily commuters in the country (25.1 minutes). However, because of the long commute to Phoenix, around 18 percent of the residents have a daily commute over 45 minutes.

Due to the lack of public transportation options, more than 80 percent of commuters prefer to drive alone for their daily commute, and around 8 percent opt for carpooling.

Safety of Gilbert Streets and Roads

To understand the relative safety of the roads in Gilbert, we can refer to the data provided by the National Highway Traffic Safety Administration. However, the data from NHTSA is at the county level.

Gilbert is part of the Maricopa County that is seated in Phoenix. The county is fourth-most populous in the country. Apart from Gilbert, other towns in the county include Phoenix, Mesa, Chandler, Scottsdale, etc.

Maricopa County is the largest county in Arizona and is the worst in terms of traffic fatalities. In the table below, you can see the traffic fatalities in the top 10 counties of Arizona.

Traffic Fatalities in Arizona: Top 10 Counties with the Highest Rates

| Arizona Counties by 2018 Ranking | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Maricopa County | 367 | 405 | 478 | 462 | 490 |

| Pima County | 88 | 93 | 111 | 114 | 125 |

| Pinal County | 45 | 55 | 62 | 71 | 71 |

| Navajo County | 39 | 43 | 31 | 52 | 56 |

| Coconino County | 45 | 58 | 50 | 47 | 47 |

| Yavapai County | 42 | 47 | 41 | 55 | 44 |

| Mohave County | 29 | 49 | 53 | 43 | 43 |

| Yuma County | 33 | 16 | 18 | 26 | 31 |

| Gila County | 17 | 31 | 19 | 26 | 24 |

| Apache County | 26 | 49 | 35 | 47 | 23 |

| Top Ten Counties | 731 | 849 | 906 | 943 | 954 |

| All Other Counties | 42 | 46 | 45 | 55 | 55 |

| All Counties | 773 | 895 | 951 | 998 | 1,009 |

The number of traffic-related fatalities has constantly been increasing in Maricopa County and there were registered 490 deaths in traffic-related incidents in 2018.

According to the National Highway Traffic Safety Administration, these are the main causes of traffic-related fatalities in Maricopa County:

Main Causes of Traffic Fatalities in Maricopa County

| Fatalities | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Fatalities (All Crashes) | 367 | 405 | 478 | 462 | 490 |

| Fatalities in Crashes Involving an Alcohol-Impaired Driver | 77 | 115 | 131 | 121 | 139 |

| Single Vehicle Crash Fatalities | 206 | 200 | 258 | 239 | 289 |

| Fatalities in Crashes Involving a Large Truck by County for 2017 | 28 | 21 | 30 | 38 | 33 |

| Fatalities in Crashes Involving Speeding | 111 | 132 | 148 | 138 | 131 |

| Fatalities in Crashes Involving an Intersection | 141 | 163 | 180 | 172 | 168 |

| Passenger Car Occupant Fatalities | 103 | 126 | 121 | 120 | 140 |

| Pedestrian Fatalities | 91 | 97 | 131 | 138 | 160 |

| Pedalcyclist Fatalities | 18 | 14 | 22 | 22 | 10 |

Single-vehicle crashes followed by intersection-related accidents are the biggest reasons for traffic-related fatalities in Maricopa County.

We also refer to another database of the National Highway Traffic Safety Administration to find out which roads are less safe to drive in Maricopa County:

Fatalities by road types in Maricopa County - Gilbert

| Roads | Fatalities |

|---|---|

| Rural Interstate | 8 |

| Urban Interstate | 39 |

| Freeway/Expressway | 42 |

| Other Principal Arterial | 195 |

| Minor Arterial | 94 |

| Collector Arterial | 26 |

| Local | 39 |

| Unknown | 0 |

| Total | 443 |

It seems that Other Principal Arterial Roads are the most fatal kind of roads in Maricopa County. If you want to understand how NHTSA classifies different types of roads, you can read the definition on their website.

Allstate America’s Best Drivers Report

Allstate comes out with a periodic study on driving behavior across 200 major cities in the country. It helps us figure out the relative driving experience in different cities of our vast country.

Driving Behavior in Gilbert

| City | Gilbert |

|---|---|

| 2018 Best Drivers Report Ranking | 21st |

| Average Years Between Claims | 10.3 |

In terms of driving behavior, Gilbert ranks 21st among 200 cities in the U.S. The good driving behavior results in an average of 10.3 years between claims filed by drivers.

Gilbert, Arizona Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 3,900 |

| Total Claims Per Year | 3,200 |

| Average Claim Size | $5,200 |

| Percentage of Uninsured Drivers | 10% |

| Vehicle Theft Rate | 620 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | Low |

Ridesharing

With no public transportation available, ridesharing serves as an excellent alternative in Gilbert, helping to reduce traffic congestion and improve air quality. Available ridesharing options in the area include Blacklane, Lyft, traditional taxis, and Uber.

E-star Repair Shops

When accidents occur, finding a reliable repair shop becomes a priority. Ensuring quick and efficient repairs can reduce stress and get drivers back on the road safely.

Driving Behavior in Gilbert

| City | Gilbert |

|---|---|

| 2018 Best Drivers Report Ranking | 21st |

| Average Years Between Claims | 10.3 |

Esurance addresses this need with its E-star network, offering access to reputable repair shops nearby, including two locations in Gilbert. With Gilbert ranked 21st in the 2018 Best Drivers Report and an average of 10.3 years between claims, the city’s driving behavior further supports a strong local network of trusted repair services.

Weather in Gilbert, Arizona

Gilbert has a desert-type climate with hot and dry summers and mild to warm winters.

In the table below, you can see the quick snapshot of the weather in Gilbert:

| Weather Facts | Details |

|---|---|

| Average Annual High Temperature | 107°F |

| Average Annual Low Temperature | 40°F |

| Average Temperature | 73.5°F |

| Average Annual Rainfall | 9 inches |

| Sunshine days | 296 |

Gilbert gets only an average of nine inches of rainfall every year, whereas the national average is 38 inches.

The Gilbert area is prone to high earthquake activity. It is 405 percent greater than the U.S. average earthquake activity. However, the city has also faced other natural disasters such as floods (10), storms (nine), and fires (three).

Public Transit in Gilbert, Arizona

Gilbert does not have an adequate public transportation system. Valley Metro provides bus connectivity to and from Gilbert. However, there are only seven bus routes plying in Gilbert.

Residents can also use a ride-matching system called ShareTheRide. It is a free service that helps commuters to quickly and securely find a carpool, vanpool, and more.

Cost of Alternate Transportation in Gilbert, Arizona

The Gilbert Town Council introduced a Micromobility Pilot Program in March 2019. The program specifies guidelines for companies providing alternate transportation options such as e-scooters or dockless scooters.

Companies such as Lime, Bird, and JUMP (from Uber) have already started operating in the city and nearby areas. Under the pilot program, these companies need to pay a one-time registration fee of $2,500, and after that, $0.10 per ride to the city council.

In case you are interested in riding these e-scooters remember the following safety tips:

Parking in Gilbert, Arizona

Gilbert has plenty of parking — even in the downtown heritage district. There are several empty parking lots that you can use around the city. The city does not use parking meters and follows a shared parking model.

The city also has a 364-space parking structure on the corner of Vaughn Avenue and Ash Street. Gilbert City Council is also developing another parking garage downtown for $14 million.

Air Quality in Gilbert, Arizona

Considering Gilbert is part of Maricopa County, the air quality in the city is about average. We know the cars contribute to air pollution, and with so many residents using cars for daily transportation, local air pollution can increase.

According to the Environmental Pollution Agency (EPA), here’s the summary of air quality in Gilbert:

Air quality in Gilbert

| Year | Good | Moderate | Unhealthy For Sensitive Groups | Unhealthy | Very Unhealthy |

|---|---|---|---|---|---|

| 2018 | 54 | 247 | 57 | 4 | 3 |

Gilbert had good quality air for only 54 days in 2018, whereas the air quality was unhealthy for 64 days.

Military/Veterans

While there are no military bases in Gilbert, the nearby Luke Air Force Base in Phoenix plays a key role in training F-16 pilots for the U.S. Air Force. Gilbert is home to a significant population of veterans who served in the Vietnam and Gulf Wars.

Several insurance companies offer discounts for military personnel, including USAA, Allstate, Esurance, Farmers Insurance, Geico, Liberty Mutual, MetLife, and State Farm.

Here are the average insurance rates in Arizona:

Military Discounts and Insurance Rates for Gilbert, Arizona Residents

| Provider | Monthly Premium | Higher/Lower (%) |

|---|---|---|

| $409 | $30 | |

| $291 | -$7 |

| $189 | -$40 | |

| $257 | -$18 | |

| $396 | $26 | |

| $298 | -$5 | |

| $257 | -$18 | |

| $417 | $33 |

USAA is generally the most cost-effective insurer for military personnel; however, in Arizona, you can also seek quotes from Geico for maximum discount.

However, these are average rates for Arizona, and the average rates and discounts for Gilbert might differ. To discover more about the company, visit our guide titled, “Best Auto Insurance for Disabled Veterans.”

Unique City Laws

Every state has some unique laws in our country. Arizona has a “Stupid Motorist Law” that states if any driver bypasses barricades and gets stuck in a flood, they will be charged for the cost of their rescue. Gain insights from our guide titled, “Auto Insurance Laws.”

Handheld Device Laws

Arizona was one of the few states that allowed cellphone usage while driving. However, in April 2019, the state banned the use of handheld devices while driving a car. You can not hold your devices to send messages, talk, browse the internet, or see maps.

You can use maps and talk in hands-free mode if you are using a car-mounted cell phone. However, these laws are not enacted until 2021. Until 2021, police can only issue warnings for cellphone usage.

From January 1st, 2021, police can issue fines that will range between $75-$149 for the first offense and $150-$250 for a subsequent violation.

Food Trucks

Food trucks enjoy a surge in popularity across the nation. Gilbert also changed the laws in 2017 to allow food truck vendors to operate comfortably while ensuring they maintain basic safety standards.

You can review the essential requirements laid down by the Gilbert City Council in this brief reference guide for food truck vendors.

Tiny Homes

With rising housing costs and stagnant wages, people are increasingly warming up to the idea of tiny homes. Although Gilbert does not seem to have any specific guidelines for tiny homes, you can refer to the guidelines for Arizona to set-up your tiny home in Gilbert.

You can start your comparison shopping today using our free online tool. Enter your ZIP code below to get started!

Frequently Asked Questions

What is auto insurance and why do I need it in Gilbert, Arizona?

Auto insurance is a contract between you and an insurance company that provides financial protection in case of vehicle-related accidents, damages, or injuries. In Gilbert, Arizona, auto insurance is mandatory, as it helps cover costs associated with accidents and protects you from potential financial liabilities.

Access comprehensive insights into our guide titled, “Does car insurance cover hail damage?”

What types of auto insurance coverage are available in Gilbert, Arizona?

In Gilbert, Arizona, you can typically find the following types of auto insurance coverage:

- Liability Coverage: Covers injuries and property damage you cause to others.

- Collision Coverage: Covers damages to your vehicle caused by collisions.

- Comprehensive Coverage: Covers non-collision-related damages, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with an uninsured or underinsured driver.

How are auto insurance rates determined in Gilbert, Arizona?

Auto insurance rates in Gilbert, Arizona are determined by several factors, including:

- Your driving record and history of accidents or traffic violations.

- The type of vehicle you drive, its age, and its safety features.

- Your age, gender, and marital status.

- The coverage limits and deductibles you choose.

- Your credit history and score.

- The location where you live and park your vehicle.

- The annual mileage you drive.

Are there any specific auto insurance requirements in Gilbert, Arizona?

Yes, in Gilbert, Arizona, the minimum auto insurance requirements are as follows:

- $25,000 bodily injury liability coverage per person

- $50,000 bodily injury liability coverage per accident

- $15,000 property damage liability coverage per accident

Are there any additional coverages I should consider in Gilbert, Arizona?

While the minimum requirements provide basic coverage, you may want to consider additional coverages to enhance your protection. Some recommended options in Gilbert, Arizona include:

- Higher liability limits to protect your assets in case of a severe accident.

- Comprehensive and collision coverage to protect your vehicle.

- Uninsured/underinsured motorist coverage to protect against uninsured drivers.

- Rental car reimbursement coverage to provide a substitute vehicle while yours is being repaired.

Learn more by reading our guide titled, “Best Uninsured and Underinsured Motorist.”

How can young drivers in Gilbert, Arizona, get affordable insurance?

While young drivers may see lower insurance rates as they gain experience, there are ways to reduce premiums immediately. They can join the policy of an older, more experienced driver, opt for a budget-friendly first car, ensure the vehicle has safety features that qualify for discounts, and maintain a clean driving record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.