Best Beaverton, Oregon Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

State Farm, Geico, and USAA have the best Beaverton, Oregon auto insurance for residents. Minimum rates for Beaverton, OR auto insurance start at $71/mo. The minimum auto insurance in Beaverton, Oregon is at least 25/50/20 in coverage to comply with Oregon auto insurance laws.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Beaverton Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Beaverton Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Beaverton Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsState Farm, Geico, and USAA have the best Beaverton, Oregon auto insurance for drivers.

Beaverton residents will also find great auto insurance policies in Beaverton, Oregon, at the auto insurance companies listed below.

Our Top 10 Company Picks: Best Beaverton, Oregon Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Coverage | State Farm | |

| #2 | 25% | A++ | Online Convenience | Geico | |

| #3 | 10% | A++ | Military Families | USAA | |

| #4 | 10% | A | Personalized Service | Farmers | |

| #5 | 29% | A | Family Protection | American Family | |

| #6 | 13% | A++ | Flexible Coverage | Travelers | |

| #7 | 12% | A+ | Customizable Plan | Progressive | |

| #8 | 10% | A+ | Extensive Coverage | Allstate | |

| #9 | 20% | A+ | Multi-Policy Discount | Nationwide |

| #10 | 10% | A | Discounts Variety | Liberty Mutual |

Finding great auto insurance in Beaverton can seem like a difficult task, but all of the information you need about the best auto insurance companies is right here.

Before you buy Beaverton, Oregon car insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Beaverton, Oregon auto insurance quotes.

- State Farm has the best auto insurance in Beaverton, Oregon

- Beaverton, Oregon auto insurance requirements are 25/50/20

- Allstate is the most expensive company in Beaverton for teen drivers

#1 – State Farm: Top Pick Overall

Pros

- Reliable Coverage: As the largest auto insurance company in the U.S., State Farm provides reliable coverage to Beaverton, Oregon residents.

- Local Assistance: Beaverton, Oregon residents will be able to visit local State Farm agents for help with State Farm insurance in Beaverton.

- Multiple Discounts: Beaverton residents can apply for several discounts at State Farm, such as a good driver discount. Visit our State Farm review for a full list of discount options.

Cons

- Financial Rating: State Farm has the lowest A.M. Best rating out of the top Beaverton, Oregon insurance companies.

- Limited Online Functions: State Farm’s local agents in Beaverton handle most policy changes.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Online Convenience

Pros

- Online Convenience: In Beaverton, Oregon, customers can use the company’s app or website for claims and policy changes.

- Discount Options: Geico offers good driver discounts and more to Beaverton drivers. Read our Geico review for a full list.

- Customer Satisfaction: Beaverton residents should be happy with the service, based on mostly positive reviews.

Cons

- Higher Rates: While Geico is usually a cheaper company, it has some of the more expensive rates on average for Beaverton drivers.

- Fewer Speciality Coverages: Beaverton, Oregon residents may not be able to purchase all their add-ons from Geico.

#3 – USAA: Best for Military Families

Pros

- Military Families: Military families in Beaverton, Oregon, should consider USAA as one of their top choices, as USAA specializes in military insurance.

- Affordable Rates: USAA rates are some of the cheapest on the market for Beaverton, Oregon residents.

- Discount Options: Beaverton, Oregon drivers can save with several discounts like good student discounts. Visit our USAA review for more information.

Cons

- No Local Agents: USAA customers in Beaverton, Oregon, will contact customer service remotely.

- Fewer Specialty Coverages: Beaverton, Oregon customers won’t have access to as many add-ons from USAA.

#4 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Beaverton, Oregon customers should have access to a local Farmers agent.

- Coverage Options: Farmers has a full list of specialty options available to Beaverton, Oregon customers, such as new car replacement. Visit our Farmers review to find out more.

- Discount Options: Farmers also has multiple discounts for Beaverton residents, such as paperless discounts.

Cons

- Customer Reviews: Beaverton, Oregon residents may find service subpar, as Farmers has average reviews.

- Discounts Vary by State: Some discounts may not be available in Beaverton, Oregon.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Family Protection

Pros

- Family Protection: American Family has great insurance options to protect the whole family in Beaverton, Oregon. Find out more in our American Family review.

- Loyalty Discount: Customers in Beaverton, Oregon who stick with American Family will earn a loyalty discount.

- Costco Members: Costco sells American Family insurance to Beaverton, Oregon, residents and offers special deals on coverage.

Cons

- Claims Satisfaction Ratings: Beaverton, Oregon, customers may run into issues with slower processing.

- Policy Management: Customers may find it harder to manage Beaverton, Oregon policies online.

#6 – Travelers: Best for Flexible Coverage

Pros

- Flexible Coverage: Beaverton, Oregon, customers will find policy customizations to be flexible at Travelers. Find out more by reading our Travelers review.

- IntelliDrive Program: Beaverton residents can join IntelliDrive in Oregon for a good driver discount.

- Financial Stability: Travelers’ financial stability allows it to maintain consistent rates for Beaverton, Oregon residents.

Cons

- IntelliDrive Rate Increases: Oregon residents could have higher rates if they have riskier driving habits.

- Local Agent Availability: Beaverton, Oregon, residents may have trouble finding a local agent in their area.

#7 – Progressive: Best for Customizable Plan

Pros

- Customizable Plan: Progressive has easily customizable plans available for Beaverton, Oregon drivers. Visit our Progressive review to find out more.

- Snapshot Program: Beaverton residents can join Snapshot for a good driver discount on their auto insurance.

- Budgeting Tool: Beaverton, Oregon customers can take advantage of the company’s budgeting tools to calculate their auto insurance costs.

Cons

- Customer Satisfaction: Beaverton, Oregon residents may find services subpar.

- Local Agent Availability: Beaverton customers may not be able to locate a local agent and will need to contact customer service virtually.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Extensive Coverage

Pros

- Extensive Coverage: Allstate has extensive options for Beaverton, Oregon customers, which we cover in our Allstate review.

- Discount Options: Allstate offers opportunities for Beaverton customers to save, such as a paperless discount or payment-in-full discount.

- Local Agents: Beaverton, Oregon, customers have a few different local agents available to them.

Cons

- Higher Rates: Allstate has some of the most expensive rates on average for Beaverton, Oregon drivers.

- Customer Complaints: Beaverton customers may find issues with Allstate’s services, as the company has a higher record of complaints filed.

#9 – Nationwide: Best for Multi-Policy Discount

Pros

- Multi-Policy Discount: Beaverton, Oregon residents can purchase different policies from Nationwide.

- Coverage Options: Nationwide has specialty coverage options available to Beaverton customers. Find out more about coverage options in our Nationwide review.

- Vanishing Deductible: Safe drivers will see their deductibles lowered on their Beaverton policies.

Cons

- Higher Rates: Nationwide is one of the more expensive choices for car insurance in Beaverton, OR.

- Customer Service: Beaverton residents may not be completely satisfied with services, as ratings for customer service are average.

#10 – Liberty Mutual: Best for Discounts Variety

Pros

- Discounts Variety: In Beaverton, Oregon, customers can save with paperless discounts, multi-car discounts, and more.

- Coverage Variety: Liberty Mutual offers specialty add-ons to Beaverton residents, which we cover in our Liberty Mutual review.

- Accident Forgiveness: Safe drivers in Beaverton, Oregon, can enroll in the company’s accident forgiveness program.

Cons

- Customer Satisfaction: Beaverton residents may not be completely satisfied with services.

- Local Agent Availability: Customers may have trouble finding local agents in Beaverton, Oregon, and will have to get virtual support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Rates in Beaverton, Oregon at the Best Companies

Beaverton, Oregon, auto insurance laws require that you have at least the Oregon minimum auto insurance to be financially responsible in the event of an accident. Take a look at the required auto insurance in Beaverton, Oregon.

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $20,000 per accident

Full coverage costs more, but it provides better financial protection to Beaverton drivers. How much does the coverage level you select affect the cost of your auto insurance in Beaverton, Oregon? Below, check out the comparison of annual Beaverton, Oregon auto insurance rates by coverage level at the best companies in Beaverton.

Beaverton, Oregon Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $91 | $140 |

| American Family | $90 | $117 |

| Farmers | $95 | $120 |

| Geico | $98 | $141 |

| Liberty Mutual | $94 | $132 |

| Nationwide | $99 | $133 |

| Progressive | $94 | $126 |

| State Farm | $71 | $119 |

| Travelers | $97 | $115 |

| USAA | $85 | $98 |

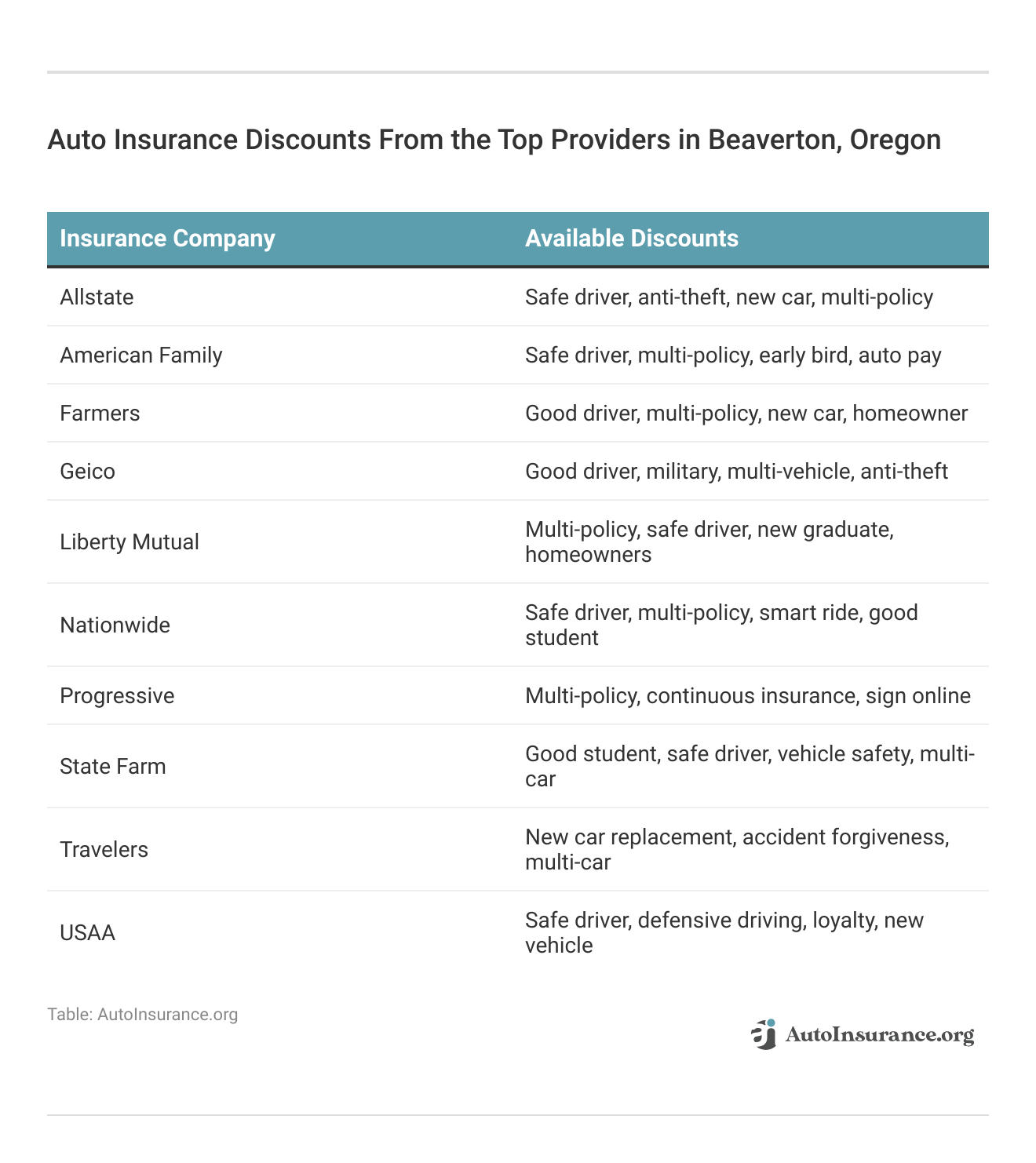

Choosing a cheaper company will make Beaverton full coverage auto insurance more affordable. Drivers can also take advantage of discounts at the best companies to lower their auto insurance rates. Some popular auto insurance discounts to look for are listed below.

Being a safe driver will pay off with lower rates at the best auto insurance companies in Beaverton, Oregon. Drivers can also save with multi-policy discounts, anti-theft discounts, and more.

Beaverton, Oregon Auto Insurance Rates by Age and Gender

Auto insurance rates in Beaverton, Oregon are affected by age and gender. See how demographics impact the cost of insurance.

Beaverton, Oregon Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $892 | $991 | $296 | $295 | $286 | $265 | $263 | $266 |

| American Family | $560 | $882 | $224 | $234 | $224 | $224 | $200 | $200 |

| Farmers | $905 | $929 | $236 | $242 | $211 | $207 | $186 | $198 |

| Geico | $564 | $511 | $228 | $194 | $215 | $208 | $203 | $207 |

| Liberty Mutual | $864 | $933 | $251 | $253 | $262 | $277 | $227 | $253 |

| Nationwide | $520 | $648 | $259 | $272 | $221 | $218 | $196 | $205 |

| Progressive | $789 | $868 | $212 | $200 | $178 | $161 | $155 | $160 |

| State Farm | $543 | $682 | $189 | $216 | $166 | $166 | $154 | $154 |

| Travelers | $558 | $690 | $197 | $201 | $189 | $191 | $173 | $180 |

| USAA | $442 | $472 | $183 | $189 | $142 | $138 | $142 | $136 |

Rates between genders vary, with men sometimes paying more for auto insurance on average (Read More: Male vs. Female Auto Insurance Rates). Age will also impact how much drivers pay, with younger drivers having the highest rates.

Retired drivers often have the cheapest rates in Beaverton, as they usually drive fewer miles and avoid rush hour traffic.Dani Best Licensed Insurance Producer

Read on to learn more about auto insurance by driver age in Beaverton, Oregon, as well as what drivers can do to save on insurance.

Cheap Beaverton, Oregon Auto Insurance for Teen Drivers

Finding cheap teen auto insurance in Beaverton, Oregon is a challenge. Take a look at the monthly teen auto insurance rates in Beaverton, Oregon below.

Beaverton, Oregon Teen Auto Insurance Monthly Rates

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $892 | $991 |

| American Family | $560 | $882 |

| Farmers | $905 | $929 |

| Geico | $564 | $511 |

| Liberty Mutual | $864 | $933 |

| Nationwide | $520 | $648 |

| Progressive | $789 | $868 |

| State Farm | $543 | $682 |

| Travelers | $558 | $690 |

| USAA | $442 | $472 |

Teens have the most expensive auto insurance quotes in Beaverton, Oregon. However, rates are highest for teens buying their own policies. Teens will have lower rates than the ones above if they join an existing policy, such as their parent’s insurance.

Teens can also lower their Beaverton, Oregon, auto insurance rates at most companies by applying for good student discounts and participating in defensive driving classes.

Cheap Beaverton, Oregon Auto Insurance for Seniors

What are senior auto insurance rates in Beaverton, Oregon? Take a look at the average rates for older drivers in Beaverton below.

Beaverton, Oregon Senior Auto Insurance Monthly Rates

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $263 | $266 |

| American Family | $200 | $200 |

| Farmers | $186 | $198 |

| Geico | $203 | $207 |

| Liberty Mutual | $227 | $253 |

| Nationwide | $196 | $205 |

| Progressive | $155 | $160 |

| State Farm | $154 | $154 |

| Travelers | $173 | $180 |

| USAA | $142 | $136 |

Cheap Beaverton, Oregon Auto Insurance By Driving Record

Your driving record has a big impact on your auto insurance rates. Below are the auto insurance rates for a bad record in Beaverton, Oregon, compared to the rates for a clean record.

Beaverton, Oregon Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $355 | $484 | $502 | $437 |

| American Family | $239 | $364 | $464 | $307 |

| Farmers | $328 | $424 | $414 | $391 |

| Geico | $190 | $307 | $407 | $262 |

| Liberty Mutual | $368 | $412 | $472 | $409 |

| Nationwide | $269 | $288 | $409 | $304 |

| Progressive | $256 | $471 | $330 | $305 |

| State Farm | $251 | $330 | $277 | $277 |

| Travelers | $240 | $308 | $348 | $293 |

| USAA | $167 | $234 | $327 | $195 |

Cheap Beaverton, Oregon Auto Insurance Rates After a DUI

Finding cheap auto insurance after a DUI in Beaverton, Oregon is not easy. Compare the rates for DUI auto insurance in Beaverton, Oregon to find the best deal.

Beaverton, Oregon Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $502 |

| American Family | $464 |

| Farmers | $414 |

| Geico | $407 |

| Liberty Mutual | $472 |

| Nationwide | $409 |

| Progressive | $330 |

| State Farm | $277 |

| Travelers | $348 |

| USAA | $327 |

If you have a DUI, make sure to shop around at different companies, as comparing quotes will help you find cheap auto insurance after a DUI.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Beaverton, Oregon Auto Insurance By Credit, ZIP, and Commute

Credit history can have a major effect on the cost of auto insurance. See how Beaverton, Oregon auto insurance rates by credit history compare in the table below.

Beaverton, Oregon Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $584 | $410 | $338 |

| American Family | $436 | $323 | $272 |

| Farmers | $447 | $369 | $350 |

| Geico | $351 | $291 | $231 |

| Liberty Mutual | $608 | $360 | $278 |

| Nationwide | $384 | $305 | $264 |

| Progressive | $381 | $331 | $309 |

| State Farm | $397 | $253 | $202 |

| Travelers | $369 | $292 | $230 |

| USAA | $345 | $193 | $154 |

Beaverton, Oregon Auto Insurance Rates By ZIP Code

Auto insurance rates by ZIP code in Beaverton, Oregon can vary. Compare the cost of auto insurance by ZIP code in Beaverton, Oregon to see how car insurance rates are affected by location.

Beaverton, Oregon Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 97003 | $306 |

| 97005 | $318 |

| 97006 | $311 |

| 97007 | $318 |

| 97008 | $318 |

| 97078 | $329 |

Your Beaverton location affects auto insurance rates due to area factors like theft, weather, accident statistics, and more.

Beaverton, Oregon Auto Insurance Rates By Commute

Commute length and annual mileage affect Beaverton, Oregon auto insurance. Find the cheapest Beaverton, Oregon auto insurance by commute length.

Beaverton, Oregon Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $444 | $889 |

| American Family | $338 | $676 |

| Farmers | $389 | $778 |

| Geico | $286 | $573 |

| Liberty Mutual | $415 | $830 |

| Nationwide | $317 | $635 |

| Progressive | $340 | $681 |

| State Farm | $276 | $553 |

| Travelers | $285 | $571 |

| USAA | $224 | $448 |

Longer commutes mean more time spent on the road, which contributes to a higher risk of being in an accident and filing a claim.

Best By Category: Auto Insurance in Beaverton, Oregon

Compare the cheapest auto insurance companies in Beaverton, Oregon in each category to find the company with the best rates for your personal needs.

Beaverton, Oregon Best Auto Insurance Providers by Category

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| 1 Accident | USAA |

| 1 DUI | State Farm |

| 1 Speeding Violation | USAA |

USAA and State Farm are usually the best options in Beaverton, Oregon. However, other car insurance companies in Beaverton, OR will also offer good auto insurance. We recommend getting quotes from a few companies to find the best deal on Beaverton insurance (Read More: Cheapest Auto Insurance Companies).

Factors That Affect Auto Insurance Rates in Beaverton, Oregon

There are a lot of reasons why auto insurance rates in Beaverton, Oregon are higher or lower than in other cities. These include traffic and the number of vehicle thefts in Beaverton, Oregon.

- Auto Theft: More theft means higher auto insurance rates because auto insurance companies are paying more in claims. According to the FBI’s annual Beaverton, Oregon auto theft statistics, there have been 261 auto thefts in the city.

- Commute Time: Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Beaverton, Oregon commute length is 25.2 minutes according to City-Data.

Other local factors that may affect your Beaverton auto insurance rates include the weather, accident statistics, and wildlife (Learn More: Factors That Affect Auto Insurance Rates).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Beaverton, Oregon Auto Insurance Quotes

State Farm, Geico, and USAA have the best Oregon auto insurance for drivers. The best companies offer great coverage options for Beaverton drivers, as well as auto insurance discounts and bundling options.

Before you buy Beaverton, Oregon auto insurance, make sure you have compared Beaverton car insurance rates from multiple companies (Read More: How to Compare Auto Insurance Quotes). Enter your ZIP code below to get free Beaverton, Oregon auto insurance quotes.

Frequently Asked Questions

What is auto insurance?

Auto insurance is a type of insurance policy that provides financial protection against damages or losses resulting from an automobile accident. It typically includes coverage for property damage, bodily injury, medical expenses, and liability.

Is auto insurance mandatory in Beaverton, OR?

Yes, auto insurance is mandatory in Beaverton, Oregon, as it is in most states. The minimum requirements for auto insurance in Oregon include liability coverage for bodily injury and property damage.

What is the minimum auto insurance coverage required in Beaverton, OR?

In Beaverton, Oregon, the minimum auto insurance coverage required is as follows:

- $25,000 per person for bodily injury liability

- $50,000 per accident for bodily injury liability

- $20,000 per accident for property damage liability

Most Oregon drivers should carry more than minimum liability insurance so that their vehicles are protected in an accident.

Can I drive without insurance in Beaverton, OR?

No, it is illegal to drive without insurance in Beaverton, Oregon. If you are caught driving without insurance, you may face penalties such as fines, license suspension, and vehicle impoundment.

What factors affect auto insurance rates in Beaverton, OR?

Several factors can affect auto insurance rates in Beaverton, Oregon, including:

- Age and gender

- Driving record and history

- Type of vehicle

- Location (ZIP code) and annual mileage

- Credit history

If you have higher auto insurance rates, use our free quote tool to find the best car insurance quotes in Beaverton, OR.

Can I get discounts on auto insurance in Beaverton, OR?

Yes, there are various discounts available on auto insurance in Beaverton, Oregon. Common discounts include:

- Multi-vehicle discount

- Good driver discount

- Safety features discount

- Anti-theft devices discount

- Bundling (multiple policies) discount

The more discounts drivers qualify for, the cheaper their rates will be. Most are very easy to qualify for, such as a bundling discount (Learn More: How to Save Money by Bundling Insurance Policies).

How can I find the best auto insurance in Beaverton, OR?

To find the best auto insurance in Beaverton, Oregon, consider the following steps:

- Research and compare multiple insurance providers.

- Obtain quotes from different companies.

- Review coverage options, deductibles, and limits.

- Check for discounts and additional benefits.

- Read customer reviews and ratings.

Then, make an informed decision based on your specific needs and budget.

What is uninsured/underinsured motorist coverage, and is it necessary in Beaverton, OR?

Uninsured/underinsured motorist coverage is an optional type of auto insurance that protects you if you are involved in an accident with a driver who has insufficient or no insurance coverage. Although it is not legally required in Beaverton, Oregon, it is highly recommended to consider this coverage as it provides added protection in case of accidents involving uninsured or underinsured drivers.

What should I do after a car accident in Beaverton, OR?

After a car accident in Beaverton, Oregon, take the following steps:

- Ensure your safety and the safety of others involved before calling the police to report the accident.

- Exchange information with the other party involved (names, contact details, insurance information).

- Document the accident scene by taking photos and gathering witness information.

- Notify your insurance company about the accident and cooperate with the insurance claims process.

- Consult with a legal professional if you have any concerns or questions.

For more information on claim filing, read our guide on how to file an auto insurance claim.

Did car insurance go up in Oregon?

Yes, Oregon car insurance rates have increased, as has the cost of auto insurance nationwide.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.