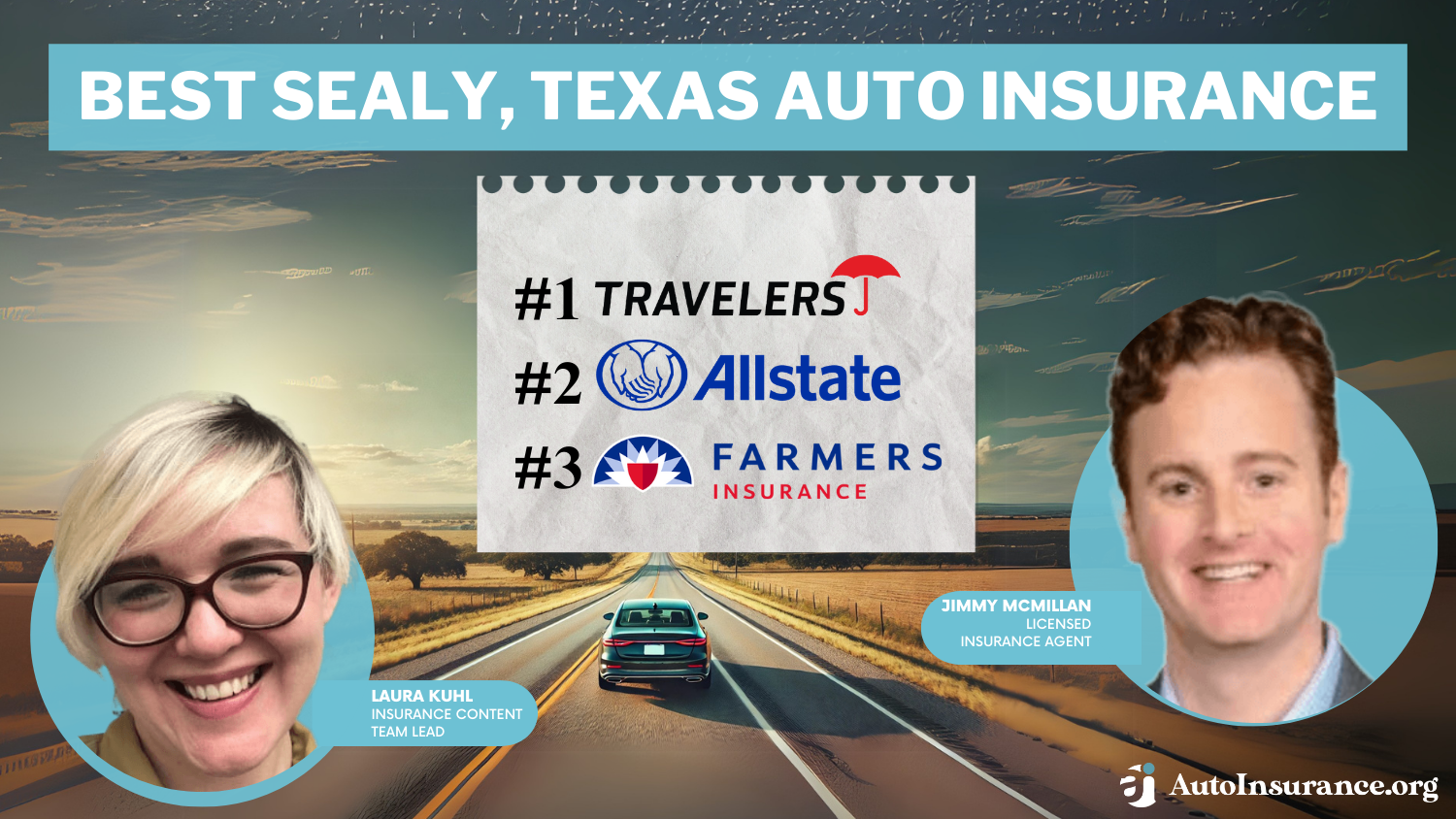

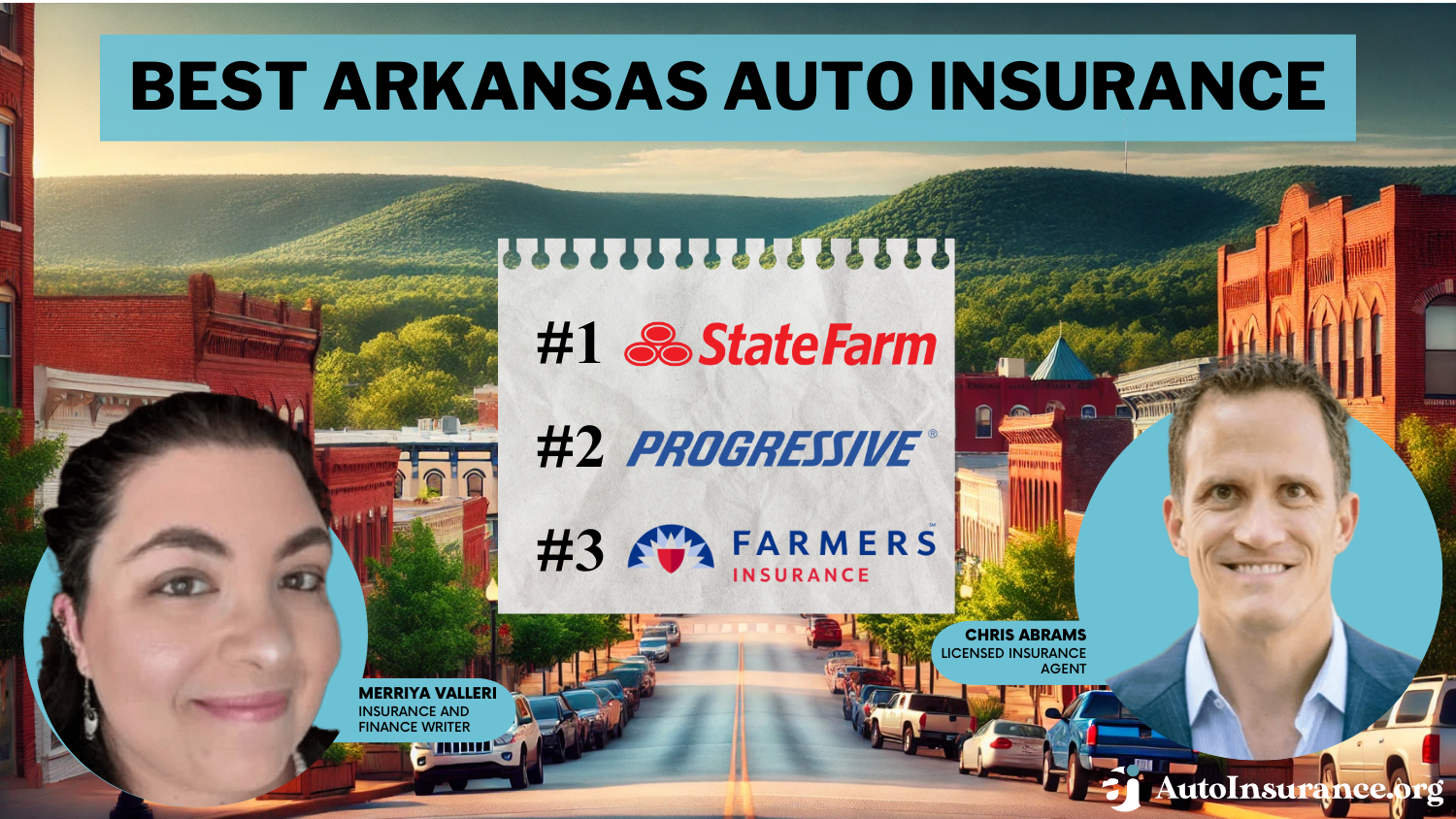

Best Arkansas Auto Insurance in 2026 (Compare the Top 10 Companies)

State Farm, Progressive, and Farmers offer the best Arkansas auto insurance with rates as low as $19/month. State Farm is the top pick, Progressive excels in online convenience, and Farmers is known for local agent support. Compare these options to find the best Arkansas auto insurance for your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe top pick overall for the best Arkansas auto insurance are State Farm, Progressive, and Farmers, with rates starting at just $19/month. State Farm stands out for its affordability and reliability, while Progressive excels in online convenience, and Farmers is known for its excellent local agent support.

Comparing these top providers helps you find the most suitable and cost-effective coverage for your needs. Whether you prioritize low rates, easy online access, or personalized service, these companies offer the best Arkansas auto insurance options.

Our Top 10 Company Picks: Best Arkansas Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | B | Many Discounts | State Farm | |

| #2 | 15% | A+ | Online Convenience | Progressive | |

| #3 | 18% | A | Local Agents | Farmers | |

| #4 | 18% | A+ | Add-on Coverages | Allstate | |

| #5 | 13% | A++ | Military Savings | USAA | |

| #6 | 18% | A | Student Savings | American Family | |

| #7 | 18% | A | Customizable Polices | Liberty Mutual |

| #8 | 18% | A++ | Accident Forgiveness | Travelers | |

| #9 | 18% | A+ | Usage Discount | Nationwide |

| #10 | 18% | A++ | Cheap Rates | Geico |

Factors affecting auto insurance rates include driving history, credit score, and ZIP code. Companies consider all this when determining how much you’ll pay for a policy.

Stop overpaying for auto insurance. Enter your ZIP code above to find out if you can get a better deal.

- Arkansas Auto Insurance

- Best West Memphis, Arkansas Auto Insurance in 2026

- Best Rogers, Arkansas Auto Insurance in 2026

- Best Perryville, Arkansas Auto Insurance in 2026

- Best Jonesboro, Arkansas Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Hot Springs, Arkansas Auto Insurance in 2026 (Top 10 Companies Ranked)

- Best Fort Smith, Arkansas Auto Insurance in 2026

- Best Fayetteville, Arkansas Auto Insurance in 2026 (Check Out the Top 10 Companies)

- Best Conway, Arkansas Auto Insurance in 2026 (Cash Savings With These 10 Companies)

- Best Batesville, Arkansas Auto Insurance in 2026 (Top 10 Providers Ranked)

- State Farm is the top pick for reliable, cost-effective insurance

- Compare Progressive and Farmers to find the best fit for your needs

- Best Arkansas auto insurance rates start at $19/month for affordable coverage

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm auto insurance review highlights that the company provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Online Convenience

Pros

- User-Friendly Website: Progressive auto insurance review offers an easy-to-navigate website for online quotes and policy management.

- Snapshot Program: The Snapshot program allows drivers to save based on their actual driving habits.

- Mobile App: Progressive’s mobile app provides a convenient way to manage your insurance on the go.

Cons

- Customer Service: Progressive’s customer service is often seen as less personal compared to local agents.

- High Rates for Some Drivers: Progressive can be more expensive for drivers with a less-than-perfect record.

#3 – Farmers: Best for Local Agents

Pros

- Personalized Service: In examining Farmers auto insurance review, it has local agents who provide personalized service and advice.

- Customizable Policies: Farmers offers a wide range of customizable policy options.

- Strong Discounts: Farmers provides various discounts, including multi-policy and safe driver discounts.

Cons

- Higher Premiums: Farmers’ premiums can be higher compared to some online-only providers.

- Limited Availability: Farmers might not be available in all areas, limiting access to their local agents.

#4 – Allstate: Best for Add-on Coverages

Pros

- Extensive Add-ons: In an Allstate auto insurance review, it offers a wide range of add-on coverages, including roadside assistance and rental reimbursement.

- Rewards Program: Allstate’s Drivewise program rewards safe driving with cashback.

- Good Hands Network: Access to a vast network of agents and repair shops.

Cons

- High Premiums: Allstate’s premiums are generally higher than many competitors.

- Complex Discounts: Some customers find Allstate’s discount structure complicated and hard to maximize.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA auto insurance review provides significant discounts for military members and their families.

- Top-Rated Customer Service: USAA is renowned for its high-quality customer service.

- Financial Strength: USAA has a strong financial rating, ensuring stability and reliability.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members, veterans, and their families.

- Limited Local Agents: USAA relies more on online and phone service, with fewer local agents available.

#6 – American Family: Best for Student Savings

Pros

- Generous Student Discounts: American Family auto insurance review offers substantial discounts for students and young drivers.

- Family-Oriented: Policies can be tailored to meet the needs of families.

- Local Agents: Access to local agents for personalized service.

Cons

- High Premiums for Older Drivers: Premiums can be higher for older, more experienced drivers.

- Availability: American Family might not be available in all states.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Flexible Coverage Options: Based on Liberty Mutual auto insurance review, the company offers highly customizable policy options.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness prevents rate hikes after your first accident.

- New Car Replacement: They offer new car replacement if your car is totaled.

Cons

- Higher Rates: Liberty Mutual’s rates can be higher than some other insurers.

- Mixed Customer Reviews: Customer satisfaction ratings are varied.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers’ accident forgiveness can help maintain your rates after an accident.

- Comprehensive Coverage Options: Travelers auto insurance review provide a broad range of coverage options.

- Financial Strength: Strong financial rating ensures stability.

Cons

- Complex Discounts: The discount structure can be confusing for some customers.

- Higher Premiums: Some policies come with higher premiums compared to competitors.

#9 – Nationwide: Best for Usage Discount

Pros

- SmartRide Program: Nationwide auto insurance review showcases a discounts for safe driving habits through their SmartRide program.

- Vanishing Deductible: Deductible decreases for every year of safe driving.

- Strong Customer Service: Known for reliable customer service and support.

Cons

- Higher Base Rates: Initial rates can be higher before discounts are applied.

- Limited Local Presence: Fewer local agents compared to some competitors.

#10 – Geico: Best for Cheap Rates

Pros

- Low Rates: Geico auto insurance review consistently offers some of the lowest rates in the industry.

- User-Friendly App: Geico’s mobile app makes managing policies and claims easy.

- Wide Availability: Geico’s services are available nationwide.

Cons

- Minimal Personal Interaction: Less emphasis on personal agent interaction.

- Service Variability: Customer service experiences can vary widely.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Minimum Coverage Auto Insurance in Arkansas

You must purchase a car insurance policy if you live and drive in Arkansas. However, you can save a lot of money if you purchase a minimum coverage policy that only includes liability auto insurance. With a minimum coverage policy, you’ll pay around $577 annually or $48 per month for coverage.

Arkansas Minimum Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| AAA | $32 |

| Allstate | $46 |

| American Family | $36 |

| Farmers | $44 |

| Geico | $26 |

| The Hartford | $43 |

| Liberty Mutual | $56 |

| Nationwide | $37 |

| Progressive | $33 |

| State Farm | $22 |

| Travelers | $32 |

| U.S. Average | $45 |

Geico is the cheapest auto insurance company in Arkansas for a minimum coverage policy. With Geico, policyholders pay around $388 per year or $32 monthly for liability coverage. State Farm is next with an annual premium of $397 or $33 a month.

Arkansas Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $56 | $162 |

| American Family | $47 | $137 |

| Farmers | $57 | $165 |

| Geico | $31 | $91 |

| Liberty Mutual | $34 | $99 |

| Nationwide | $44 | $128 |

| Progressive | $45 | $131 |

| State Farm | $28 | $80 |

| Travelers | $38 | $111 |

| USAA | $19 | $55 |

Farmers charges a bit more, with an annual premium of around $610, equating to around $51. The average cost for a minimum coverage car insurance policy with Nationwide is $677 annually or $56 each month and Progressive charges around $770 per year or $64 per month.

The most expensive minimum coverage rates come from Allstate. The annual cost of a liability-only policy with Allstate is around $783, which equates to roughly $65 per month. Rates with Allstate are more than double those with Geico, proving why it’s important to find and compare rates from several companies.

When You Should Get a Minimum Coverage Policy

While minimum coverage auto insurance can help you save on your monthly or annual premiums, a liability-only policy doesn’t offer as much protection as other, more robust options.

With a minimum coverage policy, you’re only covered if you’re in an at-fault accident and cause injuries or damage to other people or their vehicles. However, you and your vehicle may not have coverage in the accident, meaning you may have to pay out of pocket for your medical bills and car repairs.

To avoid paying hundreds or even thousands of dollars after a wreck, you can purchase additional car insurance coverage offering more protection when you get behind the wheel.

A full coverage policy offers protection when you’re at fault in an accident and helps pay for vehicle repairs if it gets damaged while parked. Though full coverage often costs much more than a liability policy, you may find the added protection is worth the cost.

Get Cheap Full Coverage Auto Insurance in Arkansas

A full coverage policy in Arkansas costs more than a minimum coverage policy with virtually any company. The average cost of a full coverage auto insurance policy in the state is around $1,853 annually or $154 per month.

Arkansas Full Coverage Auto Insurance Monthly Rates and Provider Availability

| Insurance Company | Availability | Rates | vs. U.S. Average |

|---|---|---|---|

| AAA | 34 states | $120 | Higher |

| Allstate | 50 states and Washington, D.C. | $162 | Higher |

| American Family | 19 states | $137 | Higher |

| Farmers | 50 states and Washington, D.C. | $165 | Higher |

| Geico | 50 states and Washington, D.C. | $91 | Lower |

| Liberty Mutual | 50 states and Washington, D.C. | $99 | Lower |

| Nationwide | 46 states and Washington, D.C. | $128 | Higher |

| Progressive | 50 states and Washington, D.C. | $131 | Higher |

| State Farm | 50 states and Washington, D.C. | $80 | Lower |

| The Hartford | 41 states and Washington, D.C. | $130 | Higher |

| Travelers | 42 states and Washington, D.C. | $111 | Lower |

| USAA | 50 states and Washington, D.C. | $55 | Lower |

The cheapest option for full coverage in Arkansas comes from State Farm. With State Farm, expect to pay around $1,412 annually or $118 monthly for car insurance. Farmers is the next cheapest option, charging $1,568 annually or $131 per month.

Geico comes next, offering full coverage auto insurance at around $1,622 annually or $135 per month. Nationwide charges $1,676 annually or $140 per month on average. You’ll pay roughly $2,244 annually or $187 per month for a full coverage policy with Progressive.

Allstate is the most expensive option for full coverage. With Allstate, you’ll pay around $3,415 annually or $285 each month for a full coverage policy. This price is nearly $170 more per month than a policy with State Farm. Compare State Farm vs. Allstate auto insurance to decide which company is best for you.

When You Should Get Full Coverage

A full coverage auto insurance policy includes liability insurance, collision, and comprehensive coverage. Collision coverage pays for repairs to your vehicle if you get in a car accident. So if you’re at fault in an accident, collision still helps pay for necessary car repairs, offering peace of mind.

Comprehensive auto insurance helps pay for repairs when your vehicle gets damaged outside of an accident, like inclement weather, animals, vandalism, or theft. Full coverage is a great way to ensure you’re covered no matter what happens. While a full coverage policy costs more than other options, it’s a great investment if you have the money and want the added protection.

You may be required to purchase full coverage if you have a vehicle loan or lease. However, even if you don’t require a full coverage policy, it’s worth shopping online and comparing quotes to see your options and how much a full coverage policy might cost.

Get Cheap Auto Insurance in Arkansas With Bad Credit

Believe it or not, your credit score can significantly impact your auto insurance rates. If you have a good credit score, you may notice lower-than-average rates. However, if your credit score is poor, you may pay more for car insurance in Arkansas. Always check to see how auto insurance and your credit score interact.

Studies show a correlation between poor credit scores and an increase in car insurance claims. As a result, many car insurance companies charge higher rates to people with bad credit to mitigate the risk. Ratings for credit scores can vary, but many companies consider anything 700 or higher a good score. So if you’re under 700 — especially if your score is lower than 670 — you can expect many insurers to increase your rates.

Some states have banned using a person’s credit score to determine how much they’ll pay for auto insurance coverage, but companies can still use credit scores as a factor in Arkansas. The average cost for auto insurance in Arkansas, if you have bad credit, is around $165 each month. However, you may find cheaper coverage with specific companies in the state.

Arkansas Full Coverage Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| AAA | $450 | $350 | $300 |

| Allstate | $539 | $413 | $335 |

| American Family | $475 | $390 | $350 |

| Farmers | $404 | $338 | $322 |

| Geico | $348 | $286 | $237 |

| Liberty Mutual | $482 | $291 | $228 |

| Nationwide | $381 | $306 | $279 |

| Progressive | $502 | $428 | $398 |

| State Farm | $337 | $203 | $158 |

| The Hartford | $460 | $350 | $300 |

| Travelers | $571 | $477 | $445 |

| U.S. Average | $450 | $348 | $305 |

Geico offers the cheapest full coverage policy in Arkansas if you have poor credit. A full coverage policy with Geico costs $190 per month. Farmers offers the next cheapest option, charging $197 per month for a full coverage policy with bad credit.

While car insurance rates may be more expensive for people with bad credit, you could get cheaper rates by pursuing different car insurance discounts. For example, some companies allow policyholders to save up to 25% on their coverage with specific discounts.

Additionally, you’ll enjoy more affordable coverage as your credit improves. Shop and compare quotes at least once yearly to ensure you’re not overpaying for your Arkansas auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Cheap Insurance in Arkansas With an At-Fault Accident on Your Record

Your driving record is one of the most important factors to car insurance companies. You may get cheap coverage rates if you have a clean driving record with no infractions, but if your driving record has blemishes, it’s safe to assume you’ll pay more.

An at-fault accident on your driving record can raise your rates by nearly $1,000 each year. Fortunately, you should be able to find an affordable auto insurance policy with certain insurance companies in Arkansas. Bad driving record auto insurance is available for those who don’t have a clean record.

Arkansas Full Coverage Auto Insurance Monthly Rates With Clean Record vs. One Accident by Provider

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| AAA | $200 | $170 |

| Allstate | $272 | $93 |

| American Family | $133 | $207 |

| Farmers | $175 | $236 |

| Geico | $65 | $192 |

| Liberty Mutual | $217 | $160 |

| Nationwide | $136 | $191 |

| Progressive | $113 | $240 |

| State Farm | $89 | $93 |

| The Hartford | $190 | $180 |

| Travelers | $135 | $117 |

| U.S. Average | $73 | $171 |

State Farm offers the most affordable rates for coverage if you have an at-fault accident on your record. With State Farm, you’ll pay around $1,755 annually or $146 per month for coverage. Farmers is the next cheapest option, at around $2,166 annually or $181 per month for coverage with an accident on your record.

Geico charges around $2,593 per year or $216 monthly for coverage, and Nationwide rates are around $2,681 annually or $223 per month. With Allstate, you’ll pay $4,072 annually or $339 per month for car insurance with an at-fault accident on your record.

Progressive’s rates are the most expensive. With Progressive, you’ll pay around $4,124 per year or $344 each month for car insurance. Progressive’s rates are almost $200 more expensive per month than State Farm’s. Our Progressive auto insurance review gives more information.

Though an at-fault accident can impact your car insurance rates while it’s on your record, it falls off your driving record in three to five years. Once it does, you could get cheaper car insurance rates.

It’s important to compare quotes from different car insurance companies at least once a year to avoid paying too much for coverage. You may also be able to save money by taking a safe driving or defensive driver course through your insurance company.

Affordable Auto Insurance in Arkansas for Young Drivers

Car insurance companies charge more for teens and young adult drivers because they pose more risk to the company. Young drivers are more likely to get in an accident and file a claim, so many companies charge teen drivers up to four times more than a 30-year-old with a clean driving record. Learn how to find cheap rates for teens buying auto insurance.

Arkansas Full Coverage Auto Insurance Monthly Rates for 18-Year-Olds by Gender & Provider

| Insurance Company | Male | Female |

|---|---|---|

| Allstate | $629 | $525 |

| Farmers | $751 | $713 |

| Geico | $285 | $291 |

| State Farm | $263 | $209 |

| Progressive | $955 | $841 |

| Nationwide | $439 | $335 |

| Liberty Mutual | $329 | $298 |

| Travelers | $1,159 | $726 |

Teens may save significantly on coverage by adding themselves to a parent or guardian’s policy. However, if this isn’t an option, keeping a clean driving record and comparing quotes from multiple companies is your best bet to save money on coverage.

Arkansas Auto Insurance Rates Differ Based on Where You Live

Your car insurance rates in Arkansas depend partly on your ZIP code because auto insurance companies check where you live to determine your risk level. As a result, certain areas have cheaper rates, and others are more expensive.

The cheapest city to purchase car insurance in Arkansas is Siloam Springs, and the most expensive auto insurance policies are in College Station.

Springdale rates are around $1,939 annually or $162 per month, while rates in Little Rock cost $2,325 annually or $194 per month on average.

You can speak with any auto insurance company you’re considering to see how important your location is in determining your rates. You’ll likely find that some companies use it as a significant factor while others don’t.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

DUI Laws in Arkansas

A DUI is a very serious offense in Arkansas. Auto insurance rates in Arkansas increase by nearly 60% following a DUI conviction, as you pose a higher risk to any insurance company.

You likely won’t find cheap car insurance in Arkansas with a DUI on your record, but you could find more affordable rates with certain insurers by researching and finding the best auto insurance for drivers with a DUI.

The Cost of Auto Insurance in Arkansas With a DUI

Your rates will significantly increase after a DUI or DWI conviction in Arkansas. Still, certain companies are more understanding of a DUI on your driving record than others. Your best bet is to compare rates from multiple companies to see which offers the most affordable coverage following a DUI conviction.

Arkansas Full Coverage Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | One Accident | One DUI | One Ticket | Clean Record |

|---|---|---|---|---|

| AAA | $170 | $245 | $180 | $200 |

| Allstate | $93 | $218 | $190 | $272 |

| American Family | $207 | $228 | $160 | $133 |

| Farmers | $236 | $230 | $206 | $175 |

| Geico | $192 | $289 | $100 | $65 |

| Liberty Mutual | $160 | $188 | $134 | $217 |

| Nationwide | $191 | $281 | $146 | $136 |

| Progressive | $240 | $151 | $181 | $113 |

| State Farm | $93 | $87 | $87 | $89 |

| The Hartford | $180 | $205 | $170 | $190 |

| Travelers | $117 | $178 | $137 | $135 |

| U.S. Average | $171 | $206 | $149 | $73 |

State Farm charges $1,999 annually or $167 each month for car insurance coverage, while Farmers rates are around $2,079 annually or $173 each month.

With Progressive, you’ll pay around $2,667 annually or $222 per month for car insurance following a DUI, and Geico charges $3,017 per year or $251 monthly. Allstate and Nationwide charge virtually the same amount for auto insurance following a DUI conviction, with premiums around $4,018 annually or $335 each month.

A DUI eventually falls off your driving record, but it could take a while. In the meantime, finding a company that works with you on coverage and price is a good idea. In addition, you should try to keep your driving record clean to prove to insurance companies that you’re responsible.

Arkansas Auto Insurance Cost by City

The table above table provides a comparison of auto insurance rates in various cities across Arkansas, allowing individuals to assess and compare insurance costs conveniently.

Auto Insurance Is Required in Arkansas

Car insurance is a requirement in Arkansas. The minimum auto insurance requirements by state can vary, but it’s illegal to not have basic auto insurance in Arkansas.

According to the Arkansas Insurance Department, you must have the following coverages:

- $25,000 in bodily injury liability per person

- $50,000 in bodily injury liability per accident

- $25,000 in property damage liability per person

However, the state’s minimum coverages are fairly limited, as they don’t offer personal protection.

Optional Coverage in Arkansas

If you’re considering additional car insurance coverage in Arkansas, the following options are among the most popular:

- Comprehensive Coverage: Comprehensive coverage pays for repairs to vehicles damaged by inclement weather, animals, vandalism, or other covered events unrelated to an automobile accident.

- Collision Coverage: Collision coverage pays for your vehicle repairs after a covered accident.

- Gap Insurance: Gap insurance pays the difference between your vehicle loan balance and your car’s actual cash value if it gets totaled.

- Personal Injury Protection (PIP): PIP coverage pays for medical bills like hospital stays and doctor visits. Personal injury protection (PIP) may also reimburse lost wages in certain scenarios.

- Rental Car Reimbursement: Rental car reimbursement pays you back if you have to rent a car while yours gets repaired after a covered event.

- Roadside Assistance: Roadside assistance helps if you get stranded in your vehicle. This coverage often includes towing services, fuel delivery services, lockout services, flat tire repair, and more.

- Uninsured/Underinsured Motorist Insurance: With Uninsured/underinsured motorist insurance, your insurance company pays for injuries or damages caused by another person if they don’t carry proper Arkansas coverage.

Depending on what you’re looking for, you may find that certain companies offer affordable coverage rates. However, it’s a good idea to shop online and compare quotes from multiple companies before making any final decisions on coverage.

How to Get Arkansas SR-22 Coverage

If you have certain infractions on your driving record, like a DUI, multiple accidents, or speeding tickets, you may need an SR-22. Coverage options are the same as normal coverage, but you’ll need an insurer to file an SR-22 to prove you have financial responsibility after an accident.

Many insurance companies offer SR-22 auto insurance options, and it may be simple to find SR-22 coverage with your current insurance company.

SR-22 for Insured Drivers

If you have insurance on your vehicle, you can request an SR-22 filing with your current company. You may have to pay a small fee for this service, but it could help you save time and money to stick with your current insurance company rather than find a new one.

SR-22 for Uninsured Drivers

Individuals without an existing auto insurance company may find it difficult to file an SR-22.

Some companies may refuse to cover you based on your driving record. The best way to find auto insurance coverage if you need an SR-22 is to shop and compare quotes from several insurance companies.

SR-22 for People Who Don’t Own a Vehicle

If you don’t own a car but need to file an SR-22, you may need to purchase a non-owner auto insurance policy.

Many insurance companies offer non-owner auto insurance coverage, though you may run into some unwillingness to cover you because of your driving record. Shop online and compare quotes from several companies to see your options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Arkansas Auto Insurance Providers

Choosing the best Arkansas auto insurance can be challenging. Here are three case studies that highlight how top providers—State Farm, Progressive, and Farmers—meet the unique needs of their clients. These examples illustrate why these companies are highly recommended.

- Case Study #1 – Affordability and Reliability: John, a 35-year-old resident of Little Rock, needed affordable and reliable auto insurance. After comparing several providers, he chose State Farm for its competitive rate of $19/month. State Farm’s excellent customer service and robust coverage options ensured John felt secure on the road without breaking the bank.

- Case Study #2 – Online Convenience: Emily, a tech-savvy 29-year-old from Fayetteville, preferred managing her insurance online. She found Progressive’s user-friendly platform and efficient online services perfect for her needs. Progressive offered her an easy-to-navigate website, quick quote comparisons, and comprehensive coverage at a reasonable rate.

- Case Study #3 – Local Agent Support: Mark and Susan, a retired couple in Jonesboro, valued personalized service and local support. Farmers provided them with dedicated local agents who offered customized insurance solutions. The personalized attention and tailored policies gave them peace of mind, knowing their insurance needs were always met.

These case studies demonstrate how State Farm, Progressive, and Farmers each provide exceptional service tailored to different needs.

State Farm is the best choice for affordable and reliable auto insurance in Arkansas.Justin Wright Licensed Insurance Agent

By choosing the right provider, you can find the best Arkansas auto insurance that fits your lifestyle and preferences.

Cheap Auto Insurance in Arkansas: The Bottom Line

You may be able to find cheap auto insurance in Arkansas, but it depends on several factors. For example, if you have a clean driving record, you’ll likely get affordable Arkansas car insurance coverage. However, auto insurance companies still consider many other factors when determining a person’s rates.

Before buying car insurance in Arkansas, shop online and compare quotes from multiple companies in your area — doing so could help you save hundreds of dollars on your auto insurance coverage. There are several options for car insurance in Arkansas. It’s a good idea to take your time when comparing quotes and rates to make the best decision possible for yourself and your family.

Once you find an insurer you like, compare quotes from multiple other Arkansas car insurance companies at least once annually to ensure you’re getting the best deal possible. Compare and save on auto insurance rates for custom vehicles by entering your ZIP code below now to find which car insurance company for custom vehicles is right for you.

Frequently Asked Questions

Which company offers the cheapest car insurance in Arkansas?

You need to compare quotes from several companies to find the cheapest rates, as it varies by individual profile. For a comprehensive analysis, refer to our detailed guide titled “How Insurance Providers Determine Rates.”

How much is car insurance in Arkansas?

It costs around $1,768 annually or $147 per month. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Do I need full coverage auto insurance in Arkansas?

No, only minimum coverage is required, but full coverage offers more protection.

Can I drive without car insurance in Arkansas?

No, you must have at least the state’s minimum coverage. Read more: Do you need auto insurance if you don’t drive your car?

What factors impact insurance rates in Arkansas?

Rates are affected by age, ZIP code, driving history, credit score, vehicle type, and coverage amount.

What happens if I get a DUI in Arkansas?

Your rates will increase, and some companies may refuse to insure you.

Can my insurance company cancel my policy?

Yes, they can cancel it for non-payment, false information, or a worsening driving record.

What should I do after a car accident in Arkansas?

Ensure safety, call law enforcement, exchange information, take photos, notify your insurer, and cooperate with the investigation. For a comprehensive overview, explore our detailed resource titled “Auto Insurance Policyholder Defined.”

How can I lower my car insurance rates in Arkansas?

Maintain a clean driving record, improve your credit score, bundle policies, use discounts, and compare quotes.

Is it possible to get car insurance in Arkansas if I have a bad driving record?

Yes, but you may pay higher premiums. Some companies specialize in high-risk insurance. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.