8 Best Auto Insurance Companies That Don’t Sell Your Information (2026)

The winners for the best auto insurance companies that don't sell your information are Amica, USAA, and State Farm. Individuals in this category typically face an average monthly auto insurance cost of $108. Amica leads the pack by offering a wallet-friendly monthly rate, priced at only $177.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

768 reviews

768 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 6,589 reviews

6,589 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Avg. Monthly Rate

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best auto insurance companies that don’t sell your information are Amica, USAA, and State Farm. Notably, Amica stands out by offering a budget-friendly monthly rate, priced at only $177, leading in affordability.

Do insurance companies sell your information? Yes, they do. Insurers share data with your state’s DMV for other companies to assess your insurance history and check for moving violations.

Our Top 8 Picks: Best Auto Insurance Companies That Don't Sell Your Information

| Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Customer Service | Amica | |

| #2 | 15% | A++ | Military Members | USAA | |

| #3 | 30% | B | Many Discounts | State Farm | |

| #4 | 25% | A++ | Cheap Rates | Geico | |

| #5 | 30% | A+ | Snapshot Program | Progressive | |

| #6 | 22% | A+ | Drivewise Program | Allstate | |

| #7 | 25% | A | RightTrack Program | Liberty Mutual |

| #8 | 10% | A+ | SmartRide Program | Nationwide |

In safeguarding private data, auto insurers selling information isn’t the main concern. The best companies often buy data to adjust risk and potentially reduce claim payouts.

#1 – Amica: Top Pick Overall

Pros

- Privacy Commitment: Amica is known for its strong commitment to customer privacy, and they may have policies in place to protect your information. You can learn more in our Amica auto insurance review.

- Customer Service: Amica often receives high ratings for customer service, providing a personalized experience without compromising privacy.

- Discounts for Safe Driving: Amica offers discounts for safe driving habits, potentially lowering your rates without compromising your information.

Cons

- Possibly Higher Premiums: Amica’s emphasis on quality service may be associated with slightly higher premiums compared to some competitors.

- Limited Accessibility: Amica may not have as extensive a network as larger insurers, potentially limiting accessibility for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Runner Up

Pros

- Military Focus: USAA caters specifically to military members and their families, often resulting in a more targeted and secure customer base.

- Privacy Policies: USAA typically has stringent privacy policies, aligning with their commitment to serving the military community. You can learn more about USAA’s privacy policies in our USAA auto insurance review.

- Bundle Discounts: USAA offers various discounts, including bundling insurance policies, which may help you get the best rates for minimum coverage.

Cons

- Eligibility Restrictions: USAA is exclusively available to military members and their families, restricting eligibility for the general public.

- Limited Physical Locations: USAA primarily operates online and by phone, which could be a drawback for those who prefer in-person interactions.

#3 – State Farm: Best for Drive Safe & Save Program

Pros

- Large Network: State Farm’s extensive network may allow for competitive rates, and their emphasis on customer service may include privacy protection.

- Drive Safe & Save Program: State Farm offers a usage-based insurance program that rewards safe driving, potentially reducing your premiums. You can learn more about State Farm’s Drive Safe & Save Program in our State Farm auto insurance review.

- Discounts for Multiple Policies: Bundling policies with State Farm could lead to significant discounts, helping you save on a State Farm quote.

Cons

- Potentially Higher Rates: State Farm’s large network and emphasis on customer service may be associated with rates that are not the most competitive for every individual.

- Complex Discount Structure: State Farm’s discount structure may be complex, making it challenging for some customers to maximize savings.

#4 – Geico: Best for Various Discounts

Pros

- Online Focus: Geico’s online model may streamline processes and minimize the need for extensive personal interactions, potentially enhancing privacy.

- Discounts and Savings: Geico is known for offering various discounts, including those for safe driving and multiple policies, contributing to cost savings. You can learn more about Geico’s discounts in our Geico auto insurance review.

- Easy Quoting Process: Geico’s straightforward quoting process may help you quickly identify the most affordable Geico car insurance quote.

Cons

- Limited Personal Interaction: Geico’s online model may be a drawback for individuals who prefer more personalized interactions with agents.

- Possibly Less Coverage Options: While Geico is known for affordability, some customers may find that they offer fewer coverage options compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits, potentially leading to lower premiums for minimum coverage. You can learn more about Progressive’s Snapshot program in our Progressive auto insurance review.

- Name Your Price Tool: Progressive’s tool allows you to set your budget, helping you find coverage that aligns with your financial goals.

- Discounts for Bundling: Like many insurers, Progressive offers discounts for bundling policies, providing additional savings.

Cons

- Snapshot Data Concerns: Some individuals may have privacy concerns related to the data collected through Progressive’s Snapshot program.

- Potentially Higher Premiums: Progressive’s focus on innovative programs may come with premiums that are not the most competitive for everyone.

#6 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program monitors driving habits, potentially resulting in discounts and lower premiums. You can learn more about Allstate’s Drivewise program in our Allstate auto insurance review.

- Personalized Service: Allstate emphasizes personalized service, and their privacy policies may reflect a commitment to safeguarding customer information.

- Easy Pay Plan: Allstate’s Easy Pay Plan allows for convenient and automatic premium payments.

Cons

- Potentially Higher Premiums: Allstate’s emphasis on personalized service may be associated with premiums that are relatively higher for some individuals.

- Limited Discount Programs: Allstate may have fewer innovative discount programs compared to some competitors.

#7 – Liberty Mutual: Best for RightTrack Program

Pros

- RightTrack Program: Liberty Mutual’s RightTrack program rewards safe driving, potentially leading to discounted rates for minimum coverage. You can learn more about Liberty Mutual’s RIghtTrack program in our Liberty Mutual auto insurance review.

- Multi-Policy Discounts: Bundling policies with Liberty Mutual may result in significant cost savings.

- Digital Tools: Liberty Mutual’s digital tools may streamline processes and reduce the need for extensive personal information exchanges.

Cons

- Potentially Higher Rates: Similar to other large insurers, Liberty Mutual’s premiums may not always be the most competitive for every individual.

- Complex Coverage Options: Some customers may find Liberty Mutual’s coverage options to be complex or less straightforward.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide’s SmartRide program rewards safe driving habits, contributing to potential savings on premiums. You can learn more about Nationwide’s SmartRide program in our Nationwide auto insurance review.

- Multi-Policy Discounts: Bundling policies with Nationwide can lead to significant cost reductions.

- Member Discounts: Nationwide offers various discounts for members, potentially making it more affordable for those eligible.

Cons

- Possibly Higher Rates: Nationwide’s rates may not always be the most competitive for every individual.

- Limited Accessibility: Nationwide may not have as extensive a network as larger insurers, potentially limiting accessibility for some customers.

The Best Auto Insurance Companies That Don’t Sell Personal Information

If you want affordable auto insurance companies that don’t sell info about their drivers, you can get a policy at most major insurance companies. Below are some reputable insurance companies that do not sell their drivers’ information:

Auto Insurance Companies That Don't Sell Your Information by Provider & Coverage Level

Insurance Company Minimum Coverage

$70

$72

$60

$80

$62

$75

$65

$55

Looking at this list, it’s clear that you can still obtain great auto insurance rates from auto insurance companies that don’t sell info about their clients. For example, Amica provides great coverage at an excellent price since it offers an average rate of only $177 per month.

As of yet, these major players in the insurance industry aren’t blatantly selling their drivers’ information. However, you should always keep an eye open.

When considering State Farm auto insurance quotes, State Farm doesn’t currently sell your information, but it does share your information with companies that perform marketing for State Farm.

In essence, State Farm can use your personal data to project targeted ads at you in the hope that you’ll buy more State Farm products. If you want to learn more about how State Farm handles your information, you can review the State Farm privacy policy.

Of course, with the rise of telematics technology and cheap usage-based car insurance, finding auto insurance companies that don’t sell your information to third parties could become harder in the future.

Why Auto Insurance Companies Buy Drivers’ Personal Data

Your data can be a powerful tool, especially in the hands of an insurance company lawyer.

Let's say that you use a telematics device that records your driving habits and sometimes you slam on the brakes. If you were to be in an accident that wasn't your fault, the other driver's insurance company can get all your driving data turned over.Daniel Walker Licensed Auto Insurance Agent

Even though you didn’t cause the accident, your habit of slamming on the brakes could be used to paint doubt over your side of the story and reduce the chance of your claim being paid out.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

More About Top Auto Insurance Companies That Don’t Sell Your Information

Data-selling insurance companies could be the next front in the fight to protect consumer data, but for now, auto insurance companies that don’t sell info pertaining to their clients, allowing you to compare car insurance without personal information, are just a click away.

Of course, if you’re protective of your data, you can always check out the privacy policy page on your insurance company’s website. There you’ll find a list of telephone numbers you can call into and request to have any collected information about you sent to you.

By choosing auto insurance companies that don’t sell your data, you not only protect your privacy but also contribute to a more secure and trustworthy insurance experience.

Enter your ZIP code below to get started on comparing quotes from the best insurance companies and enjoy the peace of mind that comes with knowing your information is in safe hands.

Frequently Asked Questions

Do all auto insurance companies sell your information to third parties?

No, not all auto insurance companies sell your information to third parties. However, it’s important to be aware that some insurance companies may have practices in place to share or sell customer information to third parties for marketing or other purposes.

Which auto insurance companies are known for not selling customer information?

Several auto insurance companies are known for their commitment to protecting customer information and not selling it to third parties. Some examples of such companies include:

- Amica

- USAA

- State Farm

- Geico

- Progressive

Are there any conditions or limitations to consider with these companies?

While these companies are known for not selling customer information, it’s essential to review their privacy policies to understand any conditions or limitations. They may still share information with their affiliates or service providers for specific purposes related to insurance coverage or claims processing. It’s advisable to review the privacy policies of each company to gain a comprehensive understanding of their information-sharing practices.

How can I be sure my information won’t be sold by an insurance company?

To ensure your information won’t be sold by an insurance company, it’s recommended to review their privacy policy thoroughly. Look for statements or commitments regarding the protection of customer information, restrictions on sharing data, and procedures for opting out of information sharing. You can also contact the insurance company directly to inquire about their privacy practices and express any concerns or preferences you may have.

Is it worth choosing an insurance company that doesn’t sell customer information?

Choosing an insurance company that prioritizes customer privacy and does not sell customer information can be important for individuals who value their privacy and want to minimize unwanted marketing communications. However, it’s essential to consider other factors as well, such as the overall coverage, customer service, financial stability of the insurer, and the cost of premiums. Comparing multiple insurance companies and their offerings is recommended to find the best fit for your needs.

How can I find out if an insurance company sells customer information?

To find out if an insurance company sells customer information, you can research and review their privacy policy or contact their customer service directly. Additionally, reading customer reviews and consulting with insurance agents or brokers can provide insights into the practices of different insurers regarding the sale of customer information.

Which are the best auto insurance companies that don’t sell your information?

The best auto insurance companies that don’t sell your information include Amica, USAA, and State Farm.

What is the average monthly cost for auto insurance companies that don’t sell your information?

The average monthly cost for auto insurance companies that don’t sell your information is $108.

What is Amica’s monthly rate?

Amica offers a monthly rate of $177.

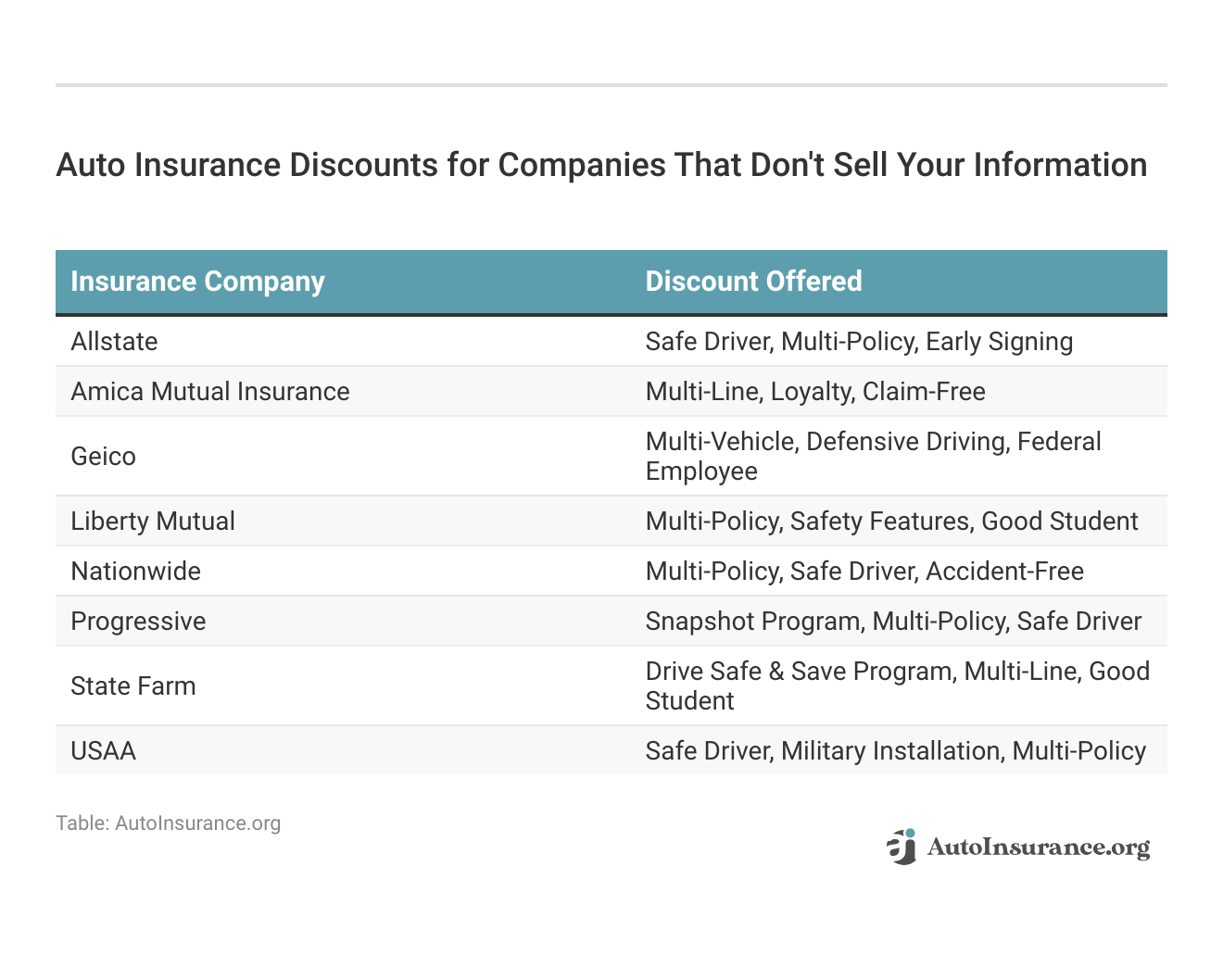

What are some discounts offered by auto insurance companies that don’t sell your information?

Some discounts offered by auto insurance companies that don’t sell your information include safe driver, multi-policy, and early signing.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.