Best Jimmy John’s Delivery Driver Auto Insurance in 2026 (Top 10 Companies Ranked)

The best Jimmy John’s delivery driver auto insurance comes from Progressive, State Farm, and Allstate. With rates starting at $85 per month, you can find cheap car insurance for fast food delivery drivers that protects you while you’re working. These companies also offer helpful add-ons like roadside assistance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated December 2024

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsProgressive, State Farm, and Allstate have the best Jimmy John’s delivery driver auto insurance.

Progressive takes the top spot for the best delivery driver insurance because it offers a robust UBI program, generous car insurance discounts, and innovative digital tools that Jimmy John’s delivery drivers will appreciate.

Our Top 10 Company Picks: Best Jimmy John's Delivery Driver Auto Insurance

| Company | Rank | Multi-Vehicle Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Customizable Coverage | Progressive | |

| #2 | 17% | 30% | Customer Service | State Farm | |

| #3 | 25% | 22% | Coverage Options | Allstate | |

| #4 | 20% | 10% | Student Discounts | Nationwide |

| #5 | 10% | 5% | Competitive Rates | Farmers | |

| #6 | 10% | 12% | Accident Forgiveness | Liberty Mutual |

| #7 | 29% | 20% | Loyalty Discounts | American Family | |

| #8 | 13% | 30% | Car Replacement | Travelers | |

| #9 | 25% | 30% | Rate Lock | Erie |

| #10 | 15% | 20% | Affordability Option | Geico |

Read on to learn more about car insurance for delivery drivers and where to find the best Jimmy John’s delivery policy. Then, enter your ZIP code to find the best coverage for your deliveries.

- Delivery drivers need either commercial insurance or rideshare coverage for work

- Delivery driver car insurance is usually affordable

- Progressive and State Farm have the best Jimmy John’s auto insurance

#1 – Progressive: Top Pick Overall

Pros

- Rideshare Coverage: Progressive offers seamless coverage from personal to delivery driving with this add-on.

- Snapshot Program: Save up to 30% on your coverage with Progressive’s usage-based insurance (UBI) program, Snapshot. Learn what Snapshot tracks in our Progressive auto insurance review.

- Digital Tools: Progressive has one of the most innovative sets of digital tools on the market to help you manage your delivery driver car insurance policy.

Cons

- Unexpected Price Increases: Many customers report unexpected rate increases on their Progressive policies, even when nothing had changed.

- Customer Service: Progressive struggles with its customer loyalty ratings and receives mixed reviews for its customer service experiences.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Personalized Assistance

Pros

- Policy Customization: State Farm has flexible policies that can include business use. Explore your customization options in our State Farm auto insurance review.

- Steer Clear Program: State Farm offers a discount to young drivers who complete the Steer Clear program. In most cases, the Steer Clear discount applies to your insurance until you’re 25.

- Personalized Service: Take advantage of State Farm’s massive network of local agents to get reliable, personalized coverage.

Cons

- Limited Online Tools: Some State Farm services require agent interaction before you can use them.

- Financial Strength Downgraded: M. Best recently downgraded State Farm’s financial rating, indicating that the company might have trouble paying claims.

#3 – Allstate: Best for Full Coverage Service

Pros

- Ride for Hire: Allstate’s specific endorsement for delivery drivers can help you get the best Jimmy John’s food delivery coverage.

- Safe Driving Discounts: Among Allstate’s 12 discounts are multiple ways to save for safe driving practices. For example, you can save up to 40% by enrolling in Allstate’s UBI program, Drivewise.

- Full Coverage Options: Get the best insurance for delivery drivers with Allstate’s robust add-on options.

Cons

- Premium Costs: Allstate has higher premiums than some competitors. Compare fast food delivery insurance rates in our Allstate auto insurance review.

- Claim Process: There are many reviews regarding the speed and ease of the Allstate claims process.

#4 – Nationwide: Best for UBI Savings

Pros

- Vanishing Deductible: Save $100 on your deductible for every year you go without filing a claim when you sign up for Nationwide’s Vanishing Deductible program, up to $500.

- Business Use Endorsement: Buy this add-on, and Nationwide will cover your personal vehicle during business use.

- SmartRide: Get up to 40% off your insurance with SmartRide. If you’re a low-mileage driver, SmartMiles might be a better choice. See which would fit your lifestyle best in our Nationwide auto insurance review.

Cons

- Higher Average Rates: Nationwide is not always the cheapest option for car insurance, with rates slightly higher than the national average.

- Coverage Complexity: Nationwide’s business use endorsement can be complex to understand and implement.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best Selection of Discounts

Pros

- Flexible Coverage: Use Farmers’ various coverage options to tailor the best Jimmy John’s car insurance.

- Rideshare Add-On: Farmers offers specific coverage for rideshare and delivery drivers.

- Discount Options: With 23 options, there are plenty of ways to find cheap car insurance for fast food delivery drivers at Farmers. Explore all 23 options in our Farmers auto insurance review.

Cons

- Higher Rates: Despite offering so many discounts, Famers’ premiums can be on the higher side.

- Customer Service: Some Farmers customers report inconsistent service experiences.

#6 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Diverse Coverage Options: Liberty Mutual offers unique coverage options so you can get delivery driver car insurance that is good enough to match Jimmy John’s guarantee for speedy service.

- Excellent Discounts: Get the cheapest delivery driver insurance by taking advantage of Liberty Mutual’s 17 discounts.

- Accident Forgiveness: If you purchase this add-on, your Liberty Mutual policy will not be increased after your first accident. Learn more about accident forgiveness in our Liberty Mutual auto insurance review.

Cons

- Premium Costs: Liberty Mutual is often more expensive than some other options, especially if you have speeding tickets or at-fault accidents.

- Service Consistency: Liberty Mutual’s customer service can vary significantly by location.

#7 – American Family: Best for Quick Claims Handling

Pros

- Delivery Driver Coverage: With more people than ever making ends meet as delivery drivers, Farmers offers a specific add-on you can add to your Jimmy John’s delivery policy.

- MyAmFam App: American Family’s convenient mobile app makes managing policies and claims simple.

- Safe Driver Discounts: Jimmy John’s delivery drivers pay for their own insurance, but taking advantage of American Family’s discounts makes it much easier to afford.

Cons

- State Availability: American Family sells coverage in just 19 states. See if you live in one of them in our American Family auto insurance review.

- Expensive Pricing: American Family premiums can be higher in certain regions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Safe Driver Savings

Pros

- Business Use Coverage: Travelers offers options specifically for delivery and business use. See other ways to customize your fast food delivery car insurance in our review of Travelers auto insurance.

- IntelliDrive Program: Travelers offers savings of up to 30% based on safe driving behaviors when you enroll in IntelliDrive.

- Strong Financial Standing: Travelers strong financial rating from A.M. Best indicates that the company offers reliable claims handling and financial stability.

Cons

- Complex Discounts: Although Travelers offers a generous 15 discounts to help any Jimmy John driver pay for their coverage, some discounts are difficult to qualify for.

- Online Tools: Some customers find American Family’s online tools less intuitive than expected.

#9 – Erie: Best Customer Service

Pros

- Business Auto Policy: Get comprehensive coverage for fast food delivery driver insurance with Erie’s business options.

- Customer Service: Erie maintains high rates for its excellent customer service, primarily because the company focuses on providing the best service possible.

- First Accident Forgiveness: Sign up for this add-on to protect your low rates against your first at-fault accident.

Cons

- Limited Availability: Erie coverage is limited to just 12 states, mostly towards the East Coast. See if you can purchase coverage in your state in our Erie auto insurance review.

- Limited Online Tools: If you’re looking for a modern take on insurance, Erie is probably not the best company for you.

#10 – Geico: Best for Cheap Minimum Coverage

Pros

- Low Minimum Coverage Rates: Geico offers affordable Jimmy John’s quotes for minimum insurance policies. See how much you might pay in our Geico auto insurance review.

- Online Policy Management: With its focus on a more modern insurance experience, Geico’s online tools generally receive praise.

- Customizable Coverage: Get the best Jimmy John’s driver insurance by adding options like rideshare coverage and roadside assistance to your Geico policy.

Cons

- Fewer Local Agents: With its focus on selling Jimmy insurance primarily online, it can be difficult in some places to get one-on-one help.

- Commercial Use Restrictions: Geico may have restrictions on car insurance for delivery drivers, so you should ask a representative to clarify for you before you do.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Commercial Auto Insurance for Delivery Drivers

Knowing about the delivery-for-a-fee exclusion means that food delivery drivers should be aware that when they use their vehicles for business purposes, they do not have auto liability coverage. If you work using your personal car, you’ll probably need to get commercial auto insurance to be covered. You can shop at the best auto insurance companies for commercial auto insurance, or you can look for companies that offer a delivery driver add-on.

Many insurance carriers will cover a known risk if it’s profitable. So, do you need extra insurance to deliver pizza, Jimmy John’s, or even DoorDash?

A commercial auto policy might provide adequate liability coverage for a Jimmy John’s delivery driver.

How much will it cost for additional food delivery commercial auto insurance? Check the rates below to see the average cost of car insurance for delivery drivers from our top companies.

Jimmy John’s Delivery Driver Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $100 | $200 |

| American Family | $90 | $180 |

| Erie | $95 | $190 |

| Farmers | $110 | $220 |

| Geico | $100 | $200 |

| Liberty Mutual | $105 | $210 |

| Nationwide | $99 | $195 |

| Progressive | $115 | $225 |

| State Farm | $85 | $175 |

| Travelers | $102 | $212 |

As you can see, your rates don’t have to be outrageously expensive to find quality delivery driver insurance.

Why Insurance Rates Can Be High for Delivery Drivers

So, why don’t delivery services cover accidents under your personal policy? It’s a complicated answer, but part of it is that delivery drivers are a high-risk occupation. Delivery drivers are actually the 4th most dangerous job in America. For insurers, that means there’s a higher likelihood that they’ll have to pay out a claim.

This video from KOAA 5 in Colorado makes some good points about how delivery drivers need to be aware their personal auto policy probably won’t cover damages that happen on the job.

When a delivery driver is in the market for business auto insurance, he or she should compare different carriers, and the driver should determine for certain whether liability coverage gets extended to a delivery person when an accident occurs during food delivery.

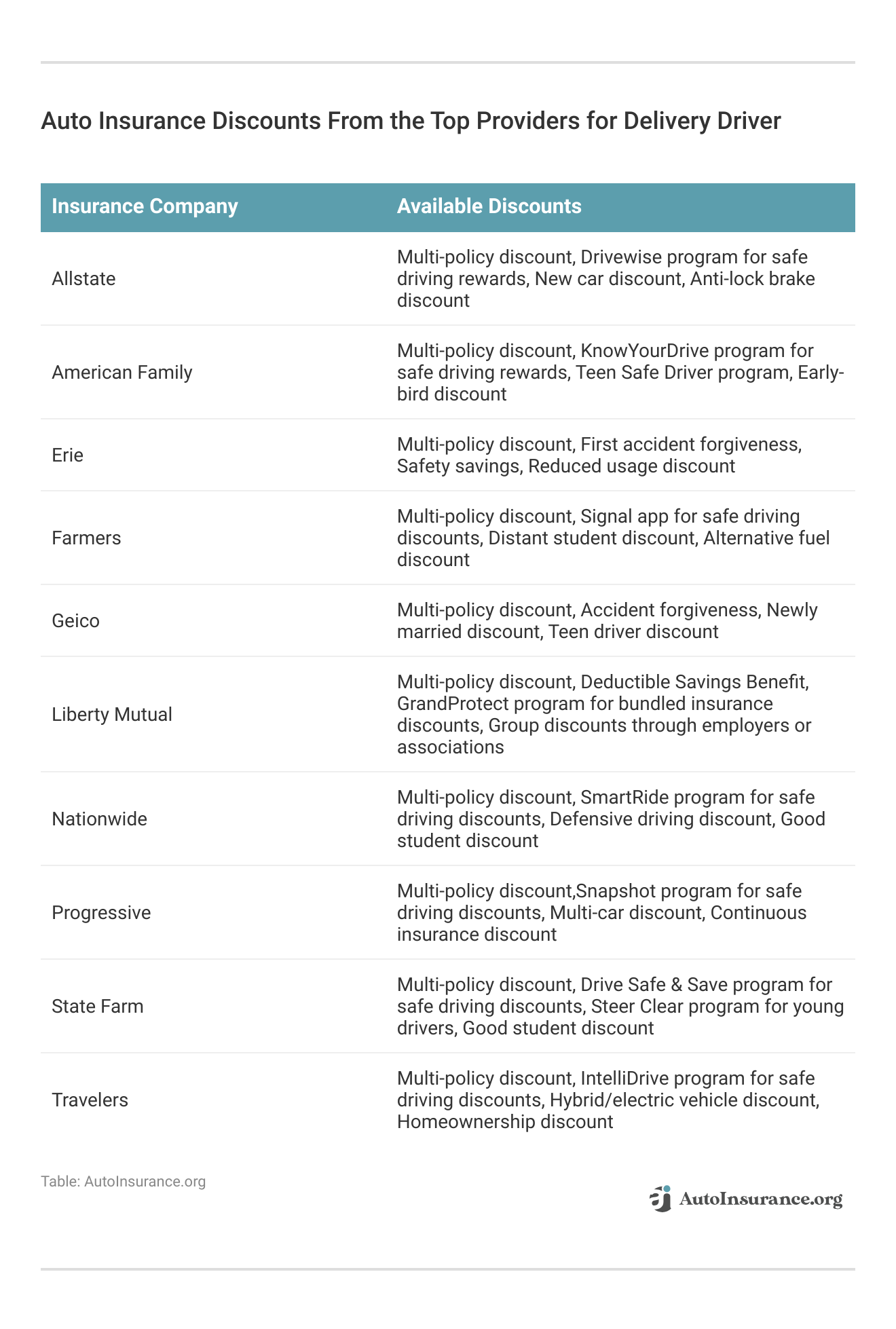

Luckily, there are ways to save. One of your first steps in finding affordable coverage should be looking for discounts. Check below to see a selection of discounts that Jimmy John’s delivery drivers might be able to take advantage of.

You can also take steps like choosing a higher deductible, lowering your coverage, and comparing rates with multiple companies to find affordable coverage. Even if you already have a policy, occasionally comparing quotes is a great way to ensure you’re still getting a good deal.

Saving is the easy part. Deciding what to spend it on, now that’s where it gets tricky! Drivers who switch and save with Progressive save hundreds on average. Screenshot and share your results. We bet they’re totally fly! pic.twitter.com/k2wGKNsG78

— Progressive (@progressive) March 29, 2024

Although Progressive is our top pick for Jimmy John’s delivery driver car insurance, you should still compare rates with multiple companies. Most companies make it easy to get a quote — simply fill out the quote request form on their website’s homepage.

If you don’t want to spend the time filling out multiple request forms, consider using a quote comparison tool instead.

Jimmy John’s Car Insurance for Drivers

Does Jimmy John’s cover insurance for their drivers?

The short answer is no. Your personal auto policy is not likely to cover damages that occur while you’re delivering food either. You must have food delivery driver insurance coverage. While a commercial policy might cover a business owner under normal circumstances, a non-owned auto coverage policy might further insulate a business owner who hires and sends out food delivery drivers.

When a delivery driver for Jimmy John's is aware that personal policy does not provide coverage when an auto accident occurs on the job, a business owner can protect their business by carrying insurance on a vehicle that they do not own, such as a delivery driver's car.Chris Abrams Licensed Insurance Agent

Unfortunately, Jimmy John’s and other food delivery drivers have a higher likelihood of getting into a car wreck than other drivers.

Delivery drivers are typically younger than the average driver, and these things are usually true:

- Less driving experience

- High pressure to make fast deliveries

- Delivery drivers are on the road more, increasing possible accidents

High pressure to deliver sandwiches so fast can lead to unsafe driving behavior. Finding the best auto insurance for drivers under 25 can be difficult, but it typically only requires a bit of research to find solid rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Delivery Drivers Can Have Their Claims Denied

Most personal automobile insurance policies usually won’t extend liability coverage for damage that occurs while being paid to deliver goods.

The coverage exclusion, which is included in the majority of auto insurance policies, is referred to as the delivery-for-a-fee exclusion. But you need liability coverage. Not only do most states require it, but you also don’t want to hit someone’s car and have to pay out-of-pocket for damages.

The coverage exclusion means that the damages that result from a car accident that happened during a Jimmy John’s food delivery were not considered as a risk when the policy was written and accepted, so insurance carriers will not extend coverage for an insured’s liabilities.

When a delivery driver can’t satisfy the liabilities, it’s possible that an injured driver or pedestrian will sue a delivery driver who caused an auto accident. When your insurance company denies coverage, they also deny you any representation under the policy.

Additional business or commercial insurance coverage is necessary to have your claims covered.

Make sure you have at least the minimum amount of liability-only auto insurance coverage for when you’re driving.

Jimmy John’s delivery drivers could get stuck paying out-of-pocket for the liabilities that come from an auto accident without additional commercial coverage.

Restaurant Location Matters for Jimmy John’s Auto Insurance

While most insurance carriers have policy language unique to their underwriting team and company, the delivery-for-a-fee exclusion is quite common. Nonetheless, the treatment of the exclusion varies by jurisdiction.

The issue of whether an insurance company can deny liability coverage to a named insured just because the insured was delivering food has not yet settled in every state or jurisdiction.

For example, in Illinois, a 20-year-old Jimmy John’s delivery driver crashed into a motorcycle rider as the delivery driver pulled out of Jimmy John’s en route to a customer. In that case, the delivery driver’s auto insurance carrier did reach a $100,000 settlement with the injured motorcyclist. However, the delivery driver got dragged into heated litigation between the motorcyclist and the owner of the Jimmy John’s restaurant.

Additionally, in the case of the injured rider and Jimmy John’s location owner noted above, the attorney representing the restaurant was quick to shift the blame for the auto accident to the 20-year-old delivery driver. The attorney stated that “an employer doesn’t have a duty to train an employee, who is an experienced driver.”

The injured rider sued Jimmy John’s because the injured plaintiff believed that Jimmy John’s location used the delivery driver as a shield.

Similar cases in each state create clearer interpretations of the delivery-for-a-fee exclusion, and as a Jimmy John’s delivery driver, you do not want to find yourself in the midst of a defining lawsuit, where a business is reducing its exposure by revealing your liability. In rare cases, you might even find that your insurance company can sue you if you lied about the business use of your vehicle.

Find the Best Jimmy John’s Delivery Driver Auto Insurance Today

From car insurance discounts to the best food delivery coverage, there are plenty of ways to find affordable coverage when you drive for Jimmy John’s. With so many excellent coverage options available, it’s more important than ever to research your choices thoroughly before making a decision.

If you’re a Jimmy John’s driver who wants an auto insurance policy that fully covers you, don’t miss out on our free insurance comparison tool below. Just enter your ZIP code and start comparing Jimmy John’s auto insurance rates now and save money.

Frequently Asked Questions

Does Jimmy John’s provide auto insurance coverage for its delivery drivers?

Jimmy John’s, as an employer, typically provides commercial auto insurance coverage for its delivery drivers while they are on the job. However, the specific details of the coverage, including rates and requirements, may vary depending on the individual franchise and the insurance policies they have in place.

Are Jimmy John’s delivery drivers required to have their own auto insurance?

It is common for Jimmy John’s delivery drivers to be required to meet the car insurance requirements in their state in addition to the commercial auto insurance provided by the company. This personal auto insurance is usually required to cover the driver’s use of the vehicle for non-work-related purposes.

What type of auto insurance coverage is typically required for Jimmy John’s delivery drivers?

Jimmy John’s generally requires its delivery drivers to carry a minimum level of liability insurance coverage. The specific requirements may vary, but they often include liability coverage for bodily injury and property damage caused by the driver while on the job. It is important for delivery drivers to check with their employer or insurance provider to determine the exact coverage requirements.

To find the best auto insurance for your Jimmy John’s delivery driver job, enter your ZIP code into our free comparison tool to see rates in your area.

Do Jimmy John’s delivery drivers pay higher insurance rates compared to regular drivers?

Insurance rates for Jimmy John’s delivery drivers may be higher compared to regular drivers due to the nature of their work. Delivery drivers typically face increased risks on the road, including frequent stops and starts, time pressure, and increased mileage. These factors can contribute to higher insurance rates. However, prices are generally more impacted by things like auto insurance rates by state, age, and gender.

Can Jimmy John’s delivery drivers qualify for any insurance discounts?

Some insurance providers may offer specific discounts for delivery drivers, including those working for Jimmy John’s. These discounts can vary but may include safe driving discounts, low mileage discounts, or discounts for completing defensive driving courses. It is recommended for drivers to inquire with their insurance company to determine if any discounts are available to them.

Does Jimmy Johns have delivery cars?

Most Jimmy John’s even put in their help-wanted ads that one requirement is to have your own vehicle with insurance coverage. You do have to have your own vehicle.

Does Jimmy Johns deliver for free?

No, they charge for delivery. Part of that charge helps with Jimmy John driver pay or Jimmy Johns delivery pay, specifically compensating for the cost of fuel.

How much do Jimmy John’s drivers make?

Payscale reports that the average Jimmy John’s pay rate is about $8.47 an hour, with additional tips of $5,600 a year.

What insurance companies cover delivery drivers?

With the advent of food delivery apps and rideshare services, most major companies offer coverage for food delivery drivers. The best company for you depends on your work needs. For example, you can get the best rideshare auto insurance from a company like State Farm, while Progressive takes our top pick for drivers working exclusively for Jimmy John’s.

Does Jimmy John’s have a delivery guarantee?

A specific delivery time is not guaranteed.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.