Best Auto Insurance for Leased Business Vehicles in 2026 (Top 10 Companies)

Progressive, Geico, and State Farm offer the best auto insurance for leased business vehicles. Progressive's average business car rate for minimum coverage is $105/mo. Business auto lease insurance is separate from your business owner's policy and required for business vehicle operation in most states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated January 2025

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Leased Business Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Leased Business Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Leased Business Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsProgressive, Geico, and State Farm have the best auto insurance for leased business vehicles.

Leasing a vehicle provides an easier way for individuals and companies to drive new cars. Leased vehicles come with reduced upfront costs and high levels of convenience. However, auto insurance laws still apply even when not using a vehicle with a personal auto lease, so you’ll still have to purchase business lease auto insurance for the vehicle.

Our Top 10 Company Picks: Best Auto Insurance for Leased Business Vehicles

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A+ | Online Convenience | Progressive | |

| #2 | 25% | A++ | Cheap Rates | Geico | |

| #3 | 20% | B | Many Discounts | State Farm | |

| #4 | 30% | A+ | Add-on Coverages | Allstate | |

| #5 | 10% | A+ | Usage Discount | Nationwide |

| #6 | 12% | A++ | Accident Forgiveness | Travelers | |

| #7 | 18% | A | Local Agents | Farmers | |

| #8 | 25% | A | Customizable Polices | Liberty Mutual |

| #9 | 15% | A++ | Military Savings | USAA | |

| #10 | 22% | A+ | Deductible Reduction | The Hartford |

Wondering how to get a business car lease or how to lease a vehicle under your business? We provide all the information you need on company lease car insurance in our guide below.

Before we get started, use your ZIP code to look at affordable business lease auto insurance quotes to conduct comparisons and find the best rates for your needs.

- Progressive is our top choice for the best business lease car insurance

- Car insurance is mandatory in most U.S. states, whether the car is owned or leased

- Your business vehicles are not covered in your business owner’s policy (BOP)

#1 – Progressive: Top Pick Overall

Pros

- Online Convenience: Business vehicle policies can be managed online at Progressive.

- Snapshot Program: Joining the Snapshot program could reduce business vehicle rates. Learn more in our Progressive Snapshot review.

- Add-On Coverages: Fully protect your leased vehicle with add-ons like gap coverage. For a full list of coverage, read our review of Progressive.

Cons

- Snapshot Rate Changes: Poor driving scores may raise business insurance rates.

- Customer Service: Progressive could further improve its customer service representation.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico has some of the most affordable auto insurance for leased business vehicles.

- Digital Tools: Business policies can be managed from Geico’s app.

- Financial Stability: A.M. Best reviewed Geico’s financial management and awarded a good rating.

Cons

- Personalized Interaction: Geico’s convenient online tools mean it has few local agents.

- DUI Rates: Business vehicle insurance will be expensive for DUI drivers. Read more in our Geico review.

#3 – State Farm: Best for Many Discounts

Pros

- Many Discounts: Check out State Farm’s many discounts in our review of State Farm.

- Adjustable Deductibles: Adjusting deductibles can lower business car insurance costs.

- Local Agents: Personalized assistance is available for car insurance for business vehicles.

Cons

- Financial Rating: A.M. Best gave the company a B rating.

- Agent Purchases: An agent must finalize all purchases, so you can’t buy a policy online.

#4 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Buy extras like gap insurance to fully protect your business lease vehicle.

- Online Convenience: Business customers can conveniently make changes from their phones.

- Discount Options: Learn about Allstate’s list of discounts in our Allstate review.

Cons

- Claim Satisfaction: Allstate struggles with multiple complaints about customer claim service.

- Higher Rates: Allstate’s average rates aren’t as competitive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers a discount based on driving performance.

- Add-On Options: Add optional coverages to your policy as needed. See what’s offered in our Nationwide review.

- Vanishing Deductible: Deductible amounts on lease car insurance may be reduced for claims-free customers.

Cons

- Limited Agent Interaction: Agents to help with lease insurance locally aren’t usually available.

- Customer Ratings: Nationwide has decent ratings but could still improve.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Applied to some driver’s policies when they are accident and claims-free.

- Safety Feature Discount: Receive a discounted rate if your business vehicle has certain safety features, like forward collision warning.

- Coverage Options: Learn about the options for business vehicles in our Travelers review.

Cons

- UBI Rate Changes: Travelers’ usage-based program raises rates for poor scorers.

- Customer Reviews: Reviews show improvements could be made by Travelers.

#7 – Farmers: Best for Local Agents

Pros

- Local Agents: Get help with your business insurance from local agents. Find out more in our review of Farmers.

- Discount Selection: A large discount selection is available at Farmers.

- Accident Forgiveness: Some claims-free customers may be able to avoid increased business insurance rates.

Cons

- High-Risk Rates: Business insurance rates are less competitive for some drivers.

- Customer Satisfaction: There could be higher ratings from customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Business auto insurance is easily customizable at Liberty Mutual.

- Accident Forgiveness: Post-accident rate increases may be avoided at Liberty Mutual.

- 24/7 Support: There are 24/7 representatives for customers. Read more in our Liberty Mutual review.

Cons

- Customer Ratings: There is room to improve customer service representation.

- Discount Availability: Some states may offer more limited options.

#9 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers insurance savings to its customers who are strictly military or veterans.

- Discount Variety: There are plenty of USAA discounts for car insurance with leases. Read more in our USAA review.

- Add-On Coverages: Business vehicle insurance policies can be rounded out with extra coverages.

Cons

- Eligibility: Only service members and veterans can buy business vehicle car insurance coverage.

- Local Agent Availability: Services are mostly provided online.

#10 – The Hartford: Best for Deductible Reduction

Pros

- Deductible Reduction: Reduce your deductibles yourself or earn deductible reductions for being claims-free.

- AARP Discount: AARP members will get discounted rates on business vehicle lease insurance.

- Accident Forgiveness: Applicable to some claims-free customers.

Cons

- Young Driver Rates: Business car rates will be less competitive for younger drivers. Learn more in our review of The Hartford.

- Customer Reviews: Not always positive ratings for customer service at The Hartford.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Vehicle Leasing Basics

Every time the legal owner and the person keeping the car differ, carriers, especially mainstream auto insurers, have a hard time drafting auto insurance policies. This complication doesn’t remove the need for company lease car insurance. You will still get a policy if you follow the proper criteria (Learn more: How to Get Auto Insurance).

The business auto lease insurance rates are relatively similar to normal auto insurance rates, but if the correct procedures are not followed when purchasing auto insurance coverage for a leased vehicle, you may have problems getting the insurer to pay a claim.Dani Best Licensed Insurance Producer

Ready to learn about some of the basics for leasing a vehicle? Wondering how to get company car insurance? How do I qualify for a business car lease? Need to know about insuring a leased vehicle? What are the company lease car insurance rules? Read through the next few sections to learn more about auto insurance for business vehicles.

How to Lease a Vehicle

Basically, a lease is a long-term rental. You get to use the vehicle for an extended time frame while making monthly lease payments. If you are wondering how to lease a car for your business, it is important to know about the time frame for leases and the business car lease requirements.

Often, a lease could last up to three years, and that’s when you turn in the car or buy it at a price specified in your leasing contract. It is important to know the business car lease criteria. When it comes to small business auto insurance, there are some requirements:

- You are required to purchase insurance coverage for the vehicle

- You must service the vehicle

- Some leases will come with mileage limitations, and if you exceed them, you are charged

- Any repairs to the vehicle will come out of your pocket

While there are different commercial vehicle lease types, most vehicle leases have the same requirements.

Company car lease costs can differ based on your state and other factors. Many companies offer commercial car lease deals, but it is important to do your research to make sure the lease fits your needs and wants. There are many business vehicle leasing companies out there to choose from.

You don’t own the vehicle. The same is true for both business and personal car leases. Any damage the vehicle sustains in the course of your lease will come out of your pocket. However, purchasing auto insurance coverage for your leased business vehicle can protect you from such financial losses.

You’ll need at least minimum liability auto insurance coverage, but in general for leased vehicles, the lease contract will define a set amount of additional coverage required for the vehicle.

Take a look at this table for commonly-required liability coverage for leased vehicles.

Typical Liability Auto Insurance Coverage Requirements for Leased Vehicles

| Coverage Type | Amount Required |

|---|---|

| Bodily injury | $100,000 per person $300,000 per accident |

| Property damage | $50,000 |

Do you need business auto insurance for a leased business vehicle? Keep reading to find out more about car insurance for business vehicles.

Common Terms for Leased Vehicles and Insurance

When you’re looking at business car lease insurance rates, private lease car insurance, and business or personal car lease information, there are a few terms to keep in mind:

- Rebates and Warranties: A rebate is a fixed sum that the leasing company will refund to you at the expiry of the lease if certain conditions are met. Read and understand the terms of the warranty before you drive off with the vehicle.

- Insurance Protection: The lease should include gap insurance, a type of coverage designed to protect you from paying the leasing company the value of the car, should it be totaled in an accident or stolen.

- Drive-Off Fees: The drive-off fee is an upfront payment (deposit) you will be asked to make and will include your fee for the first month. A drive-off fee is technically not a down payment.

What is a company or commercial leased vehicle? A commercial car lease is exactly what it sounds like—a vehicle leased for business use. Keep reading for more.

Insuring a Leased Business Vehicle

As a business owner, you will need auto coverage for your leased business vehicle, whether a van, truck, or car. Since the business owner’s policy doesn’t cover automobiles, you will have to purchase a separate policy for your company cars.

You will be required to meet the minimum required auto liability insurance in your state in case you or one of your employees gets in an accident while driving the company car.

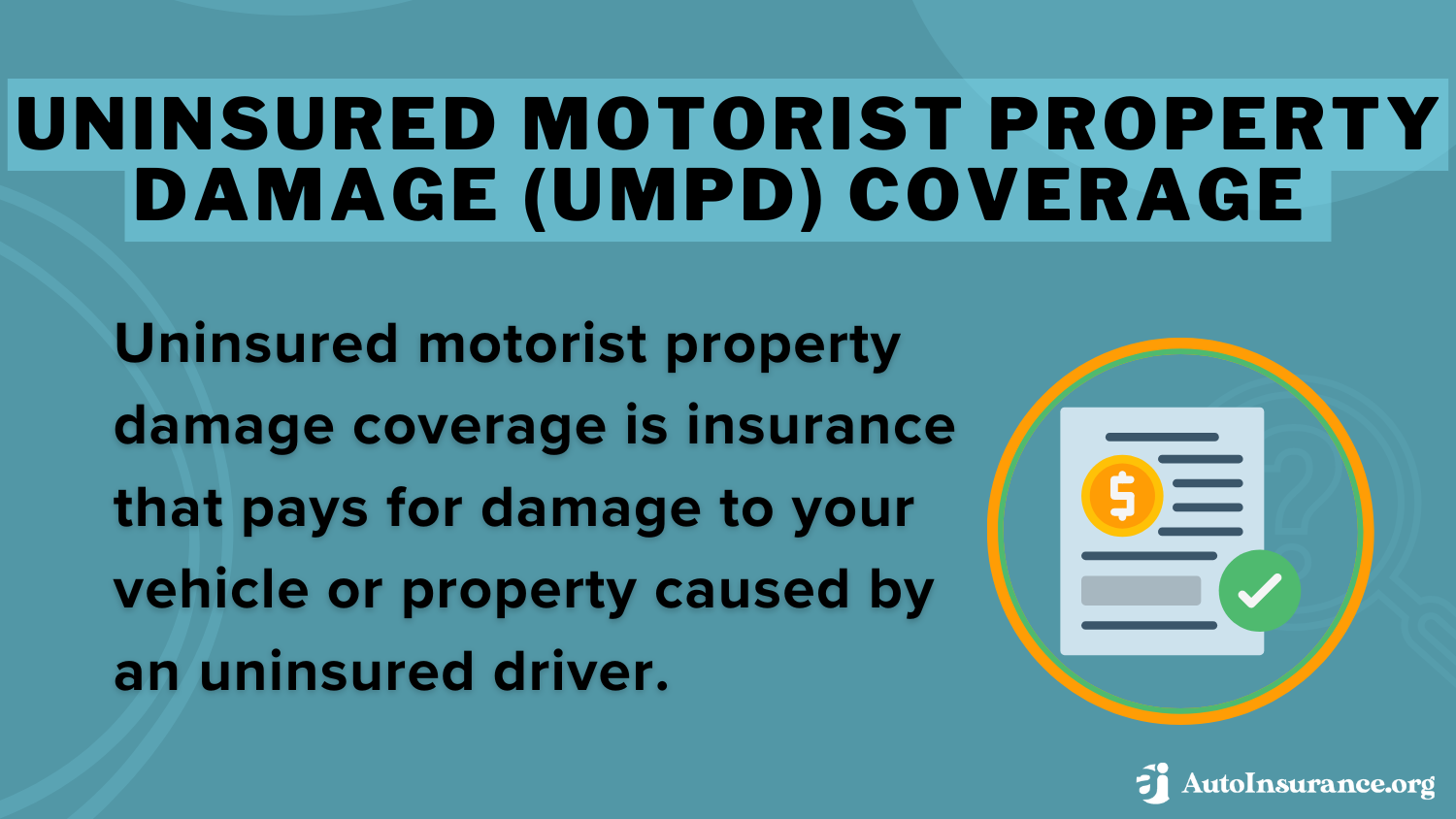

Some states will even require you to have personal injury protection (PIP) or uninsured/underinsured motorist protection when business car leasing with insurance.

How much coverage your leased business vehicle will carry depends on your state and your agreement with the leasing company.

Do I need full coverage insurance to lease a car? In most cases, on top of the state-mandated coverage, the leasing company requires business owners to carry both comprehensive and collision policies for their leased truck insurance or leased car insurance. Read on for more information on commercial car lease insurance.

Essential Auto Insurance Coverage for Leased Business Vehicles

I’ve leased a car for my business; now what? You know you need insurance coverage for any vehicle on the road, but what kind of insurance do you need on a leased car?

It’s important to keep in mind that each state sets its own requirements and expectations for both insureds and insurance companies for commercial auto insurance coverage (the category within which business lease car insurance falls). For example, in Texas, personal injury protection (PIP) coverage is required unless the insured declines it in writing. Below, you can see the different average costs of full coverage versus state minimum coverage.

Leased Business Vehicle Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $124 | $295 |

| Farmers Insurance | $128 | $304 |

| Geico | $95 | $236 |

| Liberty Mutual | $131 | $313 |

| Nationwide | $109 | $266 |

| Progressive | $105 | $257 |

| State Farm | $114 | $276 |

| The Hartford | $135 | $323 |

| Travelers | $120 | $285 |

| USAA | $85 | $209 |

Keep reading to learn more about typical business auto insurance coverage types for leased vehicles.

Liability Coverage

BACF (Business Auto Coverage Form) is the document used to provide auto liability coverage for a business. By definition, the BACF is a form provided to businesses by the insurance provider when drafting the auto insurance policy for the company vehicles.

The BACF contains detailed information pertaining to the policy. Some of the information outlined in BACF include:

- Covered incidences or the cause of damage

- The type of damage covered

- Types of vehicles

- Both insurers and insured obligations in the event of a covered incidence

Coverage includes both leased vehicles and vehicles owned by the business. The BACF helps businesses get practical commercial auto insurance coverage solutions by providing relevant information and available options.

Each vehicle used in your company’s business activities will be matched to its specific coverage, which means that you can choose each vehicle’s coverage type depending on its features and the type of coverage you need for it.

Average liability rates by state can be seen in the chart below.

Auto Insurance Monthly Rates by State & Coverage Level

| State | Minimum Coverage | Full Coverage |

|---|---|---|

| Alabama | $33 | $72 |

| Alaska | $45 | $86 |

| Arizona | $42 | $81 |

| Arkansas | $33 | $76 |

| California | $41 | $82 |

| Colorado | $43 | $82 |

| Connecticut | $54 | $96 |

| Delaware | $67 | $103 |

| Florida | $71 | $105 |

| Georgia | $46 | $87 |

| Hawaii | $38 | $73 |

| Idaho | $29 | $57 |

| Illinois | $37 | $74 |

| Indiana | $32 | $63 |

| Iowa | $25 | $59 |

| Kansas | $30 | $72 |

| Kentucky | $44 | $78 |

| Louisiana | $65 | $117 |

| Maine | $28 | $59 |

| Maryland | $51 | $93 |

| Massachusetts | $51 | $94 |

| Michigan | $66 | $114 |

| Minnesota | $38 | $73 |

| Mississippi | $38 | $83 |

| Missouri | $35 | $73 |

| Montana | $32 | $72 |

| Nebraska | $30 | $69 |

| Nevada | $57 | $92 |

| New Hampshire | $33 | $68 |

| New Jersey | $72 | $115 |

| New Mexico | $41 | $78 |

| New York | $67 | $113 |

| North Carolina | $30 | $66 |

| North Dakota | $25 | $64 |

| Ohio | $33 | $66 |

| Oklahoma | $38 | $84 |

| Oregon | $49 | $75 |

| Pennsylvania | $42 | $81 |

| Rhode Island | $63 | $109 |

| South Carolina | $44 | $81 |

| South Dakota | $25 | $64 |

| Tennessee | $34 | $73 |

| Texas | $44 | $92 |

| Utah | $41 | $73 |

| Vermont | $29 | $64 |

| Virginia | $35 | $70 |

| Washington | $50 | $81 |

| Washington, D.C. | $52 | $111 |

| West Virginia | $41 | $85 |

| Wisconsin | $31 | $61 |

| Wyoming | $27 | $71 |

| U.S. Average | $45 | $84 |

Currently, New Jersey has the highest rates for liability insurance, while North Dakota has the lowest.

Physical Damage Coverage

Physical damage coverage for a business vehicle includes comprehensive, collision, and specified perils. To find out more about these terms, read our comparison of collision vs. comprehensive auto insurance.

Depending on the types and amount of driving you plan to do, along with where you’ll be driving, this may be coverage worth considering purchasing.

Comprehensive Coverage

Besides theft, comprehensive coverage covers all damages unrelated to a collision. These damages can result from any of the following:

- Natural disasters i.e. storms, floods, earthquakes

- Hitting wild animals or birds

- Fire

- Falling objects

Policy exclusions in comprehensive coverage include acts of war, mechanical breakdown, and wear and tear.

Speak to a licensed insurance agent to find out if this is the right coverage for your needs, and check out our guide to find the best comprehensive auto insurance companies.

Collision Coverage

Collision auto insurance coverage pays for damages resulting from the vehicle colliding with other vehicles on the road or if the car overturns.

This is typically recommended as an addition to your policy beyond just liability coverage (and, in some cases, may be required by the terms of your vehicle lease contract).

Specified Perils Coverage

Specified perils coverage provides protection from a specified set of risks clearly spelled out in the policy.

When comparing the replacement cost to the actual cash value (ACV), it’s important to understand what those terms mean. ACV is the amount the insurer will pay if the car is stolen or sustains physical damage.

The ACV is usually adjusted to match the vehicle’s current value according to its physical condition and depreciation. Therefore, the older the vehicle is, the less the settlement amount.

How to Save on Business Car Lease Insurance

If your rates are higher than you would like, make sure you are applying for auto insurance discounts at your company.

If discounts don’t lower your rates enough, you should get business car insurance quotes from other companies to make sure you are getting the best rate. Companies like Progressive offer free quotes directly from their website.

There are also quote comparison tools available that can help you quickly compare rates from multiple companies at once.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Bottom Line for Business Lease Auto Insurance

You’ll need to purchase car insurance for your business lease vehicle. Standard and commercial vehicle leases may require more coverage, depending on the terms of your lease contract. The best way to make sure you’re getting competitive rates for your business lease car insurance is to compare auto insurance rates and save.

Bring down auto insurance rates for your leased business vehicle by comparing quotes from multiple providers. Use your ZIP code in our free comparison tool to find an auto insurance company near you. Our tool makes lease car insurance comparison easy.

Frequently Asked Questions

Do I need liability coverage?

Yes, liability coverage is necessary for your leased business vehicle. The Business Auto Coverage Form (BACF) is used to provide auto liability coverage, outlining the covered incidences, types of damage covered, obligations of both the insurer and insured, and more.

Do I need full coverage insurance to lease a car?

In most cases, you’ll be required to carry comprehensive and collision policies in addition to the state-mandated liability coverage for a leased car.

What about insuring a leased business vehicle?

As a business owner, you need separate auto insurance coverage for your leased business vehicle since it’s not covered under your business owner’s policy (BOP). The insurance requirements vary by state, but you’ll generally need liability coverage and may be required to have additional coverage like Personal Injury Protection (PIP) or uninsured/underinsured motorist protection (learn more: How much car insurance do I need?).

Can I lease a car under my LLC?

Yes, you can lease a car under your LLC. However, it’s important to conduct thorough research and consult experts to determine if this is the most affordable and effective option for your business vehicle leasing needs.

Can I purchase business lease car insurance in the U.K.?

Yes, you can purchase business lease car insurance in the U.K. It’s advisable to consult with a licensed insurance agent in the U.K. for more information.

Do I need collision coverage?

Collision coverage pays for damages resulting from collisions with other vehicles or if your car overturns. It’s often recommended as an addition to liability coverage and may be required by your lease contract, along with comprehensive insurance (read more: Collision vs. Comprehensive Auto Insurance).

Is insurance included on a leased car?

Most lease contracts mandate specific levels of coverage, but you’ll typically need to purchase your own coverage.

Is it more expensive to insure a leased car?

Rates themselves may not be higher, but you may be required to carry more insurance than is required for a car you own, so in effect, your costs for car insurance on a lease may be higher. Compare rates with our free tool to find the cheapest business vehicle lease insurance today.

How do I get a business car lease online quote?

You can usually get quotes directly from the companies you are interested in or use a free quote comparison tool (learn more: How to Get Fast and Free Auto Insurance Quotes).

What are business car lease requirements?

You must carry the coverages outlined on your corporate vehicle lease, or you will be violating the lease.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.