Best Auto Insurance for Papa John’s Delivery Drivers in 2026 (Top 10 Companies Ranked)

The best auto insurance for Papa John’s delivery drivers is offered by Progressive, State Farm, and Allstate, providing essential coverage at a minimum of $80 per month. These companies offer tailored protection against the unique risks faced by delivery drivers, ensuring that you and your vehicle are safeguarded.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated December 2024

Company Facts

Full Coverage for Papa Johns Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Papa Johns Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Papa Johns Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance for Papa John’s delivery drivers are Progressive, State Farm, and Allstate, offering robust coverage tailored to the unique risks of delivery work.

These providers stand out for their comprehensive protection, customer service, and flexibility in coverage options. Since Papa John’s does not provide insurance, drivers must rely on these top picks to secure the necessary liability and additional coverage. Find out more in our guide titled “Cheapest Liability-Only Auto Insurance.”

Our Top 10 Company Picks: Best Auto Insurance for Papa John's Delivery Drivers

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A+ Flexible Coverage Progressive

#2 15% B Delivery Coverage State Farm

#3 10% A+ Policy Discounts Allstate

#4 13% A Customizable Options Liberty Mutual

#5 11% A+ Affordable Rates Nationwide

#6 14% A Driver Focus Farmers

#7 8% A++ Comprehensive Coverage Travelers

#8 12% A Flexible Discounts American Family

#9 14% A Competitive Pricing Safeco

#10 17% A+ Strong Value Erie

This ensures that drivers are fully protected while on the job, whether full-time or part-time.

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Progressive is the top pick for comprehensive coverage tailored to delivery drivers

- Papa John’s drivers need more than basic liability for job risks

- Papa John’s drivers should consider a commercial policy or business-use add-on

#1 – Progressive: Top Overall Pick

Pros

- Bundling Discount: Progressive offers a 12% discount for Papa John’s delivery drivers who bundle auto insurance with other policies, like renters or homeowners insurance.

- High A.M. Best Rating: With an A+ financial stability rating, Progressive ensures Papa John’s delivery drivers can trust that claims will be handled efficiently and fairly. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

- Telematics Program: Progressive’s Snapshot program rewards safe driving habits, allowing Papa John’s delivery drivers to potentially reduce their premiums by demonstrating responsible driving behaviors.

Cons

- Price Variability: Progressive’s rates can vary significantly for Papa John’s delivery drivers based on driving history, location, and vehicle type, which might lead to unexpectedly high premiums.

- Limited Local Agent Access: Progressive relies heavily on online services, which may not be ideal for Papa John’s delivery drivers who prefer in-person interactions for policy management and claims.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Delivery Coverage

Pros

- Bundling Discount: State Farm offers a 15% bundling discount, which is particularly beneficial for Papa John’s delivery drivers needing multiple coverage types, such as auto and renters insurance. Wondering about their level of customer service? Find out in our State Farm auto insurance review.

- Tailored Delivery Coverage: State Farm provides specialized coverage options designed specifically for Papa John’s delivery drivers, including business-use endorsements that extend protection during work hours.

- Extensive Agent Network: Papa John’s delivery drivers benefit from State Farm’s vast network of local agents, offering personalized service and claims assistance, which can be especially helpful for resolving complex issues.

Cons

- Lower A.M. Best Rating: State Farm holds a B rating, which is lower than other top providers, potentially raising concerns for Papa John’s delivery drivers about the company’s financial stability.

- Higher Base Premiums: Despite available discounts, State Farm’s base premiums can be higher, particularly for Papa John’s delivery drivers with past traffic violations or accidents on their records.

#3 – Allstate: Best for Policy Discounts

Pros

- Safe Driving Rewards: Allstate provides rewards and bonuses for safe driving practices, offering Papa John’s delivery drivers the opportunity to earn cash back or lower premiums through the Drivewise program.

- Accident Forgiveness: Papa John’s delivery drivers benefit from Allstate’s accident forgiveness program, which prevents their premiums from increasing after their first at-fault accident, providing financial peace of mind.

- Claim Satisfaction Guarantee: Allstate stands behind its claim process with a satisfaction guarantee, ensuring Papa John’s delivery drivers receive the support they need when filing a claim. Find more information about Allstate’s rates in our review of Allstate auto insurance.

Cons

- Higher Premiums: Allstate’s premiums tend to be higher than average, particularly for Papa John’s delivery drivers with a history of accidents or traffic violations, making it less budget-friendly.

- Limited Customization: Allstate’s policy options may be less customizable compared to other providers, which could be restrictive for Papa John’s delivery drivers who require specific endorsements or coverage levels.

#4 – Liberty Mutual: Best for Customizable Options

Pros

- Bundling Discount: Liberty Mutual offers a 13% discount for Papa John’s delivery drivers who bundle auto insurance with other policies like renters, home, or life insurance.

- Customizable Policies: Liberty Mutual allows Papa John’s delivery drivers to tailor their insurance coverage, choosing from various endorsements such as business use, rental reimbursement, and roadside assistance.

- Comprehensive Online Resources: Liberty Mutual provides robust online tools and resources, enabling Papa John’s delivery drivers to easily manage their policies, file claims, and access important documents online. You can learn more about Liberty Mutual’s insurance options in our complete Liberty Mutual auto insurance review.

Cons

- Complex Discount System: Liberty Mutual’s discount system can be complex and harder for Papa John’s delivery drivers to fully utilize, potentially leading to missed savings opportunities.

- High Initial Premiums: Liberty Mutual’s initial premiums might be higher than those of competitors, which could be a financial strain for Papa John’s delivery drivers seeking affordable coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Affordable Rates

Pros

- Competitive Rates: Nationwide is known for offering some of the most affordable rates in the industry, making it an attractive option for budget-conscious Papa John’s delivery drivers seeking comprehensive coverage.

- High A.M. Best Rating: Nationwide holds an A+ rating, ensuring strong financial backing and reliable claim payouts for Papa John’s delivery drivers who need dependable insurance protection. Find out if Nationwide might have the lowest rates for you in our Nationwide auto insurance review.

- Vanishing Deductible: Nationwide’s vanishing deductible program allows Papa John’s delivery drivers to reduce their deductible over time by maintaining a clean driving record, lowering out-of-pocket expenses in case of a claim.

Cons

- Fewer Policy Customization Options: Nationwide may offer fewer customization options compared to other insurers, which might limit flexibility for Papa John’s delivery drivers with specific coverage needs or job-related risks.

- Limited Discount Opportunities: Nationwide’s discount offerings are not as extensive, potentially affecting the overall savings for Papa John’s delivery drivers who might qualify for more discounts with other insurers.

#6 – Farmers: Best for Driver Focus

Pros

- Specialized Driver Programs: Farmers provides programs specifically tailored to the needs of Papa John’s delivery drivers, focusing on safe driving and minimizing risks.

- Accident Forgiveness: Farmers offers accident forgiveness, preventing premium increases for Papa John’s delivery drivers after their first accident. Take a look at our Farmers auto insurance review to learn more.

- Telematics Program: Farmers’ Signal program offers discounts for Papa John’s delivery drivers who exhibit safe driving behavior, helping them save on premiums.

Cons

- Inconsistent Discounts: The availability and amount of discounts may vary significantly, potentially reducing savings for some Papa John’s delivery drivers.

- Stricter Underwriting: Farmers’ underwriting process might be more rigorous, resulting in higher premiums or coverage denials for Papa John’s delivery drivers with a history of claims.

#7 – Travelers: Best for Comprehensive Coverage

Pros

- Superior A.M. Best Rating: Travelers boasts an A++ rating, indicating exceptional financial strength and reliability for claims made by Papa John’s delivery drivers.

- Wide Range of Coverage: Travelers provides extensive coverage options, including specialized endorsements, that cater to the specific needs of Papa John’s delivery drivers.

- Safe Driver Discounts: Travelers rewards Papa John’s delivery drivers with a clean driving record through additional discounts, enhancing overall affordability. Read more about Travelers’ ratings in our Travelers auto insurance review.

Cons

- Limited Agent Access: Travelers has fewer local agents, which could be less convenient for Papa John’s delivery drivers who prefer in-person service and support.

- Stricter Claims Process: Travelers may have a more rigorous claims process, which could result in longer resolution times and added stress for Papa John’s delivery drivers after an incident.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Flexible Discounts

Pros

- Bundling Discount: American Family provides a 12% discount for Papa John’s delivery drivers who bundle their insurance policies. Read our online American Family auto insurance review to find out more about the company.

- Flexible Discount Programs: American Family offers a variety of discounts that can be tailored to the specific needs of Papa John’s delivery drivers, maximizing savings.

- Good Student Discount: Young Papa John’s delivery drivers who maintain good grades can benefit from additional savings, making insurance more affordable.

Cons

- Limited Digital Tools: The online tools and mobile app provided by American Family may not be as advanced as those of competitors, which could be a drawback for tech-savvy Papa John’s delivery drivers.

- Higher Premiums for Older Vehicles: American Family may offer fewer discounts for older vehicles, leading to higher premiums for Papa John’s delivery drivers with such cars.

#9 – Safeco: Best for Competitive Pricing

Pros

- Bundling Discount: Safeco offers a 14% bundling discount, which is beneficial for Papa John’s delivery drivers looking to save on multiple policies. Compare Safeco’s rates to other providers in our Safeco auto insurance review.

- Affordable Rates: Safeco is recognized for providing competitive rates, making it an attractive option for budget-conscious Papa John’s delivery drivers.

- New Car Replacement: Safeco offers a new car replacement feature, which is particularly beneficial for Papa John’s delivery drivers with newer vehicles, ensuring they can replace a totaled car without significant out-of-pocket costs.

Cons

- Fewer Discount Opportunities: Safeco offers fewer discounts overall, which might limit potential savings for some Papa John’s delivery drivers.

- Inconsistent Customer Support: Customer support experiences with Safeco can vary, which may cause frustration for Papa John’s delivery drivers who require consistent and reliable service.

#10 – Erie: Best for Strong Value

Pros

- Rate Lock Feature: Erie’s rate lock allows Papa John’s delivery drivers to avoid annual premium increases, offering long-term cost stability. Dive into our in-depth Erie auto insurance review to find the best policy for your needs.

- Comprehensive Coverage: Erie offers a broad range of coverage options, allowing Papa John’s delivery drivers to select policies that best suit their needs and budget.

- High Customer Satisfaction: Erie is known for strong customer satisfaction, providing reliable service and support to Papa John’s delivery drivers.

Cons

- Limited Availability: Erie’s insurance products are not available nationwide, which could limit access for some Papa John’s delivery drivers depending on their location.

- Fewer Digital Tools: Erie’s online and mobile resources are less advanced, which might be a drawback for Papa John’s delivery drivers who prefer managing their policies digitally.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

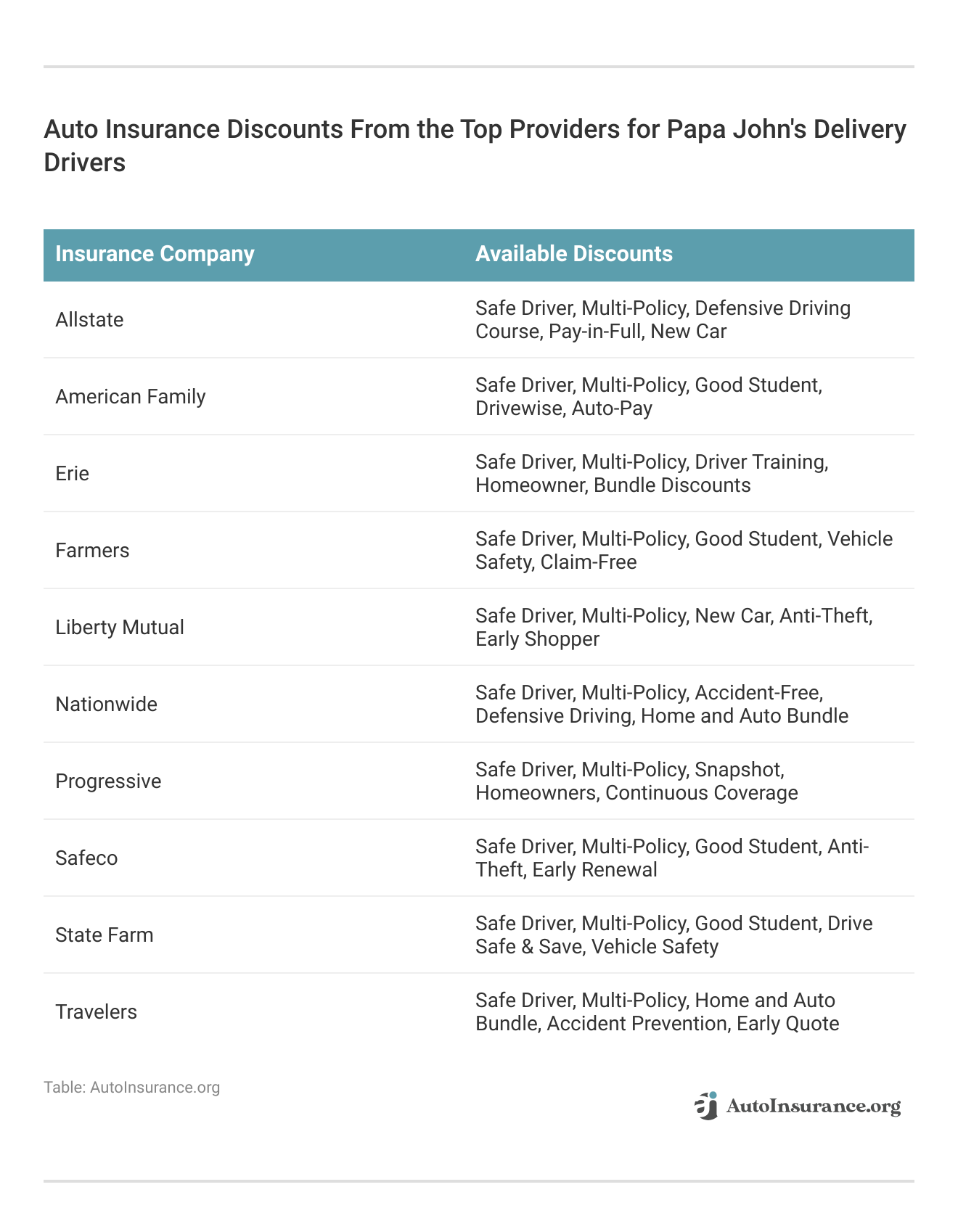

Monthly Auto Insurance Rates for Papa John’s Delivery Drivers

When selecting auto insurance as a Papa John’s delivery driver, understanding the differences in monthly rates by coverage level is crucial. Below is a detailed breakdown of the minimum and full coverage rates from various providers. Explore more coverage options in our guide titled “Cheap Full Coverage Auto Insurance.”

Papa John's Delivery Driver Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $190

American Family $87 $176

Erie $83 $174

Farmers $85 $185

Liberty Mutual $100 $200

Nationwide $80 $170

Progressive $85 $175

Safeco $82 $172

State Farm $90 $180

Travelers $88 $178

The table highlights the monthly rates across different insurance providers for Papa John’s delivery drivers. Nationwide offers the most affordable rates, with $80 for minimum coverage and $170 for full coverage. On the higher end, Liberty Mutual charges $100 for minimum coverage and $200 for full coverage.

Providers like Erie, Safeco, and Progressive offer competitive rates, with full coverage hovering around $172 to $175. This comparison allows Papa John’s delivery drivers to choose a provider that balances cost with the level of protection needed for their job.

Insurance Coverage for Papa John’s Drivers

Some delivery companies offer their employees a certain amount of commercial auto insurance coverage when actively making deliveries. But Papa John’s does not provide its employees with car insurance coverage.

Instead, Papa John’s requires that its employees purchase liability coverage. Papa John’s delivery drivers must also be at least 18 years old and have a valid U.S. driver’s license. Explore your high-risk insurance options in our guide titled “Can I keep auto insurance with a revoked driver’s license?”

If you drive for Papa John’s or are considering it, you should look into purchasing more than just liability coverage for your vehicle.

Essential Insurance Coverage for Papa John’s Delivery Drivers

The amount of insurance you need as a Papa John’s delivery driver varies based on where you live.

Each US state has different car insurance requirements for liability coverage regarding bodily injury and property damage. Therefore, if you live in a state that requires more coverage, you can expect to pay higher rates for your car insurance than if you live in a state that requires less liability insurance.

The table below shows how much liability coverage is required in each state. The coverage is broken down into bodily injury liability per person, bodily injury liability per accident, and property damage coverage.

Liability Auto Insurance Requirements by State

State Requirement

Alabama 25/50/25

Alaska 50/100/25

Arizona 15/30/10

Arkansas 25/50/25

California 15/30/5

Colorado 25/50/15

Connecticut 25/50/20

Deleware 25/50/10

District of Columbia 25/50/10

Florida 10/20/10

Georgia 25/50/25

Hawaii 20/40/10

Idaho 25/50/15

Illinois 25/50/20

Indiana 25/50/25

Iowa 20/40/15

Kansas 25/50/25

Kentucky 25/50/25

Lousiana 15/30/25

Maine 50/100/25

Maryland 30/60/15

Massachusetts 20/40/5

Michigan 20/40/10

Minnesota 30/60/10

Mississippi 25/50/25

Missouri 25/50/25

Montana 25/50/20

Nebraska 25/50/25

Nevada 25/50/20

New Hampshire 25/50/25

New Jersey 15/30/5

New Mexico 25/50/10

New York 25/50/10

North Carolina 30/60/25

North Dakota 25/50/25

Ohio 25/50/25

Oklahoma 25/50/25

Oregon 25/50/20

Pennsylvania 15/30/5

Rhode Island 25/50/25

South Carolina 25/50/25

South Dakota 25/50/25

Tennessee 25/50/15

Texas 30/60/25

Utah 25/65/15

Vermont 25/50/10

Virginia 25/50/20

Washington 25/50/10

West Virginia 25/50/25

Wisconsin 25/50/10

Wyoming 25/50/20

If you are unsure whether your current auto insurance coverage meets your state’s liability requirements, look at your insurance policy. And be sure to call your insurance company and speak to a representative if you have any questions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Coverage Needs for Papa John’s Drivers

You do not have to purchase more than liability coverage to drive for Papa John’s. But it would be best if you considered buying additional coverage as you are at a higher risk for an accident due to the nature of your job.

Additionally, many insurance companies have exclusions in their personal auto insurance policies that state if you are in an accident while using your car for work purposes, your claim can be denied.

As a result, many delivery drivers and others who use their cars for their jobs decide to purchase a commercial auto insurance policy.

Understanding Commercial Auto Insurance

Commercial car insurance is a type of policy that protects business vehicles in both accident and non-accident-related incidents.

Commercial car insurance can cost up to $167 monthly, but the coverage limits are essential for frequent drivers who could face significant financial burdens if responsible for damages in a car accident.

If you do not drive for Papa John’s full time, you may be able to purchase a business-use add-on with your insurance company. This add-on allows you to drive your car for work a certain number of hours per week. So if you work for Papa John’s part-time, this coverage could help you save money while offering the type of protection you need.

Papa John’s Delivery Drivers: Auto Insurance Rate Breakdown

Since Papa John’s doesn’t offer its employees complimentary auto insurance coverage, you will have to find your own insurance. The amount you will pay for insurance depends on several factors, such as:

- Location

- Coverage Types

- Age and Gender

- Vehicle Make and Model

- Driving Frequency and Usage

If you have a clean driving record and you don’t live or drive in a risky area, you may be able to find cheap auto insurance rates as a delivery driver. But you’ll never know until you start your search.

Progressive’s flexibility in coverage options makes it the top choice for Papa John’s delivery drivers.Jeff Root Licensed Insurance Agent

The table below shows the average monthly rates for each state in terms of liability, collision, comprehensive, and full coverage policies.

Auto Insurance Monthly Rates by State & Coverage Type

State Liability Collision Comprehensive Full Coverage

Alabama $35 $27 $13 $75

Alaska $47 $30 $12 $89

Arizona $45 $23 $16 $84

Arkansas $34 $27 $16 $78

California $42 $34 $8 $84

Colorado $45 $24 $15 $85

Connecticut $57 $31 $11 $99

Delaware $67 $27 $10 $104

Florida $74 $24 $10 $108

Georgia $50 $28 $13 $91

Hawaii $39 $26 $9 $73

Idaho $31 $19 $10 $59

Illinois $38 $26 $11 $75

Indiana $33 $21 $10 $64

Iowa $26 $19 $16 $60

Kansas $30 $22 $20 $73

Kentucky $45 $23 $12 $80

Louisiana $68 $35 $18 $121

Maine $29 $22 $8 $60

Maryland $53 $30 $13 $95

Massachusetts $51 $33 $11 $95

Michigan $68 $35 $13 $116

Minnesota $38 $20 $15 $73

Mississippi $39 $27 $18 $84

Missouri $36 $23 $15 $75

Montana $33 $22 $19 $74

Nebraska $31 $20 $19 $71

Nevada $60 $26 $10 $95

New Hampshire $34 $25 $9 $68

New Jersey $75 $32 $11 $117

New Mexico $43 $23 $15 $80

New York $69 $33 $14 $115

North Carolina $30 $25 $11 $65

North Dakota $25 $21 $20 $65

Ohio $34 $23 $10 $67

Oklahoma $39 $27 $19 $85

Oregon $51 $19 $8 $78

Pennsylvania $42 $28 $12 $82

Rhode Island $66 $35 $11 $111

South Carolina $46 $22 $15 $84

South Dakota $26 $18 $22 $65

Tennessee $36 $26 $12 $74

Texas $46 $32 $17 $95

Utah $43 $22 $9 $74

Vermont $30 $25 $11 $66

Virginia $36 $24 $12 $72

Washington $51 $22 $9 $82

Washington, D.C. $55 $39 $19 $114

West Virginia $42 $28 $17 $87

Wisconsin $32 $19 $12 $62

Wyoming $28 $23 $21 $73

You will find the cheapest rates in your state if you purchase a liability-only policy. As you add coverages to your policy, your rates will increase accordingly. The best way to find cheap rates in your area is to shop online and compare quotes from multiple companies.

In addition, you should keep in mind that if you only purchase liability insurance, you are not protecting yourself or your vehicle from harm in the event of an accident.

Key Takeaways: Papa John’s Auto Insurance

If you drive for Papa John’s, you need car insurance. You can purchase a liability-only policy and drive for the company, but you should consider purchasing additional coverage to ensure you and your vehicle are protected. “Can you view your auto insurance policy online?”

The best way to find cheap car insurance rates is to shop online and compare quotes from multiple insurance companies. This will help you find the coverage you want at a price that works with your budget.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

What is Papa John’s auto insurance?

Papa John’s auto insurance refers to the insurance coverage specifically designed for vehicles used by Papa John’s employees or the company itself for business purposes. It provides financial protection in case of accidents, damage to the vehicle, or injuries to individuals involved in a car accident while using a Papa John’s vehicle for work-related tasks.

For additional details, explore our comprehensive resource titled, “Do auto insurance companies check employment status?”

Do Papa John’s employees need auto insurance?

Yes, Papa John’s employees who operate company-owned vehicles or use their personal vehicles for work-related purposes may need auto insurance. The specific insurance requirements can vary based on the employment agreement and the policies of the Papa John’s franchise or corporate entity.

What type of auto insurance do Papa John’s employees need?

Papa John’s employees who operate company-owned vehicles for business purposes typically need commercial auto insurance. If they use their personal vehicles for work-related tasks, they may need a commercial auto policy or an endorsement on their personal auto insurance to cover business use. It’s important for employees to check with their employer or insurance provider to determine the appropriate coverage.

Does Papa John’s provide auto insurance for its employees?

Papa John’s may provide auto insurance coverage for its employees who operate company-owned vehicles for business purposes. The specific insurance arrangements can vary depending on the franchise or corporate policies. Employees should consult their employer or human resources department to understand the insurance coverage provided by Papa John’s.

To find out more, explore our guide titled, “Best Delivery Driver Auto Insurance.”

What should I do in case of an accident while using a Papa John’s vehicle?

If you’re in an accident while using a Papa John’s vehicle, first ensure safety, call the police, and exchange contact and insurance details with the other driver(s). Document the scene with photos, report the accident to your supervisor immediately, and cooperate with the employer’s insurance by providing the necessary information.

Do I need special coverage to drive for Papa John’s?

Yes, to drive for Papa John’s, you may need to consider additional coverage, like a commercial policy or business-use add-on, beyond your personal auto insurance.

Do I need special delivery insurance to work for Papa John’s?

Yes, Papa John’s delivery insurance is necessary as your personal auto policy might not cover accidents that occur while you’re working.

See details in our guide titled, “Best Auto Insurance Companies for Accident Forgiveness.”

Does Papa John’s offer health insurance?

Yes, Papa John’s offers health insurance to eligible employees, which includes medical, dental, and vision plans.

Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

What is Papa John’s delivery driver insurance?

Papa John’s delivery driver insurance is additional coverage drivers should consider to ensure they are protected while making deliveries, as personal auto policies may not be sufficient.

What are the requirements to become a Papa John’s delivery driver?

Papa John’s delivery driver requirements include being at least 18 years old, having a valid driver’s license, and maintaining proper auto insurance coverage.

To learn more, explore our comprehensive resource on our article titled, “Cheap Auto Insurance for 18-Years-Old.”

What is the best option for cheap car insurance for delivery drivers?

How can I find cheap pizza delivery insurance?

Do I need commercial auto insurance to deliver pizza?

Is commercial auto insurance included in Papa John’s insurance?

Can I rely solely on my personal policy for Papa John’s insurance needs?

What are the auto insurance requirements for Papa John’s delivery drivers in Delaware, Ohio?

How do I meet the requirements for Papa John’s insurance as a delivery driver?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.