Best Auto Insurance for Seniors in Florida (Top 10 Companies Ranked for 2026)

The Hartford, Geico, and State Farm have the best auto insurance for seniors in Florida, with rates starting at $29 per month. The Hartford sells AARP car insurance for seniors, but you have to be a member to purchase it. Seniors not affiliated with AARP will find low rates and excellent coverage options at Geico.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated October 2024

765 reviews

765 reviewsCompany Facts

Full Coverage for Seniors in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Seniors in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Seniors in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best auto insurance for seniors in Florida comes from The Hartford, Geico, and State Farm. The Hartford is our top choice for senior auto insurance because it offers coverage specifically crafted for older drivers.

However, The Hartford only sells the best Florida auto insurance to AARP members. If that doesn’t apply to you, Geico is your best option. Compare more senior auto insurance companies below:

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Florida

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Exclusive Benefits | The Hartford |

| #2 | 25% | A++ | Cheap Rates | Geico | |

| #3 | 30% | B | Local Agents | State Farm | |

| #4 | 40% | A+ | Infrequent Drivers | Allstate | |

| #5 | 30% | A+ | Online Tools | Progressive | |

| #6 | 30% | A | Add-on Coverages | Liberty Mutual |

| #7 | 30% | A++ | Customer Service | Travelers | |

| #8 | 30% | A | Group Discounts | Farmers | |

| #9 | 40% | A+ | Vanishing Deductible | Nationwide |

| #10 | 30% | A+ | Dividend Payments | Amica |

Read on to learn more about Florida car insurance rates for seniors, including where to find the best coverage.

Then, enter your ZIP code into our free comparison tool to find personalized quotes.

- Florida auto insurance rates for seniors are higher than the national average

- Seniors can save by finding discounts and comparing quotes

- The Hartford and Geico have the best senior auto insurance in Florida

#1 – The Hartford: Top Pick Overall

Pros

- AARP Partnership: The Hartford offers exclusive benefits and auto insurance discounts in Florida for seniors who are AARP members.

- Lifetime Renewability: When you buy AARP car insurance for seniors in Florida through The Hartford, you don’t have to worry about your coverage being dropped as you get older.

- RecoverCare: As part of its commitment to serving seniors, you can get help with home services in Florida when you’ve been injured in an accident with RecoverCare. Learn more in our auto insurance review of The Hartford.

Cons

- Higher Premiums: The Hartford may offer the best car insurance for seniors over 65 in Florida, but it comes at a price. This provider typically costs more than others, especially for full coverage.

- AARP Exclusive: As the exclusive auto insurance provider for AARP in Florida, The Hartford only sells senior coverage to AARP members.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Florida Rates

Pros

- Affordable Rates: Geico is known for offering some of the cheapest car insurance for seniors in Florida. See how much you might pay in our Geico auto insurance review.

- Strong Digital Presence: With its user-friendly website and mobile app, Geico offers the most convenient car insurance in Florida for seniors.

- Discounts for Seniors: Geico offers 16 auto insurance discounts to help drivers save, many of which Florida seniors may qualify for.

Cons

- Average Claims Service: Geico may offer the cheapest car insurance for seniors over 60 in Florida, but many customers report problems with the claims handling process.

- Limited Customization: Despite being one of the largest senior insurance companies in Florida, Geico offers fewer options for tailoring car insurance coverage.

#3 – State Farm: Best for Personalized Service

Pros

- Extensive Agent Network: With a strong local presence in Florida, State Farm makes it easy to find personalized auto insurance service and support for seniors.

- Drive Safe & Save: State Farm offers a usage-based insurance (UBI) program in Florida called Drive Safe & Save. Enrolling in this program and consistently practicing safe habits can save senior drivers 30% on their auto insurance.

- Good Driver Discounts: If you’re not interested in enrolling in a UBI program, you can still save on senior car insurance in Florida with multiple discounts for safe driving and vehicle safety features.

Cons

- Average Digital Experience: State Farm doesn’t impress many seniors in Florida with its digital auto insurance policy management tools.

- Slower Claims Process: With a slow claims handling process, many Florida senior drivers report being unsatisfied. See what customers have to say in our State Farm auto insurance review.

#4 – Allstate: Best for Infrequent Drivers

Pros

- Low-Mileage Savings: Tech-savvy drivers who don’t drive often qualify for pay-per-mile insurance. Learn how to get low Florida auto insurance rates for seniors in our Allstate Milewise review.

- Retirement Discounts: Allstate is one of the few companies that offer senior citizen car insurance discounts for retired drivers in Florida.

- Full Coverage Policies: Allstate offers a lot more than basic senior car insurance choices in Florida. Create a policy perfect for your needs with Allstate’s ample add-on choices.

Cons

- Higher Rates: If you want the lowest senior auto insurance quotes possible in Florida, Allstate is probably not the best choice.

- Inconsistent Customer Service: Senior Florida drivers are undecided about this company’s customer service. While some love it, others hate the Allstate customer service car insurance experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for a Digital Insurance Experience

Pros

- Snapshot Program: Get the best senior auto insurance rates in Florida by enrolling in Progressive’s Snapshot, which offers a maximum discount of 30%. Compare savings in our Progressive auto insurance review.

- Advanced Digital Tools: Florida senior car insurance from Progressive comes with some of the best digital tools in the business, like the Name Your Price tool.

- Loyalty Discounts: Get an automatic senior discount on your Progressive policy by being a customer for at least a year. Your loyalty discount increases the longer you’re a Florida customer.

Cons

- Higher Rates for Non-Participants: You can get cheap Florida car insurance rates for seniors if you enroll in Snapshot. However, Progressive may not be the cheapest if you don’t sign up.

- Complex Pricing Structure: Progressive’s senior car insurance pricing in Florida can be complicated to understand.

#6 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Customizable Coverage Options: Liberty Mutual offers a wide range of add-ons. See how to get the best senior car insurance in Florida in our Liberty Mutual auto insurance review.

- RightTrack: Liberty Mutual offers an auto insurance discount of up to 30% to senior drivers in Florida who sign up for RightTrack.

- Defensive Driver Discount for Seniors: Get cheap Florida auto insurance for seniors by completing a defensive driver course approved by Liberty Mutual.

Cons

- Higher Average Rates: Liberty Mutual isn’t always the cheapest option for Florida coverage, especially if you need auto insurance for seniors over 80.

- Limited Digital Tools: Seniors looking for robust digital tools will likely find Liberty Mutual’s auto insurance offerings in Florida lacking.

#7 – Travelers: Best Support for Senior Drivers

Pros

- Superb Customer Service: Get the best car insurance for seniors over 70 in Florida from Travelers friendly and helpful customer service representatives.

- Customizable Policies: Travelers gives seniors a variety of flexible car insurance options in Florida to suit just about any need.

- Financial Stability: A.M. Best gives Travelers an A++ for its financial stability. See more of how Florida seniors rate this company in our Travelers auto insurance review.

Cons

- Expensive Coverage: Travelers is often more expensive than most senior auto insurance companies in Florida.

- Mixed Customer Service Reviews: Many senior drivers in Florida report inconsistent experiences with Travelers customer service representatives regarding auto insurance issues.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best Senior Auto Insurance Discounts

Pros

- Strong Local Presence: Seniors can get help with auto insurance problems by contacting any of Farmers’ local agents located throughout Florida.

- Ample Selection of Discounts: Seniors looking for the best cheap car insurance in Florida should consider Farmers for its 23 discount opportunities.

- Good Customer Support: With high ratings for customer service and claims handling, Farmers makes sure all of its senior drivers in Florida get the car insurance support they need.

Cons

- Higher Prices: Farmers isn’t the best choice for cheap senior auto insurance quotes — many Florida insurance providers offer more affordable rates.

- Slower Claims: Many Florida seniors report that Farmers took much longer than expected to resolve claims. Explore the claims process in our Farmers auto insurance review.

#9 – Nationwide: Best for Safe Driver Savings

Pros

- Vanishing Deductible Program: Nationwide rewards safe driving with deductible savings, which is ideal for Florida seniors who prioritize safety. See how it works in our Nationwide auto insurance review.

- UBI Programs: Nationwide has two different UBI programs — SmartRide and SmartMiles. SmartRide offers one of the best car insurance discounts for Florida seniors on the market at an impressive 40%.

- Strong Customer Service Ratings: Most Nationwide senior drivers over 60 who live in Florida report feeling satisfied with their auto insurance policies and the company’s service.

Cons

- Higher Rates for High-Risk Drivers: High-risk car insurance for seniors in Florida is always more expensive, but drivers at Nationwide will pay much higher rates.

- Limited Local Offices: Nationwide has fewer physical locations in Florida, making it more difficult for seniors to get personalized help with their auto insurance.

#10 – Amica Mutual: Best for Dividend Payouts

Pros

- High Customer Satisfaction: Amica Mutual is known for exceptional customer service, which is especially beneficial for Florida seniors who value personalized attention on their auto insurance policies.

- Dividend Policies: As a mutual company in Florida, senior drivers have the potential to receive a portion of their premiums back every year. See how it works in our Amica auto insurance review.

- Excellent Coverage Options: Amica offers a broad range of coverage options with flexible add-ons so you can get cheap Florida car insurance for seniors that meets all your needs.

Cons

- Higher Premiums: Since it specializes in full coverage policies for expensive vehicles, Amica Mutual isn’t usually the most affordable Florida senior auto insurance choice.

- Lacking Coverage Options: Amica Mutual doesn’t have as many add-on options as some of the larger Florida senior car insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Florida Auto Insurance Rates for Seniors

Florida car insurance rates are some of the highest in the nation. Take a look below to see how much you might pay for auto insurance at our top Florida companies for seniors.

Florida Senior Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $60 | $179 |

| Amica | $100 | $220 |

| Farmers | $75 | $222 |

| Geico | $29 | $87 |

| Liberty Mutual | $53 | $158 |

| Nationwide | $34 | $100 |

| Progressive | $50 | $149 |

| State Farm | $33 | $97 |

| The Hartford | $95 | $210 |

| Travelers | $55 | $163 |

While there are many factors that affect car insurance rates, Florida prices are high primarily due to weather risks, vehicle crime rates, and a higher number of car accidents.

When you’re shopping for coverage, you should keep in mind that some auto insurance companies are pulling out of Florida. It’s especially important in the Sunshine State to research your options to ensure you get a reliable policy.

How to Save on Florida Auto Insurance for Seniors

Although Florida car insurance rates are expensive, there are plenty of ways to save without skimping on your coverage. For example, the best personal injury protection insurance companies can help you find the perfect Florida policy at the right price.

There are plenty of alternative methods to finding affordable coverage in Florida. To get cheap senior auto insurance rates, try the following tips:

- Lower your coverage limits.

- Increase your deductible.

- Improve your credit score.

- Keep your driving record clean.

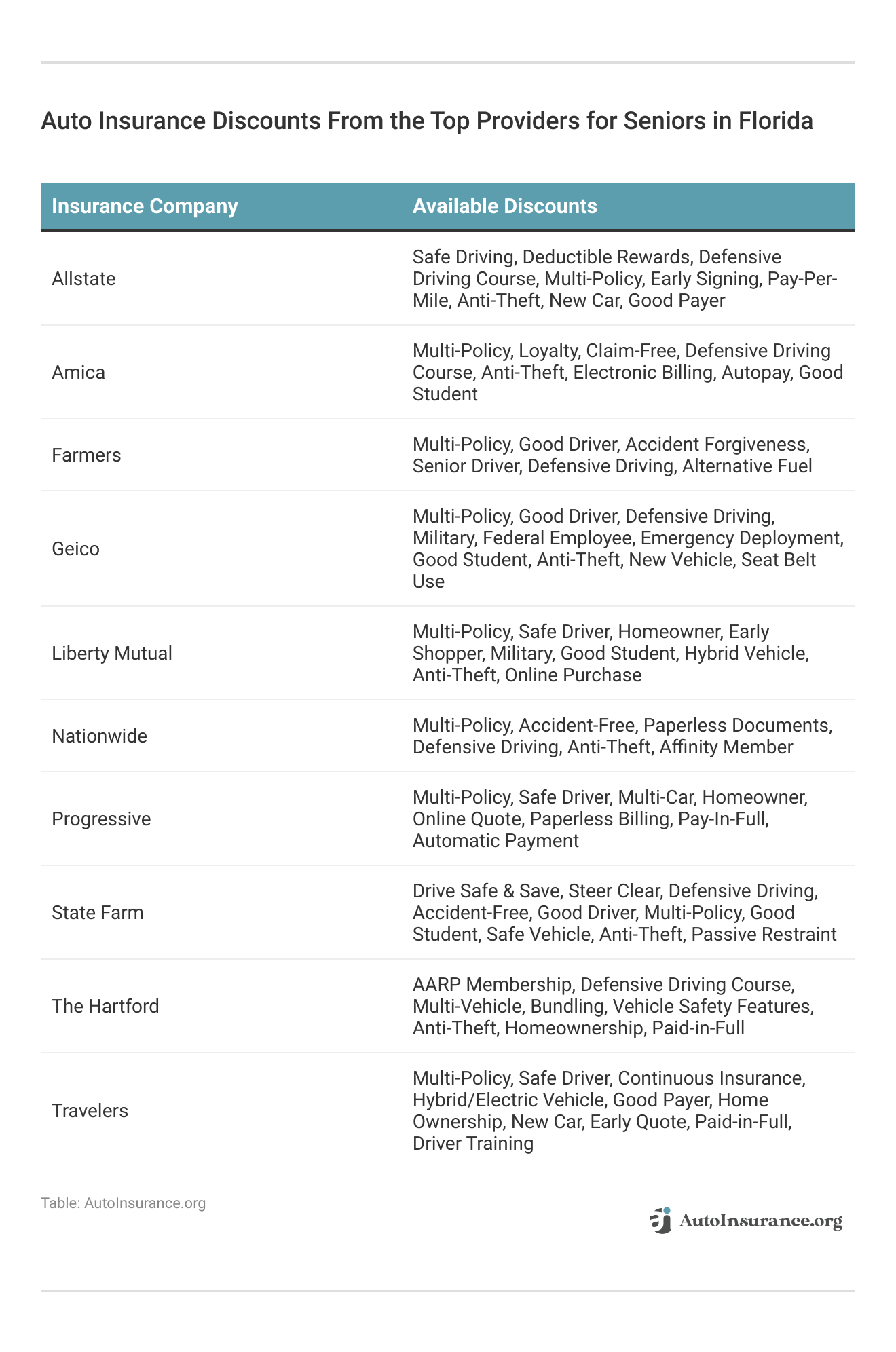

Another easy way to find low Florida rates is to look for discounts. Most companies offer a variety of auto insurance discounts to help you save.

Florida car insurance rates are high for many reasons, and the prices are still increasing. That applies to other types of insurance in Florida as well, especially for home, renters, and other types of property coverage.Jimmy McMillan Licensed Insurance Agent

Choosing the company with the most discounts you might qualify for will help you save. Explore your discount options from our top Florida car insurance companies below.

While saving money on your insurance is important, it’s not the only thing to consider. For example, many companies have programs in place to help seniors get the most out of their coverage. They may not be the cheapest companies, but their insurance options can be invaluable.

We’re developing a digital solution that may help seniors live more independently at home for as long as possible, all while staying connected to their care circles. #HereToHelp https://t.co/1eBaLL7GgL pic.twitter.com/KVe5TOB4TQ

— State Farm (@StateFarm) August 27, 2019

However, if you need to keep your monthly premium as low as possible, a final step to take is to compare quotes. If you don’t look at multiple quotes, you’ll likely overpay for senior car insurance in Florida.

Auto Insurance Requirements in Florida for Seniors

Before you can drive on a public street in Florida, you need to meet the minimum car insurance requirements by state law. Florida minimum auto insurance requirements include the following:

- $10,000 of personal injury protection coverage

- $10,000 of property damage liability insurance

Understanding car insurance laws and your own needs can be confusing. However, there’s no reason to figure it out alone — check out our guide to auto insurance laws. In fact, when you get an insurance quote, most companies will offer an insurance policy that meets the minimum Florida requirements.

If you’d like to save time by getting multiple quotes at once, a quote-generating tool will also offer rates for minimum insurance requirements.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Find the Best Auto Insurance for Seniors in Florida Today

Learning how to get multiple auto insurance quotes is an important part of finding affordable coverage for seniors. Once you know how the next step is to get personalized quotes from as many companies as possible.

The Hartford, Geico, and State Farm have the best auto insurance for seniors in Florida with exclusive policy benefits and low rates for drivers over the age of 65.Laura D. Adams Insurance & Finance Analyst

Once you’re ready, you can enter your ZIP code into our free comparison tool to see quotes from companies in your area.

Frequently Asked Questions

What are the best auto insurance companies in Florida for seniors?

According to our research shows, the best auto insurance companies for seniors in Florida are The Harford, Geico, and State Farm.

How much does Florida auto insurance cost for seniors?

While there are many driving and non-driving factors that impact auto insurance, the average senior driver in Florida pays $65 per month for minimum policies and $158 for full coverage.

Is auto insurance more expensive for seniors?

Generally speaking, older drivers pay affordable rates. Average car insurance rates by age can vary significantly, but older adults won’t see their rates increase until about the age of 75 unless they have a bad driving record.

Why do insurance rates increase after you turn 75?

Drivers older than 75 pay higher rates for a few reasons, including slower reaction times, higher chances of being physically injured in an accident, and worsening eyesight. Enter your ZIP code into our comparison tool to see exactly how much you might pay based on your age.

What are the best ways for seniors to save on their car insurance?

To save on insurance, older drivers should lower the level of coverage in their policies, pick a higher deductible, look for discounts, and compare as many quotes as possible.

Are there auto insurance discounts for seniors in Florida?

While there aren’t many companies that offer discounts specifically for seniors, most providers offer a list of ways to save, including safe driving, having safety features in their cars, and buying multiple policies from the same company. Seniors who regularly practice safe driving should also consider getting cheap usage-based auto insurance to help them save.

Which company does AARP recommend for car insurance for seniors?

The Hartford has partnered with AARP to offer seniors superb coverage and affordable rates.

What are the minimum insurance requirements in Florida?

Florida car insurance requirements include $10,000 worth of both personal injury protection and property damage liability insurance.

What happens if you drive without car insurance in Florida?

Driving without car insurance in Florida comes with serious consequences, including fines and the suspension of your license and registration. If you’re a repeat offender, you may face jail time.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.