Best Auto Insurance for Seniors in Mississippi (Top 10 Companies Ranked for 2026)

The best auto insurance for seniors in Mississippi comes from Farmers, Progressive, and State Farm, rates start as low as $20/month. These companies provide comprehensive coverage, online convenience, and excellent service, known for tailored, affordable policies for seniors in Mississippi.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated January 2025

Company Facts

Full Coverage for Seniors in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance for seniors in Mississippi comes from Farmers, Progressive, and State Farm, with premium service and low rates starting at $20/month.

Farmers excels with top coverage and discounts, while Progressive and State Farm also offer strong benefits with comprehensive coverage and great service.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Mississippi

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 20% A Comprehensive Coverage Farmers

![]()

#2 10% A+ Online Convenience Progressive

![]()

#3 17% B Customer Service State Farm

![]()

#4 13% A++ Flexible Policies Travelers

![]()

#5 10% A++ Military Support USAA

![]()

#6 25% A Local Agents American Family

#7 25% A Innovative Solutions Liberty Mutual

#8 20% A+ Financial Stability Nationwide

![]()

#9 25% A++ Competitive Rates Geico

![]()

#10 25% A+ Personalized Options Allstate

Comparing these options will help you find the best senior auto insurance in Mississippi. To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool above to instantly compare prices from various companies near you.

- Farmers provides the best auto insurance for seniors in Mississippi

- State Farm reviews rank it the best for senior car insurance customer service

- USAA has the cheapest senior auto insurance rates at $20/month

#1 – Farmers: Top Overall Pick

Pros

- Comprehensive Coverage: Farmers offers extensive coverage options that cater well to seniors in Mississippi, providing peace of mind with robust protection.

- Flexible Discounts: Seniors in Mississippi can benefit from a variety of discounts that may help reduce overall insurance costs. Read more in our review of Farmers.

- Tailored Plans: Farmers’ plans can be customized to meet the specific needs of seniors in Mississippi, offering a personalized approach to coverage.

Cons

- Limited Online Tools: Seniors in Mississippi may find Farmers’ online tools less user-friendly compared to competitors, which can make managing comprehensive coverage more difficult.

- Limited Local Presence: Availability of Farmers agents might be limited in some rural areas of seniors in Mississippi, which could be inconvenient for some seniors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best Online Tools for Seniors

Pros

- User-Friendly Online Tools: Progressive’s online tools are accessible to seniors in Mississippi, making it easy to manage policies, make payments, and file claims.

- Usage-Based Savings: Senior drivers in Mississippi can sign up for Progressive Snapshot and save up to 30% with safe driving habits.

- Discounts for Safe Driving: Progressive offers additional discounts for safe driving, which can benefit seniors in Mississippi who take a defensive driving course. Read more in our Progressive review.

Cons

- Customer Service: Some seniors in Mississippi may find Progressive’s customer service less personal compared to other companies, potentially affecting their experience.

- Limited Personalized Coverage Options: Seniors in Mississippi might find Progressive’s coverage options less tailored to their specific needs compared to competitors.

#3 – State Farm: Best Customer Service

Pros

- Exceptional Customer Service: State Farm is known for its excellent customer service, which is particularly beneficial for seniors in Mississippi who may need more assistance.

- Discounts for Safe Driving: Seniors in Mississippi can take advantage of State Farm’s safe driving discounts, which reward older drivers who maintain a clean driving record.

- Comprehensive Policies: State Farm offers a range of policies that can be well-suited to the unique needs of seniors in Mississippi. Read our State Farm review to learn what else is offered.

Cons

- Complexity of Policies: The wide range of coverage options might be overwhelming for some seniors in Mississippi, making it difficult to choose the best policy.

- Limited Online Tools: Seniors in Mississippi who prefer managing their policies online may find State Farm’s digital tools less user-friendly compared to other companies.

#4 – Travelers: Best for Flexible Policies

Pros

- Flexible Policies: Travelers offers flexible policy options that can be customized to fit the specific needs of seniors in Mississippi, which you can learn about in our Travelers review.

- Cheap Rates: Travelers senior auto insurance only costs $32/month for minimum coverage, which is cheaper than other Mississippi companies

- Discounts for Seniors: Seniors in Mississippi may benefit from various discounts offered by Travelers, helping to reduce insurance costs.

Cons

- Customer Service Variability: Seniors in Mississippi might experience inconsistent customer service, depending on their location.

- Less Competitive Rates for Low-Mileage Drivers: Seniors in Mississippi who drive less may find Travelers’ low-mileage discounts less competitive compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Retired Military

Pros

- Military Support: USAA offers excellent support for military families, which can be beneficial for seniors in Mississippi with a military background. Learn more in our USAA review.

- Competitive Rates for Members: Seniors in Mississippi who are USAA members can access competitive rates that are often lower than those of other insurers.

- Strong Financial Stability: USAA’s financial stability provides reassurance to seniors in Mississippi that their insurance provider is reliable.

Cons

- Eligibility Restrictions: USAA’s services are limited to military families, so many seniors in Mississippi may not be eligible.

- Limited Local Presence: USAA may have fewer local offices in Mississippi, potentially making in-person assistance less accessible for some seniors.

#6 – American Family: Best for Local Agents

Pros

- Local Agents: American Family’s network of local agents in Mississippi can provide personalized service to seniors, enhancing their insurance experience.

- Customizable Policies: The ability to tailor policies to specific needs is beneficial for seniors in Mississippi looking for customized coverage.

- Senior Discounts: American Family offers various discounts for seniors in Mississippi, helping to lower insurance costs, which you can check out in our American Family review.

Cons

- Limited Online Tools for Tech-Savvy: Seniors in Mississippi who prefer managing their insurance online may find American Family’s digital tools less comprehensive compared to other providers.

- Inconsistent Service: The quality of service might vary depending on the local agent, which could affect the experience of seniors in Mississippi.

#7 – Liberty Mutual: Best for Innovative Solutions

Pros

- Innovative Solutions: Liberty Mutual’s innovative insurance solutions offer seniors in Mississippi advanced coverage options tailored to their needs. For a complete list, read our Liberty Mutual review.

- Discounts for Safe Driving: Liberty Mutual provides discounts for safe driving, which is advantageous for seniors in Mississippi with good driving records.

- 24/7 Customer Support: Liberty Mutual agents are available 24/7 to help senior drivers in Mississippi with their policies.

Cons

- Customer Service Experience Varies: Some seniors in Mississippi might experience inconsistencies in customer service quality, which could affect their satisfaction with Liberty Mutual.

- Complex Policies: The range of options and add-ons may be confusing for some seniors in Mississippi, making it difficult to select the best policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best Financial Stability

Pros

- Financial Stability: Nationwide’s strong financial stability ensures reliable coverage for seniors in Mississippi, providing peace of mind, which you can learn about in our Nationwide review.

- Comprehensive Coverage: Nationwide offers extensive coverage options that are beneficial for seniors in Mississippi seeking thorough protection.

- Discounts for Multiple Policies: Seniors in Mississippi can take advantage of discounts if they bundle multiple policies with Nationwide.

Cons

- Limited Local Agents: Availability of Nationwide agents in some areas of Mississippi might be limited, potentially affecting access for some seniors.

- Variable Claim Service: Nationwide auto insurance claims satisfaction is around average, but senior drivers in Mississippi still rank it lower than other top companies on this list.

#9 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: Geico is known for competitive senior auto insurance rates in Mississippi starting at $26/month for minimum coverage.

- Online Convenience: Geico’s online tools and resources make it easy for seniors in Mississippi to manage their policies and obtain quotes from home.

- Easy Claims Process: The streamlined claims process at Geico can be beneficial for seniors in Mississippi who prefer a hassle-free experience. Discover our Geico review for a full list.

Cons

- Less Personalized Service: The emphasis on online interactions may result in less personalized service, which might not be ideal for some seniors in Mississippi.

- Limited Local Presence: Geico may have fewer local agents for seniors in Mississippi, potentially limiting in-person support for seniors.

#10 – Allstate: Best for Personalized Options

Pros

- Personalized Options: Allstate offers a range of personalized insurance options that can cater specifically to the needs of seniors in Mississippi.

- Senior Discounts: Allstate provides discounts for seniors, helping to make insurance more affordable for those in Mississippi. Find out more in our Allstate review.

- Flexible Payment Plans for Seniors: Allstate offers flexible payment options that can be beneficial for seniors in Mississippi, helping them manage their insurance costs more effectively.

Cons

- Fewer Digital Tools for Seniors: Allstate’s digital tools may not be as robust, potentially disadvantaging tech-savvy seniors in Mississippi.

- Variable Customer Service: The quality of customer service can vary based on the local agent, which could impact the overall experience for seniors in Mississippi.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding the Best Auto Insurance Rates for Seniors in Mississippi

Compare monthly auto insurance rates for Mississippi seniors by coverage level and provider. Rates for minimum coverage start at $20/month with USAA, while full coverage rates go up to $144/month with Allstate.

Mississippi Senior Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $54 $144

American Family $47 $120

Farmers $53 $142

Geico $26 $70

Liberty Mutual $45 $117

Nationwide $35 $94

Progressive $44 $118

State Farm $30 $81

Travelers $32 $86

USAA $20 $53

Out of our top picks, State Farm has the lowest senior car insurance rates at $30/month for minimum coverage and $81/month for full coverage. Only Geico and USAA are cheaper.

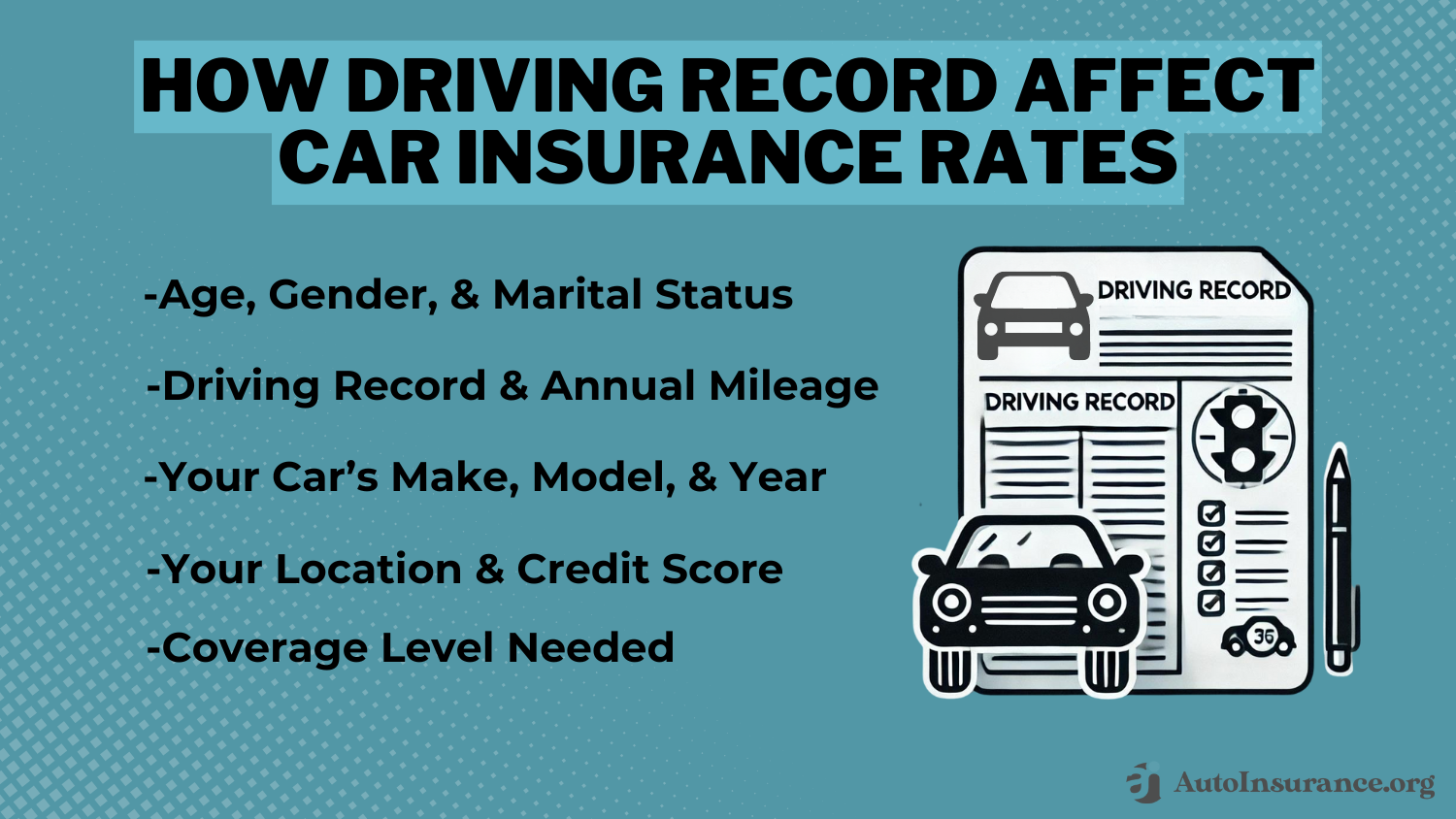

When it comes to securing the best Mississippi auto insurance, senior drivers face unique considerations that can impact their premiums. Understanding how factors like driving history to vehicle type determine rates can help in finding the most affordable and suitable coverage.

By considering factors such as your driving history, vehicle type, coverage levels, available discounts, and location, you can better manage your senior insurance costs.

Tips for Lowering Auto Insurance Costs for Seniors in Mississippi

Seniors with a clean driving record, free from accidents and traffic violations, often benefit from lower insurance rates. They can often qualify for various discounts, such as those for safe driving courses or low annual mileage. Taking advantage of these discounts can lower overall insurance costs.

Each company offers unique discounts, such as senior driver discounts and multi-policy savings, to help reduce premiums. Adjusting coverage levels by opting for higher deductibles or reducing optional coverage can also save money, as will choosing a vehicle with advanced safety features. Compare auto insurance rates by vehicle make and model to learn more.

To further reduce auto insurance costs, seniors in Mississippi should compare quotes from multiple providers to find the best rates.

Compare rates and discounts from top providers like Farmers, Progressive, and State Farm to find a plan that fits your needs and budget.

Read More: Cheap Auto Insurance for Drivers Over 60

Case Studies Evaluating Mississippi Senior Auto Insurance Options

Finding affordable and quality auto insurance can be challenging for seniors. Here, we review three case studies that approach the needs of senior drivers in Mississippi differently but effectively:

- Case Study #1 – Affordable MS Auto Insurance: Jane, a 68-year-old retiree from Jackson, chose State Farm for its excellent service and competitive rates, securing comprehensive coverage at $25/month with senior discounts.

- Case Study #2 – Transition to Comprehensive Coverage: Tom, a 72-year-old in Biloxi, upgraded to a comprehensive auto insurance policy with Farmers, starting at $142/month, after using a comparison tool to find the best coverage for his new Honda CR-V.

- Case Study #3 – Search for the Best Auto Insurance Value: Sarah, 65, in Hattiesburg, chose Geico for its $20/month plan and senior discounts, finding it the best value and appreciating its easy online management.

Whether prioritizing affordability, comprehensive coverage, or ease of management, each senior driver found a solution tailored to their unique lifestyle.

By comparing providers and understanding available discounts, seniors can make informed decisions that provide both value and peace of mind.

Read More: Cheap Auto Insurance for Drivers Over 70

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Our Top Picks for the Best Mississippi Senior Auto Insurance

Farmers, Progressive, and State Farm offer the best auto insurance for seniors in Mississippi. These top MS insurance companies have competitive rates, big discounts, and personalized customer service.

Farmers offers the best overall auto insurance for seniors in Mississippi with its top-notch coverage and competitive rates.Justin Wright Licensed Insurance Agent

Comparing auto insurance quotes from multiple providers can help seniors find the best value and save on premiums. Key factors influencing Mississippi insurance rates include driving history, vehicle type, and available discounts.

You can find affordable auto insurance by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

What is the best auto insurance for seniors in Mississippi?

The best auto insurance for seniors in Mississippi often includes companies like Farmers, Progressive, and State Farm. These providers offer competitive rates, comprehensive coverage, and excellent customer service tailored to senior drivers.

What is the average cost of auto insurance for seniors in Mississippi?

The average cost of auto insurance for seniors in Mississippi can vary, but rates typically start around $20 per month for minimum coverage. Full coverage can be higher, depending on the provider and specific coverage options.

Is auto insurance expensive in Mississippi for seniors?

Auto insurance rates in Mississippi are generally lower compared to the national average. However, costs can vary based on individual factors such as driving history, vehicle type, and coverage level.

At what age is Mississippi auto insurance the cheapest?

Mississippi car insurance rates are typically the cheapest for drivers between 55 and 65 years old. Compare auto insurance rates by age to learn more.

Who has the cheapest auto insurance for seniors in Mississippi?

Companies like Geico, USAA, and Progressive are known for offering some of the cheapest auto insurance rates for seniors in Mississippi. It’s a good idea to compare quotes from multiple providers to find the best rate for your situation. Enter your ZIP code to get free quotes from Mississippi insurers today.

How can seniors in Mississippi lower their auto insurance premiums?

Seniors in Mississippi can lower their auto insurance premiums by taking advantage of discounts for safe driving, bundling policies, opting for higher deductibles, and maintaining a clean driving record. Comparing quotes from different providers can also help find the best rates.

What type of auto insurance is required in Mississippi?

Mississippi law requires drivers to have liability insurance with a minimum coverage of $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage.

What is the penalty for not having auto insurance in Mississippi?

Driving without insurance in Mississippi can result in significant penalties, including fines, vehicle impoundment, and license suspension. The fines can range from $100 to $500, depending on the circumstances.

What is SR-22 insurance in Mississippi?

SR-22 insurance is a certificate of financial responsibility required for high-risk drivers. It verifies that you have the minimum required insurance coverage. It’s often required after violations such as DUI or driving without insurance (Learn More: High-Risk Auto Insurance Defined).

Is Mississippi a no-fault insurance state?

No, Mississippi is an at-fault state for car insurance, and drivers are allowed to sue one another for damages in an accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.