Best Auto Insurance for Seniors in North Carolina (Compare the Top 10 Companies for 2026)

State Farm, Farmers, and Nationwide sell the best auto insurance for seniors in North Carolina. State Farm has some of the most affordable senior car insurance rates and local agent assistance. Senior drivers in North Carolina will have some of the cheapest rates due to driving experience, with minimum rates starting at $13/mo.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Seniors in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Seniors in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Seniors in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsThe best auto insurance for seniors in North Carolina is at State Farm, Farmers, and Nationwide. Senior drivers can save 30% with State Farm usage-based insurance (UBI).

The top ten companies with the best auto insurance for seniors in North Carolina each offer a unique benefit to customers.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in North Carolina

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | B | Reliable Coverage | State Farm | |

| #2 | 30% | A | Comprehensive Plans | Farmers | |

| #3 | 40% | A+ | Flexible Options | Nationwide |

| #4 | 30% | A+ | Competitive Rates | Progressive | |

| #5 | 30% | A+ | Strong Reputation | Allstate | |

| #6 | 30% | A | Extensive Discounts | Liberty Mutual |

| #7 | 25% | A++ | Online Management | Geico | |

| #8 | 30% | A++ | Wide Network | Travelers | |

| #9 | 30% | A | Excellent Service | American Family | |

| #10 | 30% | A++ | Military Benefits | USAA |

To learn more about each North Carolina company for seniors, read on. We go over each company’s pros and cons, as well as ways to save on your coverage.

You can also jump right into finding senior NC auto insurance quotes by entering your ZIP in our free quote tool.

- State Farm has the best car insurance for seniors in North Carolina

- Farmers and Nationwide are the next best NC companies for seniors

- Senior auto insurance is some of the most affordable in North Carolina

#1 – State Farm: Top Pick Overall

Pros

- Reliable Coverage: State Farm has a reputation as a dependable coverage company, so seniors in North Carolina can feel safe in their coverage choices.

- Discount Options: Seniors in North Carolina can apply for good driver discounts, bundling discounts, and more.

- Local Agents: North Carolina agents offer personalized assistance to senior drivers. Read our State Farm review for more customer service details.

Cons

- Financial Rating: State Farm’s “B” rating from A.M. Best makes it the lowest-ranked NC senior auto insurance company on our list.

- Online Management: Local NC agents handle most tasks, so seniors will find online management lacking in some areas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Comprehensive Plans

Pros

- Comprehensive Plans: Senior drivers in North Carolina can easily get comprehensive coverage plans from Farmers.

- Discount Options: North Carolina senior drivers can save with over twenty discounts available at Farmers. Visit our Farmers review to learn more.

- Customer Service: Farmers has fewer NAIC complaints than expected for a North Carolina senior car insurance company of its size.

Cons

- Accident Forgiveness Costs Extra: Senior drivers in North Carolina will have to pay an extra fee to qualify for accident forgiveness.

- Higher Rates: Farmers’ rates are in the middle of the pack of best auto insurance companies for senior drivers in North Carolina, so it won’t be the cheapest choice.

#3 – Nationwide Best for Flexible Coverage

Pros

- Flexible Options: Senior drivers in North Carolina can save up to 40% with flexible usage-based coverage. Learn more by visiting our Nationwide review.

- Discount Opportunities: Senior drivers in North Carolina can save with good driver discounts and more.

- Online Management: Senior drivers can manage most North Carolina policy changes and claims online.

Cons

- Higher Rates: Nationwide’s senior auto insurance rates are higher than most of the other North Carolina companies on our list.

- Claim Reviews: Nationwide has some negative customer reviews regarding its claims, so seniors in North Carolina may run into issues.

#4 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive has the cheapest rates on average for senior drivers in North Carolina.

- Snapshot Program: Snapshot is available for free in North Carolina and rewards safe senior drivers with discounted rates.

- Coverage Options: Progressive offers multiple extras for senior drivers in North Carolina. Visit our Progressive review to learn more.

Cons

- Snapshot Rate Increases: Senior drivers in North Carolina may have increased rates if they earn bad driving scores in the program.

- Customer Service: Other senior driver companies in North Carolina have better service ratings, such as State Farm or USAA.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Strong Reputation

Pros

- Strong Reputation: Allstate has a strong reputation as one of the leading companies, making it a solid pick for North Carolina senior drivers.

- Roadside Assistance: North Carolina senior drivers can choose from three different roadside assistance plans at Allstate.

- Discount Options: Senior drivers can save on North Carolina insurance with several of Allstate’s discounts. Visit our Allstate review to learn more.

Cons

- Higher Rates: Allstate is the most expensive North Carolina company on our list for senior car insurance.

- Customer Complaints: Senior drivers in North Carolina may find service lacking, as Allstate has a higher number of customer complaints.

#6 – Liberty Mutual: Best for Extensive Discounts

Pros

- Extensive Discounts: Senior drivers in North Carolina can save with the company’s extensive discount list, which you can visit in our Liberty Mutual review.

- Coverage Options: Liberty Mutual offers comprehensive coverage options to senior drivers in North Carolina.

- Accident Forgiveness: Eligible senior drivers can enroll in the company’s accident forgiveness program to be forgiven for an accident in North Carolina.

Cons

- Claims Satisfaction: Because Liberty Mutual has lower ratings, senior drivers in North Carolina may not be completely satisfied with their claims services.

- Customer Ratings: Liberty Mutual’s customer service may not be as great as other North Carolina companies for seniors.

#7 – Geico: Best for Online Management

Pros

- Online Convenience: Geico is among the best North Carolina senior driver companies for online convenience, with a highly rated app and user-friendly website.

- Discount Options: Senior drivers in North Carolina can qualify for several discounts at Geico.

- Affordable Premiums: Geico’s rates for senior drivers are some of the cheapest in North Carolina. Visit our Geico review to learn more about its affordability.

Cons

- No Local Agents: Geico doesn’t have local NC insurance agents, so senior drivers won’t be able to get in-person help.

- Coverage Options: Geico doesn’t offer as many add-on coverage options for senior drivers in North Carolina.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Wide Network

Pros

- Wide Network: Travelers has a wide network of repair shops and more for North Carolina senior drivers.

- Coverage Options: Travelers offers more add-on coverages than usual to senior drivers in North Carolina. Visit our Travelers review to learn more.

- Bundling Discount: Travelers sells more than just auto insurance to North Carolina seniors.

Cons

- Higher Rates: Travelers is the third most expensive company on our list for North Carolina senior auto insurance.

- Customer Satisfaction: Travelers isn’t the highest-rated for customer satisfaction on our list of North Carolina senior companies.

#9 – American Family: Best for Excellent Service

Pros

- Excellent Service: American Family has local agents to help provide services to North Carolina seniors. Visit our American Family review to learn more.

- Coverage Options: Senior drivers in North Carolina can add extras like gap or roadside assistance to their policies.

- Bundling Discount: Senior drivers can purchase more than North Carolina car insurance policies from the company.

Cons

- Claims Processing: Based on ratings for the company’s overall claims satisfaction, North Carolina senior drivers’ claims may not be processed quickly.

- Higher Rates: American Family’s rates aren’t the most expensive, but it isn’t the cheapest company for North Carolina senior drivers.

#10 – USAA: Best for Military Benefits

Pros

- Military Benefits: North Carolina senior drivers will find the best military and veteran benefits at USAA. Visit our USAA review to learn more.

- Affordable Rates: USAA is one of the cheapest companies for North Carolina senior drivers.

- Roadside Assistance: Senior drivers in North Carolina can purchase roadside assistance, which is useful for older cars that are more likely to break down.

Cons

- No Local Agents: USAA provides NC auto insurance customer service to seniors virtually.

- Eligibility Restricted: USAA sells to North Carolina senior drivers who are military or veterans.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

North Carolina Senior Auto Insurance Rates by Coverage Type

Senior drivers will have a few different options for policies at the top auto insurance companies in North Carolina.

North Carolina Senior Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $70 | $166 |

| American Family | $34 | $80 |

| Farmers | $41 | $97 |

| Geico | $29 | $67 |

| Liberty Mutual | $35 | $81 |

| Nationwide | $46 | $108 |

| Progressive | $13 | $31 |

| State Farm | $32 | $75 |

| Travelers | $43 | $98 |

| USAA | $18 | $43 |

A minimum coverage policy meets the North Carolina minimum auto insurance requirements, while a full coverage policy includes collision and comprehensive insurance along with the NC minimums.

The state of North Carolina does require it, but full coverage provides the best protection. Most lenders will require it, so you’ll need it if you’re leasing or paying off your vehicle.

How Senior Drivers Can Save on North Carolina Auto Insurance

There are several ways senior drivers can lower North Carolina auto insurance rates. One simple way is to apply for discounts on senior policies that reward safe driving habits, low mileage, and defensive driving courses. (Learn More: How to Get a Defensive Driver Auto Insurance Discount).

Seniors who may have less-than-perfect driving records can still bundle home and auto insurance to get cheaper rates. State Farm gives 17% off with a bundle discount, while Farmers and Nationwide offer 20%.

Senior drivers in North Carolina will have the best rates if they keep a clean driving record and participate in good driver programs.Brandon Frady Licensed Insurance Producer

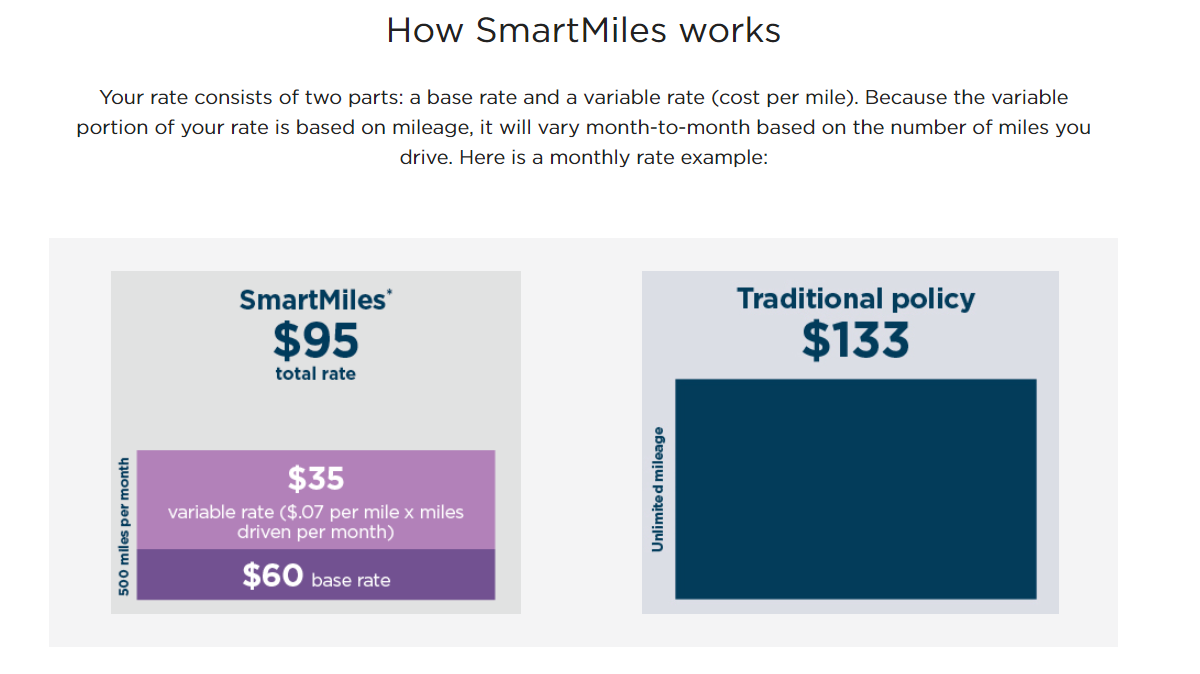

Retired seniors who drive less often can get cheaper North Carolina insurance with UBI programs. Usage-based car insurance for seniors tracks driving habits and mileage to calculate rates.

For instance, senior drivers in North Carolina can save around $60 per month with Nationwide by signing up for SmartMiles pay-as-you-go insurance.

North Carolina senior drivers with higher rates should get quotes from a few different companies to make sure that they are getting the best deal.

Finding the Best North Carolina Senior Driver Auto Insurance Companies

Senior drivers looking for a new provider should start with State Farm, Farmers, and Nationwide, as these companies have the best auto insurance for seniors in North Carolina. Each company has auto insurance discounts for seniors, comprehensive coverage options, and a good reputation in the insurance market.

Ready to shop for the best senior auto insurance in North Carolina? Compare rates today with our free quote comparison tool.

Frequently Asked Questions

Who is the best car insurance company in NC for seniors?

State Farm is the best NC company for senior drivers.

What is the cheapest auto insurance for seniors in NC?

Minimum coverage is the cheapest insurance for seniors in North Carolina. Seniors looking for the cheapest rate should use our free quote comparison tool to find cheap NC insurance.

What is the recommended auto insurance coverage in North Carolina?

We recommend that most senior drivers in North Carolina carry full coverage insurance (Learn More: Full Coverage Auto Insurance Defined).

Is Progressive insurance good in NC?

Yes, Progressive is one of the top companies in North Carolina for seniors.

Is Allstate or Progressive auto insurance cheaper?

Progressive is cheaper on average for senior drivers in North Carolina.

How do I lower auto insurance in NC?

Senior drivers looking to lower their car insurance rates can shop for quotes, drop nonessential coverages, and adjust deductibles to lower rates (Learn More: How to Lower Your Auto Insurance Rates).

What age is auto insurance most expensive?

Car insurance is the most expensive for drivers in their teen years.

Why is auto insurance so high in North Carolina?

Car insurance in North Carolina is more expensive due to the weather patterns, car accident ratios, and other local factors.

Is auto insurance cheaper in NC or SC?

Car insurance is cheaper in North Carolina (Learn More: Best South Carolina Auto Insurance).

What is the minimum auto insurance in NC?

Minimum car insurance in North Carolina is 30/60/25 in liability auto insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.