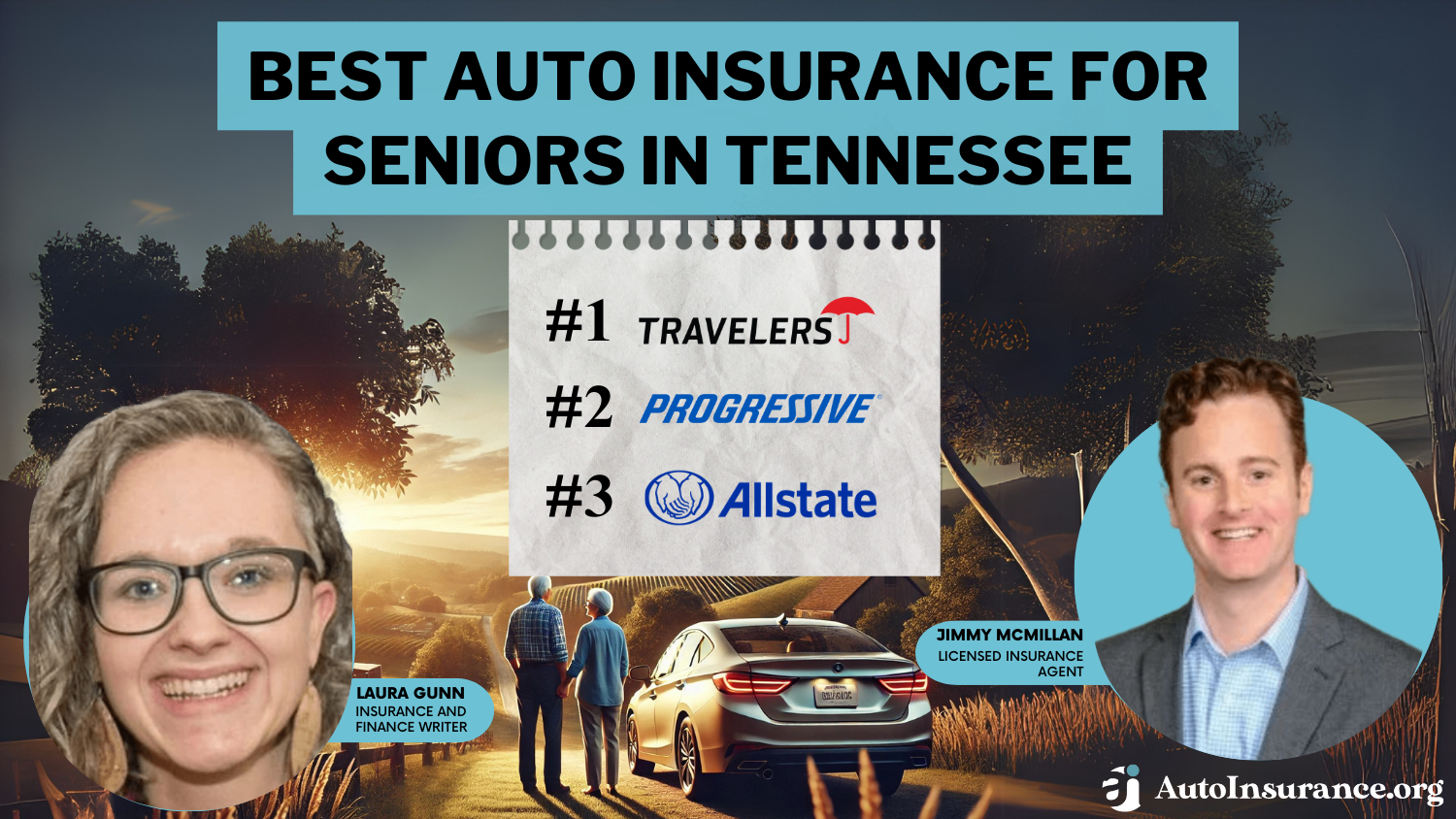

Best Auto Insurance for Seniors in Tennessee (See the Top 10 Companies for 2026)

The best auto insurance for seniors in Tennessee comes from Travelers, Progressive, and Allstate, with rates starting as low as $27 per month. Progressive and Allstate also offer extensive lists of senior discounts on Tennessee auto insurance policies. These companies are known for their reliable customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated January 2025

Company Facts

Full. Coverage for Seniors in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Seniors in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance for seniors in Tennessee is offered by Travelers, Progressive, and Allstate, with Travelers standing out for its exceptional rates starting at just $27 per month.

Travelers excels with its comprehensive plans and affordability, while Progressive and Allstate also offer strong options with great customer service and flexible coverage.

Our Top 10 Company Picks: Best Auto Insurance for Seniors in Tennessee

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 13% A++ Policy Bundling Travelers

![]()

#2 12% A+ Competitive Rates Progressive

![]()

#3 10% A+ Extensive Discounts Allstate

#4 13% A+ Senior Benefits The Hartford

![]()

#5 17% B Reliable Service State Farm

![]()

#6 15% A Flexible Policies American Family

#7 10% A Customizable Coverage Liberty Mutual

#8 20% A+ Vanishing Deductible Nationwide

![]()

#9 10% A Personalized Service Farmers

![]()

#10 8% A++ Coverage Options Geico

Each company is known for its high customer satisfaction and specialized senior policies. Find the best senior auto insurance company near you by entering your ZIP code into our free quote tool below.

- Travelers is the best auto insurance for seniors in TN at $27/month

- Senior drivers benefit from tailored coverage options and affordable premiums

- Progressive and Allstate also provide excellent coverage for senior drivers

#1 – Travelers: Top Overall Pick

Pros

- High Multi-Policy Discount: Travelers provides a 13% discount for bundling multiple policies, benefiting seniors in Tennessee looking for comprehensive coverage and savings.

- Strong A.M. Best Rating: With an A++ rating from A.M. Best, Travelers is recognized for its financial strength and reliability, making it a secure choice for auto insurance for seniors in Tennessee.

- Competitive Rates: Minimum coverage rates in Tennessee are $27, which is lower compared to many competitors. Read our full review of Travelers insurance for more information.

Cons

- Average Discounts for Seniors: While the multi-policy discount is high, Travelers’ overall discounts might not be the most extensive for auto insurance for seniors in Tennessee.

- Limited Availability of Additional Benefits: Travelers may have fewer specialized benefits tailored specifically for seniors compared to some competitors offering senior auto insurance in Tennessee.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive provides a minimum coverage rate of $28/month, which is among the cheapest Tennessee senior auto insurance companies.

- High Multi-Policy Discount: With a 12% discount for bundling, Progressive provides good savings opportunities for those seniors with multiple auto insurance in Tennessee.

- Solid A.M. Best Rating: An A+ rating from A.M. Best reflects Progressive’s strong financial stability and reliability for TN auto insurance for seniors. Get full ratings in our Progressive Review.

Cons

- Potentially Higher Costs for Full Coverage: While minimum coverage rates in Tennessee are competitive, full coverage rates can be relatively high for auto insurance for seniors in Tennessee.

- Fewer Senior-Specific Benefits: Progressive’s benefits may not be as tailored to senior drivers as some other options for auto insurance for seniors in Tennessee.

#3 – Allstate: Best for Extensive Discounts

Pros

- Comprehensive Discounts: Allstate provides a range of discounts for auto insurance for seniors in Tennessee, including a 10% multi-policy discount.

- Strong Financial Stability: With an A+ rating from A.M. Best, Allstate is a reliable choice for auto insurance for seniors in Tennessee. Read more in our Allstate auto insurance review.

- Reasonable Minimum Coverage Rates: Minimum auto insurance coverage for seniors in Tennessee costs $44, which is moderate compared to other insurers.

Cons

- Higher Full Coverage Rates: Full coverage insurance can be more expensive for auto insurance for seniors in Tennessee, with rates at $141, which might be a concern for seniors.

- Discounts May Be Complex: Understanding and maximizing all available discounts for seniors auto insurance in Tennessee can be challenging for some customers.

#4 – The Hartford: Best for Senior Benefits

Pros

- Specialized Senior Benefits: The Hartford offers tailored benefits for seniors, providing additional value and support for those seeking the best senior auto insurance in Tennessee.

- High Multi-Policy Discount: A 13% discount for bundling multiple policies helps save on auto insurance costs for seniors in Tennessee.

- Good Financial Rating: An A+ rating from A.M. Best ensures financial strength and reliability for TN senior car insurance. The Hartford auto insurance review provides more details.

Cons

- Higher Minimum Coverage Rates: Minimum coverage rates in Tennessee are $58, which is on the higher side compared to other options for seniors.

- Potentially Higher Costs for Additional Coverage: Full coverage rates can also be relatively high in Tennessee at $125 for seniors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Reliable Service

Pros

- Lowest Minimum Coverage Rates: State Farm offers the lowest minimum coverage rate in Tennessee at $22, making it a cost-effective choice for seniors seeking the best auto insurance.

- High Multi-Policy Discount: A 17% discount for bundling policies helps further reduce costs for auto insurance for seniors in Tennessee.

- Strong Reputation: State Farm has a long-standing reputation for customer satisfaction for auto insurance for seniors in Tennessee. Find out more in our State Farm company review.

Cons

- Lower A.M. Best Rating: With a B rating, State Farm’s financial strength may not be as robust as some competitors for auto insurance for seniors in Tennessee.

- Potentially Higher Premiums: Even with discounts, premiums might still be relatively high for some coverage levels for auto insurance for seniors in Tennessee.

#6 – American Family: Best for Flexible Policies

Pros

- Affordable Minimum Coverage Rates: Minimum coverage rates in Tennessee are as low as $31, making American Family a competitive option for seniors seeking the best auto insurance.

- High Multi-Policy Discount: A 15% discount for bundling policies adds value for senior drivers with multiple auto insurance needs for seniors in Tennessee. Read our American Family review for more.

- Solid Financial Rating: An A rating from A.M. Best indicates good financial stability for auto insurance for seniors in Tennessee.

Cons

- Full Coverage Rates Can Be High: Full coverage costs in Tennessee are $100, which can be more expensive compared to some other providers offering auto insurance in Tennessee.

- Fewer Senior-Specific Benefits: The range of benefits tailored specifically to seniors in Tennessee may be more limited.

#7 – Liberty Mutual: Best for Customizable Coverage

Pros

- Low Minimum Coverage Rates: With minimum senior auto insurance rates as low as $32/month, Liberty Mutual is extremely affordable. To see monthly premiums, read our Liberty Mutual review.

- Customizable Coverage: Liberty Mutual allows for high customization of auto insurance for seniors in Tennessee, catering to individual needs.

- Good Financial Rating: An A rating from A.M. Best supports Liberty Mutual’s financial reliability for auto insurance for seniors in Tennessee.

Cons

- Very Low Discounts: Only a 10% multi-policy discount in Tennessee may not be as substantial as some competitors for auto insurance for seniors in Tennessee.

- Full Coverage Costs: Full coverage rates in Tennessee are relatively high at $86 for senior drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Vanishing Deductible

Pros

- High Multi-Policy Discount: A 20% discount for bundling policies offers significant savings for seniors seeking the best auto insurance in Tennessee.

- Good Financial Stability: With an A+ rating from A.M. Best, Nationwide is financially secure for auto insurance for seniors in Tennessee.

- Vanishing Deductible Option: The vanishing deductible feature of auto insurance for seniors in Tennessee can be appealing to many drivers.

Cons

- Higher Minimum Coverage Rates: Full coverage for TN seniors is $116/month, which is higher than some competitors. See average Nationwide rates in our Nationwide insurance review.

- Full Coverage Can Be Expensive: Full auto insurance coverage rates for seniors in Tennessee are also on the higher side at $116, which may be a concern for seniors.

#9 – Farmers: Best for Personalized Service

Pros

- Affordable Minimum Coverage: Farmers offers competitive minimum coverage rates in Tennessee at $26, making it a strong contender for seniors seeking the best auto insurance.

- Personalized Service: Known for personalized customer service for auto insurance for seniors in Tennessee.

- Good Financial Rating: An A rating from A.M. Best ensures reliable financial stability for auto insurance for seniors in Tennessee. Take a look at our Farmers insurance company review to learn more.

Cons

- Higher Full Coverage Rates: Full auto insurance coverage for seniors in Tennessee is more expensive at $84, which might be less affordable for some seniors.

- Limited Discounts for Seniors: The multi-policy discount of 10% in auto insurance for seniors in Tennessee may not be as advantageous as other options.

#10 – Geico: Best for Coverage Options

Pros

- Low Minimum Coverage Rates: Geico offers cheap minimum coverage for seniors in Tennessee at $24/month. Compare rates in our Geico auto insurance company review.

- Wide Range of Coverage Options: Geico provides a variety of auto insurance coverage options for seniors in Tennessee to meet diverse needs.

- Excellent A.M. Best Rating: An A++ rating from A.M. Best reflects strong financial health and reliability for auto insurance for seniors in Tennessee.

Cons

- Limited Multi-Policy Discount: Geico’s 8% discount for bundling policies is lower compared to other auto insurance providers for seniors in Tennessee.

- Potentially Higher Costs for Full Coverage: Full coverage rates can be relatively high at $77, which may not be ideal for auto insurance for seniors in Tennessee.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tennessee Senior Auto Insurance Monthly Rates by Coverage Level

For seniors in Tennessee seeking auto insurance, monthly rates can vary significantly depending on the level of coverage and the provider chosen.

Tennessee Senior Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $44 $141

American Family $31 $100

Farmers $26 $84

Geico $24 $77

Liberty Mutual $32 $11

Nationwide $36 $116

Progressive $28 $90

State Farm $22 $71

The Hartford $58 $125

Travelers $27 $86

Companies such as State Farm and Geico offer competitive rates for minimum coverage, with State Farm at $22 and Geico slightly higher at $24. Travelers is also cheap for minimum coverage at $27/month, although full coverage is more expensive.

When opting for full coverage auto insurance, these rates increase considerably, with State Farm maintaining a lower rate of $71/month compared to Geico $77/month. On the other end of the spectrum, The Hartford presents higher monthly costs, charging $58 for minimum coverage and $125 for full coverage.

Senior Auto Insurance Coverage Options in Tennessee

Choosing the right auto insurance as a senior in Tennessee involves understanding the various coverage options so you can get the best rates.

- Liability Coverage: This covers bodily injury and property damage to others if you’re at fault in an accident. It’s a legal requirement in Tennessee and helps protect your assets in the event of a lawsuit.

- Collision Coverage: Collision auto insurance pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s especially useful if you have a newer vehicle or want peace of mind on the road.

- Comprehensive Coverage: This protects your car from non-collision-related incidents, such as theft, vandalism, or natural disasters. It’s a good option for those who want to safeguard their vehicle from unexpected events.

These coverage options form a solid base for most drivers, but seniors may need additional protection tailored to their unique circumstances:

- Uninsured/Underinsured Motorist Coverage: This covers you if you’re in an accident with a driver with little or no insurance. It’s a crucial safeguard, particularly for seniors who want to avoid out-of-pocket expenses in such scenarios.

- Gap Insurance: If you owe more on your car loan than the vehicle is worth, gap insurance covers the difference if your car is totaled. This is particularly useful for those with financed vehicles.

- Medical Payments Coverage (MedPay): MedPay covers medical expenses for you and your passengers, similar to PIP, but typically with fewer restrictions. It’s a good option for those seeking additional health coverage.

- Personal Injury Protection (PIP): PIP covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. It’s especially beneficial for seniors, as it provides an additional layer of financial protection.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car if your vehicle is in the shop due to a covered claim. It’s a convenient option for seniors who rely on their cars for daily activities.

In 2023, Tennessee auto insurance requirements for liability increased to $25,000, so ensure you’re carrying adequate senior car insurance coverage.

Read More: Minimum Auto Insurance Requirements by State

Senior Driver Discounts in Tennessee You Shouldn’t Miss

For senior drivers, securing the right coverage can be made more affordable by taking advantage of various discounts from the top Tennessee senior auto insurance companies:

These offers are tailored to meet the unique needs of senior drivers, helping you maximize the value of your insurance policy.

Taking advantage of these discounts can significantly lower your premium, making comprehensive coverage more accessible. It’s a good idea to inquire with your insurer about potential discounts you might be missing.

Learn More: Auto Insurance Discounts to Ask For

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: How Tennessee Senior Drivers Find the Best Auto Insurance

When it comes to finding the right auto insurance, real-life examples are the best insights. Below are several case studies that showcase how seniors in Tennessee discovered the best insurance options to meet their needs:

- Case Study #1 – Budget-Conscious and Covered: Mary, a 67-year-old retiree from Nashville, was able to secure comprehensive coverage with Progressive for just $30 per month. This allowed her to maintain peace of mind while keeping her expenses within a fixed retirement budget.

- Case Study #2 – High Mileage, Low Premiums: James, a 72-year-old who still commutes regularly, found that Allstate offered the best rates for his high-mileage vehicle. He was able to save 15% by bundling his auto insurance with his existing home insurance policy.

- Case Study #3 – Discounts for a Safe Driving Record: Elizabeth, an 80-year-old with a spotless driving record, took advantage of The Hartford’s senior benefits. She received significant discounts, reducing her monthly premium to $28.

- Case Study #4 – Tailored Coverage for Special Needs: Robert, a 75-year-old with unique medical needs, found that State Farm’s customizable policies allowed him to include additional coverage for medical expenses. This specialized coverage ensured he was fully protected in case of an accident.

- Case Study #5 – Maximizing Savings With Vanishing Deductibles: Susan, a 69-year-old from Memphis, chose Nationwide for its vanishing deductible feature. By maintaining a clean driving record, she was able to reduce her deductible over time.

By exploring different options and taking advantage of available discounts, seniors can ensure they’re getting the best possible deal tailored to their specific needs.

Choosing the Right Auto Insurance for Tennessee Seniors

Selecting the best Tennessee auto insurance for seniors involves carefully considering your unique needs and comparing top providers. T.e best auto insurance for seniors in Tennessee is Travelers, Progressive, and Allstate.

Travelers offers the best auto insurance for seniors in Tennessee, with rates starting at just $22 per month.Daniel Walker Licensed Auto Insurance Agent

Travelers stands out for its low premiums, starting at $22 per month. For competitive rates, Progressive may be your best choice, while Allstate excels in offering extensive discounts. Reviewing these options can help you find a plan that balances affordability with comprehensive coverage.

Start by comparing quotes to ensure you’re getting the best value for your insurance needs. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

Frequently Asked Questions

Who has the best auto insurance for senior citizens in Tennessee?

Travelers offers the best auto insurance for seniors in Tennessee, with rates starting at just $27 per month.

Who has the cheapest senior auto insurance rates in Tennessee?

The cheapest auto insurance company in Tennessee for seniors is State Farm at $22.

What type of auto insurance is required in Tennessee?

In Tennessee, all drivers must have some proof of financial responsibility in order to drive. The most common way to meet the requirement is carrying car insurance with at least the minimum coverage limits: $25,000 for bodily injury liability per person and $50,000 per accident, along with $25,000 for property damage.

Which type of vehicle insurance is best in Tennessee?

The top five types of car insurance coverage are liability, collision, personal injury protection, uninsured motorist protection, and comprehensive car insurance. Enter your ZIP code below to find out if you can get a better deal.

Which category of auto insurance is best in Tennessee?

Comprehensive auto insurance offers the most extensive coverage available. It’s ideal if you want maximum peace of mind or if you own a new or high-value vehicle. This type of insurance generally includes protection for damage caused to other people’s cars or property.

Why is auto insurance so expensive in TN?

Car insurance in Tennessee is expensive because of its high percentage of uninsured drivers–around 20% of drivers don’t have insurance in the state. In Tennessee, you can expect to pay approximately $302 per month for full coverage car insurance or $87 per month for minimum coverage.

Does Tennessee insurance follow the car or the driver?

Typically, car insurance in Tennessee follows the car, not the driver, depending on the coverage in your policy. This is known as ownership liability, which means if you allow a family member or friend to drive your car, they may be covered by your insurance policy.

What is the deductible for Tennessee auto insurance?

Simply put, an auto insurance deductible is the amount of money that the insured person must pay before their insurance policy starts paying for covered expenses.

What is the most popular auto insurance in the U.S.?

State Farm is the most popular insurance company nationwide. Progressive is the largest insurance company in 21 states, including many New England states, some states in the Midwest, Florida, and Texas.

What is the cheapest age for TN auto insurance?

Tennessee car insurance is usually most expensive for younger drivers aged 17-24. However, when you reach 25, you may have a bit more experience behind the wheel. So, you can reasonably start to expect your premiums to get cheaper. Get fast and cheap TN auto insurance coverage today with our quote comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.