Best Ford Edge Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

State Farm, Progressive, and Geico are the best Ford Edge auto insurance providers, offering rates around $80/month. State Farm excels in coverage options, Progressive rewards safe drivers, and Geico provides affordable rates. These top choices ensure comprehensive and cost-effective insurance for your Ford Edge.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Ford Edge

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Ford Edge

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Ford Edge

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThese companies ensure comprehensive and cost-effective insurance for your Ford Edge, tailored to meet diverse needs and preferences.

Our Top 10 Company Picks: Best Ford Edge Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Service | State Farm | |

| #2 | 10% | A+ | Safe-Driving Rewards | Progressive | |

| #3 | 25% | A++ | Affordable Rates | Geico | |

| #4 | 10% | A+ | Numerous Discounts | Allstate | |

| #5 | 20% | A+ | Comprehensive Coverage | Nationwide |

| #6 | 5% | A | Customizable Policies | Liberty Mutual |

| #7 | 15% | A+ | Extensive Coverage | Farmers | |

| #8 | 8% | A++ | Hybrid Vehicle | Travelers | |

| #9 | 10% | A | Customer Service | American Family | |

| #10 | 10% | A | High-Risk Drivers | The General |

Explore Ford Edge insurance rates for full coverage and liability-only coverage. You can spend less on auto insurance rates when you insure a Ford Edge.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers.

- State Farm is the top pick for the best Ford Edge auto insurance

- Ford Edge owners can save by comparing quotes and opting for discounts

- Ford Edge insurance rates vary based on driver age, location, and driving record

#1 – State Farm: Top Overall Pick

Pros

- Reliable Service: State Farm excels in providing reliable service for Ford Edge owners.

- Low Monthly Rates: State Farm offers competitive monthly rates at $85 for the Ford Edge with minimum coverage.

- Bundling Policies: State Farm auto insurance review provides significant discounts for bundling multiple insurance policies, enhancing savings for Ford Edge owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the Ford Edge.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Ford Edge owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Safe-Driving Rewards

Pros

- Safe-Driving Rewards: Progressive offers excellent rewards for safe-driving habits, benefiting Ford Edge owners.

- Affordable Rates: Progressive auto insurance review provides affordable rates at $82 per month for the Ford Edge with minimum coverage.

- Snapshot Program: The Snapshot program helps Ford Edge drivers save based on actual driving behavior.

Cons

- Average Customer Service: Progressive’s customer service may not be as responsive as some competitors for Ford Edge insurance.

- Rate Increases: Rates may increase after the initial policy period, affecting Ford Edge owners who prefer long-term stability.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico offers the most affordable rates at $80 per month for the Ford Edge with minimum coverage.

- Extensive Discounts: Geico auto insurance discounts provides numerous discounts, including good driver and military discounts, beneficial for Ford Edge owners.

- User-Friendly Website: Geico’s website and mobile app make managing Ford Edge insurance policies easy and convenient.

Cons

- Limited Local Agents: Geico has fewer local agents available for in-person support, which might affect Ford Edge owners who prefer face-to-face interactions.

- Coverage Options: Geico’s coverage options may be more limited compared to other insurers for the Ford Edge.

#4 – Allstate: Best for Numerous Discounts

Pros

- Numerous Discounts: Allstate offers a wide range of discounts, providing savings opportunities for Ford Edge owners.

- New Car Replacement: Allstate’s new car replacement feature is beneficial for Ford Edge owners with newer models.

- Accident Forgiveness: Allstate auto insurance review provides accident forgiveness, protecting Ford Edge owners from rate increases after their first accident.

Cons

- Higher Rates: Allstate’s premiums may be higher compared to some competitors for the Ford Edge.

- Mixed Customer Reviews: Some Ford Edge owners report mixed experiences with Allstate’s customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Nationwide is known for its comprehensive coverage options for the Ford Edge.

- Vanishing Deductible: Nationwide auto insurance review provides a vanishing deductible feature, which rewards Ford Edge owners for safe driving.

- On Your Side Review: Nationwide’s personalized insurance review helps Ford Edge owners optimize their coverage.

Cons

- Premium Costs: Nationwide’s premiums might be on the higher side for Ford Edge owners.

- Discount Availability: Some discounts may not be available in all states, limiting savings for Ford Edge owners.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual allows Ford Edge owners to customize their policies to fit their specific needs.

- Accident Forgiveness: Liberty Mutual auto insurance review provides accident forgiveness to prevent rate hikes after the first accident.

- New Car Replacement: This feature is advantageous for Ford Edge owners with newer vehicles.

Cons

- Higher Rates: Liberty Mutual’s rates can be higher compared to other insurers for the Ford Edge.

- Average Customer Service: Some Ford Edge owners report average experiences with Liberty Mutual’s customer service.

#7 – Farmers: Best for Extensive Coverage

Pros

- Extensive Coverage: Farmers auto insurance review provides a wide range of coverage options for the Ford Edge.

- Accident Forgiveness: Farmers’ accident forgiveness is beneficial for Ford Edge owners concerned about rate increases.

- Signal App: Farmers’ Signal app rewards Ford Edge drivers for safe driving habits.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some competitors for the Ford Edge.

- Limited Discounts: The availability of discounts may be more limited with Farmers for the Ford Edge.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Hybrid Vehicle

Pros

- Hybrid Vehicle Discounts: Travelers offers discounts for hybrid Ford Edge models.

- IntelliDrive Program: The IntelliDrive program rewards safe driving behavior, benefiting Ford Edge owners.

- Strong Financial Rating: Travelers Auto insurance review emphasize a strong A++ financial rating, providing reliability for Ford Edge insurance.

Cons

- Rates: Travelers’ rates might be higher for the Ford Edge compared to other insurers.

- Customer Support: Some Ford Edge owners report issues with Travelers’ customer support responsiveness.

#9 – American Family: Best for Customer Service

Pros

- Excellent Customer Service: American Family is known for its exceptional customer service, benefiting Ford Edge owners.

- Customizable Policies: American Family auto insurance review provides customizable policy options for the Ford Edge.

- Multi-Policy Discounts: Significant discounts for bundling policies, providing savings for Ford Edge owners.

Cons

- Limited Availability: American Family’s coverage may not be available in all states, affecting Ford Edge owners.

- Higher Premiums: Premiums can be higher compared to some competitors for the Ford Edge.

#10 – The General: Best for High-Risk Drivers

Pros

- High-Risk Coverage: The General auto insurance review specializes in providing coverage for high-risk drivers, including Ford Edge owners.

- Affordable Rates: Competitive rates at $89 per month for the Ford Edge with minimum coverage.

- Flexible Payment Options: The General offers flexible payment plans, beneficial for Ford Edge owners.

Cons

- Customer Service: The General’s customer service may not be as robust compared to other insurers for the Ford Edge.

- Limited Discounts: Fewer discount options available for Ford Edge owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford Edge Insurance Cost

The cost of insuring a Ford Edge varies depending on the coverage level and the insurance provider. For minimum coverage, monthly rates range from $80 with Geico to $90 with Liberty Mutual. Full coverage auto insurance are slightly higher, with Geico again being the most affordable at $150 per month and Liberty Mutual the highest at $165 per month.

Ford Edge Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $88 | $162 |

| American Family | $83 | $154 |

| Farmers | $87 | $158 |

| Geico | $80 | $150 |

| Liberty Mutual | $90 | $165 |

| Nationwide | $84 | $157 |

| Progressive | $82 | $155 |

| State Farm | $85 | $160 |

| The General | $89 | $161 |

| Travelers | $86 | $159 |

The average annual cost for Ford Edge insurance is approximately $1,296, equating to about $108 per month. Rates also differ based on specific categories: discount rates can lower monthly payments to $64, while opting for high deductibles typically costs $93 per month.

Ford Edge Auto Insurance Monthly Rates by Category

| Category | Rates |

|---|---|

| Average Rate | $108 |

| Discount Rate | $64 |

| High Deductibles | $93 |

| High Risk Driver | $230 |

| Low Deductibles | $136 |

| Teen Driver | $395 |

Conversely, higher-risk drivers face significantly steeper rates, averaging $230 monthly, and teen drivers can expect to pay as much as $395 per month. Lower auto insurance deductibles also increase the monthly premium to around $136.

This variety in rates highlights the importance of comparing different providers and coverage options to find the most suitable and cost-effective insurance for a Ford Edge.

Expensiveness of Ford Edges to Insure

Ford Edge Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Edge | $22 | $42 | $31 | $108 |

| Volkswagen Atlas | $30 | $58 | $33 | $133 |

| Toyota Land Cruiser | $35 | $65 | $33 | $146 |

| Jeep Grand Cherokee | $27 | $47 | $31 | $118 |

| Audi Q7 | $33 | $60 | $33 | $139 |

| Buick Enclave | $29 | $50 | $31 | $123 |

| GMC Acadia | $25 | $39 | $31 | $108 |

The Jeep Grand Cherokee, Audi Q7, and Buick Enclave are also more expensive to insure. However, you can find cheaper Ford Edge insurance rates by comparing quotes and opting for higher deductibles. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

The Impacts of Cost of Ford Edge Insurance

The Ford Edge trim and model you choose will affect the total price you will pay for Ford Edge insurance coverage. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

Older Ford Edge models typically cost less to insure. For instance, while insuring a 2020 Ford Edge costs $1,296 annually, a 2010 model costs $1,086, saving $210.

Monthly rates for comprehensive and collision auto insurance decrease with vehicle age, from $22 and $42 for a 2020 model to $15 and $26 for a 2011 model.

Ford Edge Auto Insurance Monthly Rates by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Ford Edge | $23 | $43 | $32 | $109 |

| 2020 Ford Edge | $22 | $42 | $31 | $108 |

| 2019 Ford Edge | $21 | $40 | $33 | $107 |

| 2018 Ford Edge | $20 | $40 | $33 | $107 |

| 2017 Ford Edge | $20 | $39 | $35 | $106 |

| 2016 Ford Edge | $19 | $37 | $36 | $105 |

| 2015 Ford Edge | $18 | $36 | $37 | $104 |

| 2014 Ford Edge | $17 | $33 | $38 | $101 |

| 2013 Ford Edge | $17 | $31 | $38 | $99 |

| 2012 Ford Edge | $16 | $28 | $38 | $96 |

| 2011 Ford Edge | $15 | $26 | $38 | $92 |

| 2010 Ford Edge | $14 | $24 | $39 | $91 |

Similarly, full coverage drops from $108 for a 2020 Ford Edge to $92 for a 2011 model. This trend shows how insurance costs generally decrease as the vehicle ages.

Driver Age

Ford Edge Auto Insurance Monthly Rates by Age

| Age | Monthly Rates |

|---|---|

| Age: 18 | $476 |

| Age: 20 | $420 |

| Age: 30 | $172 |

| Age: 40 | $154 |

| Age: 50 | $138 |

| Age: 60 | $130 |

In contrast, the cost decreases with age, with 30-year-olds paying $172 per month, 40-year-olds $154, 50-year-olds $138, and 60-year-olds the lowest at $130. This demonstrates that insurance rates generally decrease as drivers gain more experience and are perceived as lower risk.

Driver Location

Your location significantly affects Ford Edge insurance rates. For instance, drivers in Los Angeles pay $1,114 more annually than those in Indianapolis. Monthly rates vary widely by city, with Los Angeles at $160, New York at $150, and Houston at $145.

Ford Edge Auto Insurance Monthly Rates by City

| City | Monthly Rates |

|---|---|

| Chicago, IL | $130 |

| Columbus, OH | $115 |

| Houston, TX | $145 |

| Indianapolis, IN | $120 |

| Jacksonville, FL | $135 |

| Los Angeles, CA | $160 |

| New York, NY | $150 |

| Philadelphia, PA | $140 |

| Phoenix, AZ | $125 |

| Seattle, WA | $115 |

Conversely, cities like Indianapolis and Seattle have lower rates at $120 and $115, respectively. These variations highlight the importance of considering geographic location when assessing insurance costs for a Ford Edge.

Your Driving Record

Your driving record significantly affects your Ford Edge auto insurance rates, with the most substantial increases seen among teens and drivers in their 20s who have violations. For instance, an 18-year-old with a clean record pays $476 per month, but this jumps to $714 with one accident, $952 with a DUI, and $595 with one ticket.

Ford Edge Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $476 | $714 | $952 | $595 |

| Age: 20 | $420 | $630 | $840 | $525 |

| Age: 30 | $172 | $258 | $344 | $215 |

| Age: 40 | $154 | $231 | $308 | $193 |

| Age: 50 | $138 | $207 | $276 | $173 |

| Age: 60 | $130 | $195 | $260 | $163 |

Similarly, a 20-year-old pays $420 monthly with a clean record, increasing to $630 with one accident, $840 with a DUI, and $525 with one ticket. In contrast, older drivers face lower increases; a 40-year-old with a clean record pays $154 monthly, which rises to $231 with one accident, $308 with a DUI, and $193 with one ticket.

Ford Edge Safety Ratings

The Ford Edge boasts a comprehensive suite of safety ratings designed to enhance driver and passenger protection. Key features include 4-Wheel ABS and 4-Wheel Disc Brakes for improved control and stopping power, a Blind Spot Monitor to alert drivers of vehicles in their blind spots, and Brake Assist for maximum braking force in emergencies.

Ford Edge Safety Features

| Feature | Details |

|---|---|

| 4-Wheel ABS | The 4-Wheel ABS prevents wheel lockup during braking for better control. |

| 4-Wheel Disc Brakes | The 4-Wheel Disc Brakes provide strong and reliable stopping power. |

| Blind Spot Monitor | The Blind Spot Monitor alerts you to vehicles in your blind spots. |

| Brake Assist | Brake Assist applies maximum braking force in emergency situations. |

| Child Safety Locks | Child Safety Locks prevent children from opening rear doors from inside. |

| Cross-Traffic Alert | Cross-Traffic Alert warns of approaching vehicles when reversing. |

| Daytime Running Lights | Daytime Running Lights increase your vehicle's visibility during the day. |

| Driver Air Bag | The Driver Air Bag protects the driver in the event of a collision. |

| Electronic Stability Control | Electronic Stability Control helps maintain vehicle control on slippery roads. |

| Front Head Air Bag | The Front Head Air Bag protects front passengers during a collision. |

| Front Side Air Bag | The Front Side Air Bag protects front passengers in side-impact crashes. |

| Lane Departure Warning | Lane Departure Warning alerts you if you unintentionally drift out of your lane. |

| Lane Keeping Assist | Lane Keeping Assist helps keep your vehicle centered in its lane. |

| Passenger Air Bag | The Passenger Air Bag protects the front passenger in a collision. |

| Rear Head Air Bag | The Rear Head Air Bag protects rear passengers during a collision. |

| Traction Control | Traction Control prevents wheel spin for better grip and stability. |

Additional features such as Child Safety Locks, Cross-Traffic Alert, and Daytime Running Lights further contribute to the vehicle’s safety. The inclusion of airbags for both the driver and front passengers, as well as Electronic Stability Control, underscores the Edge’s commitment to safety.

The Ford Edge has received high safety ratings across various tests, reflecting its robust safety features. It has earned ‘Good’ ratings in critical areas including small overlap front (both driver and passenger sides), moderate overlap front, side impact, roof strength, and head restraints and seats.

Ford Edge Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

These top ratings indicate that the Ford Edge provides excellent protection in crash scenarios, making it a reliable choice for safety-conscious drivers.

Ford Edge Crash Test Ratings

Ford Edge crash test ratings are excellent, consistently earning 5-star ratings in overall, frontal, and side crash tests, with a 4-star rating for rollover tests across various model years from 2016 to 2020.

Ford Edge Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

These strong safety ratings positively impact the cost of auto insurance, as vehicles with higher safety ratings typically receive lower insurance premiums due to their reduced risk of injury in accidents. Read our article to find the best accident forgiveness auto insurance companies.

Ford Edge Insurance Loss Probability

The Ford Edge has relatively low insurance loss probabilities, which can help keep insurance costs down. Specifically, the loss probability rates are 15% for collision, 8% for property damage, and 4% for Comprehensive coverage.

Ford Edge Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | 15% |

| Property Damage | 8% |

| Comprehensive | 4% |

| Personal Injury | 7% |

| Medical Payment | 7% |

| Bodily Injury | 7% |

Personal injury, medical payment, and bodily injury all share a low loss probability of 7%. Lower percentages in these categories indicate a reduced likelihood of claims, leading to lower insurance costs for the Ford Edge.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

5 Ways to Save on Ford Edge Insurance

Drivers can save on Ford Edge auto insurance by employing several strategies. One effective method is to carpool to work instead of driving your Ford Edge daily. This reduces the vehicle’s mileage, lowering the risk of accidents and, consequently, insurance premiums.

Another way to save is by installing a tracking device on your Ford Edge. Many insurance companies offer discounts for drivers who use telematics devices, as these track driving behavior and encourage safer driving habits.

Asking about welcome discounts when purchasing insurance can also lead to significant savings. Many insurers provide discounts for new customers or those switching from another provider.

Additionally, inquire about low mileage discounts. If you drive your Ford Edge less than the average annual mileage, you may qualify for lower insurance rates due to the reduced likelihood of filing a claim.

In this special episode of 48 Hours, new Ford BroncoⓇ ambassador @carlypearce takes a time-out from touring, jumps into her beloved BadlandsⓇ and finds balance in the Tennessee countryside. pic.twitter.com/eNUQdrd6fH

— Ford Motor Company (@Ford) February 23, 2024

Finally, compare auto insurance companies after moving. Different areas have varying risk factors, and shopping around for quotes in a new location can help you find the cheap auto insurance companies for your Ford Edge.

Top Ford Edge Insurance Companies

Several insurance companies offer competitive rates for the Ford Edge, often providing discounts for safety features. The top providers by market share include State Farm, leading with a 9.3% market share, followed by Geico at 6.6% and Progressive at 5.6%.

Top 10 Ford Edge Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.3% |

| #2 | Geico | $46,106,971 | 6.6% |

| #3 | Progressive | $39,222,879 | 5.6% |

| #4 | Liberty Mutual | $35,600,051 | 5.1% |

| #5 | Allstate | $35,025,903 | 5% |

| #6 | Travelers | $28,016,966 | 4% |

| #7 | USAA | $23,483,080 | 3.3% |

| #8 | Chubb | $23,388,385 | 3.3% |

| #9 | Farmers | $20,643,559 | 2.9% |

| #10 | Nationwide | $18,442,145 | 2.6% |

Liberty Mutual and Allstate also hold significant shares at 5.1% and 5.0%, respectively. Other notable insurers include Travelers, USAA, Chubb, Farmers, and Nationwide, each offering various coverage options, auto insurance discounts, and benefits tailored to Ford Edge drivers.

Compare Free Ford Edge Insurance Quotes Online

This method not only helps you find the most affordable rates but also enables you to explore various coverage options and discounts tailored to your needs. By comparing quotes online, you can ensure you are getting the best value for your Ford Edge insurance (Read more: How to Compare Auto Insurance Quotes).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Finding the Best Ford Edge Auto Insurance

Discover how three Ford Edge owners navigated the auto insurance market to find the best coverage and rates. These case studies highlight the experiences of different drivers, their unique needs, and the solutions offered by top providers like State Farm, Progressive, and Geico.

- Case Study #1 – Young Driver Secures Affordable Coverage: John, a 25-year-old driver, recently purchased a new Ford Edge and sought affordable insurance. After comparing various quotes, he chose Geico for its competitive rate of $85/month and excellent customer service. The straightforward online process and low premiums helped him save money while maintaining comprehensive coverage.

- Case Study #2 – Family Driver Benefits: Sarah, a mother of two, needed reliable insurance for her family’s Ford Edge, focusing on comprehensive coverage and excellent service. She opted for State Farm, which offered the best Ford Edge auto insurance with extensive coverage options tailored to her needs. Sarah was impressed by State Farm’s responsive customer service and the peace of mind.

- Case Study #3 – Safe Driver Earns Discounts: Michael, a safe driver with a clean record, wanted to maximize savings on his Ford Edge insurance. He chose Progressive for its safe-driving rewards and discounts, which significantly lowered his monthly premium. By leveraging Progressive’s discount programs, Michael enjoyed top-tier coverage at a reduced cost, reinforcing the value of safe driving habits.

These case studies illustrate how different Ford Edge owners found the best auto insurance by choosing providers that met their specific needs. Check out our guide “Where to Compare Auto Insurance Rates.“

State Farm offers the best Ford Edge auto insurance with extensive coverage options and excellent customer service.Jeff Root Licensed Insurance Agent

Whether prioritizing affordability, comprehensive coverage, or discounts, these examples show that with careful comparison and consideration, securing the right insurance for a Ford Edge is achievable. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Frequently Asked Questions

What factors affect the cost of insurance for a Ford Edge?

Several factors can influence the cost of insurance for a Ford Edge, including vehicle make and model, age and driving history, location, and coverage options. Insurance companies consider these elements to determine your premiums.

Discover our comprehensive guide titled “Best Auto Insurance for Luxury Cars.”

Is the Ford Edge considered an expensive vehicle to insure?

The cost of insurance for a Ford Edge can vary based on factors such as model year, trim level, and additional features. It’s best to contact insurance providers for personalized quotes to determine the exact cost of insuring a Ford Edge. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Are there any specific safety features in the Ford Edge that could lower insurance premiums?

Yes, the Ford Edge includes safety features like ABS, ESC, front and side airbags, rearview cameras, parking sensors, lane departure warning systems, and adaptive cruise control. These features can potentially lower insurance premiums.

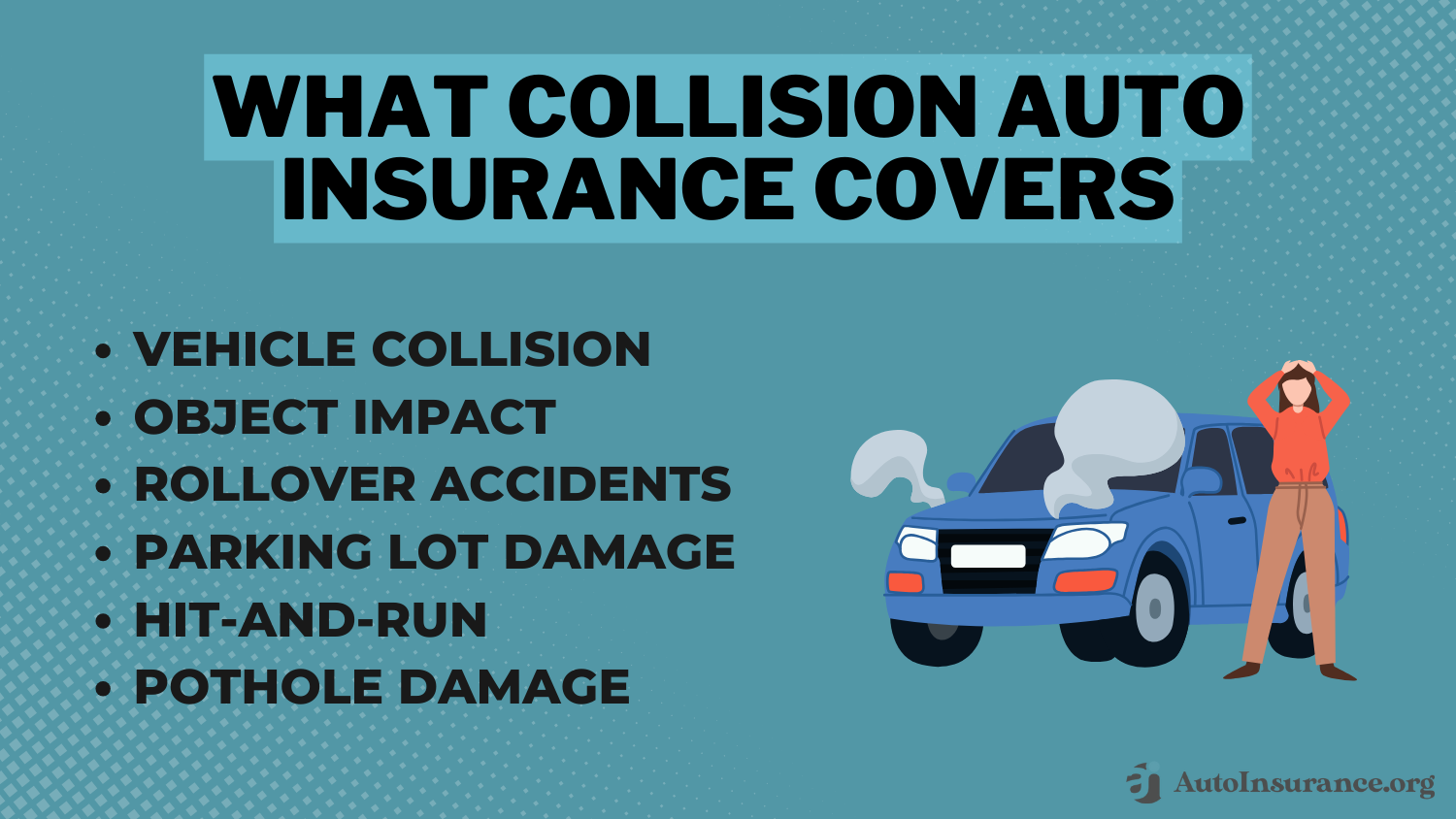

Do I need comprehensive coverage for my Ford Edge?

Comprehensive coverage is recommended for newer Ford Edge models or financed vehicles. It protects against non-collision events like theft, vandalism, and natural disasters. Older vehicles with depreciated value might opt for liability-only or collision coverage.

Learn more about collision vs. comprehensive auto insurance.

How can I find affordable insurance for my Ford Edge?

To find affordable insurance, shop around for quotes, bundle policies, increase auto insurance deductible, seek discounts, and maintain a good driving record. Comparing rates and exploring discounts can help lower premiums.

Are there any specific insurance considerations for leasing a Ford Edge?

When leasing a Ford Edge, most leasing agreements require comprehensive and collision coverage with specific limits. Review your lease agreement and consult with your insurance provider to ensure compliance with these requirements.

Does the Ford Edge’s fuel type affect insurance rates?

Generally, the fuel type of a Ford Edge does not significantly impact insurance rates. Insurers focus on the vehicle’s make, model, age, and safety features when determining premiums.

Will modifications to my Ford Edge affect insurance coverage?

Modifications to your Ford Edge can impact insurance coverage and premiums. Inform your provider about any aftermarket accessories, performance upgrades, or cosmetic changes to understand potential additional coverage needs or premium increases.

Check out our guide “Do you need medical payment coverage on auto insurance?”

Can I transfer my existing insurance policy to a new Ford Edge?

Yes, you can transfer your existing insurance policy to a new Ford Edge. Contact your insurance provider before purchasing the new vehicle to update your policy and ensure a smooth transition. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Are there any specific Ford Edge insurance discounts I should be aware of?

Common discounts for Ford Edge owners include multi-vehicle discounts, good driver discounts, anti-theft device discounts, good student discounts, and loyalty discounts. Inquire with your insurer about these and other available discounts.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.