Best Ford F-250 Super Duty Auto Insurance in 2026 (Top 10 Companies Ranked)

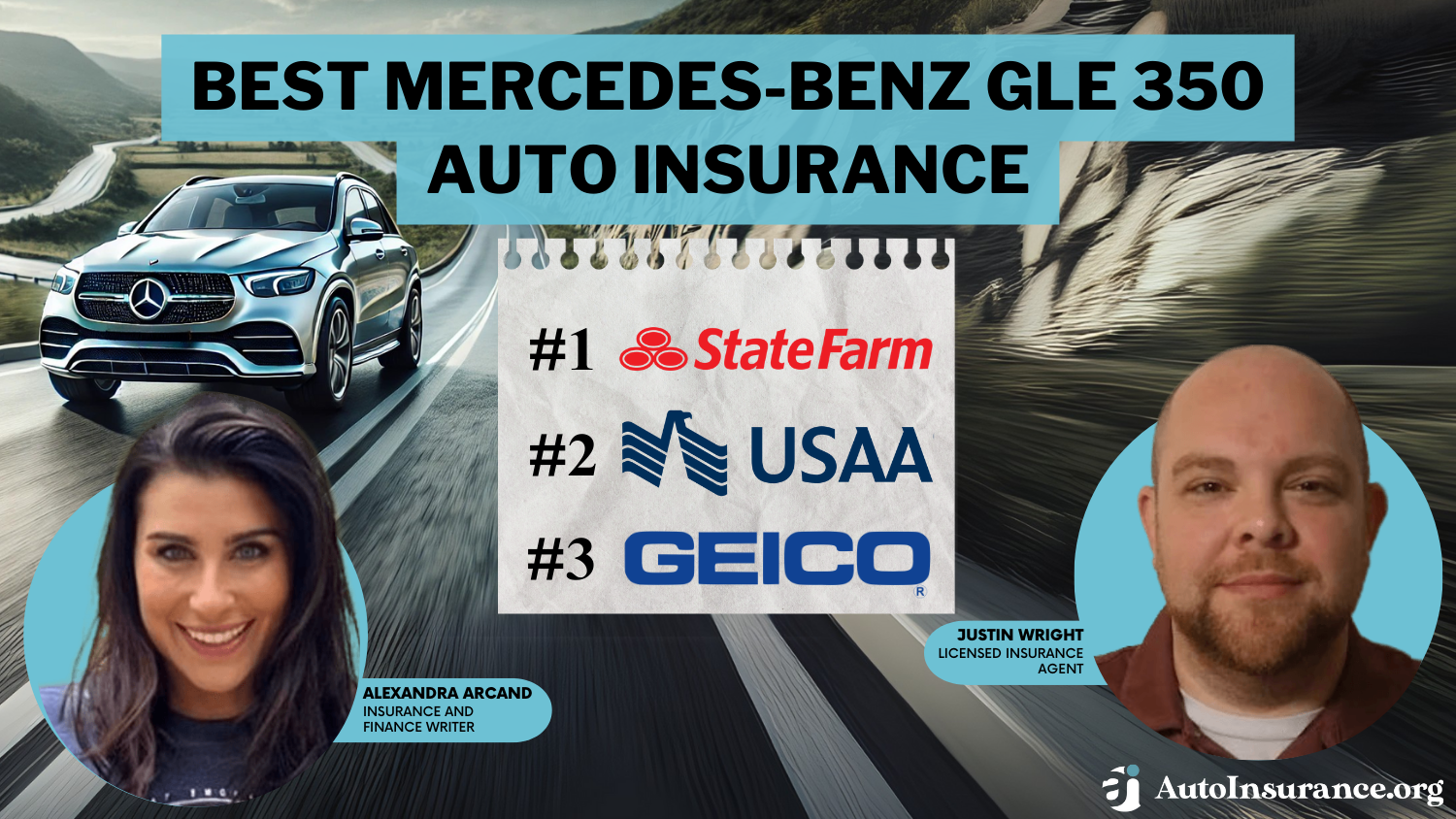

State Farm, USAA, and Geico are the best Ford F-250 Super Duty auto insurance providers, with rates starting at $38 per month. These companies offer competitive rates and extensive coverage options, making them the top choices for insuring your Ford F-250 Super Duty. Compare quotes to find the best deal.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Ford F-250 Super Duty

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Ford F-250 Super Duty

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Ford F-250 Super Duty

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe top pick overall for the best Ford F-250 Super Duty auto insurance are State Farm, USAA, and Geico, with rates starting at $38 per month. These providers offer competitive rates, extensive coverage options, and significant discounts for various driver profiles.

State Farm stands out for its comprehensive plans and affordability, while USAA is ideal for military families, and Geico excels in providing low-cost premiums.

Our Top 10 Company Picks: Best Ford F-250 Super Duty Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | B | Many Discounts | State Farm | |

| #2 | 15% | A++ | Military Savings | USAA | |

| #3 | 8% | A++ | Cheap Rates | Geico | |

| #4 | 10% | A+ | Online Convenience | Progressive | |

| #5 | 10% | A++ | Accident Forgiveness | Travelers | |

| #6 | 15% | A | Local Agents | Farmers | |

| #7 | 10% | A+ | Add-on Coverages | Allstate | |

| #8 | 15% | A | Student Savings | American Family | |

| #9 | 13% | A+ | Usage Discount | Nationwide |

| #10 | 10% | A | Customizable Polices | Liberty Mutual |

Compare quotes from these best auto insurance companies to find the best deal for your Ford F-250 Super Duty. Continue reading to learn how you can save money on Ford F-250 Super Duty insurance rates.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers.

- State Farm offers the best Ford F-250 Super Duty auto insurance

- Compare quotes to find the best insurance tailored to your needs

- The best Ford F-250 Super Duty auto insurance rates start at $38/month

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers a 12% multi-vehicle discount, making it an attractive choice for Ford F-250 Super Duty owners looking to save.

- Comprehensive Coverage: State Farm excels in providing comprehensive coverage options for the Ford F-250 Super Duty.

- Bundling Policies: State Farm auto insurance review provides significant discounts for bundling multiple insurance policies, enhancing savings for Ford F-250 Super Duty owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the Ford F-250 Super Duty.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Ford F-250 Super Duty owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers a 15% multi-vehicle discount and excellent rates for military members and their families for the Ford F-250 Super Duty.

- Superior Service: Known for superior customer service, USAA ensures a smooth insurance process for Ford F-250 Super Duty owners.

- Comprehensive Coverage Options: USAA auto insurance review provides extensive coverage options, including comprehensive and collision, for the Ford F-250 Super Duty.

Cons

- Eligibility Restrictions: USAA insurance is only available to military members and their families, limiting access for some Ford F-250 Super Duty owners.

- Limited Local Agents: USAA has fewer local agents compared to other insurers, which might be a drawback for some Ford F-250 Super Duty owners.

#3 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico offers some of the lowest rates for the Ford F-250 Super Duty, making it an attractive option with an 8% multi-vehicle discount.

- Efficient Online Tools: Geico’s robust online tools make managing insurance policies for the Ford F-250 Super Duty easy and convenient.

- Discount Opportunities: Geico auto insurance discounts provides various discount opportunities that can help Ford F-250 Super Duty owners save on premiums.

Cons

- Customer Service: Geico’s customer service ratings are mixed, which could be a concern for some Ford F-250 Super Duty owners.

- Coverage Options: While affordable, Geico’s coverage options might be less comprehensive compared to other insurers for the Ford F-250 Super Duty.

#4 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive’s online services make it convenient for Ford F-250 Super Duty owners to manage their policies. The company offers a 10% multi-vehicle discount.

- Competitive Rates: Progressive auto insurance review offers competitive rates for the Ford F-250 Super Duty, particularly for those seeking minimum coverage.

- Snapshot Program: Progressive’s Snapshot program can help Ford F-250 Super Duty owners save based on their driving habits.

Cons

- Rate Increases: Some Ford F-250 Super Duty owners have reported rate increases after the first policy term.

- Customer Service: Progressive’s customer service can be inconsistent, which might be a concern for some Ford F-250 Super Duty owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness, which can be beneficial for Ford F-250 Super Duty owners, along with a 10% multi-vehicle discount.

- High Customer Satisfaction: Travelers is known for high customer satisfaction, ensuring a positive experience for Ford F-250 Super Duty owners.

- Comprehensive Coverage Options: Travelers Auto insurance review provides extensive coverage options for the Ford F-250 Super Duty.

Cons

- Higher Premiums: Travelers’ premiums might be higher compared to some other insurers for the Ford F-250 Super Duty.

- Discounts: The availability of discounts might be limited, affecting potential savings for Ford F-250 Super Duty owners.

#6 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers has a strong network of local agents, providing personalized service for Ford F-250 Super Duty owners, and offers a 15% multi-vehicle discount.

- Comprehensive Coverage: Farmers offers comprehensive coverage options for the Ford F-250 Super Duty.

- Discounts for Safety Features: Farmers auto insurance review provides discounts for safety features, helping Ford F-250 Super Duty owners save on premiums.

Cons

- Premium Costs: Farmers’ premiums might be higher compared to some other insurers for the Ford F-250 Super Duty.

- Online Tools: Farmers’ online tools are less robust compared to some competitors, which could be a drawback for tech-savvy Ford F-250 Super Duty owners.

#7 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Allstate offers a variety of add-on coverages for the Ford F-250 Super Duty, enhancing policy customization. The company also provides a 10% multi-vehicle discount.

- Discount Opportunities: Allstate auto insurance review provides multiple discount opportunities, including safe driver discounts, for Ford F-250 Super Duty owners.

- Strong Financial Rating: Allstate’s strong financial rating ensures reliability for Ford F-250 Super Duty insurance.

Cons

- Higher Premiums: Allstate’s premiums can be higher compared to other insurers for the Ford F-250 Super Duty.

- Customer Service: Some Ford F-250 Super Duty owners have reported mixed experiences with Allstate’s customer service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Student Savings: American Family offers significant discounts for students, benefiting young Ford F-250 Super Duty owners, with a 15% multi-vehicle discount.

- Comprehensive Coverage: American Family auto insurance review provides comprehensive coverage options for the Ford F-250 Super Duty.

- Personalized Service: American Family is known for personalized service, ensuring a positive experience for Ford F-250 Super Duty owners.

Cons

- Limited Availability: American Family’s availability is limited to certain states, which might restrict access for some Ford F-250 Super Duty owners.

- Online Tools: The online tools provided by American Family are less advanced compared to some competitors.

#9 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers usage-based discounts, helping Ford F-250 Super Duty owners save based on their driving habits. The company provides a 13% multi-vehicle discount.

- Comprehensive Coverage Options: Nationwide auto insurance review provides extensive coverage options for the Ford F-250 Super Duty.

- Strong Financial Stability: Nationwide’s strong financial stability ensures reliable coverage for Ford F-250 Super Duty owners.

Cons

- Premium Rates: Nationwide’s premium rates can be higher compared to some other insurers for the Ford F-250 Super Duty.

- Customer Service: Some Ford F-250 Super Duty owners have reported mixed experiences with Nationwide’s customer service.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers highly customizable policies, allowing Ford F-250 Super Duty owners to tailor their coverage. The company also offers a 10% multi-vehicle discount.

- Discount Opportunities: Liberty Mutual auto insurance review provides various discount opportunities for Ford F-250 Super Duty owners.

- Comprehensive Coverage: Liberty Mutual offers comprehensive coverage options for the Ford F-250 Super Duty.

Cons

- Higher Premiums: Liberty Mutual’s premiums might be higher compared to some other insurers for the Ford F-250 Super Duty.

- Online Tools: Liberty Mutual’s online tools are less advanced compared to some competitors, which might be a drawback for some Ford F-250 Super Duty owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford F-250 Super Duty Insurance Cost

The insurance cost for a Ford F-250 Super Duty can vary significantly based on the coverage level and provider. For minimum coverage, rates range from $30 per month with Progressive to $79 per month with American Family. Full coverage auto insurance, on the other hand, varies from $91 per month with Progressive to $244 per month with American Family.

Ford F-250 Super Duty Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $52 | $156 |

| American Family | $79 | $244 |

| Farmers | $44 | $145 |

| Geico | $58 | $178 |

| Liberty Mutual | $43 | $138 |

| Nationwide | $58 | $179 |

| Progressive | $30 | $91 |

| State Farm | $38 | $120 |

| Travelers | $54 | $160 |

| USAA | $46 | $147 |

Other notable providers include Allstate with $52 for minimum and $156 for full coverage, Geico with $58 and $178, and State Farm with $38 and $120, respectively. On average, insuring a Ford F-250 Super Duty costs $1,580 annually or $132 monthly. Rates also differ by category, with discount rates averaging $77 per month, high deductible plans at $114, and low deductibles at $166.

Ford F-250 Super Duty Auto Insurance Monthly Rates by Category

| Category | Rates |

|---|---|

| Average Rate | $132 |

| Discount Rate | $77 |

| High Deductibles | $114 |

| High Risk Driver | $280 |

| Low Deductibles | $166 |

| Teen Driver | $481 |

Teen drivers face the highest rates at $481 per month, while high-risk drivers pay around $280 monthly. These variations highlight the importance of shopping around and comparing different providers and plans to find the best insurance rate for the Ford F-250 Super Duty.

Expensiveness of Ford F-250 Super Duty to Insure

The Ford F-250 Super Duty tends to be moderately expensive to insure compared to other trucks. Its comprehensive coverage costs $25 per month, collision coverage $40, minimum coverage $33, and full coverage $110. In comparison, the Chevrolet Silverado’s full coverage is $124 per month, and the Dodge Ram’s is $127, making them more expensive to insure.

Ford F-250 Super Duty Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford F-250 Super Duty | $25 | $40 | $33 | $110 |

| Chevrolet Silverado | $27 | $47 | $35 | $124 |

| Dodge Ram | $30 | $47 | $35 | $127 |

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| Ford Ranger | $21 | $39 | $31 | $105 |

| Ford F-150 | $27 | $39 | $31 | $110 |

Meanwhile, the Chevrolet Colorado and Ford Ranger are less costly, with full coverage rates at $102 and $105, respectively. The Ford F-150 matches the F-250 Super Duty at $110 for full coverage. To find the most affordable insurance rates for a Ford, it’s essential to compare quotes from multiple providers. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Impacts of the Cost of Ford F-250 Super Duty Insurance

The Ford F-250 Super Duty trim and model you choose can impact the total price you will pay for Ford F-250 Super Duty auto insurance coverage. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Age of the Vehicle

Ford F-250 Super Duty Auto Insurance Monthly Rates by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Ford F-250 Super Duty | $35 | $65 | $50 | $150 |

| 2023 Ford F-250 Super Duty | $34 | $63 | $49 | $147 |

| 2022 Ford F-250 Super Duty | $33 | $61 | $48 | $144 |

| 2021 Ford F-250 Super Duty | $32 | $59 | $47 | $141 |

| 2020 Ford F-250 Super Duty | $31 | $57 | $46 | $138 |

| 2019 Ford F-250 Super Duty | $30 | $55 | $45 | $135 |

| 2018 Ford F-250 Super Duty | $29 | $53 | $44 | $132 |

| 2017 Ford F-250 Super Duty | $27 | $51 | $39 | $132 |

| 2016 Ford F-250 Super Duty | $26 | $49 | $41 | $130 |

| 2015 Ford F-250 Super Duty | $24 | $47 | $42 | $128 |

| 2014 Ford F-250 Super Duty | $24 | $44 | $43 | $125 |

| 2013 Ford F-250 Super Duty | $23 | $41 | $43 | $122 |

| 2012 Ford F-250 Super Duty | $22 | $37 | $43 | $117 |

| 2011 Ford F-250 Super Duty | $20 | $34 | $43 | $113 |

| 2010 Ford F-250 Super Duty | $20 | $32 | $44 | $110 |

Minimum coverage ranges from $39 for the 2017 model to $44 for the 2010 model, and full coverage decreases from $132 to $110 over the same period. These trends illustrate how insurance costs diminish as the vehicle ages.

Driver Age

Driver age significantly affects the cost of auto insurance for the Ford F-250 Super Duty. Auto insurance for teens, particularly those aged 18, face the highest monthly rates at $481, while 20-year-olds pay $416 monthly.

Ford F-250 Super Duty Auto Insurance Monthly Rates by Age

| Age | Monthly Rates |

|---|---|

| Age: 18 | $481 |

| Age: 20 | $416 |

| Age: 30 | $132 |

| Age: 40 | $116 |

| Age: 50 | $110 |

| Age: 60 | $105 |

In contrast, the cost decreases substantially for older drivers, with 30-year-olds paying $132, 40-year-olds $116, 50-year-olds $110, and 60-year-olds $105 per month. This means a 20-year-old driver pays up to $2,002 more annually than a 40-year-old driver, illustrating how age impacts insurance premiums.

Driver Location

Where you live significantly impacts the insurance rates for a Ford F-250 Super Duty. Monthly rates also vary by city, with Chicago at $185, Columbus at $162, and Houston at $207.

Ford F-250 Super Duty Auto Insurance Monthly Rates by City

| City | Monthly Rates |

|---|---|

| Chicago, IL | $185 |

| Columbus, OH | $162 |

| Houston, TX | $207 |

| Indianapolis, IN | $168 |

| Jacksonville, FL | $193 |

| Los Angeles, CA | $264 |

| New York, NY | $235 |

| Philadelphia, PA | $220 |

| Phoenix, AZ | $190 |

| Seattle, WA | $178 |

Rates are higher in major cities like Los Angeles at $264 and New York at $235, while other cities like Indianapolis and Jacksonville have rates of $168 and $193, respectively. This geographic variation underscores the importance of considering location when estimating insurance costs for the Ford F-250 Super Duty.

Your Driving Record

Your driving record significantly impacts the insurance rates for a Ford F-250 Super Duty. Teens and drivers in their 20s experience the highest increases in auto insurance premiums when they have violations on their records.

For example, at age 18, a clean record results in a monthly rate of $481, which jumps to $722 with one accident, $962 with one DUI, and $601 with one ticket.

Ford F-250 Super Duty Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $481 | $722 | $962 | $601 |

| Age: 20 | $416 | $624 | $832 | $520 |

| Age: 30 | $132 | $198 | $264 | $165 |

| Age: 40 | $116 | $174 | $232 | $145 |

| Age: 50 | $110 | $165 | $220 | $138 |

| Age: 60 | $105 | $158 | $210 | $131 |

Similarly, at age 20, rates are $416 for a clean record, $624 for one accident, $832 for one DUI, and $520 for one ticket. As drivers age, the cost differences reduce but remain notable, with a 30-year-old paying $132 monthly with a clean record, rising to $198 with one accident, $264 with one DUI, and $165 with one ticket.

This pattern continues with older age groups, emphasizing how maintaining a clean driving record can lead to significant savings on insurance costs. Read thoroughly our guide on how credit scores affect auto insurance rates.

Ford F-250 Super Duty Safety Ratings

Ford F-250 Super Duty Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Acceptable |

| Small overlap front: passenger-side | Marginal |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

However, it has an “Acceptable” rating for small overlap front on the driver side and a “Marginal” rating for the same test on the passenger side. These varied ratings reflect the vehicle’s strong overall safety performance but highlight areas for potential improvement, which insurers consider when determining premiums.

Ford F-250 Super Duty Crash Test Ratings

The Ford F-250 Super Duty boasts impressive crash test ratings, which contribute to both enhanced protection and potentially lower insurance rates. The 2022, 2023, and 2024 models all achieved a 5-star overall rating, with 5 stars for frontal and side crashes, and 4 stars for rollover tests.

Ford F-250 Super Duty Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| Ford F-250 Super Duty 2024 | 5 stars | 5 stars | 5 stars | 4 stars |

| Ford F-250 Super Duty 2023 | 5 stars | 5 stars | 5 stars | 4 stars |

| Ford F-250 Super Duty 2022 | 5 stars | 5 stars | 5 stars | 4 stars |

These consistent high ratings reflect the vehicle’s robust safety features, making it a reliable choice for safety-conscious drivers and an attractive option for insurers. Read our article to find the best accident forgiveness auto insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Ford F-250 Super Duty Insurance

When comparing insurance quotes and policies, ensure you’re comparing equivalent coverage levels to get an accurate cost comparison. Using an accurate job title when requesting insurance can prevent overcharges.

Doors off → summer on. Quote retweet this with how you’re kicking off doors-off season. pic.twitter.com/NSihf9ki5A

— Ford Motor Company (@Ford) July 3, 2024

Additionally, inquire about seasonal insurance options if you use your vehicle seasonally, which can reduce premiums during off-peak times.

Top Ford F-250 Super Duty Insurance Companies

The best auto insurance companies for Ford F-250 Super Duty insurance offer competitive rates, various discounts, and consider the vehicle’s robust safety features. The leading providers by market share include State Farm, Geico, Progressive, Allstate, USAA, Liberty Mutual, Farmers, Nationwide, American Family, and Travelers.

Top 10 Ford F-250 Super Duty Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Liberty Mutual | $39.2 million | 5.4% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20.0 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

These companies are well-regarded for their comprehensive coverage options, customer service, and ability to tailor policies to the specific needs of Ford F-250 Super Duty owners, making them popular choices for insuring this vehicle.

Compare Free Ford F-250 Super Duty Insurance Quotes Online

This process helps you identify competitive rates and discounts tailored to your specific needs and driving profile. By leveraging these online tools, you can ensure you are getting the most cost-effective coverage for your Ford F-250 Super Duty without compromising on essential protections (Read more: How to Compare Auto Insurance Quotes).

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Finding the Best Ford F-250 Super Duty Auto Insurance

Choosing the right auto insurance for your Ford F-250 Super Duty can significantly impact your overall costs and coverage benefits. Here are three real-world examples highlighting how different drivers found the best insurance solutions tailored to their unique needs.

- Case Study #1 – Comprehensive Coverage: John, a 35-year-old contractor, needed comprehensive coverage for his brand-new Ford F-250 Super Duty. After comparing quotes, he found State Farm offered the best combination of price and extensive coverage at $38 per month. State Farm’s comprehensive plan provided John with peace of mind knowing his vehicle was fully protected against various risks.

- Case Study #2 – Military Savings: Sarah, a 28-year-old military member, sought affordable insurance for her Ford F-250 Super Duty. USAA offered her exclusive military discounts, resulting in a significantly lower premium. With USAA, Sarah not only saved money but also benefited from exceptional customer service tailored to the unique needs of military personnel and their families.

- Case Study #3 – Affordable Rates for a Young Driver: Michael, a 22-year-old recent college graduate, was looking for the most affordable insurance for his Ford F-250 Super Duty. Geico provided him with the lowest rates, starting at $38 per month. The insurer’s user-friendly online tools and low premiums made it easy for Michael to manage his policy and stay within his budget while enjoying reliable coverage.

These case studies illustrate how different drivers can find the best Ford F-250 Super Duty auto insurance tailored to their specific needs. Check out our guide “Where to Compare Auto Insurance Rates.“

State Farm offers the best comprehensive coverage and affordability for Ford F-250 Super Duty auto insurance.Jeff Root Licensed Insurance Agent

By comparing quotes from top providers like State Farm, USAA, and Geico, you can secure the best coverage and rates for your vehicle. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

How much does Ford F-250 Super Duty insurance cost?

The average auto insurance costs for a Ford F-250 Super Duty are $1,580 per year or $132 per month. Comprehensive coverage costs $385, collision coverage costs $562, and liability coverage costs $446 annually. For additional details, explore our comprehensive resource titled “Types of Auto Insurance.”

Is Ford F-250 Super Duty expensive to insure?

Compared to other trucks like the Toyota Tacoma, Chevrolet Silverado, and Dodge Ram, Ford F-250 Super Duty insurance rates are not particularly expensive, though they can vary depending on the model and trim of the vehicle.

What factors impact the cost of Ford F-250 Super Duty insurance?

Several factors influence the cost, including the vehicle’s age, driver age, location, and driving record. Newer models, younger drivers, urban locations, and poor driving records generally result in higher premiums. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Do safety ratings affect Ford F-250 Super Duty insurance rates?

Yes, better safety ratings can lower insurance premiums as vehicles with good crash test results are considered less risky to insure.

What are some ways to save on Ford F-250 Super Duty insurance?

To save on insurance, maintain a clean driving record, choose a higher auto insurance deductible, utilize available discounts, install safety features, and compare quotes from different insurance companies.

Which companies offer the best Ford F-250 Super Duty auto insurance rates?

State Farm, USAA, and Geico are among the top providers offering the best rates for Ford F-250 Super Duty auto insurance, starting at $38 per month.

How does driver age affect Ford F-250 Super Duty insurance rates?

Younger drivers, particularly those under 25, typically face higher insurance rates compared to older, more experienced drivers, due to higher perceived risk.

Can location affect my Ford F-250 Super Duty insurance premiums?

Yes, premiums can vary significantly based on location, with urban areas generally having higher rates than rural areas due to increased risk of accidents and theft.

What impact does my driving record have on Ford F-250 Super Duty insurance costs?

A clean driving record helps lower insurance premiums, while violations and accidents can lead to higher rates as they increase the perceived risk for insurers. Delve into our guide “How Auto Insurance Companies Check Driving Records.”

Are there discounts available for Ford F-250 Super Duty insurance?

Many providers offer discounts for safe driving, bundling policies, installing safety features, and being a member of certain organizations, which can help lower your insurance costs.

How can I find the best insurance deal for my Ford F-250 Super Duty?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.