Best Ford Taurus Auto Insurance in 2026 (Check Out These 10 Companies)

Travelers, Geico, and Allstate are the top providers that offer the best Ford Taurus auto insurance with rates as low as $105 per month. These companies excel in affordability, coverage options, and customer satisfaction. Choose the best coverage for your Ford Taurus and save with comprehensive plans.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated July 2024

Company Facts

Full Coverage for Ford Taurus

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Ford Taurus

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Ford Taurus

A.M. Best Rating

Complaint Level

Pros & Cons

The best Ford Taurus auto insurance providers are Travelers, Geico, and Allstate, offering rates as low as $105 per month. These companies excel in affordability, coverage options, and customer satisfaction, making them the top picks for comprehensive Ford Taurus insurance coverage across various types of auto insurance.

Discover how these insurers can provide the best protection for your vehicle. Let’s take a closer look at Ford Taurus insurance rates, crash test ratings, and more.

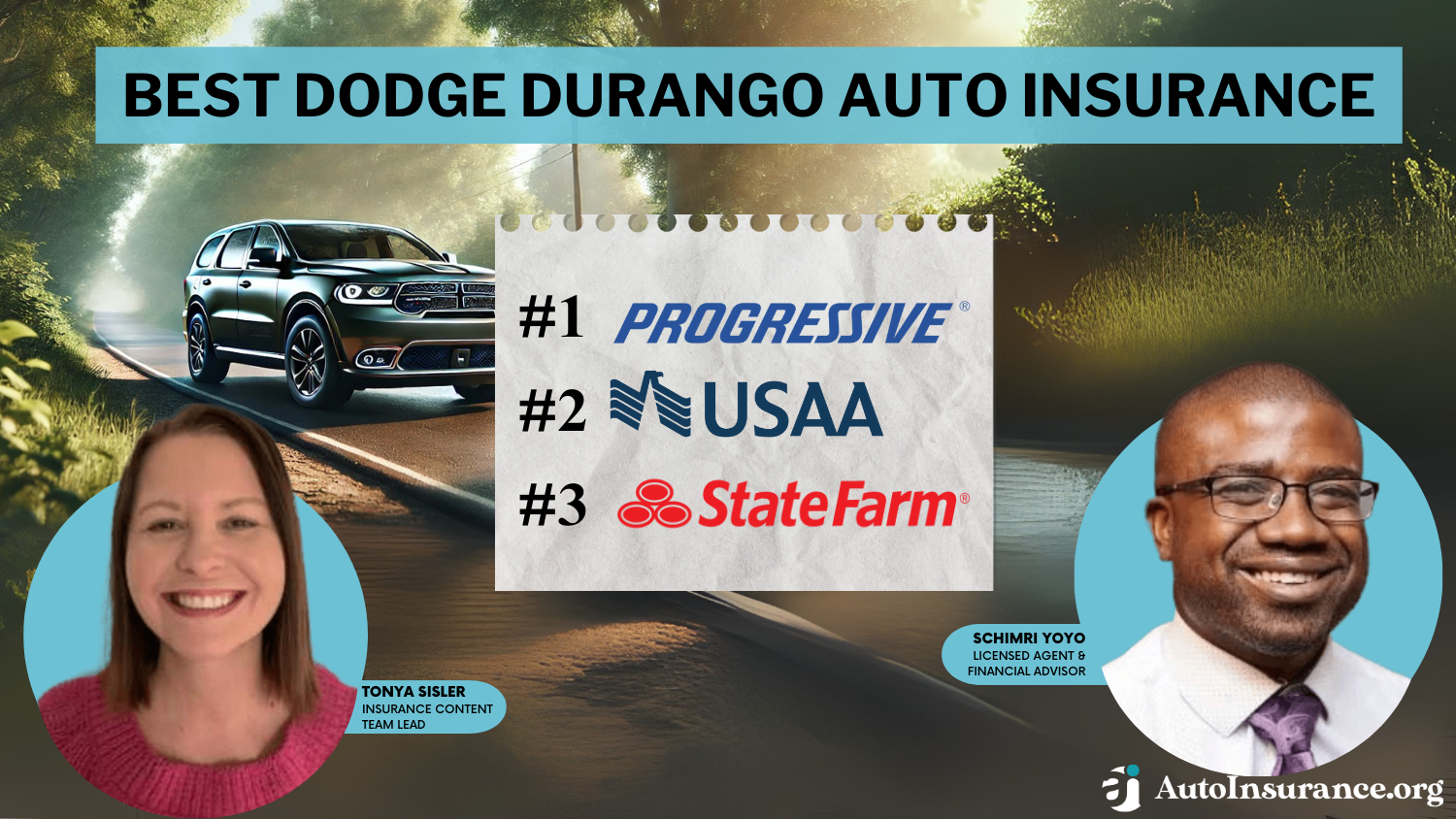

Our Top 10 Company Picks: Best Ford Taurus Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 8% A++ Reliable Coverage Travelers

![]()

#2 25% A++ Affordable Rates Geico

#3 25% A+ Comprehensive Plans Allstate

#4 10% A+ Customer Satisfaction Erie

#5 20% B Nationwide Availability State Farm

#6 10% A++ Military Benefits USAA

#7 25% A Flexible Policies Liberty Mutual

#8 20% A+ Broad Coverage Nationwide

#9 20% A Customizable Options Farmers

#10 12% A+ Innovative Discounts Progressive

You can start comparing quotes for Ford Taurus car insurance rates from some of the best car insurance companies by using our free online tool now.

- Travelers offers the best Ford Taurus auto insurance rates

- Choose from top providers like Geico and Allstate

- Enjoy excellent customer satisfaction and coverage options

#1 – Travelers: Top Overall Pick

Pros:

- Comprehensive Coverage Options: Offers comprehensive coverage options tailored specifically for Ford Taurus drivers, ensuring all aspects of the vehicle are protected.

- Affordable Rates: Competitive rates starting at $105 per month, making it one of the most affordable choices for Ford Taurus owners.

- Excellent Customer Service: High satisfaction rate among Ford Taurus owners due to excellent customer service and support. For more information, read our guide titled, “Travelers Auto Insurance Review.”

Cons:

- Limited Multi-Policy Discounts: Limited availability of multi-policy discounts specific to Ford Taurus insurance can make it less attractive for those seeking bundled savings.

- Higher Premiums for Young Drivers: Higher premiums for younger drivers with a Ford Taurus compared to other providers can be a drawback.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best For Affordable Rates

Pros:

- Affordable Rates with Discounts: Offers affordable rates for Ford Taurus insurance with extensive discount options for safe driving and multiple policies.

- Strong Financial Stability: Geico’s strong financial stability and reliable claims handling ensure peace of mind for Ford Taurus policyholders.

- User-Friendly Online Tools: As mentioned in our Geico auto insurance review, they provide a user-friendly online tools for managing Ford Taurus insurance policies.

Cons:

- Coverage Limitations: Coverage options for Ford Taurus may be limited in some regions, potentially affecting availability.

- Inconsistent Customer Service: Customer service can be inconsistent, which may impact the experience of Ford Taurus policyholders.

#3 – Allstate: Best For Comprehensive Plans

Pros:

- Comprehensive Coverage Plans: Offers comprehensive coverage plans specifically designed for Ford Taurus owners, covering a wide range of needs.

- Multiple Discount Opportunities: Multiple discount opportunities, including safe driver discounts for Ford Taurus drivers, help reduce overall costs.

- High Customer Satisfaction: High customer satisfaction ratings for Ford Taurus insurance claims process reflect the quality of service.

Cons:

- Higher Premiums in High-Risk Areas: Premiums can be higher for Ford Taurus drivers in high-risk areas, which may be a concern. Access comprehensive insights into our guide titled Allstate auto insurance review.

- Limited Specialized Agents: Limited availability of specialized Ford Taurus insurance agents in some locations can be a drawback.

#4 – Erie: Best For Customer Satisfaction

Pros:

- Competitive Rates and Discounts: Offers competitive rates and discounts tailored to Ford Taurus insurance needs, making it an economical choice.

- Personalized Customer Service: Provides personalized customer service with dedicated agents familiar with Ford Taurus coverage, enhancing the user experience.

- Generous Accident Forgiveness: As outlined in our Erie auto insurance review, they offer generous accident forgiveness policies for Ford Taurus drivers.

Cons:

- Availability Limited to Specific States: Availability limited to specific states, affecting Ford Taurus owners outside these areas.

- Less Advanced Online Tools: Online tools for managing Ford Taurus insurance policies are less advanced compared to competitors, which can be inconvenient.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best For Nationwide Availability

Pros:

- Extensive Agent Network: Extensive network of agents providing personalized Ford Taurus insurance guidance, ensuring comprehensive support.

- Safe Driving Discounts: Discounts for safe driving and bundling policies benefit Ford Taurus owners, helping to lower costs. Discover insights in our guide titled, State Farm auto insurance review.

- Comprehensive Coverage Options: State Farm provides extensive coverage options for Ford Taurus owners, including add-ons and customizations tailored to individual needs.

Cons:

- Higher Rates: Rates for Ford Taurus insurance may be higher compared to other providers, which can be a concern for budget-conscious drivers.

- Challenges with Claims Process: Some Ford Taurus policyholders report challenges with the claims process, impacting overall satisfaction.

#6 – USAA: Best For Military Benefits

Pros:

- Exclusive Military Rates: Exclusive rates and benefits for military families insuring their Ford Taurus, making it a top choice for this group.

- High Claims Satisfaction: High customer satisfaction with claims service specifically for Ford Taurus insurance, ensuring reliable support.

- Comprehensive Coverage Options: Comprehensive coverage options including roadside assistance for Ford Taurus drivers. Unlock details in our guide titled, USAA auto insurance review.

Cons:

- Eligibility Limited to Military: Eligibility limited to military members and their families, excluding many Ford Taurus owners from accessing these benefits.

- Limited Physical Locations: Limited physical locations may impact Ford Taurus policyholders needing in-person assistance, which can be a drawback.

#7 – Liberty Mutual: Best For Flexible Policies

Pros:

- Unique Coverage Options: Offers unique coverage options like new car replacement for Ford Taurus owners, providing additional protection.

- Safe Driving Discounts: Discounts for safe driving and bundling policies specific to Ford Taurus insurance help reduce overall costs.

- Strong Financial Stability: Strong financial stability ensures reliable coverage for Ford Taurus policies, giving peace of mind. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons:

- Higher Premiums for Young Drivers: Higher premiums for younger Ford Taurus drivers compared to other insurers can be a drawback.

- Lower Customer Service Ratings: Customer service ratings for Ford Taurus insurance are lower than some competitors, which can impact user satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best For Broad Coverage

Pros:

- Broad Coverage Options: Broad coverage options and discounts for Ford Taurus drivers, offering flexibility and savings. Read up on the Nationwide auto insurance review for more information.

- High Claims Satisfaction: High customer satisfaction with claims service tailored to Ford Taurus insurance ensures reliable support.

- Vanishing Deductible Feature: Offers vanishing deductible feature for Ford Taurus policyholders with safe driving records, reducing costs over time.

Cons:

- Rates Not Always Competitive: Rates for Ford Taurus insurance may not be the most competitive in the market, which can be a concern for budget-conscious drivers.

- Challenges with Renewal Process: Some Ford Taurus owners report difficulties with the policy renewal process, impacting overall satisfaction.

#9 – Farmers: Best For Customizable Options

Pros:

- Comprehensive Coverage Options: Offers comprehensive coverage options for Ford Taurus, including custom equipment coverage for added protection.

- Multiple Discounts: Discounts for multi-policy and safe driving benefits for Ford Taurus owners help reduce overall insurance costs.

- High Claims Satisfaction: High customer satisfaction with claims handling for Ford Taurus insurance, ensuring reliable service. More information is available in our Farmers auto insurance review.

Cons:

- Higher Premiums: Premiums for Ford Taurus insurance can be higher than average, which may be a concern for some drivers.

- Limited Specialized Agents: Limited availability of specialized Ford Taurus insurance agents in some regions can be a drawback.

#10 – Progressive: Best For Innovative Discounts

Pros:

- Competitive Rates and Discounts: Competitive rates and discounts specifically for Ford Taurus insurance, making it an affordable choice.

- Usage-Based Insurance Programs: Innovative usage-based insurance programs benefit Ford Taurus drivers by offering discounts based on driving habits.

- Strong Online Tools: Strong online tools for managing Ford Taurus policies and claims. Delve into our evaluation of Progressive auto insurance review.

Cons:

- Inconsistent Customer Service: Customer service ratings for Ford Taurus insurance can be inconsistent, impacting overall satisfaction.

- Higher Rates for High-Risk Drivers: Higher rates for high-risk Ford Taurus drivers compared to other insurers can be a drawback.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford Taurus Insurance Cost

The average auto insurance rates for a Ford Taurus are influenced by several factors including the coverage level and the insurance provider. Understanding these costs is crucial for making informed decisions and potentially saving money on your policy.

Below, we’ve outlined the monthly rates for both minimum and full coverage from various top providers to give you a clearer picture of what you might expect to pay for insuring your Ford Taurus.

Ford Taurus Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $120 $210

Erie $115 $200

Farmers $120 $210

Geico $105 $180

Liberty Mutual $115 $205

Nationwide $110 $195

Progressive $105 $185

State Farm $110 $190

Travelers $110 $195

USAA $100 $175

Choosing the right insurance provider and coverage level can significantly impact your overall costs. Companies like Geico and Progressive offer competitive rates, especially for minimum coverage, making them a good option for budget-conscious Ford Taurus drivers. Learn more about full coverage in our article titled “What is full coverage auto insurance? .”

Ford Taurus Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $125 |

| Discount Rate | $73 |

| High Deductibles | $108 |

| High Risk Driver | $266 |

| Low Deductibles | $157 |

| Teen Driver | $456 |

USAA provides exclusive rates for military members and their families, ensuring comprehensive coverage. By comparing these options, you can find the best Ford Taurus auto insurance that meets your specific needs and budget.

Are Ford Taurus Expensive to Insure

The chart below details how Ford Taurus insurance rates compare to other sedans like the Toyota Avalon, Chevrolet Blazer, and Chevrolet Impala. Understanding how your vehicle’s insurance costs stack up against similar models can help you make more informed decisions about your coverage.

Ford Taurus Auto Insurance Monthly Rates vs. Similar Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Taurus | $29 | $50 | $33 | $125 |

| Toyota Avalon | $27 | $45 | $28 | $111 |

| Chevrolet Blazer | $31 | $57 | $26 | $126 |

| Chevrolet Impala | $23 | $44 | $31 | $112 |

| Hyundai Sonata | $25 | $44 | $35 | $119 |

| Nissan Sentra | $21 | $48 | $33 | $114 |

| Ford Fusion | $28 | $52 | $31 | $124 |

While the Ford Taurus has competitive insurance rates, comparing it to other similar vehicles can highlight potential savings and help you decide on the best coverage. To find out more, explore our guide titled, “Top 7 Factors That Affect Auto Insurance Rates.”

Travelers stands out with its comprehensive options and affordable rates.Jeff Root LICENSED INSURANCE AGENT

However, there are a few things you can do to find the cheapest Ford insurance rates online, such as shopping around, leveraging discounts, and adjusting your coverage levels to better fit your needs.

What Impacts the Cost of Ford Taurus Insurance

The cost of insuring a Ford Taurus can be influenced by various factors, including the trim and model you choose.

Additionally, other key elements such as the vehicle’s age, the driver’s age, location, driving record, and safety ratings also play significant roles in determining your insurance premiums.

Below, we explore these factors in detail to help you understand how they impact your Ford Taurus insurance costs and how you can potentially save money on your policy.

Age of the Vehicle

Older Ford Taurus models generally cost less to insure. As vehicles age, they typically depreciate in value, which can lead to lower insurance premiums.

For example, a newer model like the 2018 Ford Taurus may have higher insurance costs compared to a 2010 model. The following table shows how insurance rates vary by model year for the Ford Taurus.

Ford Taurus Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Ford Taurus | $30 | $50 | $34 | $124 |

| 2023 Ford Taurus | $29 | $50 | $34 | $124 |

| 2022 Ford Taurus | $29 | $50 | $33 | $123 |

| 2021 Ford Taurus | $28 | $49 | $33 | $123 |

| 2020 Ford Taurus | $28 | $49 | $33 | $124 |

| 2019 Ford Taurus | $28 | $49 | $32 | $123 |

| 2018 Ford Taurus | $27 | $48 | $32 | $122 |

| 2017 Ford Taurus | $26 | $46 | $35 | $122 |

| 2016 Ford Taurus | $25 | $44 | $36 | $120 |

| 2015 Ford Taurus | $24 | $41 | $37 | $116 |

| 2014 Ford Taurus | $23 | $39 | $38 | $113 |

| 2013 Ford Taurus | $22 | $35 | $38 | $109 |

| 2012 Ford Taurus | $20 | $32 | $38 | $104 |

| 2011 Ford Taurus | $20 | $30 | $38 | $102 |

Knowing how the age of your vehicle impacts insurance rates can help you plan your budget and choose the best coverage. As older models typically incur lower premiums, you can use this information to find cost-effective insurance solutions for your Ford Taurus. Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Driver Age

Driver age can have a significant impact on Ford Taurus auto insurance rates. Younger drivers, particularly those in their teens and early twenties, often face higher premiums due to their increased risk factors.

Travelers announces Stay-at-Home Auto Premium Credit Program – personal auto insurance customers will receive a 15% credit on April and May auto premiums. pic.twitter.com/88YWduIcHS

— Travelers (@Travelers) April 8, 2020

Conversely, older drivers tend to benefit from lower rates. The following chart illustrates how insurance rates for the Ford Taurus change with the driver’s age.

Ford Taurus Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $654 |

| Age: 18 | $456 |

| Age: 20 | $283 |

| Age: 30 | $130 |

| Age: 40 | $125 |

| Age: 45 | $121 |

| Age: 50 | $114 |

| Age: 60 | $111 |

Understanding how age affects your insurance rates allows you to anticipate changes in your premiums over time and explore discounts or coverage adjustments that may be beneficial as you age.

Driver Location

Where you live can have a large impact on Ford Taurus insurance rates. For example, drivers in Houston may pay more than drivers in Columbus.

Ford Taurus Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $188 |

| New York, NY | $197 |

| Houston, TX | $195 |

| Jacksonville, FL | $181 |

| Philadelphia, PA | $167 |

| Chicago, IL | $165 |

| Phoenix, AZ | $145 |

| Seattle, WA | $121 |

| Indianapolis, IN | $106 |

| Columbus, OH | $104 |

Location-based rate variations highlight the importance of considering your geographical area when budgeting for car insurance. By comparing rates in different locations, you can find the most cost-effective insurance options for your Ford Taurus.

Your Driving Record

Your driving record can have an impact on the cost of Ford Taurus auto insurance. Teens and drivers in their 20’s see the highest jump in their Ford Taurus car insurance with violations on their driving record.

Ford Taurus Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $654 | $980 | $1,320.00 | $830 |

| Age: 20 | $456 | $684 | $920.00 | $580 |

| Age: 30 | $283 | $425 | $573.00 | $361 |

| Age: 40 | $130 | $195 | $263.00 | $166 |

| Age: 50 | $125 | $187 | $252.00 | $160 |

| Age: 60 | $121 | $181 | $244.00 | $155 |

| Age: 50 | $114 | $170 | $229.00 | $146 |

| Age: 60 | $111 | $166 | $223.00 | $142 |

Maintaining a clean driving record is crucial for keeping insurance costs low. Awareness of how violations impact your rates can motivate you to drive safely and explore programs that reward good driving behavior.

Ford Taurus Safety Ratings

Your Ford Taurus auto insurance rates are tied to the vehicle’s safety ratings. Better safety ratings often lead to lower premiums as they indicate a lower risk of injury in accidents. The table below provides an overview of the Ford Taurus’s safety ratings.

Ford Taurus Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Acceptable |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Understanding your vehicle’s safety ratings can help you select insurance plans that offer discounts for safer cars. This knowledge can also guide you in choosing vehicles that are not only safe but also economical to insure.

Ford Taurus Crash Test Ratings

Good Ford Taurus crash test ratings mean the VW is safer, which could mean cheaper Ford Taurus car insurance rates.

Ford Taurus Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2024 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford Taurus 4 DR FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford Taurus 4 DR AWD | 5 stars | 5 stars | 5 stars | 4 stars |

Crash test ratings provide valuable insights into the safety and durability of your vehicle. Opting for a car with high crash test ratings not only enhances safety but also potentially reduces your insurance costs.

Ford Taurus Safety Features

The Ford Taurus safety features play a vital role in keeping passengers safe in crashes, but they can also help lower your Ford Taurus auto insurance rates. The Ford Taurus’s safety features include:

- Air Bags: Driver, passenger, front head, rear head, and front side airbags.

- Braking Systems: 4-wheel ABS and 4-wheel disc brakes with brake assist.

- Stability Control: Electronic stability control and traction control.

- Child Safety: Child safety locks.

- Advanced Safety: Traction control

Incorporating safety features into your vehicle can lead to significant insurance savings. These features not only protect you and your passengers but also reduce the likelihood of accidents, leading to lower premiums.

Ford Taurus Insurance Loss Probability

The Ford Taurus’s insurance loss probability varies between different coverage types. The lower percentage means lower Ford Taurus auto insurance costs; higher percentages mean higher Ford Taurus auto insurance costs.

Ford Taurus Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | 9% |

| Property Damage | -12% |

| Comprehensive | 34% |

| Personal Injury | 15% |

| Medical Payment | 15% |

| Bodily Injury | 1% |

By understanding the various factors that impact the cost of Ford Taurus insurance, including vehicle age, driver demographics, location, driving history, and safety ratings, you can better navigate your options and find the most cost-effective coverage for your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ford Taurus Finance and Insurance Cost

Shopping around for Ford Taurus car insurance quotes can help you find the best deals and potentially save hundreds of dollars annually. By comparing quotes from multiple insurance providers, you can ensure that you are getting comprehensive coverage at the most affordable price.

This is especially important if your auto insurance deductible is high, as finding lower premium rates can help offset the out-of-pocket costs you may incur in the event of a claim.

Read more: Top 7 Factors That Affect Auto Insurance Rates

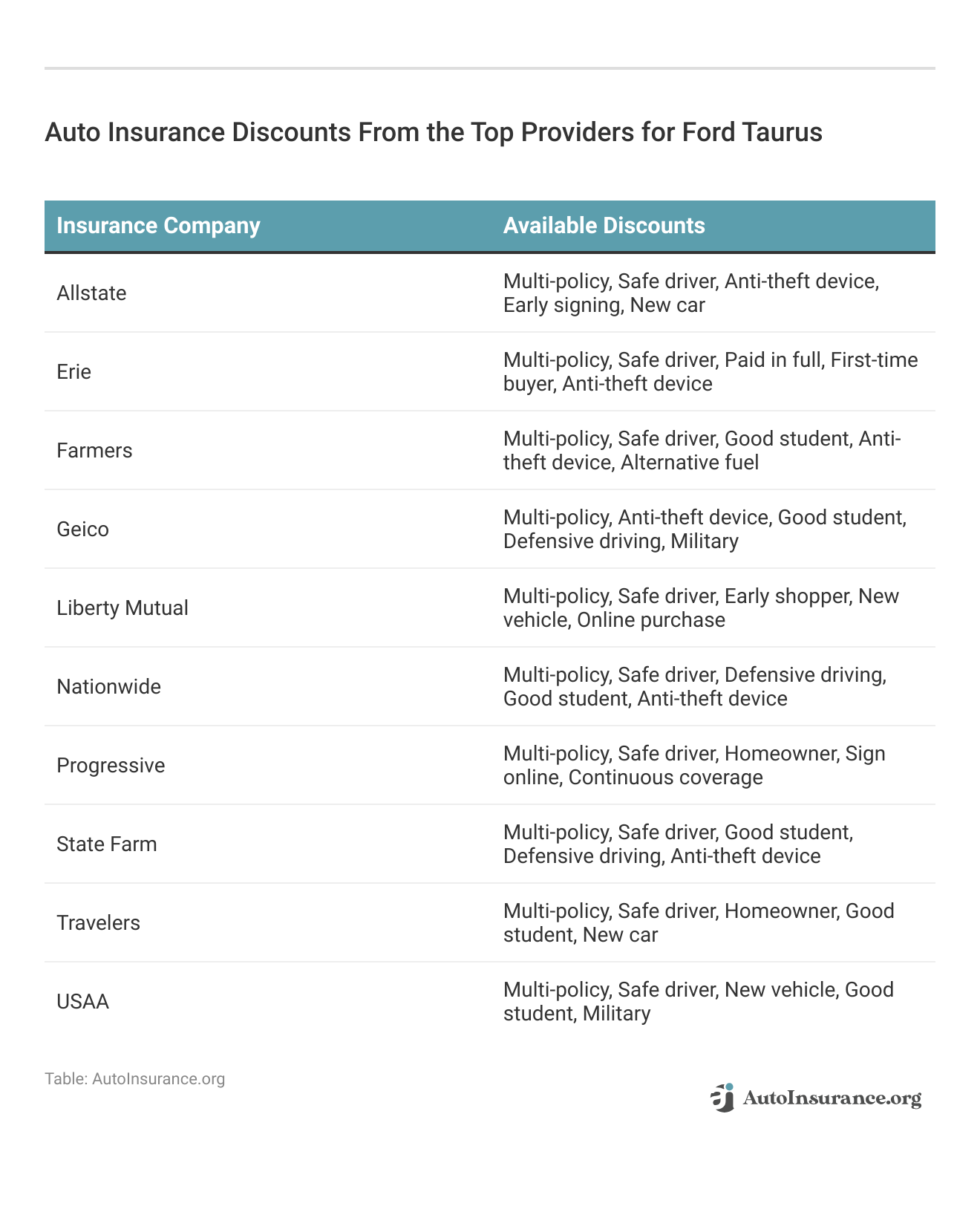

Ways to Save on Ford Taurus Insurance

You have more options at your disposal to save money on your Ford Taurus auto insurance costs. For example, try taking advantage of the following five strategies to reduce your Ford Taurus car insurance rates

- Ask Your Insurance Company About Ford Taurus Discounts.

- Reduce Modifications on Your Ford Taurus.

- Audit Your Ford Taurus Driving When You Move to a New Location or Start a New Job.

- Spy on Your Teen Driver.

- Re-Check Ford Taurus Quotes Every 6 Months.

When you implement these strategies, you can ensure that you are getting the best possible rates for your Ford Taurus insurance, helping you save money while maintaining excellent coverage.

Taking advantage of these discounts can lead to substantial savings on your Ford Taurus insurance premiums. Be sure to ask your insurance provider about all available discounts to maximize your potential savings. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Top Ford Taurus Insurance Companies

The best auto insurance companies for Ford Taurus car insurance rates will offer competitive rates, discounts, and account for the Ford Taurus’s safety features. The following list of car insurance companies outlines which companies hold the highest market share.

Top 10 Ford Taurus Auto Insurance Providers by Market Share

| Rank | Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 5% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

You can start comparing quotes for Ford Taurus auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

How does the model and year of my Ford Taurus affect my auto insurance rates?

The model and year of your Ford Taurus can impact your auto insurance rates. Typically, newer models tend to have higher insurance premiums due to the cost of repairs and replacement parts. Additionally, certain features or trim levels of the Ford Taurus may affect the rates as well.

It’s best to check with insurance providers to understand how the specific model and year of your Taurus can influence your premiums.

Are there any safety features in the Ford Taurus that can help lower my insurance rates?

Yes, many safety features in the Ford Taurus may help reduce your auto insurance rates. Some common safety features that insurers consider include anti-lock brakes (ABS), airbags, traction control, electronic stability control, and collision warning systems.

These features can reduce the risk of accidents and injuries, which may result in lower insurance premiums. Consult with your insurance provider to see which safety features in your Ford Taurus qualify for potential discounts.

Read more: Are backup cameras required on new vehicles?

What factors other than the car itself can affect my Ford Taurus auto insurance rates?

Several factors beyond the vehicle itself can impact your Ford Taurus auto insurance rates. Some common factors include your driving record, age, gender, location, annual mileage, credit history, and the coverage options you choose. Insurance companies assess these variables to determine the level of risk associated with insuring you and your vehicle.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Does the color of my Ford Taurus affect my insurance rates?

No, the color of your Ford Taurus does not typically affect your auto insurance rates. Insurers primarily consider factors like the model, year, engine size, safety features, and your personal details. The color of your vehicle does not directly impact its safety or insurability.

However, it’s important to provide accurate information about your Ford Taurus, including its color, when obtaining insurance quotes. Learn more in our article titled “Does auto insurance cover paint damage?.”

Can I get discounts on my Ford Taurus auto insurance?

Yes, you may be eligible for various discounts on your Ford Taurus auto insurance. Insurance companies often offer discounts for factors such as having multiple policies with the same insurer, having a good driving record, completing a defensive driving course, being a safe driver, having certain safety features installed in your vehicle, or maintaining low annual mileage. Contact your insurance provider to inquire about the specific discounts available for your Ford Taurus.

Is it necessary to have comprehensive and collision coverage for my Ford Taurus?

The need for comprehensive and collision coverage for your Ford Taurus depends on various factors, including the value of your vehicle and your personal preferences. Comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters, while collision coverage covers damages from accidents involving other vehicles or objects.

How do I find the best Ford Taurus auto insurance rates?

To find the best Ford Taurus auto insurance rates, compare quotes from multiple insurance providers. Utilize online tools to get customized quotes based on your specific needs and driving history. Look for discounts such as multi-policy, safe driver, and anti-theft device discounts.

Read more: Where to Buy Auto Insurance Online

What are the best companies for Ford Taurus auto insurance?

The best companies for Ford Taurus auto insurance include Travelers, Geico, and Allstate. These companies offer competitive rates, comprehensive coverage options, and high customer satisfaction. Each provider has unique discounts and benefits that can cater to the specific needs of Ford Taurus owners.

How does an auto insurance deductible affect my Ford Taurus insurance rates?

An auto insurance deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premium, but it means you’ll pay more in the event of a claim. Consider your financial situation and driving habits when selecting a deductible for your Ford Taurus insurance policy.

What factors impact the cost of Ford Taurus auto insurance?

Several factors impact the cost of Ford Taurus auto insurance, including the age and model of the vehicle, driver age, location, driving record, and safety features. Older models and drivers with clean records typically enjoy lower premiums, while younger drivers and those in high-risk areas may face higher rates.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.