Best Lexus LC 500h Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

Discover why State Farm, Allstate, and AAA are the top picks for the best Lexus LC 500h auto insurance, offering competitive plans starting at just $41 a month. These providers deliver the best rates and comprehensive coverage, ensuring optimal insurance solutions for your Lexus LC 500h.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

Company Facts

Full Coverage for Lexus LC 500h

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Lexus LC 500h

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Lexus LC 500h

A.M. Best Rating

Complaint Level

Pros & Cons

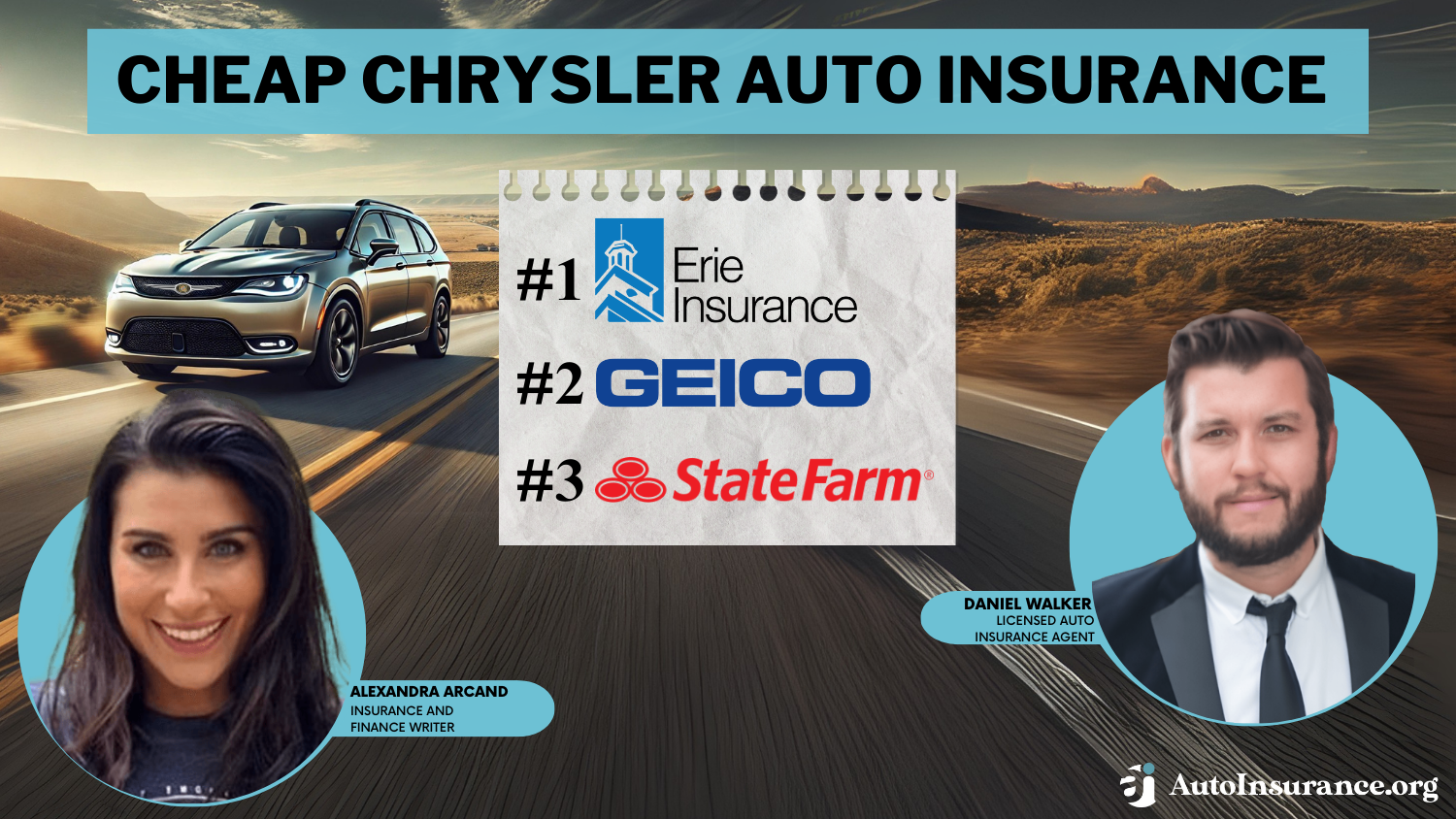

The top picks for the best Lexus LC 500h auto insurance are State Farm, Allstate, and AAA, renowned for their superior coverage options and customer service.

These providers stand out in the competitive auto insurance market by offering tailored policies that enhance the safety and value of your Lexus LC 500h. See more details in our guide titled, “Cheap Lexus Auto Insurance.”

Our Top 10 Company Picks: Best Lexus LC 500h Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% B Many Discounts State Farm

#2 15% A+ Add-on Coverages Allstate

#3 12% A++ Military Savings USAA

#4 18% A Online App AAA

#5 20% A+ Usage Discount Nationwide

#6 5% A++ Cheap Rates Geico

#7 14% A+ Online Convenience Progressive

#8 17% A Customizable Polices Liberty Mutual

#9 8% A++ Accident Forgiveness Travelers

#10 19% A Local Agents Farmers

With comprehensive plans that cater specifically to luxury hybrid vehicles, they ensure that your investment is well-protected. Delve into what makes these companies the leaders in Lexus LC 500h auto insurance and how they can benefit you as a car owner.

To compare Lexus LC 500h auto insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- State Farm is the top pick for the best Lexus LC 500h auto insurance

- Tailored coverage meets the specific needs of the Lexus LC 500h

- Specialized policies enhance protection for luxury hybrid vehicles

#1 – State Farm: Top Overall Pick

Pros

- Bundling Benefits: State Farm offers attractive discounts for bundling Lexus LC 500h auto insurance with other policies.

- Low Mileage Rewards: Drivers of the Lexus LC 500h benefit from significant low-mileage discounts at State Farm. Discover insights in our guide titled, State Farm auto insurance review.

- Comprehensive Coverage: State Farm provides a range of coverage options tailored to the unique needs of Lexus LC 500h owners.

Cons

- Restrictive Multi-Policy Savings: Compared to competitors, State Farm’s multi-policy discounts are less generous for Lexus LC 500h owners.

- Higher Premiums: Premium levels for Lexus LC 500h insurance can be relatively high at State Farm, even with discounts applied.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Add-on Coverages

Pros

- Enhanced Protection Options: Allstate offers extensive add-on coverages that cater specifically to the Lexus LC 500h, enhancing vehicle protection.

- Superior Claim Service: Lexus LC 500h owners can benefit from Allstate’s highly-rated claims service, ensuring quick and effective support.

- Generous Multi-Vehicle Discount: Allstate provides a 15% discount for Lexus LC 500h owners insuring multiple vehicles. Access comprehensive insights into our guide titled Allstate auto insurance review.

Cons

- Premium Cost: Despite robust coverage options, Allstate’s premiums for the Lexus LC 500h can be on the higher side.

- Coverage Limitations: Some desired coverages for Lexus LC 500h may not be available or are limited under Allstate’s standard policies.

#3 – USAA: Best for Military Savings

Pros

- Military-Focused Discounts: USAA offers substantial discounts and benefits for military members who own a Lexus LC 500h. Unlock details in our guide titled, USAA auto insurance review.

- Exceptional Customer Service: Recognized for top-tier customer service, USAA provides Lexus LC 500h owners with reliable and attentive support.

- High Financial Stability: With an A++ rating from A.M. Best, USAA promises robust financial reliability for Lexus LC 500h insurance claims.

Cons

- Eligibility Restrictions: USAA’s services are limited to the military community, which excludes non-military Lexus LC 500h owners.

- Limited Physical Presence: USAA mainly operates online, which might be a drawback for those who prefer in-person service for their Lexus LC 500h insurance.

#4 – AAA: Best for Online App

Pros

- Digital Convenience: AAA’s advanced online app simplifies managing Lexus LC 500h auto insurance policies. See more details in our guide titled, “AAA Auto Insurance Review.”

- High Multi-Vehicle Discount: Lexus LC 500h owners enjoy an 18% discount when insuring multiple vehicles with AAA.

- Robust Support Network: AAA offers a comprehensive support network, enhancing the insurance experience for Lexus LC 500h owners.

Cons

- Membership Requirement: AAA requires membership to access auto insurance for the Lexus LC 500h, which can be a barrier for some.

- Variable Service Quality: The quality of service can vary significantly between different regions for Lexus LC 500h insurance at AAA.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Usage-Based Savings: Nationwide offers significant discounts for Lexus LC 500h owners who opt for usage-based insurance, rewarding safe and low-mileage driving.

- Comprehensive Options: Provides a broad range of customizable coverage options tailored to the specific needs of Lexus LC 500h owners. Read up on the Nationwide auto insurance review for more information.

- Strong Financial Rating: With an A+ rating from A.M. Best, Nationwide ensures strong backing for claims related to Lexus LC 500h insurance.

Cons

- Higher Rates for Frequent Drivers: Lexus LC 500h owners who drive frequently may face higher premiums with Nationwide’s usage-based plans.

- Complexity in Policy Customization: While offering customization, the options can be complex and overwhelming for new Lexus LC 500h insurance buyers.

#6 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing: Geico offers some of the most affordable rates for Lexus LC 500h auto insurance, making it an attractive option for budget-conscious owners.

- Fast Claims Processing: Geico is known for its efficiency in handling claims, ensuring quick resolution for Lexus LC 500h insurance claims.

- Extensive Coverage Options: Offers a wide array of coverage options that provide comprehensive protection for the Lexus LC 500h. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

Cons

- Basic Customer Service: Geico’s customer service might not match the personalized attention offered by smaller insurers for Lexus LC 500h owners.

- Limited Customization: Geico’s lower rates come with more standardized policies, which might limit customization options for the specific needs of Lexus LC 500h owners.

#7 – Progressive: Best for Online Convenience

Pros

- Innovative Online Tools: Progressive offers state-of-the-art online tools that streamline managing and purchasing Lexus LC 500h auto insurance.

- Discounts for Continuous Coverage: Lexus LC 500h owners benefit from discounts for maintaining continuous coverage with Progressive. Delve into our evaluation of Progressive auto insurance review.

- Flexible Coverage Levels: Progressive offers flexible coverage options, allowing Lexus LC 500h owners to tailor their policies to their exact needs.

Cons

- Higher Premiums for High-Risk Drivers: Lexus LC 500h owners with a history of claims or traffic violations may face significantly higher premiums at Progressive.

- Inconsistent Agent Experience: The quality of service can vary depending on the agent or region, affecting the overall experience for Lexus LC 500h owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Policies: Liberty Mutual offers highly customizable policies, allowing Lexus LC 500h owners to tailor coverage to their specific needs. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Accident Forgiveness: Offers accident forgiveness programs that can prevent premium increases after the first at-fault accident for qualifying Lexus LC 500h owners.

- Diverse Discount Options: Provides a variety of discounts, including for safe driving, which can significantly lower premiums for Lexus LC 500h insurance.

Cons

- Higher Costs for Additional Features: Adding extra features and customizations to Lexus LC 500h insurance policies at Liberty Mutual can significantly increase costs.

- Variable Customer Satisfaction: Customer satisfaction can vary, with some Lexus LC 500h owners experiencing issues with claim processing times and service quality.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Robust Accident Forgiveness: Travelers offers robust accident forgiveness options, protecting Lexus LC 500h owners from premium spikes after their first accident.

- High Financial Stability: With an A++ rating from A.M. Best, Travelers provides excellent financial reliability for handling Lexus LC 500h insurance claims.

- Comprehensive Coverage: Offers extensive coverage options that cater to the advanced features and needs of the Lexus LC 500h. See more details in our guide titled, “Travelers Auto Insurance Review.”

Cons

- Premium Pricing: Travelers’ extensive coverage and benefits come at a higher price, which may not be ideal for all Lexus LC 500h owners.

- Selective Coverage Availability: Some of Travelers’ best features may not be available in all states, limiting options for some Lexus LC 500h owners.

#10 – Farmers: Best for Local Agents

Pros

- Personalized Service: Farmers provides personalized service through local agents who understand the specific needs of Lexus LC 500h owners.

- High Coverage Customization: Offers high levels of customization in policies, allowing for tailored coverage that suits the individual requirements of Lexus LC 500h owners.

- Strong Local Presence: With a widespread network of agents, Farmers ensures accessible and responsive service for Lexus LC 500h insurance. More information is available about this provider in our Farmers auto insurance review.

Cons

- Higher Local Premiums: Depending on the region, premiums for Lexus LC 500h auto insurance can be higher at Farmers, affected by local risk factors.

- Inconsistent Experience Across Agents: The quality of service can vary significantly between different agents, which might affect the insurance experience for Lexus LC 500h owners.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Lexus LC 500h Insurance Costs by Coverage Level

The table below presents a detailed comparison of monthly insurance rates for the Lexus LC 500h, segmented by coverage level and provider. This overview facilitates a clear understanding of how minimum and full coverage premiums vary across major insurance companies.

Lexus LC 500h Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $41 $131

Allstate $59 $186

Farmers $58 $176

Geico $61 $182

Liberty Mutual $98 $310

Nationwide $72 $204

Progressive $64 $199

State Farm $52 $151

Travelers $74 $226

USAA $74 $224

For the Lexus LC 500h, monthly insurance costs range significantly depending on the level of coverage and the insurer. AAA offers the most affordable minimum coverage at $41 per month, while Liberty Mutual presents the highest rate for full coverage at $310 per month.

Amazing to see such a huge turnout. Women’s sports know how to draw a crowd! https://t.co/VDR2FDwduy

— State Farm (@StateFarm) July 23, 2024

State Farm and Allstate offer competitive rates for both coverage levels, balancing affordability with comprehensive protection.

This range in pricing reflects the different value propositions and coverage specifics offered by each insurer, giving Lexus LC 500h owners a broad spectrum of options to choose from based on their insurance needs and budget constraints

Learn more: What is the average auto insurance cost per month?

Are Vehicles Like the Lexus LC 500h Expensive to Insure

Understanding the insurance costs associated with luxury coupes like the Lexus LC 500h is essential for potential buyers. Comparing rates with other similar models such as the Nissan 240SX, Audi A5, and Audi Coupe can provide valuable insights.

The comparison of insurance rates for coupes demonstrates the financial commitment required to insure high-end vehicles like the Lexus LC 500h. Owning such models involves significant insurance costs, which are crucial to consider when making a purchase decision.

The diversity in insurance rates for vehicles akin to the Lexus LC 500h highlights the importance of evaluating insurance costs as part of the overall ownership expenses.

Whether considering a sporty Subaru BRZ or a high-end Porsche 911, potential buyers should factor in these costs when choosing their next vehicle.

Insurance Rates for Vehicles Similar to the Lexus LC 500h

Understanding insurance rates for vehicles similar to the Lexus LC 500h helps potential buyers estimate costs and make informed decisions. This comparison includes various vehicles, highlighting their comprehensive, collision, and liability coverage costs.

Lexus LC 500h Auto Insurance Monthly Rates vs. Similar Cars by Coverage Level

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Hyundai Veloster | $26 | $44 | $35 | $117 |

| MINI Cooper | $23 | $42 | $30 | $106 |

| Audi TT | $32 | $60 | $33 | $138 |

| Infiniti Q60 | $32 | $62 | $33 | $140 |

| MINI Hardtop 2 Door | $24 | $45 | $28 | $108 |

| Mazda RX-8 | $21 | $34 | $38 | $106 |

| Mercedes-Benz CLA 250 | $34 | $70 | $33 | $150 |

| Cadillac ATS-V | $34 | $70 | $33 | $150 |

| Lexus LC 500h | $36 | $74 | $35 | $158 |

Comparing the insurance rates of vehicles like the Lexus LC 500h demonstrates the variety in coverage costs based on vehicle type and brand. Such information is crucial for those looking to balance the performance and luxury of their car with potential insurance expenditures. Delve into our evaluation of “What are the recommended auto insurance coverage levels?“

What Impacts the Cost of Lexus LC 500h Insurance

As with any car, your Lexus LC 500h car insurance costs will be affected by personal factors like where you live, your driving record, and your driving habits.

The Lexus LC 500h trim level you buy will also have an impact on the total price you will pay for Lexus LC 500h insurance coverage.

Lexus LC 500h Crash Test Ratings

Crash test ratings are a critical factor in determining auto insurance rates, and good ratings for the Lexus LC 500h could potentially reduce costs. Below is a summary of the most recent crash test results for this model.

Lexus LC 500h Crash Test Ratings by Vehicle

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Lexus LC 500h 2 DR RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2023 Lexus LC 500h 2 DR RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2022 Lexus LC 500h 2 DR RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2021 Lexus LC 500h 2 DR RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

| 2020 Lexus LC 500h 2 DR RWD | 5 Stars | 5 Stars | 5 Stars | 4 Stars |

While the specific crash test results for the 2020 Lexus LC 500h are not rated (N/R), potential and current owners should consider how these ratings, once available, could influence their auto insurance premiums.

Good ratings typically lead to lower insurance costs, reflecting the vehicle’s safety and reliability. See more details in our guide titled “Factors That Affect Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on Lexus LC 500h Insurance

Securing lower insurance rates for your Lexus LC 500h is possible with a few strategic actions. These practical tips can help reduce premiums while maintaining excellent coverage.

- Reduce modifications on your Lexus LC 500h.

- Improve your credit score.

- Tell your insurer how you use your Lexus LC 500h.

- Consider Lexus LC 500h insurance costs before buying a Lexus LC 500h.

- Never drink and drive your Lexus LC 500h.

By following these straightforward strategies, you can significantly decrease the cost of insuring your Lexus LC 500h. Smart decisions such as improving your credit score and honest communication with your insurer can lead to substantial savings. To find out more, explore our guide titled, “Top 7 Factors That Affect Auto Insurance Rates.”

Top Lexus LC 500h Insurance Companies

Selecting the right insurer for your Lexus LC 500h is crucial, as different companies offer varying rates and discounts. This overview identifies the largest auto insurers by market share that provide competitive insurance for the Lexus LC 500h. To learn more, explore our comprehensive resource on “Auto Insurance Premium Defined.”

Identifying the top insurance companies for the Lexus LC 500h by market share offers a clear view of where most consumers are placing their trust.

State Farm's dominance in market share is a clear testament to its consistent reliability and competitive pricing.Jeffrey Manola Licensed Insurance Agent

This information aids Lexus LC 500h owners in making an informed choice about their auto insurance, taking into account both market dominance and potential savings through available discounts.

Largest Auto Insurers by Market Share

Market share is a critical indicator of an insurance company’s dominance and consumer trust in the industry. This list details the largest auto insurers by market share, showcasing the leading companies and their financial volumes.

Lexus LC 500h Largest Auto Insurers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9.1% |

| #2 | Geico | $46.3 million | 6.4% |

| #3 | Progressive | $41.7 million | 5.7% |

| #4 | Allstate | $39.2 million | 5.4% |

| #5 | Liberty Mutual | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3.4% |

| #8 | Chubb | $24.1 million | 3.3% |

| #9 | Farmers | $20.0 million | 2.8% |

| #10 | Nationwide | $18.4 million | 2.5% |

The rankings of the largest auto insurers by market share reveal the competitive landscape of the auto insurance industry. State Farm leads, highlighting its significant role in shaping market dynamics and consumer choices.

You can compare quotes for Lexus LC 500h auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Frequently Asked Questions

How can I find the best insurance rates for my Lexus LC 500h?

To find the best insurance rates for your Lexus LC 500h, it’s advisable to shop around and obtain quotes from multiple insurance providers.

Each company has its pricing models and considerations, so comparing rates will help you identify the most competitive options. Additionally, consider factors such as coverage limits, deductibles, customer service reputation, and any available discounts when evaluating insurance companies.

For additional details, explore our comprehensive resource titled, “Auto Insurance Deductibles.”

Can I get insurance discounts for installing anti-theft devices in my Lexus LC 500h?

Yes, installing anti-theft devices in your Lexus LC 500h can often lead to insurance discounts. Anti-theft devices such as car alarms, tracking systems, or immobilizers make your vehicle less prone to theft or damage, reducing the insurance company’s risk. Check with your insurance provider to see if they offer discounts for specific anti-theft devices and how much you can save.

Are there any specific insurance considerations for leased or financed Lexus LC 500h?

If you lease or finance a Lexus LC 500h, the leasing or financing company may require you to carry specific insurance coverage. This often includes liability insurance, comprehensive coverage, and collision coverage. It’s essential to review the terms of your lease or financing agreement and consult with your insurance provider to ensure you meet the necessary insurance requirements.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Should I purchase comprehensive and collision coverage for my Lexus LC 500h?

The decision to purchase comprehensive and collision coverage for your Lexus LC 500h depends on your circumstances and preferences. Comprehensive coverage protects against non-collision-related damages such as theft, vandalism, or natural disasters.

Collision coverage protects against damages from collisions with other vehicles or objects. If you have a loan or lease on your vehicle, your lender may require comprehensive and collision coverage. Otherwise, the choice is yours to make based on your assessment of the risks involved.

Can I save money on insurance for a Lexus LC 500h by taking a defensive driving course?

In some cases, completing a defensive driving course may help you save money on insurance for your Lexus LC 500h. Many insurance providers offer discounts for drivers who have completed an approved defensive driving course. It’s best to check with your insurance company to see if they offer such discounts and if they apply to the Lexus LC 500h.

To find out more, explore our guide titled, “Why You Should Take a Defensive Driving Class.”

What factors affect the LC500 insurance cost?

The LC500 insurance cost is influenced by factors such as the driver’s age, driving history, location, and the level of coverage selected.

Is Lexus IS 250 insurance more affordable than other luxury cars?

Lexus IS 250 insurance is generally considered more affordable compared to other luxury cars, thanks to its safety features and reliability.

What should I expect to pay for Lexus LC 500 insurance cost monthly?

Monthly, the Lexus LC 500 insurance cost can vary, typically averaging between $180 and $350, based on the insurance plan, driver’s profile, and vehicle condition.

Does insurance tend to be higher for the Lexus LC 500h compared to other vehicles?

Yes, insurance rates for the Lexus LC 500h are generally higher due to its classification as a luxury hybrid sports coupe, which comes with high repair costs.

See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Is the Lexus LC 500h considered a high-risk vehicle for insurance purposes?

While not typically classified as high-risk, the Lexus LC 500h’s high value and performance capabilities may lead to slightly higher insurance premiums compared to more standard vehicles.

How does the rarity of the Lexus LC 500h affect its insurance costs?

Which insurance providers offer the best coverage for the Lexus LC 500h?

What kind of insurance coverage is recommended for the Lexus LC 500h?

Does the Lexus LC 500h’s performance impact its insurance rates?

Are there specific factors about the Lexus LC 500h that could lower insurance costs?

What demographics typically receive the best insurance rates for the Lexus LC 500h?

Where is the Lexus LC 500h manufactured and does this affect its insurance costs?

How does the projected future value of the Lexus LC 500h influence insurance rates?

Are the engines in the Lexus LC 500h considered more reliable, and how does this affect insurance?

What is the fuel economy of the Lexus LC 500h and how does this impact its insurance costs?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.