Best Pay-As-You-Go Auto Insurance in Florida (Top 10 Companies in 2026)

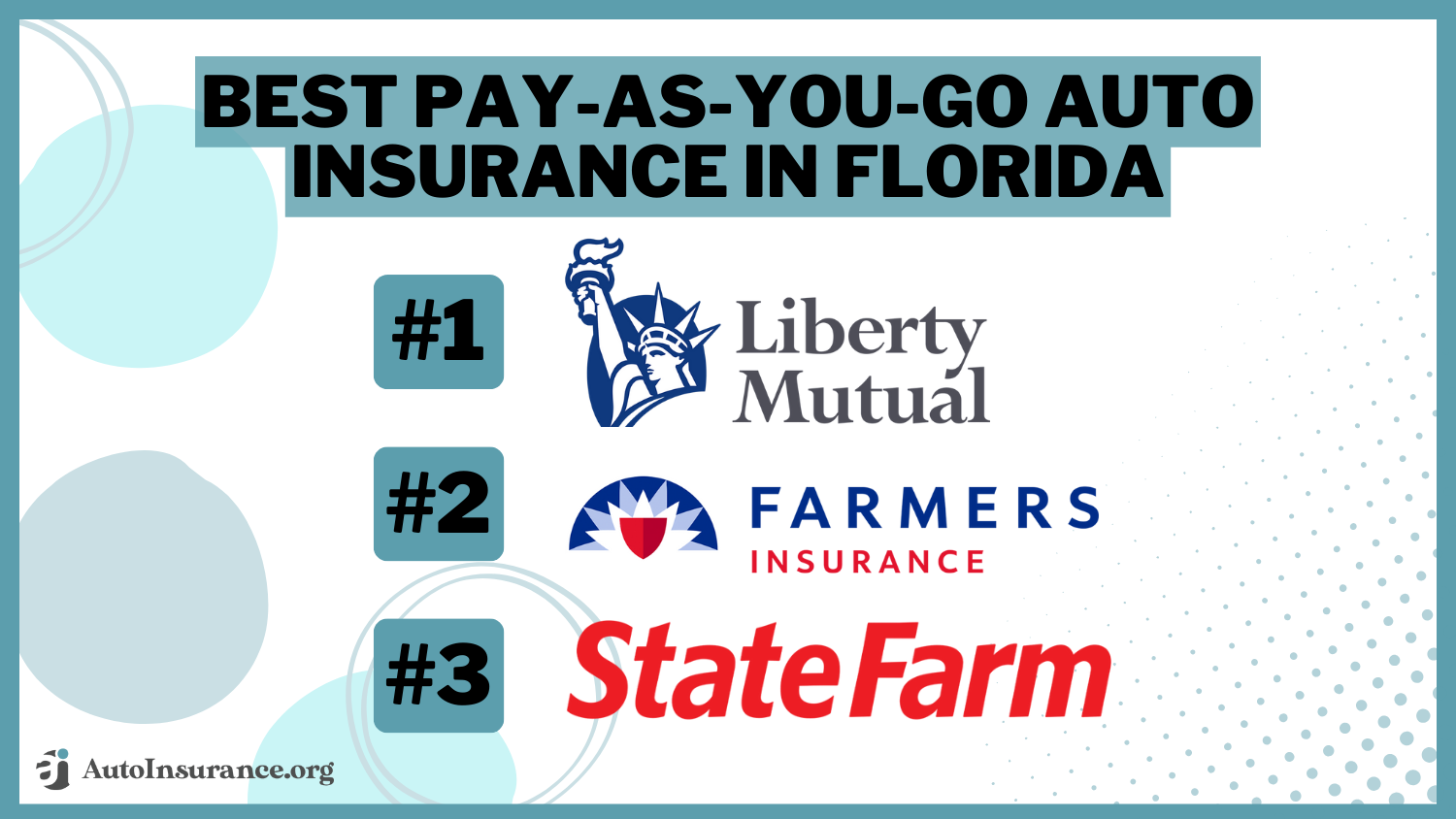

The best pay-as-you-go auto insurance in Florida are Liberty Mutual, Farmers, or State Farm, offering minimum rate starting at $22 per month. They lead the pack in pay-as-you-go auto insurance in Florida due to their comprehensive coverage options, competitive rates, and exceptional customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe top pick overall for the best pay-as-you-go auto insurance in Florida is Liberty Mutual, followed closely by Farmers and State Farm.

These companies distinguish themselves with their competitive rates, providing affordable premiums without sacrificing coverage quality. Their comprehensive coverage options ensure protection against a wide range of risks, from accidents to theft and more.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Florida

| Company | Rank | Safe Driving Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 21% | A | Tailored Coverage | Liberty Mutual |

| #2 | 21% | A | Comprehensive Coverage | Farmers | |

| #3 | 20% | B | Reliable Service | State Farm | |

| #4 | 17% | A | Enhanced Protection | Safeco | |

| #5 | 23% | A | Usage-Based | Metromile | |

| #6 | 19% | A+ | Filing Claims | Erie |

| #7 | 24% | A | Flexible Plans | AAA |

| #8 | 25% | A++ | Custom Discounts | Travelers | |

| #9 | 20% | A | Personalized Service | American Family | |

| #10 | 18% | A+ | Organization Discount | The Hartford |

Moreover, their commitment to excellent customer service ensures policyholders receive prompt assistance and support whenever needed, fostering a trusting and reliable relationship between insurer and insured.

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Liberty Mutual has the best pay-per-mile insurance in Florida

- You can also get pay-as-you-go monthly auto insurance at Farmers or State Farm

- Most companies don’t offer pay-as-you-go commercial auto insurance

#1 – Liberty Mutual: Top Pick Overall

Pros

- Tailored Coverage: Liberty Mutual has a variety of coverages, which you can read about in our Liberty Mutual review.

- Coverages: Drivers have access to Liberty Mutual’s range of coverage and deductible options.

- 24/7 Support Line: Customers can get help with claims, policy changes, and more.

Cons

- Discount Availability: Liberty Muutal’s UBI discount isn’t available everywhere.

- Data Tracking: Drivers may need additional tracking devices to monitor driving behavior.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Farmers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Farmers offer comprehensive policies. Learn about its other coverages in our review of Farmers.

- Financial Stability: A.M. Best gave Farmers an A rating for financial stability.

- Local Agents: Farmers’ agent network helps provide personalized support.

Cons

- High-Risk Driver Rates: Farmers’ rates may not be as competitive for drivers with high-risk records.

- UBI Discount Availability: Currently, Farmers doesn’t offer its UBI discount in Florida.

#3 – State Farm: Best for Reliable Service

Pros

- Reliable Service: State Farm has great reliability ratings, which we cover in our State Farm review.

- Low-Mileage Discounts: State Farm offers several discounts, including a low-mileage one.

- Coverage Options: The company offers extras like roadside assistance.

Cons

- No Online Purchases: Purchases are agent-only at State Farm.

- Data Tracking: Customers may need to get an additional tracking device for the UBI program.

#4 – Safeco: Best for Enhanced Protection

Pros

- Enhanced Protection: Safeco offers enhanced protection options with adjustable deductibles and add-on coverages.

- User-Friendly: Safeco’s apps are user-friendly and convenient.

- Multiple Discounts: Safeco offers discounts besides low-mileage discounts. Learn more in our Safeco review.

Cons

- Availability: Safeco is limited to specific Florida regions.

- High-Mileage Rates: Prices may not be as affordable for high-mileage drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Metromile: Best for Usage-Based

Pros

- Usage-Based: Metromile calculates rates based on how much drivers travel. Our Metromile review covers this in more detail.

- User-Friendly: Metromile’s app makes tracking trips and managing policies easy.

- Coverage Options: Metromile has a good selection of basic coverages.

Cons

- Availability: Metromile is only available in a few states.

- Not for High-Mileage Drivers: Metromile isn’t great for drivers who drive over 10,000 miles annually.

#6 – Erie: Best for Filing Claims

Pros

- Filing Claims: Erie’s claim filing process is simple, and you can check your status online.

- Customer Service: Erie has a good reputation for customer service, which you can learn about in our Erie review.

- Multiple Discounts: Customers can get safe driving discounts and more.

Cons

- Availability: Erie has limited availability in states across the U.S.

- Data Tracking: Some customers may need an additional device to monitor driving behavior for the UBI discount.

#7 – AAA: Best for Flexible Plans

Pros

- Flexible Plans: Customers can make a plan that suits their needs at AAA. Our AAA review goes over AAA plans in more detail.

- Roadside Assistance: AAA’s roadside assistance is highly rated.

- Travel and Shopping Discounts: AAA members get discounts on more than just auto insurance.

Cons

- Membership Fees: The fees for joining AAA may negate savings for some customers.

- High-Mileage Rates: AAA’s rates are best for low-mileage drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Custom Discounts

Pros

- Custom Discounts: Travelers offers custom discounts in its usage-based auto insurance program.

- Unique Coverage: Customers can purchase less common coverages like non-owner insurance. Read more about coverage options in our review of Travelers.

- Accident Forgiveness: Travelers may forgive some drivers’ first accident.

Cons

- Customer Service: Customers gave Travelers a few negative ratings.

- High-Mileage Rates: Travelers may not be best for drivers who travel more than the average annually.

#9 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family’s agents provide personalized service to customers.

- Discounts: American Family has several discounts. Learn about the company’s discounts in our American Family review.

- User-Friendly: American Family’s app and website are simple to use.

Cons

- Availability: American Family isn’t sold in many states.

- High-Mileage Rates: American Family’s rates aren’t the best for high-mileage discounts.

#10 – The Hartford: Best for Organization Discount

Pros

- Organization Discount: The Hartford has organization discounts, such as military discounts.

- Customizable Coverages: The Hartford has customizable policies, which you can learn more about in our review of The Hartford.

- Financial Stability: The Hartford has strong ratings for financial strength.

Cons

- High-Mileage Rates: Rates for The Hartford can be higher for high-mileage drivers.

- Tracking Devices: Some drivers may need additional devices for the UBI discount.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Florida Pay-As-You-Go Auto Insurance: How It Works

Pay-as-you-go auto insurance often works by paying a base rate daily or monthly and then a per-mile rate. However, some companies like Liberty Mutual also offer usage-based insurance programs that offer discounts on regular auto insurance for safe driving and low mileage.

If you want pay-per-mile insurance, then make sure to check out the best pay-as-you-go auto insurance companies. Bear in mind that these companies do use telematics technology to base rates, so you will need to be comfortable with your driving data being recorded.

Pay-as-you-go auto insurance in Florida provides drivers with a flexible and customizable alternative to traditional insurance policies, allowing them to pay for coverage based on their actual usage of the vehicle and potentially save money in the process.

This table outlines the monthly rates for pay-as-you-go auto insurance in Florida, covering both minimum and full coverage options.

Florida Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| American Family | $53 | $139 |

| Erie | $22 | $58 |

| Farmers | $44 | $117 |

| Liberty Mutual | $68 | $174 |

| Metromile | $44 | $115 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

| Travelers | $37 | $99 |

Rates vary across different insurance companies, with minimum coverage ranging from $22 to $68 per month, and full coverage ranging from $58 to $174 per month.

Benefits of Pay-As-You-Go Auto Insurance

Pay-as-you-go auto insurance offers several advantages, with one significant benefit being its pay-per-mile structure. This model ensures that your insurance rates correlate directly with your driving habits. The less you drive, the lower your insurance costs will be, making it a particularly attractive option for those who drive infrequently or have shorter commutes.

Florida Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $98 | $159 | $176 | $214 |

| 16-Year-Old Male | $111 | $162 | $183 | $226 |

| 20-Year-Old Female | $123 | $186 | $203 | $254 |

| 20-Year-Old Male | $137 | $191 | $226 | $272 |

| 30-Year-Old Female | $119 | $174 | $197 | $236 |

| 30-Year-Old Male | $124 | $187 | $211 | $268 |

| 40-Year-Old Female | $107 | $168 | $185 | $224 |

| 40-Year-Old Male | $112 | $174 | $202 | $252 |

| 50-Year-Old Female | $101 | $154 | $189 | $221 |

| 50-Year-Old Male | $116 | $169 | $194 | $234 |

| 60-Year-Old Female | $88 | $138 | $166 | $206 |

| 60-Year-Old Male | $93 | $142 | $179 | $218 |

| 70-Year-Old Female | $77 | $126 | $143 | $188 |

| 70-Year-Old Male | $86 | $138 | $155 | $190 |

This approach promotes fairness and affordability, as individuals are rewarded for their reduced mileage with reduced premiums. Moreover, it encourages environmentally friendly behavior by incentivizing fewer miles driven, which can contribute to lower carbon emissions and less traffic congestion.

Florida Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Jacksonville | Miami | Orlando | Tallahassee | Tampa |

|---|---|---|---|---|---|

| 16-Year-Old Female | $950 | $1,060 | $1,031 | $936 | $980 |

| 16-Year-Old Male | $715 | $785 | $763 | $706 | $740 |

| 20-Year-Old Female | $211 | $236 | $228 | $207 | $216 |

| 20-Year-Old Male | $225 | $250 | $244 | $222 | $231 |

| 30-Year-Old Female | $136 | $148 | $144 | $132 | $139 |

| 30-Year-Old Male | $144 | $157 | $152 | $141 | $148 |

| 40-Year-Old Female | $184 | $201 | $196 | $180 | $190 |

| 40-Year-Old Male | $182 | $200 | $193 | $179 | $189 |

| 50-Year-Old Female | $186 | $206 | $198 | $184 | $191 |

| 50-Year-Old Male | $188 | $208 | $201 | $185 | $193 |

| 60-Year-Old Female | $112 | $126 | $122 | $110 | $115 |

| 60-Year-Old Male | $111 | $127 | $122 | $110 | $115 |

| 70-Year-Old Female | $193 | $216 | $208 | $191 | $201 |

| 70-Year-Old Male | $194 | $215 | $207 | $191 | $201 |

Overall, pay-as-you-go insurance aligns insurance costs more closely with actual vehicle usage, providing a flexible and cost-effective solution for many drivers. It is easier to get cheap low-mileage Florida auto insurance for seniors, as companies consider seniors less risky to insure. However, your location in Florida will also have an impact on your rates.

Miami and Tampa are some of the more expensive cities in Florida. Make sure you get a low-mileage discount if you live in these cities (learn more: how to get a low-mileage auto insurance discount).

Florida Auto Insurance Requirements

If you don’t fulfill Florida minimum auto insurance requirements, you will be driving illegally. Florida has different insurance requirements than most states, as it is a no-fault insurance state. If you want cheap no-fault auto insurance, then minimum coverage with just personal injury protection (PIP) and property damage insurance will be the most economical.

Monthly Florida Auto Insurance Rates by Age, Gender and Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Female (Age 16) | $260 | $736 |

| Male (Age 16) | $299 | $808 |

| Female (Age 20) | $71 | $193 |

| Male (Age 20) | $77 | $113 |

| Female (Age 30) | $66 | $97 |

| Male (Age 30) | $71 | $104 |

| Female (Age 40) | $58 | $156 |

| Male (Age 40) | $59 | $260 |

| Female (Age 50) | $54 | $156 |

| Male (Age 50) | $55 | $160 |

| Female (Age 60) | $53 | $139 |

| Male (Age 60) | $56 | $148 |

| Female (Age 70) | $56 | $161 |

| Male (Age 70) | $58 | $164 |

This table illustrates the monthly rates for auto insurance in Florida based on age, gender, and coverage level. It showcases the minimum and full coverage costs for various demographics, highlighting variations in premiums.

While it’s the most economical option, providing basic financial protection, it’s important to note that minimum coverage may not offer as comprehensive a safety net as full coverage. Thus, while it satisfies legal mandates, individuals should carefully weigh the level of protection they desire against their budget constraints.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Florida No-Fault Insurance Laws

In Florida, the legal framework for auto insurance laws operates under the no-fault system, which mandates drivers to hold Personal Injury Protection (PIP) insurance and property damage insurance. Under this system, fault is not attributed in accidents, regardless of the circumstances.

Instead, each driver is responsible for covering their own accident-related expenses, irrespective of who caused the collision. Consequently, having comprehensive coverage becomes crucial in Florida. This ensures that drivers are adequately protected in case of an accident, safeguarding against potential financial liabilities and ensuring access to necessary medical and property damage coverage.

Case Studies: Exploring the Benefits of Pay-As-You-Go Auto Insurance in Florida

Pay-as-you-go auto insurance has emerged as a viable option, offering drivers the ability to tailor their coverage and costs based on their individual driving habits. In this study, we delve into the world of pay-as-you-go auto insurance in Florida, exploring its benefits through real-life case studies.

- Case Study #1 – Reducing Costs for Occasional Drivers: Sarah, a Florida college student on a tight budget, chooses Metromile’s pay-as-you-go insurance to cut costs while maintaining coverage for occasional drives, saving money and easing financial strain.

- Case Study #2 – Balancing Coverage and Affordability: Retired couple Mark and Lisa R. in Florida opt for State Farm’s pay-as-you-go auto insurance, cutting costs for occasional road trips while maintaining comprehensive coverage, easing their retirement budget worries.

- Case Study #3 – Flexible Coverage for Seasonal Residents: Jack and Emma, seasonal travelers, found insurance flexibility with Liberty Mutual’s pay-as-you-go, adapting coverage between Florida and home effortlessly, ensuring protection on the move.

Whether it’s for occasional drivers, retirees seeking to balance coverage and affordability, or seasonal residents navigating multiple locations, pay-as-you-go insurance offers a personalized approach to auto coverage. To gain further insights, consult our comprehensive guide titled “Types of Auto Insurance.”

Liberty Mutual stands out as the top choice for pay-as-you-go auto insurance in Florida, offering competitive rates, comprehensive coverage options, and exceptional customer service.Jeff Root Licensed Insurance Agent

By aligning premiums with actual usage, drivers can enjoy peace of mind knowing they’re protected without breaking the bank. In an ever-changing world, pay-as-you-go auto insurance proves to be a driving force in empowering drivers to take control of their coverage.

Summary: Navigating Pay-As-You-Go Auto Insurance in Florida

Signing up for a low-mileage auto insurance discount or buying a pay-per-mile insurance policy is one of the best ways for low-mileage drivers to save. Even if you drive over 10,000 miles per year, though, this doesn’t mean you can’t get affordable insurance by shopping at the cheapest auto insurance companies.

Whether you opt for a pay-per-mile insurance policy or leverage low-mileage discounts, seizing these opportunities empowers you to navigate Florida’s auto insurance landscape with financial prudence and peace of mind.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

Is Florida mileage-based insurance worth it?

If you drive fewer than 10,000 miles per year, then it may be worth it. Make sure to look at pay-per-mile auto insurance comparisons to see which company offers the best deal for you.

Which insurance company has the highest customer satisfaction in Florida?

USAA has the highest customer satisfaction in Florida.

Who has the most affordable auto insurance in Florida?

The cheapest auto insurance companies in Florida are USAA, Erie, Safeco, and State Farm.

How do Florida insurance companies verify mileage?

Pay-as-you-go insurance companies verify mileage through device tracking or by having drivers send pictures of their mileage each month.

Who is cheaper than Geico auto insurance in Florida?

USAA has the cheapest Florida auto insurance rates on average. Enter your ZIP code below to find cheap USAA quotes in your Florida area.

What is the cheapest annual mileage for Florida auto insurance?

Drivers with fewer than 10,000 miles generally have the cheapest rates (learn more: how annual mileage affects auto insurance rates).

Is Progressive auto insurance good in Florida?

Progressive’s rates can be more expensive, but it does have good coverage options. Make sure to read Florida pay-per-mile insurance reviews on Progressive and other companies before making a final choice.

Is Root auto insurance available in Florida?

Yes, Root auto insurance is available in Florida.

Is State Farm auto insurance leaving Florida?

No, State Farm is not leaving Florida. Check out our article to find out which auto insurance companies are leaving Florida: Auto Insurance Companies Pulling Out of Florida.

Can I pay for Florida pay-as-you-go auto insurance in full?

You can’t pay for a pay-per-mile insurance policy in full, but you can pay for a regular monthly policy in full.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.