Best Porsche 911 Turbo Auto Insurance in 2026 (Check Out These 10 Companies)

Chubb, State Farm, and Travelers are the top picks for the best Porsche 911 Turbo auto insurance, with rates starting at $210 monthly. They deliver the best value and comprehensive coverage for this luxury vehicle, making them the ideal choice for discerning Porsche 911 Turbo owners seeking reliable protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated October 2024

Company Facts

Full Coverage for Porsche 911 Turbo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Porsche 911 Turbo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Porsche 911 Turbo

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Porsche 911 Turbo auto insurance are Chubb, State Farm, and Travelers, known for their superior coverage options and customer service.

These companies stand out in the competitive insurance market by offering tailored policies that address the unique needs of Porsche 911 Turbo owners. Access comprehensive insights into our guide titled, “Types of Auto Insurance.”

Our Top 10 Company Picks: Best Porsche 911 Turbo Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 12% A++ Comprehensive Coverage Chubb

![]()

#2 20% B Competitive Rates State Farm

![]()

#3 8% A++ Tailored Policies Travelers

#4 10% A++ Military Benefits USAA

#5 25% A+ Trusted Reputation Allstate

#6 12% A+ Reliable Service Progressive

#7 25% A Flexible Options Liberty Mutual

#8 20% A+ Extensive Network Nationwide

#9 10% A+ Customer Focused Erie

#10 25% A++ Affordable Premiums Geico

Each provider has been selected based on their comprehensive protection plans, affordability, and excellent claims service, ensuring that your high-performance vehicle receives the care it deserves. Opting for any of these insurers means choosing security and peace of mind for your luxurious investment.

If you need insurance for a Porsche 911 Turbo right now, we can help. Enter your ZIP code for free Porsche 911 Turbo car insurance quotes from top companies.

- Chubb is the top pick for best Porsche 911 Turbo auto insurance

- Tailored coverage meets the specific needs of Porsche 911 Turbo owners

- Specialized policies enhance protection for high-performance features

#1 – Chubb: Top Overall Pick

Pros

- Elite Coverage Options: Chubb provides elite coverage options for Porsche 911 Turbo, ensuring extensive protection. Discover insights in our guide titled, “Chubb Auto Insurance Review.”

- High Multi-Vehicle Discount: Offers a 12% discount for multiple vehicles, beneficial for Porsche 911 Turbo owners with more than one car.

- Top-Notch Financial Stability: Backed by an A++ rating from A.M. Best, indicating superior financial health and claim-paying ability for Porsche 911 Turbo owners.

Cons

- Premium Pricing: Chubb’s premiums are typically higher, reflecting its comprehensive coverage and elite client base for Porsche 911 Turbo owners.

- Selective Coverage Accessibility: Chubb’s policies, while excellent, may not be accessible to all Porsche 911 Turbo drivers due to stringent underwriting.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Competitive Rates

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies, including Porsche 911 Turbo.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage Porsche 911 Turbo usage. Discover insights in our guide titled, State Farm auto insurance review.

- Wide Coverage: Offers various coverage options tailored for different needs, including those of Porsche 911 Turbo owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors of Porsche 911 Turbo insurers.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for Porsche 911 Turbo coverage levels.

#3 – Travelers: Best for Tailored Policies

Pros

- Customized Insurance Solutions: Travelers offers tailored insurance policies specifically designed for Porsche 911 Turbo, catering to unique needs.

- Robust Financial Rating: With an A++ rating from A.M. Best, Travelers promises excellent financial reliability and service for Porsche 911 Turbo owners.

- Moderate Multi-Vehicle Discount: Provides an 8% discount for multi-vehicle owners, which includes Porsche 911 Turbo. See more details in our guide titled, “Travelers Auto Insurance Review.”

Cons

- Higher Base Rates: Base rates for Travelers might be higher for Porsche 911 Turbo drivers, even with discounts.

- Limited High-Value Vehicle Experience: Travelers has less experience with high-value vehicles like Porsche 911 Turbo compared to others like Chubb.

Porsche 911 Turbo Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $240 $480

Chubb $250 $500

Erie $220 $445

Geico $215 $430

Liberty Mutual $235 $475

Nationwide $230 $470

Progressive $225 $460

State Farm $220 $450

Travelers $230 $470

USAA $210 $420

The monthly rates for Porsche 911 Turbo auto insurance vary significantly between providers, reflecting different levels of coverage and service. For minimum coverage, USAA offers the lowest rate at $210, while Chubb presents the highest at $250.

When looking at full coverage, the costs range from $420 with USAA to $500 with Chubb, indicating a broader spectrum of services and protection. Companies like State Farm and Erie offer competitive rates at $450 and $445 respectively for full coverage, balancing cost with comprehensive benefits.

This range in prices illustrates the importance of comparing insurance options based on both price and the extent of coverage provided. Learn more by reading our guide “What is the average auto insurance cost per month?“

Are Vehicles Like the Porsche 911 Turbo Expensive to Insure

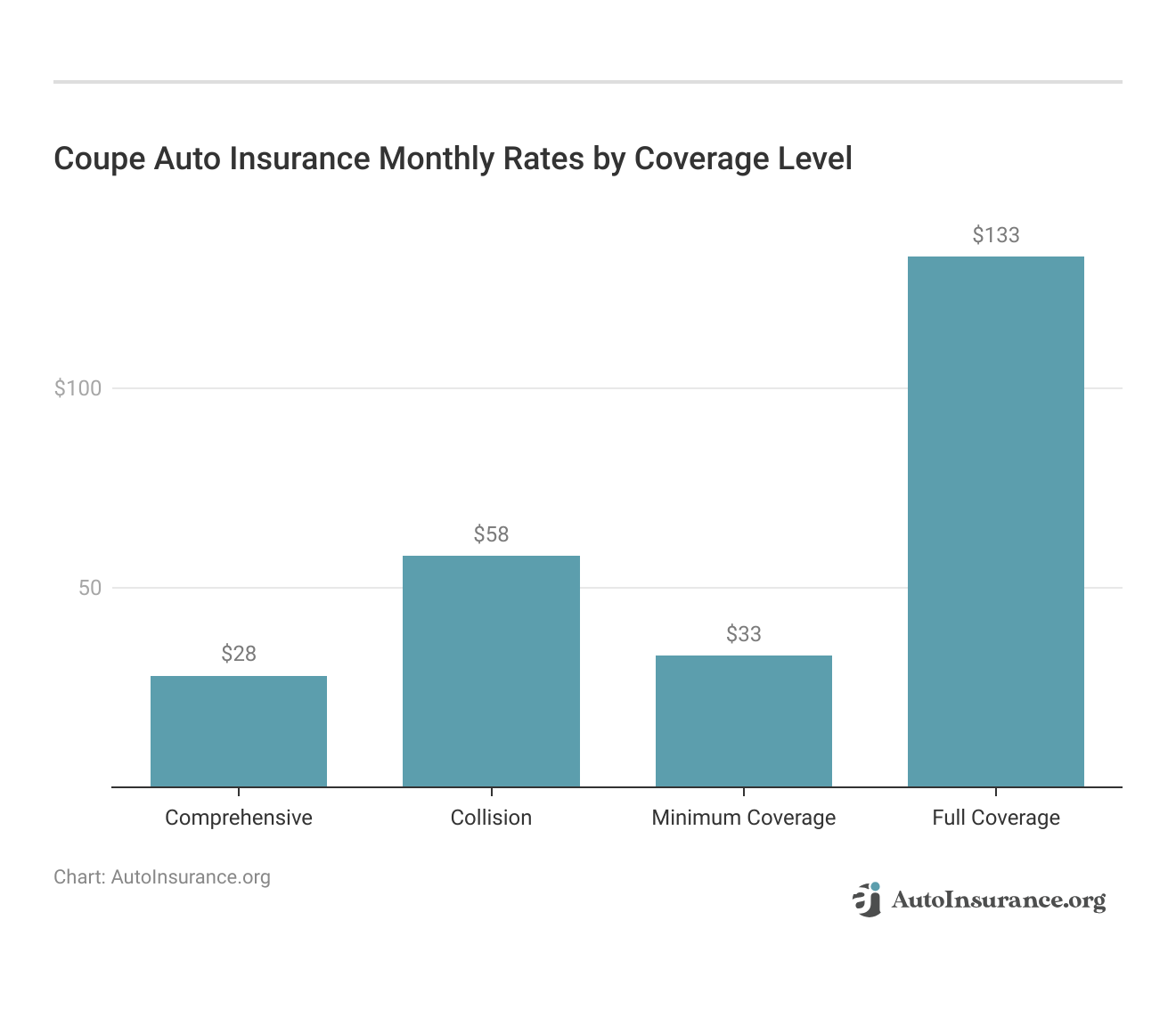

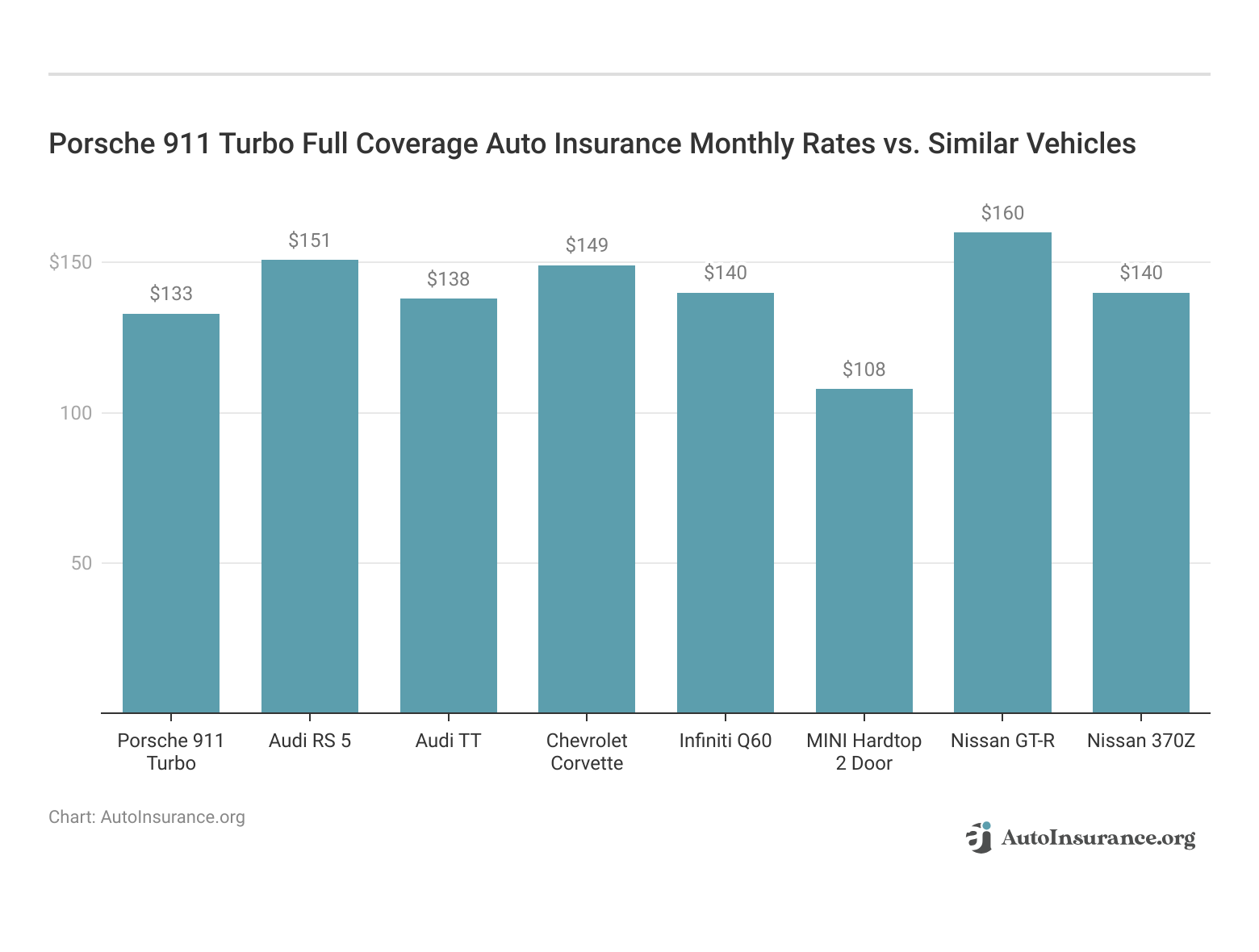

High-performance vehicles like the Porsche 911 Turbo often come with higher insurance costs. To better understand these expenses, comparing the Porsche 911 Turbo’s insurance rates with those of other similar coupes provides valuable insights.

The comprehensive analysis of insurance rates for coupes such as the Lexus LC 500h, BMW 1 Series M, and Hyundai Tiburon highlights the financial considerations owners of high-performance vehicles must manage.

It underscores the importance of researching and comparing rates to find the most suitable and cost-effective insurance options.

The insurance costs illustrated reveal significant variations in premiums across different sports and luxury vehicles, highlighting the importance of thorough comparison and consideration for potential owners. This analysis helps in making informed decisions when choosing the right insurance for similar high-end vehicles.

Insurance Rates for Vehicles Similar to the Porsche 911 Turbo

When considering insurance for high-performance vehicles like the Porsche 911 Turbo, it’s useful to compare rates with other similar models. Below is a breakdown of insurance costs including comprehensive, collision, and liability coverages for a selection of vehicles that share characteristics with the Porsche 911 Turbo.

Porsche 911 Turbo Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi S5 | $33 | $72 | $33 | $151 |

| Mercedes-Benz CLA 250 | $34 | $70 | $33 | $150 |

| Nissan GT-R | $37 | $82 | $30 | $160 |

| Mitsubishi Eclipse | $19 | $33 | $38 | $104 |

| Porsche 911 | $40 | $87 | $33 | $173 |

| Chrysler Sebring | $17 | $29 | $39 | $98 |

| MINI Cooper | $23 | $42 | $30 | $106 |

| Hyundai Veloster | $26 | $44 | $35 | $117 |

Insurance costs for vehicles similar to the Porsche 911 Turbo differ significantly, highlighting the variance in vehicle value, repair expenses, and risk factors. Ranging from the more affordable Mitsubishi Eclipse to the upscale Porsche 911, the pricing of insurance reveals the considerations taken by insurers, such as Porsche insurance services, in setting rates for both high-performance and luxury vehicles.

Read more: Comprehensive Auto Insurance Defined

What Impacts the Cost of Porsche 911 Turbo Insurance

The average annual rate for the Porsche 911 Turbo is just that, an average. Your insurance rates for a Porsche 911 Turbo can be higher or lower depending on the trim level and personal factors.

Those factors include your age, home address, driving history, and the model year of your Porsche 911 Turbo. Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

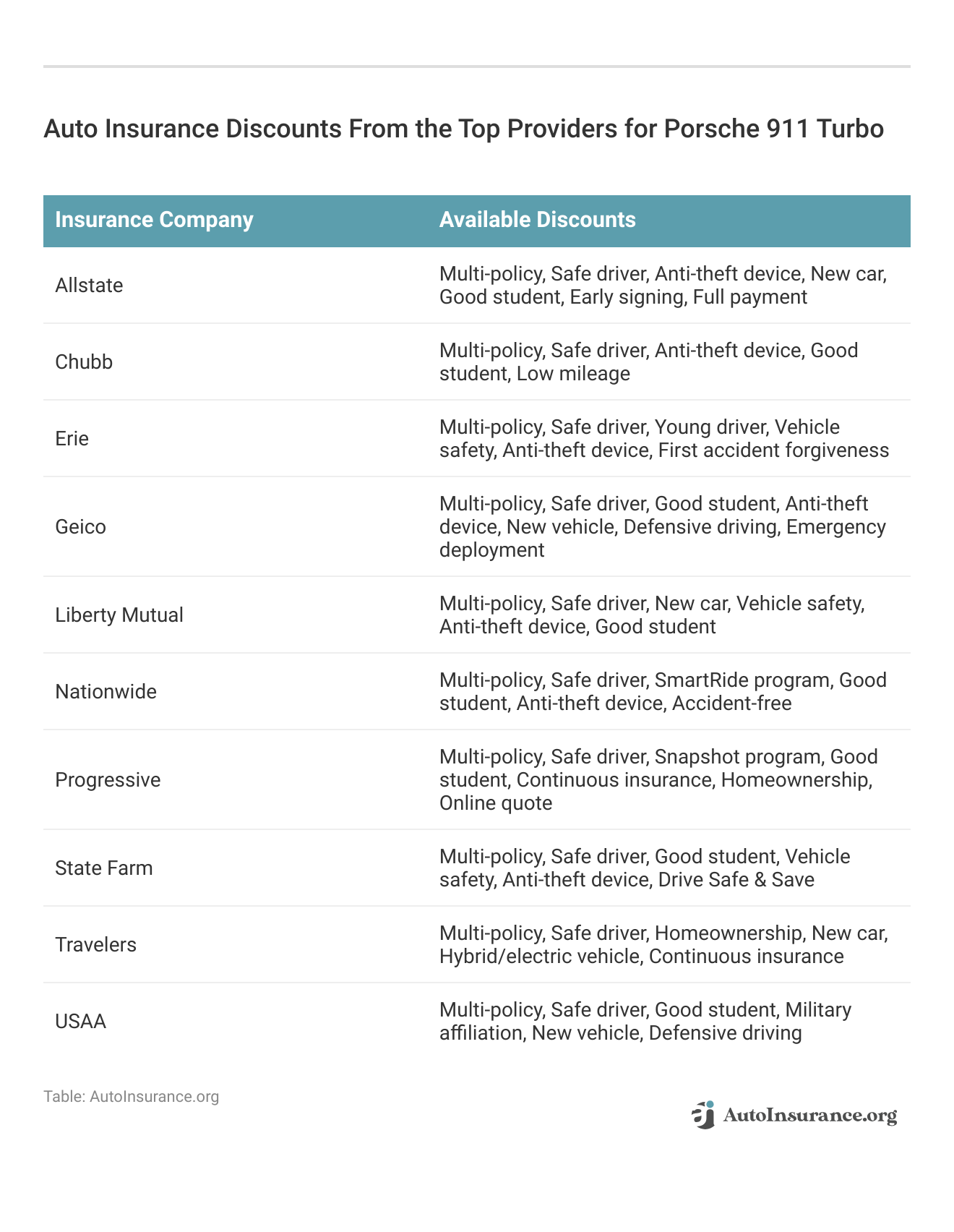

Ways to Save on Porsche 911 Turbo Insurance

Owning a Porsche 911 Turbo can bring thrilling experiences, but it also comes with high insurance costs. Here are some strategic ways to potentially lower these expenses without compromising on coverage.

- Remove unnecessary insurance once your Porsche 911 Turbo is paid off.

- Renew your Porsche 911 Turbo insurance coverage to avoid lapses.

- Check Porsche 911 Turbo auto insurance rates through Costco.

- Get cheaper Porsche 911 Turbo car insurance rates as a full-time parent.

- Consider ride-sharing services to lower your Porsche 911 Turbo mileage.

Applying these strategies can result in lower insurance rates for a Porsche 911 Turbo. By effectively managing your policy, comparing quotes, and leveraging particular situations, you can relish driving your vehicle while ensuring it’s cost-effective to maintain. This approach is key when considering how much it costs to insure a Porsche 911 or how much to insure a Porsche 911.

See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

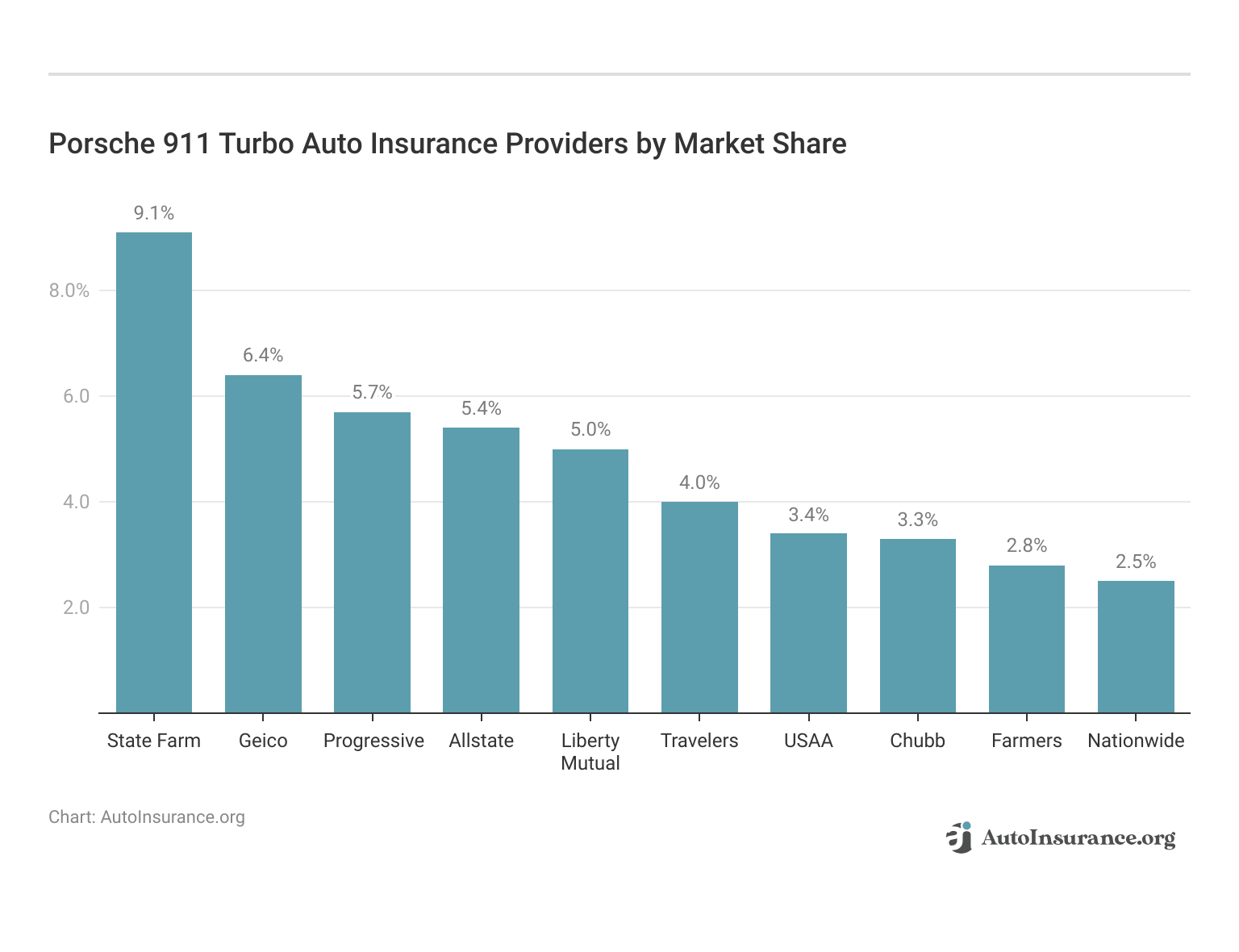

Top Porsche 911 Turbo Insurance Companies

Selecting the right insurance provider for a Porsche 911 Turbo involves considering various factors, including affordability and the availability of discounts for safety features. Here’s a look at the major insurers, ranked by market share, that offer coverage for this high-performance vehicle. To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

The insurance market for the Porsche 911 Turbo is diverse, with major players like State Farm, Geico, and Progressive leading in market share.

Chubb's market position reflects its exceptional ability to offer robust and customized insurance solutions.Michelle Robbins Licensed Insurance Agent

This overview helps Porsche owners gauge which companies might offer the most competitive rates and best coverage options for their needs.

Largest Auto Insurers by Market Share

Understanding the landscape of the auto insurance market can provide valuable insights into consumer preferences and insurer reliability. Here’s a look at the largest auto insurers by market share, showcasing the leading companies in terms of volume and their respective percentages of the market.

Top Porsche 911 Turbo Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9.1% |

| #2 | Geico | $46,358,896 | 6.4% |

| #3 | Progressive | $41,737,283 | 5.7% |

| #4 | Allstate | $39,210,020 | 5.4% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3.4% |

| #8 | Chubb | $24,199,582 | 3.3% |

| #9 | Farmers | $20,083,339 | 2.8% |

| #10 | Nationwide | $18,499,967 | 2.5% |

The information detailing the largest auto insurers by market share underscores the prominence of industry leaders like State Farm, Geico, and Progressive in terms of their influence and volume. This data is essential for both consumers and analysts to grasp market dynamics and make well-informed choices concerning auto insurance, particularly when seeking an insurance cost Porsche 911 or a turbo insurance quote.

You can compare quotes for Porsche 911 Turbo auto insurance rates from some of the best auto insurance companies by using our free online tool below now.

Frequently Asked Questions

What factors impact the cost of Porsche 911 Turbo insurance?

The Porsche 911 insurance cost is influenced by factors such as your age, home address, driving history, and the model year of your car.

To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

How can I save on Porsche 911 Turbo insurance?

To reduce the cost of your Porsche 911 Turbo insurance, you can follow these tips: maintain a clean driving record, consider increasing your deductibles, bundle your car insurance with other policies, and inquire about available discounts.

Which insurance companies offer affordable rates for Porsche 911 Turbo coverage?

Some of the top companies that provide insurance for a Porsche 911 Turbo include those with high market shares. However, rates may vary based on personal factors and discounts. It’s recommended to compare quotes from multiple companies to find the best rates.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

How can I compare free quotes for Porsche 911 Turbo insurance online?

You can easily compare quotes for Porsche 911 auto insurance online by using a free online tool. Enter your ZIP code to view quotes from different insurance companies and choose the best Porche insurance that suits your needs.

Are vehicles like the Porsche 911 Turbo expensive to insure?

The cost of insuring vehicles like the Porsche 911 Turbo can vary. To get an idea of insurance rates, you can compare them to other similar models, such as the Lexus LC 500h, BMW 1 Series M, and Hyundai Tiburon.

For additional details, explore our comprehensive resource titled, “What is full coverage auto insurance?“

What factors influence cheap Porsche insurance?

Factors include the Porsche model, driver’s age, driving history, and the level of coverage selected.

What determines the cost of insurance on a Porsche 911?

Costs are influenced by the Porsche 911’s model year, your driving record, geographical location, and chosen insurance provider.

Can you detail the factors affecting Hyundai Tiburon insurance cost?

The cost is influenced by the vehicle’s age, the driver’s safety record, and the extent of coverage purchased.

What should I consider when looking for insurance for Porsche 911?

Consider the vehicle’s value, your personal driving history, and the types of coverage you need, such as collision and comprehensive.

Access comprehensive insights into our guide titled, “How Auto Insurance Companies Check Driving Records.”

How much is insurance on a Porsche 911?

The cost to insure Porche 911 typically ranges from $200 to $400.

What coverage options are available for Porsche car insurance?

What are the key benefits of Porsche insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.