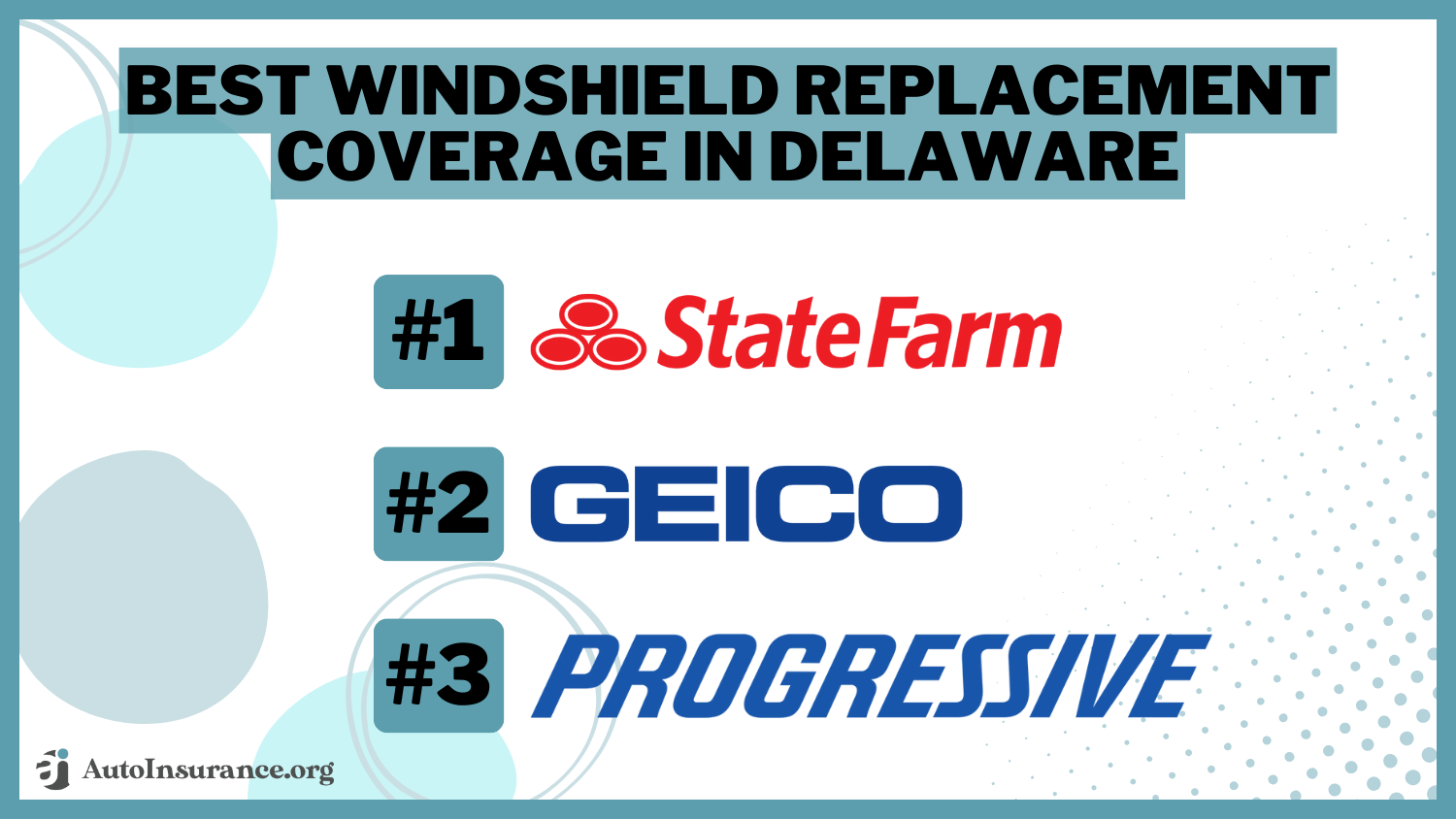

Best Windshield Replacement Coverage in Delaware (Top 10 Companies in 2026)

State Farm, Geico, and Progressive provide the best windshield replacement coverage in Delaware, with monthly premiums starting at just $42. Our goal is to help you compare quotes from these insurers, ensuring you find the most appropriate coverage and personalized discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2024

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage Windshield Replacement in Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in Delaware

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews- State Farm provides competitive pricing, beginning at $42 per month

- Major insurance companies present choices for windshield replacements

- Multiple discount possibilities exist for windshield replacement coverage

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm has a vast network of agents and service centers, making it easy for customers to access assistance and file claims.

- Personalized Service: They offer personalized customer service, with agents available to help tailor coverage to individual needs.

- Multiple Policy Discounts: State Farm offers discounts for bundling multiple policies, such as auto and home insurance.

Cons

- Higher Premiums: Some customers may find State Farm’s premiums to be slightly higher compared to other insurers. Find out more in our State Farm auto insurance review.

- Limited Online Tools: While State Farm has a user-friendly website, their online tools for managing policies and claims may not be as robust as some competitors’.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Affordability: Geico is known for offering competitive rates and discounts, making it a popular choice for budget-conscious customers.

- Convenient Mobile App: Their mobile app provides easy access to policy information, roadside assistance, and claims filing. Read more through our Geico auto insurance review.

- Fast Claims Processing: Geico is praised for its efficient claims processing, often providing quick resolutions to customers’ issues.

Cons

- Limited Agent Interaction: Geico primarily operates online and over the phone, so customers seeking in-person agent assistance may find their options limited.

- Less Personalized Service: Due to its direct-to-consumer model, Geico may offer less personalized service compared to insurers with dedicated agents.

#3 – Progressive: Best for Online Convenience

Pros

- Name Your Price Tool: In our Progressive auto insurance review, Progressive’s “Name Your Price” tool allows customers to customize their coverage and find a policy that fits their budget.

- Snapshot Program: The Snapshot program rewards safe driving habits with discounts based on actual driving behavior.

- Wide Range of Coverage Options: Progressive offers a variety of coverage options, including unique add-ons like pet injury protection and custom parts coverage.

Cons

- Average Customer Service: While Progressive offers competitive rates and innovative programs, some customers report average satisfaction with their customer service experience.

- Limited Agent Availability: Progressive relies heavily on online and phone-based interactions, which may be a drawback for customers who prefer face-to-face interactions with agents.

#4 – Allstate: Best for Add-on Coverages

Pros

- Claim Satisfaction Guarantee: Allstate offers a Claim Satisfaction Guarantee, promising to reimburse customers if they’re not satisfied with their claims experience.

- Multiple Policy Discounts: Customers can save money by bundling their auto insurance with other policies like home or renters insurance.

- Drivewise Program: Allstate’s Drivewise program rewards safe driving habits with discounts on premiums. Use our Allstate auto insurance review as your guide.

Cons

- Higher Premiums for Some: Allstate’s premiums may be higher compared to some competitors, especially for drivers with less-than-perfect driving records.

- Limited Local Agents: While Allstate has a network of local agents, they may not be as widespread as other insurers, limiting in-person support for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Usage Discount

Pros

- Member Benefits: Nationwide offers member benefits beyond just insurance, including discounts on travel, shopping, and financial services. Read more through our Nationwide auto insurance review.

- Vanishing Deductible: With their Vanishing Deductible program, customers can earn $100 off their deductible for every year of safe driving.

- On Your Side Review: Nationwide provides an annual insurance review to ensure customers have the coverage they need and are taking advantage of available discounts.

Cons

- Limited Availability: Nationwide may not be available in all states, limiting options for customers in certain regions.

- Average Claims Process: While Nationwide’s claims process is generally smooth, some customers report average satisfaction with the speed and efficiency of claims resolution.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor coverage to their specific needs.

- 24/7 Claims Assistance: Customers can file claims and get assistance 24/7 through Liberty Mutual’s website, app, or hotline. For further insights, refer to our Liberty Mutual auto insurance review.

- Better Car Replacement: With their Better Car Replacement coverage, Liberty Mutual will replace your totaled car with a newer model if it’s less than a year old and has fewer than 15,000 miles.

Cons

- Mixed Customer Service Reviews: While Liberty Mutual provides various avenues for customer support, some customers have reported mixed experiences with their customer service.

- Potential for Higher Premiums: Depending on factors like driving history and location, some customers may find Liberty Mutual’s premiums to be higher compared to other insurers.

#7 – Farmers: Best for Local Agents

Pros

- Local Agent Support: Farmers boasts a network of local agents who can provide personalized assistance and guidance. Read more through our Farmers auto insurance review.

- Optional Coverage Add-ons: Farmers offers a range of optional coverage add-ons, allowing customers to customize their policies to suit their needs.

- Discount Opportunities: Farmers provides various discounts for safe driving, bundling policies, and more, helping customers save on their premiums.

Cons

- Limited Online Tools: While Farmers offers online account management and claims filing, their online tools may be less robust compared to some competitors.

- Mixed Customer Reviews: Some customers report mixed experiences with Farmers’ customer service and claims handling, with occasional delays in resolution.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Our Travelers auto insurance review reveals that Travelers offers accident forgiveness, which means your rates won’t increase after your first accident if you qualify.

- Strong Financial Stability: Travelers has a solid financial reputation, providing customers with confidence in their ability to pay claims.

- Personalized Coverage Options: Travelers offers a variety of coverage options and discounts, allowing customers to tailor their policies to their specific needs and budget.

Cons

- Limited Availability: Travelers may not be available in all states, limiting options for some customers.

- Higher Premiums for Some: Depending on factors like driving history and location, Travelers’ premiums may be higher compared to some other insurers.

#9 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers exclusive discounts and benefits for military members and their families, including deployed vehicle storage and reduced premiums during deployment.

- Excellent Customer Service: USAA consistently receives high ratings for customer satisfaction and claims handling, with dedicated support for military members.

- Financial Strength: With its strong financial stability, USAA provides assurance that it can fulfill its obligations to policyholders. Read more through our USAA auto insurance review.

Cons

- Membership Eligibility: USAA membership is limited to military members, veterans, and their families, excluding the general public from accessing their services.

- Limited Branch Locations: USAA primarily operates online and through phone support, with limited physical branch locations, which may inconvenience some customers who prefer in-person interactions.

#10 – Erie: Best for 24/7 Support

Pros

- Local Presence: Erie Insurance operates through a network of local agents, providing personalized service and support to customers in their communities.

- Stable Rates: Erie is known for offering stable and competitive rates, with fewer rate fluctuations compared to some other insurers. Read more through our Erie auto insurance review.

- Erie Rate Lock: With the Erie Rate Lock feature, customers can lock in their auto insurance rates, providing stability and predictability in premiums.

Cons

- Limited Availability: Erie Insurance is available in a limited number of states, which may restrict options for customers outside of their service area.

- Online Tools: While Erie offers basic online account management and claims filing, their online tools may not be as advanced or user-friendly as those offered by larger insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving With a Cracked Windshield in Delaware

Zero Deductible Option for Auto Glass Replacement

Filing a Claim with my Auto Insurance Company

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cracked Windshield in Delaware: The Bottom Line

Frequently Asked Questions

Is windshield replacement covered by auto insurance in Delaware?

Yes, windshield replacement is typically covered by auto insurance in Delaware if you have comprehensive coverage. Comprehensive coverage is an optional insurance policy that covers damages to your vehicle caused by non-collision events, such as vandalism, theft, or weather-related incidents like a cracked or shattered windshield.

Do I need to pay a deductible for windshield replacement in Delaware?

Whether or not you need to pay a deductible for windshield replacement depends on the terms of your auto insurance policy. In Delaware, comprehensive coverage deductibles generally range from $0 to $1,000. Review your policy or contact your insurance provider to determine the deductible amount and if it applies to windshield replacement. Enter your ZIP code now to begin.

Are there any specific requirements for windshield replacement coverage in Delaware?

Can I choose any windshield replacement provider in Delaware?

Most auto insurance policies allow policyholders to choose their preferred windshield replacement provider. However, some insurance companies may have a network of authorized repair facilities or preferred providers that offer direct billing to the insurance company. It’s recommended to verify with your insurance provider if they have any preferred providers or if you have the freedom to choose any reputable windshield replacement service.

Will filing a windshield replacement claim increase my insurance rates in Delaware?

Generally, filing a windshield replacement claim should not directly increase your insurance rates in Delaware. Windshield claims are typically classified as comprehensive claims, which are not considered “at-fault” incidents. However, insurance companies have different policies and rating systems, so it’s advisable to contact your insurance provider and inquire about their specific guidelines regarding comprehensive claims and rate increases. Enter your ZIP code now to begin.

Are there any alternatives to filing a windshield replacement claim?

What are the average monthly rates for windshield replacement coverage offered by the top insurance providers in Delaware?

The average monthly rates for windshield replacement coverage from the top insurance providers in Delaware start at $42 per month.

How do State Farm, Geico, and Progressive differentiate themselves in terms of windshield replacement coverage and pricing?

State Farm, Geico, and Progressive offer competitive rates and comprehensive coverage options tailored to individual driving needs in Delaware. Enter your ZIP code now to begin.

What are the key considerations for Delaware drivers when dealing with a cracked windshield, and how can insurance coverage help mitigate expenses?

What are the primary benefits and drawbacks of comprehensive coverage for windshield replacement in Delaware, and how do deductible options factor into the decision-making process?

Comprehensive coverage for windshield replacement in Delaware provides benefits such as protection from non-collision damages and options for zero deductibles. However, drivers should consider factors like policy terms, deductible amounts, and potential premium increases when making coverage decisions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.