Best Windshield Replacement Coverage in Iowa (Top 10 Companies Ranked for 2026)

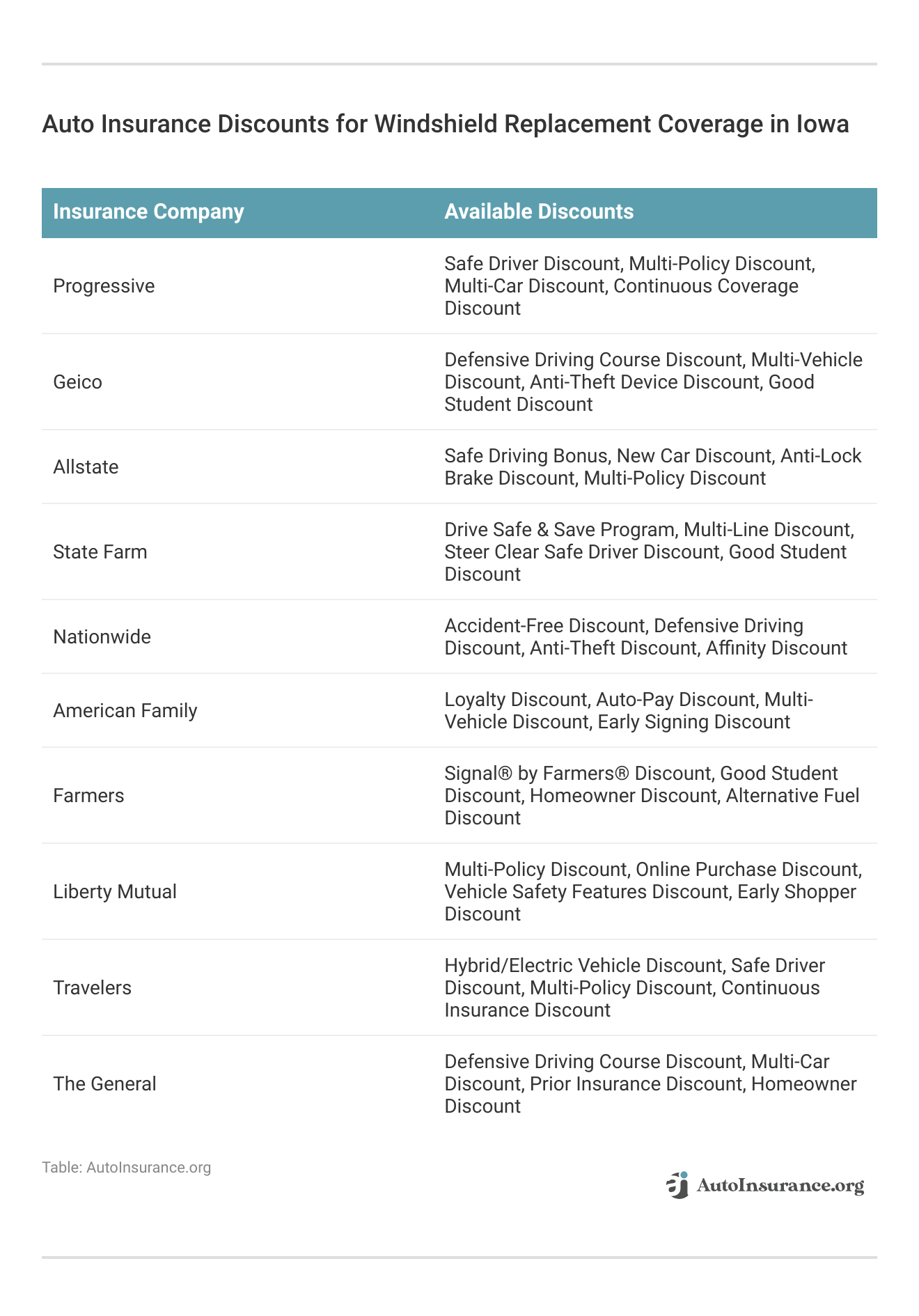

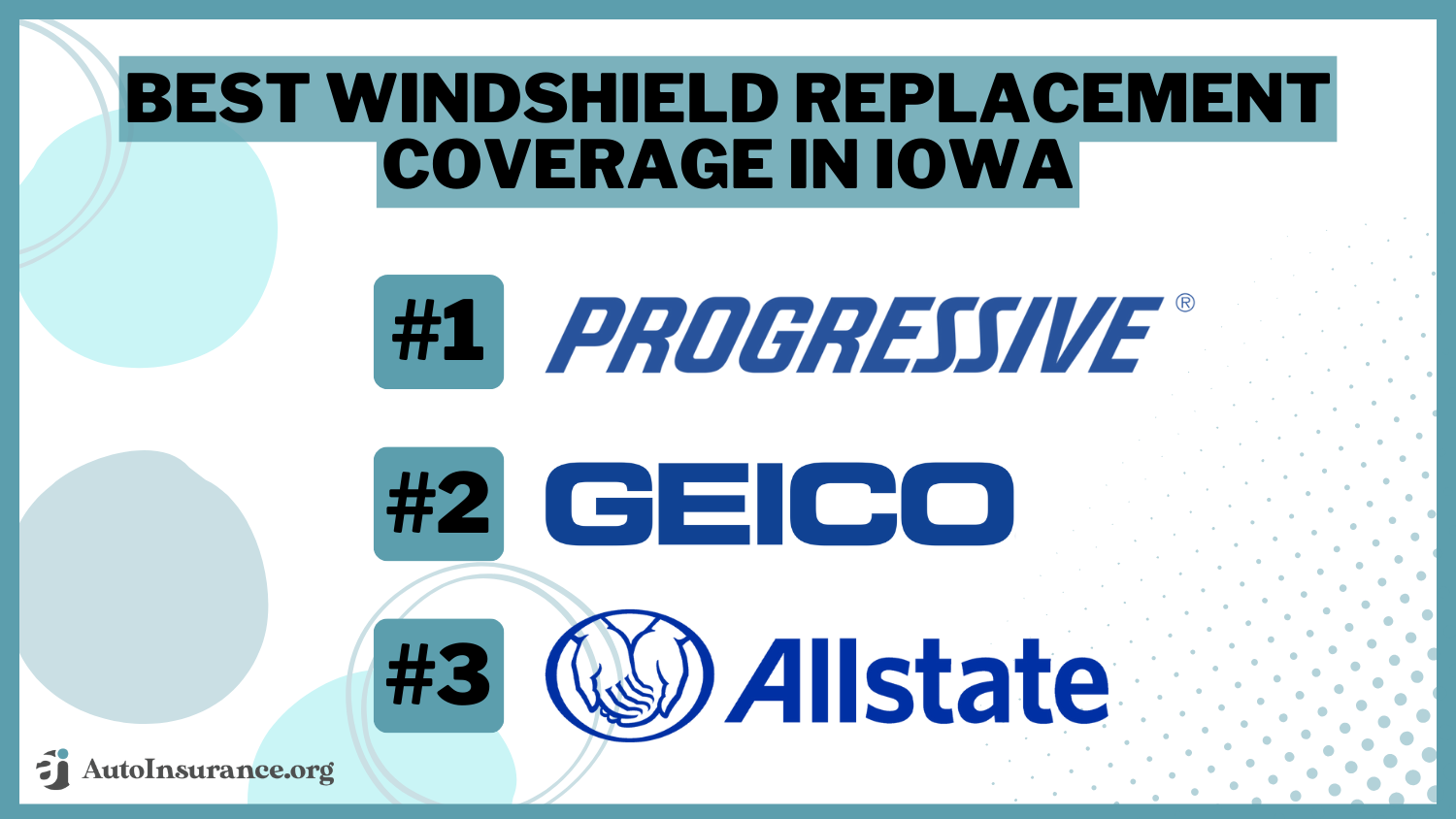

Progressive, Geico, and Allstate offer the best windshield replacement coverage in Iowa, with rates starting as low as $45 per month. We aim to assist you in comparing quotes from these esteemed insurers, guaranteeing you secure the ideal coverage and capitalize on tailored discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Sr. Director of Content

Sara Routhier, Managing Editor and Outreach Director, has professional experience as an educator, SEO specialist, and content marketer. She has over five years of experience in the insurance industry. As a researcher, data nerd, writer, and editor she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world o...

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated October 2024

Company Facts

Full Coverage for Windshield Replacement in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Windshield Replacement in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Windshield Replacement in Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

- Progressive offers competitive rates beginning at $45 monthly

- Top insurance providers offer options for windshield replacements

- There are many discount opportunities for windshield replacement coverage

#1 – Progressive: Top Overall Pick

Pros

- Flexible Coverage Options: In our Progressive auto insurance review, Progressive offers a wide range of coverage options, allowing customers to tailor their policies to suit their individual needs.

- Innovative Technology: Progressive is known for its innovative use of technology, such as Snapshot, which can lead to potential discounts for safe driving habits.

- Strong Online Presence: Progressive provides a user-friendly online platform for managing policies, filing claims, and accessing resources, enhancing customer convenience.

Cons

- Average Customer Service: While Progressive offers convenient online services, some customers may find their customer service quality to be average compared to other insurers.

- Limited Agent Availability: Progressive primarily operates online, which may be a disadvantage for customers who prefer face-to-face interactions with insurance agents.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Excellent Service

Pros

- Affordability: Geico is often praised for its competitive rates and various discounts, making it an attractive option for budget-conscious individuals. Read more in our Geico auto insurance review.

- Ease of Access: Geico offers a user-friendly website and mobile app, providing customers with convenient access to policy management, claims filing, and support resources.

- Financial Stability: Geico is backed by the financial strength of Berkshire Hathaway, instilling confidence in its ability to fulfill claims obligations.

Cons

- Limited Local Agents: Geico primarily operates through its direct-sales model, which means fewer opportunities for in-person interactions with local agents.

- Potentially Higher Rates for Certain Drivers: While Geico offers competitive rates for many drivers, some individuals may find that other insurers offer lower premiums based on their specific circumstances.

#3 – Allstate: Best for Extensive Coverage

Pros

- Wide Range of Coverage Options: Allstate offers a diverse selection of coverage options, allowing customers to customize their policies to meet their unique needs.

- Strong Customer Support: Allstate is known for its attentive customer service, providing support through various channels, including agents, phone, and online chat.

- Innovative Features: Allstate offers innovative features such as Drivewise, which rewards safe driving behavior with discounts, and QuickFoto Claim, which simplifies the claims process.

Cons

- Higher Premiums: Allstate’s premiums may be relatively higher compared to some other insurers, particularly for certain demographics or coverage levels. Use our Allstate auto insurance review as your guide.

- Limited Availability of Discounts: While Allstate offers various discounts, some customers may find that other insurers provide more extensive discount options, potentially resulting in higher overall premiums.

#4 – State Farm: Best for Trusted Reputation

Pros

- Extensive Agent Network: State Farm boasts a vast network of local agents, providing personalized assistance and guidance to customers. Find out more in our State Farm auto insurance review.

- Strong Reputation: State Farm has a long-standing reputation for reliability and financial stability, instilling confidence in its ability to fulfill claims obligations.

- Multiple Policy Discounts: State Farm offers discounts for bundling multiple insurance policies, such as auto and home insurance, potentially leading to significant savings for customers.

Cons

- Potentially Higher Rates for Some Drivers: While State Farm offers competitive rates for many customers, some individuals may find that other insurers offer lower premiums based on their specific circumstances.

- Limited Online Tools: State Farm’s online platform may not be as robust or user-friendly as those of some other insurers, which could be a drawback for customers who prefer digital interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Nationwide Coverage

Pros

- Wide Range of Coverage Options: Nationwide offers a variety of coverage options to meet diverse customer needs, including customizable policies and add-on coverages.

- Member Benefits: Nationwide offers member benefits beyond insurance, such as discounts on travel, entertainment, and shopping, providing added value to customers.

- Strong Financial Stability: Nationwide is backed by solid financial strength, reassuring customers of its ability to handle claims and provide support when needed.

Cons

- Potentially Higher Premiums: Nationwide’s premiums may be higher compared to some other insurers, particularly for certain demographics or coverage levels.

- Limited Availability of Discounts: Nationwide, as mentioned in our Nationwide insurance review, offers various discounts, some customers may find that other insurers provide more extensive discount options, potentially resulting in higher overall premiums.

#6 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family emphasizes personalized service, with dedicated agents who provide tailored guidance and support to customers.

- Wide Array of Discounts: American Family offers a variety of discounts, including multi-policy, safe driving, and loyalty discounts, helping customers save on their premiums.

- Community Involvement: American Family is known for its community involvement and support through initiatives such as the American Family Insurance Dreams Foundation, fostering goodwill and trust among customers.

Cons

- Limited Availability: American Family primarily operates in specific regions of the United States, which may limit its availability to customers in other areas. Read more through our American Family auto insurance review.

- Potentially Higher Rates: While American Family offers competitive rates for many customers, some individuals may find that other insurers offer lower premiums based on their specific circumstances.

#7 – Farmers: Best for Strong Benefits

Pros

- Comprehensive Coverage Options: Farmers, as mentioned in our Farmers auto insurance review, provides a wide range of coverage options, allowing customers to tailor their policies to suit their individual needs.

- Strong Claims Handling: Farmers is known for its efficient claims handling process, with dedicated claims representatives who strive to provide prompt and fair resolutions to customers.

- Flexible Payment Options: Farmers offers flexible payment options, including various installment plans, making it easier for customers to manage their premiums.

Cons

- Potentially Higher Premiums: Farmers’ premiums may be relatively higher compared to some other insurers, particularly for certain demographics or coverage levels.

- Limited Online Tools: Farmers’ online platform may not be as robust or user-friendly as those of some other insurers, which could be a drawback for customers who prefer digital interactions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customized Options

Pros

- Customized Coverage Options: Liberty Mutual offers customizable coverage options, allowing customers to build policies that meet their specific needs and budget.

- Online Policy Management: Liberty Mutual provides an intuitive online platform for policy management, claims filing, and support, enhancing customer convenience.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling multiple insurance policies, such as auto and home insurance, potentially leading to significant savings for customers.

Cons

- Potentially Higher Premiums: Liberty Mutual’s premiums may be higher compared to some other insurers, particularly for certain demographics or coverage levels. For further insights, refer to our Liberty Mutual auto insurance review.

- Limited Availability of Discounts: While Liberty Mutual offers various discounts, some customers may find that other insurers provide more extensive discount options, potentially resulting in higher overall premiums.

#9 – Travelers: Best for Financial Stability

Pros

- Financial Stability: Travelers is backed by strong financial stability, providing customers with confidence in its ability to handle claims and fulfill policy obligations.

- Customized Policies: Travelers offers customizable policies, allowing customers to tailor coverage options to their individual needs and preferences.

- Discount Opportunities: Travelers provides various discount opportunities, such as safe driver discounts and multi-policy discounts, helping customers save on their premiums.

Cons

- Limited Availability: Our Travelers auto insurance review reveals that they may have limited availability in certain regions, which could restrict access for potential customers in those areas.

- Higher Premiums for Some: While Travelers offers competitive rates for many customers, some individuals may find that other insurers offer lower premiums based on their specific circumstances.

#10 – The General: Best for High-Risk Coverage

Pros

- Specialized Coverage: The General specializes in providing coverage for high-risk drivers, offering options for those who may have difficulty obtaining insurance elsewhere.

- Convenient Online Services: The General offers convenient online services for obtaining quotes, managing policies, and filing claims, catering to customers who prefer digital interactions.

- Quick Claims Processing: The General is known for its efficient claims processing, with a focus on providing fast and responsive service to policyholders.

Cons

- Higher Premiums: The General’s premiums may be higher compared to standard insurers, reflecting the increased risk associated with insuring high-risk drivers. Check out our The General auto insurance review.

- Limited Coverage Options: The General may offer fewer coverage options compared to traditional insurers, which could result in less comprehensive protection for some policyholders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Policy No-Deductible Clause for Glass Replacement

Iowa State Law About the Use of Used Glass

Getting Cheap Auto Insurance with Full Glass Coverage in Iowa

Frequently Asked Questions

Does auto insurance in Iowa cover windshield replacement?

Yes, auto insurance in Iowa typically covers windshield replacement under certain conditions. Most comprehensive insurance policies include coverage for windshield damage caused by common hazards such as rocks, debris, or vandalism.

What type of auto insurance coverage includes windshield replacement in Iowa?

Comprehensive coverage is the type of auto insurance that typically includes windshield replacement in Iowa. This coverage protects against non-collision-related damage to your vehicle, including windshield damage. Enter your ZIP code now.

Are there any deductibles or out-of-pocket expenses for windshield replacement in Iowa?

Is windshield repair covered, or does insurance only cover full replacement?

In many cases, insurance coverage for windshield damage in Iowa extends to both repair and replacement. Insurance companies often prefer windshield repair when it is feasible and cost-effective. However, if the damage is extensive or repair is not possible, the insurance policy may cover the full replacement cost.

Do I need to get my windshield repaired or replaced at a specific shop?

Insurance policies in Iowa may have preferred or recommended auto glass repair shops. These shops often have established relationships with insurance companies, making the claims process smoother. However, you generally have the freedom to choose the repair shop you prefer, even if it’s not on the insurer’s list. Review your policy or consult your insurance provider for guidance on preferred shops. Enter your ZIP code now to begin.

What are the top three insurance companies for windshield replacement coverage in Iowa?

What type of insurance coverage typically includes windshield replacement in Iowa?

Comprehensive coverage typically includes windshield replacement in Iowa.

Does the article suggest that some insurers offer separate deductibles for glass-related claims?

Yes, the article suggests that some insurance policies have separate deductibles for glass-related claims. Enter your ZIP code now to start comparing.

What is a unique feature of Progressive’s insurance offerings mentioned?

What are the two potential disadvantages of Geico’s insurance model as highlighted?

Two potential disadvantages of Geico’s insurance model are the limited availability of local agents due to its direct-sales model and potentially higher rates for certain drivers compared to other insurers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.