Best Windshield Replacement Coverage in Oregon (Top 10 Companies in 2026)

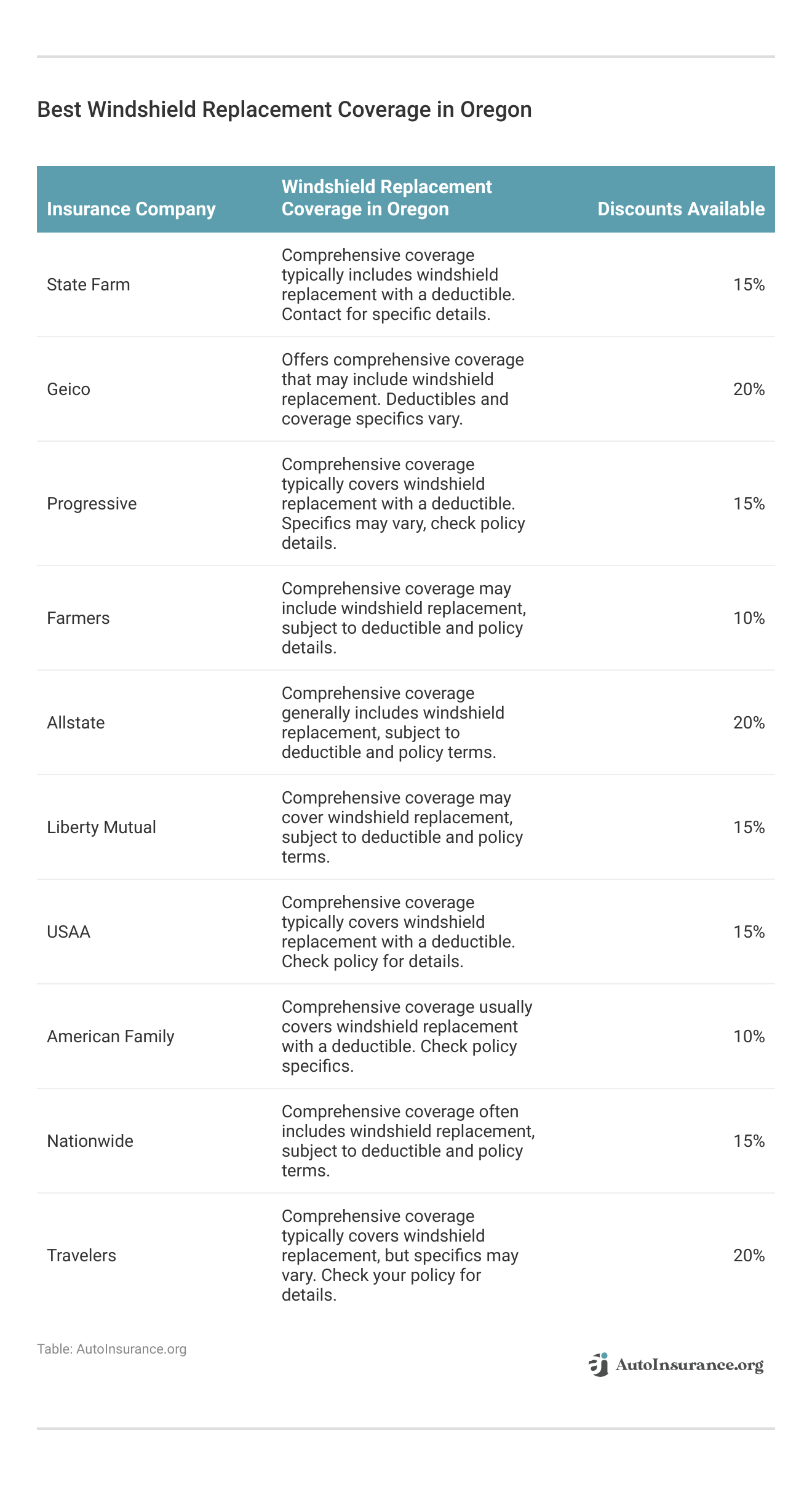

State Farm, Geico, and Progressive offer top-tier windshield replacement coverage options in Oregon, beginning at just $51 per month. We aim to facilitate a thorough comparison of quotes from these esteemed providers, ensuring you secure optimal coverage complete with tailored discounts for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated May 2024

Company Facts

Full Coverage Windshield Replacement in Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

- State Farm offers competitive rates beginning at $51 per month

- Leading insurance firms offer chances to save on windshield expenses

- Various discount opportunities exist for coverage of windshield replacements

#1 – State Farm: Top Overall Pick

Pros

- Extensive Coverage Options: State Farm offers a wide range of coverage options, including comprehensive windshield replacement coverage, ensuring you have protection tailored to your needs.

- Strong Customer Service: With a large network of agents and responsive customer support, State Farm provides excellent assistance and guidance throughout the claims process.

- Discount Opportunities: State Farm offers various discounts, such as multi-policy discounts and safe driving discounts, helping policyholders save money on their premiums. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Rates: While State Farm provides comprehensive coverage, its rates may be slightly higher compared to some other providers, especially for certain demographics or regions.

- Limited Online Tools: State Farm’s online tools and mobile app may not be as robust or user-friendly as those offered by some other insurance companies, which could be inconvenient for tech-savvy customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico is known for offering competitive rates, making it an attractive option for budget-conscious individuals seeking windshield replacement coverage. Read more in our Geico auto insurance review.

- Online Convenience: Geico provides a user-friendly website and mobile app, allowing customers to manage their policies, file claims, and access resources conveniently online.

- Fast Claim Processing: Geico is renowned for its efficient claims processing, ensuring quick resolution and reimbursement for windshield replacement expenses.

Cons

- Limited Coverage Options: While Geico offers basic windshield replacement coverage, its options for additional coverage may be limited compared to some other insurers, potentially leaving policyholders with gaps in protection.

- Less Personalized Service: Geico primarily operates online and over the phone, which means customers may have less opportunity for face-to-face interaction with agents, leading to a less personalized experience.

#3 – Progressive: Best for Online Convenience

Pros

- Innovative Tools: Progressive offers innovative tools like Snapshot, which tracks driving habits to potentially lower premiums, and Name Your Price, allowing customers to customize coverage based on their budget.

- Flexible Payment Options: Progressive provides flexible payment plans, including options for bundling policies and setting up automatic payments, making it convenient for customers to manage their insurance payments.

- Transparent Pricing: In our Progressive auto insurance review, Progressive’s pricing transparency, including the ability to see competitor rates, helps customers make informed decisions and ensures they’re getting the best value for their coverage.

Cons

- Average Customer Service: While Progressive offers decent customer service, some customers may find that the level of support provided doesn’t meet their expectations, especially during peak periods.

- Complex Claims Process: Progressive’s claims process may be more complex compared to some other insurers, potentially causing delays or confusion for policyholders filing windshield replacement claims.

#4 – Farmers: Best for Local Agents

Pros

- Local Agent Network: Farmers, as mentioned in our Farmers auto insurance review, has a widespread network of local agents who can provide personalized assistance and guidance, ensuring that policyholders receive tailored coverage solutions.

- Customizable Policies: Farmers offers customizable policies, allowing customers to add optional coverage for windshield replacement and other specific needs, ensuring comprehensive protection.

- Strong Financial Stability: With a solid financial standing, Farmers provides peace of mind to policyholders, knowing that their claims will be promptly handled and fulfilled.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some other insurers, particularly for certain demographics or regions, potentially making it less affordable for budget-conscious individuals.

- Limited Online Features: Farmers’ online platform and mobile app may lack some features and functionalities offered by competitors, which could be inconvenient for customers who prefer managing their policies digitally.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Add-on Coverages

Pros

- Wide Range of Coverage Options: Allstate offers a comprehensive selection of coverage options, including windshield replacement coverage, ensuring that policyholders can tailor their policies to their specific needs.

- Access to Resources: Allstate provides access to a variety of resources, including educational materials and tools, helping customers make informed decisions about their coverage and claims.

- Strong Reputation: With a strong reputation for reliability and customer service, Allstate instills confidence in policyholders, knowing that their insurance needs will be well taken care of. Use our Allstate auto insurance review as your guide.

Cons

- Potentially Complex Claims Process: Allstate’s claims process may be more complex compared to some other insurers, potentially leading to longer processing times or confusion for policyholders filing windshield replacement claims.

- Higher Premiums for Additional Coverage: While Allstate offers comprehensive coverage options, adding additional coverage for windshield replacement and other needs may result in higher premiums, making it less affordable for some customers.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor their coverage to their specific needs, including optional windshield replacement coverage for added protection.

- Discount Opportunities: Liberty Mutual provides various discounts, such as multi-policy discounts and safe driving discounts, helping policyholders save money on their premiums.

- Strong Financial Strength: With a solid financial standing, Liberty Mutual provides reassurance to policyholders that their claims will be promptly handled and fulfilled, even in times of economic uncertainty.

Cons

- Limited Availability: Liberty Mutual may not be available in all states or regions, limiting access to its coverage options for some customers. For further insights, refer to our Liberty Mutual auto insurance review.

- Mixed Customer Service Reviews: While Liberty Mutual offers decent customer service overall, some customers may have mixed experiences with responsiveness and support, depending on their specific circumstances and interactions with agents.

#7 – USAA: Best for Military Savings

Pros

- Exceptional Customer Service: USAA is renowned for its outstanding customer service, consistently receiving high ratings and reviews for its responsiveness, support, and claims handling. Read more in our USAA auto insurance review.

- Exclusive Membership: USAA is available exclusively to military members, veterans, and their families, providing tailored coverage options and specialized support to those who have served in the armed forces.

- Competitive Rates: USAA offers competitive rates for its members, often providing discounts and benefits that make its coverage more affordable compared to many other insurers.

Cons

- Limited Membership Eligibility: USAA membership is restricted to military members, veterans, and their families, meaning that it’s not available to the general public, limiting access to its coverage options.

- Limited Physical Locations: USAA primarily operates online and over the phone, which means that customers may have limited access to in-person support from agents or representatives, depending on their location.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Personalized Service: American Family prioritizes personalized service, offering a network of local agents who can provide customized guidance and support to policyholders, ensuring that their insurance needs are met.

- Innovative Coverage Options: American Family offers innovative coverage options, including customizable policies with optional windshield replacement coverage, allowing customers to tailor their coverage to their specific needs.

- Community Involvement and Support: American Family is known for its strong commitment to community involvement and support, often sponsoring local events and initiatives, which can resonate with customers who value companies with a social conscience.

Cons

- Limited Availability: Our examination of American Family insurance review reveals, American Family may not be available in all states or regions, limiting access to its coverage options for some customers.

- Average Customer Satisfaction Ratings: While American Family provides decent customer service overall, some customers may have mixed experiences with responsiveness and support, depending on their specific circumstances and interactions with agents.

#9 – Nationwide: Best for Usage Discounts

Pros

- Wide Range of Coverage Options: Nationwide, as mentioned in our Nationwide insurance review, offers a comprehensive selection of coverage options, including windshield replacement coverage, ensuring that policyholders can tailor their policies to their specific needs.

- Strong Financial Stability: With a solid financial standing, Nationwide provides reassurance to policyholders that their claims will be promptly handled and fulfilled, even in times of economic uncertainty.

- Comprehensive Coverage Packages: Nationwide offers comprehensive coverage packages that include windshield replacement coverage as part of their standard offerings, simplifying the process for policyholders and ensuring they have adequate protection.

Cons

- Potentially Higher Premiums: Nationwide’s premiums may be higher compared to some other insurers, particularly for certain demographics or regions, potentially making it less affordable for budget-conscious individuals.

- Average Claims Process: While Nationwide offers decent claims processing, some customers may find that the process is not as streamlined or efficient as that of some other insurers, potentially leading to longer processing times for claims.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Flexible Coverage Options: Our Travelers auto insurance review reveals that travelers offers flexible coverage options, allowing customers to customize their policies with optional windshield replacement coverage and other add-ons to suit their specific needs.

- Strong Financial Strength: With a solid financial standing, Travelers provides reassurance to policyholders that their claims will be promptly handled and fulfilled, even in times of economic uncertainty.

- Discount Opportunities: Travelers offers various discounts, such as multi-policy discounts and safe driving discounts, helping policyholders save money on their premiums.

Cons

- Mixed Customer Service Reviews: While Travelers offers decent customer service overall, some customers may have mixed experiences with responsiveness and support, depending on their specific circumstances and interactions with agents.

- Limited Availability: Travelers may not be available in all states or regions, limiting access to its coverage options for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Oregon’s Full Glass Coverage Laws for Damage

Driving with a Cracked Windshield in Oregon

Oregon allows driving with minor windshield damage, but any impairment to vision or safety is prohibited. While specific size regulations are not defined, obstructive materials on the windshield are not allowed.

Police may issue warnings or citations for severe damage, with fines starting at $110 per violation. Windshield replacements range from $170 to $1,110, but insurance coverage, including high-risk auto insurance, may help offset costs. Enter your ZIP code now.

Oregon Windshields Replacement

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Filing a Claim for a Windshield

Find the Best Oregon Full Glass Coverage

Frequently Asked Questions

What are the full glass coverage laws for windshield damage in Oregon?

Oregon doesn’t have specific laws for full glass coverage, but the federal government prohibits cracks touching or within two inches of the edge and any damage in front of the driver.

Can you drive with a cracked windshield in Oregon?

Minor windshield damage may be acceptable, but you cannot drive with damage that impairs your vision or jeopardizes safety. Police officers use discretion to determine if a car is unsafe to drive. Enter your ZIP code now.

What happens if you drive with a cracked windshield in Oregon?

Does insurance cover windshield replacement in Oregon?

Windshield replacement or repairs are typically covered through comprehensive insurance or full glass coverage. Liability insurance, which is the minimum requirement in Oregon, does not cover windshields.

How do you file a claim for windshield replacement?

Determine if filing a claim is necessary based on the severity of the damage and potential impact on your insurance rates. If a claim is warranted, contact your insurance provider, provide necessary details, and follow the claims process instructed by the company. Enter your ZIP code now to start.

What factors should you consider when choosing windshield replacement coverage in Oregon?

When choosing windshield replacement coverage in Oregon, consider factors like coverage options, cost, deductible, collision insurance, and the insurer’s reputation for customer service.

Which insurers in Oregon offer windshield replacement coverage starting at $51 per month?

State Farm, Geico, and Progressive offer windshield replacement coverage in Oregon starting at $51 per month.

How does Oregon law regulate driving with a cracked windshield?

Oregon law allows driving with minor windshield damage but prohibits impairment to vision or safety. Police may issue warnings or citations for severe damage. Enter your ZIP code now to start.

What common hazards lead to windshield damage, and how does comprehensive coverage help?

What are the advantages and disadvantages of choosing Geico for windshield replacement coverage?

Geico offers competitive rates and online convenience but may have limited coverage options and less personalized service compared to other insurers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.