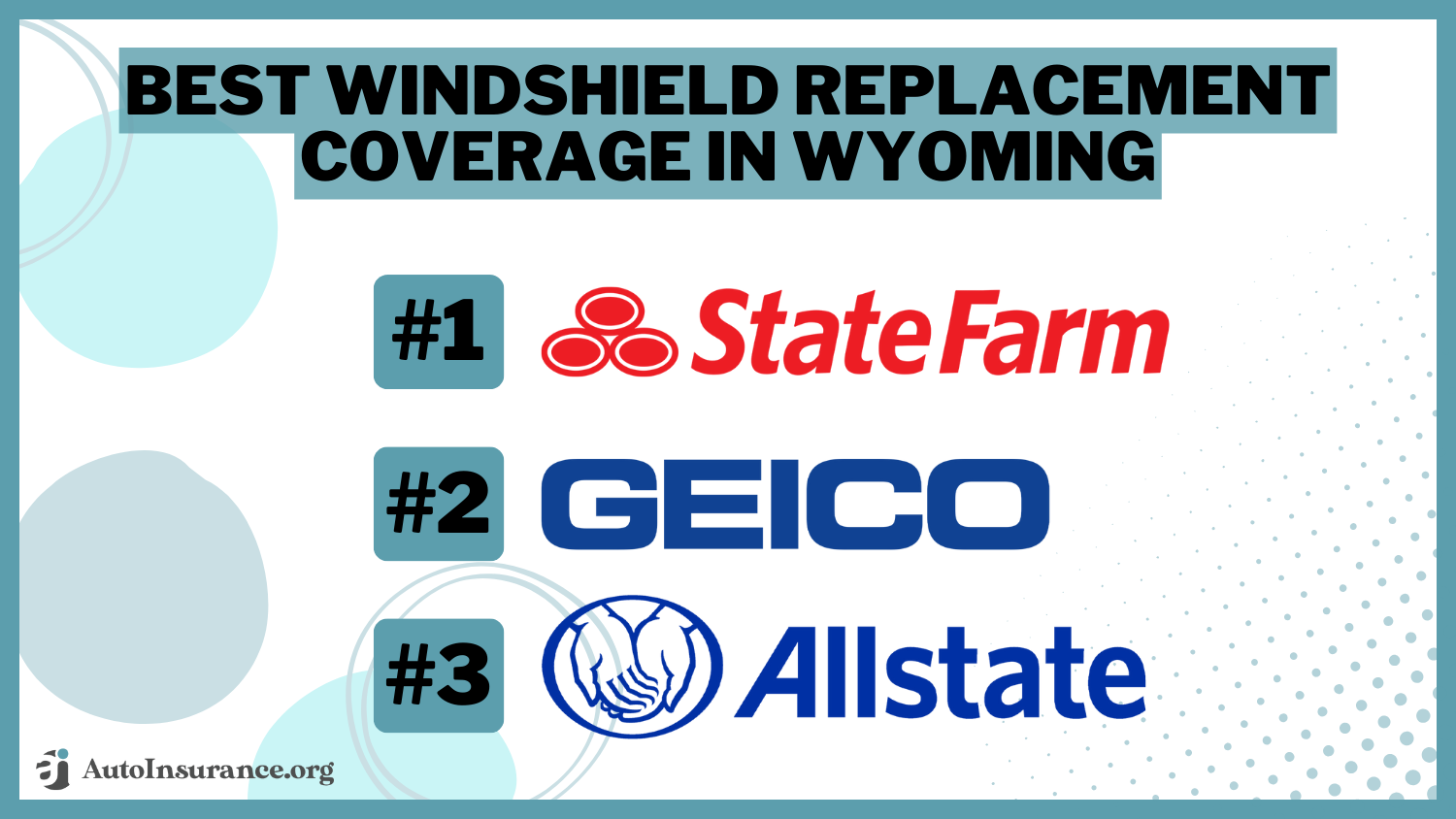

Best Windshield Replacement Coverage in Wyoming (Top 10 Companies Ranked for 2026)

State Farm, Geico, and Allstate provide the best windshield replacement coverage in Wyoming, with rates starting as low as $65 monthly. Our objective is to facilitate your comparison of quotes from these respected insurers, ensuring you discover the finest coverage for your peace of mind.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Licensed Insurance Producer

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated October 2024

Company Facts

Full Coverage Windshield Replacement in WY

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in WY

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage Windshield Replacement in WY

A.M. Best Rating

Complaint Level

Pros & Cons

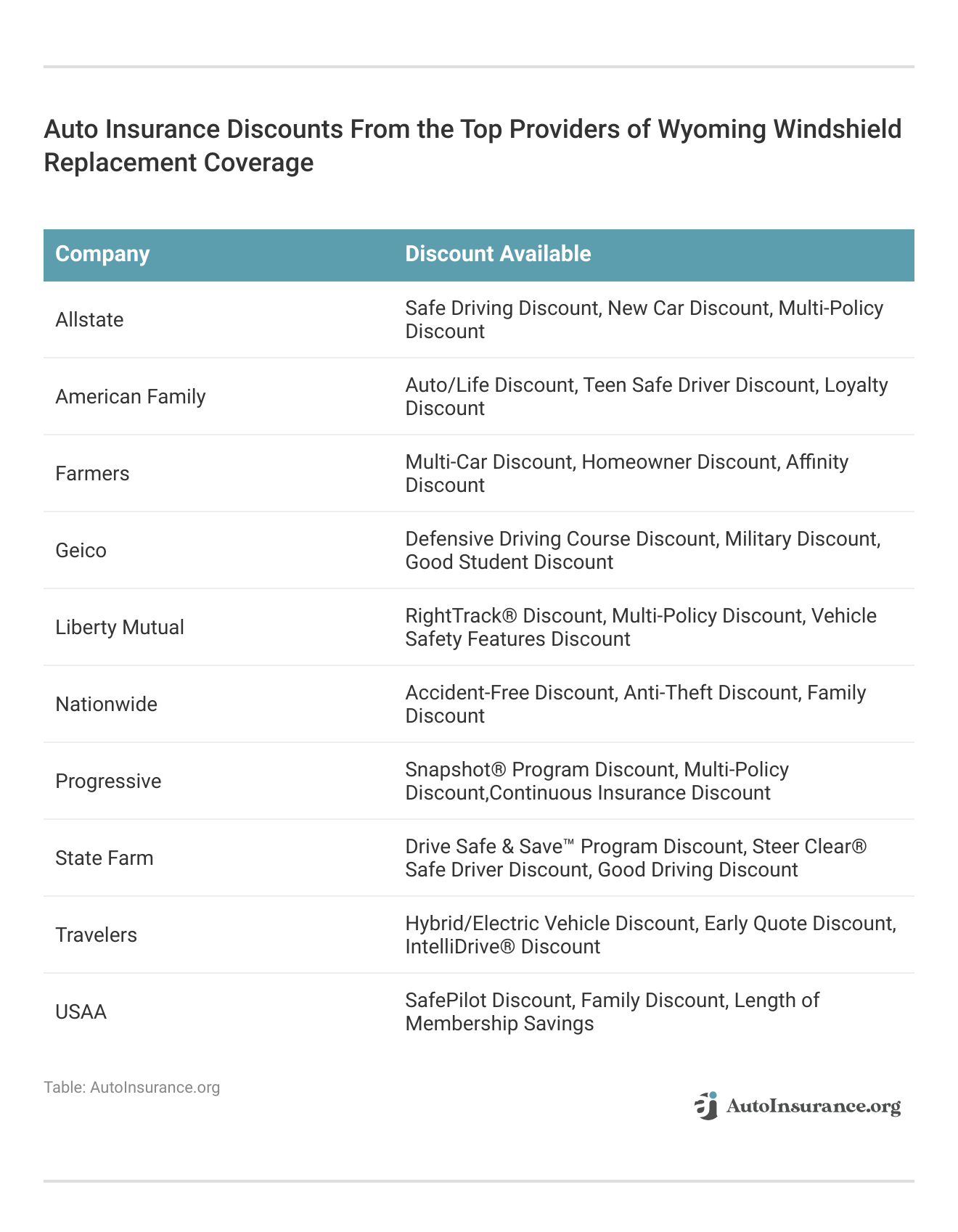

- State Farm offers competitive pricing starting from $65 per month

- Premier insurance providers offer opportunities to save on windshield expenses

- Numerous discount options are accessible for windshield replacement coverage

#1 – State Farm: Top Overall Pick

Pros

- Excellent Customer Service: State Farm is known for its exceptional customer service, with agents readily available to assist customers with their needs. Find out more in our State Farm auto insurance review.

- Wide Range of Coverage Options: They offer a variety of coverage options, including comprehensive coverage for windshield replacement, providing flexibility to customers.

- Strong Financial Stability: State Farm has a solid financial standing, providing customers with confidence in their ability to fulfill claims.

Cons

- Potentially Higher Rates: While they offer comprehensive coverage, their rates may be slightly higher compared to some other providers.

- Limited Discounts: State Farm may not offer as many discounts compared to other insurers, potentially leading to fewer opportunities for savings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico is often praised for its competitive rates, making it a popular choice for budget-conscious customers.

- User-Friendly Technology: They offer a user-friendly website and mobile app, making it convenient for customers to manage their policies and file claims.

- Wide Range of Discounts: Geico provides a variety of discounts, including discounts for safe driving, which can help customers save money on their premiums.

Cons

- Limited Coverage Options: While Geico offers essential coverage, they may have fewer options compared to some other providers, potentially limiting customization.

- Average Customer Service: Some customers have reported average experiences with Geico’s customer service, with longer wait times for assistance. Read more in our Geico auto insurance review.

#3 – Allstate: Best for Add-on Coverages

Pros

- Customizable Policies: Allstate offers customizable policies, allowing customers to tailor their coverage to suit their specific needs.

- Innovative Features: They provide innovative features like Drivewise, which rewards safe driving behavior with discounts, appealing to tech-savvy customers.

- Wide Network of Agents: Allstate has a vast network of agents across the country, providing personalized assistance to customers.

Cons

- Potentially Higher Rates: Similar to State Farm, Allstate may have slightly higher rates compared to some competitors. Use our Allstate auto insurance review as your guide.

- Mixed Customer Service Reviews: While they have a wide network of agents, some customers have reported mixed experiences with Allstate’s customer service, with issues related to responsiveness and claims processing.

#4 – Progressive: Best for Online Convenience

Pros

- Convenient Online Tools: Progressive offers a range of online tools and resources, making it easy for customers to manage their policies, file claims, and track their driving habits.

- Name Your Price Tool: In our Progressive auto insurance review, they have a unique “Name Your Price” tool that allows customers to set their desired premium and then helps find a policy that fits within that budget.

- Discount Opportunities: Progressive provides various discount opportunities, such as the Snapshot program, which rewards safe driving behavior with lower rates.

Cons

- Potentially Complex Claims Process: Some customers have reported experiencing a somewhat complicated claims process with Progressive, leading to delays in claim resolution.

- Limited Agent Availability: While Progressive offers online tools, customers who prefer in-person assistance may find limited availability of local agents compared to other providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Exclusive to Military Members and Their Families: USAA exclusively serves military members and their families, offering specialized services tailored to their unique needs.

- High Customer Satisfaction: They consistently receive high ratings for customer satisfaction, with many customers praising their exceptional service and support.

- Competitive Rates: USAA is known for offering competitive rates and a variety of discounts for military members, helping them save on their premiums.

Cons

- Limited Eligibility: USAA membership is restricted to military personnel and their families, so not everyone can access their services. Read more in our USAA auto insurance review.

- Limited Physical Locations: While USAA offers excellent online and phone support, they have limited physical branch locations, which may inconvenience some customers who prefer face-to-face interactions.

#6 – Farmers: Best for Local Agents

Pros

- Personalized Service: Farmers Insurance offers personalized service through a network of local agents, providing individualized assistance to customers.

- Comprehensive Coverage Options: They provide a wide range of coverage options, including windshield replacement coverage, allowing customers to find policies that meet their specific needs.

- Strong Financial Stability: Farmers has a solid financial standing, instilling confidence in customers regarding the company’s ability to fulfill claims and obligations.

Cons

- Potentially Higher Rates: As mentioned in our Farmers auto insurance review, Farmers may have higher rates compared to some competitors, especially for certain types of coverage.

- Limited Online Tools: While Farmers offers personalized service through agents, their online tools and resources may be more limited compared to some other insurers, potentially affecting convenience for tech-savvy customers.

#7 – Nationwide: Best for Usage Discount

Pros

- Wide Range of Coverage Options: Nationwide offers a variety of coverage options, including comprehensive coverage for windshield replacement, providing flexibility to customers.

- Discount Opportunities: Nationwide, as mentioned in our Nationwide insurance review, provide various discount opportunities, such as bundling discounts and safe driving discounts, helping customers save on their premiums.

- Strong Financial Stability: Nationwide has a strong financial stability rating, ensuring customers that the company can meet its financial obligations and pay claims promptly.

Cons

- Average Customer Service: Some customers have reported average experiences with Nationwide’s customer service, with issues related to responsiveness and claims processing.

- Potentially Limited Availability: Nationwide may have limited availability in certain areas compared to larger insurers, potentially affecting accessibility for some customers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Local Agent Support: American Family offers personalized service through a network of local agents, providing customers with individualized assistance and support.

- Innovative Features: They offer innovative features such as the MyAmFam app, which allows customers to manage their policies, file claims, and access resources conveniently.

- Discount Opportunities: American Family provides various discount opportunities, such as bundling discounts and loyalty discounts, helping customers save on their premiums.

Cons

- Potentially Limited Availability: Our examination of American Family insurance review reveals, they may have limited availability in certain regions, especially compared to larger national insurers.

- Mixed Customer Reviews: While they offer personalized service, some customers have reported mixed experiences with American Family’s customer service, with issues related to responsiveness and claims processing.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing customers to tailor their coverage to suit their specific needs. For further insights, refer to our Liberty Mutual auto insurance review.

- Online Tools and Resources: They provide a range of online tools and resources, making it easy for customers to manage their policies, file claims, and access educational materials.

- Discount Opportunities: Liberty Mutual offers various discount opportunities, such as multi-policy discounts and safe driver discounts, helping customers save on their premiums.

Cons

- Potentially Higher Rates: Liberty Mutual may have higher rates compared to some competitors, especially for certain types of coverage.

- Mixed Customer Service Reviews: While they offer online tools and resources, some customers have reported mixed experiences with Liberty Mutual’s customer service, with issues related to responsiveness and claims processing.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Strong Financial Stability: Travelers has a strong financial stability rating, ensuring customers that the company can meet its financial obligations and pay claims promptly.

- Customizable Coverage Options: Our Travelers auto insurance review reveals they offer customizable coverage options, allowing customers to tailor their policies to meet their specific needs and budget.

- Innovative Features: Travelers provides innovative features such as IntelliDrive, which monitors driving behavior and offers potential discounts based on safe driving habits.

Cons

- Limited Availability: Travelers may have limited availability in certain regions, potentially affecting accessibility for some customers.

- Potentially Complex Claims Process: Some customers have reported experiencing a somewhat complicated claims process with Travelers, leading to delays in claim resolution and customer dissatisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Requirements in Wyoming

Auto Glass Insurance Requirements in Wyoming

If pulled over, officers decide if the damage is hazardous. Glass coverage isn’t mandated but is typically included in comprehensive coverage, not in minimum coverage. Enter your ZIP code now to begin.

Full Glass Coverage Options in Wyoming

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Glass Coverage

Tips for Finding the Best Insurance Rates

Frequently Asked Questions

Are there specific auto glass insurance requirements in Wyoming?

Wyoming requires all vehicles to have a working windshield made of safety glass without any impairments that hinder visibility. However, there is no specific requirement for auto glass coverage.

Should I get auto glass coverage?

Whether you need auto glass coverage depends on your personal situation. If you finance or lease your car, you may already have this coverage as part of your full-coverage policy. It’s important to review your policy to understand if your windshield damage is covered. Enter your ZIP code now to begin.

Can I add full glass coverage to my policy in Wyoming?

How can I start comparing car insurance quotes in Wyoming?

To start comparing car insurance quotes in Wyoming, you can enter your ZIP code on our website to view companies that offer cheap auto insurance rates. This allows you to begin the process of finding the most affordable coverage for your specific needs.

What happens if I drive with a cracked windshield that impairs my vision?

Driving with a cracked windshield that impairs your vision is not only unsafe but also illegal in Wyoming. If you are caught driving with such a windshield, you may face penalties, fines, or even a license suspension. It’s crucial to repair or replace a cracked windshield that obstructs your vision. Enter your ZIP code now.

Can I transfer my glass coverage to a new vehicle?

What are the key factors to consider when comparing windshield replacement coverage options in Wyoming?

The key factors to consider when comparing windshield replacement coverage options in Wyoming include the availability of comprehensive coverage, rates offered by different insurers, the reputation of the insurance companies for customer service, and the range of coverage options tailored to individual needs.

How do State Farm, Geico, and Allstate stand out in terms of windshield replacement coverage in Wyoming?

State Farm, Geico, and Allstate stand out in terms of windshield replacement coverage in Wyoming due to their competitive rates starting as low as $65 per month, their comprehensive protection options, and their reputation for providing excellent customer service. Enter your ZIP code now to start.

What are some of the common auto insurance requirements in Wyoming?

What are some tips provided for finding the best insurance rates and coverage options in Wyoming?

The article provides tips for finding the best insurance rates and coverage options in Wyoming, including checking for errors on your credit report to potentially qualify for discounts, comparing quotes from multiple insurers to find the most affordable coverage, and considering factors such as driving history, location, and vehicle type that influence premiums.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.