Best Birmingham, Alabama Auto Insurance in 2026 (Compare the Top 10 Companies)

Obtain the best Birmingham, Alabama auto insurance prices from Geico, Progressive, and State Farm for as low as $45/month. These insurers are recognized for financial stability and effective claims handling during unpredictable weather, making them top choices for drivers seeking peace of mind and coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated October 2024

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Birmingham Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Birmingham Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage in Birmingham Alabama

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsYou can secure the best Birmingham, Alabama auto insurance coverage from Geico, Progressive, and State Farm, starting at $45 per month.

This guide explores leading insurance providers and their offerings, highlighting the cheapest rates and best features for Birmingham drivers. We break down what you need to know.

Do all auto insurance companies offer the same thing? Not quite—discover how rates and coverage vary to help you find the best fit for your needs.

Our Top 10 Company Picks: Best Birmingham, Alabama Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Safe Driving | Geico | |

| #2 | 10% | A+ | Loyalty Rewards | Progressive | |

| #3 | 17% | B | Cheap Rates | State Farm | |

| #4 | 10% | A++ | Military Service | USAA | |

| #5 | 25% | A | Accident Prevention | Liberty Mutual |

| #6 | 20% | A+ | Usage Tracking | Nationwide |

| #7 | 25% | A+ | Continuous Coverage | Allstate | |

| #8 | 13% | A++ | Policy Bundling | Travelers | |

| #9 | 20% | A | Eco-Friendly Vehicles | Farmers | |

| #10 | 25% | A | Military Membership | American Family |

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool above.

- The top pick for Birmingham’s auto insurance company is Geico

- Birmingham is the 36th most congested city in the country

- Drivers in Birmingham spend an average of 22 minutes on their way to work

#1 – Geico: Top Overall Pick

Pros

- Birmingham Commuter-Friendly Rates: Geico’s $120 monthly full coverage is ideal for Birmingham’s workforce, easing the financial burden of daily commutes on I-65 and Highway 280.

- Safe Driver Rewards: Offers discounts for safe driving, helping Birmingham motorists save, especially around Malfunction Junction. Safe drivers can find more savings in Geico auto insurance review.

- Financial Strength: With an A++ rating, Geico ensures reliable coverage for drivers in Birmingham, even after major accidents on Highway 31.

Cons

- Claims Support During Severe Weather: Geico’s standard claims process may lag during severe weather compared to local insurers with better weather response.

- Stringent Policies for High-Crime Areas: Higher crime neighborhoods in Birmingham might face stricter policies or higher premiums with Geico.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Loyalty Rewards

Pros

- Red Mountain Expressway Regulars: Birmingham commuters on the Red Mountain Expressway can benefit from Progressive’s Snapshot program, potentially lowering rates based on their driving patterns.

- Claims for Unpredictable Weather: Their mobile app supports quick claims for Birmingham’s storms. Explore Progressive auto insurance review for coverage that protects you in any condition.

- Birmingham’s Automotive Industry Workers: Employees of Mercedes-Benz or Honda Manufacturing may find tailored rates and coverage with Progressive.

Cons

- Reduced Savings for Defensive Drivers: Defensive driving course graduates may find Progressive’s discounts less generous compared to competitors in Birmingham.

- Inflexible Policies for Seasonal Drivers: UAB students or seasonal drivers in Birmingham may struggle to find flexible coverage options with Progressive.

#3 – State Farm: Best for Cheap Rates

Pros

- Affordable Coverage for Birmingham Educators: $130 monthly rate provides budget-friendly protection for Birmingham teachers, ensuring peace of mind in school zones.

- Tailored Policies for Medical Community: Specialized coverage for UAB and Children’s of Alabama staff, addressing unique needs like irregular shifts.

- Stadium Sports Fan Coverage: Flexible policies for Birmingham Legion FC season ticket holders, including travel expense reimbursement. For details, check the State Farm auto insurance review.

Cons

- Birmingham’s Rideshare Drivers: State Farm’s rideshare coverage may be less comprehensive for Birmingham Uber and Lyft drivers compared to specialized providers.

- Pricing for Minimal Coverage: Residents seeking only state-required minimum coverage might find better rates elsewhere.

#4 – USAA: Best for Military Service

Pros

- Unbeatable Rates for Birmingham’s Military Community: USAA’s $110 monthly premium benefits service members at Birmingham Air National Guard Base and veterans at UAB.

- Civil Air Patrol Volunteer Discounts: Exclusive discounts for members of Birmingham’s 117th Air Refueling Wing Civil Air Patrol.

- Birmingham-Based Military Family Support: USAA auto insurance review highlights how their policies cater to military families, ensuring coverage continuity during deployments or relocations.

Cons

- Less Familiarity With Non-Military Sectors: Fewer specialized coverages for Birmingham’s diverse workforce, such as employees at Regions Bank or Alabama Power.

- Limited Partnerships With Auto Services: Limited preferred repair shops in neighborhoods like Avondale or Crestwood, complicating the claims process.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Accident Prevention

Pros

- Protection for Event Organizers: Event planners coordinating gatherings at Railroad Park benefit from Liberty Mutual’s comprehensive liability coverage.

- Specialized Insurance: The company provides coverage for food trucks. For further information, please refer to the Liberty Mutual auto insurance review.

- Sustainability Discounts: Commuters using Birmingham’s expanding bike lanes or the upcoming Bus Rapid Transit system can access eco-friendly discounts.

Cons

- Less Competitive Rates : Retirees in communities like Sun Valley or Mount Olive might find Liberty Mutual’s rates less favorable.

- Inadequate Coverage for Classic Cars: Liberty Mutual’s classic car policies are less comprehensive than specialized local providers.

#6 – Nationwide: Best for Usage Tracking

Pros

- Policies for Education Sector: As outlined in Nationwide auto insurance review, teachers and staff in Birmingham City Schools benefit from Nationwide’s specialized.

- Coverage for Vulcan Park Staff: Employees at Birmingham’s iconic Vulcan Park can access policies that account for the varying risks of working at a major tourist attraction.

- Discounts for Commuters: Residents of bedroom communities like Vestavia Hills or Trussville can leverage Nationwide’s usage-based program.

Cons

- Rigid Policies for Tourism Workers: Employees at seasonal attractions like Birmingham Zoo may struggle to find appropriately flexible coverage options with Nationwide.

- Insufficient Options: Nationwide’s coverage for part-time delivery drivers in Birmingham may be less comprehensive than specialized policies.

#7 – Allstate: Best for Continuous Coverage

Pros

- Coverage for Breweries: Allstate’s includes specialized options for those who work in Birmingham’s breweries. Allstate auto insurance review also looks at other coverage options.

- Policies for District Workers: Employees at the Birmingham Civil Rights Institute can access coverage that accounts for the unique aspects of working in this historic area.

- Birmingham Rideshare Driver Support: Allstate provides comprehensive options for Uber and Lyft drivers serving popular areas in Birmingham.

Cons

- Inflexible Policies for Students: Students in Birmingham might struggle to find appropriately flexible coverage options.

- Green Transportation Users: Commuters utilizing Birmingham’s expanding bike share program or electric scooters may not find as many discount opportunities with Allstate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Policy Bundling

Pros

- Policies for Railway Workers: Explore Travelers auto insurance review for a variety of additional auto insurance options for railway workers in Birmingham.

- Flexible Options for Field Event Staff: Part-time workers at Birmingham Barons games and other Regions Field events can access tailored coverage.

- Customized Protection : Staff at this beloved Birmingham attraction can enjoy policies that account for the specific risks of working in a large public garden.

Cons

- Rigid Policies for Economy Workers: Freelancers and contract workers in Birmingham’s growing gig economy, might struggle to find appropriately flexible coverage options.

- Insufficient Options: Adventure seekers participating in Birmingham may not find specialized coverage for outdoor and extreme sports with Travelers.

#9 – Farmers: Best for Eco-Friendly Vehicles

Pros

- Exceptional 24/7 Customer Service: The company has exceptional 24/7 customer service, see Farmers auto insurance review for more information.

- Protection for College Faculty: Professors and staff at Birmingham enjoy policies that accommodate the changing risks associated.

- Insurance for Market Vendors: Regular vendors at Birmingham benefit from Farmers’ understanding of the specific needs of local producers.

Cons

- Less Rates for Eco-Friendly Drivers: Owners of electric vehicles charging at stations in Birmingham may not find as many green vehicle discounts with Farmers.

- Inadequate Coverage for Food Delivery Services: Farmers’ policies for part-time delivery drivers may be less comprehensive than specialized options.

#10 – American Family: Best for Military Membership

Pros

- Wide Range of Discounts: Visit our page, American Family auto insurance review, to see all the discounts you can snag to cut down your rates.

- Protection for Civil Rights Institute Docents: Volunteer guides at Birmingham benefit from American Family’s understanding of the specific risks associated with public-facing roles.

- Home-Based Daycare Provider Support: American Family offers comprehensive policies for providers balancing personal and business auto use.

Cons

- Less Competitive Rates for Classic Car Collectors: Enthusiasts might find American Family’s classic car policies less comprehensive than specialized local providers.

- Inadequate Coverage for Esports Community: Professional gamers and event organizers might find American Family’s policies less attuned to their specific requirements.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Guide to Birmingham, Alabama Auto Insurance

For the best auto insurance rates in Birmingham, Alabama, Geico and USAA offer the most competitive prices for both basic and full coverage. The table below details monthly rates by provider and coverage level.

Birmingham, Alabama Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $70 | $140 | |

| $56 | $125 | |

| $75 | $145 | |

| $50 | $120 | |

| $65 | $135 |

| $63 | $132 |

| $55 | $125 | |

| $60 | $130 | |

| $68 | $138 | |

| $45 | $110 |

To drive legally in Birmingham, you must carry Alabama minimum auto insurance requirements. This includes $25,000 per person and $50,000 per incident for bodily injury liability, and $25,000 per incident for property damage.

Driving without car insurance is illegal in most states, including Birmingham. Car insurance also protects you financially in case of an accident, so it's crucial to have a policy in place.Scott W. Johnson LICENSED INSURANCE AGENT

Ensuring you have the proper coverage not only keeps you compliant with the law but also provides essential financial protection in case of an accident.

Birmingham, Alabama Auto Insurance Cost Factors

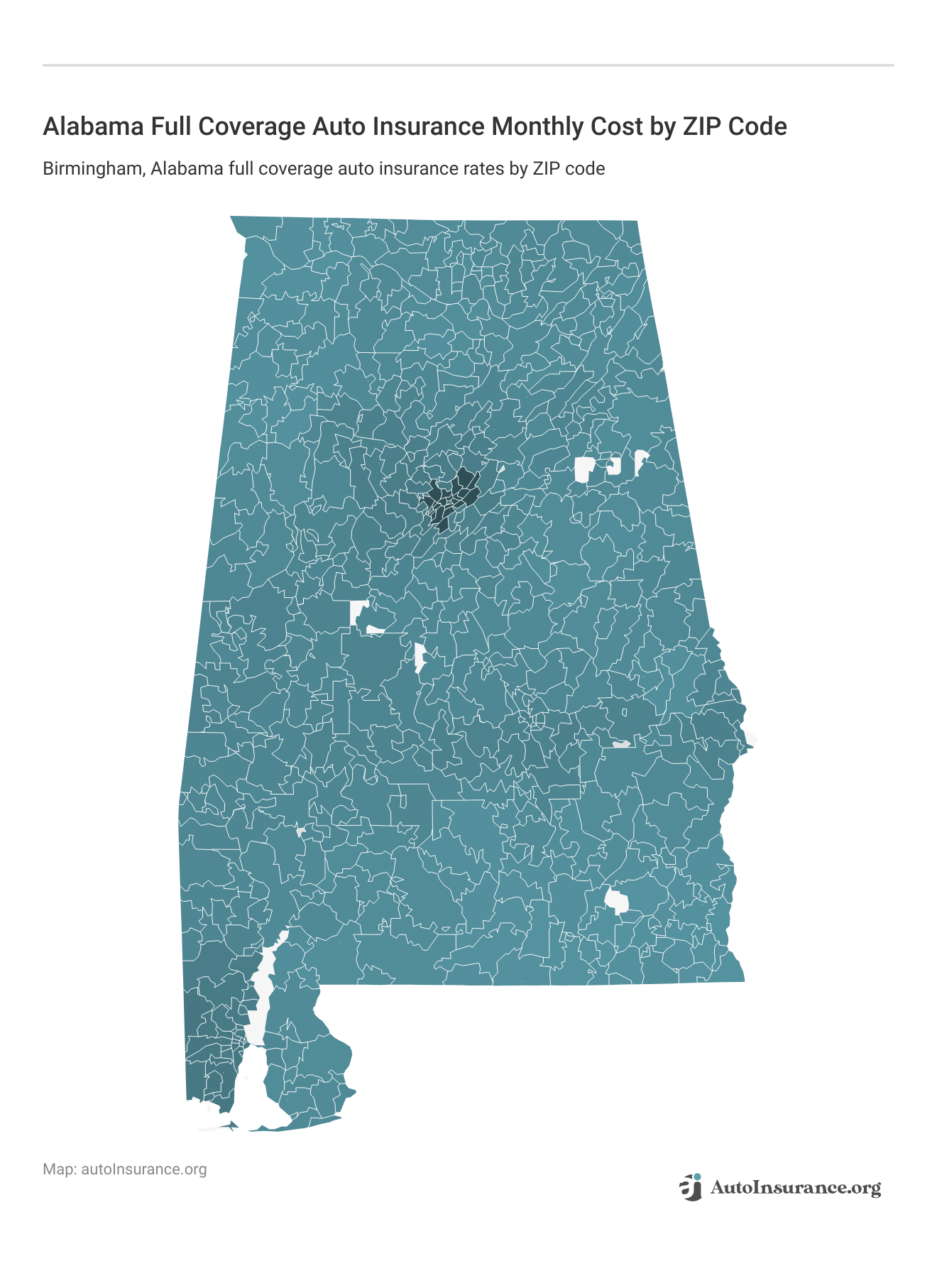

When exploring the landscape of full coverage auto insurance in the state of Alabama, it’s essential to consider the varying monthly costs associated with different ZIP codes.

This comprehensive analysis focuses specifically on Birmingham, Alabama, providing an in-depth examination of the full coverage auto insurance rates within the city, categorized by ZIP code.

Whether you are a long-time resident or new to the area, knowing how your ZIP code influences your insurance rates can be a valuable asset in your search for the best coverage. An auto insurance broker can help you understand these factors better and find the most suitable policy.

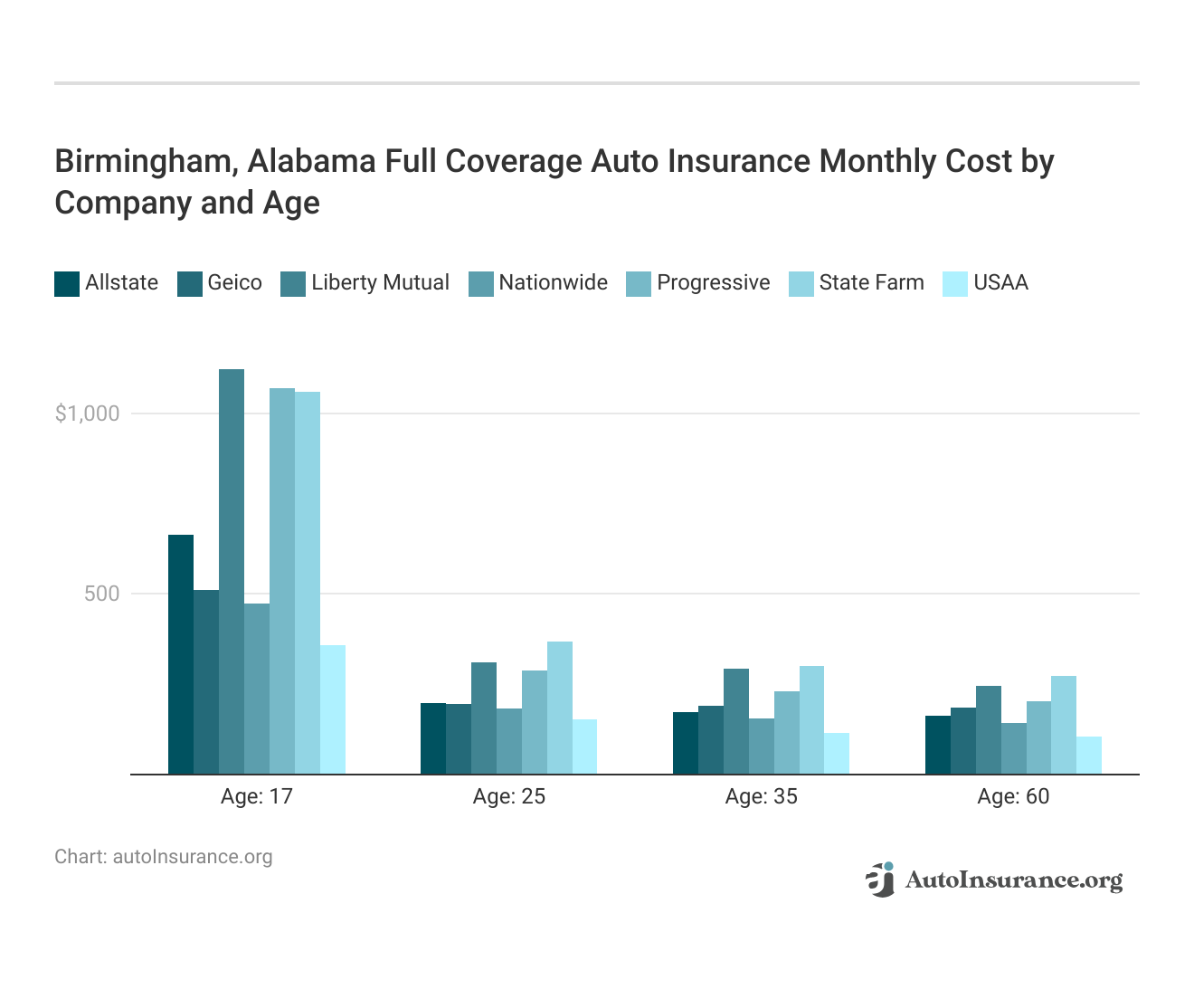

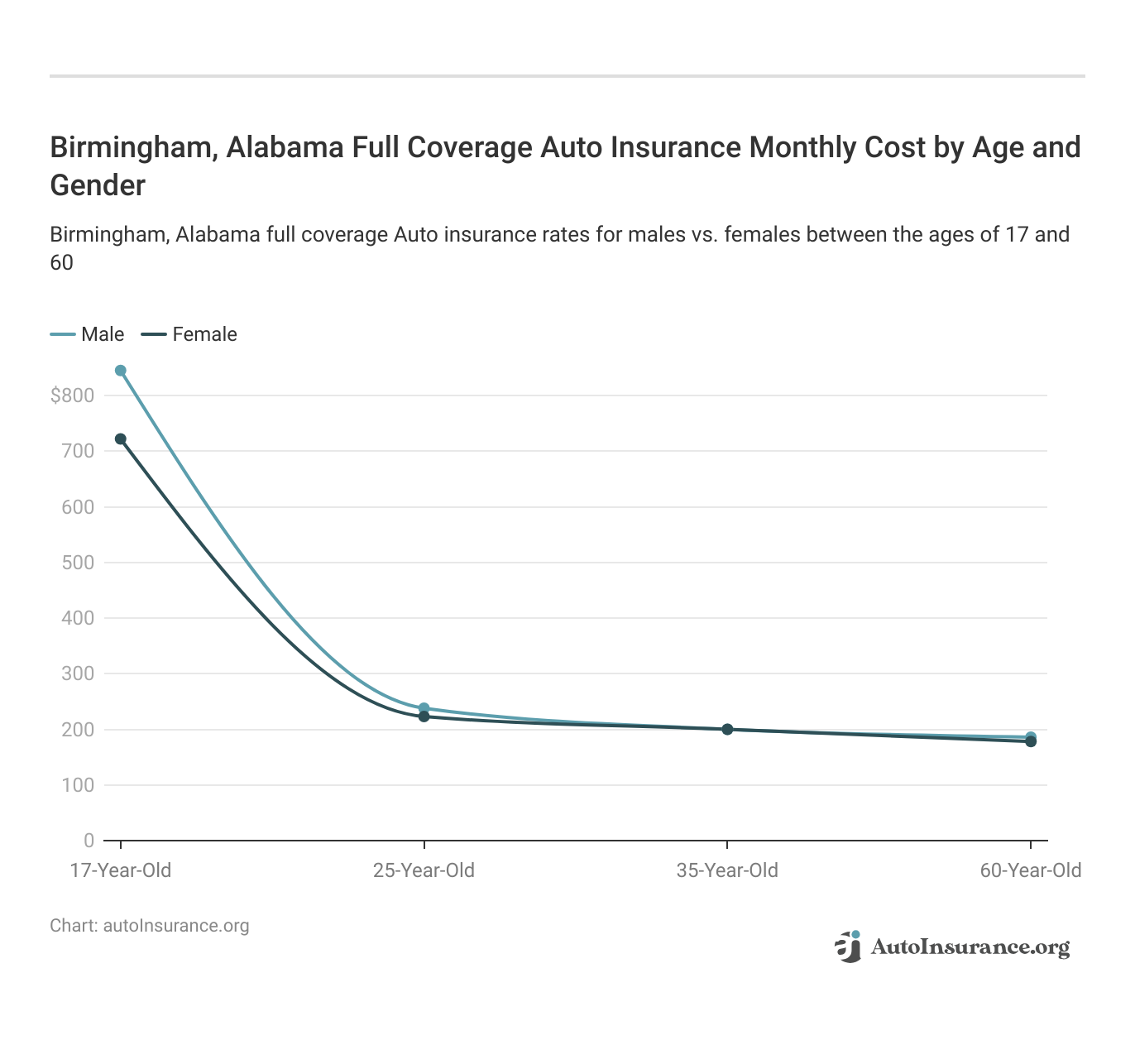

The graph presented below provides the monthly rates for full coverage auto insurance in Birmingham, focusing on how different insurance providers set their prices based on the policyholder’s age.

Several factors impact these costs, including the choice of insurance provider and the age of the insured. Different companies may present varying rates based on their assessments of risk and available coverage options.

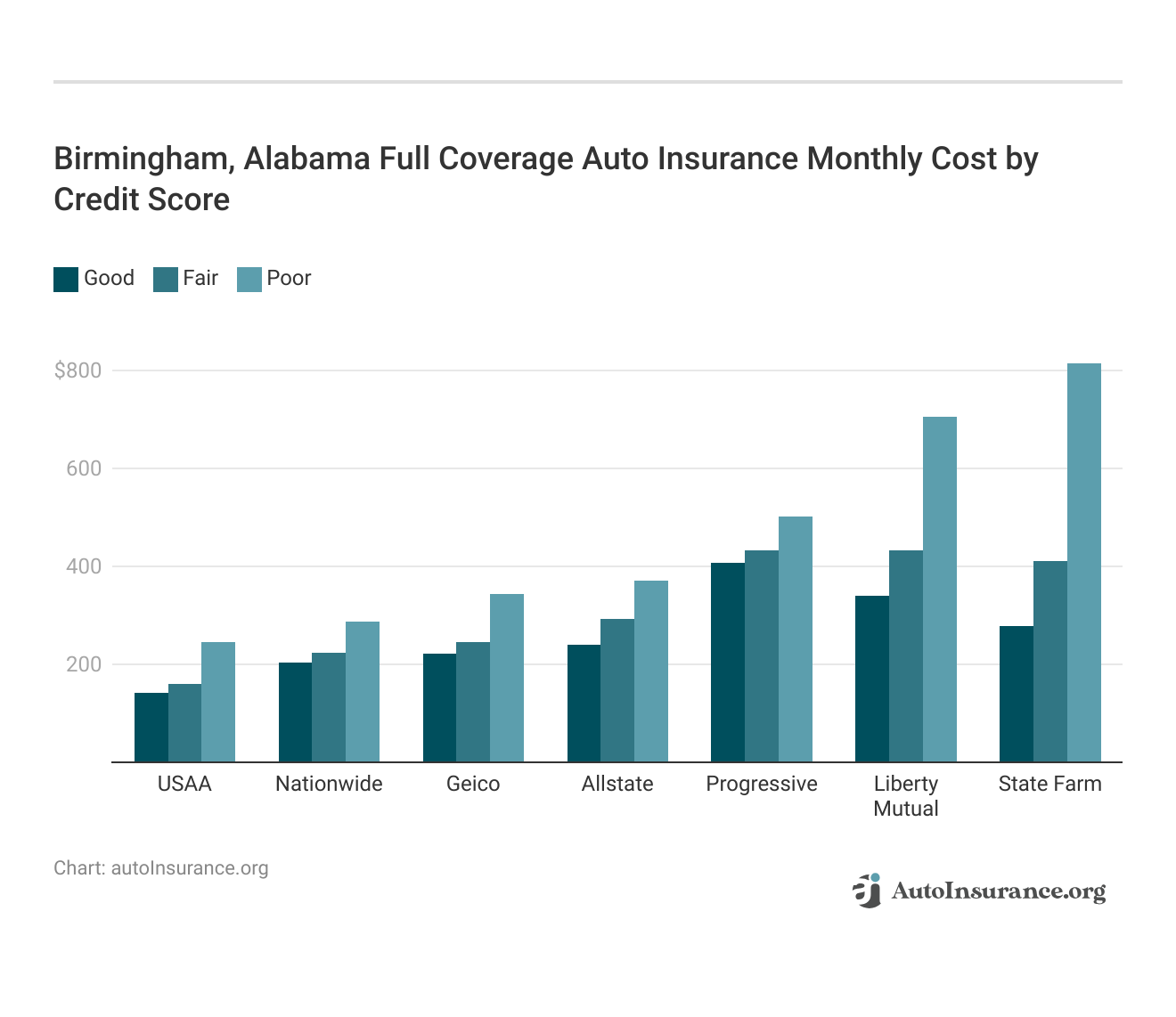

Drivers should be aware that their credit score can play a crucial role in shaping their overall insurance expenses.

A driver with an excellent credit score may pay substantially less each month compared to someone with a poor credit rating. Refer to the table provided below for a comprehensive comparison of interest rates, categorized from those with excellent credit histories to those with less favorable credit standings.

By being proactive in maintaining a good credit score, individuals can potentially reduce their insurance expenses and secure more favorable coverage options.

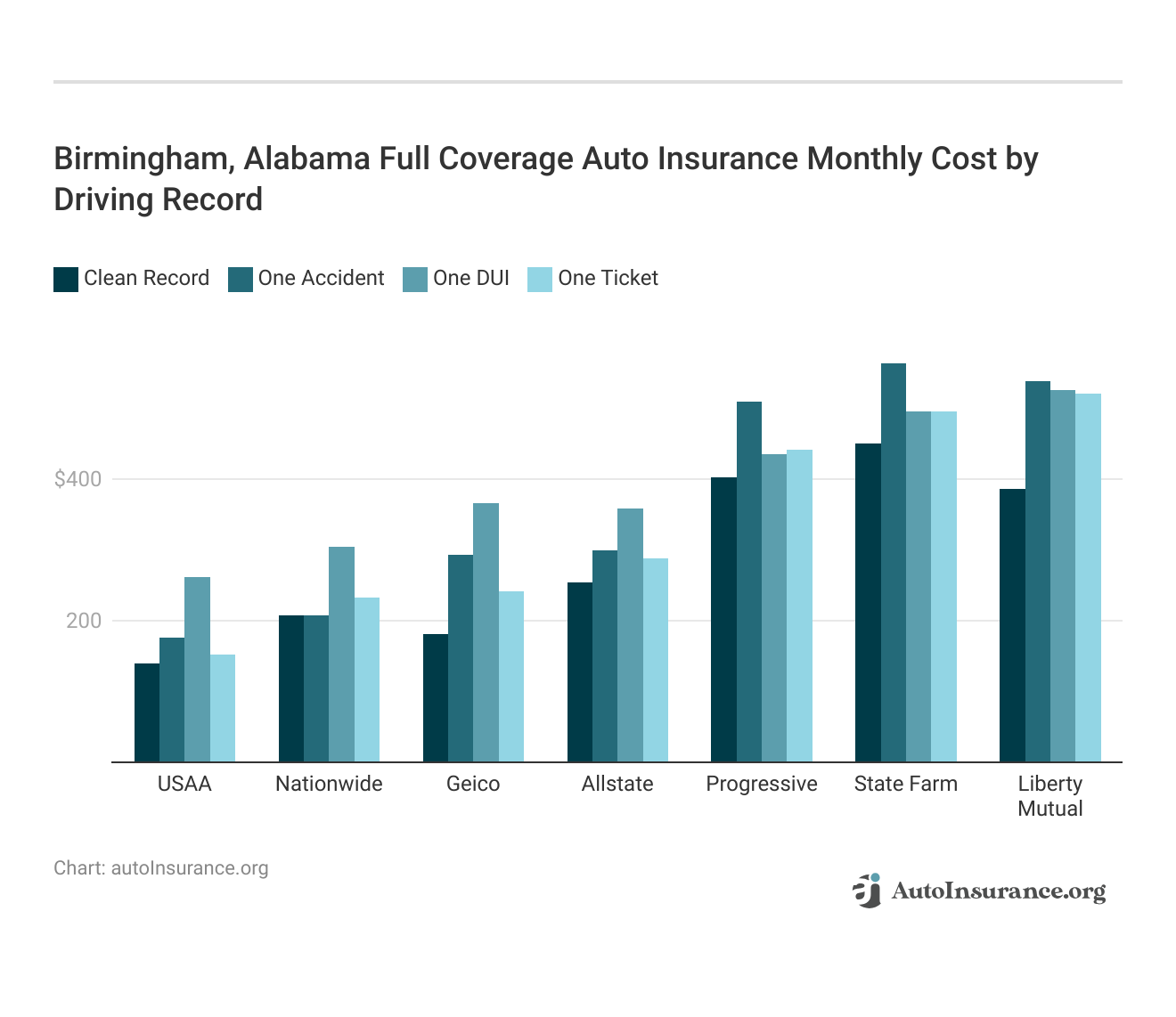

The monthly costs for full coverage auto insurance in Birmingham, Alabama, fluctuate widely based on the driver’s history, with clean records enjoying the lowest premiums and those with violations facing significantly higher rates.

For those drivers with violations seeking a cheap coverage, it is essential to consider the best auto insurance companies that don’t penalize for speeding tickets.

Birmingham, Alabama Statistics

Birmingham, Alabama sees 1,100 auto accidents annually, resulting in 850 claims averaging $5,900 each. With 20% uninsured drivers, 350 vehicle thefts, and high weather-related incidents, drivers face notable risks.

Birmingham, Alabama Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 1,100 |

| Claims per Year | 850 |

| Average Claim Cost | $5,900 |

| Percentage of Uninsured Drivers | 20% |

| Vehicle Theft Rate | 350 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | High |

Birmingham’s auto accident and insurance stats underscore the need for comprehensive coverage. High weather-related incidents and significant theft rates highlight the importance of staying insured and vigilant.

Read More: Does auto insurance cover vehicle theft?

Birmingham, Alabama Report Card on Auto Insurance Premiums evaluates key factors affecting insurance costs. These include vehicle theft rates, traffic density, weather-related risks, average claim sizes, and the rate of uninsured drivers, providing a comprehensive overview of the city’s insurance landscape.

Birmingham, Alabama Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | B | Medium traffic density, with occasional congestion in peak hours. |

| Average Claim Size | B | Claims are generally average compared to other cities in Alabama. |

| Vehicle Theft Rate | C | Moderate vehicle theft rate, slightly above the national average. |

| Weather-Related Risks | C | Moderate risk due to tornadoes and severe thunderstorms in certain seasons. |

| Uninsured Drivers Rate | C | Higher-than-average rate of uninsured drivers, common in urban Alabama areas. |

Understanding Birmingham’s auto insurance premiums involves assessing various factors. With moderate vehicle theft rates, medium traffic density, and significant weather-related risks, drivers must navigate a challenging environment. The higher-than-average rate of uninsured drivers further emphasizes the need for robust insurance coverage in the city.

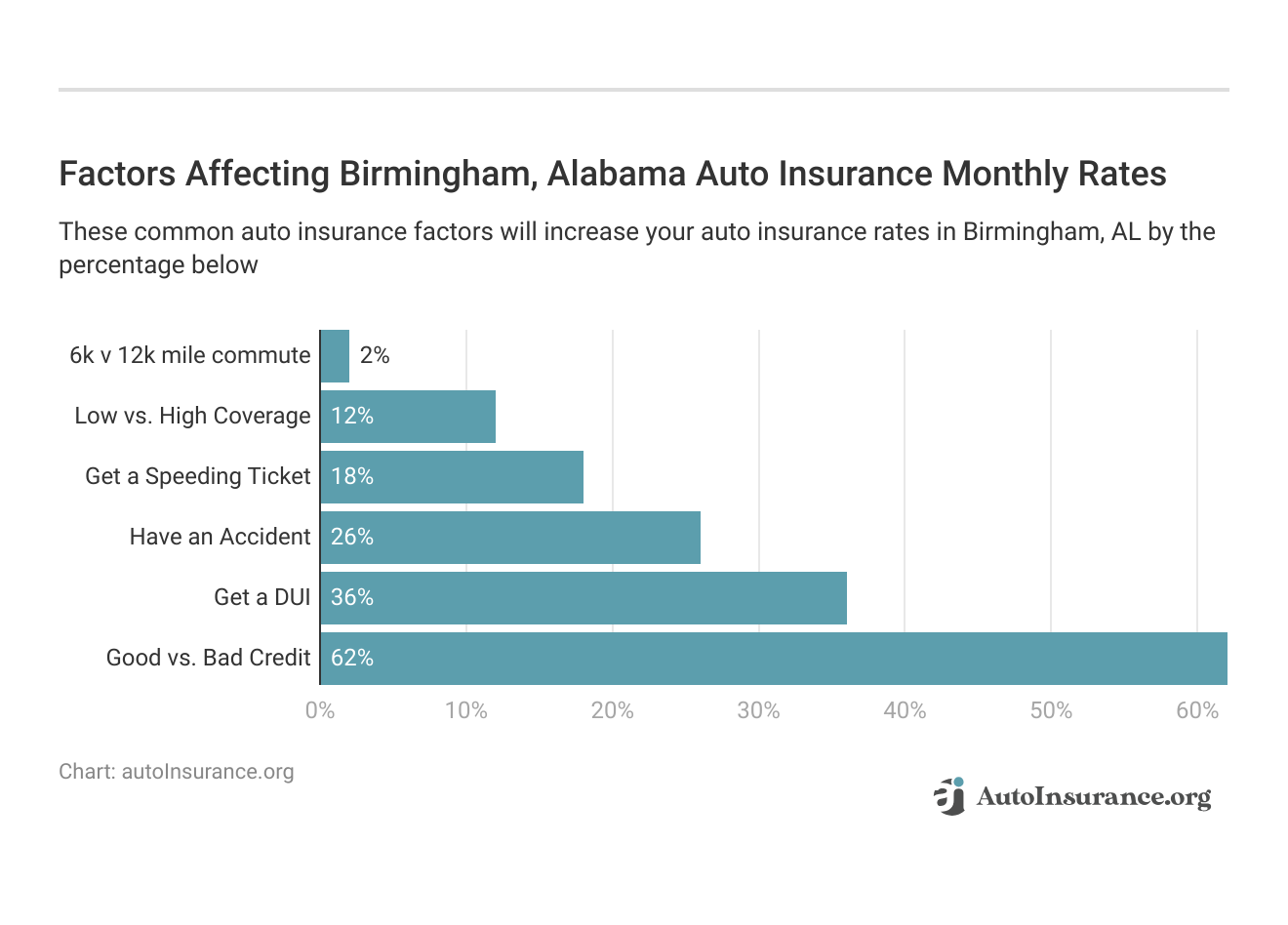

Understanding how different things affect your car insurance rates in Birmingham, Alabama, helps you make smarter decisions about your coverage. With this info, you can tweak your policy and maybe even lower your monthly payments.

This detailed examination below focuses on comparing the insurance premiums for male and female drivers within the age range of 17 to 60 years old.

By exploring the differences in costs associated with these demographic factors, we aim to provide a clearer understanding of how age and gender influence auto insurance pricing in this particular region.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Discounts and Commute in Birmingham, AL

Geico, Progressive, and State Farm are the best Birmingham, Alabama auto insurance providers, with low starting rates of $45 for most drivers and top-rated customer service.

As the second largest city in Alabama, Birmingham sees heavy traffic congestion, increasing the chances of accidents and road hazards. This congestion is a key factor driving up auto insurance rates in the area.Daniel S. Young Insurance Content Managing Editor

City records show that Birmingham drivers spend an average of 22 minutes on their commute. This time spent on the road can also affect your auto insurance rates.

Compare your commute with the most expensive commute in the United States to see how yours stacks up. Car theft also affects insurance costs. The FBI reports that every year, there are 816 cars stolen.

Auto Insurance Discounts From the Top Providers in Birmingham, Alabama

| Insurance Company | Available Discounts |

|---|---|

| Safe driver discount, multi-policy discount, new car discount, anti-theft device discount | |

| Multi-vehicle discount, loyalty discount, defensive driving discount, low mileage discount | |

| Good student discount, homeowner discount, bundling discount, mature driver discount | |

| Military discount, good driver discount, multi-policy discount, federal employee discount | |

| Multi-car discount, accident-free discount, paperless discount, newly married discount |

| SmartRide discount, multi-policy discount, accident-free discount, paperless billing discount |

| Snapshot usage-based discount, multi-policy discount, homeowner discount, continuous insurance discount | |

| Safe driving discount, good student discount, accident-free discount, multi-line discount | |

| Safe driver discount, multi-policy discount, new car discount, hybrid/electric vehicle discount | |

| Military discount, safe driver discount, family/legacy discount, loyalty discount |

Ready to unlock affordable Birmingham, AL insurance rates? Enter your ZIP code into our free quote tool below to find the best auto insurance companies for your needs and budget.

Frequently Asked Questions

How do Birmingham’s traffic congestion levels impact my auto insurance rates?

Birmingham’s traffic congestion, ranking 36th in the U.S. for congestion, can lead to higher auto insurance rates due to increased accident risks. Insurance companies in Birmingham may adjust premiums based on the likelihood of accidents in high-traffic areas.

Are there specific insurance providers in Birmingham offering discounts for local drivers?

Yes, some car insurance companies in Birmingham, like Geico and State Farm, offer local discounts for drivers who live in low-risk areas or have shorter commutes. Regional discounts may be based on local traffic data and accident statistics, which affect car insurance in Birmingham.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

How do Birmingham’s high vehicle theft rates influence auto insurance premiums?

Birmingham’s vehicle theft rates, with 816 cars stolen annually, can increase auto insurance quotes in Birmingham. Providers may charge higher rates for coverage in areas with higher theft risks, which can drive up car insurance quotes in Birmingham.

Read More: Does auto insurance cover vehicle theft?

What role does my Birmingham ZIP code play in determining my auto insurance rates?

Your Birmingham ZIP code affects auto insurance rates based on local crime rates, accident frequency, and overall traffic patterns. Car insurance companies in Birmingham use ZIP code data to assess risk and set premiums accordingly.

How can I benefit from Birmingham-specific auto insurance policies?

Birmingham-specific policies may include coverage tailored to local risks, such as enhanced protection against theft or vandalism. Look for insurers that offer local endorsements or adjustments based on auto insurance in Birmingham and its unique conditions.

What are the most common auto insurance claims in Birmingham, and how do they affect rates?

Common claims in Birmingham include accidents caused by traffic congestion and theft. These claims can drive up Birmingham, AL car insurance costs, so insurers may factor in these local risks when calculating premiums.

Read More: How to Dispute an Auto Insurance Claim

How does Birmingham’s weather impact auto insurance rates?

Birmingham’s weather, with its occasional severe storms and flooding, can affect auto insurance in Birmingham, AL. Insurers may adjust premiums to cover potential damage from weather-related incidents, especially in flood-prone areas.

Are there any Birmingham-based auto insurance providers known for exceptional customer service?

Local providers such as Alfa Insurance are recognized for their personalized customer service in Birmingham. Research local insurers to find cheap car insurance in Birmingham, AL with a strong service reputation.

How do Birmingham’s local ordinances and regulations impact auto insurance requirements?

Local ordinances, such as those related to parking regulations and road safety measures, can influence car insurance Birmingham AL requirements. Ensure your policy meets all local regulations and consider providers who are familiar with Birmingham, AL car insurance rules. Learn more in our article titled “Is it illegal to live in your car?”

What should I consider when comparing auto insurance quotes in different Birmingham neighborhoods?

When comparing car insurance quotes in Birmingham, AL, consider neighborhood-specific factors like crime rates, local accident statistics, and historical claims data. Some areas may have higher premiums due to these factors, so comparing car insurance quotes in Birmingham by neighborhood can help you find the best rate.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.