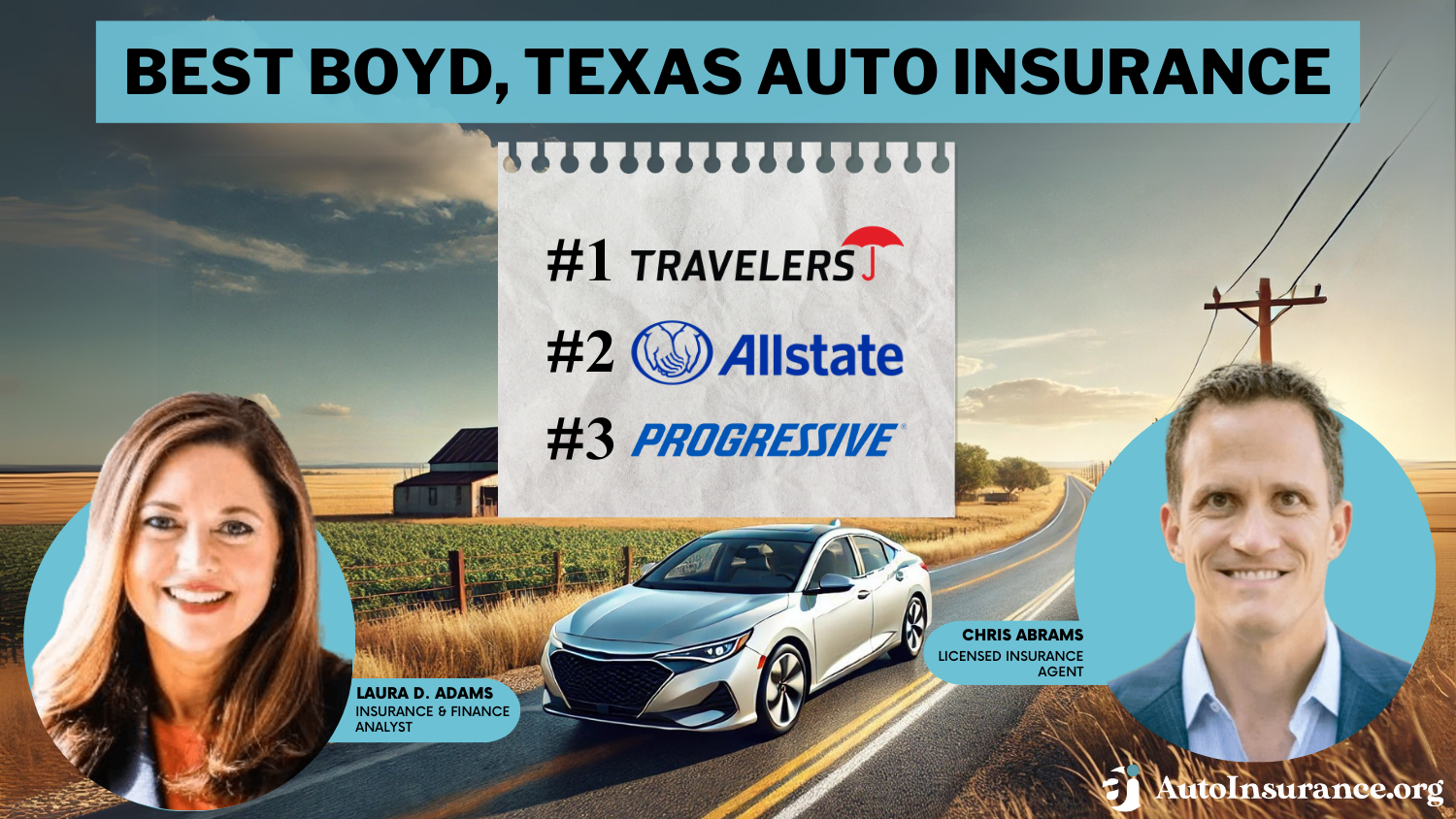

Best Boyd, Texas Auto Insurance in 2026 (Check Out the Top 10 Companies)

The best Boyd, Texas auto insurance are Travelers, Allstate, and Progressive. meanwhile, USAA provides the lowest rate at $35 per month. Travelers excels in bundling policies, Allstate offers a rewarding Drivewise program, and Progressive features the SmartRide program for additional discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Boyd TX

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Boyd TX

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Boyd TX

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Boyd, Texas auto insurance options are Travelers, Allstate, and Progressive, with rates starting at just $35 per month. Travelers excels in insurance bundling policies, allowing for greater savings, while Allstate offers its Drivewise program to reward safe driving habits.

Progressive stands out with its SmartRide program, providing additional discounts for safe drivers. Each company caters to different needs, ensuring competitive rates and valuable coverage for drivers in Boyd.

Our Top 10 Company Picks: Best Boyd, Texas Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 23% | A++ | Bundling Policies | Travelers | |

| #2 | 25% | A+ | Drivewise Program | Allstate | |

| #3 | 18% | A+ | SmartRide Discounts | Progressive | |

| #4 | 22% | A+ | Affordable Rates | Nationwide |

| #5 | 16% | A++ | Claims Service | Geico | |

| #6 | 17% | B | Add-on Coverages | State Farm | |

| #7 | 20% | A | Local Support | Farmers | |

| #8 | 22% | A | Snapshot Program | Liberty Mutual |

| #9 | 21% | A++ | Personalized Service | USAA | |

| #10 | 24% | A | Drivewise Savings | American Family |

These providers offer excellent coverage options for the best Boyd, Texas auto insurance tailored for the needs of Boyd drivers. Comparing their strength and weaknesses will help when choosing the right provider. Enter your zip code above to start saving on car insurance in Boyd.

- Travelers is the best Boyd Texas auto insurance offering rates staring at $58/month

- Boyd drivers enjoy customizable coverage options to meet their needs

- Discounts for safe driving help reduce auto insurance costs in Boyd

#1 – Travelers: Top Overall Pick

Pros

- Great for Bundling: Travelers is a good choice for auto insurance in Boyd, Texas, especially for bundling policies. They offer big savings when you insure multiple vehicles, as noted in our Travelers review.

- Affordable Rates: Starting at just $58 a month, Travelers offers competitive prices for drivers in Boyd.

- Good Customer Service: Travelers have friendly and reliable service making it a trusted provider in Boyd.

Cons

- Fewer Local Agents: Travelers has a limited number of local agents in Boyd, which might make it harder to find in-person assistance.

- Limited Customization Options: When it comes to personalizing coverage, Travelers may not offer as many options compared to some other insurance providers in the area.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Drivewise Program

Pros

- Strong Customer Service: Allstate offers excellent customer service, with local agents providing personalized support in Boyd.

- Drivewise Program: Allstate features its Drivewise program, rewarding safe driving through discounts that align with the best Boyd, Texas auto insurance, as noted in our Allstate review.

- Comprehensive Coverage: Allstate provides a wide range of coverage options to suit various auto insurance needs in Boyd.

Cons

- Higher Rates Without Discounts: Allstate’s rates can be higher than some competitors in Boyd without utilizing discounts like Drivewise.

- Discounts Tied to Driving Habits: Many savings opportunities depend on driving behavior, limiting flexibility for some Boyd drivers.

#3 – Progressive: Best for SmartRide Discounts

Pros

- Adaptable Coverage Options: Progressive offers a variety of adaptable coverage choices designed for clients in Boyd, Texas.

- Digital Convenience: Boyd residents can easily access and manage their auto insurance through Progressive’s online tools and digital platform.

- SmartRide Discount Program: With Progressive’s SmartRide program, drivers in Boyd can access usage-based discounts, as discussed in our Progressive review.

Cons

- Higher Rates for Some: Progressive’s rates might be higher for drivers in Boyd who don’t participate in savings programs like SmartRide.

- Customer Service Fluctuations: Some policyholders in Boyd report mixed experiences when it comes to Progressive’s customer service.

#4 – Nationwide: Best for Affordable Rates

Pros

- Affordable Rates: Nationwide highlights affordable rates that manifest competitive pricing for the best Boyd, Texas auto insurance without sacrificing coverage, as explained in our Nationwide review.

- Accident Forgiveness: Offers solid accident forgiveness options, preventing Boyd drivers’ premiums from increasing after a first accident.

- Reliable Coverage Options: Nationwide provides comprehensive and flexible auto insurance policies for Boyd residents.

Cons

- Higher Premiums: Boyd drivers might find Nationwide’s rates higher compared to more budget-friendly options.

- Fewer Local Agents: Limited local presence may make it difficult for Boyd residents seeking in-person service.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Geico: Best for Claims Service

Pros

- Low Rates: Geico is known for providing some of the cheapest auto insurance in Boyd, Texas.

- Excellent Claims Service: Geico presents great claims service, showing efficiency for customers seeking the best Boyd, Texas auto insurance while navigating claims, as shown in our Geico review.

- Military Discounts: Like USAA, Geico also provides special discounts for military families, making it more affordable for the said demographic.

Cons

- Limited Face-to-Face Service: Geico relies primarily on online tools, with minimal in-person support in Boyd.

- Basic Coverage Options: Boyd drivers looking for more customization may find Geico’s coverage options limited.

#6 – State Farm: Best for Add-on Coverages

Pros

- Strong Local Agent Presence: Boyd drivers benefit from State Farm’s wide network of local agents for personalized service.

- Good for Claims Processing: State Farm boasts efficient and fast insurance claims in Boyd.

- Add-On Coverages: State Farm showcases extensive add-on coverages that enhance basic policies within the best Boyd, Texas auto insurance market, as highlighted in our State Farm review.

Cons

- Higher Premiums Without Discounts: Rates can be on the higher side for Boyd drivers not bundling or taking advantage of discounts.

- Limited Digital Features: State Farm’s digital tools are less advanced compared to some competitors in Boyd.

#7 – Farmers: Best for Local Support

Pros

- Great Local Support: As one of the best Boyd, Texas auto insurance, Farmers shows great local support for their clients in the area, as outlined in our Farmers review.

- Customizable Coverage: Drivers in Boyd can have flexible coverage depending on their personal preferences.

- Safe Driver Discounts: Farmers provides good discounts for safe drivers and multi-policy holders in Boyd, Texas.

Cons

- Higher Rates: Farmers tends to have higher premiums compared to other Boyd providers.

- Fewer Digital Tools: Lacks the robust online tools available from other insurers in Boyd.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Snapshot Program

Pros

- Comprehensive Coverage Options: Boyd drivers can benefit from Liberty Mutual’s extensive coverage options tailored to different needs.

- Snapshot Program: Liberty Mutual flaunts its Snapshot program, providing discounts based on driving behavior for the best Boyd, Texas auto insurance, as revealed in our Liberty Mutual review.

- Good Driver Discounts: Liberty Mutual rewards Boyd drivers with discounts for safe driving habits.

Cons

- Higher Premiums: Liberty Mutual tends to have higher rates compared to some competitors in Boyd.

- Variable Customer Service: Boyd residents report mixed experiences with Liberty Mutual’s customer support.

#9 – USAA: Best for Personalized Service

Pros

- Exclusive Low Rates: USAA offers some of the best rates for military members and their families in Boyd.

- Tailored Military Discounts: USAA provides exclusive discounts for active-duty and retired military in Boyd, Texas.

- Personalized Service: USAA presents exceptional personalized service, addressing the specific needs of military families within the best Boyd, Texas auto insurance, as featured in our USAA review.

Cons

- Membership Restrictions: Only available to military personnel and their families, limiting access to Boyd residents.

- Limited In-Person Support: Boyd drivers may face fewer opportunities for face-to-face support due to fewer local agents.

#10 – American Family: Best for Drivewise Savings

Pros

- Local Agent Support: Boyd drivers can benefit from American Family’s strong local agent presence for personal service.

- Drivewise Program: American Family’s Drivewise program rewards safe driving, benefiting policyholders seeking the best Boyd, Texas auto insurance, as mentioned in our American Family review.

- Digital Convenience: Offers reliable online tools for managing policies and filing claims in Boyd, Texas.

Cons

- Limited Availability: Not all coverage options may be available for drivers in Boyd.

- Higher Premiums Without Discounts: Boyd drivers who don’t qualify for discounts may find rates on the higher side.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Boyd, Texas

In Boyd, Texas minimum auto insurance requirements include liability coverage to protect against damages to others in an accident. Drivers must carry at least $30,000 for bodily injury per person, $60,000 for total bodily injury per accident, and $25,000 for property damage.

Travelers stands out as the top choice for the best Boyd, Texas auto insurance, offering competitive rates and excellent bundling options.Tracey L. Wells Licensed Insurance Agent & Agency Owner

These minimums ensure financial protection and compliance with state laws. Failing to meet these requirements can result in penalties and increased liability for the driver.

Best Boyd, Texas Auto Insurance Rates by Provider Coverage Level

When choosing the right policy, understanding the best Boyd, Texas auto insurance rates by coverage level is essential. Drivers can select from various coverage options, including liability, collision, and comprehensive insurance, each affecting premium costs.

Boyd, Texas Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $130 | |

| $48 | $115 | |

| $60 | $125 | |

| $40 | $105 | |

| $62 | $135 |

| $52 | $118 |

| $50 | $120 | |

| $45 | $110 | |

| $58 | $122 | |

| $35 | $95 |

Additionally, knowing what are the recommended auto insurance coverage levels? is essential as higher coverage levels typically provides better protection but come with increased premiums.

Boyd, Texas Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B+ | Lower-than-average claim costs |

| Traffic Density | B | Low to moderate congestion |

| Weather-Related Risks | B | Occasional severe weather |

| Uninsured Drivers Rate | C | Moderate, about 20% uninsured |

| Vehicle Theft Rate | C | Moderate rate, lower than urban areas |

Evaluating your coverage needs against your budget can help you secure the most suitable and affordable auto insurance.

Best Boyd, Texas Auto Insurance by Driving Record

Driving record is crucial in determining auto insurance rates in Boyd, Texas. How auto insurance companies check driving records is essential, as safe drivers with clean driving records typically qualify for the lowest premiums.

However, drivers with accidents or violations may face higher costs, but some insurers offer specialized coverage options. Comparing quotes according to your driving record can help you find the best car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Boyd, Texas Auto Insurance Rates by ZIP Code

Auto insurance rates by ZIP code in Boyd, Texas, depend on factors like crime rates, traffic, and local accidents. Safer neighborhoods have lower premiums, while high-risk areas may face increased costs.

Comparing auto insurance rates by ZIP code in Boyd, Texas, is essential, as premiums vary with local crime, traffic, and accident rates.

Insurers assess these factors when setting rates for specific locations. Comparing auto insurance rates by ZIP code helps find the best options for your area.

Best Boyd, Texas Auto Insurance Discounts by Provider

The best Boyd, Texas auto insurance providers offer various discounts to help lower premiums. Common discounts include safe driver, multi-policy, and good student savings.

Auto Insurance Discounts From the Top Providers in Boyd, Texas

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Anti-Theft | |

| Loyalty, Multi-Vehicle | |

| Home & Auto Bundle, Safe Driver | |

| Multi-Policy, Good Student | |

| Early Shopper, Military |

| SmartRide, Multi-Policy |

| Snapshot, Multi-Policy | |

| Safe Driver, Multi-Policy | |

| Multi-Policy, Hybrid/Electric Vehicle | |

| Military, Safe Driver |

Each company features unique discount options, so it’s important to compare offers. Finding the best discounts can significantly reduce your overall insurance costs.

Read more: How to Lower Your Auto Insurance Rates

The Best Boyd, Texas Auto Insurance Companies

When searching for the best auto insurance companies in Boyd, Texas, it’s crucial to consider coverage options, customer service, and pricing. Leading insurers in the area, such as Travelers, Allstate, and Progressive, offer competitive rates and unique programs tailored to meet diverse needs.

Each company has strengths and weaknesses, from bundling discounts to safe driving rewards. Evaluating these factors will help you find the best auto insurance premium that fits your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors that affect auto insurance rates in Boyd, Texas.

Several factors that affect auto insurance rates in Boyd, Texas, include your driving record, vehicle type, and coverage amounts. Insurers also evaluate demographic information such as age, gender, and credit score when determining premiums.

Boyd, Texas Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 200 |

| Total Claims Per Year | 120 |

| Average Claim Size | $20,000 |

| Percentage of Uninsured Drivers | 13% |

| Vehicle Theft Rate | 10 thefts/year |

| Traffic Density | Moderate |

| Weather-Related Incidents | Moderate |

Local conditions, like crime rates and the frequency of accidents in your ZIP code, can significantly influence pricing as well. By understanding these factors, you can make informed decisions to obtain the best Boyd, Texas auto insurance rates.

Enter your ZIP code below into our free comparison tool, to get the best car insurance in Boyd.

Frequently Asked Questions

How much is car insurance in Texas per month?

On average, car insurance in Texas costs around $125 per month, although this can vary based on factors like driving history and coverage needs.

Which company gives the best auto insurance in Texas?

Travelers is often rated as the best Boyd, Texas auto insurance provider due to its competitive rates and bundling options. You can start shopping for the best car insurance near you by Entering your ZIP code below.

What is the recommended auto insurance coverage in Texas?

The recommended auto insurance coverage in Texas typically includes liability, comprehensive, and collision insurance to ensure adequate protection.

Who is the largest insurer in Texas?

State Farm is currently the largest auto insurer in Texas, providing extensive coverage options and affordable rates.

Is Texas auto insurance high?

Yes, Texas auto insurance rates tend to be higher than the national average due to factors like population density and accident rates.

What are the 3 most important insurance types?

The three most important types of insurance typically include liability insurance, collision insurance, and comprehensive insurance.

What is the average price of car insurance in Texas?

The average price of car insurance in Texas is about $1,500 annually, although rates vary depending on coverage and driving history.

Do you need a driver’s license to get car insurance in Texas?

Yes, you need a valid driver’s license to obtain auto insurance in Texas, as insurers require proof of legal driving status. Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Which insurance company has the highest customer satisfaction?

USAA is frequently noted for having the highest customer satisfaction among auto insurance providers, especially for military families.

What is the most basic form of car insurance?

The most basic form of car insurance is liability insurance, which covers damages to others in the event of an accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.