Cheap Auto Insurance for Drivers Over 60 in 2026 (10 Most Affordable Companies)

AAA, State Farm, and Travelers are our top picks for cheap auto insurance for drivers over 60, with rates starting at $31/mo. AAA has low-cost full coverage auto insurance for seniors at $31/mo, but drivers over 60 get the cheapest senior auto insurance rates from Nationwide with safe driving habits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated January 2025

3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Driver Over 60

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Driver Over 60

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Driver Over 60

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsThe lowest rates possible for cheap auto insurance for drivers over 60 are at AAA, State Farm, and Travelers. These companies have the best auto insurance for seniors, with affordable rates and plentiful coverage options.

While these are the top three companies, plenty of other companies have cheap car insurance for 60-year-old drivers.

Our Top 10 Company Picks: Cheap Auto Insurance for Drivers Over 60

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons | |

|---|---|---|---|---|---|---|

| #1 | $23 | NR | Low Rates | Root | |

| #2 | $64 | A+ | Customer Service | Amica | ||

| #3 | $66 | A++ | Broad Coverage | Kemper | ||

| #4 | $75 | A | Claims Support | Farmers | ||

| #5 | $85 | A+ | Specialty Coverage | National General | ||

| #6 | $86 | A+ | Policy Options | Allstate | ||

| #7 | $95 | A | Custom Policies | Liberty Mutual | |

| #8 | $113 | A | Business Insurance | Hanover | ||

| #9 | $119 | A+ | High-Risk Drivers | Dairyland | ||

| #10 | $121 | A | Affordable Options | The General |

To find the best auto insurance rates for seniors quickly, use our free tool to compare quotes from companies in your area.

- AAA has the cheapest car insurance for seniors over 60

- State Farm and Travelers are also affordable companies for 60-year-old drivers

- Some cheap companies offer a senior citizen auto insurance discount

#1 – AAA: Top Pick Overall

Pros

- Roadside Assistance: AAA’s roadside assistance helps with breakdowns from dead batteries, flat tires, and more. You can learn more about this coverage in our AAA review.

- AAA Perks: Policyholders also get travel and other service discounts with their AAA membership.

- Widely Available: AAA’s availability makes it easy to keep it as a provider when moving.

Cons

- Membership Fee: To buy AAA auto insurance, you must pay a small annual fee to be a member of AAA.

- Various AAA Clubs: The AAA clubs that provide auto insurance vary from state to state, so the level of service you receive in one state may be different in another state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Extensive Discounts

Pros

- Extensive Discounts: State Farm’s extensive list of discounts helps seniors save. Learn more in our State Farm auto insurance review.

- Agents Are Local: State Farm has a network of local agents nationwide, making it easier for customers to find in-person assistance with policy changes.

- Roadside Assistance: State Farm offers roadside assistance as an add-on to basic policies, which can be an affordable addition for drivers with cars prone to breaking down.

Cons

- Accident Forgiveness: State Farm doesn’t offer accident forgiveness, so drivers will see a rate increase after their first at-fault accident.

- No Instant Purchases: All purchases must be completed through a State Farm agent, so you can’t quickly buy coverage online.

#3 – Travelers: Best for Safety Features

Pros

- Safety Features: If you have a car with great safety features, you may see a lower rate at Travelers. Learn more about the company’s rates in our review of Travelers.

- Accident Forgiveness: Traveler’s accident forgiveness is a great perk for safe drivers.

- Insurance Options: Travelers offers multiple types of insurance, from home to pet insurance, that can be bundled with auto insurance.

Cons

- Not Sold in 8 States: While Travelers is sold in the vast majority of the U.S., it is not yet in all 50 states.

- Customer Satisfaction: J.D. Power rated Travelers’ customer satisfaction as just average.

#4 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico auto insurance for seniors is affordable for most drivers (read more about Geico’s rates in our Geico review).

- Affiliation Discounts: Along with various other Geico auto insurance discounts, the company offers affiliation discounts, such as military and membership discounts.

- Mobile App: Geico’s mobile app has high ratings on Apple and allows policyholders to do everything from adding cars to filing a claim.

Cons

- No Gap Insurance: New car owners won’t be able to purchase gap insurance at Geico.

- Local Agents Limited: Geico customers who prefer in-person assistance may have trouble finding a local agent in their area to assist with buying Geico car insurance for seniors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Coverage Options

Pros

- Coverage Options: Progressive has numerous coverages available for auto insurance policies, which you can read more about in our Progressive review.

- Accident Forgiveness: Progressive’s accident forgiveness makes it a great choice for safe drivers.

- Availability: Progressive auto insurance is sold in all 50 states.

Cons

- UBI Program Rate Increases: Progressive may raise your rates if you participate in its UBI program and score poorly.

- Customer Service: J.D. Power gave Progressive just average ratings for customer service.

#6 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Savings: Bundling more than one type of insurance at Nationwide will result in multi-policy savings.

- Accident Forgiveness: Nationwide’s accident forgiveness benefits safe drivers in their 60s.

- Pay-Per-Mile Insurance: Seniors who rarely drive can benefit from Nationwide’s SmartMiles program (read more: Nationwide SmartMiles review).

Cons

- Availability: Nationwide auto insurance isn’t sold in a few states.

- Customer Service: Nationwide has just average ratings for customer service. Learn more in our Nationwide review.

#7 – American Family: Best for Discount Availability

Pros

- Discount Availability: American Family has plenty of discounts available, which you can learn about in our American Family auto insurance review.

- Vanishing Deductibles: Safe drivers will see their American Family deductibles decrease over time.

- Add-On Coverage Options: American Family’s coverage options range from roadside assistance to rental reimbursement.

Cons

- Availability: Currently, American Family is only sold in 19 states.

- Rate Competitivity: American Family’s rates aren’t always as competitive for customers as at larger companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Occupational Discounts

Pros

- Occupational Discounts: Farmers offers occupational discounts, such as military discounts.

- Availability: Farmers’ auto insurance is sold in all 50 states.

- Coverages: Farmers has coverages ranging from new car insurance to windshield replacement.

Cons

- Customer Satisfaction: Farmers’ customer service reviews are just average. Learn more in our Farmers review.

- High Rates for High-Risk Drivers: Farmers is often not one of the cheaper companies for high-risk drivers.

#9 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate has a great selection of add-on coverages, which you can learn about in our Allstate review.

- Bundling Options: Allstate’s range of insurance options makes it easy to bundle two coverages together for a discount.

- Pay-Per-Mile Insurance: Allstate offers pay-per-mile insurance that makes it easier to get cheap auto insurance for infrequent drivers.

Cons

- Rates Higher for High-Risk Drivers: Allstate is likely not the most affordable company if drivers are considered high-risk.

- Claims Ratings: Allstate’s rating for customer satisfaction for claims is just average.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual is great for seniors who want to make customizable policies, as it offers a good selection of coverages.

- Discounts: Liberty Mutual offers a good selection of auto insurance discounts.

- Availability: Liberty Mutual is available in all 50 states.

Cons

- Claims Satisfaction: J.D. Power rates Liberty Mutual’s claims satisfaction as just average.

- High Rates for High-Risk Drivers: Liberty Mutual’s rates may not be economical for all drivers. You can learn more about Liberty Mutual’s rates in our Liberty Mutual review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Age Impacts Auto Insurance Rates for Drivers Over 60

Age is one of the many factors that insurance companies use to calculate risk. Drivers over the age of 60 will often have a decrease in rates, as they are considered less risky to insure by companies. Below, you can see rates for cheap auto insurance for drivers over 60 by age.

Drivers Over 60 Auto Insurance Monthly Rates by Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 60-Year-Old Female | $36 | $100 |

| 60-Year-Old Male | $35 | $100 |

| 65-Year-Old Female | $34 | $95 |

| 65-Year-Old Male | $33 | $95 |

Once drivers retire and start driving less, they will often see a slight rate decrease due to mileage discounts (learn more: best auto insurance for retirees).

Another factor that impacts average auto insurance rates by age is location.

States with higher crash numbers and severe weather will have higher average senior car insurance rates. Take a look below to see rates for cheap auto insurance for drivers over 60 by state.

Drivers Over 60 Auto Insurance Monthly Rates by State & Gender

| State | Age: 60 Female | Age: 60 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|

| Alabama | $115 | $120 | $105 | $110 |

| Alaska | $125 | $130 | $115 | $120 |

| Arizona | $120 | $125 | $110 | $115 |

| Arkansas | $105 | $110 | $95 | $100 |

| California | $135 | $140 | $125 | $130 |

| Colorado | $125 | $130 | $115 | $120 |

| Connecticut | $145 | $150 | $135 | $140 |

| Delaware | $130 | $135 | $120 | $125 |

| Florida | $155 | $160 | $145 | $150 |

| Georgia | $135 | $140 | $125 | $130 |

| Hawaii | $110 | $115 | $100 | $105 |

| Idaho | $115 | $120 | $105 | $110 |

| Illinois | $120 | $125 | $110 | $115 |

| Indiana | $105 | $110 | $95 | $100 |

| Iowa | $100 | $105 | $90 | $95 |

| Kansas | $110 | $115 | $100 | $105 |

| Kentucky | $125 | $130 | $115 | $120 |

| Louisiana | $145 | $150 | $135 | $140 |

| Maine | $105 | $110 | $95 | $100 |

| Maryland | $130 | $135 | $120 | $125 |

| Massachusetts | $135 | $140 | $125 | $130 |

| Michigan | $155 | $160 | $145 | $150 |

| Minnesota | $120 | $125 | $110 | $115 |

| Mississippi | $105 | $110 | $95 | $100 |

| Missouri | $115 | $120 | $105 | $110 |

| Montana | $110 | $115 | $100 | $105 |

| Nebraska | $100 | $105 | $90 | $95 |

| Nevada | $135 | $140 | $125 | $130 |

| New Hampshire | $105 | $110 | $95 | $100 |

| New Jersey | $140 | $145 | $130 | $135 |

| New Mexico | $110 | $115 | $100 | $105 |

| New York | $145 | $150 | $135 | $140 |

| North Carolina | $110 | $115 | $100 | $105 |

| North Dakota | $100 | $105 | $90 | $95 |

| Ohio | $110 | $115 | $100 | $105 |

| Oklahoma | $115 | $120 | $105 | $110 |

| Oregon | $125 | $130 | $115 | $120 |

| Pennsylvania | $120 | $125 | $110 | $115 |

| Rhode Island | $135 | $140 | $125 | $130 |

| South Carolina | $115 | $120 | $105 | $110 |

| South Dakota | $100 | $105 | $90 | $95 |

| Tennessee | $105 | $110 | $95 | $100 |

| Texas | $125 | $130 | $115 | $120 |

| Utah | $120 | $125 | $110 | $115 |

| Vermont | $105 | $110 | $95 | $100 |

| Virginia | $115 | $120 | $105 | $110 |

| Washington | $125 | $130 | $115 | $120 |

| Washington, D.C. | $105 | $125 | $95 | $110 |

| West Virginia | $110 | $115 | $100 | $105 |

| Wisconsin | $105 | $110 | $95 | $100 |

| Wyoming | $90 | $95 | $80 | $85 |

| U.S. Average | $110 | $106 | $117 | $117 |

High-risk states like Florida and California will have higher average rates for senior drivers.

Why Drivers Pay More for Auto Insurance After 60

While most drivers can expect to pay lower rates in their 60s, some exceptions exist. As you can see from the rates below, drivers with poor credit scores will see higher rates than drivers with good credit scores.

Drivers Over 60 Auto Insurance Monthly Rates by Gender & Credit Score

| Age & Gender | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| 60-Year-Old Female | $116 | $136 | $156 |

| 60-Year-Old Male | $120 | $140 | $160 |

| 65-Year-Old Female | $106 | $126 | $146 |

| 65-Year-Old Male | $110 | $130 | $150 |

Another factor affecting monthly car insurance quotes for seniors is the type of coverage purchased.

Auto Insurance Monthly Rates for Drivers Over 60 by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $86 | $223 | |

| $64 | $211 | |

| $119 | $332 | |

| $75 | $194 | |

| $113 | $296 | |

| $66 | $175 | |

| $95 | $243 |

| $85 | $225 | |

| $23 | $60 |

| $121 | $317 |

Full coverage costs more, but it does provide the best coverage for seniors (learn more: cheap full coverage auto insurance).

Tips to Get Cheap Auto Insurance for Drivers Over 60

If you are having trouble finding cheap monthly auto insurance quotes for seniors, there are a few things you can do to ensure you’re getting the cheapest auto insurance for seniors over 60. The first is to make sure you are keeping a clean driving record, as well as getting quotes from the cheapest companies like State Farm.

As you can see below, rates change drastically for auto insurance for different types of drivers.

Drivers Over 60 Auto Insurance Monthly Rates by Driving Record & Gender

| Age & Gender | Clean Record | Speeding Ticket | At-Fault Accident | DUI/DWI |

|---|---|---|---|---|

| 60-Year-Old Female | $106 | $130 | $165 | $240 |

| 60-Year-Old Male | $110 | $135 | $170 | $250 |

| 65-Year-Old Female | $117 | $142 | $180 | $265 |

| 65-Year-Old Male | $117 | $142 | $180 | $265 |

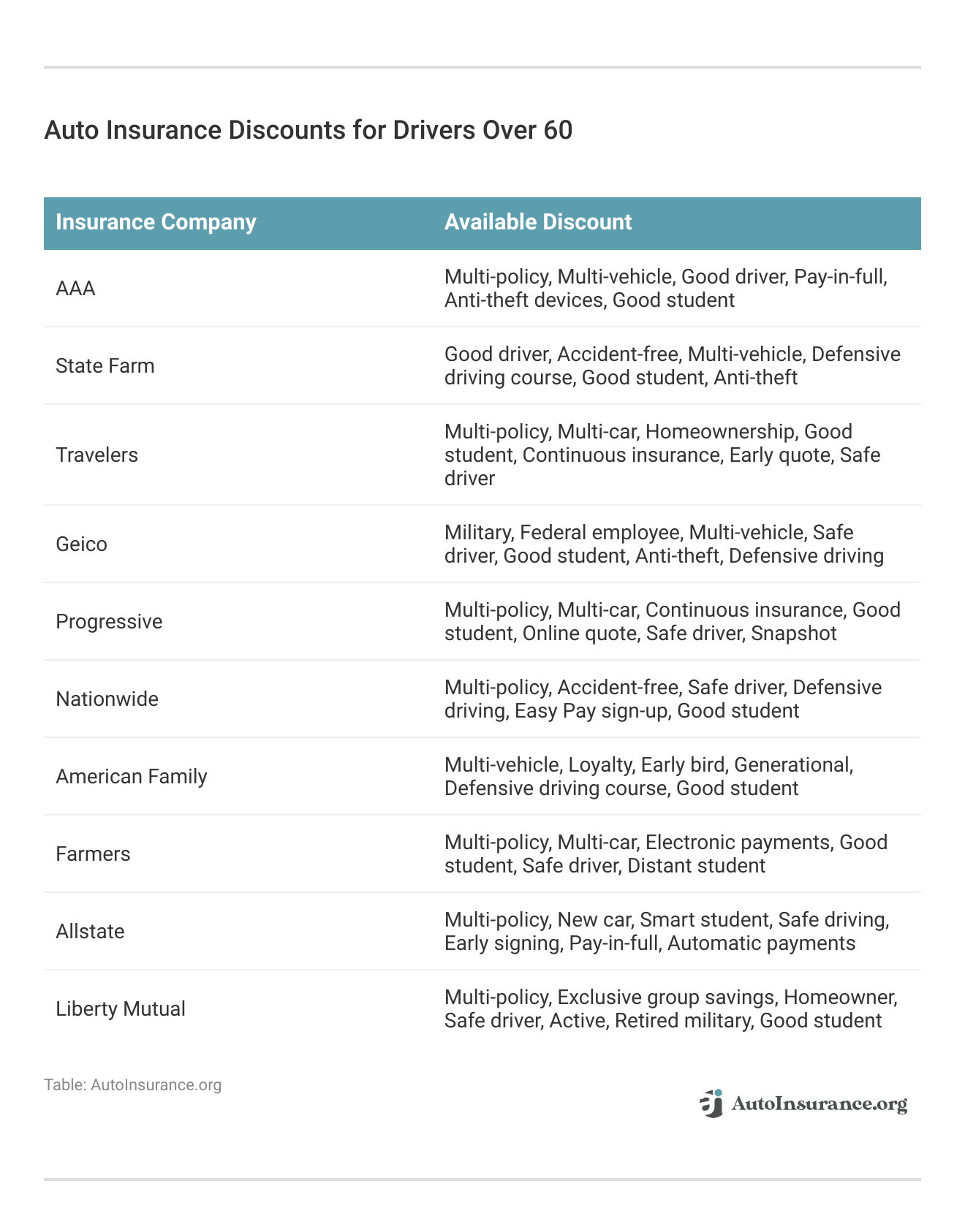

In addition to keeping a clean driving record, make sure you are taking advantage of all the auto insurance discounts for seniors.

The companies with the cheapest auto insurance for senior citizens offer plenty of discounts.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Usage-Based Auto Insurance for Senior Drivers

When looking for the best auto insurance for seniors, one thing to consider is usage-based auto insurance for seniors. Usage-based insurance can reward drivers with discounts for safe driving or track miles for pay-per-mile insurance. Read more in our article: Cheap Usage-Based Auto Insurance.

If you are retired and drive fewer than 10,000 miles per year, pay-per-mile insurance may be a good option to save on auto insurance.Dani Best Licensed Insurance Producer

If you are a safe driver or rarely drive, look into UBI programs or pay-per-mile insurance that make it easier to save on the best full coverage car insurance for seniors.

Bottom Line on the Cheapest Auto Insurance for Drivers Over 60

There are plenty of options for cheap companies offering multiple types of car insurance for seniors, from AAA to Liberty Mutual. And with senior citizen car insurance discounts, drivers over 60 may be able to save even more.

Ready to buy auto insurance today? If you want to discover the cheapest car insurance for senior citizens in your area, use our free tool.

Frequently Asked Questions

What is the cheapest auto insurance for senior citizens?

AAA is the best auto insurance company for seniors for affordable rates.

What factors affect senior auto insurance rates?

Senior auto insurance rates will be affected by driving record, location, coverage types, and similar factors.

Which is better auto insurance for drivers over 60, AAA or AARP?

AAA is the better choice for most drivers. You can read more in our article on AAA vs. AARP auto insurance.

Which insurance company is best for senior citizens?

It depends on what you are looking for, but AAA is the best car insurance company for seniors for affordable rates. State Farm and Travelers are also good choices. Enter your ZIP code below to find the best quotes for senior citizens in your area.

Is AARP auto insurance good for seniors?

AARP auto insurance can be a good choice for some seniors.

Do retirees pay less for car insurance?

Yes, retirees often pay less for car insurance as they drive less. If you drive only to run errands, volunteer, or do other simple tasks, then you should see a decrease in rates (learn more: cheap auto insurance for volunteers).

Is AARP auto insurance cheaper than Allstate for drivers over 60?

It depends on a driver’s profile. The only way to know which is cheaper is to get quotes.

Is Allstate or Progressive auto insurance more expensive for drivers over 60?

Allstate’s rates are more expensive on average than Progressive’s for types of auto insurance for seniors.

What is a mature insured auto insurance discount?

It is a discount for drivers older than 55 who have driving experience. Some companies require older drivers to take a defensive driving course to qualify for the discount. Read more in our article: Why You Should Take a Defensive Driving Class.

Does Allstate give AARP discounts?

Yes, Allstate gives AARP discounts.

How can seniors save money on car insurance?

What is the best auto insurance for a 69-year-old woman?

At what age is auto insurance most expensive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.