Cheap Cadillac Auto Insurance in 2026 (Cash Savings With These 10 Providers!)

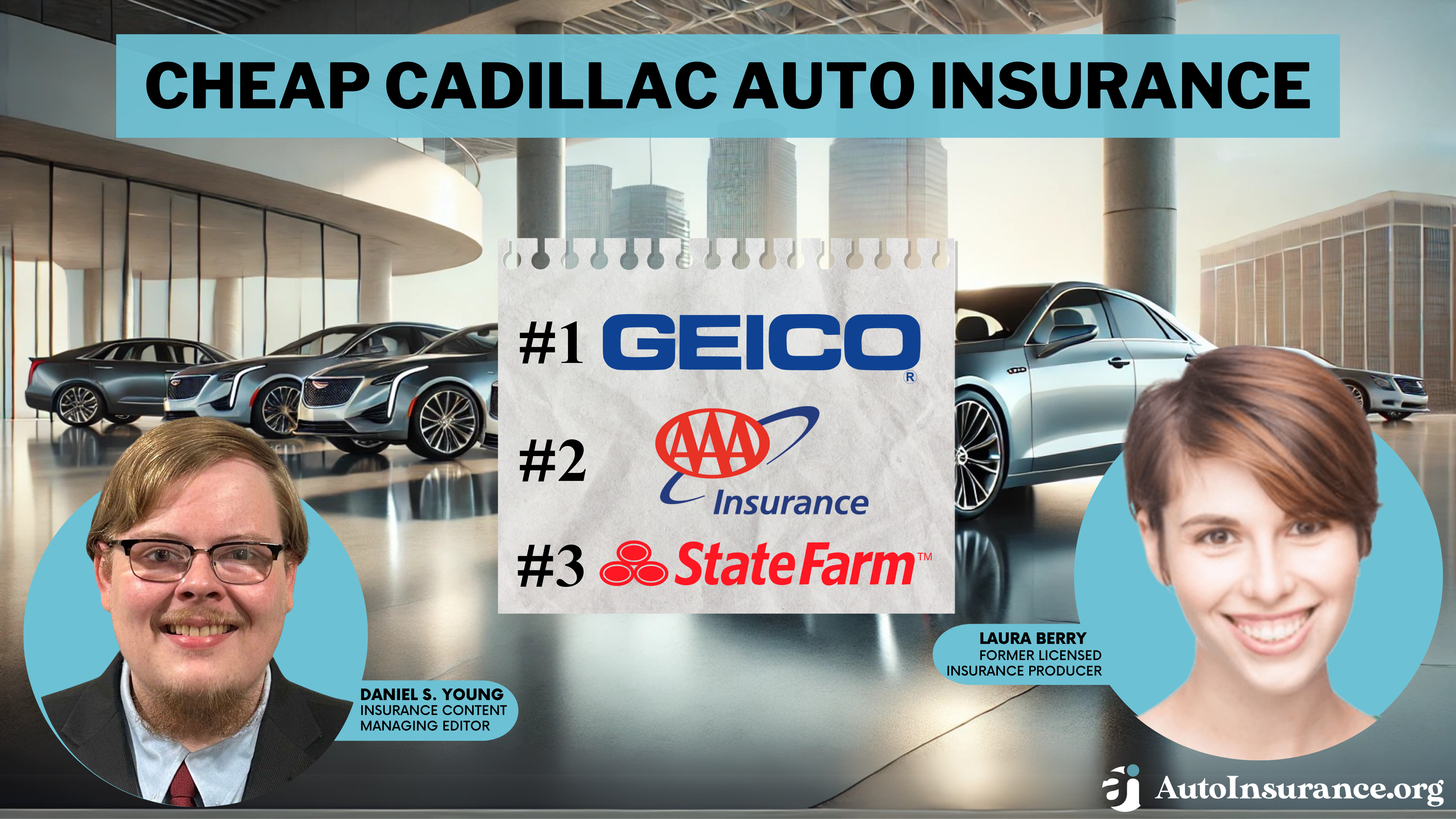

The top picks for cheap Cadillac auto insurance are Geico, AAA, and State Farm. While Cadillacs are considered a luxury brand and therefore cost more to insure, Geico has minimum coverage rates that average only $30/mo. The cheapest Cadillac insurance companies also offer plenty of discount opportunities.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Updated January 2025

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Cadillac

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Cadillac

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Cadillac

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGeico, AAA, and State Farm are our top companies for cheap Cadillac auto insurance.

Cadillac drivers have plenty of options to save on their insurance, from finding discounts to enrolling in a telematics program.

Our Top 10 Company Picks: Cheap Cadillac Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | A++ | Cheap Rates | Geico | |

| #2 | $32 | A | Roadside Assistance | AAA |

| #3 | $33 | B | Coverage Options | State Farm | |

| #4 | $37 | A+ | Loyalty Discounts | Travelers | |

| #5 | $39 | A | Budgeting Tools | Progressive | |

| #6 | $43 | A+ | Accident Forgiveness | American Family | |

| #7 | $44 | A | Customizable Policies | Nationwide |

| #8 | $53 | A | Usage-Based Savings | Farmers | |

| #9 | $61 | A+ | Pay-Per-Mile Rates | Allstate | |

| #10 | $68 | A | 24/7 Support | Liberty Mutual |

However, the best way to get started on saving on your Cadillac insurance cost is to shop at the cheapest companies.

Read on to learn about Cadillac luxury car insurance, how you can keep your Cadillac insurance cost low, and find the best auto insurance for luxury cars like Cadillacs. Then, enter your ZIP code in our free tool to compare Cadillac insurance quotes with as many companies as possible to find the right policy.

- Geico is our top choice for cheap Cadillac car insurance

- AAA and State Farm also have cheap car insurance for Cadillacs

- Cadillacs are a luxury brand, so they come with higher auto insurance rates

- Cadillac Auto Insurance

- Best Cadillac CTS Wagon Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Cadillac XT5 Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Cadillac SRX Auto Insurance in 2026 (Find the Top 10 Companies Here)

- Best Cadillac CT6 Auto Insurance in 2026 (Check Out These 10 Companies!)

- Best Cadillac ATS Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

- Best Cadillac XTS Auto Insurance in 2026 (Check Out These 10 Companies)

- Best Cadillac CTS Auto Insurance in 2026 (See Our Top 10 Company Picks)

- Best Cadillac Escalade Auto Insurance in 2026 (Find the Top 10 Companies Here)

#1 – Geico: Top Overall Pick

Pros

- Cheap Rates: Good drivers will find some of the cheapest rates for their Cadillac at Geico. Read our Geico review for more details on rates.

- Easy Policy Management: Geico’s app and website allow customers to make quick policy changes.

- Safe-Driver Discount: Demonstrating safe driving through Geico’s UBI program will help drivers save.

Cons

- In-Person Assistance: Most customers won’t be able to find a local agent near their location.

- Discount Availability: Some discounts may be limited depending on a customer’s state.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best For Roadside Assistance

Pros

- Roadside Assistance: AAA will help with fixes or tows in various situations, from dead batteries to flat tires.

- Benefits With Membership: Use your AAA membership to score discounts while shopping.

- Multiple Discounts: AAA’s discounts can help Cadillac owners save. Read more in our review of AAA.

Cons

- Membership Purchase: You will have to purchase an annual AAA membership to buy auto insurance.

- Service Can Vary: Discounts, coverages, and customer service may vary from state to state.

#3 – State Farm: Best For Coverage Options

Pros

- Coverage Options: Cadillac owners can add coverages like roadside assistance to their policy.

- Local Support: Most customers will have a local agent in their area. Read our State Farm review to learn more about its customer service.

- Availability: You can buy State Farm insurance in any state.

Cons

- Discount Availability: State Farm has great discounts, but some aren’t available in every state.

- Purchases through Agent: You will have to contact an agent to finalize your purchase.

#4 – Travelers: Best For Loyalty Discounts

Pros

- Loyalty Discounts: One of the discounts Travelers offers is loyalty rewards. Learn about other ways to save in our Travelers review.

- Flexible Deductibles: Adjust your deductibles as needed to fit your budget.

- Coverage Options: Travelers has roadside assistance, gap insurance, rental coverage, and more.

Cons

- UBI Increases: Travelers may raise rates if drivers perform poorly in its UBI program.

- Discount Availability: Some areas won’t have all of Travelers’ discounts available.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best For Budgeting Tools

Pros

- Budgeting Tools: Discover how much coverage you can purchase on a budget with Progressive’s budgeting tool.

- Availability: You can still keep Progressive as an insurance company if you move.

- Easy Online Quotes: You can quickly get a quote online. Learn about Progressive’s average costs in our Progressive review.

Cons

- Agent Availability: Progressive’s local agents aren’t as numerous as those of other companies.

- UBI Increases: Progressive may raise rates if drivers do poorly in its UBI program.

#6 – American Family: Best For Accident Forgiveness

Pros

- Accident forgiveness: American Family’s accident forgiveness is one of the many ways you can save at the company. Learn more in our review of American Family.

- Service Reputation: Customers seem to have positive reviews for American Family’s service.

- Discounts: Cadillac owners can apply for multiple discounts at the company.

Cons

- Limited Availability: Most states don’t sell American Family insurance.

- Poor Driving Record Rates: Other companies may have more affordable rates than American Family.

#7 – Nationwide: Best For Customizable Policies

Pros

- Customizable Policies: Nationwide has various auto insurance products, which we cover in our Nationwide review.

- Accident Forgiveness: You may be able to avoid expensive rate increases with Nationwide’s accident forgiveness program.

- Bundling Discounts: Nationwide offers a discount if you buy home and auto insurance together.

Cons

- Discount Availability: Discounts like Nationwide’s UBI discount may not be available everywhere.

- Claim Reviews: Some customers are dissatisfied with the processing of their claims at Nationwide.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best For Usage-Based Savings

Pros

- Usage-Based Savings: Drivers can earn discounts by driving safely in Farmers’ UBI program.

- Local Agents: Most customers should be able to find a local agent.

- Customizable Coverages: Adjust coverages and deductibles to fit your needs. Learn about Farmers’ options in our review of Farmers.

Cons

- Claims Processing: A few customers aren’t thrilled with the company’s claims processing.

- High Rates for Some: Farmers’ rates can be more expensive for some high-risk demographics.

#9 – Allstate: Best For Pay-Per-Mile Rates

Pros

- Pay-Per-Mile Rates: Cadillac owners whose annual mileage is less than 10,000 miles can save with Allstate’s low-mileage insurance.

- Coverage Options: Read about Allstate’s various options in our Allstate review.

- Availability: Cadillac owners can purchase insurance in any state.

Cons

- Agent Availability: Allstate’s communication isn’t conducted primarily through local agents.

- Claims Satisfaction: Some customers gave Allstate’s customer service and claims processing negative reviews.

#10 – Liberty Mutual: Best For 24/7 Support

Pros

- 24/7 Support: Liberty Mutual is one of the few companies that offers support 24/7. Learn about the company’s services in our Liberty Mutual review.

- Quick Claims: File a claim online easily or check its status with Liberty Mutual’s app.

- Discount Opportunities: Caddilac owners can apply for discounts like a good student or a payment-in-full discount.

Cons

- Availability of Local Agents: Most support from Liberty Mutual will be given online, not in person.

- Poor Driving Record Rates: Liberty Mutual’s rates are best for drivers with clean driving records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cadillac Auto Insurance Coverage Options

While you can buy several types of car insurance add-ons to customize your Cadillac luxury car insurance policy, there are two primary types of policies: minimum liability insurance and full coverage.

Cadillac Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $86 |

| $61 | $160 | |

| $43 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $89 | |

| $37 | $99 |

You must meet state minimum auto insurance requirements before you can drive or register your car. While minimum Cadillac insurance coverage is a good choice for people with older cars they own outright, it’s usually unsuitable for new Cadillac owners.

Full coverage auto insurance is better if you’ve recently purchased a new Cadillac. Full coverage costs more, but it gives your Cadillac much better protection. You will be able to find the cheapest rates, whether you are shopping for a 2013 Cadillac XTS premium or Cadillac SRX insurance premium, by getting quotes from cheap companies like Geico.

When you buy full coverage auto insurance, you’ll get the following types of auto insurance coverage:

- Liability: Liability auto insurance covers the property damage and bodily injury of the other party in an at-fault accident. Most states require liability insurance to drive legally.

- Collision: Collision auto insurance helps pay for your car repairs after an at-fault accident. It also covers you if you run into an object, like a mailbox.

- Comprehensive: Comprehensive auto insurance covers damage outside of accidents, including fires, floods, extreme weather, animal contact, vandalism, and theft.

- Personal Injury Protection/Medical Payments Coverage: Medical payments and personal injury protection insurance cover your health care expenses after an accident.

- Uninsured/Underinsured Motorist: While most states require a minimum amount of insurance, many areas have high rates of uninsured drivers. Uninsured/underinsured motorist coverage protects you from drivers without coverage.

Most companies offer multiple add-ons you can buy to increase the coverage on your Cadillac. Popular add-ons include rental car reimbursement, gap insurance, and roadside assistance. Be careful about adding too much extra coverage to your policy, though — add-ons quickly increase your Cadillac insurance premiums. Find the cheapest full coverage auto insurance here.

Cadillac Auto Insurance Cost

Luxury insurance always comes at a higher price than it does for standard vehicles. Cadillac rates are usually on the lower end.

Check the Cadillac insurance premiums below to see how much you might pay for a new Cadillac:

Cadillac Auto Insurance Monthly Rates by Coverage Level & Model

| Vehicle Model | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Cadillac XTS | $150 | $250 | $200 | $600 |

| 2024 Cadillac XT5 | $140 | $240 | $190 | $570 |

| 2024 Cadillac Escalade ESV | $180 | $290 | $230 | $700 |

| 2024 Cadillac Escalade | $170 | $280 | $220 | $670 |

| 2024 Cadillac CTS-V | $160 | $260 | $210 | $630 |

| 2024 Cadillac CTS | $130 | $230 | $180 | $540 |

| 2024 Cadillac CT6 | $140 | $240 | $190 | $570 |

| 2024 Cadillac ATS-V | $150 | $250 | $200 | $600 |

| 2024 Cadillac ATS Coupe | $140 | $240 | $190 | $570 |

| 2024 Cadillac ATS | $130 | $230 | $180 | $540 |

| 2024 Cadillac XT4 | $135 | $235 | $185 | $555 |

The variation you see above mainly exists because of the difference in models.

Learn more: Collision vs. Comprehensive Auto Insurance

For example, the Cadillac Escalade is one of the most expensive models to insure because it’s one of Cadillac’s most expensive models. On the other hand, the ATS has one of the lowest Cadillac insurance premiums because it has an affordable price tag.

Factors Affecting Cadillac Auto Insurance Premiums

Whether you’re looking for the best car insurance for used cars or the highest-end luxury vehicles, companies look at the same factors to determine your rates.

While your Cadillac's model and year play an important role, they are not the only things that will affect your Cadillac car insurance rates. Cadillac car insurance companies will also look at your location, age, and driving record.Brandon Frady Licensed Insurance Producer

When you need coverage for a Cadillac, the following factors will impact your rates:

- Credit Score: How do credit scores affect auto insurance rates? Unless you live in California, Massachusetts, or Hawaii, insurance companies can use credit score when setting rates. The lower your credit score, the higher your rates will be.

- Marital Status: Insurance companies charge married people a little less for their insurance than single people since they file fewer claims. Read more about the best auto insurance companies for married couples.

- Age and Gender: Insurance companies carefully track who files claims, and they know men and young drivers get in more accidents. While they pay more for insurance, the price gap lessens with age. Compare average auto insurance rates by age and gender for the best Cadillac insurance quotes.

- Location: Auto insurance rates by ZIP code vary, since companies track who files claim by location.

- Driving History: Traffic violations like at-fault accidents, speeding tickets, and DUIs will significantly impact your rates. You may also need high-risk auto insurance. Read more about how to find affordable auto insurance for drivers with accidents.

- Model: The Lexus model you choose also impacts your auto insurance rates. For example, Cadillac XT5 insurance cost averages $162/mo, while Cadillac Escalade insurance costs $190/mo.

Companies will look at all these factors to craft your Cadillac insurance premiums, but the amount of coverage you want to buy also plays an important role. You should also compare Cadillac insurance quotes and policies since companies use unique formulas when determining rates.

For example, some companies are more forgiving than others for things like low credit scores or at-fault accidents. Comparing auto insurance quotes online is the only way to determine which company is best for you.

Cadillac Auto Insurance Cost Comparison Table

This table directly compares auto insurance costs between the Cadillac Escalade and BMW X5, offering a clear overview for those seeking insights into insurance expenses for these two luxury vehicles in the current year.

| Cadillac Vehicle Comparison |

|---|

| Cadillac Escalade vs. BMW X5 Auto Insurance (#current_year) |

No matter what model or brand you are shopping for, get the best Cadillac car insurance by shopping for Cadillac auto insurance quotes.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save on Cadillac Auto Insurance

Even though Cadillacs have cheaper car insurance rates than many other luxury brands, coverage can still be expensive. If you want to get your insurance rates even lower, you can use the following tips:

- Increase your deductible. Your auto insurance deductible is the amount you must pay before your insurance kicks in. If you choose a higher deductible, you’ll pay less.

- Try a telematics program. Most companies offer usage-based car insurance and telematic systems to help safe, low-mileage drivers save. If you regularly practice safe driving habits, you can save up to 40%.

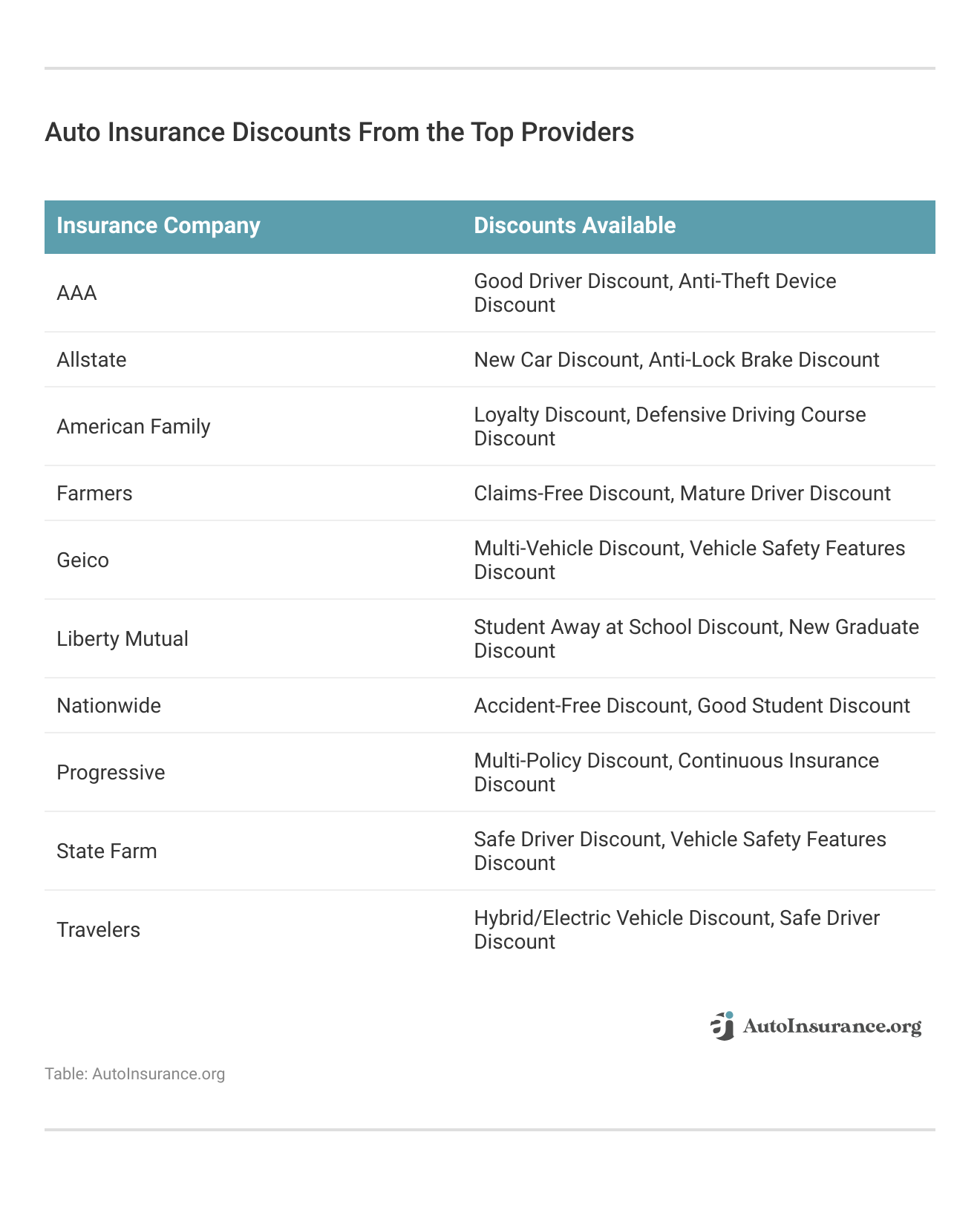

- Look for discounts. Insurance companies offer discounts to help customers save. Availability varies by company, but common auto insurance discounts include safe driving, policy bundling, and paying for your insurance in full.

- Maintain a clean record. Keeping your driving record clean of incidents will keep your rates as low as possible. If you have incidents on your record, you should avoid adding additional infractions to avoid higher rates. Read more about how auto insurance companies check driving records.

You can always find discounts to lower your Cadillac luxury car insurance premiums.

While these tips are solid options to get your rates as low as possible, the best way to get the lowest priced policy is to compare Cadillac insurance quotes.

How to Find the Best Cadillac Auto Insurance

Luxury car insurance rates are always high, and some Cadillac models are more expensive than others, but Cadillac’s reputation for reliability helps keep its prices low. While the average insurance price is $164 per month, finding affordable Cadillac luxury car insurance is still possible if you know how to lower your auto insurance rates.

You can use the tips above to keep your insurance rates low, but to find the best Cadillac auto insurance, you should compare Cadillac insurance quotes with as many companies as possible. Compare rates now with our free quote tool to find affordable Cadillac car insurance.

Frequently Asked Questions

Are Cadillacs expensive to insure?

Car insurance is always more expensive for luxury cars than for standard vehicles. While Cadillacs are considered luxury vehicles, they tend to have low car insurance rates. The average Cadillac owner pays about $164 a month for full coverage, a little higher than the national average of $119 per month.

Is car insurance higher on a Cadillac?

Car insurance on a Cadillac is higher than you would pay for standard vehicles but less than you might see for other luxury cars. However, the amount you pay for auto insurance is determined by several factors.

Are Cadillac XT5s expensive to insure?

On average, Cadillac XT5 insurance costs $162 monthly for full coverage, making it one of the brand’s more affordable models to insure. Learn more about Cadillac XT5 car insurance in our guide to the best Cadillac XT5 auto insurance.

What types of coverage should I consider for my Cadillac?

When insuring your Cadillac, it’s important to consider the mandatory coverages, such as liability insurance that includes bodily injury and property damage coverage. Additionally, comprehensive coverage protects against non-collision incidents like theft or vandalism, while collision coverage covers damages resulting from accidents. Other optional coverages to consider include uninsured/underinsured motorist coverage, medical payments coverage, and roadside assistance.

What factors can affect the cost of Cadillac auto insurance?

Several factors can influence the cost of Cadillac auto insurance. These include the model and year of the Cadillac, the driver’s age, location, driving record, credit history, and the desired coverage limits and deductibles. Insurance providers also consider the vehicle’s safety features, repair costs, and theft rates associated with Cadillac models.

How much is insurance for a Cadillac CTS?

On average, Cadillac CTS auto insurance costs $149 monthly, lower than the overall Cadillac average. However, you can still find the best Cadillac auto insurance rates by comparing quotes from various companies.

Can I save money on Cadillac auto insurance?

Yes, there are several ways to potentially save money on Cadillac auto insurance. You can explore discounts offered by insurance companies, such as safe driver discounts, multi-policy discounts, good student discounts, and discounts for safety features installed in your Cadillac. Additionally, maintaining a clean driving record, opting for a higher deductible, and bundling your Cadillac insurance with other policies can help lower your premiums.

How can I find the best insurance rates for my Cadillac?

To find the best insurance rates for your Cadillac, it’s recommended to compare quotes from multiple insurance providers. You can contact insurance companies directly, use online comparison tools, or work with an independent insurance agent who can help you find the most competitive rates based on your specific needs and location.

What are the most reliable Cadillac Escalade years?

JD Power found that the best Cadillac Escalade years are either 2002 or 2013. Shopping for Cadillac Escalade coverage? Check out our guide on the best Cadillac Escalade auto insurance.

How do I find a Cadillac XT6 for sale?

Check your local Cadillac dealer to find the best Cadillacs for sale. Just remember to shop around for Cadillac car insurance quotes and purchase insurance when you choose a car.

What is the length of XT5 models?

How much do Cadillacs cost?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.