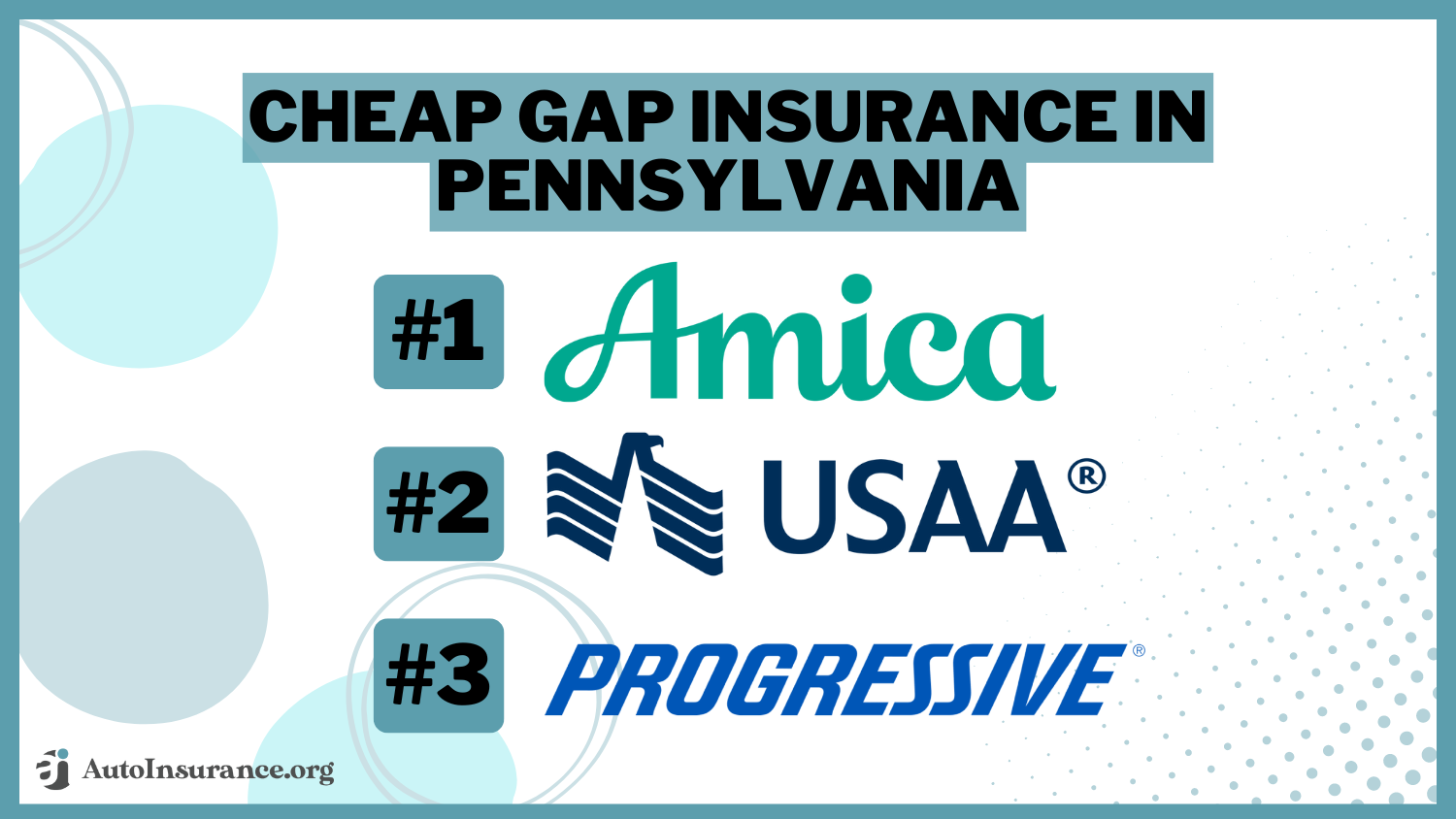

Cheap Gap Insurance in Pennsylvania (Check Out These 10 Companies for 2026)

Amica, USAA, and Progressive are the top choices for cheap gap insurance in Pennsylvania, with premiums starting at $62 per month. Amica is the cheapest PA gap insurance company, but USAA excels with unique military perks, making it the ideal pick for veterans in Pennsylvania looking for affordable gap coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. In 2018, she started writing for the cannabis industry. She curated news articles and insider interviews with investors and small business ow...

Laura Kuhl

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated October 2024

Company Facts

Min. Coverage for Gap Insurance in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap Insurance in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Gap Insurance in Pennsylvania

A.M. Best Rating

Complaint Level

Pros & Cons

Amica, USAA, and Progressive stand out as the top picks for cheap gap insurance in Pennsylvania, each offering exceptional coverage tailored to local drivers.

USAA leads with cheap Pennsylvania gap insurance rates, but auto insurance is only available to active and retired military members. Amica and Progressive have the cheapest gap insurance in PA for all drivers.

Our Top 10 Company Picks: Cheap Gap Insurance in Pennsylvania

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $62 | A++ | Low Rates | Amica | |

| #2 | $69 | A | Military Discounts | USAA | |

| #3 | $72 | A+ | Online Tools | Progressive | |

| #4 | $76 | A+ | Local Agents | Allstate | |

| #5 | $78 | A+ | Financial Stability | Nationwide |

| #6 | $84 | A++ | Coverage Variety | Auto-Owners | |

| #7 | $89 | A++ | Specialized Coverage | Travelers | |

| #8 | $90 | B | Nationwide Availability | State Farm | |

| #9 | $96 | A | 24/7 Support | Liberty Mutual |

| #10 | $103 | A | Safe Drivers | Farmers |

These companies consistently deliver value and reliability, making them the top choices for gap insurance in the state. Ready to find cheaper gap insurance coverage in Pennsylvania? Enter your ZIP code above to begin.

- USAA is the leading provider of cheap gap insurance for military members

- Amica has the cheapest Pennsylvania gap insurance at $62/month

- Safe drivers save money on PA gap insurance with Progressive Snapshot

#1 – Amica: Top Pick Overall

Pros

- Dividend Payments: Policyholders in Pennsylvania can receive dividend payments on gap insurance every year if Amica has fewer claims than premium payments.

- Multi-Vehicle Savings: Pennsylvania drivers who insure more than one vehicle on a policy can earn up to 25% off gap insurance rates.

- Exceptional Claims Service: Amica is the #1 gap insurance company in Pennsylvania for claims service and speed. Read our Amica insurance review for full ratings.

Cons

- Rate Increases: Amica Reddit reviews report gap insurance rate increases after policy renewal in certain parts of Pennsylvania and the Northeast U.S.

- Limited Online Features: Amica may not be the top choice for gap insurance in Pennsylvania for more tech-savvy drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Cheapest for Military Drivers

Pros

- Exclusive Membership Benefits: USAA offers specialized coverage in Pennsylvania, with unique member benefits that cater to military families.

- Top Financial Stability: USAA holds an A.M. Best rating of A++, ensuring reliable claims processing for Pennsylvania drivers. See how you can save money in our USAA auto insurance review.

- Tailored Coverage Options: Pennsylvania-specific policies provide extensive options, from gap insurance to comprehensive auto protection.

Cons

- Restricted Eligibility: USAA gap insurance in Pennsylvania is limited to military personnel and their families.

- Higher Premiums for Non-Members: Gap insurance premiums can be steep for those who don’t qualify for USAA military discounts in Pennsylvania.

#3 – Progressive: Best for Online Tools

Pros

- User-Friendly Online Platform: Progressive excels with a robust online system, allowing drivers to easily manage Pennsylvania gap coverage, compare rates, and access claim details.

- Snapshot Program: Pennsylvania drivers can reduce gap insurance rates through Progressive’s Snapshot program, which rewards safe driving habits.

- Customizable Coverage: Flexible policy options include Pennsylvania gap insurance, roadside assistance, and more. More information is available in our Progressive auto insurance review.

Cons

- Potential Rate Increases: Pennsylvania drivers might experience gap insurance rate hikes after claims or policy changes.

- Mixed Customer Service Reviews: Some Pennsylvania customers report inconsistent experiences with Progressive gap insurance customer support.

#4 – Allstate: Best for Local Agent Support

Pros

- Extensive Agent Network: Allstate offers Pennsylvania drivers access to a broad network of local agents, providing personalized support and gap insurance policy customization.

- Exclusive Discounts: Pennsylvania drivers can take advantage of various gap insurance discounts, including those for multi-policy bundles and safe driving.

- Accident Forgiveness: Allstate’s accident forgiveness program in Pennsylvania helps prevent gap insurance rate increases after an accident. Find more in our Allstate auto insurance review.

Cons

- Higher Premiums: Allstate gap insurance costs in Pennsylvania can be higher compared to other insurers, even after applying available discounts.

- Limited Online Tools: Pennsylvania gap insurance customers may find Allstate’s online platform less comprehensive compared to competitors like Progressive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Financial Stability

Pros

- Strong Financial Ratings: Nationwide holds an A+ rating from A.M. Best, indicating strong financial stability for Pennsylvania gap insurance. See more details in our Nationwide auto insurance review.

- On Your Side Review: Pennsylvania drivers benefit from Nationwide’s personalized policy review service, ensuring they get the best gap insurance coverage for their needs.

- Vanishing Deductible: Policyholders can lower their deductible for safe driving with Nationwide’s vanishing deductible program and save on overall PA gap insurance costs.

Cons

- Moderate Coverage Options: In Pennsylvania, Nationwide’s add-on coverages and gap insurance might not be as comprehensive as those of rival companies.

- Rate Variability: Pennsylvania gap insurance customers may experience fluctuating rates depending on their driving history and credit score.

#6 – Auto-Owners: Best Coverage Variety

Pros

- Wide Variety of Coverage Options: Along with PA gap insurance, Auto-Owners offers uncommon types of auto policies, including modified car and classic car coverage.

- Student Savings: Young drivers who need gap insurance in Pennsylvania can save 20% on their rates if they maintain good grades while enrolled in school.

- Financial Strength: With an A++ financial rating from A.M. Best, Auto-Owners is one of the most reliable gap insurance companies in Pennsylvania.

Cons

- Limited Online Services: Auto-Owners has fewer online and mobile tools for customers than other Pennsylvania gap insurance companies.

- Regional Availability: If you move out of Pennsylvania, you may not find Auto-Owners gap insurance in other states.

#7 – Travelers: Best for Customizable Policies

Pros

- Flexible Coverage: Travelers offers highly customizable gap insurance options in Pennsylvania. Get the details in our Travelers auto insurance review.

- Strong Financial Stability: With an A++ A.M. Best rating, Travelers provides Pennsylvania gap insurance policyholders with peace of mind regarding financial strength.

- Discount Programs: Pennsylvania drivers can access multiple discount opportunities with Travelers, such as bundling auto and home insurance, to get cheaper gap insurance rates.

Cons

- Higher Premiums: Travelers gap insurance premiums in Pennsylvania can be higher than those of some competitors, despite the extensive customization options.

- Limited Availability: Not all gap coverage options are available across Pennsylvania, potentially limiting choices for some drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Best for Nationwide Presence

Pros

- Extensive Agent Network: State Farm has a vast network of agents in Pennsylvania, offering personalized service and support to local drivers who need gap insurance.

- National Coverage: You can find affordable State Farm gap insurance no matter where you live in Pennsylvania and even if you move out of state.

- Comprehensive Coverage Options: State Farm provides a wide range of gap insurance coverages in Pennsylvania, catering to various driver needs. Compare coverage in our State Farm review.

Cons

- Higher Premiums: State Farm gap insurance premiums in Pennsylvania tend to be higher compared to more budget-friendly options.

- Discount Limitations: Some gap insurance discounts available nationally may not be offered in Pennsylvania, limiting potential savings for drivers.

#9 – Liberty Mutual: Best for 24/7 Support

Pros

- Around-the-Clock Claims Support: You can file Pennsylvania gap insurance claims or speak with your adjuster online or over the phone at any time.

- Customizable Policies: Pennsylvania drivers can customize their gap insurance coverage with Liberty Mutual, tailoring it to their unique needs.

- Strong Online Tools: Liberty Mutual provides robust online resources for policyholders to manage their PA gap insurance policies efficiently. Find out more in our Liberty Mutual insurance review.

Cons

- Higher Premiums: Liberty Mutual’s gap insurance premiums in Pennsylvania can be on the higher side, even with available discounts.

- Mixed Customer Reviews: Pennsylvania customers report varying levels of satisfaction with Liberty Mutual gap insurance claims process and customer service.

#10 – Farmers: Best for Safe Drivers

Pros

- Dedicated Agents: Farmers offers personalized service for gap insurance in Pennsylvania, with local agents who provide tailored advice and support. Learn more in our Farmers Insurance review.

- Strong Coverage Options: Farmers provides comprehensive gap insurance coverage in Pennsylvania, accommodating various driver needs.

- Safe Driving Discounts: Safe drivers in PA save 30% on gap insurance by avoiding accidents and claims, or save more by tracking your driving habits with Farmers Signal usage-based insurance.

Cons

- Limited Availability: Some gap insurance options with Farmers may not be available across all regions of Pennsylvania.

- Higher Rates: Farmers gap insurance rates in Pennsylvania are often higher compared to other insurers like Geico or Progressive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pennsylvania Gap Insurance Companies and Monthly Rates

Gap insurance rates differ significantly depending on the provider and the level of coverage chosen. The table below highlights the minimum and full coverage rates with gap insurance across the top ten Pennsylvania auto insurance companies:

Gap Insurance Rates in Pennsylvania by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $76 | |

| $62 | |

| $84 | |

| $103 | |

| $96 |

| $78 |

| $72 | |

| $90 | |

| $89 | |

| $69 |

For minimum coverage, Amica offers the most affordable rate at $62 per month, making it the top pick for budget-conscious drivers. On the higher end, Farmers charges $103 for minimum coverage, reflecting the range of options available.

Opting for full coverage insurance on a leased car or new vehicle (rather than minimum coverage) increases the cost, as it provides more comprehensive protection. Amica and USAA lead with the lowest rates on full coverage auto insurance in Pennsylvania, while Farmers remains the most expensive.

Learn More: Pennsylvania Minimum Auto Insurance Requirements

Key Factors Affecting Gap Insurance Costs in Pennsylvania

Knowing the factors influencing gap coverage in Pennsylvania is essential to getting cheap rates. These elements vary widely among providers, so always compare insurance quotes based on these top three impacts on gap insurance rates:

- Vehicle Value: The higher the value of your car, the more you’ll pay for gap insurance, as coverage needs to account for greater potential losses with luxury vehicles and classic cars.

- Credit Score: Insurers often consider your credit score and reward good credit with cheaper rates. Read how credit scores affect auto insurance rates

- Provider Discounts: Taking advantage of Pennsylvania insurance providers’ discounts can help reduce your overall insurance costs.

This table showcases the auto insurance discounts to ask for from the top gap insurance companies in Pennsylvania. Choosing the right discounts can substantially impact your monthly gap insurance costs, especially if you qualify for safe driver and low-mileage discounts.

By considering these factors, Pennsylvania drivers can better navigate the complexities of gap insurance costs, ensuring they secure the most cost-effective and comprehensive coverage.

More Effective Ways to Lower Pennsylvania Gap Insurance Rates

To effectively cut down on gap insurance premiums, start by bundling your gap insurance with other policies — such as home or renters insurance — under the same provider. This unlocks multi-policy discounts with the best companies, including 10% with Progressive and USAA.

It’s hard to find cheap auto insurance for a bad driving record in Pennsylvania, so maintaining a clean driving record is crucial. It not only keeps your primary auto insurance premiums low but can also influence the cost of your gap coverage. Additionally, consider opting for a higher deductible. While this increases your out-of-pocket expenses in the event of a claim, it significantly reduces your monthly payments.

Regularly reviewing your coverage needs and shopping around for better deals ensures you’re always getting the best rate available. By leveraging these strategies, Pennsylvania drivers can secure the protection they need without overspending on their gap insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Gap Insurance Company Reviews in Pennsylvania

When it comes to securing the best cheap gap insurance in Pennsylvania, Amica, USAA, and Progressive emerge as the top contenders, each offering distinct advantages tailored to different needs.

USAA stands out as one of the best auto insurance companies for military families with its unparalleled member benefits and military-specific perks.

USAA excels in delivering the best gap insurance in Pennsylvania, with a focus on customer satisfaction and exceptional financial stability.Laura Berry Former Licensed Insurance Producer

These providers consistently deliver a blend of value, reliability, and tailored coverage, making them the premier choices for gap insurance across Pennsylvania. Our free online comparison tool below allows you to compare the cheapest gap insurance in Pennsylvania instantly, just enter your ZIP code to get started.

Frequently Asked Questions

How much is gap insurance in Pennsylvania?

Gap insurance in Pennsylvania typically costs around $40 to $60 per month when combined with minimum coverage policies, depending on your provider and coverage level.

What is the most gap insurance in Pennsylvania will pay?

Gap insurance in Pennsylvania generally pays the difference between your car’s actual cash value and the remaining loan balance. Find cheap gap insurance quotes in Pennsylvania by entering your ZIP code below.

Is gap insurance in Pennsylvania taxed?

In Pennsylvania, gap insurance is typically not subject to taxes, but it’s important to confirm with your provider.

How many claims can you make on gap insurance in Pennsylvania?

With gap insurance in Pennsylvania, you can usually make only one claim, as it is designed to cover a single loan or lease gap. (Learn More: Is gap insurance transferable if you sell the car?)

Is gap insurance in Pennsylvania a type of auto insurance?

Yes, Pennsylvania gap insurance is a specific type of car insurance that covers the difference between your car’s value and the loan amount.

What is the best type of gap insurance in Pennsylvania?

The best type of gap insurance in Pennsylvania is one that offers comprehensive coverage and fits your financial needs, often available through providers like Amica and USAA.

What is true gap insurance in Pennsylvania?

True gap insurance in Pennsylvania covers the full difference between your vehicle’s value and the remaining loan or lease balance, ensuring you’re not left with out-of-pocket costs. Find out when is a good time to refinance an auto loan.

How is gap insurance in Pennsylvania calculated?

Gap insurance in Pennsylvania is calculated by subtracting your car’s actual cash value from the remaining balance on your loan or lease. See if you’re getting the best deal on gap insurance in Pennsylvania by entering your ZIP code below.

What does gap insurance in Pennsylvania cover?

Gap insurance in Pennsylvania covers the financial gap between what your car is worth and what you owe on your loan or lease after a total loss.

What is the gap coverage option in Pennsylvania?

Pennsylvania gap coverage is an add-on that ensures full coverage of the remaining loan balance if your vehicle is totaled or stolen in a covered event.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.