Cheap Hyundai Auto Insurance in 2026 (Our Top 10 Companies)

Erie, Geico, and State Farm are our winners for cheap Hyundai auto insurance. Erie emerges as our top choice, offering the most budget-friendly option at just $22 per month, along with multi-vehicle discounts. Check out this guide to compare cheap Hyundai auto insurance by model and discover low-cost options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Hyundai

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Hyundai

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Hyundai

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsWhat insurance companies cover Hyundai? Erie, Geico, and State Farm are the top picks for cheap Hyundai auto insurance.

Cheap Hyundai auto insurance is available for as low as $28 per month with these insurers, making Hyundais a brand with cheap auto insurance costs.

Our Top 10 Company Picks: Cheap Hyundai Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A+ Customer Service Erie

#2 $30 A++ Competitive Rates Geico

#3 $33 B Safe-Driving Discounts State Farm

#4 $37 A++ Budgeting Tools Travelers

#5 $39 A+ Multi-Policy Discounts Progressive

#6 $43 A Loyalty Rewards American Family

#7 $44 A+ SmartRide Program Nationwide

#8 $53 A Affinity Discounts Farmers

#9 $61 A+ Customized Policies Allstate

#10 $68 A Safe-Driving Discounts Liberty Mutual

Rates will vary slightly depending on your Hyundai model. Car insurance companies will consider your age and driving record when calculating your Hyundai auto insurance rates.

This review will list Hyundai insurance coverage options for your Hyundai vehicle and average rates based on Hyundai models. Enter your ZIP code above to get cheap Hyundai auto insurance quotes.

- Hyundai Sonata Hybrid’s insurance rates are the priciest Hyundai models

- The Hyundai Tucson has some of the cheapest rates out of the Hyundai models

- Hyundai auto insurance rates will also depend upon the driver’s record and age

#1 – Erie: Top Pick Overall

Pros

- Competitive Rates: Erie offers affordable rates, which can be advantageous for Hyundai owners looking to save on insurance costs.

- Personalized Service: Known for its personalized customer service, Erie agents can assist Hyundai owners in finding the best coverage options tailored to their needs.

- Multi-Vehicle Discounts: Erie provides discounts for insuring multiple vehicles, making it a cost-effective option for Hyundai owners with more than one vehicle. Learn more about Erie’s multi-vehicle discounts in our article: Erie Auto Insurance Review.

Cons

- Limited Availability: Erie’s coverage may be limited to certain regions, potentially restricting access for Hyundai owners living in areas where Erie doesn’t operate.

- Limited Online Tools: Erie’s online platform might lack some features compared to other insurers, which could be inconvenient for Hyundai owners who prefer managing their policies digitally.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Premiums: Will Geico insure Hyundai? Geico offers competitive rates, making it an attractive option for Hyundai owners seeking budget-friendly insurance.

- Convenient Mobile App: Geico’s mobile app allows Hyundai owners to manage their policies, file claims, and access roadside assistance easily.

- Wide Network of Repair Shops: Geico has a vast network of approved repair shops, ensuring Hyundai owners have access to quality repair services.

Cons

- Customer Service Concerns: Some Hyundai owners may experience issues with Geico’s customer service, including delays in claims processing or difficulty reaching representatives. Read more about Geico’s customer service in our Geico auto insurance review.

- Limited Coverage Options: Geico may have fewer coverage options compared to other insurers, which could be a drawback for Hyundai owners looking for comprehensive coverage.

#3 – State Farm: Best for Multi-Policy Discounts

Pros

- Personalized Agents: State Farm’s network of agents can provide personalized assistance to Hyundai owners, helping them tailor their policies to their specific needs.

- Strong Financial Stability: With its solid financial standing, State Farm offers Hyundai owners peace of mind knowing their claims will be handled efficiently (read more: State Farm Auto Insurance Review).

- Multiple Policy Discounts: State Farm offers discounts for bundling auto insurance with other policies, potentially saving Hyundai owners money on their premiums.

Cons

- Higher Premiums: State Farm’s rates may be slightly higher compared to some other insurers on the list, which could be a concern for Hyundai owners on a tight budget.

- Limited Online Tools: State Farm’s online platform may lack some features, such as instant policy management or quote comparison tools, which could be inconvenient for Hyundai owners who prefer online services.

#4 – Travelers: Best for Strong Financial Ratings

Pros

- Customizable Policies: Travelers offers customizable policies, allowing Hyundai owners to tailor their coverage to their individual needs.

- Multi-Policy Discounts: Hyundai owners can save money by bundling their auto insurance with other policies through Travelers’ multi-policy discount program. Learn more about Travelers’ multi-policy discounts in our Travelers auto insurance review.

- Strong Financial Ratings: Travelers boasts strong financial ratings, providing Hyundai owners confidence in the company’s ability to pay claims.

Cons

- Limited Availability: Travelers’ coverage may be limited in certain regions, potentially restricting access for Hyundai owners living outside of those areas.

- Average Customer Service: Some Hyundai owners may find Travelers’ customer service to be lacking compared to other insurers, with longer wait times or difficulty reaching representatives.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Program

Pros

- Name Your Price Tool: Progressive’s Name Your Price Tool allows Hyundai owners to customize their coverage based on their budget, ensuring they get the coverage they need at a price they can afford.

- Snapshot Program: Hyundai owners can potentially save money on their premiums by participating in Progressive’s Snapshot program, which rewards safe driving habits. Read more about Progressive’s Snapshot Program in our article: Progressive Auto Insurance Review.

- Wide Range of Coverage Options: Progressive offers a variety of coverage options, allowing Hyundai owners to tailor their policies to their specific needs.

Cons

- Higher Premiums for Some Drivers: Progressive’s rates may be higher for Hyundai owners with less-than-perfect driving records, which could be a concern for those seeking affordable coverage.

- Customer Service Concerns: Some Hyundai owners may experience issues with Progressive’s customer service, including delays in claims processing or difficulty reaching representatives.

#6 – American Family: Best for Bundling Discounts

Pros

- Bundling Discounts: American Family offers discounts for bundling auto insurance with other policies, potentially saving Hyundai owners money on their premiums.

- Excellent Customer Service: American Family is known for its excellent customer service, providing Hyundai owners with personalized assistance and quick claims processing. Learn more about American Family’s customer service in our American Family auto insurance review.

- Wide Range of Coverage Options: American Family offers a variety of coverage options, allowing Hyundai owners to customize their policies to their individual needs.

Cons

- Higher Premiums: American Family’s rates may be slightly higher compared to some other insurers on the list, which could be a concern for Hyundai owners seeking budget-friendly coverage.

- Limited Availability: American Family’s coverage may be limited to certain regions, potentially restricting access for Hyundai owners living in areas where American Family doesn’t operate.

#7 – Nationwide: Best for Vanishing Deductible Program

Pros

- Multi-Vehicle Discounts: Nationwide offers discounts for insuring multiple vehicles, making it a cost-effective option for Hyundai owners with more than one vehicle.

- Vanishing Deductible Program: Hyundai owners can potentially lower their deductibles over time by participating in Nationwide’s Vanishing Deductible program, rewarding safe driving habits. Read more about Nationwide’s Vanishing Deductible program in our article: Nationwide Auto Insurance Review.

- Strong Financial Ratings: Nationwide boasts strong financial ratings, providing Hyundai owners confidence in the company’s ability to pay claims.

Cons

- Average Customer Service: Some Hyundai owners may find Nationwide’s customer service to be lacking compared to other insurers, with longer wait times or difficulty reaching representatives.

- Limited Coverage Options: Nationwide may have fewer coverage options compared to some other insurers, which could be a drawback for Hyundai owners looking for comprehensive coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Agents

Pros

- Personalized Agents: Farmers’ network of agents can provide personalized assistance to Hyundai owners, helping them tailor their policies to their specific needs.

- Multiple Policy Discounts: Hyundai owners can save money by bundling their auto insurance with other policies through Farmers’ multi-policy discount program (learn more: Farmers Auto Insurance Review).

- Strong Financial Stability: With its solid financial standing, Farmers offers Hyundai owners peace of mind knowing their claims will be handled efficiently.

Cons

- Higher Premiums: Farmers’ rates may be slightly higher compared to some other insurers on the list, which could be a concern for Hyundai owners on a tight budget.

- Limited Online Tools: Farmers’ online platform may lack some features, such as instant policy management or quote comparison tools, which could be inconvenient for Hyundai owners who prefer online services.

#9 – Allstate: Best for Accident Forgiveness

Pros

- Customizable Policies: Allstate offers customizable policies, allowing Hyundai owners to tailor their coverage to their individual needs.

- Accident Forgiveness: Hyundai owners can potentially avoid rate increases after their first at-fault accident by participating in Allstate’s Accident Forgiveness program (read more: What is accident forgiveness?).

- Strong Financial Stability: With its solid financial standing, Allstate offers Hyundai owners peace of mind knowing their claims will be handled efficiently.

Cons

- Higher Premiums: Allstate’s rates may be higher compared to some other insurers on the list, which could be a concern for Hyundai owners seeking budget-friendly coverage.

- Average Customer Service: Some Hyundai owners may find Allstate’s customer service to be lacking compared to other insurers, with longer wait times or difficulty reaching representatives. Learn more about Allstate’s customer service in our Allstate auto insurance review.

#10 – Liberty Mutual: Best for Wide Range of Coverage Options

Pros

- Bundling Discounts: Does liberty mutual insure Hyundai cars? Liberty Mutual offers discounts for bundling auto insurance with other policies, potentially saving Hyundai owners money on their premiums.

- Wide Range of Coverage Options: Liberty Mutual offers a variety of coverage options, allowing Hyundai owners to customize their policies to their individual needs.

- Strong Financial Stability: With its solid financial standing, Liberty Mutual offers Hyundai owners peace of mind knowing their claims will be handled efficiently.

Cons

- Higher Premiums: Liberty Mutual’s rates may be higher compared to some other insurers on the list, which could be a concern for Hyundai owners seeking budget-friendly coverage. Read more about Liberty Mutual’s higher premiums in our Liberty Mutual auto insurance review.

- Limited Availability: Liberty Mutual’s coverage may be limited in certain regions, potentially restricting access for Hyundai owners living outside of those areas.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hyundai Auto Insurance Coverage

Are Hyundais expensive to insure? Making sure you have the right coverage for your Hyundai is important, as you want to ensure you have protection if anything goes wrong on the road. In most states, your state will require you to carry liability auto insurance on your vehicle, which pays for other parties’ accident bills if you cause an accident that injures others or damages their property.

State minimum auto insurance requirements may include the following Hyundai auto insurance coverages:

- Medical Payments: Medical payments coverage on auto insurance helps pay the medical bills of you and your passengers if you get injured in a car accident.

- Personal Injury Protection (PIP): Helps pay the medical bills and lost wages of you and your passengers if you get injured in a car accident.

- Underinsured Motorist Insurance: This coverage helps pay for your accident bills if the driver who hit you doesn’t have enough insurance coverage to pay your accident bills.

- Uninsured Motorist Coverage: Helps pay for your accident bills if the driver who hit you doesn’t have auto insurance.

These are the only auto insurance coverages that your state may require. All other auto insurance coverages will be optional unless you have a lease or loan on your Hyundai. In those cases, your lender will legally require you to have collision and comprehensive insurance to protect assets.

These Hyundai auto insurance coverages pay for your car’s repairs if you cause an accident or circumstances beyond your control damage your vehicle. Comprehensive auto insurance covers animal collisions, weather damages, vandalism, and falling objects, whereas collision auto insurance covers crashes with other vehicles or stationary objects like fences.

Hyundai Auto Insurance Rates

Hyundai models with higher purchase prices will cost more to insure than cheaper models. However, most Hyundai models have similar auto insurance rates that fall around $150 per month for a full coverage auto insurance policy. Take a look at the table below to compare Hyundai auto insurance rates by model:

Hyundai Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$61 $160

$43 $117

$22 $58

$53 $139

$30 $80

$68 $174

$44 $115

$39 $105

$33 $86

$37 $99

On average, you can find cheap Hyundai Accent insurance, Hyundai Elantra insurance, and Hyundai Tucson insurance. On the other hand, auto insurance for a Hyundai Sonata Hybrid is the most expensive of all Hyundai models. Why are Hyundai Sonatas so expensive to insure? There are several factors that can contribute to the higher insurance costs, including location and the vehicle’s value.

Besides the model of Hyundai you own, two other factors that affect your Hyundai insurance rates are driving record and age.Daniel Walker Licensed Auto Insurance Agent

Generally, auto insurance for young adults is more expensive than for older drivers due to inexperience. If possible, it’s cheaper for young drivers to join a parent’s policy than to purchase an auto insurance policy themselves.

A clean driving record will also come with cheaper Hyundai insurance costs on average than high-risk driver rates. You’ll see a Hyundai car insurance rate increase with an accident, traffic violation, or DUI on your record.

Learn how to find the best auto insurance for drivers with a bad driving record here.

Compare the Auto Insurance Costs Across Hyundai Models

How to Save on Hyundai Auto Insurance

While Hyundai car insurance rates aren’t that expensive on average, it’s always prudent to maximize your savings on the price of Hyundai car insurance. One of the first things you can do to save on your auto insurance rates is to get plenty of quotes from Hyundai auto insurance companies and compare auto insurance rates to find the company with the cheapest rates for you.

You should also apply for auto insurance discounts to maximize your savings. Some discounts may require successfully passing a class or course to earn the discount, such as defensive driving auto insurance discounts or safe driving discounts. If your insurance company offers multiple types of insurance, you should also see if you can save by getting a discount for bundling insurance policies, such as home and auto insurance.

Finally, raising your auto insurance deductible will reduce your Hyundai insurance costs, as you are assuming more financial risk. Since the deductible is the amount you agree to pay out of pocket after an accident, it’s important not to raise it beyond an amount you can afford.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Cheap Hyundai Auto Insurance Coverage

Most full coverage policies for Hyundai models will cost about $140 a month, but auto insurance rates also depend upon your driving record, age, and Hyundai model. Your choice of an insurance company is also a big factor in your Hyundai car insurance price, as rates vary greatly.

To find the best auto insurance types for Hyundai vehicles based on your coverage needs and budget, enter your ZIP code below for the best Hyundai car insurance quotes in your area.

Frequently Asked Questions

Which auto insurance company is best for Hyundais?

No one company has the best Hyundai auto insurance since it depends on coverage needs and budget. Some companies that tend to be cheaper on average include Erie, Geico, and State Farm.

Are Hyundais more expensive to insure?

Hyundai auto insurance averages $140 monthly, close to the national average. However, Hyundai auto insurance rates vary by model, company, and location. For example, drivers with poor driving records and young drivers will see higher rates, regardless of vehicle model.

Does Hyundai have their own insurance?

Hyundai Power Protect, underwritten by Liberty Mutual, offers insurance coverage to Hyundai drivers. Some of the benefits of Power Protect include new car replacement, roadside assistance, a multi-policy discount, and a discount for going 3 years violation-free.

Why are Hyundais so expensive to insure?

Hyundai auto insurance costs $140 monthly, 15% lower than the national average for all vehicle models.

Unfortunately, recent Hyundai insurance issues stemming from the vehicle make’s vulnerability to theft have led to higher rates and coverage denial.

Can I transfer my Hyundai auto insurance to a new Hyundai vehicle?

Yes, in most cases, you can transfer your Hyundai auto insurance to a new Hyundai vehicle. However, you should notify your insurance company about the change in the insured vehicle and update your policy accordingly. Read more about how to transfer auto insurance to a new car purchase.

There may be some adjustments to the premium based on the new vehicle’s value and other factors. For instance, your monthly cost may change if you go from a Sonata Hybrid to an Elantra since Hyundai auto insurance rates by model vary.

Will my Hyundai auto insurance cover me if I drive outside of my country?

You might be wondering whether auto insurance covers you when driving abroad — it all depends on your policy’s terms. Some policies offer limited coverage for certain geographic regions, while others provide international coverage.

Review your policy or contact your insurance company to determine the extent of coverage when driving outside your country.

Is it expensive to insure a Hyundai Sonata?

Auto insurance for a Hyundai Sonata costs $143/mo, around the overall average for Hyundai models. Enter your ZIP code to compare Hyundai car insurance quotes to find the company with the best rates.

Why are Hyundai Elantras so expensive to insure?

Auto insurance for a Hyundai Elantra costs $137 monthly on average, about 15% higher than the national average for all vehicle models. However, Elantra car insurance coverage is slightly cheaper than the overall Hyundai average.

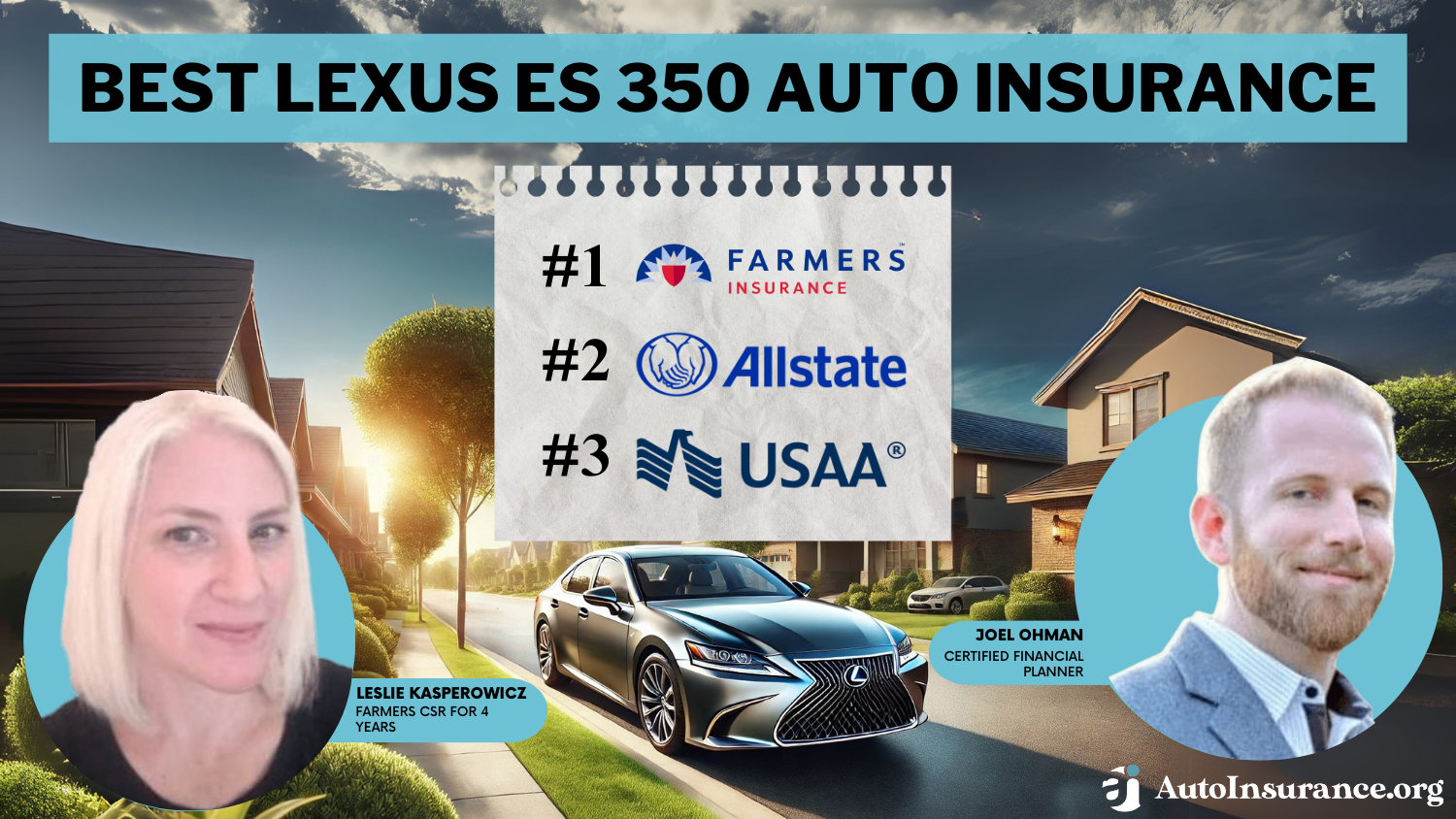

Are there any discounts available for Hyundai auto insurance?

Insurance companies often offer various auto insurance discounts. You could earn Hyundai auto insurance discounts for having safety features in your vehicle, anti-theft devices, good driving records, multiple policies, and more, so always ask about available discounts.

Learn more about how to get an anti-theft auto insurance discount.

How much does Erie charge for Hyundai auto insurance?

Erie offers Hyundai auto insurance starting at $22/mo.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.