Cheap Jaguar Auto Insurance in 2026 (Save With These 10 Companies!)

The top picks for cheap Jaguar auto insurance are Geico, Progressive, and State Farm. Geico has the cheapest minimum Jaguar auto insurance, with rates averaging $44/mo. While Jaguars are more expensive to insure, buying a cheaper Jaguar model, such as a Jaguar XF, will help you find more affordable Jaguar car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated February 2026

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Jaguar

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Jaguar

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Jaguar

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsGeico, Progressive, and State Farm are the top picks for cheap Jaguar auto insurance.

Other great companies that offer cheap insurance for a Jaguar are listed below.

Our Top 10 Company Picks: Cheap Jaguar Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons | |

|---|---|---|---|---|---|---|

| #1 | $44 | A++ | Cheap Rates | Geico | ||

| #2 | $47 | A+ | Online Convenience | Progressive | ||

| #3 | $48 | B | Many Discounts | State Farm | ||

| #4 | $52 | A+ | Add-on Coverages | Allstate | ||

| #5 | $55 | A++ | Military Savings | USAA | ||

| #6 | $57 | A | Local Agents | Farmers | ||

| #7 | $66 | A+ | Usage Discount | Nationwide | |

| #8 | $69 | A | Customizable Polices | Liberty Mutual | |

| #9 | $71 | A++ | Accident Forgiveness | Travelers | ||

| #10 | $73 | A | Student Savings | American Family |

Keep reading to learn more about how to find the best car insurance for luxury cars. You can also compare insurance rates at any time using our free quote tool.

- Jaguar F-Type insurance costs are the highest Jaguar insurance costs on average

- The cheapest Jaguars to insure are the Jaguar XE and Jaguar XF

- Jaguar car insurance rates also depend on a driver’s age and driving record

#1 – Geico: Top Pick Overall

Pros

- Cheap Rates: Geico has the more affordable rates for Jaguar owners. Learn more about Geico’s rates in our review of Geico.

- User-Friendly: Geico’s app and website are simple for customers to navigate.

- Coverage Options: Jaguar owners can choose among several coverage options.

Cons

- UBI Discount Availability: Geico’s UBI discount isn’t offered in a few states.

- Virtual Communication: Geico has few local agents, limiting most communication to virtual.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive’s website and app make managing policies, filing claims, and getting quotes easier.

- Coverage Options: There is a variety of coverage at Progressive. Learn more in our Progressive review.

- Discount Opportunities: Progressive has a full list of discounts customers can qualify for.

Cons

- UBI Rate Raises: Performing poorly in Progressive’s UBI program may result in rate increases.

- Customer Ratings: Progressive has some negative ratings for customer service.

#3 – State Farm: Best for Many Discounts

Pros

- Many Discounts: State Farm offers good driver discounts, good student discounts, bundling discounts, and many more.

- Local Agents: State Farm’s multiple local agents help the company maintain a reputation for great customer service.

- Coverage Options: State Farm has roadside assistance and more, which you can learn about in our State Farm review.

Cons

- No Online Purchases: You can’t purchase a policy online, although you can get quotes online.

- UBI Availability: State Farm’s UBI program isn’t available in all states.

#4 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate has a great selection of add-ons, such as rideshare insurance. Learn more about Allstate’s coverage options in our Allstate auto insurance review.

- Financial Ratings: Allstate has a good financial standing based on its financial ratings.

- Availability: Currently, Allstate sells auto insurance in every state.

Cons

- DUI Rates: Jaguar owners with a DUI may not get the cheapest rates at Allstate.

- UBI Availability: Allstate’s UBI discount program isn’t available in all states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers savings for military members when traveling, shopping, and more.

- Customer Service: USAA has high customer satisfaction ratings. Read more in our USAA review.

- Bundling Discount: Purchasing more than one type of insurance can save customers money.

Cons

- Limited Eligibility: USAA keeps rates low by selling insurance only to military members, veterans, and their immediate families.

- Local Agent Availability: USAA doesn’t have as many in-person agents as some companies.

#6 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers has a good selection of local agents to offer in-person assistance.

- Accident Forgiveness: Farmers’ accident forgiveness is a great perk for safe drivers.

- Multiple Discounts: Farmers’ selection of discounts can help Jaguar owners save. Learn more in our review of Farmers.

Cons

- Add-On Coverages: Farmers doesn’t offer gap insurance, which can be a negative for owners of new Jaguars.

- UBI Availability: Some states don’t have Farmers’ UBI discount.

#7 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide’s UBI program offers a large discount to safe drivers.

- Accident Forgiveness: Good drivers may be forgiven for their first at-fault accident. Learn about Nationwide’s other perks in our Nationwide review.

- Vanishing Deductible: Nationwide reduces deductibles for each claims-free policy period.

Cons

- Availability: You can’t purchase Nationwide auto insurance in a few states.

- High-Risk Driver Rates: Young drivers and DUI drivers may not find the best rates at Nationwide.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Customers can easily customize policies at Liberty Mutual. Learn about its coverage options in our review of Liberty Mutual.

- 24/7 Support: Customers can get 24/7 assistance from a Liberty Mutual representative.

- Accident Forgiveness: Eligible drivers can enroll in Liberty Mutual’s accident forgiveness program.

Cons

- Customer Ratings: Liberty Mutual has some negative customer ratings.

- UBI Availability: Liberty Mutual’s UBI discount isn’t available in all states.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Safe drivers can qualify for Traveler’s accident forgiveness policy.

- Add-On Coverages: Travelers has a great selection of add-on coverages, which you can learn about in our Travelers review.

- Multiple Discounts: Travelers has bundling discounts, multi-car discounts, and more.

Cons

- Customer Service: Travelers has a few negative ratings from customers.

- High-Risk Driver Rates: Travelers’ average rates for high-risk drivers often aren’t the cheapest.

#10 – American Family: Best for Student Savings

Pros

- Student Savings: American Family has multiple discounts for young drivers.

- Coverage Options: American Family offers minimum and full coverage options. Learn more in our American Family review.

- Accident Forgiveness: Safe drivers may avoid rate increases after their first at-fault accident.

Cons

- Availability: American Family isn’t available in all states.

- High-Risk Driver Rates: American Family’s rates may not be the cheapest for some high-risk drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Auto Insurance Coverages for Jaguars

Most states require drivers to carry liability auto insurance. Liability auto insurance pays for other drivers’ medical and property repair bills if you cause an accident, so it’s essential Jaguar auto insurance coverage.

Car insurance requirements by state vary, but you might also need to carry one or more of the following types of auto insurance coverage for Jaguars:

- Medical Payments: Medical payments coverage on auto insurance covers you and your passengers’ medical bills up to the policy limit if you get injured in a car accident.

- Personal Injury Protection: Personal injury protection insurance covers you and your passengers’ medical bills and lost wages up to the policy limit if you get injured in a car accident.

- Underinsured Motorist Insurance: This coverage helps pay the remainder of your accident bills if the driver who hit you lacks enough coverage to pay your bills.

- Uninsured Motorist Insurance: Uninsured motorist coverage pays your accident bills if the driver who hit you doesn’t have insurance.

Collision and comprehensive auto insurance are good coverages, as they cover the costs of your repairs if you cause an accident or factors outside your control damage your car.

If you have a lease or loan on your Jaguar, your lender will require you to have collision and comprehensive insurance alongside the state’s required coverages.Daniel Walker Licensed Insurance Agent

For example, collision auto insurance covers your Jaguar repairs if you crash into another car. Comprehensive auto insurance covers your repairs if you crash into an animal or your car gets damaged by weather, falling objects, or vandals. So, these two coverages protect your Jaguar from numerous situations.

Average Jaguar Auto Insurance Rates

Your Jaguar insurance costs partly depend on your Jaguar model. More expensive Jaguar models cost more to insure, as insurance companies must pay more for repairs if you file an auto insurance claim. Luckily the companies below offer great rates on Jaguars.

Jaguar Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $52 | $160 | |

| $73 | $187 | |

| $57 | $175 | |

| $44 | $133 | |

| $69 | $180 |

| $66 | $165 |

| $47 | $144 | |

| $48 | $149 | |

| $71 | $176 | |

| $55 | $165 |

Take a look at the table below to see the average Jaguar auto insurance rates for different models.

Jaguar Auto Insurance Monthly Rates by Model and Coverage Level

| Jaguar Model | Minimum Coverage | Full Coverage |

|---|---|---|

| 2023 Jaguar F-PACE | $185 | $199 |

| 2023 Jaguar F-TYPE | $200 | $214 |

| 2023 Jaguar XE | $155 | $170 |

| 2023 Jaguar XF | $160 | $175 |

| 2023 Jaguar XJ | $173 | $188 |

A Jaguar F-Type model is the most expensive model to insure on average since it has the highest price tag of all the models listed. Auto insurance for models that cost less, such as the Jaguar XE and Jaguar XF, comes with cheaper average rates for full coverage. So, always compare auto insurance rates by make and model to get the cheapest Jaguar car insurance quotes at companies like Geico.

Since Jaguar model is just one of the many factors that affect auto insurance rates, we’ll also examine Jaguar insurance rates based on driving record and age:

Below, you can see average rates by different Jaguar models based on age and driving record:

Jaguar Auto Insurance Minimum Coverage Monthly Rates by Age

| Car Model | 16-Year-Old Rates | 20-Year-Old Rates | 40-Year-Old Rates | 60-Year-Old Rates |

|---|---|---|---|---|

| 2023 Jaguar F-PACE | $175 | $160 | $140 | $130 |

| 2023 Jaguar F-TYPE | $185 | $170 | $150 | $140 |

| 2023 Jaguar XE | $160 | $145 | $125 | $115 |

| 2023 Jaguar XF | $165 | $150 | $130 | $120 |

| 2023 Jaguar XJ | $170 | $155 | $135 | $125 |

It usually isn’t a surprise to most people that younger drivers pay more for a Jaguar auto insurance policy, as less driving experience means a higher likelihood of crashing. High-risk auto insurance for Jaguar drivers with DUIs, at-fault accidents, and traffic tickets is always more expensive, regardless of model.

Compare Jaguar Auto Insurance Rates by Model

Discovering the nuances of auto insurance costs for luxury vehicles like Jaguars can be complex. This guide focuses on the insurance expenses for two popular Jaguar models: the XF and the X-TYPE.

| Cost of Auto Insurance for Jaguar's by Model |

|---|

| Jaguar XF |

| Jaguar X-TYPE |

Understanding these insurance dynamics is essential for current and prospective Jaguar owners aiming to grasp the associated expenses accurately.

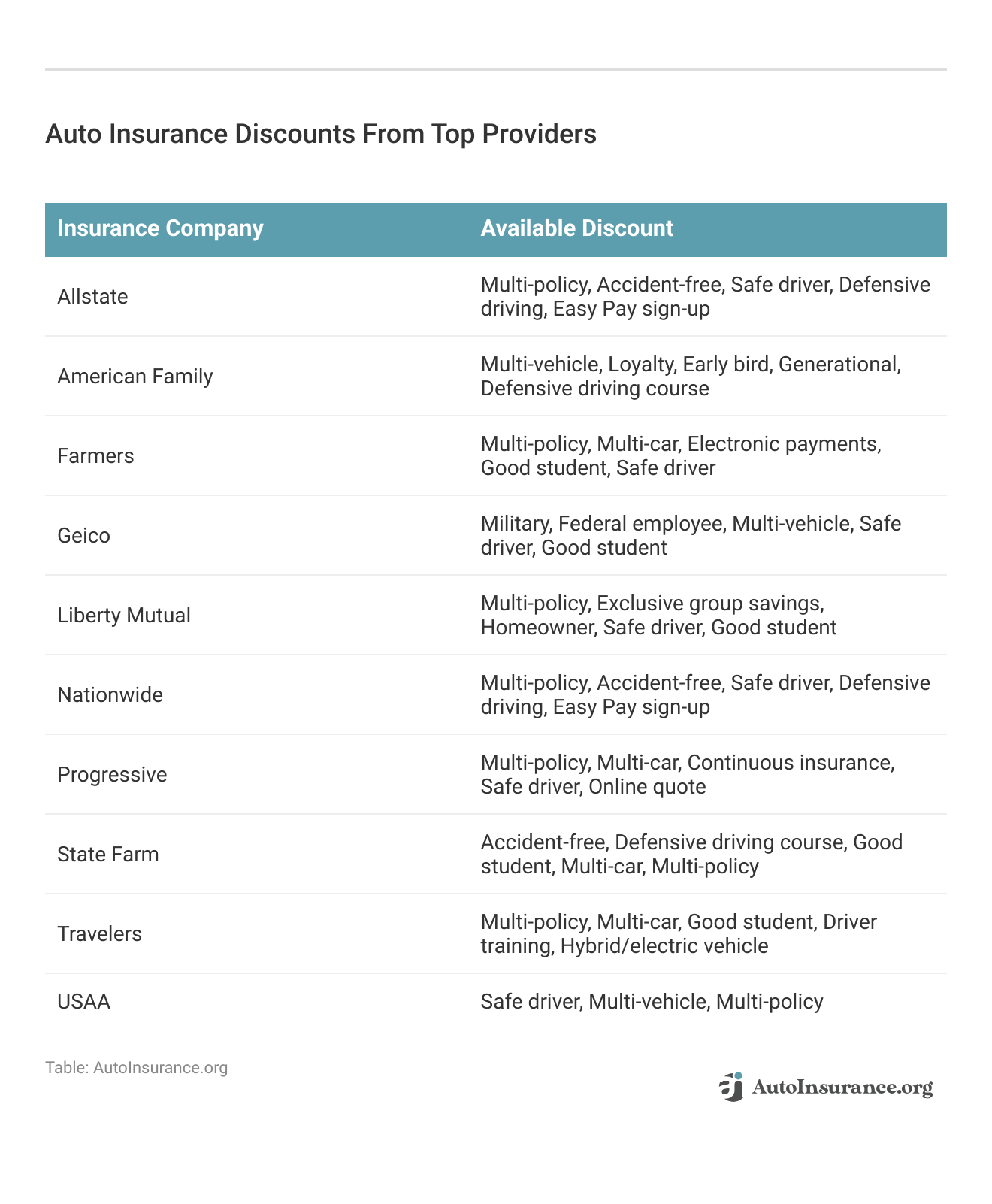

How to Save on Jaguar Auto Insurance

Since Jaguars are more expensive to insure, we’ll review a few tips on saving money on the best Jaguar auto insurance. The first tip is to shop around and get plenty of Jaguar auto insurance quotes to determine which company has the best rates based on your driving record, model, and location.

Our second tip is to utilize all available car insurance discounts at your company. You may need to submit paperwork or participate in a program for some discounts, meaning they don’t automatically apply to your Jaguar car insurance rates. Some examples include defensive driving, good student, and safe driving discounts.

Another big discount that most insurance companies offer is a bundling discount, where you earn a discount for purchasing more than one type of insurance from the company. Examples include bundling home and auto insurance or renters and auto insurance. Learn more about how to save money by bundling insurance policies.

Our final savings tip for lowering Jaguar insurance costs is raising your auto insurance deductible. Since a deductible is an amount, you agree to pay out of pocket before the insurance covers a claim, a higher deductible will help you get cheap Jaguar insurance. However, never increase your Jaguar auto insurance deductible to an amount you can’t afford.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Affordable Jaguar Auto Insurance Coverage

Jaguar luxury car insurance is more expensive on average than standard vehicles, and some models cost more to insure than others. Fortunately, you can reduce your rates by shopping around for cheap Jaguar auto insurance quotes, getting auto insurance discounts, and raising your deductible.

To find the best Jaguar insurance today, compare rates with our free quote tool.

Frequently Asked Questions

How much is insurance on Jaguars from 2017?

Insurance for Jaguars from 2017 will likely be cheaper than insurance for the new models we showed, as older cars are depreciated in value and, therefore, cost a little less to insure (learn more: Cheap Auto Insurance for Older Vehicles).

Are Jaguars expensive to insure?

Jaguars are more expensive to insure than other cars, since you’re paying for Jaguar luxury car insurance. How much you pay for insurance on a Jaguar also depends on your model, as Jaguar XJL car insurance will be different in cost than Jaguar XJ car insurance. Your choice of auto insurance company is also important, as some companies offer cheaper Jaguar insurance costs than others. Use our quote tool to compare rates.

Is auto insurance high on a Jaguar F-Pace?

On average, a full-coverage auto insurance policy for a Jaguar F Pace costs $199 monthly. Jaguar F Pace car insurance rates vary based on model year, driving record, age, and other factors.

Is auto insurance high on a Jaguar XF?

Jaguar XF car insurance costs $175 monthly on average, making it one of the more affordable Jaguar models to insure. However, you’ll need a Jaguar auto insurance quote to know exactly what you’ll pay.

How much are Jaguar F-Type auto insurance rates?

Jaguar F-Type insurance rates are $214 monthly on average, making it the highest of all Jaguar models. Compare Jaguar insurance costs to find better rates for your F-Type.

How much does Jaguar gap insurance cost?

It depends on what company you choose and many other factors. The only way to know for sure what gap insurance costs is to get quotes. Learn more about this coverage in our article: Guaranteed Auto Protection (Gap) Insurance.

How expensive is Jaguar XE auto insurance?

Jaguar XE car insurance costs an average of $170/mo for full coverage.

How much do Jaguars cost?

Most Jaguar models cost at least $50,000 to purchase, making them expensive exotic cars to insure (learn more: Auto Insurance for Exotic Vehicles).

Who has the absolute cheapest auto insurance for Jaguars?

Geico has the cheapest Jaguar car insurance price on average.

Who is cheaper Geico or Progressive?

Geico is cheaper on average than Progressive for those looking for Jaguar cheap insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.