Best Des Moines, Iowa Auto Insurance in 2026 (Check Out the Top 10 Companies)

For as low as $35 each month, you can get the best Des Moines, IA auto insurance from our top picks like State Farm, Geico, and Progressive. We'll show you how to leverage the capital city's unique advantages to secure budget-friendly protection without sacrificing quality coverage for your vehicle.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated January 2025

Company Facts

Full Coverage in Des Moines Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Des Moines Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Des Moines Iowa

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Geico, and Progressive are the top providers offering the best Des Moines, Iowa auto insurance premiums starting at $35 per month.

If you’re wondering, “Who are the reputable auto insurance companies in, Des Moines? No need to worry, our easy guide will show you the best options. We’ll help you find out which car insurance companies are trustworthy here, from big names to local ones.

Our Top 10 Company Picks: Best Des Moines, Iowa Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 17% B Customer Service State Farm

![]()

#2 25% A++ Affordable Rates Geico

![]()

#3 12% A+ Online Tools Progressive

![]()

#4 10% A+ Coverage Options Allstate

![]()

#5 10% A++ Military Members USAA

#6 10% A Unique Discounts Liberty Mutual

#7 20% A+ Coverage Variety Nationwide

![]()

#8 15% A Comprehensive Coverage Farmers

![]()

#9 13% A++ Flexible Policies Travelers

![]()

#10 15% A Family Benefits American Family

You will also learn about different coverage choices, discounts you can get, and what makes your insurance cost more or less in this busy city. Use our free comparison tool above to see what auto insurance quotes look like in your area.

- State Farm is the top auto insurance provider in Des Moines

- Des Moines is the capital and most populated city in Iowa

- Auto insurance in Des Moines, IA, is among the cheapest in the state

#1 – State Farm: Top Overall Pick

Pros

- Local Expertise: State Farm’s established presence in Des Moines, Iowa, ensures that its agents have significant local knowledge, enabling them to provide personalized advice and policies that consider regional driving conditions and risks.

- Economical Excellence: As outlined in State Farm auto insurance discounts, State Farm’s premium of $135 in Des Moines, Iowa, is notable for offering high-quality coverage at an economical price, making it an ideal option for budget-conscious drivers who do not wish to compromise on protection.

- Customized Coverage Options: State Farm provides a wide array of coverage choices in Des Moines, Iowa, allowing drivers to tailor their insurance to their specific needs, from liability to other coverage options, ensuring thorough protection on the road.

Cons

- Limited Discounts: Although State Farm offers robust coverage, its discount options in Des Moines, Iowa, are relatively limited, potentially restricting opportunities for additional savings on premiums.

- Premium Comparison: At $135, State Farm’s rate might be on the higher side for some drivers in Des Moines, Iowa, particularly those with less favorable driving records or financial profiles compared to other insurers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Affordable Rates

Pros

- Unbeatable Monthly Rate: As outlined in Geico auto insurance review, Geico’s $120 per month in Des Moines, Iowa, offers exceptional value, making it the most budget-friendly option while still delivering solid insurance coverage.

- Innovative Savings Opportunities: Geico’s diverse range of discounts in Des Moines, Iowa, including safe driver and multi-policy savings, provides numerous ways to reduce your premiums and maximize value.

- Online Convenience: Geico’s online platform simplifies managing your policy, making it easy for Des Moines, Iowa drivers to get quotes, make adjustments, and handle claims without needing to visit an office.

Cons

- Virtual Service Limitations: Geico’s focus on online and phone service may be less convenient for Des Moines, Iowa residents who prefer face-to-face interactions with local agents for personalized support.

- Service Satisfaction Variability: Some customers in Des Moines, Iowa, have noted issues with Geico’s customer service, which could impact your experience in managing claims and policy changes.

#3 – Progressive: Best for Online Tools

Pros

- Dynamic Coverage Solutions: As outlined in Progressive auto insurance review, Progressive’s $140 premium offers a wide range of coverage selections in Des Moines, Iowa, including unique features like Snapshot, which allows you to tailor your policy based on your driving habits.

- Customizable Policy Features: With an extensive array of add-ons and coverage options available in Des Moines, Iowa, Progressive enables drivers to create a policy that fits their specific needs and driving environment.

- Innovative Savings Tools: Progressive’s Snapshot program in Des Moines, Iowa, provides an opportunity to potentially lower your premium based on safe driving behaviors, adding an element of reward for cautious drivers.

Cons

- Increased Premium Potential: Progressive may increase rates in Des Moines, Iowa, based on driving history or periodic policy reviews, which could affect long-term affordability for some drivers.

- Premium Adjustments for Risk: Drivers in Des Moines, Iowa, with higher risk profiles might encounter higher premiums with Progressive, making it less advantageous for those with less favorable driving records.

#4 – Allstate: Best for Coverage Options

Pros

- Strong Financial Stability: As outlined in Allstate auto insurance review, Allstate’s strong financial stability ensures that they are capable of handling claims efficiently and reliably, providing peace of mind to policyholders.

- Discount Variety: Allstate offers a wide array of discounts in Des Moines, Iowa, such as bundling and safe driver discounts, which can help lower overall insurance costs for eligible drivers.

- Personalized Agent Service: With a strong local presence in Des Moines, Iowa, Allstate provides access to knowledgeable agents who can offer tailored advice and personalized support for your insurance needs.

Cons

- Premium Cost Considerations: Allstate’s $145 rate is relatively high compared to some competitors in Des Moines, Iowa, which may be a downside for drivers looking for more economical insurance options.

- Complex Policy Options: The extensive range of coverage options and add-ons offered by Allstate in Des Moines, Iowa, can be overwhelming, potentially making it difficult for some drivers to select the best policy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Members

Pros

- Exceptional Value Rate: As outlined in USAA auto insurance review, USAA’s $115 premium is the most cost-effective option in Des Moines, Iowa, providing outstanding value for military families and veterans with excellent coverage at a low cost.

- Top-Tier Customer Experience: Known for its exceptional customer support, USAA offers highly responsive support in Des Moines, Iowa, ensuring that policyholders receive prompt and effective assistance with claims and inquiries.

- Generous Savings Programs: USAA offers a range of discounts in Des Moines, Iowa, such as safe driver and multi-car discounts, which contribute to further reducing insurance premiums for eligible members.

Cons

- Eligibility Restrictions: USAA’s services are exclusively tailored to military families and veterans, effectively precluding a considerable segment of drivers in Des Moines, Iowa, from accessing the company’s superior service.

- Limited Physical Presence: USAA’s lack of local branches in Des Moines, Iowa, may be inconvenient for those who prefer face-to-face interactions with insurance representatives for managing their policies.

#6 – Liberty Mutual: Best for Unique Discounts

Pros

- Extensive Discount Options: As outlined in Liberty Mutual auto insurance review, Liberty Mutual provides a variety of discounts in Des Moines, Iowa, including bundling and safe driver incentives, which substantially reduce the overall insurance costs for qualifying drivers.

- Tailored Insurance Solutions: Liberty Mutual’s insurance policies available in Des Moines, Iowa, offer a high degree of customization, enabling policyholders to adjust their coverage to align with distinct requirements and preferences, thereby optimizing their overall insurance experience.

- Robust Regional Presence: Liberty Mutual maintains a strong foothold in Des Moines, Iowa, facilitating the provision of more tailored services and understanding of the area’s specific driving conditions and insurance regulations.

Cons

- Premiums on the Higher Side: Liberty Mutual’s $150 rate is among the highest in Des Moines, Iowa, which may not be ideal for those seeking the most affordable insurance options.

- Customer Feedback Variability: some drivers spoke of their dealings with Liberty Mutual. Their words were varied. Some found satisfaction, others did not. The way the company handled claims and customer service was the dividing line. It mattered.

#7 – Nationwide: Best for Coverage Variety

Pros

- Competitive Premium Structure: As outlined in Nationwide auto insurance review, Nationwide’s $137 monthly premium provides a balanced rate in Des Moines, Iowa, offering good value with a variety of coverage options to meet different driver needs.

- Diverse Discount Offerings: Nationwide’s range of discounts in Des Moines, Iowa, including safe driver and multi-policy discounts, can help reduce overall insurance costs and increase affordability.

- User-Friendly Mobile App: Nationwide offers a well-designed mobile app for policy management, claims tracking, and accessing digital ID cards, enhancing convenience and accessibility for customers in Des Moines, Iowa.

Cons

- Potential for Premium Increases: Nationwide might adjust premiums in Des Moines, Iowa, based on policy reviews or claims history, which could affect long-term cost predictability for drivers.

- Mixed Service Reviews: Customer feedback in Des Moines, Iowa, is mixed, with some drivers experiencing delays or issues with Nationwide’s claims processing and customer support.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Comprehensive Coverage

Pros

- Enhanced Customization: As outlined in Farmers auto insurance review, Farmers allows for extensive customization of policies in Des Moines, Iowa, enabling drivers to add specific coverage options and endorsements to tailor their insurance to unique personal needs.

- Variety of Savings Opportunities: Farmers provides numerous discount options in Des Moines, Iowa, such as bundling and safe driver discounts, which can significantly lower insurance premiums for eligible customers.

- Accessible Local Agents: Farmers’ presence in Des Moines, Iowa, ensures that drivers have access to knowledgeable local agents who can offer personalized assistance and support for their insurance needs.

Cons

- Higher Cost Premiums: Farmers’ $142 premium rate is relatively high compared to some competitors in Des Moines, Iowa, which might not be ideal for those seeking more budget-friendly insurance options.

- Inconsistent Customer Feedback: Some drivers in Des Moines, Iowa, have reported mixed experiences with Farmers’ customer assistance and claims handling, potentially affecting overall satisfaction.

#9 – Travelers: Best for Flexible Policies

Pros

- Affordable Insurance Rates: As outlined in Travelers auto insurance review, Travelers offers a competitive monthly rate of $130 in Des Moines, Iowa, delivering a cost-effective solution while providing solid coverage options for drivers.

- 24/7 Customer Support: Travelers provides 24/7 customer support in Des Moines, Iowa, ensuring that help is always available whenever you need assistance with your policy or claims.

- Discount Incentives: With several discount programs available in Des Moines, Iowa, such as safe driver and bundling discounts, Travelers helps drivers save on insurance premiums while maintaining quality coverage.

Cons

- Potential Higher Rates for High-Risk Drivers: Drivers with higher risk profiles in Des Moines, Iowa, may face elevated premiums with Travelers, which could be less advantageous for those with less favorable driving records.

- Limited Local Agent Network: Travelers may have fewer local agents in Des Moines, Iowa, compared to other providers, which could be a drawback for those preferring in-person support for their insurance needs.

#10 – American Family: Best for Family Benefits

Pros

- Flexible Payment Options: As outlined in American Family auto insurance review, American Family offers a range of payment plans, including monthly, quarterly, and annual options, giving policyholders the flexibility to choose a payment schedule that best fits their budget and financial situation.

- Generous Discount Programs: American Family provides a variety of discounts in Des Moines, Iowa, such as safe driver and multi-policy discounts, which help reduce overall insurance premiums for eligible customers.

- Personalized Local Service: With a strong presence in Des Moines, Iowa, American Family offers access to knowledgeable local agents who can provide tailored advice and support for your insurance needs.

Cons

- Higher Premium Costs: American Family’s $148 rate is on the higher side compared to some competitors in Des Moines, Iowa, which might be a disadvantage for those seeking more affordable insurance options.

- Different Customer Satisfaction: In Des Moines, Iowa, the feelings about American Family are a mixed bag. Some folks have run into trouble with how the company handles customer service and processes claims, and it shows in their satisfaction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Auto Insurance Companies in Des Moines, IA

We’ve gone through auto insurance quotes in Des Moines. These are the ones that provide you with the greatest value.

Des Moines, Iowa Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $145

American Family $57 $148

Farmers $52 $142

Geico $46 $120

Liberty Mutual $60 $150

Nationwide $42 $137

Progressive $50 $140

State Farm $39 $135

Travelers $48 $130

USAA $35 $115

Don’t forget to consider auto insurance deductibles when comparing policies. A higher deductible could lower your premium, but make sure it’s an amount you can comfortably afford if you need to file a claim.

Whether you’re driving down Grand Avenue or heading to the Capitol, we’ll point you to the providers with the best monthly rates and solid coverage.

Auto Insurance Coverage Required in Des Moines, IA

Iowa stands out as one of the few states without mandatory auto insurance. However, this doesn’t absolve drivers of financial responsibility. If you opt out of insurance, you must demonstrate the ability to cover costs associated with accidents you may cause.

These minimums below serve as a baseline for financial protection on Iowa roads, including in Des Moines. However, it’s worth noting that while these limits satisfy legal requirements, they may not provide comprehensive protection in all accident scenarios.

- $20,000 per person and $40,000 per incident for bodily injury liability

- $15,000 per incident for property damage

For the best Des Moines, IA auto insurance, consider whether these minimums adequately protect your assets. Many drivers opt for higher coverage limits to ensure more robust financial security in the event of a serious accident.

Whether you’re commuting on I-235 or exploring the East Village, don’t let high premiums slow you down. Dive into these discount options and uncover hidden savings.

Des Moines residents aiming to reduce their auto insurance expenses can benefit from a valuable resource offered by local insurance providers: discount programs. These often overlooked savings opportunities have the potential to significantly lower monthly premium costs.

It’s crucial to understand that insurance rates are influenced by various factors. Geographic location within Des Moines plays a key role in determining premiums. Each neighborhood’s unique characteristics, including traffic density, accident rates, and crime statistics, contribute to its risk profile from an insurer’s perspective.

Young drivers often face higher premiums due to their perceived risk, while middle-aged drivers typically enjoy more favorable rates. Senior drivers may see rates increase again as insurers adjust for age-related risk factors.

Typically, drivers with higher credit scores are offered lower insurance premiums, as they are statistically less likely to file claims. Conversely, those with lower credit scores may face higher rates. See the breakdown below:

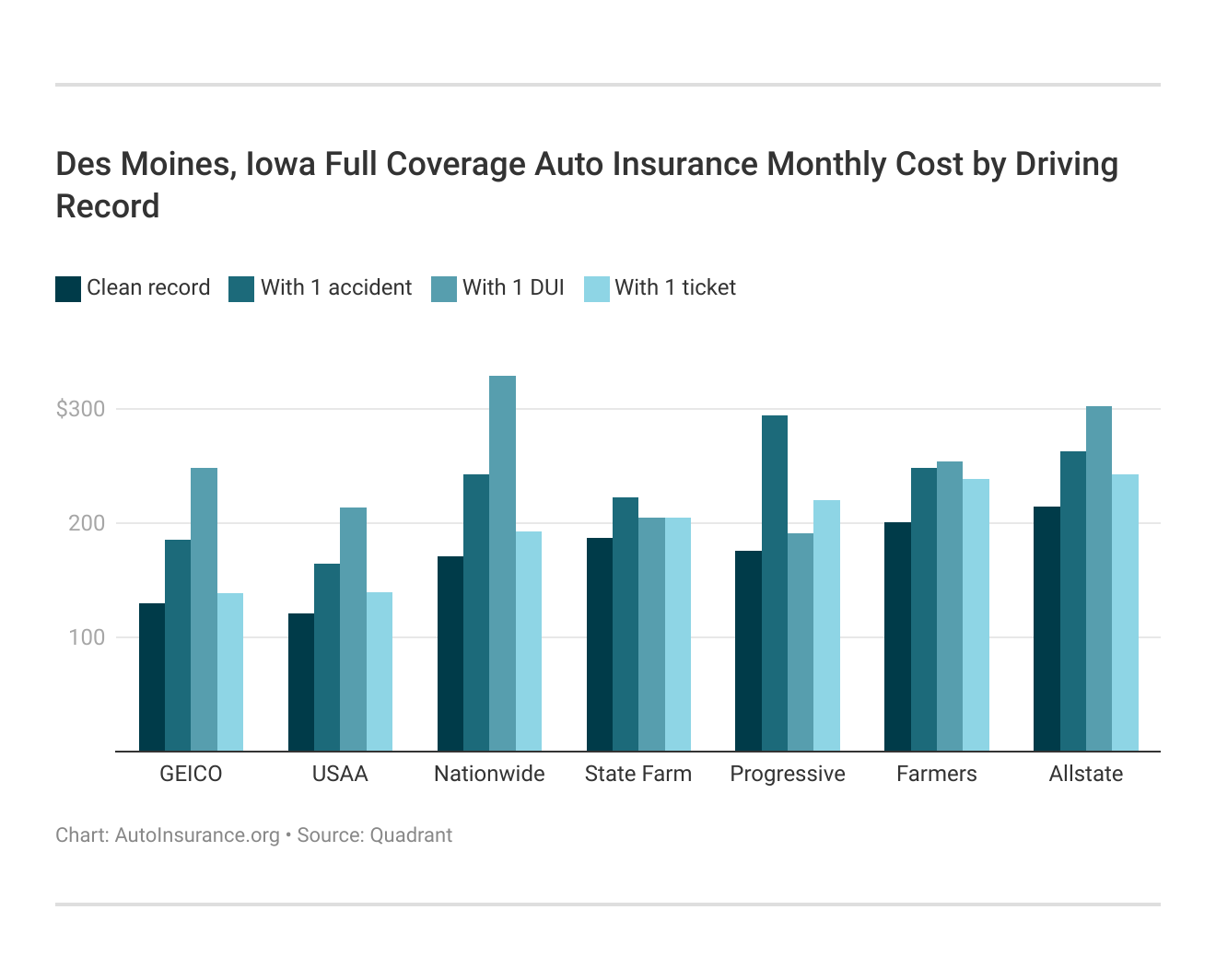

Driving record is a critical factor in determining car insurance rates in Des Moines, IA. Insurers view your driving history as a strong indicator of future risk, which directly impacts your premiums. Discover the most affordable car insurance rates in Des Moines, IA, based on your credit score:

Knowing how your driving record affects your car insurance rates can help you make smarter choices when it comes to finding the right coverage in Des Moines, IA. Check out different rates to find the best deal that fits your needs.

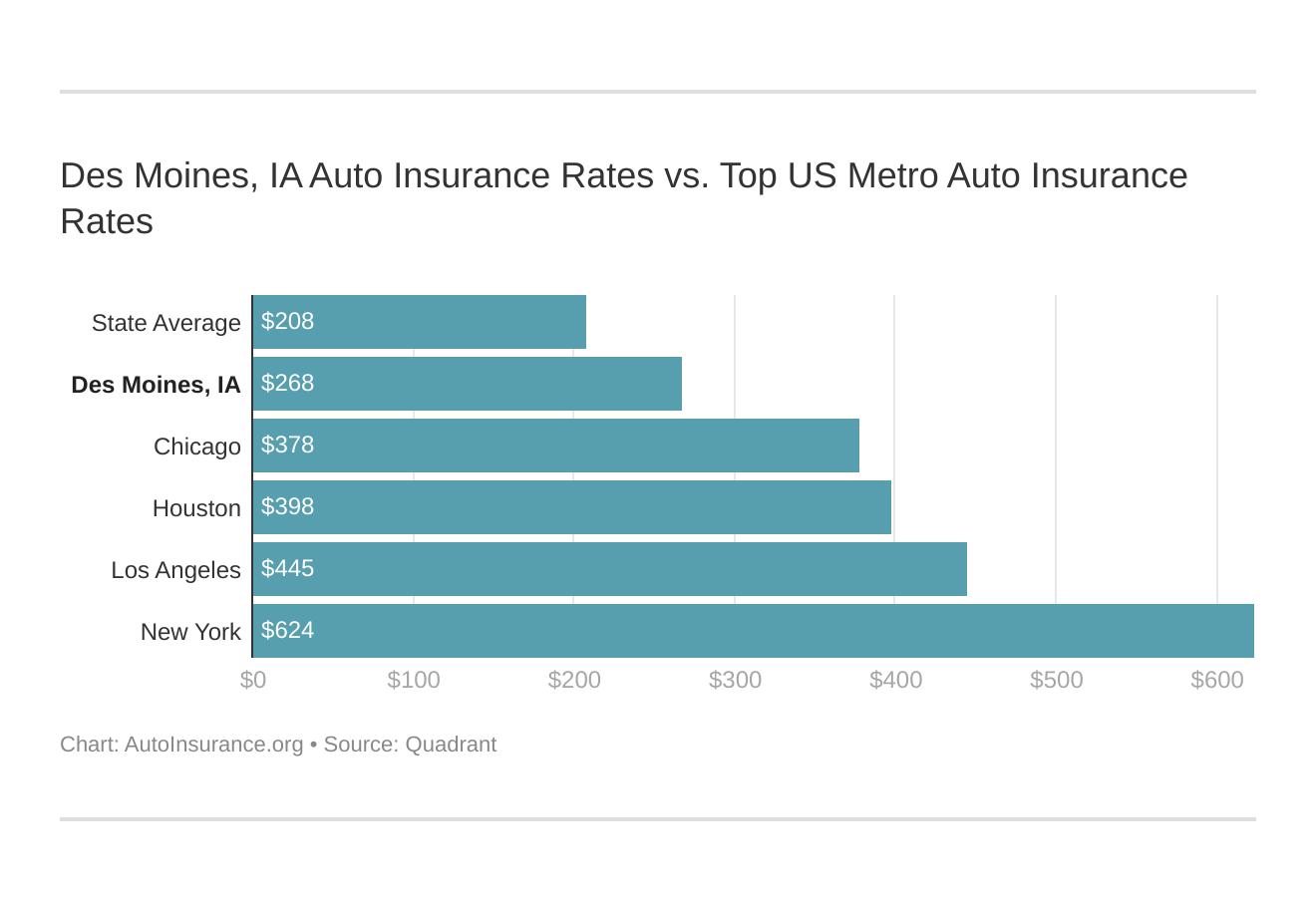

Comparing Des Moines Car Insurance Rates to Top US Metro Car Insurance Rates

This comparison of Des Moines auto insurance rates with other major U.S. metropolitan areas provides valuable context for local drivers. It offers insight into how Des Moines’ insurance market compares on a national scale, potentially highlighting the city’s relative affordability or expense.

This data can serve as a powerful tool for Des Moines drivers in negotiations with insurance providers. It enables residents to make informed decisions about coverage levels, deductibles, and potential relocation impacts on their insurance costs.

Factors such as traffic density, accident rates, and cost of living can influence insurance premiums across different cities.Jeffrey Manola LICENSED INSURANCE AGENT

By understanding how Des Moines stacks up against other cities, drivers can more effectively advocate for fair rates and optimal coverage in their pursuit of the best Des Moines, IA auto insurance.

Read More: Los Angeles, CA Auto Insurance

Key Factors Influencing Auto Insurance Rates in Des Moines,

Des Moines’ traffic situation is relatively favorable, ranking 196th in congestion among U.S. cities, with average commute times of 25 minutes or less. This lower traffic density potentially leads to reduced insurance rates due to decreased accident risk.

However, the city’s auto theft rate of one theft per 172 residents could increase premiums, especially for comprehensive coverage. For those looking for cheap auto insurance in Des Moines, Iowa, it’s important to compare auto insurance rates from multiple providers to find the most competitive offers that balance cost with adequate protection.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

What factors can affect my auto insurance premiums?

Several factors can influence your auto insurance premiums, including your driving history, age, location, type of vehicle, coverage levels, and credit score.

How does my deductible affect my insurance premium?

Generally, a higher deductible leads to a lower insurance premium, while a lower deductible results in a higher premium. Choosing a deductible amount is about finding the right balance between out-of-pocket expenses and monthly premiums.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

What types of coverage should I consider for my auto insurance policy?

It’s essential to consider liability coverage, which is typically required by law, to protect against damages or injuries you may cause to others. Additionally, comprehensive and collision coverage can help protect your own vehicle from damage due to accidents, theft, or natural disasters.

Are there any discounts available to lower my insurance costs?

Yes, many insurance companies offer various discounts. Common discounts include safe driver discounts, bundling multiple policies, good student discounts, and discounts for installing safety devices in your vehicle.

What should I do if I’m involved in an accident?

If you’re involved in an accident, ensure everyone’s safety, exchange insurance information with the other party, and report the incident to your insurance company promptly. They will guide you through the claims process and help handle any necessary repairs or medical expenses.

Read More: How long after a car accident can you file a claim?

Is it cheaper to pay auto insurance annually or monthly in Des Moines, IA?

Paying your auto insurance annually can be cheaper, as many car insurance companies in Des Moines, IA, offer discounts for full upfront payments. Comparing auto insurance quotes in Des Moines, IA, can help you decide between annual and monthly payments.

What is the best auto insurance coverage for new drivers in Des Moines, IA?

New drivers should consider comprehensive coverage, including liability and collision, from the best car insurance in Des Moines. To find cheap car insurance in Des Moines, Iowa, compare car insurance quotes in Des Moines and consider safe driving discounts.

How can I lower my auto insurance premium in Des Moines, IA?

Lowering your premium may involve raising deductibles, maintaining a good credit score, or bundling policies. To find cheap car insurance in Des Moines, compare auto insurance quotes in Des Moines, IA, and ask about available discounts.

What should I know about uninsured motorist coverage in Des Moines, IA?

Uninsured motorist coverage protects against accidents with uninsured drivers. While not required in Iowa, it’s recommended by many car insurance companies in Des Moines, IA. Compare car insurance quotes in Des Moines to see how this coverage affects your rate.

Read More: How many drivers don’t have auto insurance?

Are there discounts for electric or hybrid vehicles in Des Moines, IA?

Yes, discounts for electric or hybrid vehicles are available from many car insurance companies in Des Moines, IA. To find cheap car insurance in Des Moines, compare quotes to see which providers offer the best rates for these vehicles.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.