Best Hot Springs, Arkansas Auto Insurance in 2026 (Top 10 Companies Ranked)

The best Hot Springs, Arkansas auto insurance, USAA, Allstate, and Geico offer rates starting at just $37 per month. These top three providers excel in affordability, excellent customer service, and comprehensive coverage, ensuring they are the best options for quality auto insurance in Hot Springs, Arkansas.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific car insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. She also specializes in sustai...

Melanie Musson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Hot Springs AR

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Hot Springs AR

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Hot Springs AR

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best Hot Springs, Arkansas auto insurance providers are USAA, Allstate, and Geico. These companies stand out for offering competitive rates and excellent insurance coverage options in the area.

USAA leads with its unmatched service for military families, while Allstate and Geico provide robust policies that cater to various needs and budgets.

Our Top 10 Company Picks: Best Hot Springs, Arkansas Auto Insurance

| Company | Rank | Low Mileage Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% | A++ | Military Savings | USAA | |

| #2 | 7% | A+ | Add-on Coverages | Allstate | |

| #3 | 10% | A++ | Competitive Rates | Geico | |

| #4 | 6% | A+ | Good Drivers | Progressive | |

| #5 | 15% | A | Discount Availability | American Family | |

| #6 | 12% | A++ | Bundling Policies | Travelers | |

| #7 | 9% | B | Teen Discounts | State Farm | |

| #8 | 6% | A+ | Vanishing Deductible | Nationwide |

| #9 | 8% | A | Safe-Driving Discounts | Liberty Mutual |

| #10 | 10% | A+ | Exclusive Benefits | The Hartford |

This article explores why these three insurers excel and how they compare in terms of affordability and value for Hot Springs residents.

Before you buy Hot Springs, Arkansas auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Hot Springs, Arkansas auto insurance quotes.

- USAA is the top pick for Hot Springs, Arkansas auto insurance at $105/month

- Tailored policies provide the best Hot Springs, Arkansas auto insurance coverage

- Competitive pricing ensures top value for Hot Springs, Arkansas auto insurance

#1 – USAA: Top Overall Pick

Pros

- Military Savings: Based on our USAA auto insurance review, the company offers significant savings for military members, making it a top option for the best Hot Springs, Arkansas auto insurance if you qualify.

- Comprehensive Coverage: USAA provides extensive coverage options tailored to the unique needs of military families, enhancing its appeal as the best Hot Springs, Arkansas auto insurance.

- Competitive Rates: USAA offers competitive rates, which can contribute to finding the best Hot Springs, Arkansas auto insurance.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, which may restrict access for those seeking the best Hot Springs, Arkansas auto insurance who are not eligible.

- Limited Optional Coverages: Compared to other providers, USAA may have fewer optional coverages, potentially impacting customization for the best Hot Springs, Arkansas auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Add-on Coverages

Pros

- Add-On Coverages: Allstate excels in offering a range of add-on coverages, making it a strong contender for the best Hot Springs, Arkansas auto insurance.

- Extensive Network: Allstate’s broad network of agents and service providers ensures accessible support for the best Hot Springs, Arkansas auto insurance.

- Strong Customer Service: As per our Allstate auto insurance review, they are known for reliable customer service, enhancing its reputation as a provider of the best Hot Springs, Arkansas auto insurance.

Cons

- Higher Premiums: Allstate’s premiums can be higher, which might affect its affordability as the best Hot Springs, Arkansas auto insurance option.

- Inconsistent Claims Processing: Customer satisfaction with claims processing can be variable, which may impact the overall experience with the best Hot Springs, Arkansas auto insurance.

#3 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates, making it a strong choice for the best Hot Springs, Arkansas auto insurance.

- Innovative Tools: Geico provides useful online tools and resources, making it easier to manage and find the best Hot Springs, Arkansas auto insurance. Unlock details in our Geico auto insurance review.

- Robust Coverage Options: Geico offers a range of coverage options that can cater to different needs, enhancing its appeal as the best Hot Springs, Arkansas auto insurance.

Cons

- Limited Local Agents: Geico’s reliance on online and phone services may not be ideal for those seeking face-to-face support for the best Hot Springs, Arkansas auto insurance.

- Customer Service Issues: Some users report less satisfactory customer service experiences, which could affect its ranking for the best Hot Springs, Arkansas auto insurance

#4 – Progressive: Best for Good Drivers

Pros

- Good Drivers Discount: Progressive offers discounts for drivers with clean records, which can make it a favorable option for the best Hot Springs, Arkansas auto insurance. See more details on our Progressive auto insurance review.

- Customizable Coverage: Progressive provides customizable coverage options, allowing for a tailored policy that suits individual needs for the best Hot Springs, Arkansas auto insurance.

- Convenient Online Services: Progressive’s online tools and resources make it easier to manage your policy, enhancing the convenience of securing the best Hot Springs, Arkansas auto insurance.

Cons

- Rate Increases: Premiums can increase after policy renewal, which might affect long-term affordability for the best Hot Springs, Arkansas auto insurance.

- Complex Pricing Structure: The pricing structure can be complex, potentially making it challenging to understand costs for the best Hot Springs, Arkansas auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Discount Availability

Pros

- Discount Variety: American Family offers a range of discounts, including those for bundling policies, which can contribute to finding the best Hot Springs, Arkansas auto insurance.

- Comprehensive Coverage Options: American Family provides a broad selection of coverage options, allowing for a well-rounded policy suitable for the best Hot Springs, Arkansas auto insurance.

- Customer Satisfaction: According to our American Family auto insurance review, the company is known for good customer satisfaction, which enhances its standing as the best Hot Springs, Arkansas auto insurance provider.

Cons

- Higher Premiums: American Family’s premiums may be higher compared to some competitors, impacting its overall affordability for the best Hot Springs, Arkansas auto insurance.

- Regional Variability: The availability of coverage and discounts can vary by state, which might limit American Family’s appeal as the best Hot Springs, Arkansas auto insurance for some customers.

#6 – Travelers: Best for Bundling Policies

Pros

- Bundling Policies: Travelers offers significant savings through bundling home and auto insurance, making it a strong option for the best Hot Springs, Arkansas auto insurance.

- Exclusive Benefits: Travelers provides unique benefits and perks, which can enhance the value of the best Hot Springs, Arkansas auto insurance. Learn more in our Travelers auto insurance review.

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, ensuring a comprehensive policy for the best Hot Springs, Arkansas auto insurance.

Cons

- Premium Variability: Rates can vary widely based on location and individual factors, which might affect consistency as the best Hot Springs, Arkansas auto insurance.

- Customer Service Challenges: Some customers have reported issues with customer service, which could impact the perception of the best Hot Springs, Arkansas auto insurance.

#7 – State Farm: Best for Teen Discounts

Pros

- Teen Discounts: State Farm offers discounts for teen drivers, making it an appealing choice for families seeking the best Hot Springs, Arkansas auto insurance.

- Local Agent Availability: State Farm’s network of local agents provides personalized service, enhancing the experience of finding the best Hot Springs, Arkansas auto insurance. Detailed information can be found in our State Farm auto insurance review.

- Wide Range of Coverage Options: State Farm offers a variety of coverage options, which can help in securing the best Hot Springs, Arkansas auto insurance tailored to specific needs.

Cons

- Limited Discount Variety: The range of available discounts might not be as extensive as those from other insurers, affecting its competitiveness for the best Hot Springs, Arkansas auto insurance.

- Potentially Higher Premiums: Insurance costs could be higher for some drivers, impacting its overall affordability as the best Hot Springs, Arkansas auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program can reduce deductibles over time, which is a valuable feature for those seeking the best Hot Springs, Arkansas auto insurance.

- Comprehensive Coverage Options: Nationwide offers a wide array of coverage options, making it a strong contender for the best Hot Springs, Arkansas auto insurance.

- User-Friendly Online Tools: In line with our Nationwide auto insurance review, they provide convenient online tools for managing policies, enhancing the overall experience for the best Hot Springs, Arkansas auto insurance.

Cons

- Limited Optional Coverages: Nationwide may have fewer optional coverages compared to some competitors, which might impact the customization of the best Hot Springs, Arkansas auto insurance.

- Premium Variability: Insurance rates can fluctuate based on various factors, which might affect Nationwide’s consistency as the best Hot Springs, Arkansas auto insurance provider.

#9 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Liberty Mutual provides discounts for safe driving, which can enhance its appeal as a provider of the best Hot Springs, Arkansas auto insurance.

- Unique Coverage Options: Liberty Mutual auto insurance review offers unique coverage options, making it a distinctive choice for those seeking the best Hot Springs, Arkansas auto insurance.

- Comprehensive Policy Choices: Liberty Mutual offers a variety of policy choices, catering to different needs and preferences for the best Hot Springs, Arkansas auto insurance.

Cons

- Higher Premiums: Premiums with Liberty Mutual can be higher compared to some competitors, which might affect its affordability as the best Hot Springs, Arkansas auto insurance.

- Customer Support Issues: Some customers have reported challenges with customer support, which could impact the overall satisfaction with the best Hot Springs, Arkansas auto insurance.

#10 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford offers exclusive benefits and perks, making it a top choice for the best Hot Springs, Arkansas auto insurance.

- Competitive Rates: The Hartford is known for providing competitive insurance rates, enhancing its value as the best Hot Springs, Arkansas auto insurance provider.

- Comprehensive Coverage: As outlined by our The Hartford auto insurance review, the company provides a broad range of coverage options, contributing to its appeal as the best Hot Springs, Arkansas auto insurance.

Cons

- Higher Premiums for Some: Rates might be higher for certain driver profiles, which could impact its overall appeal for the best Hot Springs, Arkansas auto insurance.

- Limited Discount Variety: The Hartford may offer fewer discount options compared to other insurers, affecting its standing as the best Hot Springs, Arkansas auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in Hot Springs, Arkansas

In Hot Springs, Arkansas, drivers must meet state-mandated minimum auto insurance requirements to ensure financial responsibility in case of an accident. These regulations mandate coverage for both bodily injury and property damage to safeguard all parties involved.

To comply with state laws, Hot Springs drivers must have liability insurance with minimum coverage limits of $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. Meeting these minimum auto insurance requirements ensures compliance with state regulations and protects against financial risks in the event of an accident.

USAA consistently delivers top-rated service and affordable rates, making it the best choice for comprehensive car insurance.Brandon Frady Licensed Insurance Producer

This essential coverage not only satisfies legal standards but also offers vital protection, providing peace of mind as you drive through Hot Springs.

Hot Springs, Arkansas Auto Insurance Monthly Rates by Providers & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $46 | $110 |

| American Family | $44 | $120 |

| Geico | $42 | $115 |

| Liberty Mutual | $50 | $130 |

| Nationwide | $45 | $125 |

| Progressive | $41 | $116 |

| State Farm | $47 | $123 |

| The Hartford | $52 | $135 |

| Travelers | $44 | $122 |

| USAA | $37 | $105 |

The table outlines monthly auto insurance rates for Hot Springs, Arkansas, showing costs for minimum and full coverage. Minimum coverage ranges from $37 with USAA to $52 with The Hartford, while full coverage spans from $105 with USAA to $135 with The Hartford. The comparison includes prominent insurers, offering a clear view of the price differences for various coverage levels.

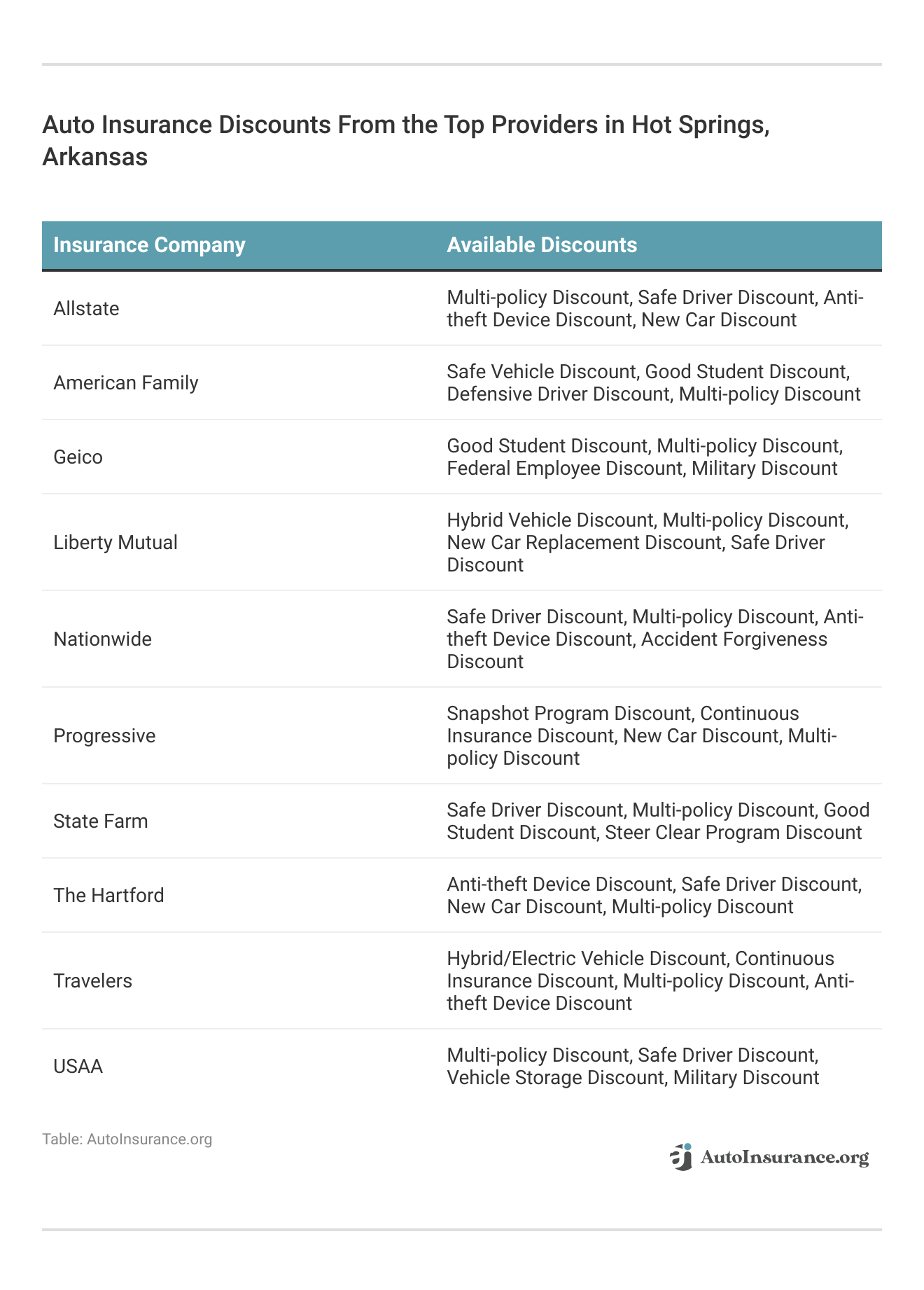

Discover the range of discounts available from top auto insurance companies in Hot Springs, Arkansas. From safe driver and multi-policy discounts to unique offers like hybrid vehicle savings, explore how each provider stacks up to give you the best deals on your auto insurance.

Cheap Hot Springs, Arkansas Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Hot Springs, Arkansas, vary significantly based on age, gender, and marital status. Here’s a breakdown of annual insurance costs across different demographics and providers, highlighting how these factors impact insurance premiums.

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $246 | $247 | $221 | $236 | $932 | $1,121 | $270 | $292 |

| Farmers | $204 | $202 | $182 | $191 | $887 | $921 | $234 | $246 |

| Geico | $220 | $217 | $202 | $197 | $598 | $597 | $218 | $221 |

| Liberty Mutual | $205 | $220 | $194 | $216 | $724 | $798 | $222 | $234 |

| Nationwide | $232 | $236 | $208 | $220 | $570 | $726 | $266 | $287 |

| Progressive | $242 | $227 | $199 | $209 | $1,069 | $1,203 | $289 | $314 |

| State Farm | $159 | $159 | $144 | $144 | $481 | $603 | $179 | $206 |

| Travelers | $1,101 | $1,772 | $197 | $225 | $184 | $187 | $183 | $183 |

| USAA | $378 | $395 | $152 | $164 | $118 | $119 | $109 | $110 |

Knowing how age, gender, and marital status affect auto insurance premiums in Hot Springs, Arkansas, can help one make some informed decisions about his or her coverage. Comparing the yearly premiums of various companies may help someone who wants to purchase a policy that suits a particular demographic profile best.

Recognizing the difference can lead you to more cost-effective and customized insurance plans, whether you’re single and young or married.

Cheap Hot Springs, Arkansas Auto Insurance for Teen Drivers

Securing affordable auto insurance for teen drivers in Hot Springs, Arkansas, can be tough. However, some insurance companies offer notably lower rates for young drivers. In Hot Springs, the best options for cheap teen auto insurance include USAA, State Farm, and Geico, with annual rates as low as $4,530 for a 17-year-old female with USAA. For a more detailed breakdown, here are the annual rates by insurance company:

Hot Springs, Arkansas Teen Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $246 | $247 |

| Farmers | $204 | $202 |

| Geico | $220 | $217 |

| Liberty Mutual | $205 | $220 |

| Nationwide | $232 | $236 |

| Progressive | $242 | $227 |

| State Farm | $159 | $159 |

| Travelers | $1,101 | $1,772 |

| USAA | $378 | $395 |

Finding affordable auto insurance for teen drivers in Hot Springs, Arkansas, is crucial for managing costs while ensuring coverage. As highlighted, USAA, State Farm, and Geico offer the most competitive rates for young drivers.

By choosing one of these providers, you can secure cost-effective insurance while meeting your teen’s needs. Learn more by reading our guide titled “Best Auto Insurance by Age.”

Cheap Hot Springs, Arkansas Auto Insurance for Seniors

Finding budget-friendly auto insurance as a senior in Hot Springs, Arkansas is easier than you think. The most competitive options ensure you get the best value while maintaining coverage that meets your needs. Take a look at the annual average rates for older drivers.

Hot Springs, Arkansas Senior Auto Insurance Monthly Rates by Provider & Gender

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $270 | $292 |

| Farmers | $234 | $246 |

| Geico | $218 | $221 |

| Liberty Mutual | $222 | $234 |

| Nationwide | $266 | $287 |

| Progressive | $289 | $314 |

| State Farm | $179 | $206 |

| Travelers | $183 | $183 |

| USAA | $109 | $110 |

Navigating auto insurance for seniors in Hot Springs, Arkansas, can be surprisingly affordable. With annual premiums ranging from $1,312 to $2,830, there are plenty of options to suit both your budget and coverage needs. By exploring these top picks, you’ll find great value without sacrificing quality. Choose the right policy to ensure safety and savings, making each journey more worry-free.

Cheap Hot Springs, Arkansas Auto Insurance By Driving Record

Your driving record significantly influences your auto insurance rates. For instance, in Hot Springs, Arkansas, insurance premiums for drivers with a bad record can be substantially higher than those for individuals with a clean record.

Hot Springs, Arkansas Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $365 | $462 | $516 | $439 |

| Farmers | $324 | $416 | $406 | $388 |

| Geico | $211 | $322 | $476 | $227 |

| Liberty Mutual | $240 | $389 | $456 | $322 |

| Nationwide | $267 | $345 | $467 | $294 |

| Progressive | $403 | $565 | $424 | $483 |

| State Farm | $237 | $282 | $259 | $259 |

| Travelers | $422 | $436 | $640 | $518 |

| USAA | $148 | $188 | $272 | $164 |

Maintaining a clean driving record is essential for securing the lowest rates in Hot Springs, as insurance costs rise markedly with each blemish. Understanding how insurance companies assess driving records can help you manage your rates effectively.

To find the best rates, prioritize safe driving and regularly compare quotes from various providers.

Cheap Hot Springs, Arkansas Auto Insurance Rates After a DUI

Securing affordable auto insurance in Hot Springs, Arkansas, after a DUI can be challenging. To help, we’ve compared annual DUI auto insurance rates from various companies. Here are the rates:

Hot Springs, Arkansas DUI Auto Insurance Monthly Rates by Provider

| Insurance Company | One DUI |

|---|---|

| Allstate | $516 |

| Farmers | $406 |

| Geico | $476 |

| Liberty Mutual | $456 |

| Nationwide | $467 |

| Progressive | $424 |

| State Farm | $259 |

| Travelers | $640 |

| USAA | $272 |

Finding cheap auto insurance in Hot Springs, Arkansas, after a DUI doesn’t have to be difficult. State Farm and USAA offer the best rates for competitive pricing that doesn’t skimp on protection. These top picks provide excellent value and dependable coverage, helping you recover from a DUI while keeping costs manageable.

Explore the following options for getting you back on the road with peace of mind, at a better rate.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Hot Springs, Arkansas Auto Insurance By Credit History

In Hot Springs, Arkansas, your credit score plays a crucial role in determining your auto insurance rates. Drivers with poor credit often face higher premiums, while those with better credit scores benefit from lower rates.

For example, USAA offers some of the lowest annual premiums in the area, charging $3,068 for drivers with poor credit and $1,784 for those with good credit. State Farm and Liberty Mutual also offer competitive rates, making them strong contenders for cost-conscious consumers. By comparing these options, you can secure the best insurance deal that aligns with your credit profile.

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $559 | $429 | $348 |

| Farmers | $435 | $366 | $349 |

| Geico | $370 | $304 | $252 |

| Liberty Mutual | $509 | $306 | $240 |

| Nationwide | $405 | $326 | $298 |

| Progressive | $528 | $454 | $424 |

| State Farm | $376 | $226 | $176 |

| Travelers | $577 | $483 | $452 |

| USAA | $256 | $175 | $149 |

These numbers reflect just how much higher insurance costs can be based on credit score differences.

All options are offered below to consider finding the cheap auto insurance that applies uniquely to your situation, based on your credit score.

Cheap Hot Springs, Arkansas Auto Insurance Rates By ZIP Code

Auto insurance rates by ZIP code in Hot Springs, Arkansas can vary. Compare the annual cost of auto insurance by ZIP code in Hot Springs, Arkansas to see how car insurance rates are affected by location.

| ZIP Code | Monthly Rates |

|---|---|

| 71901 | $371 |

| 71913 | $371 |

By comparing auto insurance rates across different ZIP codes in Hot Springs, Arkansas, you can make an informed decision and potentially save on your insurance premium. Understanding these variations ensures you choose the most cost-effective coverage for your area.

Cheap Hot Springs, Arkansas Auto Insurance Rates By Commute

Commute length and annual mileage affect Hot Springs, Arkansas auto insurance. Find the cheapest annual Hot Springs, Arkansas auto insurance by commute length.

Hot Springs, Arkansas Auto Insurance Monthly Rates by Provider & Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $445 | $445 |

| Farmers | $383 | $383 |

| Geico | $306 | $311 |

| Liberty Mutual | $352 | $352 |

| Nationwide | $343 | $343 |

| Progressive | $469 | $469 |

| State Farm | $253 | $266 |

| Travelers | $504 | $504 |

| USAA | $188 | $198 |

To wrap it up, the quest of acquiring the lowest-priced car insurance in Hot Springs, Arkansas, must involve the matching of your commute to the right policy.

When minimal miles are put on your vehicle, you cannot go wrong with most USAA years, though the daily number might be 10 or 25. Embrace the savings by aligning your insurance with your driving habits and drive confidently knowing you’ve snagged a great deal.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheap Hot Springs, Arkansas Auto Insurance Rates By Coverage Level

Auto insurance rates in Hot Springs, Arkansas, vary significantly depending on the coverage level you choose. To help you find the best rates, we’ve compared annual auto insurance costs across different coverage levels from top insurers. The following explanation will outline how coverage impacts the cost:

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $296 | $309 | $459 |

| Farmers | $341 | $350 | $408 |

| Geico | $344 | $336 | $322 |

| Liberty Mutual | $426 | $460 | $364 |

| Nationwide | $245 | $259 | $349 |

| Progressive | $477 | $505 | $521 |

| State Farm | $185 | $192 | $274 |

| Travelers | $477 | $505 | $530 |

| USAA | $185 | $192 | $201 |

Compare annual rates of auto insurance based on different levels of insurance coverage in Hot Springs, Arkansas, and make an informed decision that balances coverage needs with your budget.

Whether you’re seeking the most affordable option or comprehensive protection, knowing these rates helps you choose the best insurance provider for your situation.

Best By Category: Cheapest Auto Insurance in Hot Springs, Arkansas

For drivers in Hot Springs, Arkansas, finding affordable auto insurance can be simplified by comparing the best rates in each category. This guide highlights the cheapest auto insurance providers based on specific driver profiles.

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | State Farm |

| With 1 Speeding Violation | USAA |

Finding the right auto insurance in Hot Springs, Arkansas, can make all the difference in keeping your insurance premiums low while getting the coverage you need. Whether you’re a young driver, a seasoned veteran, or someone with a few traffic blemishes, focusing on companies that offer tailored rates for your specific situation can save you money.

By choosing wisely based on your unique driving profile, you can drive confidently, knowing you’re getting the best value for your insurance dollar.

The Cheapest Hot Springs, Arkansas Auto Insurance Companies

When searching for affordable auto insurance providers in Hot Springs, Arkansas, finding the best rates is crucial. The following companies offer some of the most competitive annual premiums for auto insurance in the area:

Average Annual Auto Insurance Rates by Company in Hot Springs, Arkansas

| Insurance Company | Average Annual Rates |

|---|---|

| Allstate | $5,345 |

| Farmers | $4,599 |

| Geico | $3,706 |

| Liberty Mutual | $4,220 |

| Nationwide | $4,115 |

| Progressive | $5,626 |

| State Farm | $3,111 |

| Travelers | $6,047 |

| USAA | $2,315 |

By comparing these average annual rates, you can identify the most cost-effective auto insurance providers in Hot Springs, Arkansas. USAA stands out as the cheapest option, followed by State Farm and Geico. Choosing the right insurance company can lead to significant savings, so consider these rates to make an informed decision on your coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What affects auto insurance rates in Hot Springs, Arkansas

Auto insurance rates in Hot Springs, Arkansas, can fluctuate due to a blend of local factors that set them apart from other cities. From the dynamics of traffic patterns to the prevalence of vehicle theft, various elements shape the insurance landscape in this charming city.

A common concern is whether auto insurance covers vehicle theft. By exploring these factors and understanding coverage options, you can better manage your insurance costs.

Hot Springs Commute Time

In many cases, longer commute times can drive up auto insurance rates as extended driving periods increase the risk of accidents. However, Hot Springs offers a different story. With an average commute of just 17.8 minutes, according to City-Data, residents benefit from shorter travel times, which can help keep insurance rates more affordable compared to regions with longer commutes.

This relatively quick drive contributes to lower risk exposure and potentially lower insurance premiums for Hot Springs drivers.

Compare Hot Springs, Arkansas Auto Insurance Quotes

Don’t settle for just any auto insurance policy. Take a minute and shop rate comparisons from some of Hot Springs, Arkansas’ top insurance companies to find the perfect coverage that fits both your needs and budget.

USAA stands out for its exceptional customer service and competitive pricing, making it the premier option for reliable car insurance coverage.Justin Wright Licensed Insurance Agent

You only need to enter your ZIP code below to get no-obligation quotes tailored specifically for you from a number of providers so that you’ll know how much you can save on your auto insurance.

Frequently Asked Questions

What are the best auto insurance companies in Hot Springs, Arkansas?

The best auto insurance companies in Hot Springs, Arkansas, typically offer competitive rates and comprehensive coverage options. Companies such as Geico, State Farm, and Progressive are often highlighted for their affordability and quality of service in the area.

What factors influence the cost of auto insurance in Hot Springs, Arkansas?

The cost of auto insurance in Hot Springs, Arkansas, is influenced by factors such as your driving record, age, type of vehicle, coverage levels, and your credit history. Additionally, local risk factors and insurance company rates also play a significant role in determining premiums.

To learn more, explore our comprehensive resource on “Best Auto Insurance by Vehicle Type.”

Why is auto insurance expensive in Hot Springs, Arkansas?

Auto insurance in Hot Springs is costly due to high traffic fatality rates, averaging $4,768 for full coverage and $1,291 for minimum coverage. Comparing quotes can help you find the best Hot Springs, Arkansas auto insurance.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

What age is car insurance most expensive in Hot Springs, Arkansas?

In Hot Springs, Arkansas, car insurance is most expensive for drivers aged 16 to 24. This age group faces higher premiums due to inexperience and a higher risk of accidents. To find the best Hot Springs auto insurance rates for young drivers, compare quotes and seek age-related discounts.

Are there any discounts available for auto insurance in Hot Springs, Arkansas?

Yes, many auto insurance companies in Hot Springs, Arkansas, offer discounts for safe driving, bundling policies, having anti-theft devices, and maintaining good credit. Check with your insurance provider to find out which discounts you may qualify for.

To find out more, explore our guide titled, “How to Save Money by Bundling Insurance Policies.”

How often should I review my auto insurance policy in Hot Springs, Arkansas?

It’s a good idea to review your auto insurance policy in Hot Springs, Arkansas, at least once a year or whenever there are significant changes in your life, such as moving, buying a new vehicle, or changing your driving habits. Regular reviews ensure that your coverage remains adequate and cost-effective.

How can I find the best Hot Springs, Arkansas auto insurance rates?

To find the best Hot Springs, Arkansas auto insurance rates, compare quotes from multiple insurers. Utilize online comparison tools, check customer reviews, and consider factors like coverage options, discounts, and customer service to identify the most cost-effective and reliable insurance provider.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

How do I choose the best auto insurance coverage for my needs in Hot Springs, Arkansas?

To choose the best auto insurance coverage in Hot Springs, Arkansas, assess your specific needs and budget. Consider the level of coverage you require, such as liability, collision, and comprehensive coverage, and compare policies from top insurers to find the best fit.

For additional details, explore our comprehensive resource titled, “Types of Auto Insurance.”

Can I get affordable auto insurance in Hot Springs, Arkansas, with a poor driving record?

Yes, you can still find affordable auto insurance in Hot Springs, Arkansas, even with a poor driving record. Some insurers specialize in high-risk policies and offer tailored coverage options. It’s important to compare quotes and consider insurers known for working with drivers with less-than-perfect records.

Which car insurance is required in Arkansas?

As a resident of Arkansas, there are two types of liability coverage your insurance policy must include: property damage and bodily injury. Property damage safeguards your assets if you are found legally responsible for a covered accident.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.