Best Auto Insurance for Hungry Howie’s Pizza Delivery Drivers in 2026 (Compare the Top 10 Companies)

If you're looking for the best auto insurance for Hungry Howie’s Pizza delivery drivers, check out our top three favorites, which are Nationwide, USAA, and Geico, with plans starting at just $65/month. To drive for Hungry Howie's, ensure state insurance requirements and consider commercial coverage for delivery.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Feature Writer

Aremu Adams Adebisi graduated from college with a B.Sc in Economics. He's currently pursuing his MBA while writing insurance features covering trending topics in the car insurance industry. He's fascinated by the surges of insurtech in an era of decentralized finance (DeFi). Aremu has written for several insurance agencies and companies. He profiles startups on Insideropedia and serves as a con...

Aremu Adams Adebisi

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated December 2024

Company Facts

Full Coverage for Hungry Howies Pizza Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hungry Howies Pizza Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Hungry Howies Pizza Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

The coverage for best auto insurance for Hungry Howie’s Pizza delivery drivers begins at only $65/month from top providers such as Nationwide, USAA, and Geico. If you’re a Hungry Howie’s Pizza delivery driver, finding the right auto insurance can be as challenging as picking the perfect pizza toppings

Our guide simplifies the process by highlighting the best insurance options tailored for delivery drivers, including how to meet state requirements and select the top coverage for your needs.

Our Top 10 Company Picks: Best Auto Insurance for Hungry Howie's Pizza Delivery Drivers

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 9% A+ Accident Forgiveness Nationwide

#2 8% A++ Military Savings USAA

#3 10% A++ Cost Savings Geico

#4 6% A Loyalty Discounts American Family

#5 8% A++ Specialized Coverage Travelers

#6 7% A+ Local Agents Allstate

#7 9% B Personalized Policies State Farm

#8 11% A+ Loyalty Rewards Progressive

#9 8% A Safe Drivers Farmers

#10 9% A 24/7 Support Liberty Mutual

Wondering if your job affects auto insurance rates? Keep reading and discover everything you need to make informed, savvy insurance choices while on the road. Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- Hungry Howie’s Pizza doesn’t offer commercial auto insurance

- Nationwide is the top insurer for Hungry Howie’s Pizza delivery drivers

- Personal policies often exclude business-related accidents

#1 – Nationwide: Top Overall Pick

Pros

- Delivery-Focused Accident Forgiveness: Hungry Howie’s Pizza delivery drivers benefit from Nationwide’s specialized accident forgiveness program, which prevents rate increases after a first at-fault accident during delivery runs, crucial for those frequently navigating busy streets. Explore our in-depth Nationwide auto insurance review for more insights.

- Pizza-Thermal Bag Coverage: Nationwide provides specialized add-ons for Hungry Howie’s drivers, such as coverage for expensive pizza-thermal bags and other delivery equipment, protecting against theft or damage during shifts.

- Delivery Route Optimization: Hungry Howie’s Pizza delivery drivers can utilize Nationwide’s advanced mobile app features for route optimization, helping reduce mileage and potentially lowering usage-based insurance costs.

Cons

- Peak Hour Penalty: Some Hungry Howie’s drivers report higher premiums for frequent driving during peak pizza delivery hours (evenings and weekends), despite these being prime money-making times.

- Tip Income Protection Gaps: Hungry Howie’s drivers might discover that Nationwide’s policies don’t adequately cover loss of tip income during delivery downtime caused by accidents or vehicle repairs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Pizza Delivery Perks: Hungry Howie’s Pizza delivery drivers with military backgrounds can access USAA’s exclusive discounts tailored for service members delivering food, recognizing their unique schedules and commitments. Uncover the full details in our USAA auto insurance review.

- Base-to-Pizzeria Coverage: USAA offers seamless coverage for Hungry Howie’s drivers transitioning from on-base duties to off-base pizza delivery work, a common scenario for active duty members supplementing income.

- Veteran-to-Pizza-Driver Transition Support: USAA provides specialized insurance guidance for veterans transitioning to civilian life as Hungry Howie’s Pizza delivery drivers, easing the shift to gig economy work.

Cons

- Overseas Base Delivery Gaps: USAA’s coverage may have limitations for Hungry Howie’s drivers delivering to overseas military bases, creating potential gaps for those serving military communities abroad.

- Limited Pizza Franchise Recognition: Some Hungry Howie’s Pizza delivery drivers report that USAA’s policies don’t always recognize the specific needs of smaller pizza franchises compared to larger chains.

#3 – Geico: Best for Cost Savings

Pros

- Pizza-Scent-Based Discounts: Hungry Howie’s Pizza delivery drivers can access Geico’s unique olfactory-based discount program, which rewards drivers whose vehicles maintain a fresh pizza aroma, indicating frequent deliveries and driving experience.

- Dough-Timer Integration: Geico’s mobile app integrates with Hungry Howie’s pizza preparation timers, optimizing insurance coverage activation to match precise delivery windows and reducing overall costs for drivers. Find out more in our thorough Geico auto insurance review.

- Pizza-Pun Policy Perks: Hungry Howie’s drivers can earn additional discounts by engaging with Geico’s pizza-pun-based safe driving reminder system, making policy management both fun and relevant to their work.

Cons

- Mozzarella-Mileage Limitations: Some Hungry Howie’s Pizza delivery drivers report strict mileage limitations based on cheese usage, potentially penalizing drivers for stores with higher-than-average cheese consumption on pizzas.

- Sauce-Spill Surcharges: Hungry Howie’s Pizza delivery drivers face potential surcharges for sauce spills in their vehicles, with Geico’s policies often classifying these as high-risk interior damage events.

#4 – American Family: Best for Loyalty Discounts

Pros

- Flavored-Crust Fidelity Program: Hungry Howie’s Pizza delivery drivers earn loyalty points with American Family based on the variety of flavored crusts delivered, encouraging diverse order fulfillment and safe driving across menu options. Get all the facts in our American Family auto insurance review.

- Pizza-Party Protection: Delivery drivers benefit from American Family’s unique coverage extension for large orders to pizza parties, accounting for the increased risks associated with high-value, high-pressure deliveries.

- Hungry Howie’s Uniform Discount: American Family offers special rate reductions for Hungry Howie’s Pizza delivery drivers who consistently wear branded uniforms, promoting company visibility and professional appearance.

Cons

- Calzone Confusion Clause: American Family’s policies may have coverage gaps for Hungry Howie’s Pizza delivery drivers when delivering calzones, as these items fall into a gray area between pizza and sandwich classifications.

- Limited Cold-Item Coverage: Hungry Howie’s Pizza delivery drivers may find American Family’s policies lack comprehensive coverage for incidents involving cold items like salads or desserts, focusing primarily on hot pizza deliveries.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Travelers: Best for Specialized Coverage

Pros

- Multi-Franchise Flexibility: Hungry Howie’s Pizza delivery drivers who also work for other chains benefit from Travelers’ seamless multi-franchise coverage, ideal for drivers maximizing earnings across pizza brands. Dive deeper into our Travelers auto insurance review for a full understanding of their offerings for more information.

- Pizza-Preservation Protection: Travelers offers unique coverage for Hungry Howie’s drivers using advanced pizza-preservation techniques, insuring against risks associated with experimental heat retention methods.

- Traffic-Jam Temperature Compensation: Travelers provides special compensation for Hungry Howie’s Pizza delivery drivers facing extended delays due to traffic, covering potential losses from temperature-sensitive deliveries.

Cons

- Dough-Stretch Downtime: Travelers’ policies might not adequately cover income loss during vehicle downtime for Hungry Howie’s drivers, particularly problematic during high-demand “dough-stretch” promotional periods.

- Limited Beverage-Spill Buffers: Hungry Howie’s delivery drivers could find Travelers’ coverage lacking for incidents involving spilled beverages, a common risk when delivering complete meal combos.

#6 – Allstate: Best for Local Agents

Pros

- Neighborhood Pizza-Route Expertise: Hungry Howie’s Pizza delivery drivers benefit from Allstate’s local agents’ deep understanding of neighborhood-specific delivery risks, optimizing coverage for familiar routes. Check out our extensive Allstate auto insurance review for additional details.

- Hot-Bag Malfunction Coverage: Allstate offers specialized coverage for incidents resulting from malfunctioning hot bags, a crucial tool for Hungry Howie’s drivers in maintaining pizza quality during delivery.

- Delivery-Zone Defender Discount: Hungry Howie’s Pizza delivery drivers receive premium reductions for consistently serving challenging delivery zones, recognizing their expertise in navigating difficult areas.

Cons

- Topping-Weight Technicalities: Policies could include complex restrictions based on pizza topping weights, complicating coverage for Hungry Howie’s drivers delivering heavily loaded specialty pizzas.

- Limited Pizza-Pun Protection: Hungry Howie’s delivery drivers might find Allstate’s policies lack coverage for customer complaints arising from overuse of pizza puns, a unique risk in the fun, pun-loving Hungry Howie’s culture.

#7 – State Farm: Best for Personalized Policies

Pros

- Delivery-Time Defender: Hungry Howie’s drivers benefit from State Farm’s innovative coverage that protects against claims related to delivery time guarantees, prioritizing safety over speed. Learn all about it in our State Farm auto insurance review.

- Topping-Weight Watchers: Hungry Howie’s Pizza delivery drivers enjoy flexible coverage that adapts to varying vehicle weights due to fluctuating pizza topping trends, ensuring accurate risk assessment.

- Slice-And-Dice Defense: State Farm offers specialized legal defense coverage for Hungry Howie’s drivers facing unusual claims related to pizza cutting techniques or slice distribution disputes.

Cons

- Cheese-Stretch Chargeback: Hungry Howie’s delivery drivers might face unique deductibles for incidents involving Hungry Howie’s extra-stretchy cheese, classified by State Farm as a specialized risk factor.

- Crust-Clock Constraints: State Farm’s coverage may adhere strictly to Hungry Howie’s promised delivery times, potentially reducing protection for drivers who prioritize safe driving over meeting aggressive crust-freshness guarantees.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Progressive: Best for Loyalty Rewards

Pros

- Flavor-Fusion Flexibility: Hungry Howie’s Pizza delivery drivers benefit from Progressive’s adaptive coverage that adjusts to Hungry Howie’s rotating flavored-crust options, ensuring protection aligns with menu innovations. See our comprehensive Progressive auto insurance review for further information.

- Decibel-Based Discounts: Progressive offers unique discounts for Hungry Howie’s drivers based on vehicle noise levels, rewarding those who maintain quiet, well-maintained delivery vehicles.

- Topping-Tornado Coverage: Progressive provides specialized protection for Hungry Howie’s Pizza delivery drivers against topping displacement during sharp turns, a common issue with heavily loaded specialty pizzas.

Cons

- Limited Uniform-Stain Liability: Progressive’s policies may not adequately cover uniform replacement costs for Hungry Howie’s drivers, a frequent expense due to sauce spills and grease stains inherent in pizza delivery.

- Mileage-to-Marinara Metrics: Hungry Howie’s Pizza delivery drivers could face complex coverage terms based on Progressive’s unique “mileage-to-marinara” ratio, potentially complicating insurance for drivers in areas with varying sauce preferences.

#9 – Farmers: Best for Safe Drivers

Pros

- Crust-Crisis Coverage: Farmers offers Hungry Howie’s Pizza delivery drivers unique protection against customer disputes arising from rare crust preparation issues, safeguarding drivers from liability in these specialized scenarios. Gain more knowledge in our complete Farmers auto insurance review.

- Flavor-Forecast Flexibility: Farmers provides adaptive policies for Hungry Howie’s delivery drivers that adjust coverage based on predicted flavor popularity, ensuring optimal protection during limited-time offering rushes.

- Dough-Toss Disability Coverage: Farmers offers specialized income protection for Hungry Howie’s Pizza delivery drivers who may face temporary inability to work due to dough-tossing related injuries, a unique occupational hazard.

Cons

- Aroma-Based Assessments: Farmers’ policy pricing for Hungry Howie’s drivers might include controversial olfactory evaluations, potentially leading to higher premiums for vehicles with persistent pizza aromas.

- Limited Late-Night Liability: Hungry Howie’s delivery drivers working peak late-night hours could find Farmers’ coverage reduced during these high-risk periods, despite being crucial earning times.

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- Crust-Customization Calculator: Liberty Mutual offers Hungry Howie’s Pizza delivery drivers a unique policy pricing tool that factors in the complexity of flavored crust options, ensuring coverage matches the specific risks of Hungry Howie’s signature offering. Learn more in Liberty Mutual auto insurance review page.

- Topping-Weight Telemetrics: Hungry Howie’s drivers benefit from Liberty Mutual’s advanced telematics that adjust coverage on-the-fly based on the varying weights of specialty pizzas, accounting for everything from light veggie toppings to hefty meat lovers.

- Pizza-Pun Performance Bonuses: Liberty Mutual rewards Hungry Howie’s Pizza delivery drivers who effectively use the brand’s signature puns during customer interactions, viewing it as a sign of engagement and reduced delivery risk.

Cons

- Limited Breakfast-Pizza Protection: Liberty Mutual’s policies may have coverage gaps for Hungry Howie’s Pizza delivery drivers during early morning hours, failing to account for the unique risks associated with breakfast pizza deliveries.

- Garlic-Knot Navigation Penalties: Hungry Howie’s delivery drivers might face surcharges for routes frequently featuring garlic knot orders, as Liberty Mutual’s algorithms classify the irresistible aroma as a potential driver distraction.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Needs for Hungry Howie’s Pizza Delivery Drivers Explained

The amount of liability coverage you need as a delivery driver depends on where you live. Different states have different liability requirements, so you will need to familiarize yourself with the limits in your state and ensure any insurance policy you purchase meets or exceeds those limits.

Hungry Howie's Pizza Delivery Driver Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $70 $175

American Family $68 $173

Farmers $72 $180

Geico $66 $170

Liberty Mutual $75 $182

Nationwide $68 $165

Progressive $70 $178

State Farm $71 $176

Travelers $69 $174

USAA $65 $168

The table below shows each state’s car insurance coverage requirements for bodily injury liability per person, bodily injury liability per accident, and property damage liability.

Liability Auto Insurance Requirements by State

State Requirement

Alabama 25/50/25

Alaska 50/100/25

Arizona 15/30/10

Arkansas 25/50/25

California 15/30/5

Colorado 25/50/15

Connecticut 25/50/20

Deleware 25/50/10

District of Columbia 25/50/10

Florida 10/20/10

Georgia 25/50/25

Hawaii 20/40/10

Idaho 25/50/15

Illinois 25/50/20

Indiana 25/50/25

Iowa 20/40/15

Kansas 25/50/25

Kentucky 25/50/25

Lousiana 15/30/25

Maine 50/100/25

Maryland 30/60/15

Massachusetts 20/40/5

Michigan 20/40/10

Minnesota 30/60/10

Mississippi 25/50/25

Missouri 25/50/25

Montana 25/50/20

Nebraska 25/50/25

Nevada 25/50/20

New Hampshire 25/50/25

New Jersey 15/30/5

New Mexico 25/50/10

New York 25/50/10

North Carolina 30/60/25

North Dakota 25/50/25

Ohio 25/50/25

Oklahoma 25/50/25

Oregon 25/50/20

Pennsylvania 15/30/5

Rhode Island 25/50/25

South Carolina 25/50/25

South Dakota 25/50/25

Tennessee 25/50/15

Texas 30/60/25

Utah 25/65/15

Vermont 25/50/10

Virginia 25/50/20

Washington 25/50/10

West Virginia 25/50/25

Wisconsin 25/50/10

Wyoming 25/50/20

Insurance companies will remind you of your legal requirements based on where you live and will not let you purchase coverage that falls short of meeting those requirements. But it is still your responsibility to ensure you carry the proper coverage before getting behind the wheel.

If you have auto insurance now but aren’t sure what your coverage limits are, you should review your policy.

Hungry Howie’s Approach to Auto Insurance for Delivery Drivers

Hungry Howie’s does not provide commercial coverage to its delivery drivers when they are on the clock. Instead, all delivery drivers must purchase their own auto insurance coverage.

But you don’t have to carry much auto insurance to work for Hungry Howie’s. In fact, the only requirements you have to meet to be a Hungry Howie’s delivery driver include the following:

- Be 18 years of age or older

- Have a valid U.S. driver’s license

- Carry auto insurance that meets your state’s liability requirements

While it’s a good idea to carry more than your state’s minimum liability requirements, you do not have to do so to get a job as a delivery driver.

Liability Coverage for Hungry Howie’s Pizza Delivery Drivers

A personal insurance policy that only includes liability coverage is the cheapest policy you can purchase. But rates for liability insurance coverage are still likely to vary based on many factors, including the following:

- Age and driving record

- Delivery vehicle’s make and model

- ZIP code

- Credit score

- Aggressive driving or difficult delivery routes

You can expect reasonable insurance rates if you do not pose much risk to an insurance provider. But if a company senses that your driving habits or lifestyle could increase your likelihood of being in an accident, your insurance costs will likely be higher than average.

The table below shows average yearly car insurance rates for liability coverage, comprehensive coverage, and collision coverage, as well as the cost of a full coverage policy that combines the three coverage types into one policy.

Auto Insurance Monthly Rates by State & Coverage Type

State Liability Collision Comprehensive Full Coverage

Alabama $35 $27 $13 $75

Alaska $47 $30 $12 $89

Arizona $45 $23 $16 $84

Arkansas $34 $27 $16 $78

California $42 $34 $8 $84

Colorado $45 $24 $15 $85

Connecticut $57 $31 $11 $99

Delaware $67 $27 $10 $104

Florida $74 $24 $10 $108

Georgia $50 $28 $13 $91

Hawaii $39 $26 $9 $73

Idaho $31 $19 $10 $59

Illinois $38 $26 $11 $75

Indiana $33 $21 $10 $64

Iowa $26 $19 $16 $60

Kansas $30 $22 $20 $73

Kentucky $45 $23 $12 $80

Louisiana $68 $35 $18 $121

Maine $29 $22 $8 $60

Maryland $53 $30 $13 $95

Massachusetts $51 $33 $11 $95

Michigan $68 $35 $13 $116

Minnesota $38 $20 $15 $73

Mississippi $39 $27 $18 $84

Missouri $36 $23 $15 $75

Montana $33 $22 $19 $74

Nebraska $31 $20 $19 $71

Nevada $60 $26 $10 $95

New Hampshire $34 $25 $9 $68

New Jersey $75 $32 $11 $117

New Mexico $43 $23 $15 $80

New York $69 $33 $14 $115

North Carolina $30 $25 $11 $65

North Dakota $25 $21 $20 $65

Ohio $34 $23 $10 $67

Oklahoma $39 $27 $19 $85

Oregon $51 $19 $8 $78

Pennsylvania $42 $28 $12 $82

Rhode Island $66 $35 $11 $111

South Carolina $46 $22 $15 $84

South Dakota $26 $18 $22 $65

Tennessee $36 $26 $12 $74

Texas $46 $32 $17 $95

Utah $43 $22 $9 $74

Vermont $30 $25 $11 $66

Virginia $36 $24 $12 $72

Washington $51 $22 $9 $82

Washington, D.C. $55 $39 $19 $114

West Virginia $42 $28 $17 $87

Wisconsin $32 $19 $12 $62

Wyoming $28 $23 $21 $73

You can see by the rates that a liability-only policy offers cheaper rates. But a full coverage policy provides more in terms of protection.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Hungry Howie’s Pizza Delivery Drivers With Full Insurance Coverage

Full coverage policies are perfect for a personal policy. Still, it’s up to your insurance company whether a full coverage policy will benefit you as a delivery driver.

Many insurance companies do not allow someone’s personal insurance policy to cross over into business use.Justin Wright LICENSED INSURANCE AGENT

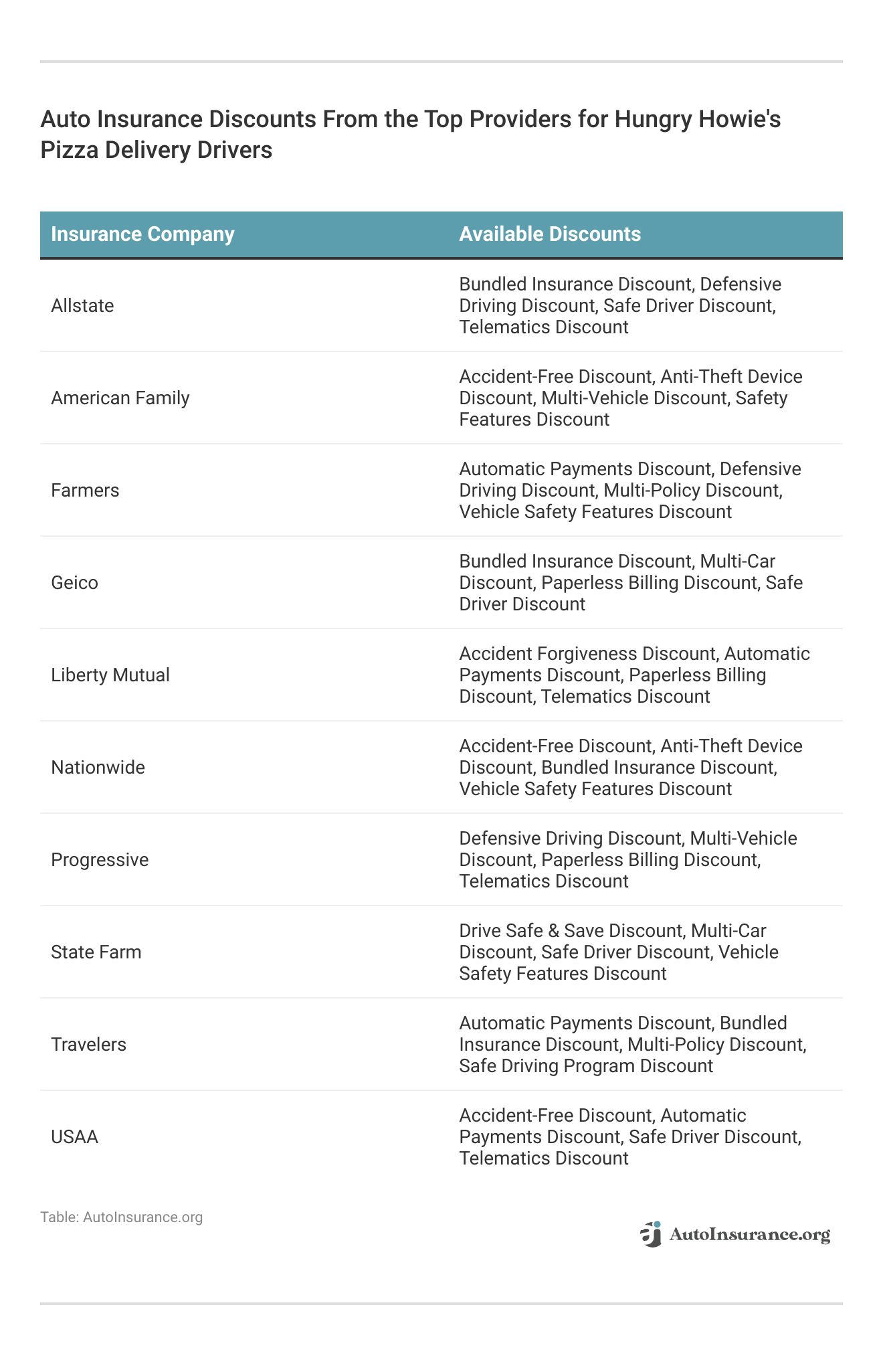

If you are driving your personal vehicle for work purposes — like when you’re delivering a Hungry Howie’s pizza — and you get in an accident, your insurance might not cover the damages. Take a look at the table below for some ideas on auto insurance discounts options from the top companies.

If your personal insurance policy does not extend to business use, you may have to purchase a commercial insurance policy. You could also see if your insurance provider offers add-ons for work coverage.

Read More: Best Commercial General Liability Insurance

Commercial Auto Insurance for Hungry Howie’s Pizza Delivery Drivers

Commercial car insurance is a type of insurance policy designed to cover vehicles used by or for a business. The primary purpose of a commercial car insurance policy is to protect the driver against liability for any damages that occur during an accident.

Most businesses purchase commercial car insurance policies to cover a fleet of vehicles. An example of this practice is Amazon Prime vehicles driven by delivery personnel. But people can purchase commercial car insurance on personal vehicles if they use those vehicles for business purposes.

While a commercial insurance policy is a great way to protect yourself in an accident, commercial car insurance is not cheap. A commercial car insurance policy can cost anywhere from $1,500 to $10,000 annually, depending on your vehicle type and the nature of your business. Because the cost of commercial auto insurance can be so high, many people look into other options through their current providers.

Read More: Compare Auto Insurance Rates by Vehicle Make and Model

Business Use Add-Ons

Some insurance companies allow individuals to purchase add-ons for their personal policies, so they are covered even when driving their car for work purposes. However, many companies have restrictions for this type of coverage, such as the maximum number of hours you can use your vehicle for business in a week and still be covered.

But a business use add-on might be a great coverage option if you are a part-time delivery driver and don’t want to spend too much money on car insurance. If you’re interested in this type of coverage, you can call your insurance company and speak to a representative to see if you qualify.

Hungry Howie’s Car Insurance: The Bottom Line

If you drive for Hungry Howie’s, you must carry liability coverage. It’s a good idea to purchase additional coverage to ensure you’re covered in a car accident.

With Nationwide’s SavingsWatch, we’ll tell you when we have new savings accounts or better rates.

You need to be 16 or over with an e-mail address and have a current account, savings account or mortgage with us. To register visit https://t.co/3EhnQxQATz. T&Cs apply. pic.twitter.com/ZsdgwXcva4

— Nationwide (@AskNationwide) February 12, 2024

Anyone using their car for work may need more than a personal auto insurance policy. You can speak to a representative with your current insurance provider to see your options and determine how much it would cost to add different coverages to your policy or purchase a commercial policy for your personal vehicle.

Read More: How to Find Auto Insurance Agents in Your Area

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

What insurance options are available for delivery drivers working at Hungry Howie’s?

Hungry Howies delivery drivers should have comprehensive insurance that covers both personal and commercial use. Options include a personal auto policy with a business-use rider, delivery insurance, or a specialized delivery vehicle insurance policy. Some companies provide tailored auto insurance for delivery drivers that ensures coverage during deliveries.

Does Hungry Howie’s Pizza offer any auto insurance policy for its delivery drivers?

No, Hungry Howies delivery policy does not include auto insurance for its drivers. Delivery drivers must secure their own coverage, which may include standard auto insurance or food delivery insurance to cover the specific risks associated with delivering food.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

What is the age requirement to become a delivery driver at Hungry Howie’s?

The Hungry Howie’s age requirement for delivery drivers typically starts at 18 years old. However, some locations may require drivers to be older due to state insurance laws or company policies. (Click here for Auto Insurance Rates by Age)

What type of auto insurance do delivery drivers for Hungry Howie’s need?

Delivery drivers for Hungry Howie’s generally need auto insurance for food delivery or commercial auto insurance. These policies provide coverage beyond a standard personal policy, protecting against accidents and liabilities while making deliveries.

Is personal auto insurance sufficient for Hungry Howie’s delivery drivers?

In most cases, a standard personal auto insurance policy does not cover delivery-related activities. Does car insurance cover delivery drivers? Typically, no. Drivers should consider either a commercial auto policy or an add-on that specifically includes delivery coverage.

What is the best auto insurance for delivery drivers, including those at Hungry Howie’s?

The best car insurance for delivery drivers includes companies like Nationwide, USAA, and Geico, which offer policies starting around $65/month. These companies provide tailored insurance for delivery drivers to cover the unique risks associated with delivery work. Read our article titled “Best Auto Insurance When You Drive for Work” for more information.

Are there specific insurance policies for part-time delivery drivers at Hungry Howie’s?

Yes, there are part-time driver insurance policies available for those who deliver less frequently. These policies can be more affordable and still provide adequate coverage for delivery activities. It’s important for drivers to check if their insurer offers a policy that matches their part-time work needs.

Read More: Best Auto Insurance for Limited-Use Vehicles

Do delivery drivers need independent courier insurance while working for Hungry Howie’s?

If you’re an independent contractor delivering for Hungry Howie’s, you may need independent courier insurance. This type of insurance is designed for self-employed drivers who use their vehicles for delivery services, ensuring they are covered in case of an accident or damage while on a delivery.

How does delivery vehicle insurance differ from regular auto insurance?

Delivery vehicle insurance specifically covers the risks associated with using a vehicle for business purposes, such as delivering food or packages. Unlike regular auto insurance, it includes protection for commercial activities, making it essential for those working as delivery drivers at Hungry Howie’s.

What should I consider when choosing insurance for a delivery business, like working for Hungry Howie’s?

When selecting insurance for delivery business activities, consider factors such as coverage for vehicle damage, liability, medical expenses, and protection against uninsured motorists. It’s important to choose a policy that covers both personal and business use to ensure full protection while driving for Hungry Howie’s.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.