Best New Orleans, Louisiana Auto Insurance in 2026 (Find the Top 10 Companies Here)

For best New Orleans, Louisiana auto insurance, the top insurers are Erie, Amica, and USAA offering rates starts at $120 per month. In New Orleans, the minimum auto insurance required by Louisiana law is 15/30/25 in coverage. Compare quotes to find the best auto insurance in New Orleans, Louisiana.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated October 2024

1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in New Orleans Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 768 reviews

768 reviewsCompany Facts

Full Coverage in New Orleans Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in New Orleans Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsCompare the best New Orleans, Louisiana auto insurance from Erie, Amica, and USAA offering rates starts at $120 per month. These providers offer the most competitive rates and extensive coverage.

New Orleans, Louisiana auto insurance requirements are 15/30/25 according to Louisiana auto insurance laws. Finding best auto insurance companies in New Orleans can seem like a difficult task, but all of the information you need is right here.

Our Top 10 Company Picks: Best New Orleans, Louisiana Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Affordable Premiums | Erie |

| #2 | 25% | A+ | Exceptional Service | Amica | |

| #3 | 10% | A++ | Military Benefits | USAA | |

| #4 | 20% | A | Local Agents | Auto-Owners | |

| #5 | 20% | A | Broad Coverage | Nationwide |

| #6 | 20% | A | Extensive Network | State Farm | |

| #7 | 12% | B | Digital Tools | Progressive | |

| #8 | 25% | A++ | Competitive Pricing | Geico | |

| #9 | 20% | A+ | Customizable Policies | Liberty Mutual |

| #10 | 25% | A+ | Financial Strength | Allstate |

We’ll cover factors that affect auto insurance rates in New Orleans, Louisiana, including driving record, credit, commute time, and more. Compare auto insurance in New Orleans to other Louisiana cities. Enter your ZIP code above to get free New Orleans, Louisiana auto insurance quotes.

-

Progressive has the highest rates for teen drivers in New Orleans

- The minimum auto insurance required in New Orleans, Louisiana is 15/30/25

- The average commute length in New Orleans is 24.2 minutes

#1 – Erie: Top Overall Pick

Pros

- Comprehensive Coverage at Low Rates: Erie offers full coverage at rates starting at $225 per month, highly competitive for those seeking the best New Orleans, Louisiana auto insurance. With an A+ A.M. Best rating, Erie ensures financial stability, and a 10% multi-vehicle discount makes it a cost-effective choice for families.

- Exceptional Customer Service: Known for personalized service, Erie ranks #1 in the best New Orleans, Louisiana auto insurance market. Its top-tier customer service, backed by strong claims support, caters well to local drivers. Uncover insights in our guide, “Erie Auto Insurance Review.”

- Broad Range of Discounts: Erie’s wide array of discounts, including multi-policy options, makes it easier to reduce premiums. This flexibility is crucial for drivers seeking the best New Orleans, Louisiana auto insurance without compromising on coverage.

Cons

- Limited Availability: While Erie excels in offering the best New Orleans, Louisiana auto insurance, its limited state presence may be a drawback if you relocate. The lack of nationwide coverage could be a concern for those planning to move.

- Slower Claims Processing: Some policyholders have reported slower-than-average claims processing, which can be frustrating. This delay could impact those relying on timely service from the best New Orleans, Louisiana auto insurance provider.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Amica: Best for Exceptional Service

Pros

- Top-Tier Customer Satisfaction: Amica is renowned for its customer service, consistently earning top ratings in satisfaction surveys, making it a standout choice for the best New Orleans, Louisiana auto insurance. Its 25% multi-vehicle discount further enhances its appeal.

- Dividend Policies: Amica offers dividend-paying policies that can return a portion of your premiums, providing long-term savings. This feature, combined with its A+ A.M. Best rating, makes it a strong contender for the best New Orleans, Louisiana auto insurance. Try to check more on our Amica auto insurance review.

- Comprehensive Coverage Options: Amica provides extensive coverage options, including collision and comprehensive, crucial for the best New Orleans, Louisiana auto insurance. These options, along with exceptional service, cater to drivers who demand robust protection.

Cons

- Higher Premiums: Amica’s superior service comes at a cost, with higher premiums than some competitors. This may not suit budget-conscious drivers searching for the best New Orleans, Louisiana auto insurance.

- Limited Discounts: While Amica offers a few discounts, they are not as extensive as those from other providers. This limitation might deter drivers looking to maximize savings on the best New Orleans, Louisiana auto insurance.

#3 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA provides specialized benefits for military members, veterans, and their families, making it ideal for those eligible. With a 10% multi-vehicle discount and an A++ A.M. Best rating, USAA stands out as the best New Orleans, Louisiana auto insurance for military personnel.

- High Customer Satisfaction: USAA consistently ranks high in customer satisfaction, offering dedicated service tailored to military families. Its strong financial backing adds to its reputation as the best New Orleans, Louisiana auto insurance.

- Competitive Rates: USAA’s rates are among the most competitive, particularly for military families. Coupled with its strong coverage options, USAA is a top choice for the best New Orleans, Louisiana auto insurance, as highlighted in our USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA is only available to military members and their families, limiting its reach. This restriction can be a drawback for the general public seeking the best New Orleans, Louisiana auto insurance.

- Fewer Local Agents: While USAA excels in online and phone support, it has fewer local agents, which might be a concern for those who prefer in-person assistance with the best New Orleans, Louisiana auto insurance.

#4 – Auto-Owners: Best for Local Agents

Pros

- Strong Local Agent Network: Auto-Owners boasts a robust network of local agents, offering personalized service and support. Ranked #4 for the best New Orleans, Louisiana auto insurance, it provides a 20% multi-vehicle discount and strong A.M. Best rating.

- Comprehensive Policy Options: Auto-Owners offers extensive coverage options, including add-ons like accident forgiveness, crucial for full protection. This makes it a reliable choice for the best New Orleans, Louisiana auto insurance, as noted in our Auto-Owners auto insurance review.

- Bundling Discounts: Auto-Owners offers significant discounts for bundling auto with home or life insurance, making it cost-effective. This discount, paired with strong coverage, makes it ideal for those seeking the best New Orleans, Louisiana auto insurance.

Cons

- Limited Online Tools: Auto-Owners lags behind in digital offerings, which can be a disadvantage for tech-savvy drivers. This limitation might affect those looking for the best New Orleans, Louisiana auto insurance with robust online features.

- Higher Premiums: The personalized service and extensive coverage can result in higher premiums. This cost might deter budget-conscious drivers seeking the best New Orleans, Louisiana auto insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Broad Coverage

Pros

- Broad Coverage Options: Nationwide offers extensive coverage, including accident forgiveness and vanishing deductibles, ideal for comprehensive protection. Ranked #5, it’s a strong contender for the best New Orleans, Louisiana auto insurance.

- User-Friendly Online Platform: Nationwide’s digital tools, including a robust mobile app, make it easy to manage policies. This ease of use is essential for those seeking the best New Orleans, Louisiana auto insurance, according to Nationwide auto insurance review.

- Strong Financial Ratings: Backed by solid financial strength and an A.M. Best rating of A, Nationwide ensures reliable claims payment, crucial for long-term security with the best New Orleans, Louisiana auto insurance.

Cons

- Above-Average Rates: Nationwide’s premiums tend to be higher, which might not appeal to budget-conscious drivers. This cost factor can be a drawback for those seeking the best New Orleans, Louisiana auto insurance.

- Mixed Customer Service Reviews: Some customers praise Nationwide’s service, while others report inconsistencies. This variability might concern drivers looking for reliable support from the best New Orleans, Louisiana auto insurance provider.

#6 – State Farm: Best for Extensive Network

Pros

- Extensive Agent Network: State Farm’s large network of local agents in New Orleans offers personalized service. Ranked #6, it’s a solid choice for the best New Orleans, Louisiana auto insurance, with a 20% multi-vehicle discount.

- Reliable Coverage: Known for its reliable coverage, including rideshare insurance, State Farm is versatile. This flexibility is crucial for drivers seeking the best New Orleans, Louisiana auto insurance. Explore our review of State Farm auto insurance review.

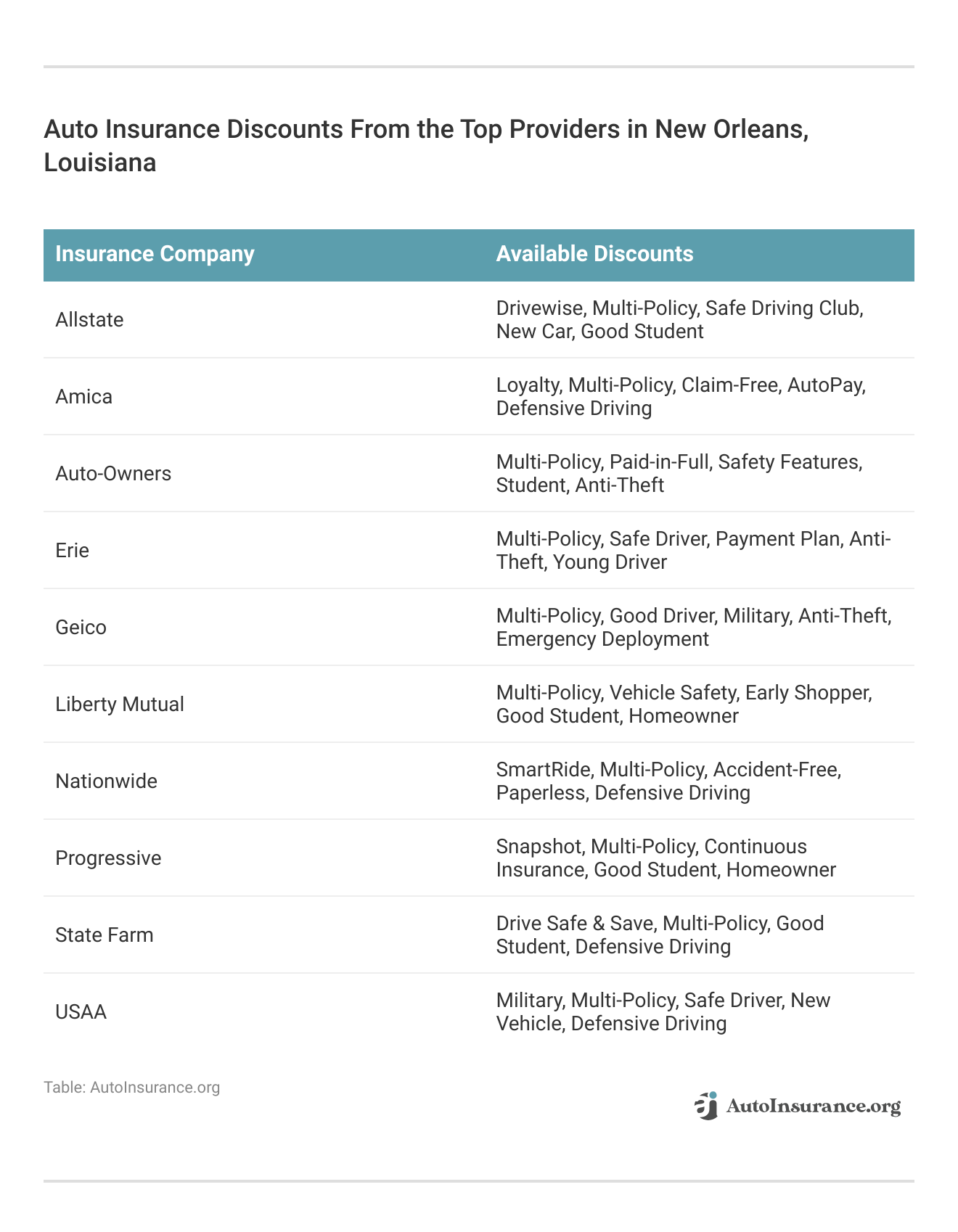

- Good Student Discounts: State Farm offers substantial discounts for young drivers with good grades, reducing costs. This feature is particularly appealing to families looking for the best New Orleans, Louisiana auto insurance.

Cons

- Average Rates: While not the lowest, State Farm’s rates are not the most competitive. This may be a consideration for price-sensitive drivers seeking the best New Orleans, Louisiana auto insurance.

- Limited Online Features: Some users find State Farm’s online tools less advanced, particularly its mobile app. This limitation might affect those looking for the best New Orleans, Louisiana auto insurance with strong digital support.

#7 – Progressive: Best for Digital Tools

Pros

- Competitive Digital Tools: Progressive excels with its digital tools, including a highly-rated mobile app. Ranked #7, it’s a strong option for the best New Orleans, Louisiana auto insurance with a 12% multi-vehicle discount.

- Snapshot Program: Progressive offers a usage-based insurance program that can lower rates for safe drivers. This program is ideal for those looking for cost-effective, best New Orleans, Louisiana auto insurance. Learn more about offerings in our complete Progressive auto insurance review.

- Broad Range of Discounts: Progressive offers various discounts, including bundling and continuous coverage, enhancing its value. These savings make it appealing for those seeking the best New Orleans, Louisiana auto insurance.

Cons

- Higher Rates for Young Drivers: Progressive tends to charge higher premiums for younger drivers. This may be a drawback for families seeking the best New Orleans, Louisiana auto insurance for younger members

- Average Customer Service: Progressive’s customer service ratings are mixed, with some users experiencing delays in claims processing. This inconsistency might concern drivers looking for reliable support from the best New Orleans, Louisiana auto insurance provider.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Geico: Best for Competitive Pricing

Pros

- Competitive Pricing: Geico is well-known for offering some of the most competitive rates in the industry, making it a top choice for those seeking the best New Orleans, Louisiana auto insurance. Ranked #8, Geico’s pricing is further enhanced by a 25% multi-vehicle discount and an A++ A.M. Best rating.

- Extensive Digital Tools: Geico’s mobile app is one of the highest-rated in the industry, providing seamless policy management and claims processing. This digital prowess is essential for tech-savvy drivers searching for the best New Orleans, Louisiana auto insurance, as highlighted in our Geico auto insurance review.

- Customizable Coverage Options: Geico offers a variety of customizable coverage options, including mechanical breakdown insurance, which is particularly appealing for those with older vehicles. This flexibility makes Geico a versatile option for the best New Orleans, Louisiana auto insurance.

Cons

- Limited Local Agents: While Geico excels in online services, it has fewer local agents, which may be a drawback for those who prefer in-person support. This limitation could be a concern for drivers seeking the best New Orleans, Louisiana auto insurance with a personal touch.

- Average Customer Satisfaction: Geico’s customer service ratings are generally positive, but not exceptional. Some customers have reported issues with claims processing, which might be a concern for those seeking the best New Orleans, Louisiana auto insurance.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual stands out for its highly customizable policies, allowing drivers to tailor their coverage to specific needs. Ranked #9, Liberty Mutual’s A+ A.M. Best rating and 20% multi-vehicle discount make it a strong contender for the best New Orleans, Louisiana auto insurance.

- Unique Coverage Options: Liberty Mutual offers unique coverage options, including new car replacement and better car replacement, which can be particularly beneficial for drivers with newer vehicles. This feature makes it an attractive option for the best New Orleans, Louisiana auto insurance.

- Strong Financial Stability: With an A+ A.M. Best rating, Liberty Mutual ensures reliable claims payment, which is crucial for drivers seeking long-term security with the best New Orleans, Louisiana auto insurance, as mentioned in our Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Liberty Mutual’s extensive coverage options come with higher premiums, which may not suit budget-conscious drivers. This cost factor could be a drawback for those seeking the best New Orleans, Louisiana auto insurance.

- Mixed Customer Service Reviews: Liberty Mutual’s customer service reviews are varied, with some customers reporting issues with claims processing. This inconsistency might concern drivers looking for reliable support from the best New Orleans, Louisiana auto insurance provider.

#10 – Alllstate: Best for Financial Strength

Pros

- Strong Financial Stability: Allstate’s A+ A.M. Best rating indicates solid financial strength, ensuring reliable claims payments. Ranked #10, Allstate’s 25% multi-vehicle discount and broad coverage options make it a strong choice for the best New Orleans, Louisiana auto insurance. Dive into our analysis of Allstate auto insurance review.

- Wide Range of Discounts: Allstate offers various discounts, including those for safe drivers, multiple policies, and anti-theft devices. These savings make Allstate appealing for drivers seeking the best New Orleans, Louisiana auto insurance.

- Innovative Digital Tools: Allstate’s mobile app and online tools are highly rated, providing convenient access to policy management and claims. This digital innovation is essential for tech-savvy drivers looking for the best New Orleans, Louisiana auto insurance.

- Comprehensive Coverage Options: Allstate offers a wide range of coverage options, including accident forgiveness and deductible rewards, which can be particularly beneficial for drivers seeking full protection. This makes Allstate a versatile option for the best New Orleans, Louisiana auto insurance.

Cons

- Higher Premiums: Allstate’s premiums tend to be on the higher side, which may not be suitable for budget-conscious drivers. This cost factor could be a drawback for those seeking the best New Orleans, Louisiana auto insurance.

- Mixed Customer Service Reviews: Allstate has received mixed reviews regarding its customer service, with some customers reporting delays in claims processing. This inconsistency might be a concern for drivers seeking reliable support from the best New Orleans, Louisiana auto insurance provider.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Auto Insurance in New Orleans, Louisiana

In New Orleans, Louisiana, state laws mandate that drivers carry at least the minimum auto insurance to ensure financial responsibility if an accident occurs. This minimum coverage requirements includes liability limits that protect both the driver and other parties involved in a collision.

New Orleans, Louisiana Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $170 | $260 |

| Amica | $145 | $235 |

| Auto-Owners | $140 | $230 |

| Erie | $135 | $225 |

| Geico | $142 | $236 |

| Liberty Mutual | $165 | $255 |

| Nationwide | $150 | $240 |

| Progressive | $155 | $245 |

| State Farm | $160 | $250 |

| USAA | $120 | $210 |

Having the required auto insurance not only complies with Louisiana law but also provides essential financial protection against potential lawsuits or significant out-of-pocket expenses.

Minimum Required Auto Insurance Coverage in New Orleans, Louisiana

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $15,000 per person $30,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

It’s crucial to review and understand these requirements to maintain proper coverage and avoid legal penalties.

Cheap New Orleans, Louisiana Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in New Orleans, Louisiana, are significantly influenced by factors like age, gender, and marital status. For example, when comparing average auto insurance rates by age, married 35-year-olds typically see lower rates compared to single 17-year-olds, reflecting how insurers view the risk associated with different demographics.

According to the data, companies like Geico and State Farm offer competitive rates for older, married drivers, while Progressive tends to be more expensive, particularly for teen drivers.

These variations highlight the importance of understanding how personal demographics can impact your monthly insurance costs in New Orleans. By entering your ZIP code below, you can easily access free quote.

Cheap New Orleans, Louisiana Auto Insurance for Teen Drivers

For a single 17-year-old female, USAA offers the lowest rate at $120, while Progressive charges the highest at $155. For a single 17-year-old male, USAA remains the most affordable at $120, whereas Progressive is the most expensive, with an monthly rate of $155.

Cheap New Orleans, Louisiana Auto Insurance for Seniors

Everyone who is seeking for best senior auto insurance in New Orleans, Louisiana, it’s important to compare rates among top providers. Monthly rates vary significantly, with Allstate charging $170 for both a married 60-year-old female and male driver.

Geico offers lower rates for females at $142, but higher for males at $236. Progressive provides more affordable options, with rates of $155 for females and $245 for males.

State Farm and USAA offer the most competitive rates, with State Farm at $160 for both genders and USAA at $120 for females and $120 for males.

Factors Affecting Auto Insurance Rates in New Orleans, Louisiana

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare New Orleans, Louisiana Auto Insurance Quotes

Frequently Asked Questions

What factors should I consider when choosing the best auto insurance in New Orleans, Louisiana?

Consider factors like coverage options, premium costs, the insurer’s A.M. Best rating, and specific discounts offered, such as multi-vehicle or safe driver discounts. Additionally, think about the insurer’s customer service reputation and their ability to handle claims efficiently in New Orleans.

How does multi-vehicle discount work, and can it significantly lower my premiums?

A multi-vehicle discount is offered when you insure more than one car with the same provider, which can result in a reduction of up to 25% on your premiums. This discount can lead to significant savings, especially for families or households with multiple vehicles. By entering your ZIP code below, you can start comparing quote.

What is A.M. Best rating, and why is it important when selecting auto insurance?

A.M. Best rating measures an insurance company’s financial stability and ability to pay out claims. Choosing a company with a high A.M. Best rating, like A or A+, ensures you’re with a reliable insurer that is likely to remain solvent and handle claims efficiently.

Are there specific coverage options that are particularly beneficial for New Orleans, Louisiana drivers?

In New Orleans, coverage options like comprehensive insurance, which covers flood damage, and higher liability limits are beneficial due to the city’s flood risks and high accident rates. Uninsured motorist coverage is also crucial given the state’s high number of uninsured drivers.

How do digital tools like mobile apps enhance the auto insurance experience?

Digital tools, such as mobile apps, allow for easy policy management, quick claims filing, and access to ID cards or roadside assistance directly from your phone. These tools make the insurance process more convenient and responsive, improving overall customer satisfaction. Enter your ZIP code now to start free quote.

What are the common exclusions in auto insurance policies that I should be aware of?

Common exclusions include intentional damage, using the vehicle for commercial purposes without proper coverage, and certain types of natural disasters not covered under standard policies. It’s essential to read your policy carefully to understand what is not covered.

How can I maximize the discounts available on my auto insurance policy?

To maximize discounts, consider bundling policies, maintaining a clean driving record, enrolling in defensive driving courses, and taking advantage of multi-vehicle or good student discounts. Regularly reviewing your policy and comparing rates can also help you find additional savings.

What should I do if I’m not satisfied with my current auto insurance provider?

If you’re dissatisfied, start by comparing quotes from other providers to find a better deal or service. Once you’ve selected a new provider, ensure your new policy is active before canceling your current one to avoid any coverage gaps. Enter your ZIP code today.

How does bundling auto and home insurance policies affect my overall premium?

Bundling auto and home insurance policies typically results in a discount on both, potentially saving you up to 20% on your premiums. This approach not only reduces costs but also simplifies your insurance management by dealing with a single provider.

What are the most common mistakes people make when buying auto insurance in New Orleans, Louisiana?

Common mistakes include choosing the minimum coverage required by law, not comparing multiple quotes, and overlooking crucial coverage options like uninsured motorist or flood protection. These oversights can lead to inadequate coverage and higher out-of-pocket costs in the event of a claim.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.