To secure the best rates, comparing quotes from various companies is essential. This ensures you find the right coverage at a price that suits your budget. This is especially crucial when looking for full-coverage auto insurance, as it helps you understand the options available and select the best fit for your needs.

Best Palmdale, California Auto Insurance in 2026 (Check Out the Top 10 Companies)

Progressive, Allstate, and Geico have the best Palmdale, California, auto insurance from $120/month. Progressive has the lowest rates, Allstate has good customer service and Geico offers low-cost coverage in Palmdale making them a solid bet if you're looking for the best insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Alexandra Arcand

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Written by

Alexandra Arcand

Alexandra Arcand

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Reviewed by

Travis Thompson

Travis Thompson

Updated October 2024

Top Pick in Palmdale California: Progressive

Company Facts

Full Coverage in Palmdale California

$285/moA.M. Best Rating

A+Complaint Level

LowPros & Cons

Best Palmdale CA Program: Allstate

Best Palmdale CA Program: Allstate

Company Facts

Full Coverage in Palmdale California

$310/moA.M. Best Rating

A+Complaint Level

MedPros & Cons

Best Palmdale CA Premiums: Geico

Best Palmdale CA Premiums: Geico

Company Facts

Full Coverage in Palmdale California

$270/moA.M. Best Rating

A++Complaint Level

LowPros & Cons

Progressive, Allstate, and Geico are the best auto insurance rates in Palmdale, California, starting at $120/month. Progressive has the best rates and is our top overall consistent pick, though Allstate is an award-winning customer service provider. At the same time, Geico gives you some of the most affordable coverages.

In Palmdale, rates are right around average due to high traffic and crime—all the more reason to request quotes from various providers when looking for the best deal on car insurance that fits your needs, whether you’re seeking basic coverage or comprehensive protection.

Our Top 10 Company Picks: Best Palmdale, California Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 18% A+ High-Risk Drivers Progressive

![]()

#2 20% A+ Drivewise Program Allstate

![]()

#3 22% A++ Affordable Premiums Geico

![]()

#4 15% A Comprehensive Coverage Farmers

#5 19% A New Drivers Liberty Mutual

![]()

#6 17% B Safe Drivers State Farm

![]()

#7 25% A++ Military Families USAA

![]()

#8 16% A California Drivers Mercury

#9 23% A+ Home-Auto Bundles Nationwide

![]()

#10 21% A++ Environmentally-Conscious Vehicles Travelers

Compare RatesStart Now →

You have to be sure that you read up on this to make the best decisions based on factors affecting California auto insurance in your area. By entering your ZIP code into our comparison tool today, please find the best auto insurance rates, no matter how much coverage you need.

Things to Remember

- Progressive offers the best overall rates, starting at $120 per month

- Palmdale drivers face higher insurance rates due to traffic and theft risks

- Compare the best Palmdale, California auto insurance to find affordable coverage

When looking for the best Palmdale, California auto insurance, it’s important to consider both minimum and full coverage options. Rates vary significantly by provider; the right plan depends on your specific needs and budget. Below is a comparison of monthly rates for minimum and full coverage from some of the top providers in Palmdale:

Palmdale, California Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

![]()

$140 $310

![]()

$135 $295

![]()

$130 $270

$145 $320

![]()

$125 $280

$138 $300

![]()

$132 $285

![]()

$128 $265

![]()

$136 $290

![]()

$120 $255

Compare RatesStart Now →

Auto Insurance Discounts From the Top Providers in Palmdale, California

Insurance Company Available Discounts

![]()

Multi-Policy, Safe Driver, Anti-Theft, Good Student, New Car

![]()

Multi-Car, Home/Auto Bundle, Safe Driver, Senior Discount

![]()

Multi-Vehicle, Defensive Driving, Military, Good Student

Multi-Policy, Accident-Free, Early Shopper, Paperless

![]()

Multi-Policy, Good Driver, Renewal, Electric/Hybrid Vehicle

SmartRide, Accident-Free, Defensive Driving, Multi-Policy

![]()

Multi-Car, Continuous Coverage, Good Student, Snapshot

![]()

Multi-Policy, Safe Driver, Good Student, Drive Safe & Save

![]()

Safe Driver, Multi-Policy, New Car, Hybrid Vehicle

![]()

Military, Family Legacy, Defensive Driving, Good Student

Compare RatesStart Now →

Monthly Palmdale, CA Car Insurance Rates by ZIP Code

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Palmdale, CA Car Insurance Rates vs. Top US Metro Car Insurance Rates

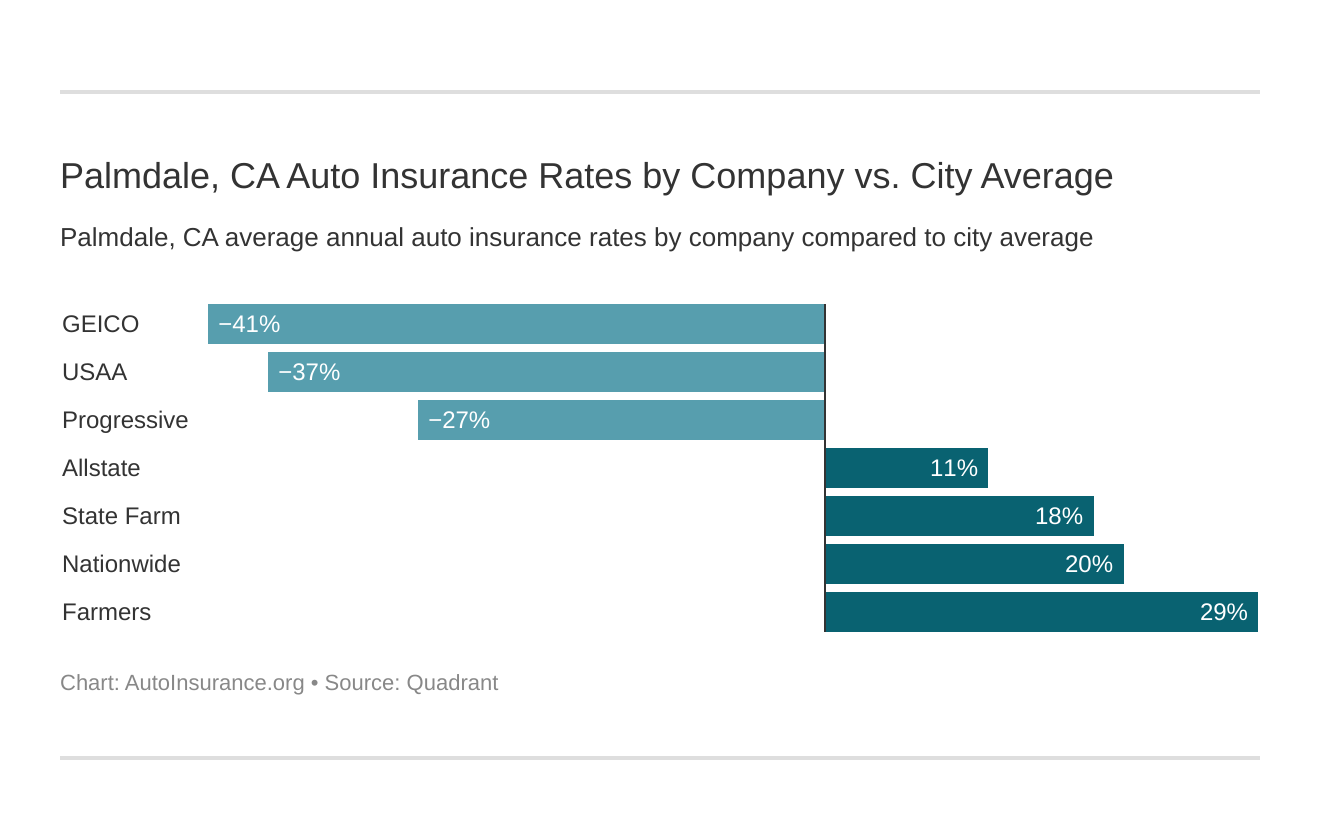

The city in which you reside will significantly impact your car insurance. That’s why shopping around for the best auto insurance rates in Palmdale, CA, and other major U.S. metropolitan areas is essential.

The Cheapest Auto Insurance Company in Palmdale, CA

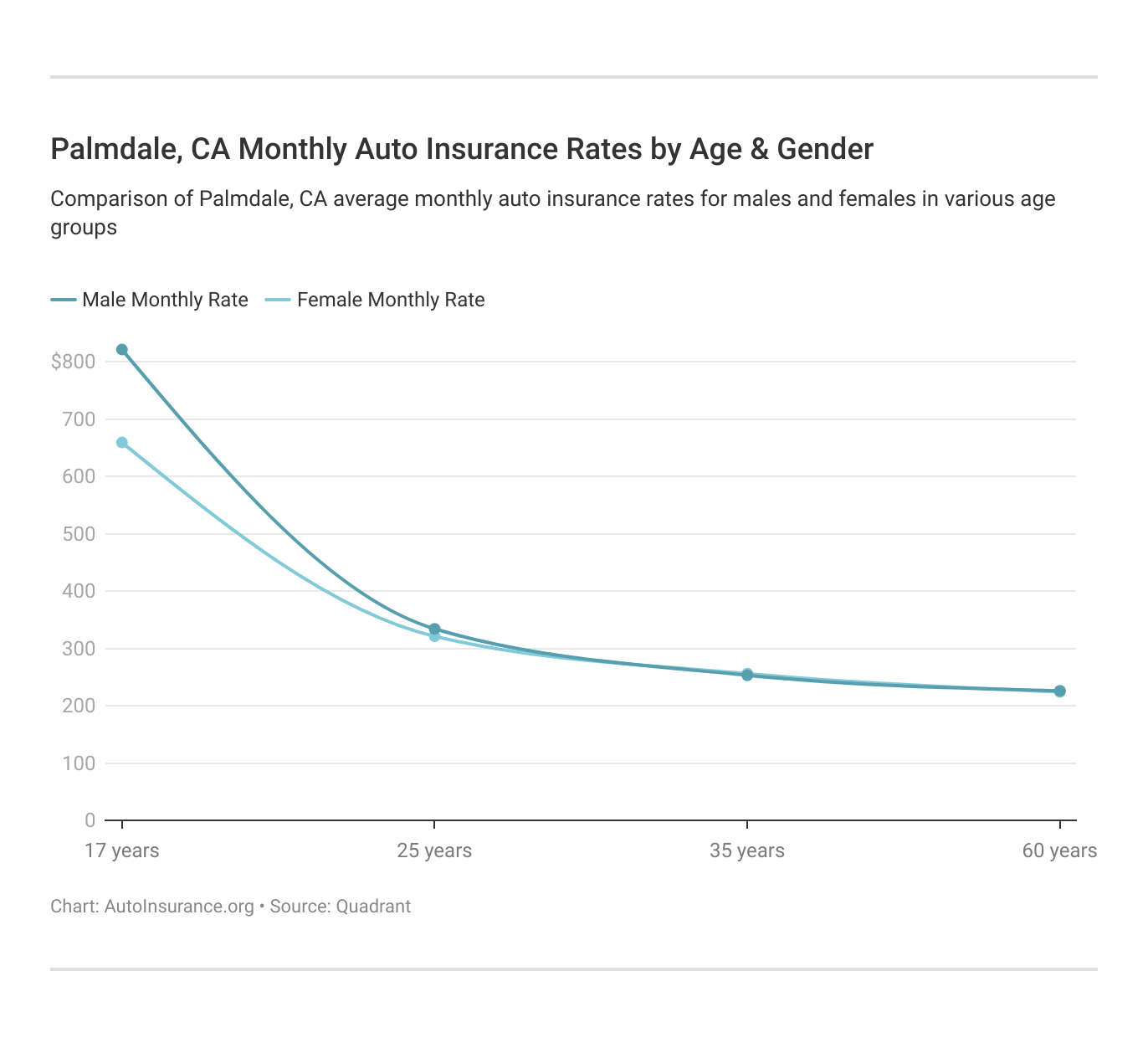

Your auto insurance rates are affected by many different factors, such as your age and driving record. Many companies will also use gender to determine your rates, but California is one of the few states that doesn’t allow it.

Your rates are also influenced by where you live. Auto insurance is more expensive in larger cities with more crime and traffic. Los Angeles auto insurance, for example, is more costly than coverage in Palmdale, even though the two cities are close.

California does offer low-cost auto insurance for low-income drivers. The California Low-Cost Auto (CLCA) program provides shallow coverage to drivers who meet specific requirements.

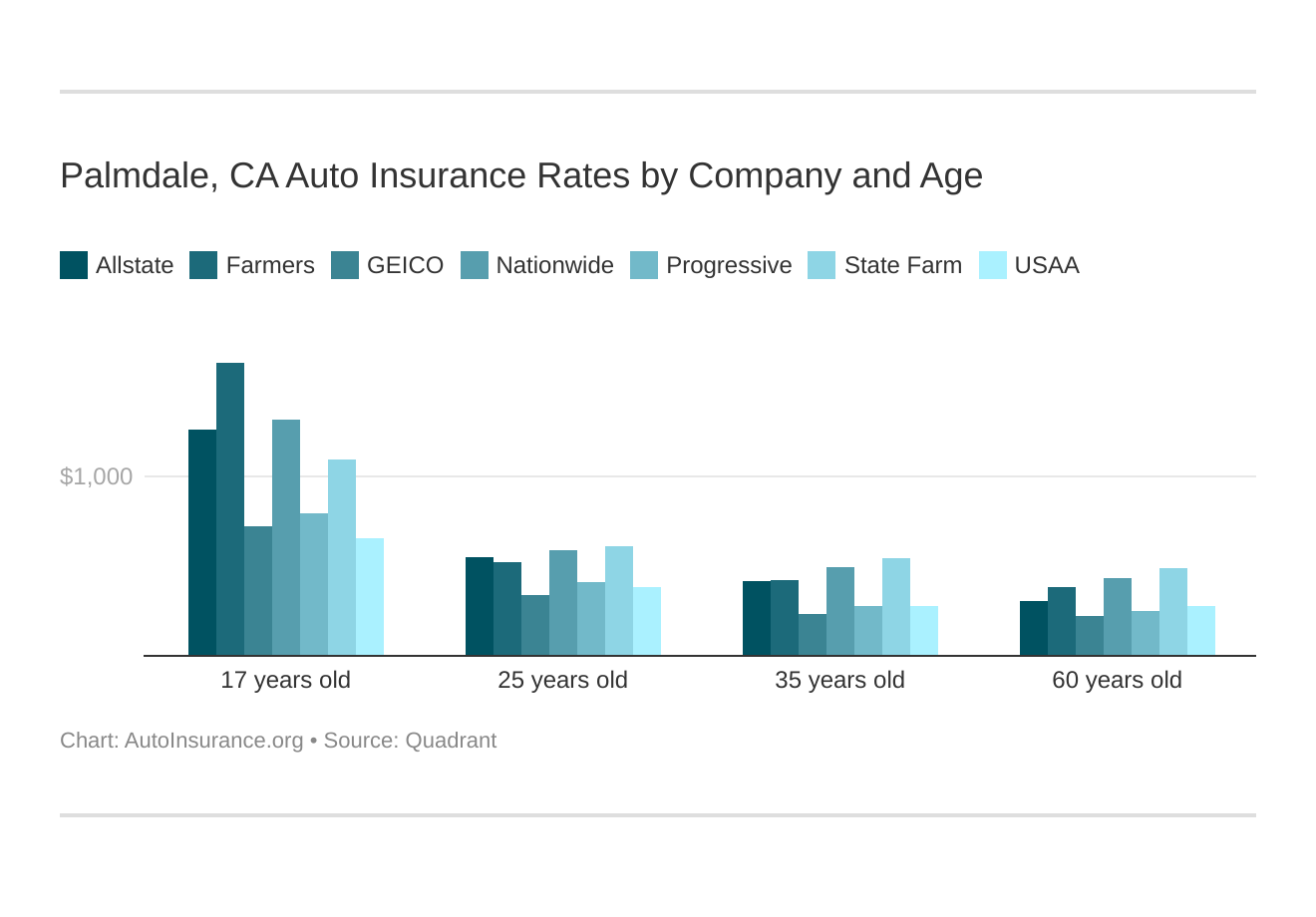

Palmdale, California, car insurance rates by company and age are essential to a comparison. The top car insurance company for one age group may not be the best company for another age group.

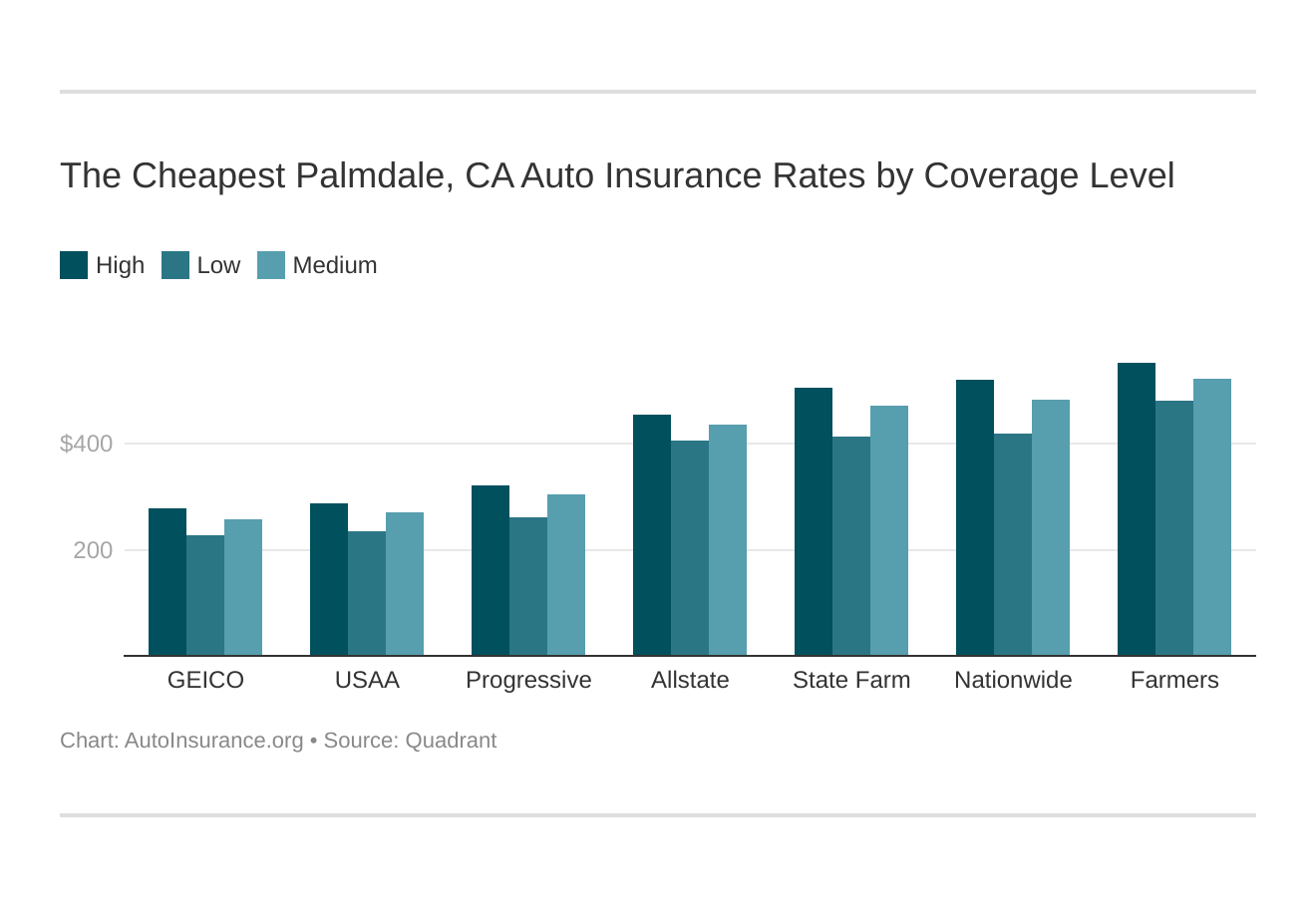

Your coverage level will affect your Palmdale, CA, car insurance rates. Find the cheapest Palmdale, California car insurance rates by coverage level below:

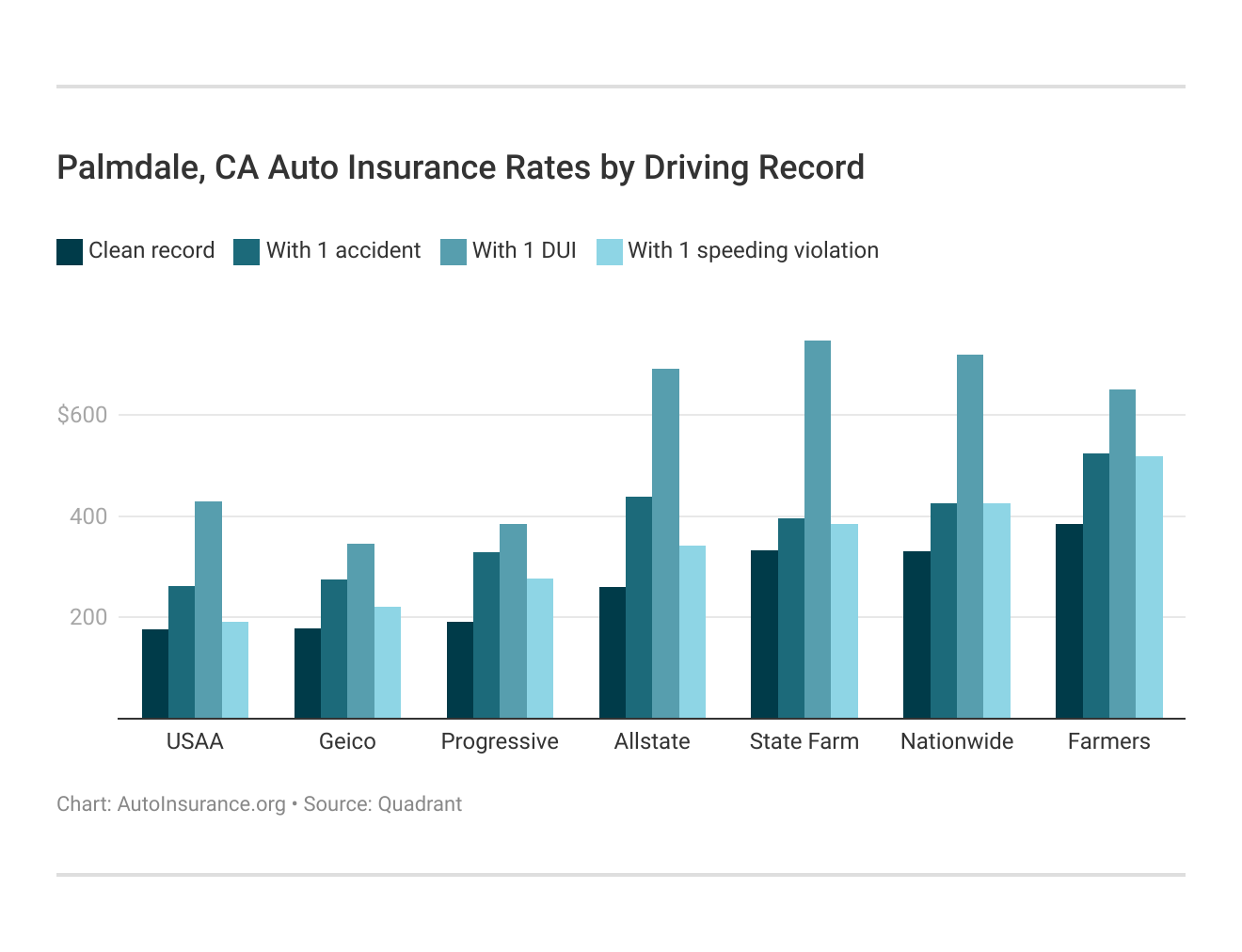

Your driving record will affect your Palmdale car insurance rates. For example, a Palmdale, California DUI may increase your car insurance rates by 40 to 50 percent. Use your driving record to find the cheapest car insurance rates in Palmdale, California.

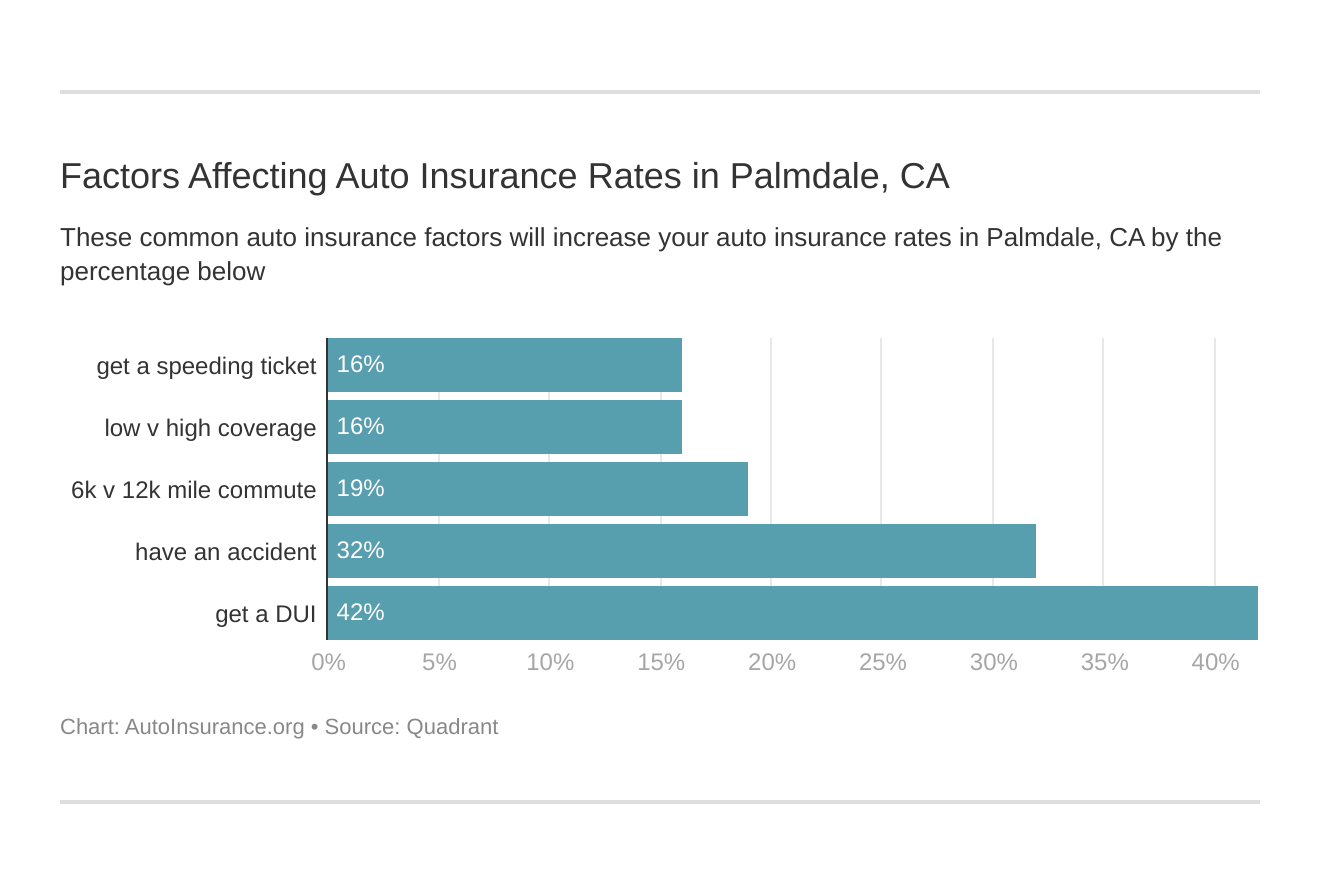

Factors affecting car insurance rates in Palmdale, CA, may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest car insurance in Palmdale, California.

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. However, age is still significant because young drivers are considered high-risk in Palmdale. CA does use gender, so check out the average monthly car insurance rates by age and gender in Palmdale, CA.

Required Auto Insurance Coverage in Palmdale, CA

Almost every state, including California, requires at least a minimum amount of auto insurance for drivers to drive legally. The minimum auto insurance requirements for Palmdale drivers are:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

These are very low minimums, and drivers should consider increasing them and adding additional coverages. These low minimums won’t completely protect you in a major accident, leaving you to pay out of pocket for everything not covered.

Progressive is the top choice for Palmdale drivers, offering the lowest rates and comprehensive coverage options tailored to fit diverse needs.

Consider adding collision and comprehensive insurance to your policy. Collision insurance assists in paying for damages incurred due to an accident. Comprehensive insurance covers accidents that aren’t caused by an accident, such as those caused by the Palmdale, CA weather.

Traffic can also affect auto insurance rates because more cars on the road equals a higher chance of an accident.

Although INRIX doesn’t have data for Palmdale, it does rank nearby Los Angeles, CA, as the fifth most congested city in the U.S. and the 37th-most congested city in the world.

Progressive stands out as the top choice for Palmdale drivers, offering the lowest rates combined with comprehensive coverage options.Tim Bain Licensed Insurance Agent

City-Data reports that most drivers in Palmdale, CA, commute around 20 minutes, and most choose to drive alone, contributing to the expensive Palmdale, CA, car insurance rates. Theft can also raise your rates. According to the FBI, 435 motor vehicle thefts occurred in one year in Palmdale.

Palmdale, CA Auto Insurance: Key Takeaways

Palmdale auto insurance is much more expensive than average, but Liberty Mutual offers the cheapest coverage in the city. Before purchasing auto insurance in Palmdale, CA, shopping around to secure the best full-coverage car insurance is essential.

Each insurer has varying rates, so it’s crucial to compare options to find the best deal tailored to your needs. Enter your ZIP code to compare Palmdale, CA, auto insurance rates for free.

Frequently Asked Questions

What types of auto insurance coverage are available in Palmdale, CA?

Palmdale, CA, offers various types of auto insurance coverage, including liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, personal injury protection (PIP), and medical payments coverage. Each type of auto insurance offers different levels of protection.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.