Best Pensacola, Florida Auto Insurance in 2026 (Top 10 Companies Ranked)

The best Pensacola, Florida auto insurance companies are Farmers, Geico, and Allstate, with rates starting at $84/month. These companies offer affordable rates, wide variety of discounts, and local agents, making them top choices for reliable, cost-effective coverage in Pensacola, Florida.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated August 2025

Company Facts

Full Coverage in Pensacola

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Pensacola

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Pensacola

A.M. Best Rating

Complaint Level

Pros & Cons

The best Pensacola, Florida auto insurance companies are Farmers, Geico, and Allstate, each offering highly-rated coverage with rates beginning at $84 per month.

These companies stands out as the top pick overall due to its combination of affordable rates, a wide range of discounts, and the availability of local agents.

Our Top 10 Company Picks: Best Pensacola, Florida Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 25% A Discount Variety Farmers

![]()

#2 25% A++ Local Agents Geico

![]()

#3 25% A+ Affordable Rates Allstate

#4 10% A+ Customer Satisfaction Erie

#5 10% A++ Military Benefits USAA

#6 8% A++ Flexible Options Travelers

#7 25% A Discounts Available Liberty Mutual

#8 20% A Personalized Service American Family

#9 20% B Extensive Network State Farm

#10 12% A+ Competitive Pricing Progressive

This article explains why the best auto insurance companies offer great value in Pensacola, Florida, highlighting factors such as customer service, coverage options, and cost-effectiveness.

Enter your ZIP code into our free quote tool above to find the best auto insurance providers for your needs and budget.

- Farmers offers top Pensacola auto insurance with great rates and discounts

- Get rates as low as $84/month and local agent support from top insurers

- Compare providers for top value, discounts, and coverage options in Pensacola

#1 – Farmers: Top Overall Pick

Pros

- Discount Variety: Farmers offers a wide range of discounts in Pensacola, Florida, allowing drivers to potentially lower their premiums based on various qualifications.

- Local Agents: With local agents available in Pensacola, Florida, Farmers provides personalized service and support to help with any insurance needs.

- Customizable Coverage: Farmers offers flexible coverage options that can be tailored to meet the specific needs of drivers in Pensacola, Florida. Read more in our review of Farmers.

Cons

- Higher Rates for Some Drivers: In Pensacola, Florida, some drivers may find that Farmers’ rates are higher compared to other providers, especially if they do not qualify for multiple discounts.

- Limited National Discounts: While Farmers offers many discounts in Pensacola, Florida, some of their national discounts may not be as applicable or generous locally.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Local Agents

Pros

- Local Agents: Geico provides access to local agents in Pensacola, Florida, ensuring personalized assistance and support, which you can learn about in our Geico review.

- Competitive Rates: Geico is known for its competitive pricing in Pensacola, Florida, helping drivers find affordable coverage.

- Strong Online Tools: Geico’s robust online tools make it easy for Pensacola, Florida residents to manage their policies and file claims.

Cons

- Limited Local Presence: Despite having local agents, Geico’s physical office presence in Pensacola, Florida might be less extensive compared to other insurers.

- Customer Service Issues: Some Pensacola, Florida customers have reported less-than-stellar experiences with Geico’s customer service.

#3 – Allstate: Best for Affordable Rates

Pros

- Affordable Rates: Allstate offers competitive rates in Pensacola, Florida, making it a cost-effective choice for many drivers.

- Discount Opportunities: Pensacola, Florida residents can benefit from a variety of discounts offered by Allstate, potentially lowering insurance costs, which is covered in our Allstate review.

- Local Agents: Allstate has local agents in Pensacola, Florida who can provide personalized service and support.

Cons

- Higher Full Coverage Costs: For Pensacola, Florida residents needing full coverage, Allstate’s rates may be higher compared to some other providers.

- Mixed Customer Service Reviews: There can be inconsistent customer service experiences reported by Pensacola, Florida customers.

#4 – Erie: Best for Customer Satisfaction

Pros

- Customer Contentment: Erie receives excellent ratings for customer satisfaction in Pensacola, Florida, reflecting positive experiences from local drivers.

- Comprehensive Coverage Options: Erie offers extensive coverage options in Pensacola, Florida, catering to diverse needs.

- Strong Local Presence: Erie’s local agents in Pensacola, Florida provide personalized and attentive service. Read our Erie review to learn what else is offered.

Cons

- Limited National Reach: Erie’s limited presence outside of Pensacola, Florida may affect coverage options for those traveling out of state.

- Higher Premiums for Some Drivers: Erie’s rates in Pensacola, Florida might be higher for certain drivers, particularly those with less-than-perfect driving records.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Benefits

Pros

- Benefits for Military Personnel: USAA offers unique advantages and savings for military families in Pensacola, Florida, potentially resulting in substantial savings.

- Competitive Rates: USAA provides some of the lowest rates in Pensacola, Florida for those who qualify, which you can read more about in our review of USAA.

- Outstanding Customer Support: USAA is known for its high level of customer service in Pensacola, Florida, catering well to its members.

Cons

- Eligibility Restrictions: USAA’s services in Pensacola, Florida, are exclusively available to members of the military and their relatives, and are not open to the general public.

- Limited Local Presence: USAA does not have physical branches in Pensacola, Florida, which might inconvenience those preferring face-to-face interactions.

#6 – Travelers: Best for Flexible Options

Pros

- Flexible Options: Travelers offers flexible insurance options in Pensacola, Florida, allowing drivers to customize their coverage.

- Competitive Pricing: Travelers’ pricing is often competitive in Pensacola, Florida, making it an attractive choice for many.

- Good Discounts: Pensacola, Florida drivers can benefit from a variety of discounts offered by Travelers. Discover our Travelers review for a full list.

Cons

- Variable Service Quality: Customer service experiences can vary in Pensacola, Florida, leading to mixed reviews.

- Complex Policy Details: Some Pensacola, Florida drivers may find Travelers’ policy details and options more complex compared to other providers.

#7 – Liberty Mutual: Best for Discounts Available

Pros

- Discounts Available: Liberty Mutual offers a range of discounts in Pensacola, Florida, which can help reduce insurance premiums.

- Customizable Coverage: Pensacola, Florida residents can benefit from Liberty Mutual’s customizable coverage options, which you can check out in our Liberty Mutual review.

- Local Agents: Liberty Mutual provides access to local agents in Pensacola, Florida for personalized service and support.

Cons

- Higher Premiums for Some: Liberty Mutual’s premiums in Pensacola, Florida can be higher compared to some competitors.

- Mixed Reviews: There are varying reviews about Liberty Mutual’s customer service in Pensacola, Florida.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family offers personalized service in Pensacola, Florida through local agents who cater to individual needs.

- Wide Range of Coverage Options: Pensacola, Florida drivers can choose from a wide range of coverage options with American Family.

- Discount Opportunities: American Family provides several discount options in Pensacola, Florida to help lower insurance costs. For a complete list, read our American Family review.

Cons

- Higher Rates for Some Drivers: American Family’s rates may be higher in Pensacola, Florida, especially for drivers with less favorable profiles.

- Limited Local Offices: The availability of local offices in Pensacola, Florida may be limited compared to some other insurers.

#9 – State Farm: Best for Extensive Network

Pros

- Extensive Network: State Farm’s extensive network in Pensacola, Florida ensures widespread access to local agents and services.

- Competitive Rates: State Farm offers competitive insurance rates in Pensacola, Florida. Find out more in our State Farm review.

- Strong Customer Support: Pensacola, Florida residents benefit from State Farm’s solid customer support.

Cons

- Inconsistent Discount Application: The application of discounts in Pensacola, Florida might not always be consistent.

- Complex Claims Process: Some Pensacola, Florida drivers have reported a complex claims process with State Farm.

#10 – Progressive: Best for Competitive Pricing

Pros

- Competitive Pricing: Progressive is known for competitive pricing in Pensacola, Florida, which can be beneficial for many drivers.

- Wide Range of Discounts: Pensacola, Florida residents can take advantage of Progressive’s various discount opportunities.

- Flexible Coverage Options: Progressive offers flexible coverage options to meet the needs of drivers in Pensacola, Florida. Learn more in our Progressive review.

Cons

- Customer Service Issues: There are reports of mixed customer service experiences in Pensacola, Florida.

- Potential Rate Increases: Pensacola, Florida drivers may experience rate increases over time with Progressive.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Affordable Pensacola, Florida Auto Insurance Rates and Discounts

This article explores why these companies offer the best value by analyzing customer service, coverage options, and cost-effectiveness, while also highlighting how minimum auto insurance requirements by state impact rates and discounts among top providers in Pensacola, Florida.

Pensacola, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $96 $239

American Family $92 $235

Erie $90 $229

Farmers $91 $232

Geico $89 $228

Liberty Mutual $95 $237

Progressive $91 $232

State Farm $88 $226

Travelers $93 $233

USAA $84 $210

Compare Pensacola, Florida auto insurance monthly rates by coverage level and provider. USAA offers the lowest rates for full coverage at $210, while Allstate is the highest at $239. Minimum coverage rates start from $84 with USAA and go up to $96 with Allstate.

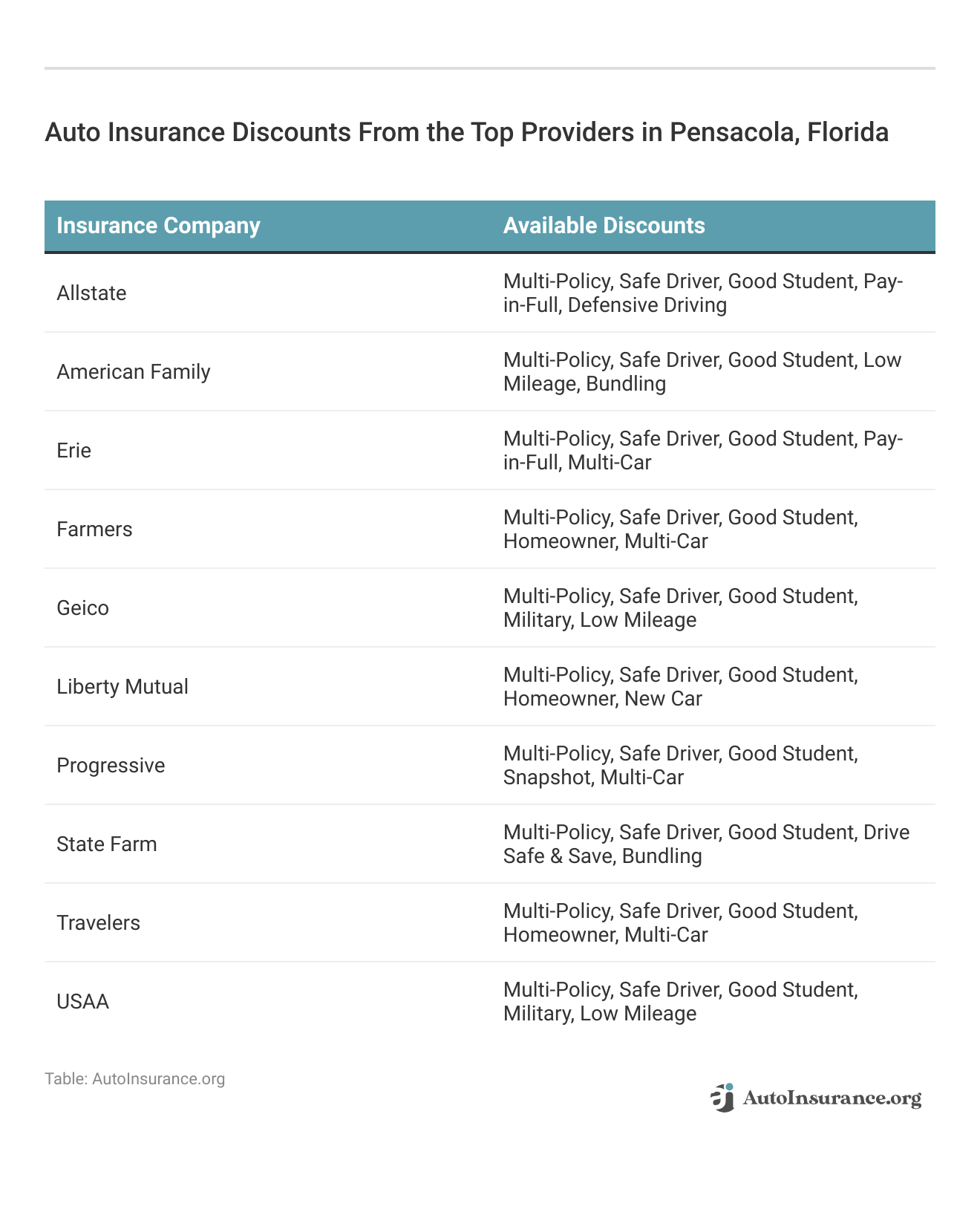

Discover the best auto insurance discounts from major providers in Pensacola, Florida. This table showcases the available discounts for each insurer, including options such as multi-policy, safe driver, and good student discounts, to help you maximize your savings on coverage.

By reviewing the rates and discounts offered by top auto insurance companies in Pensacola, you can discover the best value for your coverage. Use these insights to select a plan that aligns with your needs and financial plan, ensuring you make the most of your insurance investment.

Essential Auto Insurance Coverage for Pensacola Drivers: What You Need to Know

In Pensacola, Florida, state regulations require drivers to maintain a minimum level of auto insurance to be financially responsible after an accident. This includes having bodily injury liability coverage of $10,000 per individual and $20,000 per accident, as well as property damage liability coverage of at least $10,000.

Farmers stands out as the top choice in Pensacola for its blend of affordable rates, extensive discounts, and excellent local service.Justin Wright Licensed Insurance Agent

These basic coverage requirements are designed to ensure drivers can manage the costs associated with potential accidents and damages. For more details, see our guide titled “How long does an accident stay on your record?”

Tailoring Auto Insurance in Pensacola: Insights by Age, Gender, and Marital Status

Understanding the factors that affect auto insurance rates in Pensacola, Florida, such as age, gender, and provider, is crucial for making informed coverage decisions—find the best option for you.

Pensacola, Florida Auto Insurance Monthly Rates by Age, Gender & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $1,100 | $1,179 | $328 | $332 | $329 | $312 | $284 | $287 |

| Geico | $428 | $540 | $262 | $266 | $237 | $238 | $222 | $222 |

| Liberty Mutual | $587 | $904 | $277 | $376 | $277 | $277 | $254 | $254 |

| Nationwide | $532 | $658 | $243 | $254 | $221 | $219 | $197 | $204 |

| Progressive | $756 | $831 | $321 | $312 | $266 | $252 | $230 | $246 |

| State Farm | $486 | $622 | $185 | $199 | $167 | $167 | $151 | $151 |

| USAA | $399 | $466 | $151 | $163 | $120 | $118 | $111 | $111 |

In Pensacola, auto insurance rates differ by age, gender, and provider. For 17-year-olds, rates range from $1,100 with Allstate to $1,179 for males. At 25, Geico offers the lowest rates, starting at $262. By 35, USAA provides the best rates at $120.

For 60-year-olds, USAA remains the most affordable at $111 for both genders. Compare these rates to find the best insurance option for your needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Teen Auto Insurance in Pensacola: A Fresh Perspective

Insuring teenage drivers in Pensacola, Florida, monthly auto insurance rates can vary significantly depending on the insurance provider and the driver’s gender. For 17-year-olds, the cost of coverage is influenced by several factors, leading to a range of prices across different insurers. Check out our ranking of the top providers: Cheap Auto Insurance for 17-Year-Olds

Pensacola, Florida Teen Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $1,100 | $1,179 |

| Geico | $428 | $540 |

| Liberty Mutual | $587 | $904 |

| Nationwide | $532 | $658 |

| Progressive | $756 | $831 |

| State Farm | $486 | $622 |

| USAA | $399 | $466 |

For 17-year-old drivers in Pensacola, female rates range from $399 with USAA to $1,100 with Allstate, while male rates go from $466 with USAA to $1,179 with Allstate. Providers like Geico, Liberty Mutual, and State Farm also offer varying rates. Comparing these options can help you find the best and most affordable coverage for your teen.

Senior-Friendly Auto Insurance Options in Pensacola, Florida

When it comes to auto insurance for senior drivers in Pensacola, Florida, rates can vary significantly by provider and gender. Here’s a snapshot of what you can expect from different insurance companies. For more details, check out our resource titled “Male vs. Female Auto Insurance Rates.”

Pensacola, Florida Senior Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $284 | $287 |

| Geico | $222 | $222 |

| Liberty Mutual | $254 | $254 |

| Nationwide | $197 | $204 |

| Progressive | $230 | $246 |

| State Farm | $151 | $151 |

| USAA | $111 | $111 |

Auto insurance rates for senior drivers vary by gender and provider. For a 60-year-old female, rates range from $111 with USAA to $287 with Allstate. For a 60-year-old male, the rates range from $111 with USAA to $246 with Progressive. Geico and Liberty Mutual offer consistent rates for both genders.

Understanding these rates can help senior drivers make informed decisions about their auto insurance. Be sure to compare offers from multiple providers to find the best coverage and value for your needs.

Pensacola Auto Insurance: Tailoring Rates to Your Driving History

Your driving record has a major impact on your auto insurance premiums, so it’s crucial to know where to compare auto insurance rates for both poor and clean driving records in Pensacola, Florida.

Pensacola, Florida Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $449 | $536 | $593 | $497 |

| Geico | $210 | $269 | $401 | $329 |

| Liberty Mutual | $291 | $376 | $543 | $395 |

| Nationwide | $271 | $296 | $397 | $300 |

| Progressive | $318 | $469 | $395 | $426 |

| State Farm | $243 | $288 | $266 | $266 |

| USAA | $162 | $198 | $290 | $169 |

In Pensacola, Florida, auto insurance rates vary widely by provider and driving record. For a clean record, USAA offers the lowest monthly rate at $162, while Allstate is the highest at $449. State Farm’s rates are consistent for DUI and ticket violations at $266, while USAA continues to offer competitive rates for all infractions.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Auto Insurance Costs in Pensacola: What to Expect After a DUI

The auto insurance premium varies greatly between insurance companies, showing significant cost differences; here’s a quick overview of what you can expect from different providers.

Pensacola, Florida DUI Auto Insurance Cost

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $593 |

| Geico | $401 |

| Liberty Mutual | $543 |

| Nationwide | $397 |

| Progressive | $395 |

| State Farm | $266 |

| USAA | $290 |

After a DUI, auto insurance rates in Pensacola vary widely. State Farm offers the cheapest at $266, with USAA at $290. Geico and Progressive are priced at $401 and $395, respectively, while Nationwide is $397. Liberty Mutual and Allstate are higher at $543 and $593. Understanding these differences can help you find the best deal.

Pensacola Auto Insurance: Tailored Rates Based on Your Credit History

When shopping for auto insurance in Pensacola, Florida, understanding how credit history impacts your premiums is crucial. Rates can vary widely depending on your credit score and the insurance provider you choose. Here’s a snapshot of how different providers set their rates based on credit history, helping you make an informed decision.

Pensacola, Florida Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $373 | $459 | $724 |

| Geico | $199 | $266 | $441 |

| Liberty Mutual | $307 | $379 | $517 |

| Nationwide | $263 | $290 | $395 |

| Progressive | $311 | $372 | $522 |

| State Farm | $197 | $239 | $362 |

| USAA | $118 | $162 | $335 |

Auto insurance rates differ by provider and credit history; for example, Geico offers rates from $199 to $441 based on credit scores, while USAA’s rates range from $118 to $335, and other providers like Allstate and Liberty Mutual have higher premiums for those with bad credit, illustrating how credit scores affect auto insurance rates—choose wisely to get the best deal.

Examining these rates reveals the impact of credit scores on auto insurance premiums from different providers in Pensacola. This insight not only helps in identifying the most cost-effective options but also assists in choosing a policy that aligns with your budget and insurance needs.

Exploring Auto Insurance Rates in Pensacola: A ZIP Code-Based Breakdown

In Pensacola, Florida, auto insurance rates can differ based on ZIP code. Check the annual insurance costs for various ZIP codes to understand how your location influences your car insurance rates.

Pensacola, Florida Auto Insurance Monthly Rates by ZIP Code

| ZIP | Rate |

|---|---|

| 32502 | $265 |

| 32503 | $265 |

| 32504 | $265 |

| 32505 | $265 |

| 32506 | $265 |

| 32507 | $265 |

| 32508 | $265 |

| 32514 | $268 |

| 32526 | $265 |

In Pensacola, Florida, auto insurance monthly rates vary slightly by ZIP code. Most areas, including 32502, 32503, 32504, 32505, 32506, 32507, 32508, and 32526, have a consistent rate of $265. The ZIP code 32514 has a slightly higher rate at $268.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pensacola Commute-Driven Auto Insurance Rates: A Comprehensive Guide

Understanding auto insurance rates in Pensacola, Florida, can help you make an informed decision when choosing a provider. Monthly premiums can vary significantly based on the annual mileage you drive and the insurance company you select.

Pensacola, Florida Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $504 | $534 |

| Geico | $300 | $303 |

| Liberty Mutual | $388 | $414 |

| Nationwide | $316 | $316 |

| Progressive | $402 | $402 |

| State Farm | $257 | $275 |

| USAA | $203 | $207 |

By comparing the monthly rates for different annual mileage levels, you can better gauge which insurance provider offers the best value for your needs in Pensacola. Whether you’re driving 6,000 or 12,000 miles a year, this information helps you find a plan that balances coverage and cost effectively.

Navigating the Influences on Rates in Pensacola, Florida: Key Factors Unveiled

Auto insurance rates in Pensacola, Florida can vary significantly compared to other cities due to factors such as local traffic conditions and the frequency of vehicle thefts.

Many local factors may affect your Pensacola auto insurance rates.

Pensacola Auto Theft

Increased auto theft leads to higher insurance rates due to higher claim costs; with 105 auto thefts reported in Pensacola, Florida, knowing how to get an anti-theft auto insurance discount could help reduce your premiums.

Pensacola Commute Time

Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Pensacola, Florida commute length is 19.5 minutes according to City-Data.

Pensacola Traffic

Pensacola, Florida ranks 780th globally for traffic congestion, according to Inrix, reflecting moderate traffic conditions compared to other cities worldwide.

Navigating Affordable Auto Insurance in Pensacola, Florida

The top auto insurance providers in Pensacola, Florida include Farmers, Geico, and Allstate, with rates starting around $84/month. Full coverage costs range from $210 with USAA to $239 with Allstate, while minimum coverage rates start at $84 with USAA and go up to $96 with Allstate.

Key factors affecting rates include auto theft, commute time, and traffic congestion. Florida requires bodily injury and property damage liability coverage, but additional coverage options like comprehensive and collision are recommended for better protection.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

What are the best auto insurance companies in Pensacola, Florida?

The top auto insurance companies in Pensacola include Farmers, Geico, and Allstate. These companies are known for their competitive rates, wide range of discounts, and excellent customer service.

Who offers the cheapest auto insurance quotes in Pensacola, Florida?

USAA typically offers some of the lowest auto insurance rates in Pensacola, with minimum coverage starting at $84 per month. It’s a good idea to compare quotes from multiple providers to find the best rate for your needs.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

What does full coverage auto insurance in Pensacola, Florida include?

Full coverage auto insurance in Pensacola typically includes liability coverage, collision coverage, comprehensive coverage, and often uninsured/underinsured motorist coverage. It provides broader protection than the state minimum requirements.

To enhance your understanding, explore our comprehensive resource on insurance titled “Collision Auto Insurance Defined.”

What is the minimum auto insurance required in Pensacola, Florida?

Florida requires drivers to have a minimum of $10,000 in bodily injury liability per individual, $20,000 per accident, and $10,000 in property damage liability coverage.

Are there affordable auto insurance options available near Pensacola Beach?

Yes, there are affordable auto insurance options available for those living near Pensacola Beach. It’s best to compare quotes from various insurers to find coverage that fits your budget and location.

How can I find affordable auto insurance in Pensacola, Florida?

To find affordable auto insurance in Pensacola, compare quotes from different insurance companies, look for discounts, and consider factors such as your driving record, credit history, and coverage needs.

For detailed information, refer to our comprehensive report titled “What are the recommended auto insurance coverage levels?”

Which Pensacola, Florida insurance companies offer the best rates?

Companies like Farmers, Geico, and Allstate are known for offering some of the best rates in Pensacola. It’s recommended to get quotes from these and other insurers to determine the best option for your situation.

What are some tips for finding cheap auto insurance in Pensacola, Florida?

To find cheap auto insurance in Pensacola, maintain a good driving record, utilize discounts, compare quotes from multiple providers, and consider adjusting your coverage levels based on your needs.

What are some common discounts available for auto insurance in Pensacola, Florida?

Common discounts for auto insurance in Pensacola include multi-policy discounts, safe driver discounts, good student discounts, and discounts for having anti-theft devices installed in your vehicle.

For a comprehensive analysis, refer to our detailed guide titled “How to Get a Multi-Vehicle Auto Insurance Discount.”

How do demographics affect auto insurance rates in Pensacola, Florida?

Demographics such as age, gender, and marital status can impact auto insurance rates. For instance, younger drivers and those with a less favorable driving record may face higher premiums.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.