Best Port St. Lucie, Florida Auto Insurance in 2026 (See the Top 10 Companies)

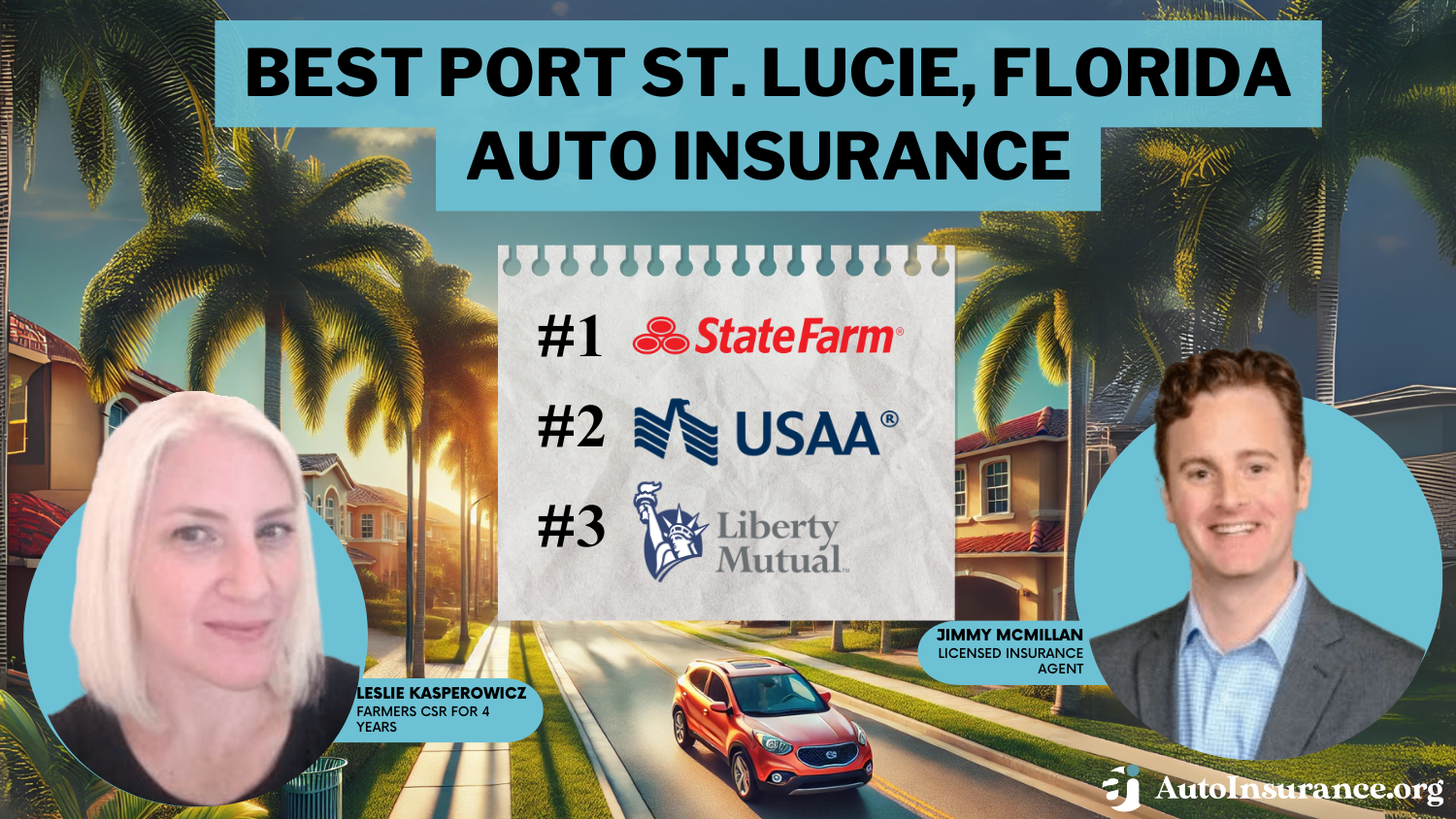

The best Port St. Lucie, Florida auto insurance options include State Farm, USAA, and Liberty Mutual, all offering competitive rates starting at $135/mo. Whether you're a new driver or seeking to switch providers, understanding your choices can help you secure the coverage that best fits your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Leslie Kasperowicz

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Jimmy McMillan

Updated August 2025

Company Facts

Full Coverage in Port St. Lucie Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Port St. Lucie Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Port St. Lucie Florida

A.M. Best Rating

Complaint Level

Pros & Cons

The best Port St. Lucie, Florida auto insurance options are State Farm, USAA, and Liberty Mutual, all known for their competitive rates and robust coverage.

With starting rates around $135 per month, these providers stand out for their exceptional customer service and diverse policy offerings. Continue reading our full “Car Insurance Quotes: Compare Cheap Coverage” guide for extra tips.

Choosing the right insurance involves considering factors like discounts, coverage types, and financial stability. This guide will help you navigate your options and find the coverage that best fits your needs.

Our Top 10 Company Picks: Best Port St. Lucie, Florida Auto Insurance

Company Rank UBI Savings A.M. Best Best For Jump to Pros/Cons

![]()

#1 30% B Reliable Coverage State Farm

![]()

#2 30% A++ Military Benefits USAA

#3 30% A Customizable Plans Liberty Mutual

![]()

#4 15% A Broad Discounts Farmers

![]()

#5 25% A++ Affordable Premiums Geico

![]()

#6 30% A+ Online Convenience Progressive

![]()

#7 20% A++ Flexible Options Travelers

![]()

#8 40% A+ Strong Reputation Allstate

![]()

#9 20% A Personalized Service American Family

#10 40% A+ Comprehensive Protection Nationwide

Get the right car insurance at the best price — entering your ZIP code above to shop for coverage from the top insurers.

#1 – State Farm: Top Overall Pick

Pros

- Claims Handling: State Farm’s efficient claims process is a major advantage for Port St. Lucie, FL drivers seeking quick resolutions.. This reliable service offers peace of mind, making it a popular choice.

- Bundling Discounts: Port St. Lucie, FL residents can save with State Farm’s bundling discounts on auto, homeowners, and renters insurance, offering both convenience and cost efficiency.

- Available Discounts: According to State Farm auto insurance review, drivers in Port St. Lucie, FL, State Farm provides discounts on insurance for teens and young adults to save money on premiums.

Cons

- Premiums Increase: Drivers with less-than-perfect records might notice that rates in Port St. Lucie, FL, are higher than those of other insurers, which is less appealing for those seeking lower premiums.

- Digital Tools: While State Farm’s digital tools function, tech-savvy Port St. Lucie, Florida consumers looking for more sophisticated online administration may find them frustrating.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Competitive Rates

Pros

- Competitive Rates: Offers competitive auto insurance rates in Port St. Lucie, FL, especially for military members and families, making it a top choice, as noted in our USAA auto insurance review.

- Flexible Coverage: Drivers in Port St. Lucie, Florida, can customize insurance with USAA’s broad coverage options, which makes it an excellent alternative for local drivers.

- Digital Tools: USAA is a great option for tech-savvy drivers because of its user-friendly website and app, which make managing policies and claims simple for consumers in Port St. Lucie, FL.

Cons

- Restricted Membership: Many Port St. Lucie, FL residents looking for affordable coverage cannot obtain USAA’s services since they are restricted to military personnel, veterans, and their families.

- Military Discounts: In Port St. Lucie, Florida, civilian drivers are not eligible for many of the discounts USAA offers, which limits their ability to save money compared to military families.

#3 – Liberty Mutual: Best for Policy Customization

Pros

- Policy Customization: Offers a wide range of add-ons and customizable coverage options, allowing Port St. Lucie, FL, drivers to tailor their insurance policies to their specific needs and lifestyles.

- Discount Opportunities: In Port St. Lucie, FL, drivers reduce premiums through multi-policy discounts and safe driving incentives, resulting in savings while ensuring comprehensive coverage.

- New Car Replacement: In Port St. Lucie, FL, residents with newer vehicles can benefit from new car replacement coverage, ensuring full compensation if their car is totaled in the first year or two.

Cons

- Pricey Add-Ons: Drivers in Port St. Lucie, Florida, may find their premiums for optional Liberty Mutual coverages—such as gap insurance and rental car reimbursement—prohibitively expensive.

- Complex Coverage: According to Liberty Mutual auto insurance review, choosing the right plans can be challenging for some Port St. Lucie, FL customers due to the many coverage options.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Farmers: Best for Diverse Coverage

Pros

- Diverse Coverage: Residents of Port St. Lucie, Florida, can tailor their insurance policies from a variety of Farmers offers to suit their needs and lifestyles for complete protection.

- Accident Forgiveness: The Accident Forgiveness program offers drivers in Port St. Lucie, FL, peace of mind and improved security by preventing premium increases following an at-fault collision.

- Educational Resources: According to Farmers auto insurance review, Port St. Lucie, FL, residents have been offered online resources that help them understand their coverage options.

Cons

- Higher Premiums: Port St. Lucie, FL residents with driving mishaps may find Farmers’ rates higher than other insurers, making it less appealing for those seeking affordable coverage.

- Limited Discounts: Discounts are offered but might not be as substantial as those offered by other companies, so some locals may look for more specialized offers that better suit their needs.

#5 – Geico: Best for Unbeatable Rates

Pros

- Unbeatable Rates: Geico is renowned for its aggressive pricing. It offers affordable vehicle insurance for drivers in Port St. Lucie, FL, that appeals to those seeking savings while guaranteeing coverage.

- Claims Resolution: According to Geico auto insurance review, claims processing helps Port St. Lucie, FL, drivers recover after an accident, minimizing downtime and enabling prompt road recovery.

- Discount Opportunities: Provides incentives, such as multi-policy savings and good driving, to assist Port St. Lucie, FL drivers in lowering insurance premiums and improving affordability.

Cons

- Premium Increases: Geico has a reputation for sharply hiking premiums following collisions, which can surprise and annoy drivers in Port St. Lucie, Florida, when they renew.

- Telematics Program: While Port St. Lucie, Florida, drivers who drive safely can save a little money with the DriveEasy telematics program, some are looking for more efficient ways to save insurance.

#6 – Progressive: Best for Telematics Rewards

Pros

- Telematics Rewards: The Snapshot program in Port St. Lucie, Florida, rewards responsible driving and promotes road safety by providing discounts based on real-time driving data.

- Pet Injury Coverage: Progressive covers pets injured in accidents, catering to Port St. Lucie, FL pet owners and providing peace of mind while driving.

- Online Resources: This site offers extensive educational resources for Port St. Lucie, FL, residents, helping them navigate coverage options and make informed decisions about their policies.

Cons

- Telematics: According to Progressive auto insurance review, this program offers potential savings but raises privacy concerns for Port St. Lucie, FL, drivers concerned about monitoring their habits.

- Optional Add-Ons: Adding coverages like rental car reimbursement can increase premiums, challenging budget-conscious Port St. Lucie, FL, drivers seeking to manage costs and convenience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Travelers: Best for Bundling Savings

Pros

- Bundling Savings: Provides significant discounts to customers who bundle auto insurance with other policies, creating a compelling opportunity for Port St. Lucie, FL, drivers to maximize their savings.

- Gap Insurance: This company offers gap insurance for Port St. Lucie, FL, residents with newer vehicles. The insurance covers the difference between the car’s cash value and the remaining loan balance.

- Telematics Program: According to Travelers auto insurance review, IntelliDrive rewards safe driving with discounts for Port St. Lucie, FL drivers, promoting responsible driving and savings.

Cons

- Policy Complexity: Some Port St. Lucie, FL customers find Travelers’ policies complex and hard to navigate, which can confuse them when selecting suitable coverage.

- Customer Service: Customer experiences vary for Port St. Lucie, FL drivers. Some report service difficulties during busy times, leading to frustration and a sense of being overlooked.

#8 – Allstate: Best for Mobile App

Pros

- Mobile App: The app provides Port St. Lucie, FL residents an intuitive platform to manage their insurance policies, file claims, and conveniently request roadside assistance with just a few taps.

- Discount Options: Discounts offer—ranging from safe driving rewards to enticing multi-policy bundling options—drivers in Port St. Lucie, FL can unlock substantial savings on their insurance premiums.

- Educational Resources: As per Allstate auto insurance review, Drivers in Port St. Lucie, FL can investigate coverage alternatives and make well-informed decisions by using internet resources.

Cons

- Higher Rates: Some residents in Port St. Lucie, FL, might perceive Allstate’s premiums as comparatively steep, which could prompt budget-conscious consumers to explore more affordable alternatives.

- Rate Hikes: Allstate’s premium increases after claims may leave Port St. Lucie, FL residents blindsided at renewal, prompting budget concerns and a reevaluation of insurance options.

#9 – American Family: Best for Policy Options

Pros

- Policy Options: Provides an extensive array of insurance products, enabling drivers in Port St. Lucie, Florida,to alter their coverage to suit their own requirements and way of life.

- Online Tools: Online tools empowers drivers in Port St. Lucie, Florida, to seamlessly manage their policies while gaining a clearer understanding of their coverage options.

- Flexible Payment: Residents of Port St. Lucie, Florida, can choose from diverse payment options that suit their financial circumstances and budgeting preferences.

Cons

- Complex Policy: The overwhelming array of insurance options can leave many drivers in Port St. Lucie, FL, feeling confused and uncertain about selecting the right policy for comprehensive protection.

- Rate Increases: Often raises premiums after a claim, surprising Port St. Lucie, FL drivers at renewal, similar to other facing unexpected costs, as noted in our American Family auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Coverage Options

Pros

- Coverage Options: Nationwide offers an extensive array of insurance policies specifically designed to meet the diverse needs of drivers in Port St. Lucie, Florida, guaranteeing robust coverage options.

- Claims System: Offers an extensive array of insurance policies specifically designed to meet the varied needs of drivers in Port St. Lucie, FL, ensuring that they enjoy robust and comprehensive coverage.

- Coverage Features: Driving safely is encouraged by disappearing deductibles for drivers in Port St. Lucie, Florida, according to Nationwide auto insurance review.

Cons

- Higher Rates: Some residents of Port St. Lucie, FL, may perceive premiums as less competitive, particularly those with challenging driving records, prompting them to explore alternative insurance.

- Limited Discount: Not every driver in Port St. Lucie, FL, will meet the eligibility criteria for all available discounts, which can limit their opportunities for significant savings on insurance premiums.

Car Insurance Rate Trends by ZIP Code in Port St. Lucie, FL

Navigating the complexities of car insurance can feel overwhelming, particularly given the stark differences in rates that can arise depending on your specific location.

Port St. Lucie, Florida Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

![]()

$190 $277

![]()

$151 $220

![]()

$180 $275

![]()

$140 $211

$200 $300

$145 $195

![]()

$160 $240

![]()

$150 $210

![]()

$120 $160

![]()

$135 $185

Just as drivers in Port St. Lucie, FL, must consider their local market dynamics, Port St. Lucie, FL residents need to grasp how ZIP code trends influence monthly premiums to secure the most suitable coverage without breaking the bank.

Auto Insurance Discounts From the Top Providers in Port St. Lucie, Florida

Insurance Company Available Discounts

![]()

Safe driver, Multi-policy, Good student, Anti-theft, Defensive driving, Early signing, Responsible payer, Drivewise usage-based program

![]()

Multi-policy, Good student, Auto safety features, Low mileage, Defensive driving, Safe driver, Early signing, Teen Safe Driver, Loyalty

![]()

Multi-policy, Good student, Safe driver, Homeowner, Affinity groups, Pay-in-full, Auto safety features, Signal usage-based program

![]()

Multi-policy, Multi-car, Safe driver, Good student, Defensive driving, Anti-theft, Military, Federal employee, New vehicle

Multi-policy, Good student, Multi-car, Safe driver, Anti-theft, Advanced safety features, Hybrid vehicle, Paperless policy, Pay-in-full

Multi-policy, Multi-car, Safe driver, Accident-free, Defensive driving, Good student, Pay-in-full, SmartRide usage-based program

![]()

Multi-policy, Multi-car, Safe driver, Good student, Pay-in-full, Snapshot usage-based program, Continuous insurance, Online quote

![]()

Safe driver, Multi-policy, Good student, Defensive driving, Vehicle safety, Accident-free, Anti-theft, Drive Safe & Save program

![]()

Multi-policy, Multi-car, Safe driver, Good student, Hybrid/electric vehicle, Pay-in-full, New car, Homeowner, Early quote, IntelliDrive

![]()

Safe driver, Multi-policy, Good student, New vehicle, Family discount, Defensive driving, Vehicle storage, Mileage-based discounts

This guide will dissect the variations in car insurance rates across various ZIP codes in Port St. Lucie, enabling you to make well-informed choices that align with your insurance requirements and financial goals.

Check out the monthly Port St. Lucie, FL auto insurance rates by ZIP Code below:

In conclusion, understanding car insurance rate trends by ZIP code in Port St. Lucie, FL, empowers you to choose the best policy for your needs. Just like in Port St. Lucie, FL, comparing rates and recognizing pricing factors helps you navigate your options confidently. Whether you’re a new driver or switching providers, being informed leads to better coverage and savings.

Car Insurance Rates: Port St. Lucie, FL Compared to Top U.S. Cities

Furthermore, it offers valuable insights that resonate with the experiences of drivers in Port St. Lucie, FL, empowering you to make informed decisions as you navigate your insurance options with confidence. Ready to find affordable Port St. Lucie, FL auto insurance rates? Enter your ZIP code above to get started.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Budget Auto Insurance: Port St. Lucie, FL Edition

USAA emerges as the most budget-friendly auto insurance option in Port St. Lucie, FL, yet it exclusively serves military veterans and their immediate families, creating a unique niche in the market.

Following closely, State Farm and Nationwide also offer competitive rates, making them strong contenders for cost-conscious drivers. For further details, check out our in-depth “How to Compare Auto Insurance Quotes” article.

Curious about which auto insurance company in Port St. Lucie, FL provides the lowest rates and how these stack up against the average rates across Florida? We’ve delved into the details to provide you with comprehensive insights, including comparisons that may resonate with residents in Port St. Lucie, FL.

USAA, State Farm, Nationwide, and Geico stand out as the sole providers in Port St. Lucie offering auto insurance rates that fall below the average, presenting enticing options for budget-conscious drivers. Nevertheless, it’s crucial to remember that your individual auto insurance rates are influenced by a myriad of personal factors, including your driving history, credit score, and even the neighborhood you reside in.

Port St. Lucie, Florida Report Card: Auto Insurance Premiums

Category Grade Explanation

Uninsured Drivers Rate C Higher-than-average rate of uninsured drivers, common in urban Florida areas.

Weather-Related Risks C Moderate risk due to seasonal hurricanes and tropical storms.

Average Claim Size B Claims are generally average compared to other cities in Florida.

Traffic Density B Medium traffic density, with manageable congestion during peak hours.

Vehicle Theft Rate B Lower-than-average vehicle theft rate compared to other cities in Florida.

Interestingly, the most affordable ZIP code in Port St. Lucie, FL, is 34953, where the average monthly auto insurance cost is a mere $294—an appealing figure for many. This localized insight could help you make decisions that align with your needs, similar to those faced by residents in Port St. Lucie, FL.

Auto Insurance Requirements: A Focus on Port St. Lucie, FL

All Florida drivers must carry the minimum auto insurance requirements, which are:

- $10,000 for personal injury protection (PIP)

- $10,000 for property damage liability (PDL)

It’s recommended that you get a higher coverage limit. Florida car insurance requirements are lower than average. Therefore, it would be best to buy a higher coverage limit, such as 50/100/50.

Port St. Lucie, FL auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Your coverage level will play a major role in your Port St. Lucie auto insurance rates. Find the cheapest Port St. Lucie, FL auto insurance rates by coverage level below:

Your credit score will play a major role in your Port St. Lucie auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Port St. Lucie, FL auto insurance rates by credit score below.

Your driving record will play a major role in your Port St. Lucie auto insurance rates. For example, other factors aside, a Port St. Lucie, FL DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Port St. Lucie, FL auto insurance rates by driving record.

Factors affecting auto insurance rates in Port St. Lucie, FL may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Port St. Lucie, Florida auto insurance.

Monthly Cost of Port St. Lucie, FL Auto Insurance by Age & Gender

Age Male Monthly Rate Female Monthly Rate

Age: 17 $811 $673

Age: 25 $295 $277

Age: 35 $249 $255

Age: 60 $233 $229

In {STATE}, gender is not a factor for determining rates, so it’s essential to explore the average monthly auto insurance rates based on age and gender in Port St. Lucie, FL, to better understand how these variables can impact your insurance costs.

Discovering What Drives Auto Insurance Costs in Port St. Lucie, FL

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Port St. Lucie, FL Auto Insurance: Critical Insights

State Farm's extensive network of agents and local presence ensures personalized service, making it a top choice for drivers seeking reliable support in Port St. Lucie.Jeff Root Licensed Insurance Agent

Additionally, equipping your vehicle with advanced safety and anti-theft features can lead to substantial savings, making your policy even more cost-effective. These strategies resonate with drivers in Port St. Lucie, FL, who are similarly focused on minimizing their insurance expenses while maximizing protection.

Before you buy car insurance in Port St. Lucie, Florida, be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Port St. Lucie, FL auto insurance quotes.

Frequently Asked Questions

How reliable is the Allstate insurance company in Port St. Lucie, Florida?

The Allstate insurance company in Port St. Lucie, Florida, has garnered a reputation for its comprehensive coverage and responsive customer service. Many local drivers appreciate their commitment to support and claims handling, making Allstate a favored choice in the community.

What is considered the best full coverage car insurance in Port St. Lucie, Florida?

When it comes to the best full coverage car insurance in Port St. Lucie, Florida, options can vary based on individual needs. Providers like State Farm and Allstate are frequently recommended for their robust policies, which cater to various driver requirements.

What are the car insurance requirements in Port St. Lucie, Florida?

Car insurance requirements in Port St. Lucie, Florida, necessitate proof of liability coverage, while drivers are encouraged to explore additional options for enhanced protection. This approach helps safeguard against unforeseen circumstances on the road.

Explore our detailed analysis on “How to Evaluate Auto Insurance Quotes” for additional information.

How does car insurance work in Port St. Lucie, Florida?

Understanding how car insurance works in Port St. Lucie involves familiarizing yourself with the various coverage types, the claims process, and the significance of adhering to required insurance levels. This knowledge is crucial for effective financial planning.

How can I compare Port St. Lucie, Florida auto insurance options?

To effectively compare Port St. Lucie, Florida auto insurance options, consider using online comparison tools and obtaining quotes from multiple providers. Evaluating coverage features and costs will help you make an informed decision that suits your needs.

What does State Farm car insurance coverage include?

State Farm car insurance coverage typically encompasses liability, collision, and comprehensive options, along with various add-ons like roadside assistance. These offerings allow drivers to customize their policies according to individual preferences.

Get more insights by reading our expert “Where can I compare online auto insurance companies?” advice.

What should I know about Allstate insurance coverage in Port St. Lucie, Florida?

Allstate insurance coverage in Port St. Lucie, Florida, provides a diverse range of options, allowing drivers to tailor their policies to meet specific needs. This flexibility is beneficial for those looking to enhance their insurance experience.

How is the Allstate insurance company’s reputation in Port St. Lucie, Florida?

The Allstate insurance company’s reputation in Port St. Lucie is largely favorable, with many customers praising their claims process and customer service. This positive feedback contributes to their strong presence in the local insurance market.

What are some tips for finding the best car insurance in Port St. Lucie, Florida?

Finding the best car insurance in Port St. Lucie, Florida, requires diligent research into various providers, comparing rates, reading customer reviews, and evaluating your specific coverage needs. This proactive approach will help you secure the most suitable policy.

Continue reading our full “Compare Cheap Online Auto Insurance Quotes” guide for extra tips.

How do Port St. Lucie, Florida car insurance costs vary by provider?

Car insurance costs in Port St. Lucie, Florida, vary significantly among providers, influenced by each company’s coverage options, discounts, and overall market reputation. Understanding these differences is essential for making an informed choice.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What are the car insurance costs per age group in Port St. Lucie, Florida?

How do provider car insurance costs by age in Port St. Lucie, Florida compare?

What constitutes good car insurance coverage in Port St. Lucie, Florida?

How many car insurances do you need in Port St. Lucie, Florida?

What considerations should I keep in mind for car insurance coverage in Port St. Lucie, Florida?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.